Steinhoff International was a multinational retail company based in South Africa. Founded in 1964, the company quickly grew into a global retail powerhouse, with operations in Europe, Africa, and the United States. However, in 2017, Steinhoff was hit by a major financial scandal that would rock the company to its core.Steinhoff International

Mattress Firm Inc was a major American mattress retailer that was acquired by Steinhoff International in 2016. With over 3,500 stores across the United States, Mattress Firm was one of the largest specialty mattress retailers in the country. However, the acquisition would ultimately lead to the downfall of both Steinhoff and Mattress Firm.Mattress Firm Inc

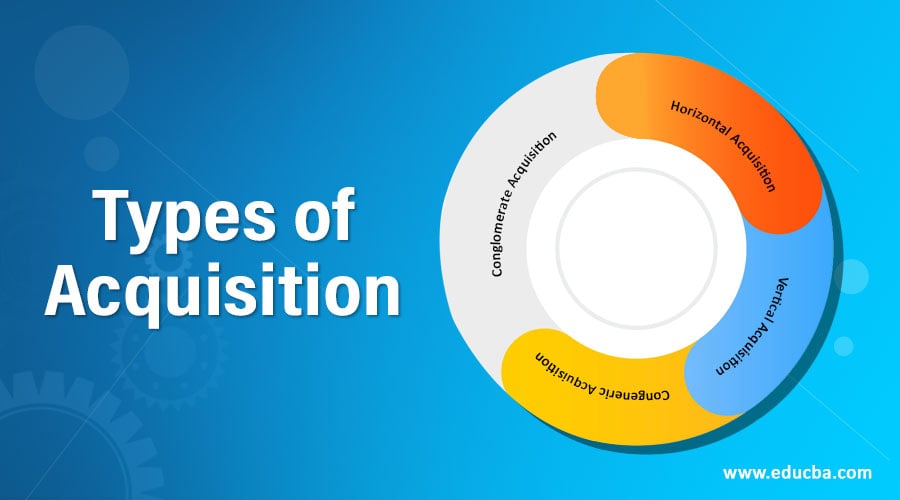

In 2016, Steinhoff International announced its acquisition of Mattress Firm Inc for $3.8 billion, making it the largest mattress retailer in the world. The acquisition was seen as a strategic move for Steinhoff, as it gave them a strong foothold in the highly lucrative American market.Acquisition

However, just a year after the acquisition, Mattress Firm Inc filed for Chapter 11 bankruptcy in October 2017. This was a major blow to Steinhoff, as it had invested a significant amount of money in the acquisition. The bankruptcy was attributed to the over-expansion of Mattress Firm and the rise of online mattress retailers, which affected its sales and profitability.Bankruptcy

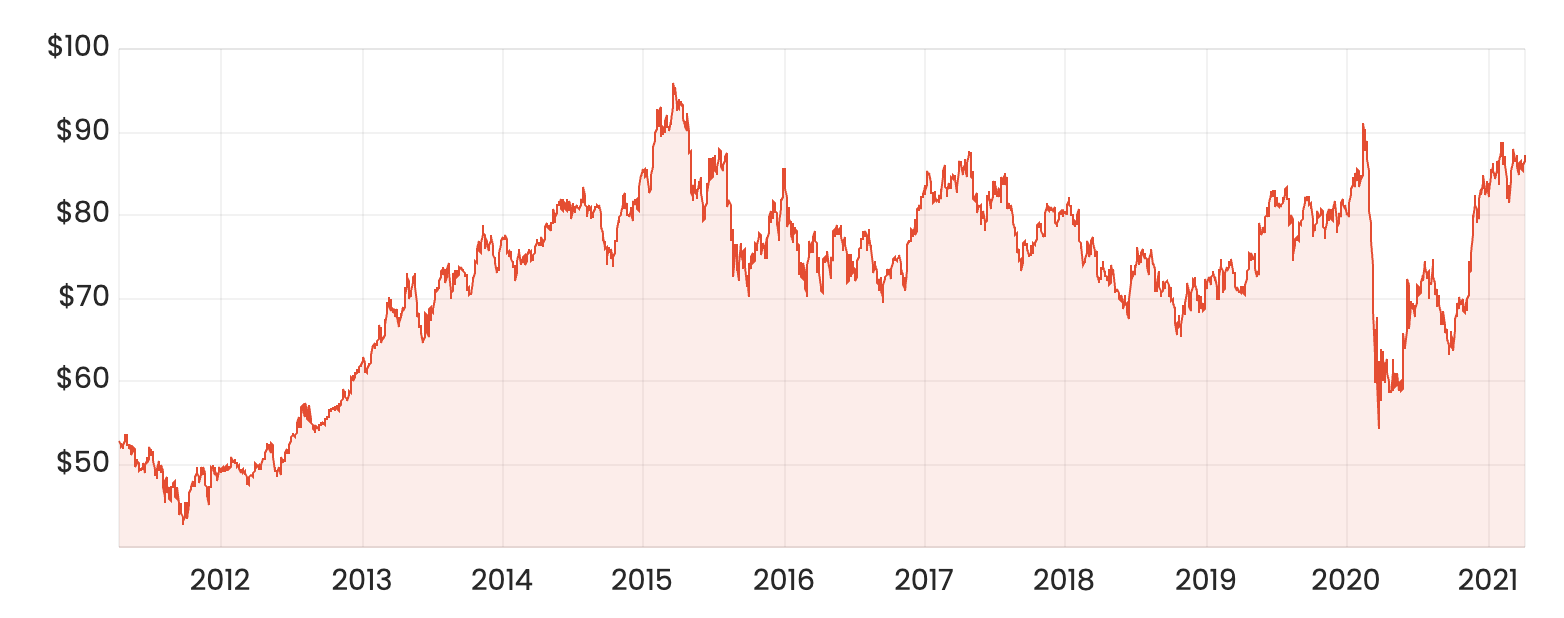

In December 2017, Steinhoff International was hit by a major financial scandal when it announced that it had discovered accounting irregularities in its financial statements. This led to a massive drop in its share price and triggered an investigation by regulators and authorities in multiple countries.Financial Scandal

The investigation into Steinhoff's financial irregularities revealed that the company had overstated its profits and assets by over $12 billion. This was one of the largest accounting frauds in history and led to the resignation of the company's CEO and several other top executives.Investigation

The news of the financial scandal and accounting irregularities caused Steinhoff's share price to plummet by over 90%, wiping out billions of dollars in shareholder value. The company's stock was delisted from several stock exchanges, and investors who had put their faith in the company were left reeling from the losses.Share Price

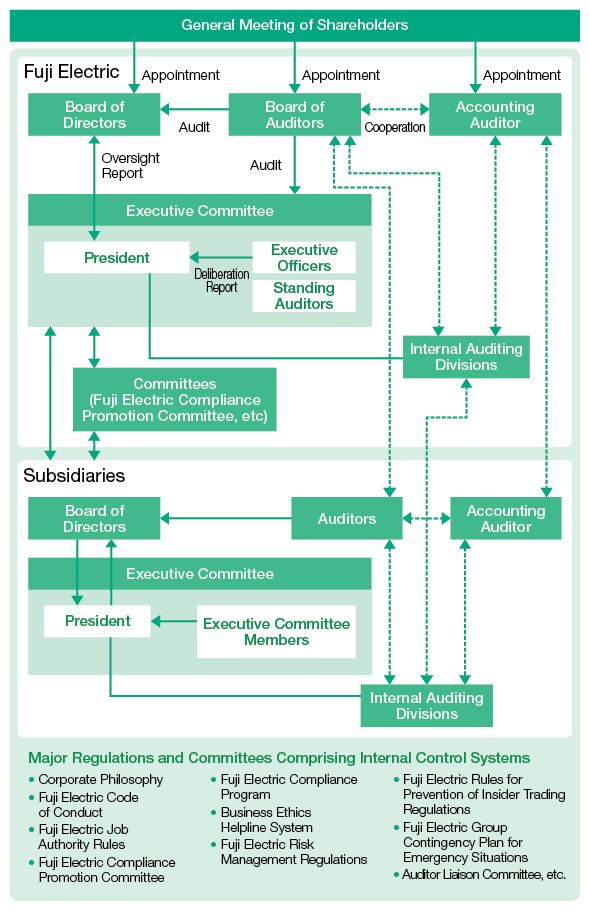

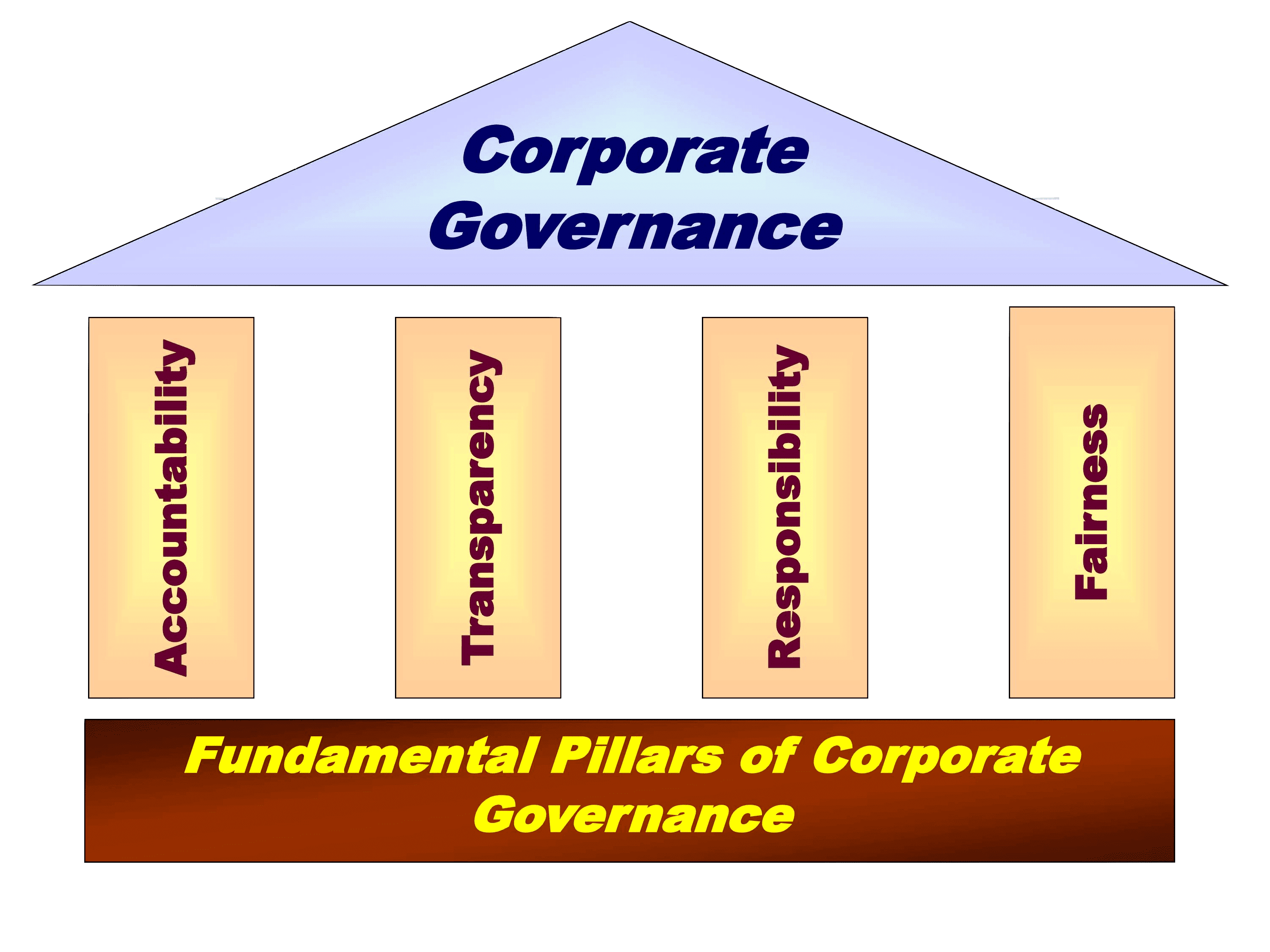

The financial scandal also brought to light major issues with Steinhoff's corporate governance practices. It was revealed that the company's board had failed to provide proper oversight and had allowed the fraudulent activities to go undetected for several years. This led to major changes in the company's leadership and board of directors.Corporate Governance

In an effort to salvage the company, Steinhoff embarked on a major restructuring plan that involved selling off assets and cutting costs. This included the sale of Mattress Firm Inc, as well as other subsidiaries, to raise much-needed cash and pay off its debts.Restructuring

The fallout from the financial scandal and subsequent bankruptcy has led to numerous legal proceedings against Steinhoff International and its former executives. Shareholders and investors have filed lawsuits in multiple countries, seeking compensation for their losses. The investigations are ongoing, and the full extent of the company's wrongdoing is yet to be determined.Legal Proceedings

Mattress Firm Inc. and Steinhoff International: A Strategic Partnership for the Future of Sleep

Revolutionizing the Mattress Industry

The mattress industry has seen a significant shift in recent years, with an increase in online mattress sales and the emergence of new innovative mattress technologies. In this fast-paced and competitive market,

Mattress Firm Inc.

, one of the largest mattress retailers in the United States, has partnered with

Steinhoff International

, a global retail company based in South Africa, to stay ahead of the curve and continue providing customers with the best sleep experience.

The mattress industry has seen a significant shift in recent years, with an increase in online mattress sales and the emergence of new innovative mattress technologies. In this fast-paced and competitive market,

Mattress Firm Inc.

, one of the largest mattress retailers in the United States, has partnered with

Steinhoff International

, a global retail company based in South Africa, to stay ahead of the curve and continue providing customers with the best sleep experience.

Combining Strengths for Success

The partnership between Mattress Firm Inc. and Steinhoff International brings together two industry leaders with complementary strengths. Mattress Firm Inc. has a strong presence in the US market with over 2,500 stores, while Steinhoff International has a global reach with operations in Europe, Africa, and Australia. This collaboration allows them to leverage each other's strengths and resources to expand their market reach and provide customers with a wider range of products.

The partnership between Mattress Firm Inc. and Steinhoff International brings together two industry leaders with complementary strengths. Mattress Firm Inc. has a strong presence in the US market with over 2,500 stores, while Steinhoff International has a global reach with operations in Europe, Africa, and Australia. This collaboration allows them to leverage each other's strengths and resources to expand their market reach and provide customers with a wider range of products.

Innovation and Technology at the Forefront

With the rise of online mattress sales, both companies recognize the importance of embracing technology and innovation to stay competitive. Mattress Firm Inc. has been investing in new technologies, such as their Sleepy’s mattress diagnostic system, which uses data to recommend the perfect mattress for each customer. Steinhoff International has also been investing in advanced technologies, such as their Smartmatic Sleep System, which uses sensors to track and analyze sleep patterns for a personalized sleep experience. Together, they are committed to staying at the forefront of the industry and providing customers with the latest and most innovative sleep solutions.

With the rise of online mattress sales, both companies recognize the importance of embracing technology and innovation to stay competitive. Mattress Firm Inc. has been investing in new technologies, such as their Sleepy’s mattress diagnostic system, which uses data to recommend the perfect mattress for each customer. Steinhoff International has also been investing in advanced technologies, such as their Smartmatic Sleep System, which uses sensors to track and analyze sleep patterns for a personalized sleep experience. Together, they are committed to staying at the forefront of the industry and providing customers with the latest and most innovative sleep solutions.

Commitment to Sustainability

In addition to their focus on technology and innovation, both Mattress Firm Inc. and Steinhoff International share a commitment to sustainability. Mattress Firm Inc. has implemented a recycling program for old mattresses, while Steinhoff International has set ambitious sustainability targets, including using 100% renewable energy in their operations. This partnership not only benefits customers but also the environment.

In addition to their focus on technology and innovation, both Mattress Firm Inc. and Steinhoff International share a commitment to sustainability. Mattress Firm Inc. has implemented a recycling program for old mattresses, while Steinhoff International has set ambitious sustainability targets, including using 100% renewable energy in their operations. This partnership not only benefits customers but also the environment.

A Bright Future for Sleep

The partnership between Mattress Firm Inc. and Steinhoff International is a strategic move that allows them to stay ahead of the competition and continue providing customers with the best sleep experience. With a focus on innovation, technology, and sustainability, they are setting a new standard in the mattress industry and shaping the future of sleep.

The partnership between Mattress Firm Inc. and Steinhoff International is a strategic move that allows them to stay ahead of the competition and continue providing customers with the best sleep experience. With a focus on innovation, technology, and sustainability, they are setting a new standard in the mattress industry and shaping the future of sleep.

/Bankruptcy-Ahead-sign-577474b35f9b585875cbe782.jpg)