For seniors and their families, the cost of assisted living can be a significant financial burden. However, in the state of New Jersey, there are several tax deductions and benefits available to help alleviate some of the financial strain. Here are the top 10 assisted living room and board tax deductions in NJ that you should know about.Assisted Living Tax Deductions in New Jersey

One of the biggest expenses when it comes to assisted living is the cost of room and board. However, in New Jersey, these expenses are tax deductible for seniors who meet certain criteria. This can provide significant savings for families struggling to afford the high cost of assisted living.Assisted Living Room and Board Tax Deductions in NJ

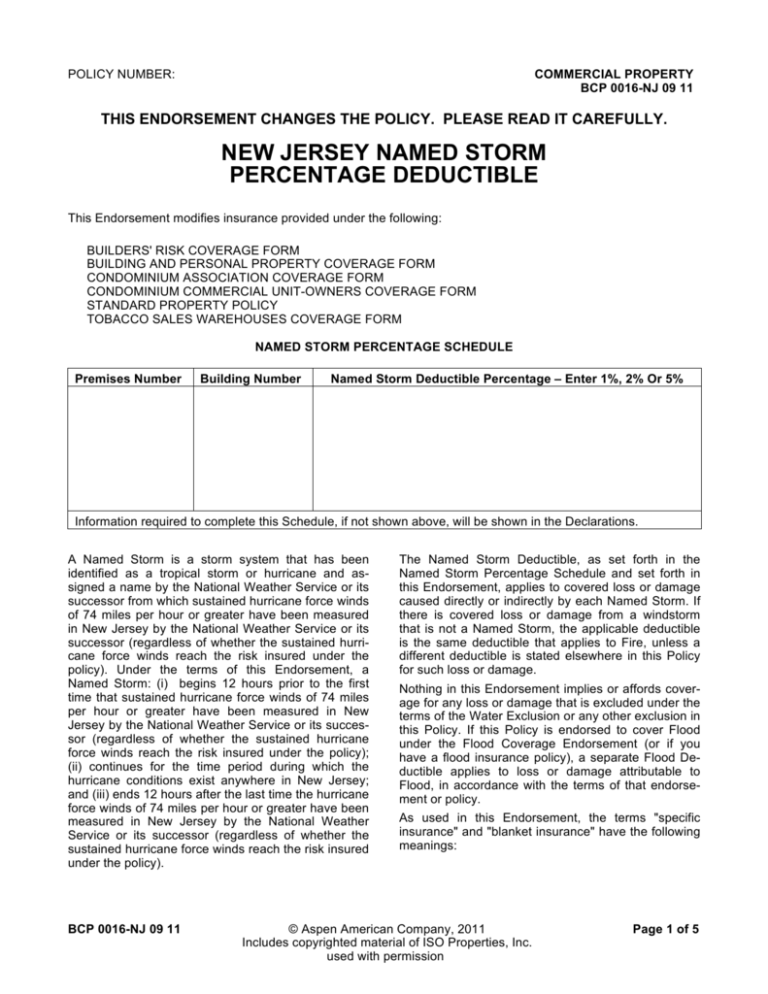

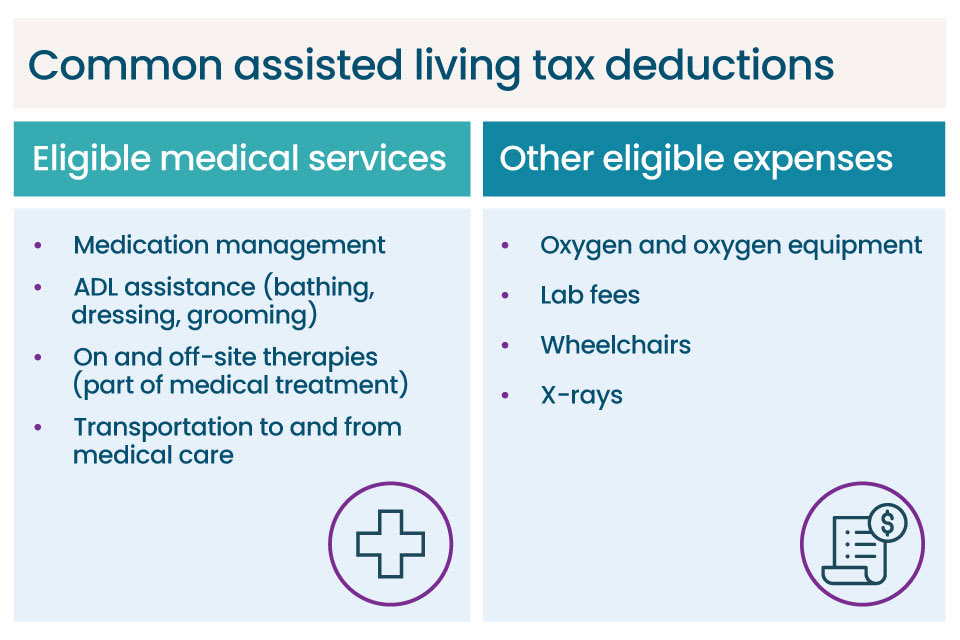

In addition to room and board, there are other assisted living expenses that may be tax deductible in New Jersey. These include medication costs, medical supplies, and even some personal care services. It's important to keep detailed records of these expenses and consult with a tax professional to determine if they are eligible for deductions.Assisted Living Expenses Tax Deductible in New Jersey

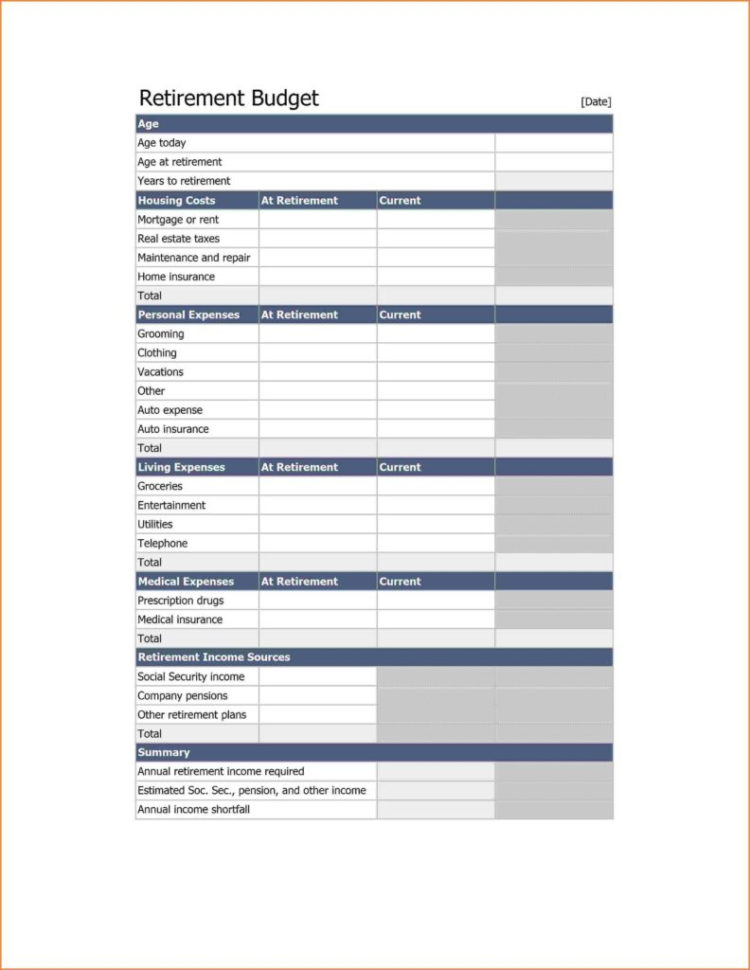

New Jersey offers several tax benefits for seniors living in assisted living facilities. These include deductions for medical expenses, property taxes, and even long-term care insurance premiums. These benefits can help reduce the overall tax liability for seniors and their families.Assisted Living Tax Benefits in NJ

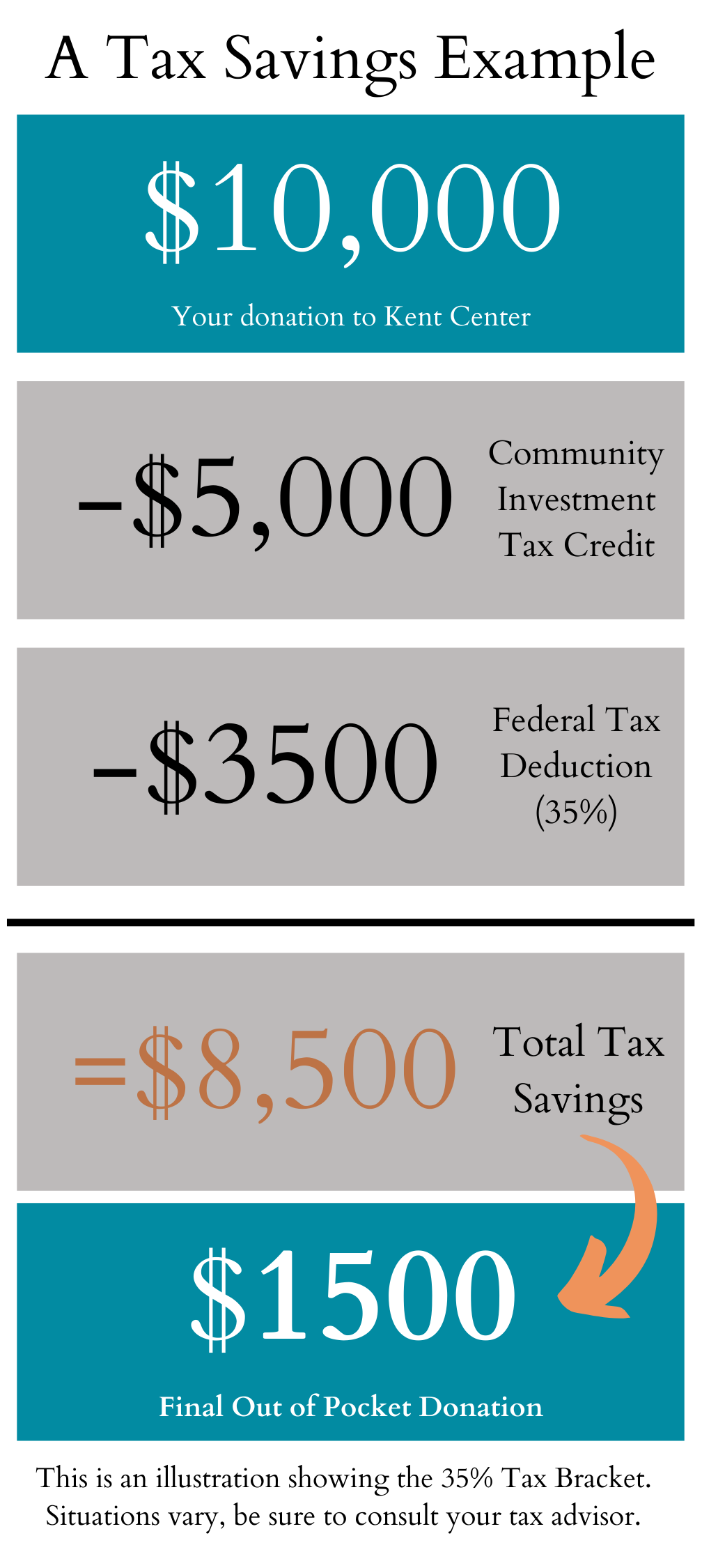

In addition to deductions, there are also tax credits available for seniors in assisted living in New Jersey. These credits directly reduce the amount of taxes owed, providing even more savings for families. One example is the Senior Freeze Property Tax Reimbursement Program, which helps eligible seniors with their property tax bills.Assisted Living Tax Credits in New Jersey

New Jersey also offers tax breaks for families caring for aging parents or relatives. The state's Caregiver Tax Credit allows for a credit of up to $1,000 for eligible caregiving expenses. This can be a great help for families who are taking on the financial responsibility of caring for their loved ones.Assisted Living Tax Breaks in NJ

As mentioned earlier, assisted living room and board expenses are tax deductible in New Jersey. However, it's important to note that this only applies to expenses related to medical care. Any room and board expenses that are deemed to be for personal or social reasons are not eligible for deductions.Assisted Living Room and Board Expenses Tax Deductible in NJ

Seniors who are living in assisted living facilities in New Jersey may also be eligible for additional tax deductions. These include deductions for retirement income, social security benefits, and even charitable donations. It's important for seniors and their families to take advantage of these deductions to maximize their tax savings.Assisted Living Tax Deductions for Seniors in New Jersey

In addition to deductions and credits, there are also some tax write-offs available for seniors in assisted living in New Jersey. These include expenses related to home modifications, such as installing grab bars or wheelchair ramps, that are necessary for aging in place. It's important to keep detailed records of these expenses to ensure they are eligible for write-offs.Assisted Living Tax Write-Offs in NJ

Overall, the various tax deductions, benefits, and credits available in New Jersey can provide significant tax savings for seniors and their families. It's important to carefully review all available options and consult with a tax professional to ensure you are taking full advantage of these savings opportunities.Assisted Living Tax Savings in New Jersey

Maximizing Tax Deductions for Assisted Living Room Board in NJ

Understanding the Benefits of Assisted Living Room Board Tax Deductions

For many families in New Jersey, the cost of assisted living can be a major financial burden. However, there is some good news for those who have a loved one residing in an assisted living facility – room and board expenses may be tax deductible. This can provide some much-needed relief for families who are already struggling with the high cost of care. But how exactly can one go about claiming these deductions and maximizing their benefits?

Assisted Living Room Board

refers to the cost of lodging and meals provided by an assisted living facility for its residents. In New Jersey, these expenses can be considered medical expenses and therefore, may be tax deductible. This is because the state recognizes that the services provided by these facilities are essential for the health and well-being of their residents.

For many families in New Jersey, the cost of assisted living can be a major financial burden. However, there is some good news for those who have a loved one residing in an assisted living facility – room and board expenses may be tax deductible. This can provide some much-needed relief for families who are already struggling with the high cost of care. But how exactly can one go about claiming these deductions and maximizing their benefits?

Assisted Living Room Board

refers to the cost of lodging and meals provided by an assisted living facility for its residents. In New Jersey, these expenses can be considered medical expenses and therefore, may be tax deductible. This is because the state recognizes that the services provided by these facilities are essential for the health and well-being of their residents.

Qualifying for Tax Deductions

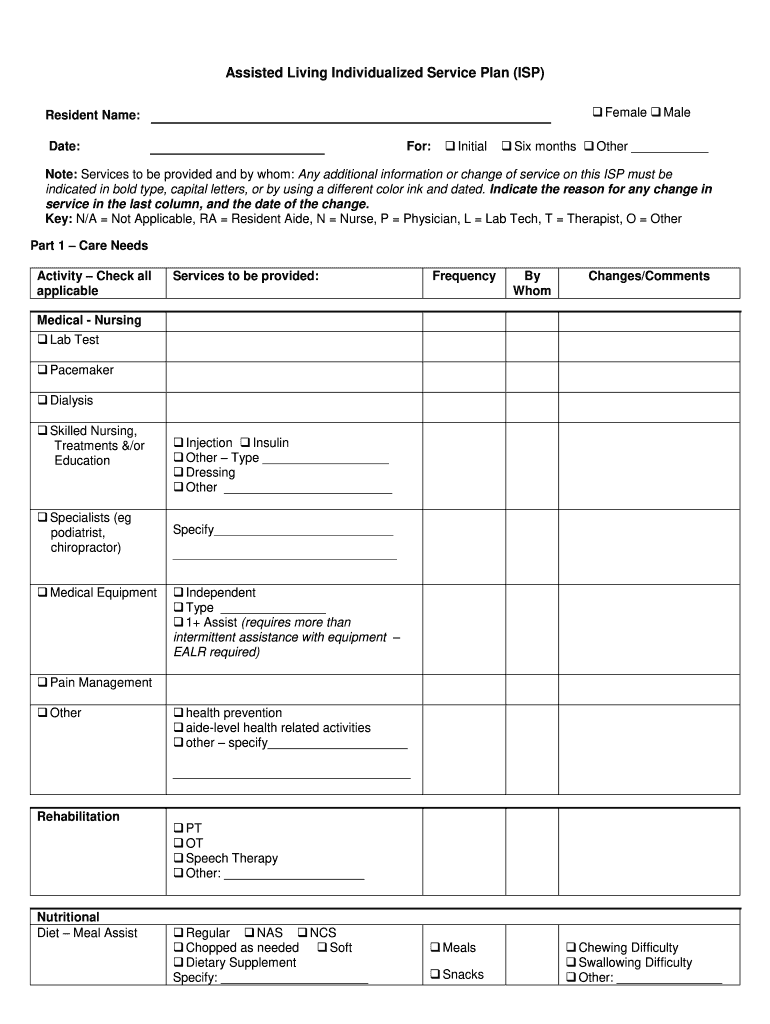

In order to claim

assisted living room board

as a tax deduction, the resident must meet certain criteria. First and foremost, they must have a documented medical need for assisted living care. This can include physical or mental impairments that require assistance with daily activities such as bathing, dressing, and meal preparation. The resident must also be certified by a physician to have lived in the facility for at least 90 days during the tax year.

In order to claim

assisted living room board

as a tax deduction, the resident must meet certain criteria. First and foremost, they must have a documented medical need for assisted living care. This can include physical or mental impairments that require assistance with daily activities such as bathing, dressing, and meal preparation. The resident must also be certified by a physician to have lived in the facility for at least 90 days during the tax year.

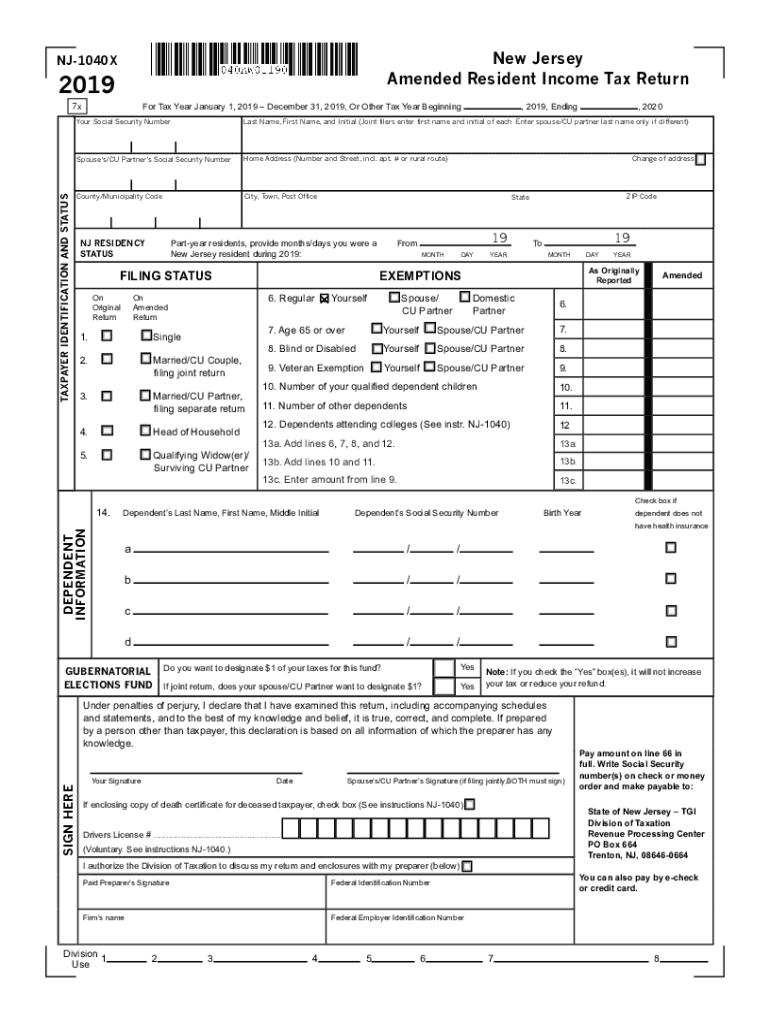

Calculating and Claiming Deductions

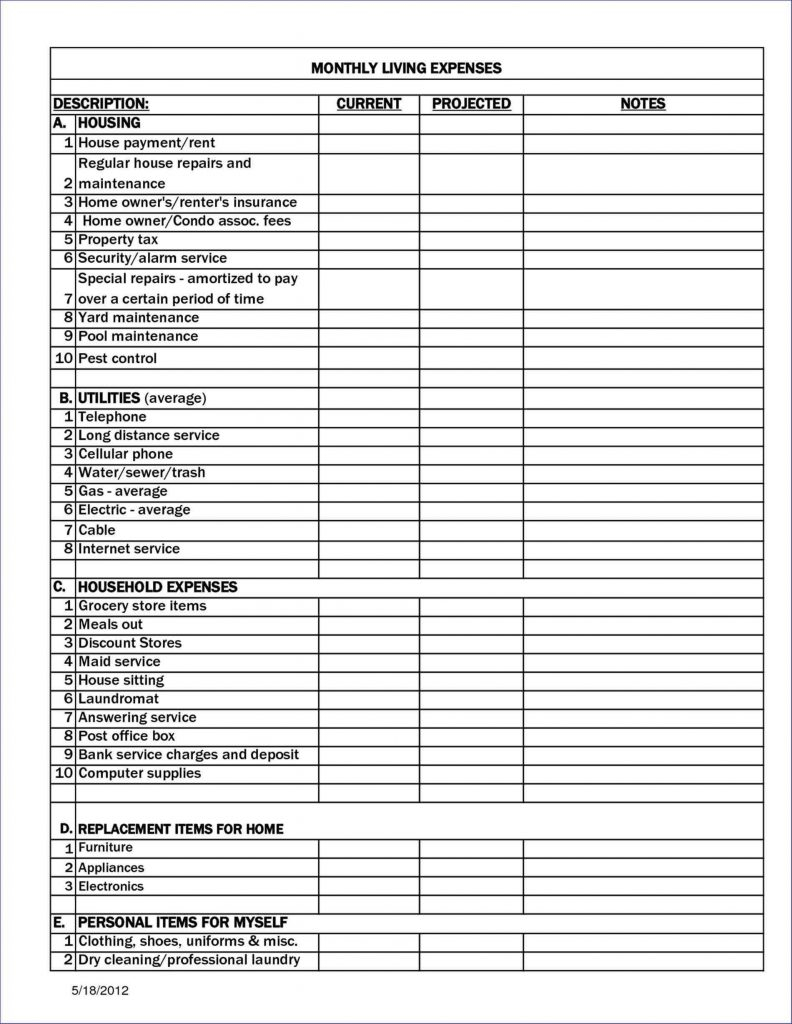

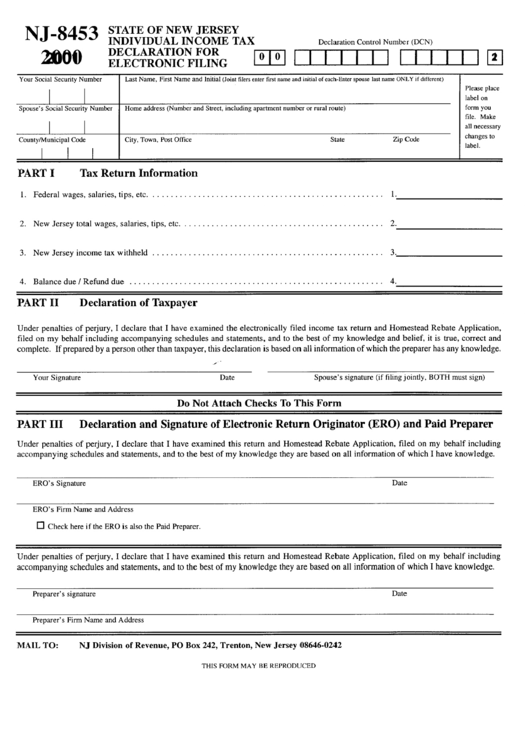

To claim deductions for assisted living room board, the resident or their family must itemize their tax deductions using Form 1040 Schedule A. The amount that can be deducted is the total cost of the resident's room and board, minus any personal expenses such as clothing and toiletries. However, the total amount of medical expenses must exceed 7.5% of the resident's adjusted gross income in order to be deductible.

Maximizing tax deductions

for assisted living room board in NJ also requires proper record-keeping. The resident or their family must keep detailed records of all medical expenses paid, including receipts and invoices from the assisted living facility. This will help ensure that all eligible expenses are accounted for and that the maximum deduction is claimed.

To claim deductions for assisted living room board, the resident or their family must itemize their tax deductions using Form 1040 Schedule A. The amount that can be deducted is the total cost of the resident's room and board, minus any personal expenses such as clothing and toiletries. However, the total amount of medical expenses must exceed 7.5% of the resident's adjusted gross income in order to be deductible.

Maximizing tax deductions

for assisted living room board in NJ also requires proper record-keeping. The resident or their family must keep detailed records of all medical expenses paid, including receipts and invoices from the assisted living facility. This will help ensure that all eligible expenses are accounted for and that the maximum deduction is claimed.

Seeking Professional Advice

Navigating tax deductions for assisted living room board in NJ can be complex and overwhelming. It is always recommended to seek the advice of a professional tax advisor or accountant to ensure that all deductions are claimed accurately and in compliance with state and federal tax laws.

In conclusion, the cost of assisted living in NJ can be a heavy financial burden for families. However, understanding and utilizing tax deductions for assisted living room board can help alleviate some of the financial strain. By meeting the necessary criteria, keeping proper records, and seeking professional advice, families can maximize their tax deductions and receive much-needed relief.

Navigating tax deductions for assisted living room board in NJ can be complex and overwhelming. It is always recommended to seek the advice of a professional tax advisor or accountant to ensure that all deductions are claimed accurately and in compliance with state and federal tax laws.

In conclusion, the cost of assisted living in NJ can be a heavy financial burden for families. However, understanding and utilizing tax deductions for assisted living room board can help alleviate some of the financial strain. By meeting the necessary criteria, keeping proper records, and seeking professional advice, families can maximize their tax deductions and receive much-needed relief.

.jpg?format=1500w)

.jpg)