Donating a Mattress and Box Spring for a Tax Deduction

Donating to charity is not only a way to give back to your community, but it can also provide you with tax benefits. While many people know that they can write off donations of clothing and household items, not everyone is aware that they can also receive tax deductions for donating a mattress and box spring.

How to Donate a Mattress for a Tax Write-Off

If you have a mattress and box spring that you no longer need or want, consider donating it to a charitable organization. This can not only help someone in need, but it can also benefit you during tax season. To donate a mattress for a tax write-off, follow these steps:

Charitable Donation Tax Deduction for Mattresses and Box Springs

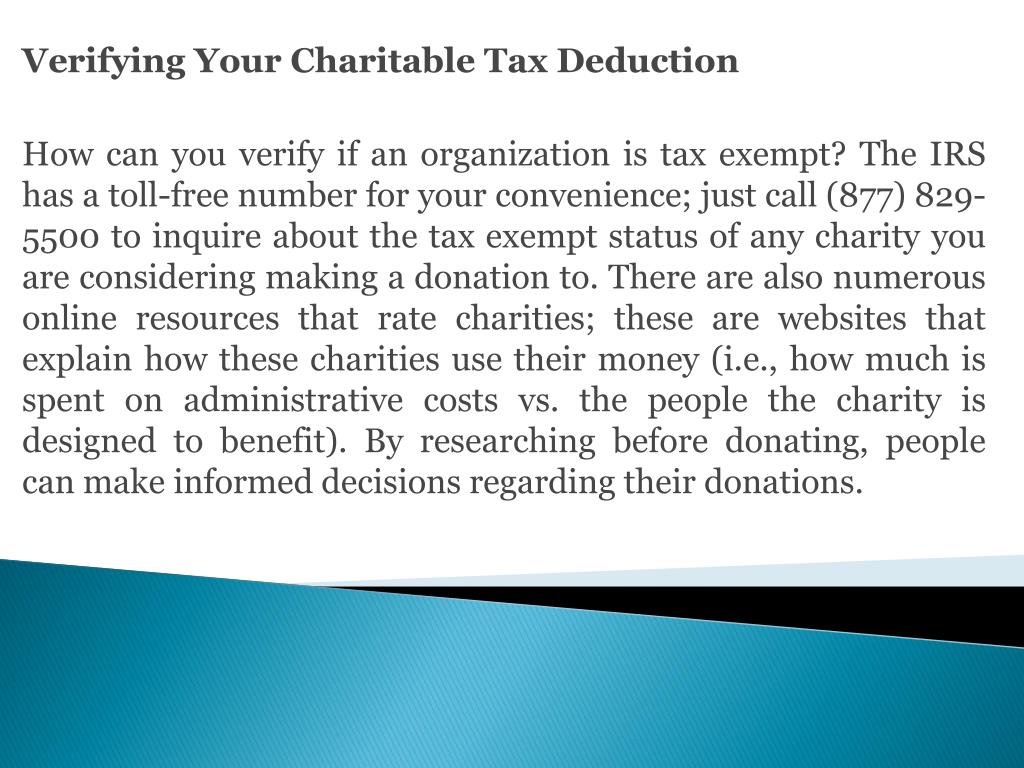

According to the IRS, you can claim a tax deduction for donations of mattresses and box springs if they are in good, usable condition. The amount you can deduct will depend on the fair market value of the items. If you are unsure of the value, you can use the Salvation Army's donation value guide as a reference.

Maximizing Your Tax Write-Off for Donating a Mattress and Box Spring

If you want to maximize your tax write-off for donating a mattress and box spring, consider donating to a non-profit organization that directly benefits the community. Some charities may sell donated items at a discounted price, while others may distribute them to individuals or families in need at no cost. By donating to a charity that directly benefits the community, you may be eligible for a larger tax deduction.

IRS Guidelines for Donating a Mattress and Box Spring for a Tax Deduction

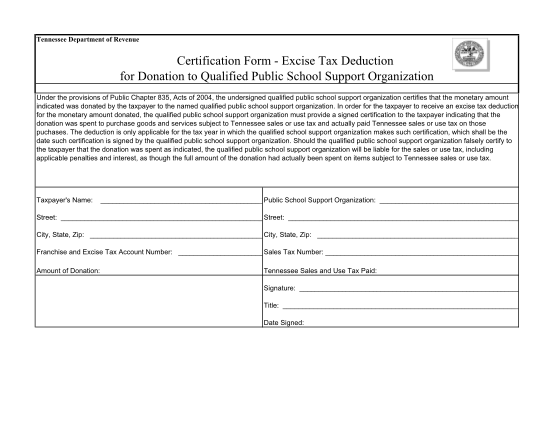

When claiming a tax deduction for donating a mattress and box spring, it is important to follow the IRS guidelines. These include:

Tax Benefits of Donating a Mattress and Box Spring to Charity

Aside from the tax deduction, there are other tax benefits to donating a mattress and box spring to charity. These include:

Claiming a Tax Deduction for Donating a Mattress and Box Spring

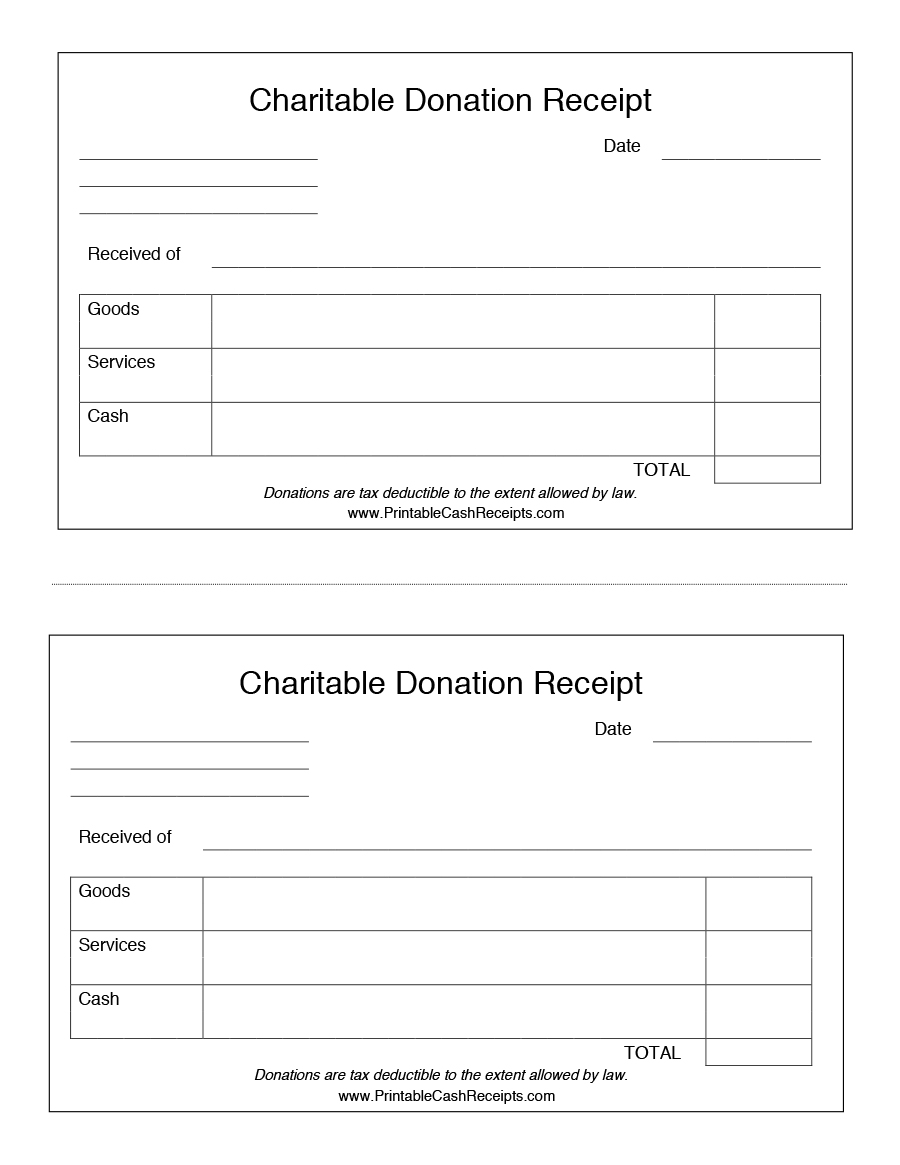

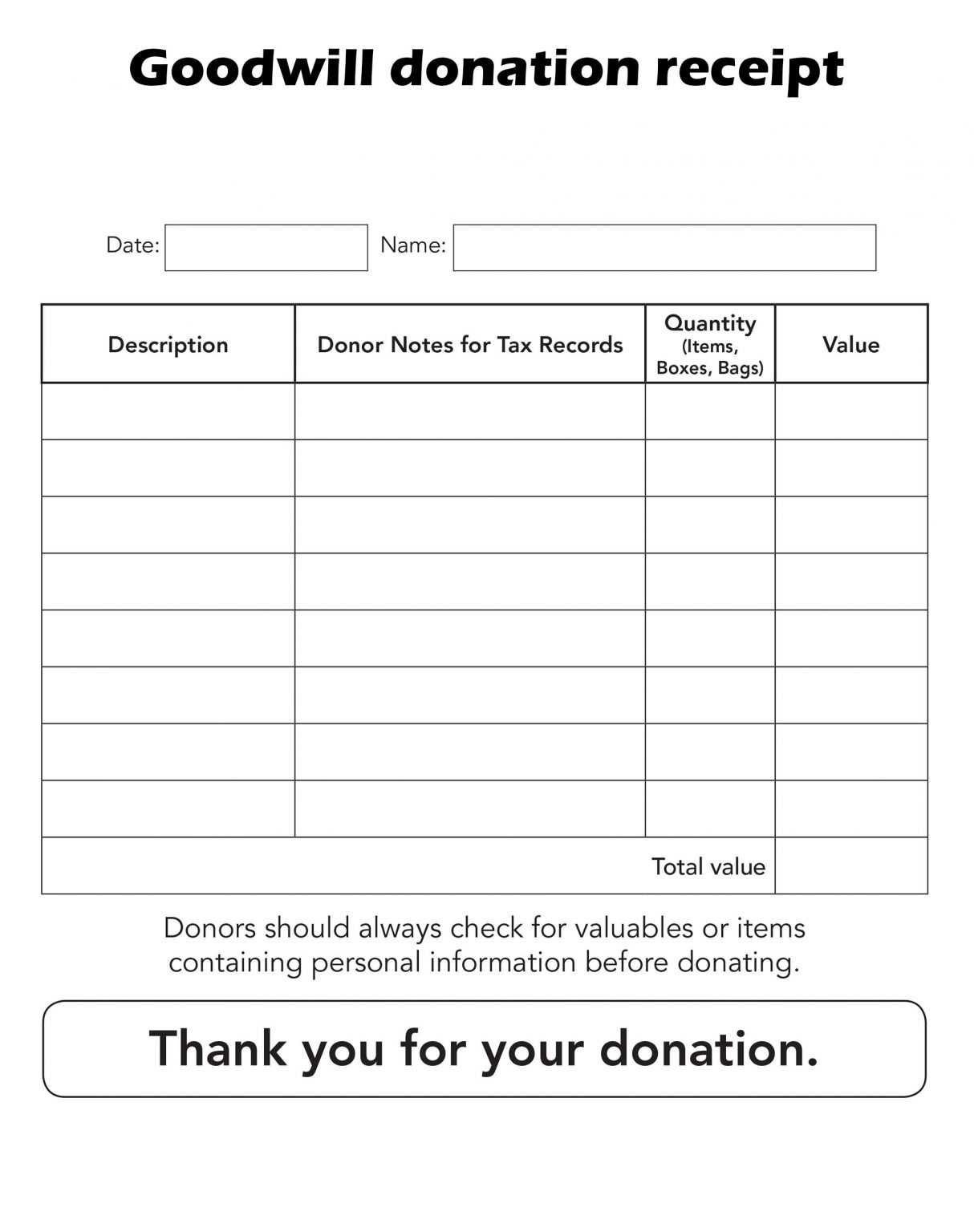

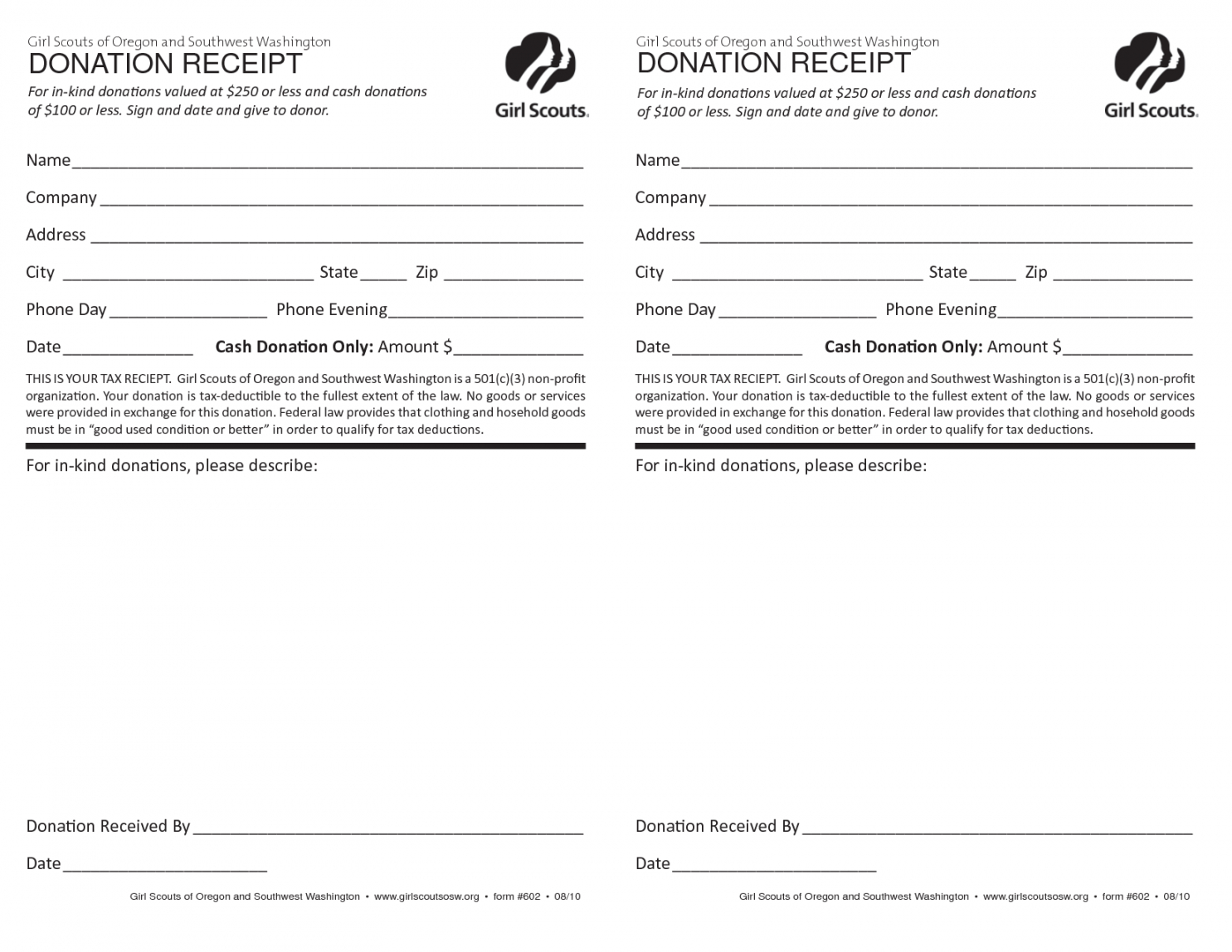

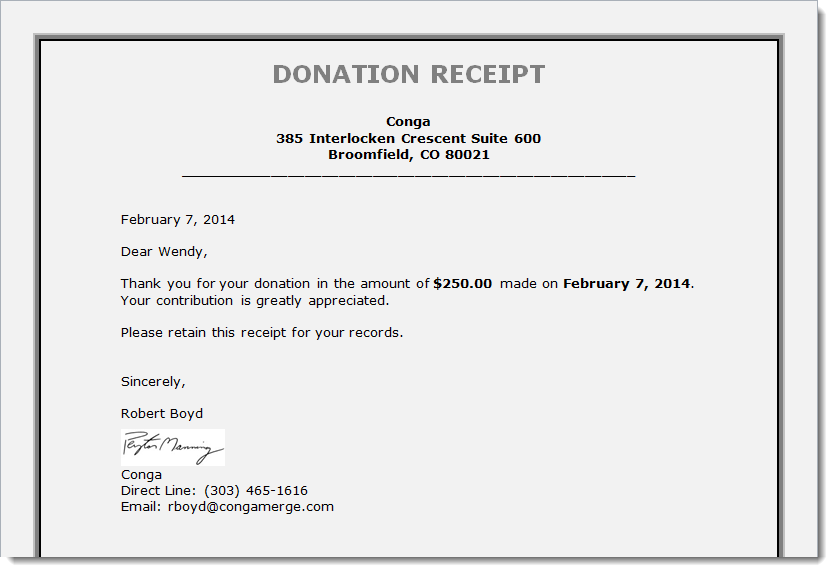

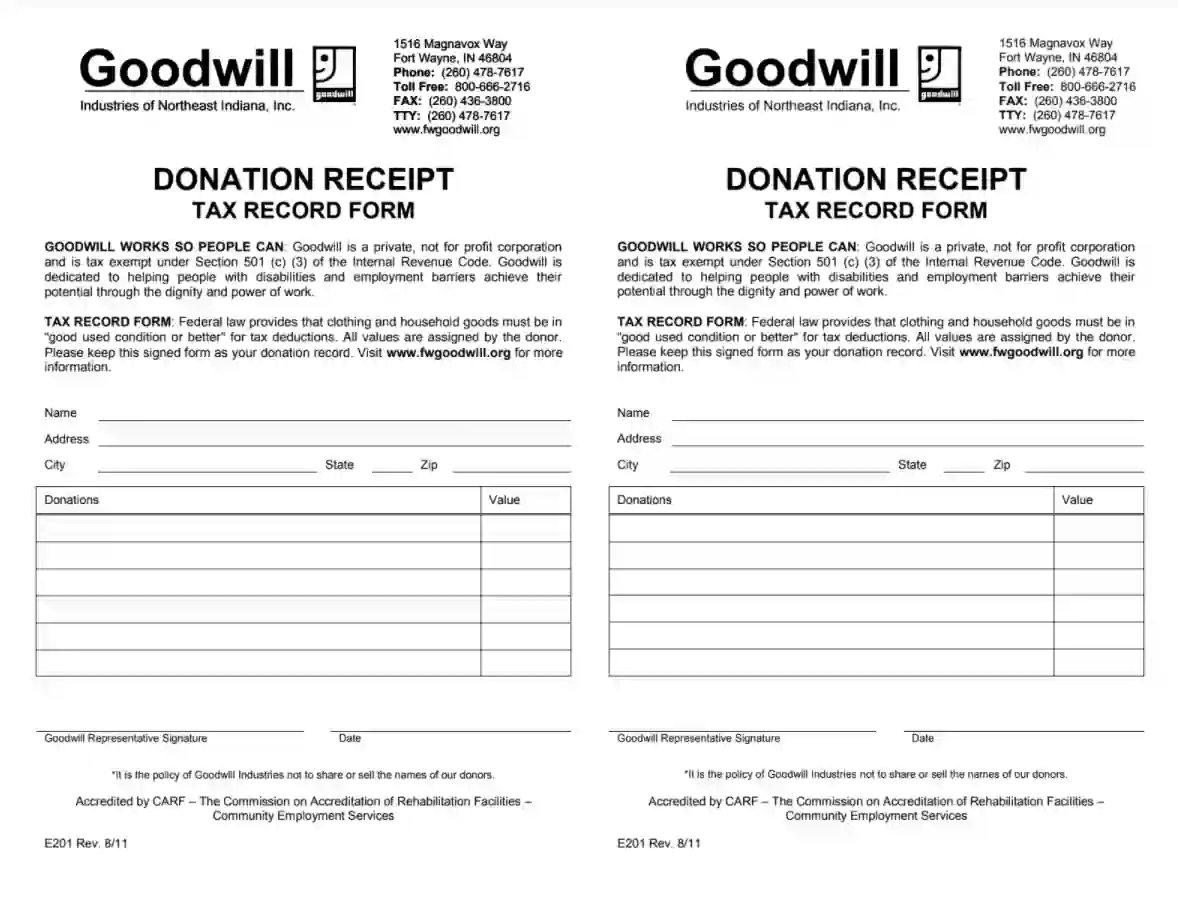

When it comes time to file your taxes, you will need to claim your deduction for donating a mattress and box spring. This can be done by filling out the appropriate tax forms and providing documentation of your donation, such as a receipt from the charity.

How to Determine the Value of Your Donated Mattress and Box Spring for Tax Purposes

In order to claim a tax deduction for donating a mattress and box spring, you must determine their fair market value. This can be done by researching the value of similar items in your area, using online valuation tools, or consulting with a tax professional.

Donating a Mattress and Box Spring to a Non-Profit Organization for a Tax Write-Off

Donating to a non-profit organization is a great way to give back to your community and receive a tax write-off for your generosity. By donating a mattress and box spring to a non-profit, you are not only helping those in need, but you are also reducing your tax burden.

Tips for Donating a Mattress and Box Spring for a Tax Deduction

To ensure that you receive the maximum tax deduction for your donation, keep these tips in mind:

The Benefits of Donating Your Old Mattress and Springs for a Tax Write-Off

Why Donate Instead of Discard?

When it's time to upgrade your mattress and springs, you may be wondering what to do with your old ones. Instead of simply tossing them to the curb, consider donating them to a charitable organization. Not only does this help those in need, but it can also benefit you in the form of a tax write-off. By donating your old mattress and springs, you can declutter your home, help the environment, and potentially save money on your taxes.

When it's time to upgrade your mattress and springs, you may be wondering what to do with your old ones. Instead of simply tossing them to the curb, consider donating them to a charitable organization. Not only does this help those in need, but it can also benefit you in the form of a tax write-off. By donating your old mattress and springs, you can declutter your home, help the environment, and potentially save money on your taxes.

Declutter and Do Good

Donating your old mattress and springs is a great way to declutter your home while also doing some good. Many organizations, such as homeless shelters and charities, are in need of gently used mattresses and springs. By donating them, you can help provide a comfortable and safe place for someone in need to sleep. This not only helps individuals, but it also benefits the community as a whole by reducing the number of items that end up in landfills.

Related Keyword: Charitable Organizations

Donating your old mattress and springs is a great way to declutter your home while also doing some good. Many organizations, such as homeless shelters and charities, are in need of gently used mattresses and springs. By donating them, you can help provide a comfortable and safe place for someone in need to sleep. This not only helps individuals, but it also benefits the community as a whole by reducing the number of items that end up in landfills.

Related Keyword: Charitable Organizations

Environmental Impact

Did you know that mattresses and springs can take up to 20 years to decompose in a landfill? By donating them, you are preventing these items from taking up valuable space in the environment. Additionally, the materials used in mattresses and springs, such as metal and foam, can be recycled and repurposed for other items. This reduces the need for new materials and helps reduce our carbon footprint.

Related Keyword: Recycling

Did you know that mattresses and springs can take up to 20 years to decompose in a landfill? By donating them, you are preventing these items from taking up valuable space in the environment. Additionally, the materials used in mattresses and springs, such as metal and foam, can be recycled and repurposed for other items. This reduces the need for new materials and helps reduce our carbon footprint.

Related Keyword: Recycling

Tax Benefits

One of the biggest benefits of donating your old mattress and springs is the potential tax write-off. When you donate to a qualified charitable organization, you can deduct the fair market value of the items on your tax return. This can help offset the cost of your new mattress and springs, making it a more affordable upgrade. Just be sure to keep all documentation and receipts for your donation for tax purposes.

Featured Keyword: Tax Write-Off

One of the biggest benefits of donating your old mattress and springs is the potential tax write-off. When you donate to a qualified charitable organization, you can deduct the fair market value of the items on your tax return. This can help offset the cost of your new mattress and springs, making it a more affordable upgrade. Just be sure to keep all documentation and receipts for your donation for tax purposes.

Featured Keyword: Tax Write-Off

How to Donate

To ensure that your donation is eligible for a tax write-off, be sure to donate to a qualified charitable organization. This can include local homeless shelters, furniture banks, or other charities that accept mattress and spring donations. You can also check with your local tax office for a list of qualified organizations. Some organizations may even offer pick-up services for larger items, making the donation process even easier.

Related Keyword: Furniture Banks

To ensure that your donation is eligible for a tax write-off, be sure to donate to a qualified charitable organization. This can include local homeless shelters, furniture banks, or other charities that accept mattress and spring donations. You can also check with your local tax office for a list of qualified organizations. Some organizations may even offer pick-up services for larger items, making the donation process even easier.

Related Keyword: Furniture Banks

In conclusion, donating your old mattress and springs is a win-win situation. Not only do you declutter your home and help those in need, but you also make a positive impact on the environment and potentially save money on your taxes. So, next time you're ready to upgrade your mattress and springs, consider donating them for a good cause and reap the benefits.

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)