Synchrony Financial is a premier consumer financial services company that provides a wide range of customized financing programs for various industries, including the retail sector. With over 85 years of experience, Synchrony Financial has become a trusted partner for businesses and consumers alike.Synchrony Financial: The Leading Provider of Consumer Financing

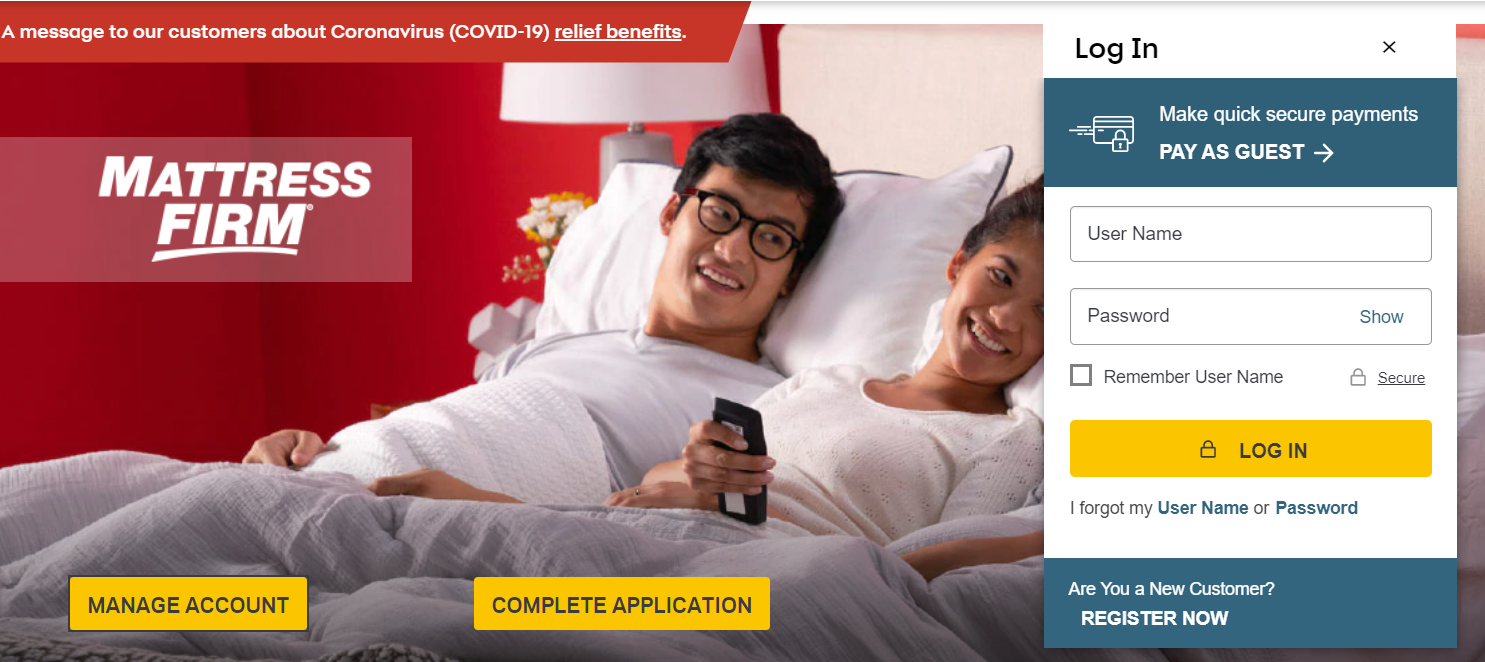

Mattress Firm is one of the largest mattress retailers in the United States, offering a wide selection of mattresses, bedding, and other sleep accessories. With over 3,500 stores nationwide, Mattress Firm is a household name in the mattress industry, known for its quality products and exceptional customer service.Mattress Firm: A Household Name in the Mattress Industry

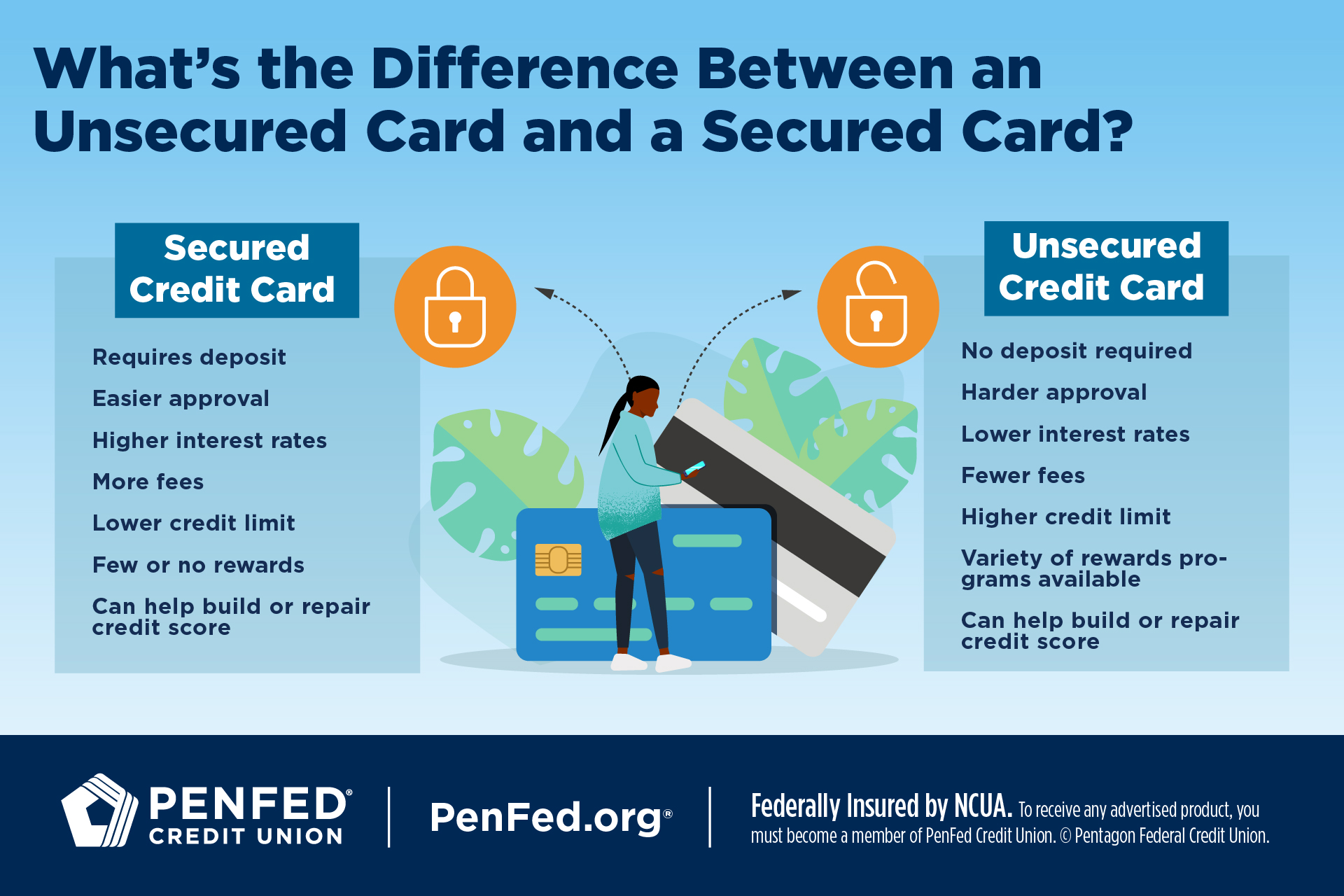

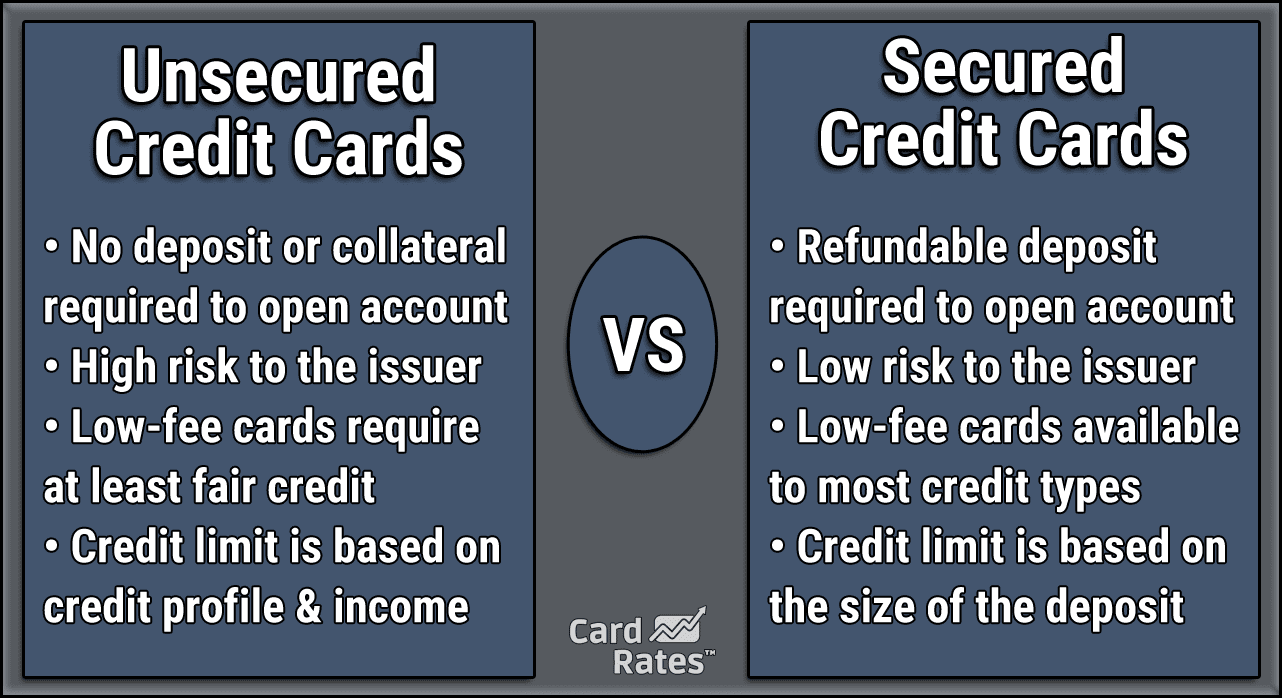

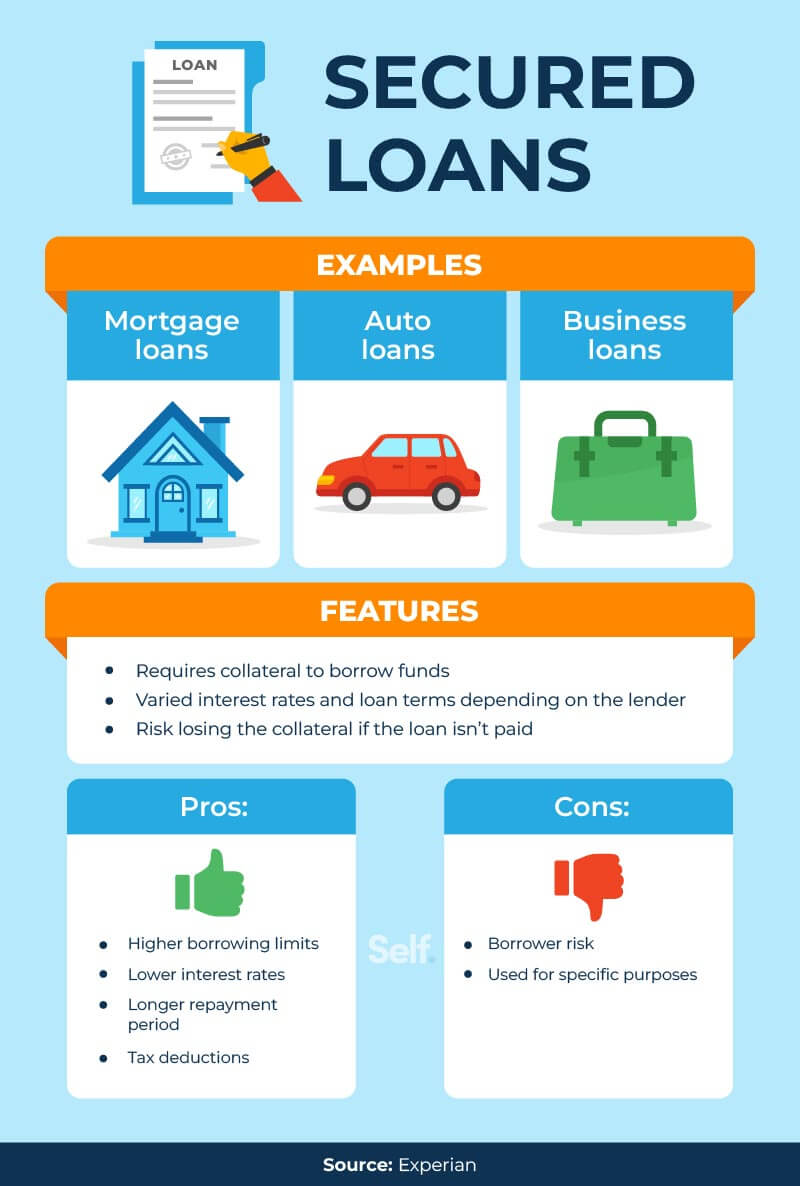

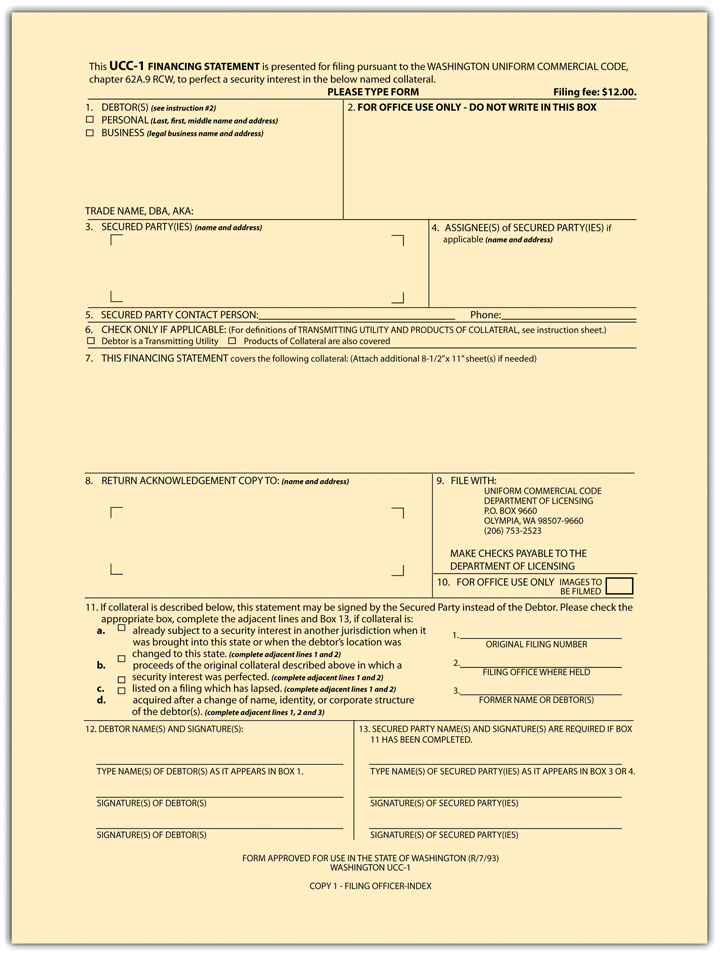

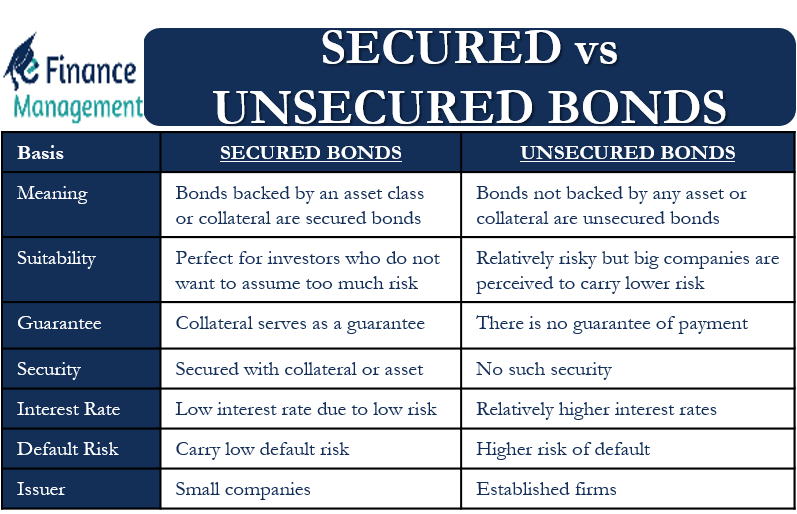

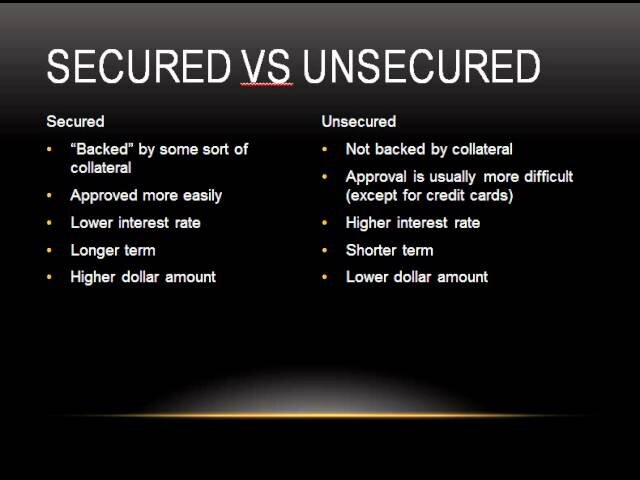

Secured financing is a type of loan or credit that requires collateral, such as a property or a valuable asset, to secure the debt. This type of financing is considered a safe and reliable option for both lenders and borrowers as it minimizes the risk of default.Secured Financing: A Safe and Reliable Option

Non-secured financing, also known as unsecured financing, does not require any collateral to secure the debt. This type of financing is a convenient alternative for those who do not have valuable assets to offer as collateral.Non-Secured Financing: A Convenient Alternative

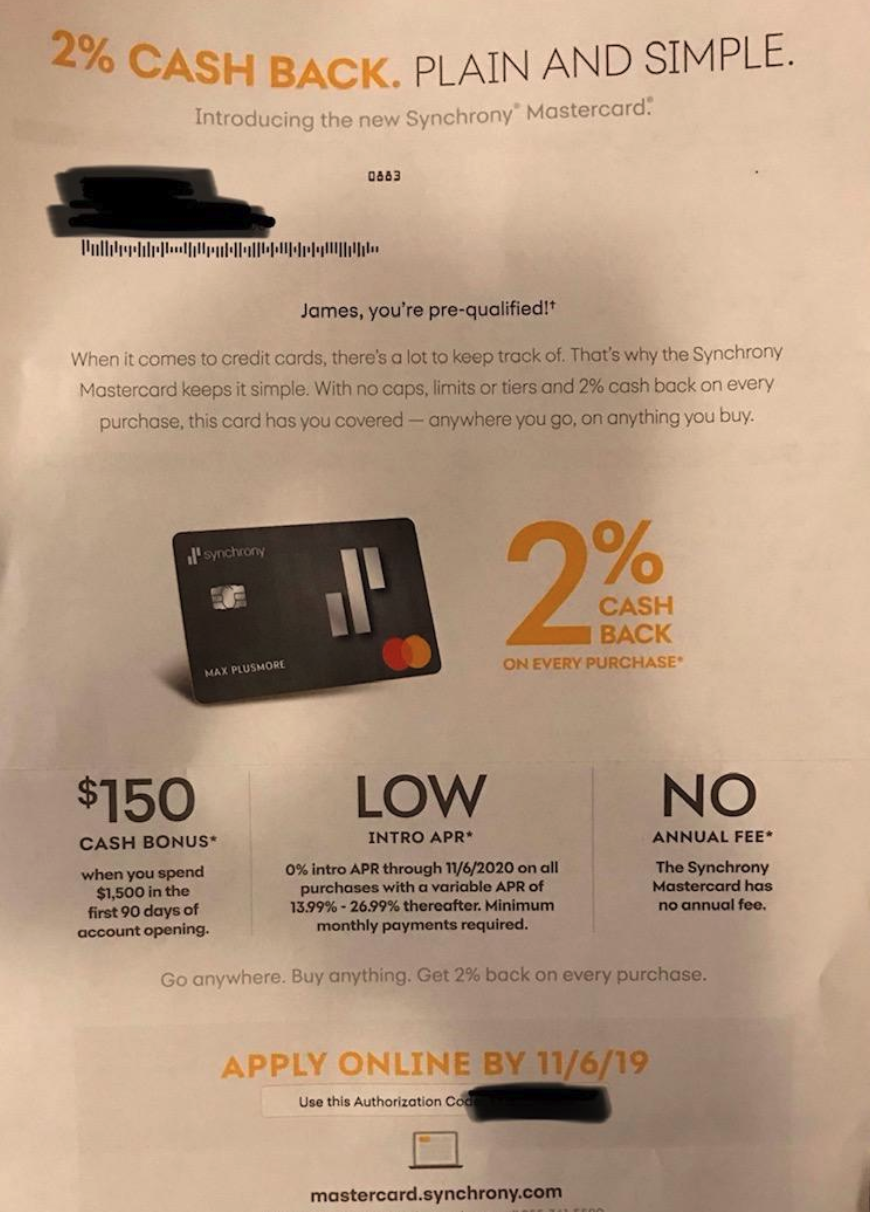

Synchrony Bank is a subsidiary of Synchrony Financial and is the issuer of the popular Synchrony credit card. With a focus on providing flexible and convenient financing options, Synchrony Bank has become a go-to for consumers looking for easy payment solutions.Synchrony Bank: Your Trusted Partner for Financing Needs

With the rising cost of living, it can be challenging to purchase a new mattress outright. That's where mattress financing comes in. Mattress financing allows customers to spread the cost of their purchase over time, making quality sleep more accessible and affordable.Mattress Financing: Making Quality Sleep Affordable

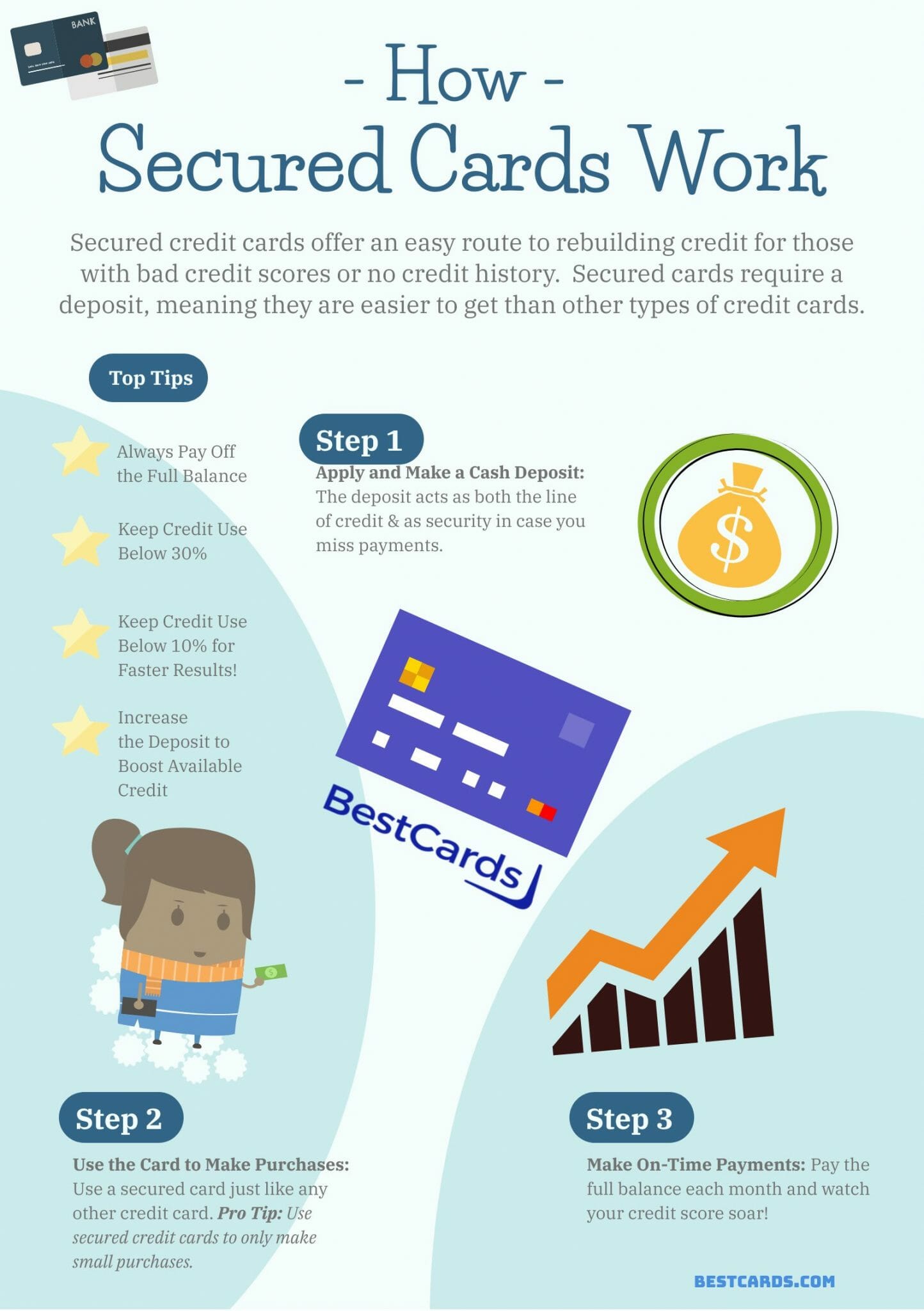

A secured credit card is a credit card that requires a cash deposit as collateral. This deposit serves as a security against the credit limit and is typically equal to the credit limit. Secured credit cards are a great way for individuals with no or poor credit to build their credit score.Secured Credit Card: A Great Way to Build Credit

Non-secured credit cards, also known as unsecured credit cards, do not require any collateral to secure the credit limit. These types of credit cards are ideal for individuals with established credit who can qualify for higher credit limits and better rewards and benefits.Non-Secured Credit Card: Ideal for Those with Established Credit

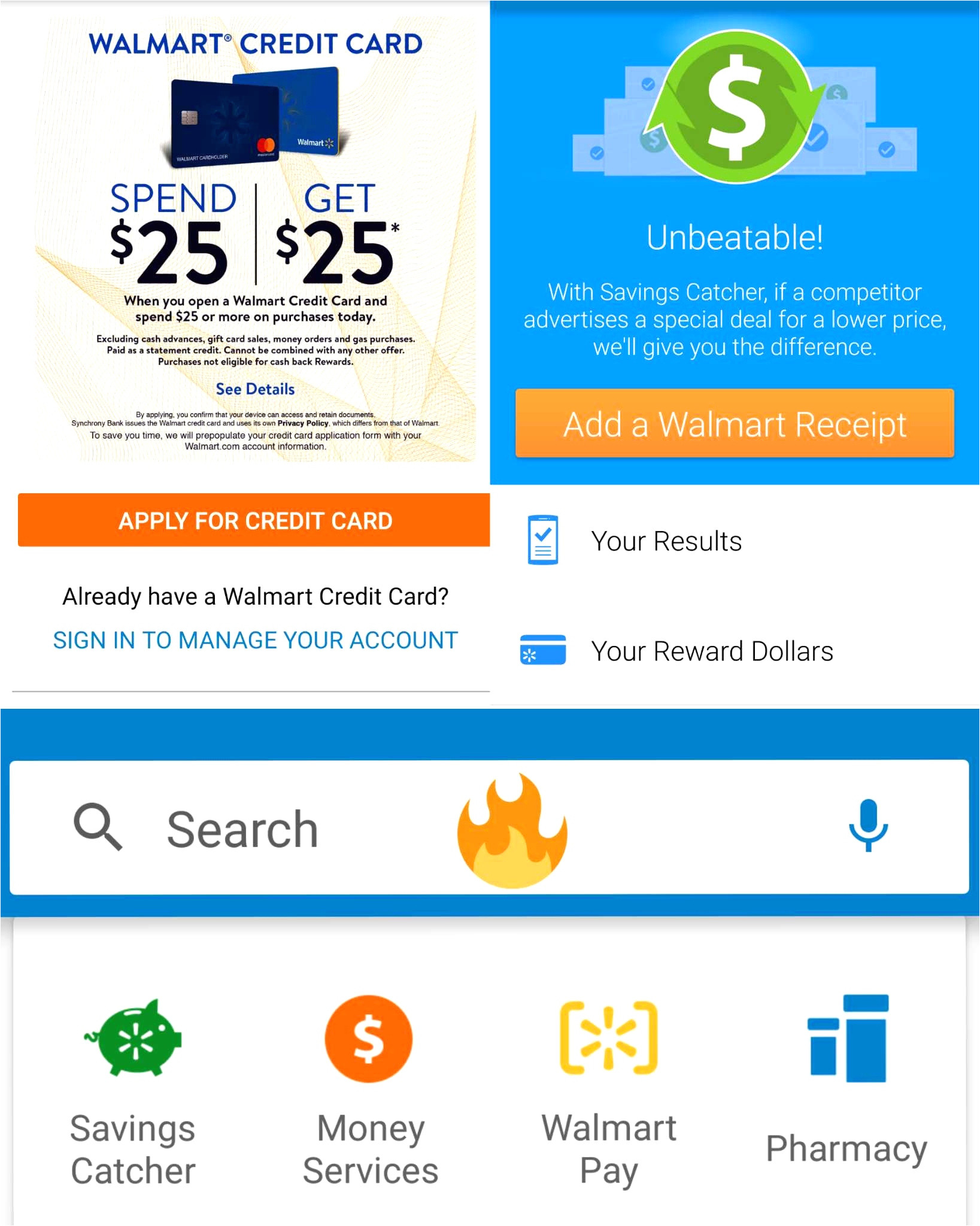

Synchrony credit cards, such as the Mattress Firm credit card, are a popular choice for customers looking for a flexible and convenient payment solution. With special financing options, rewards, and other benefits, Synchrony credit cards have become a go-to for many consumers.Synchrony Credit Card: The Ultimate Payment Solution

With the variety of financing and payment options available, you can choose what works best for you when purchasing a new mattress. Whether it's through a Synchrony credit card, secured or non-secured financing, or other payment methods, you can find a solution that fits your budget and needs.Mattress Payment Options: Choose What Works Best for You

Synchrony Mattress Firm: Secured or Non-Secured?

Introduction

When it comes to choosing a new mattress, there are many factors to consider, such as comfort, support, and durability. However, one aspect that often gets overlooked is the security of the mattress. A secure mattress not only provides a sense of safety and peace of mind, but it also ensures a longer lifespan for your investment. In this article, we will explore the differences between secured and non-secured mattresses, specifically focusing on the Synchrony Mattress Firm.

When it comes to choosing a new mattress, there are many factors to consider, such as comfort, support, and durability. However, one aspect that often gets overlooked is the security of the mattress. A secure mattress not only provides a sense of safety and peace of mind, but it also ensures a longer lifespan for your investment. In this article, we will explore the differences between secured and non-secured mattresses, specifically focusing on the Synchrony Mattress Firm.

Secured Mattresses

Secured mattresses are designed with durability in mind. They are constructed with high-quality materials and reinforced with additional layers to provide a sturdy and long-lasting product. These mattresses are perfect for those who are looking for a reliable and secure option for their sleep needs. The Synchrony Mattress Firm offers a range of secured mattresses that come with various features to suit different preferences and needs.

One of the key features of a secured mattress is its strong edge support. This means that the edges of the mattress are reinforced to prevent sagging or sinking, allowing for a comfortable and stable sleeping surface. This is especially beneficial for couples who share a bed, as it minimizes motion transfer and provides a larger usable sleeping area.

Another advantage of secured mattresses is their ability to maintain their shape and support over time. This is achieved through the use of high-density foam and sturdy coils, providing consistent and reliable support for years to come. Additionally, secured mattresses are less prone to wear and tear, making them a great investment for those looking for a long-term solution.

Secured mattresses are designed with durability in mind. They are constructed with high-quality materials and reinforced with additional layers to provide a sturdy and long-lasting product. These mattresses are perfect for those who are looking for a reliable and secure option for their sleep needs. The Synchrony Mattress Firm offers a range of secured mattresses that come with various features to suit different preferences and needs.

One of the key features of a secured mattress is its strong edge support. This means that the edges of the mattress are reinforced to prevent sagging or sinking, allowing for a comfortable and stable sleeping surface. This is especially beneficial for couples who share a bed, as it minimizes motion transfer and provides a larger usable sleeping area.

Another advantage of secured mattresses is their ability to maintain their shape and support over time. This is achieved through the use of high-density foam and sturdy coils, providing consistent and reliable support for years to come. Additionally, secured mattresses are less prone to wear and tear, making them a great investment for those looking for a long-term solution.

Non-Secured Mattresses

On the other hand, non-secured mattresses may offer initial comfort, but they lack the sturdiness and durability of secured mattresses. These mattresses are often made with lower quality materials and may have less reinforcement in their construction. This can lead to sagging, sinking, and a shorter lifespan for the mattress.

One of the main drawbacks of non-secured mattresses is their lack of edge support. This can cause the edges of the mattress to sink or collapse, making it difficult to sit or sleep comfortably near the edges. Additionally, non-secured mattresses are more prone to wear and tear, and their support may deteriorate over time, resulting in a less comfortable sleeping surface.

On the other hand, non-secured mattresses may offer initial comfort, but they lack the sturdiness and durability of secured mattresses. These mattresses are often made with lower quality materials and may have less reinforcement in their construction. This can lead to sagging, sinking, and a shorter lifespan for the mattress.

One of the main drawbacks of non-secured mattresses is their lack of edge support. This can cause the edges of the mattress to sink or collapse, making it difficult to sit or sleep comfortably near the edges. Additionally, non-secured mattresses are more prone to wear and tear, and their support may deteriorate over time, resulting in a less comfortable sleeping surface.

The Synchrony Mattress Firm: Secured Options

As mentioned earlier, the Synchrony Mattress Firm offers a variety of secured mattresses to cater to different needs and preferences. Their flagship model, the Synchrony Plush, features a reinforced edge support system and high-density foam for added durability. The Synchrony Euro Top also offers strong edge support and uses gel-infused memory foam for enhanced comfort.

In conclusion, when it comes to choosing a mattress, it is important to consider not just the comfort and support it provides, but also its security and durability. Secured mattresses, such as those offered by the Synchrony Mattress Firm, provide a reliable and long-lasting option for a good night's sleep. Make sure to carefully consider your options and invest in a mattress that will keep you secure and comfortable for years to come.

As mentioned earlier, the Synchrony Mattress Firm offers a variety of secured mattresses to cater to different needs and preferences. Their flagship model, the Synchrony Plush, features a reinforced edge support system and high-density foam for added durability. The Synchrony Euro Top also offers strong edge support and uses gel-infused memory foam for enhanced comfort.

In conclusion, when it comes to choosing a mattress, it is important to consider not just the comfort and support it provides, but also its security and durability. Secured mattresses, such as those offered by the Synchrony Mattress Firm, provide a reliable and long-lasting option for a good night's sleep. Make sure to carefully consider your options and invest in a mattress that will keep you secure and comfortable for years to come.

.jpg)

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

/synchrony_inv-04e10bc2d0ce451b932c26efc2c62fdf.png)

/DiscoveritSecured-5a6f549f8e1b6e00378a25dd.jpg)