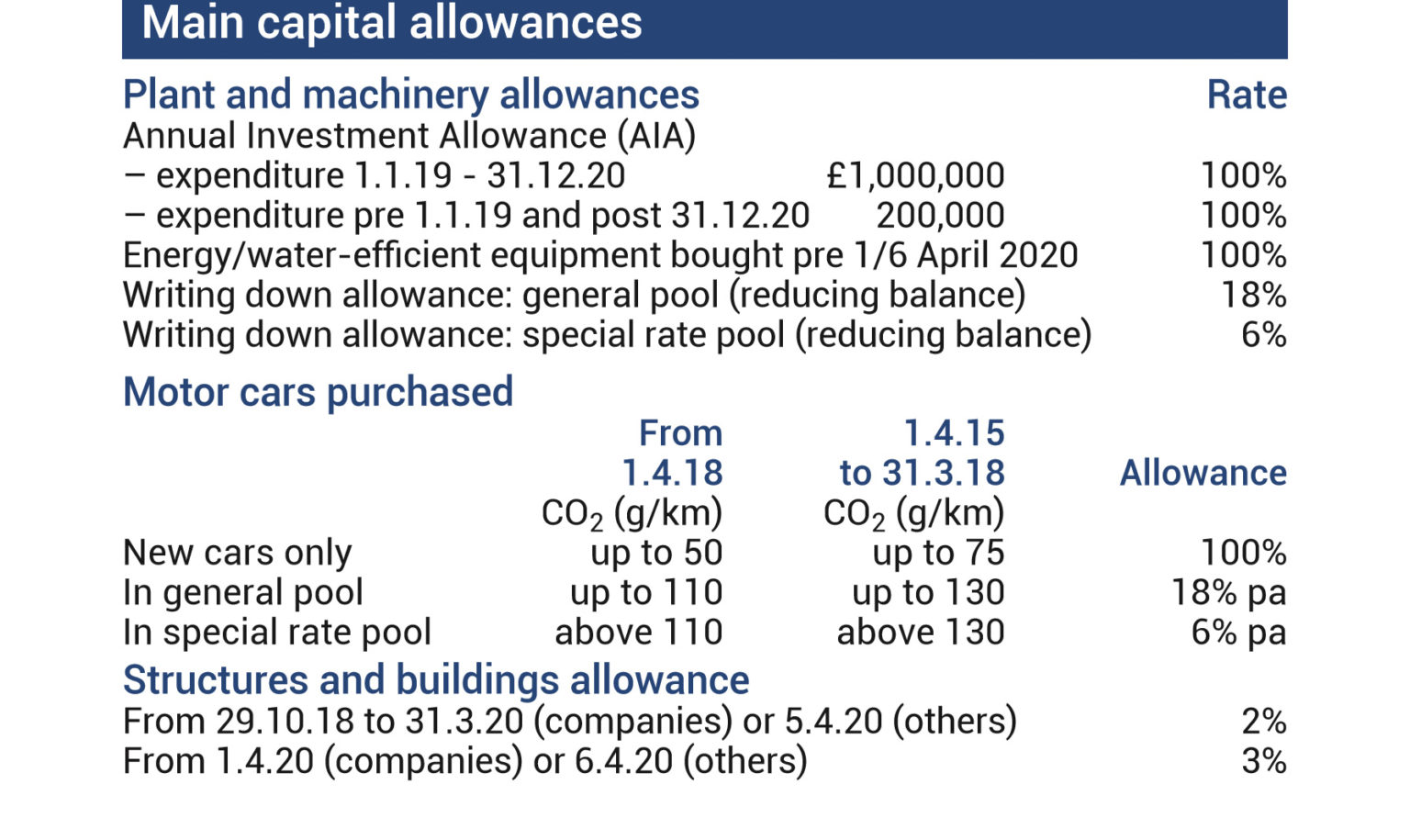

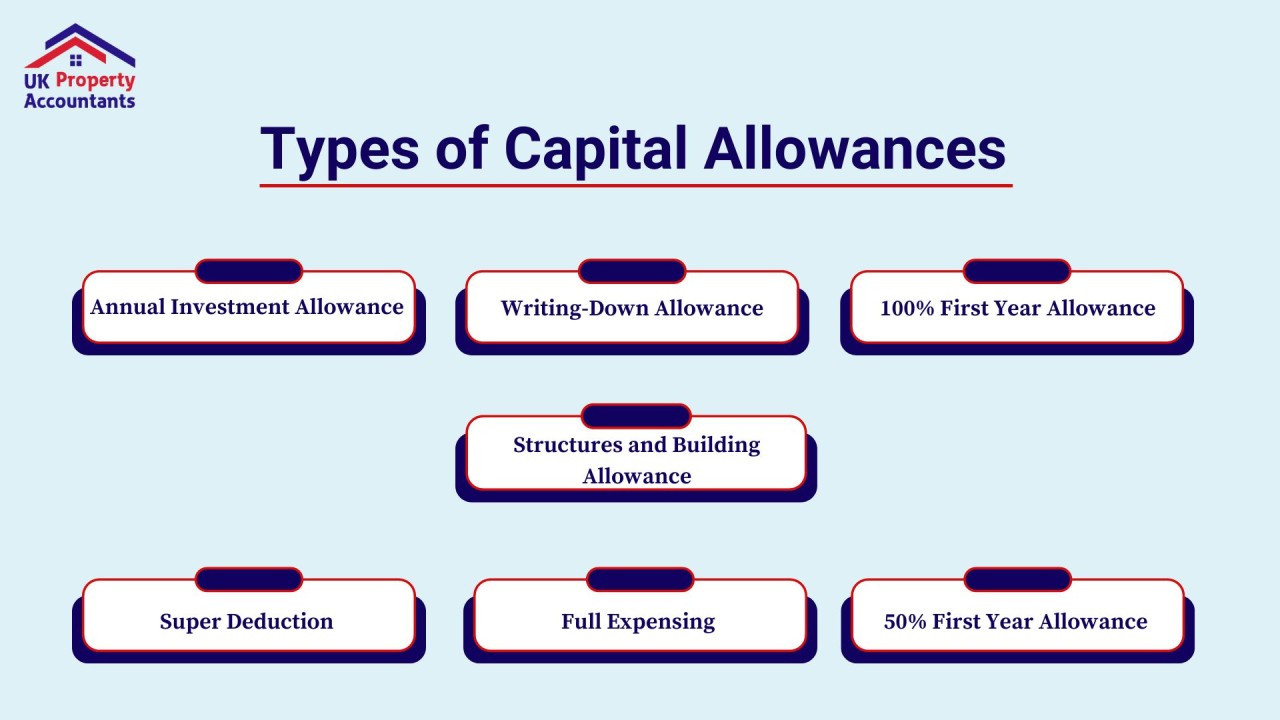

Plant and machinery are essential assets for any business, and the government offers capital allowances to offset the cost of acquiring and using them. These allowances allow businesses to deduct a portion of the cost from their taxable profits, reducing their tax bill. The list of qualifying items is extensive, and it includes not just the obvious equipment like computers and vehicles but also items like furniture, tools, and even certain fixtures and fittings. Businesses can claim the Annual Investment Allowance (AIA), which allows them to deduct up to £1 million from their profits in a single year, for most plant and machinery purchases. This has been temporarily increased from £200,000 to help stimulate business investment in light of the COVID-19 pandemic. For larger items, businesses can claim Capital Allowances on Plant and Machinery (FYAs), which allow for a higher rate of deduction.Capital Allowances for Plant and Machinery

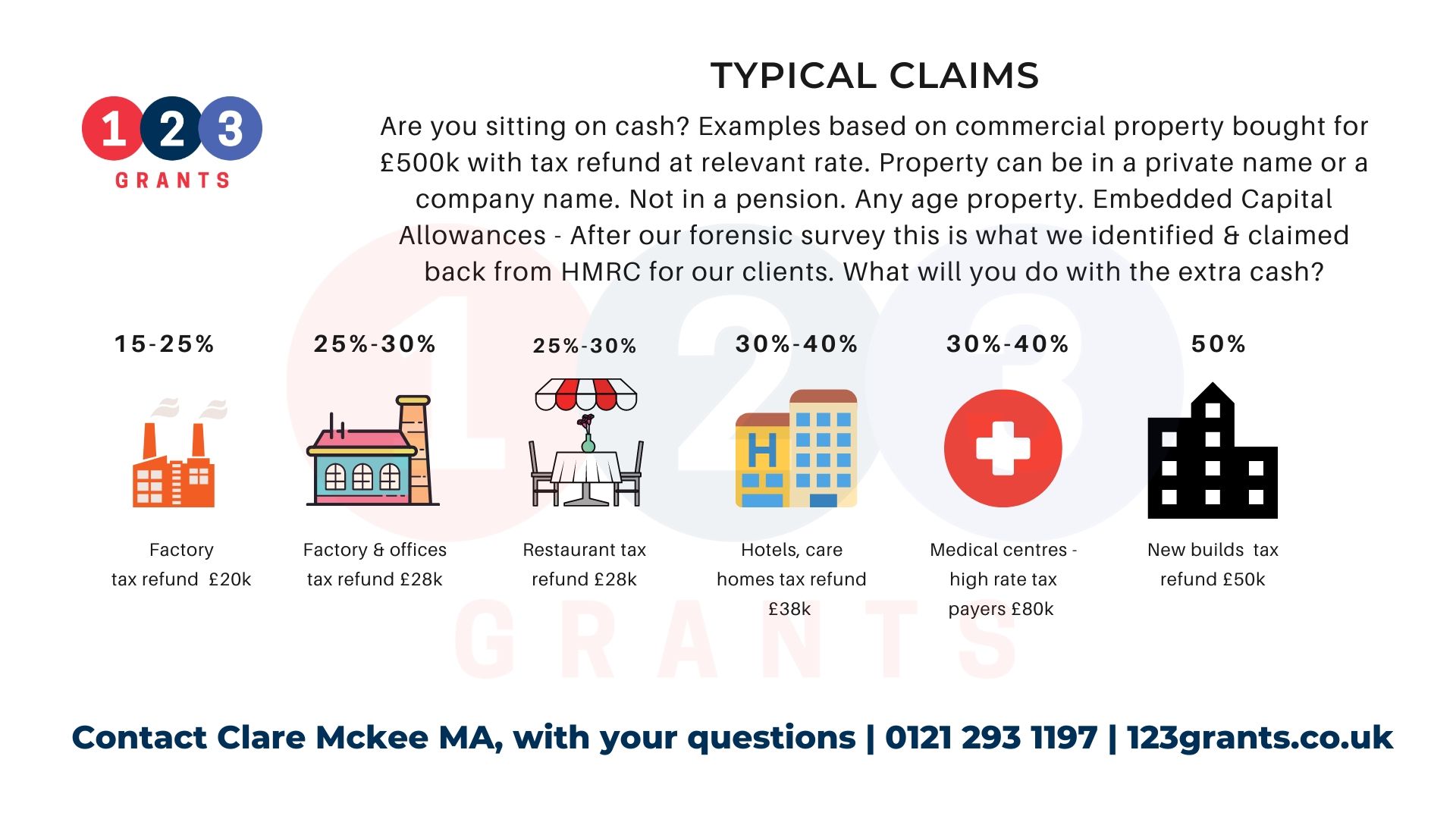

Capital allowances are also available for the cost of acquiring, constructing or improving business premises. These include commercial buildings, offices, and even rental properties. The main allowances for business premises are Business Premises Renovation Allowances (BPRAs), which are available for the renovation or conversion of non-residential buildings that have been unused for at least one year. This allows for a 100% deduction of the costs incurred. Another type of allowance is the Industrial Buildings Allowances (IBAs), which are available for the construction or renovation of industrial and agricultural buildings. This allows for a 4% deduction of the costs per year for 25 years.Capital Allowances for Business Premises

With the increasing focus on sustainability and energy efficiency, the government offers capital allowances for businesses that invest in energy-saving equipment. These include items like solar panels, wind turbines, and energy-efficient lighting and heating systems. The Enhanced Capital Allowances (ECAs) allow businesses to deduct the full cost of these items from their taxable profits in the year of purchase, providing a significant tax relief.Capital Allowances for Energy Saving Equipment

Research and development (R&D) is essential for innovation and growth in businesses, and the government offers capital allowances to encourage it. These allowances are available for expenses incurred in developing new products, processes, or services. The R&D Allowances allow for a 100% deduction of the costs incurred, providing a significant tax relief for businesses investing in R&D.Capital Allowances for Research and Development

Agricultural businesses can also benefit from capital allowances on the construction or renovation of agricultural buildings, such as barns and silos. The Agricultural Buildings Allowances (ABAs) allow for a 4% deduction of the costs per year for 25 years. These allowances are available for both farmers and landlords who rent out agricultural buildings.Capital Allowances for Agricultural Buildings

For businesses that operate furnished holiday lettings, there are specific capital allowances available. These include Plant and Machinery Allowances (PMAs) for items such as furniture, appliances, and other equipment, and Capital Allowances for Integral Features (CAIFs), which cover items like heating and air conditioning systems. These allowances can provide significant tax relief for businesses in the holiday letting industry.Capital Allowances for Furnished Holiday Lettings

Businesses that use cars and other vehicles for their operations can also benefit from capital allowances. However, the rules for these allowances are more complex, and the amount that can be claimed depends on the type of vehicle and its emissions. The Writing Down Allowance (WDA) allows for a deduction of a percentage of the cost of the vehicle per year, while the First Year Allowance (FYA) allows for a higher rate of deduction in the first year of ownership.Capital Allowances for Cars and Vehicles

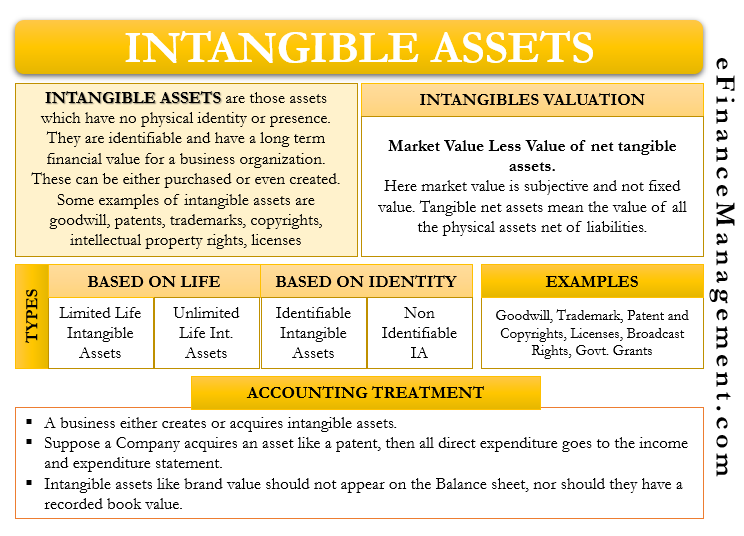

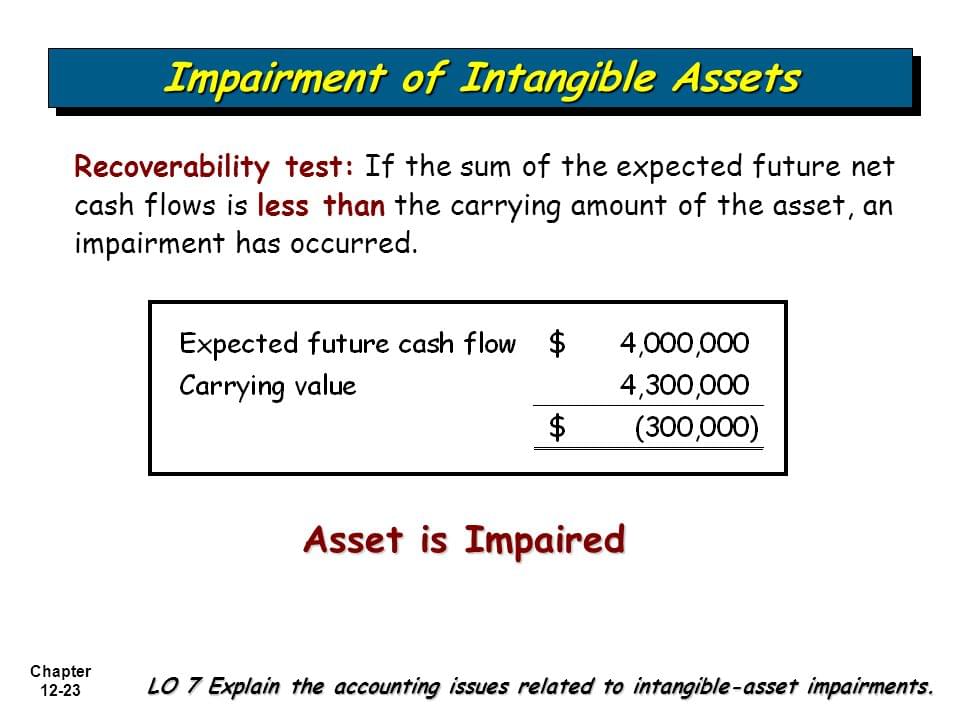

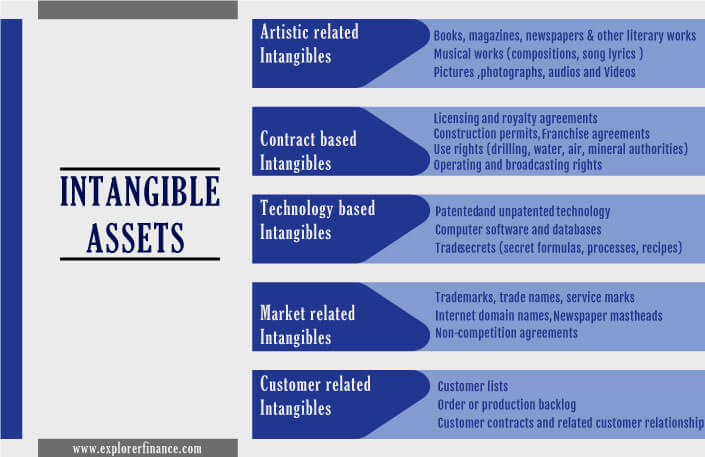

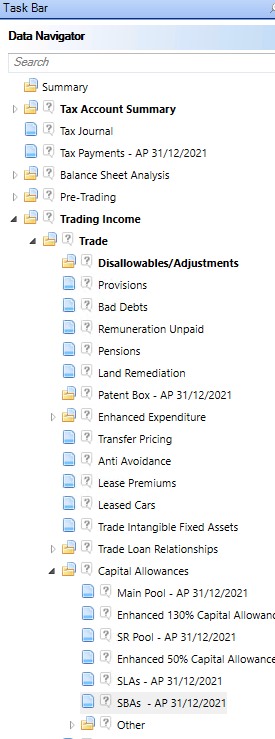

Intangible assets, such as patents, trademarks, and copyrights, can also qualify for capital allowances. The Intangible Fixed Assets (IFA) regime allows businesses to deduct a portion of the cost of acquiring and using these assets from their taxable profits. This includes not just the cost of purchasing the asset but also any costs incurred in creating, developing, or enhancing it.Capital Allowances for Intangible Assets

From April 2020, a new type of capital allowance was introduced for the construction or renovation of non-residential structures and buildings. The Structures and Buildings Allowance (SBA) allows for a 3% deduction of the costs per year for 33 years. This is available for both businesses and landlords, providing a significant tax relief for these types of investments.Capital Allowances for Structures and Buildings

Businesses that incur costs for cleaning up contaminated land can also claim capital allowances for these expenses. The Land Remediation Relief (LRR) allows for a 150% deduction of the costs incurred, providing a significant tax relief for businesses that undertake these types of projects.Capital Allowances for Land Remediation

Maximizing the Benefits of Kitchen Sink Capital Allowances in House Design

Creating the Perfect Kitchen Space

When designing a new house, one of the most important areas to consider is the kitchen. It's a space that is not only functional but also serves as the heart of the home. This is why it's crucial to carefully plan and design the kitchen to meet the needs and lifestyle of the homeowners. However, creating a dream kitchen can also come at a high cost. Thankfully, there is a tax incentive that can help reduce the financial burden of kitchen renovations -

kitchen sink capital allowances

. Let's explore how this allowance can benefit your house design and help you create the perfect kitchen space.

When designing a new house, one of the most important areas to consider is the kitchen. It's a space that is not only functional but also serves as the heart of the home. This is why it's crucial to carefully plan and design the kitchen to meet the needs and lifestyle of the homeowners. However, creating a dream kitchen can also come at a high cost. Thankfully, there is a tax incentive that can help reduce the financial burden of kitchen renovations -

kitchen sink capital allowances

. Let's explore how this allowance can benefit your house design and help you create the perfect kitchen space.

Understanding Kitchen Sink Capital Allowances

When it comes to tax deductions for house renovations, most people are familiar with the concept of depreciation. This is where the cost of an asset is deducted over its useful life. However, with

kitchen sink capital allowances

, you can claim the entire cost of the kitchen sink and its installation as a tax deduction in the first year. This means you can save a significant amount of money on your tax bill and use those savings towards your dream kitchen.

When it comes to tax deductions for house renovations, most people are familiar with the concept of depreciation. This is where the cost of an asset is deducted over its useful life. However, with

kitchen sink capital allowances

, you can claim the entire cost of the kitchen sink and its installation as a tax deduction in the first year. This means you can save a significant amount of money on your tax bill and use those savings towards your dream kitchen.

The Benefits of Kitchen Sink Capital Allowances in House Design

Aside from the obvious financial benefits, kitchen sink capital allowances can also have a positive impact on your house design. By being able to claim the full cost of the kitchen sink and its installation, you can allocate more funds towards other design elements such as high-quality appliances or luxurious finishes. This can help elevate the overall look and feel of your kitchen and make it a space that you'll truly love spending time in.

Furthermore, claiming this allowance can also allow for more flexibility in the design process. You may be able to invest in more eco-friendly and energy-efficient options, such as water-saving faucets or energy-efficient lighting, without worrying about the added cost. This not only benefits the environment but can also save you money in the long run on utility bills.

Aside from the obvious financial benefits, kitchen sink capital allowances can also have a positive impact on your house design. By being able to claim the full cost of the kitchen sink and its installation, you can allocate more funds towards other design elements such as high-quality appliances or luxurious finishes. This can help elevate the overall look and feel of your kitchen and make it a space that you'll truly love spending time in.

Furthermore, claiming this allowance can also allow for more flexibility in the design process. You may be able to invest in more eco-friendly and energy-efficient options, such as water-saving faucets or energy-efficient lighting, without worrying about the added cost. This not only benefits the environment but can also save you money in the long run on utility bills.

Maximizing the Benefits of Kitchen Sink Capital Allowances

To fully reap the benefits of kitchen sink capital allowances, it's important to keep accurate records and consult with a tax professional. This will ensure that you are claiming the correct amount and following all the necessary guidelines. It's also important to note that this allowance can only be claimed on new assets, so if you're planning on renovating an existing kitchen, it's best to consult with a professional to determine the best course of action.

In conclusion, incorporating

kitchen sink capital allowances

into your house design can provide significant financial and design benefits. It allows for more flexibility and creativity in the design process, while also helping to reduce the overall cost of your dream kitchen. With the help of a tax professional and careful planning, you can maximize the benefits of this allowance and create the perfect kitchen space in your new home.

To fully reap the benefits of kitchen sink capital allowances, it's important to keep accurate records and consult with a tax professional. This will ensure that you are claiming the correct amount and following all the necessary guidelines. It's also important to note that this allowance can only be claimed on new assets, so if you're planning on renovating an existing kitchen, it's best to consult with a professional to determine the best course of action.

In conclusion, incorporating

kitchen sink capital allowances

into your house design can provide significant financial and design benefits. It allows for more flexibility and creativity in the design process, while also helping to reduce the overall cost of your dream kitchen. With the help of a tax professional and careful planning, you can maximize the benefits of this allowance and create the perfect kitchen space in your new home.