If you're a piano teacher who conducts private lessons from your dining room, you may be eligible for a home office tax deduction. This deduction can help reduce your tax burden and save you money in the long run. However, it's important to understand the rules and regulations surrounding this deduction to ensure you are claiming it correctly. Here's everything you need to know about claiming a home office tax deduction as a piano teacher.Home Office Tax Deduction Benefits You Need to Know

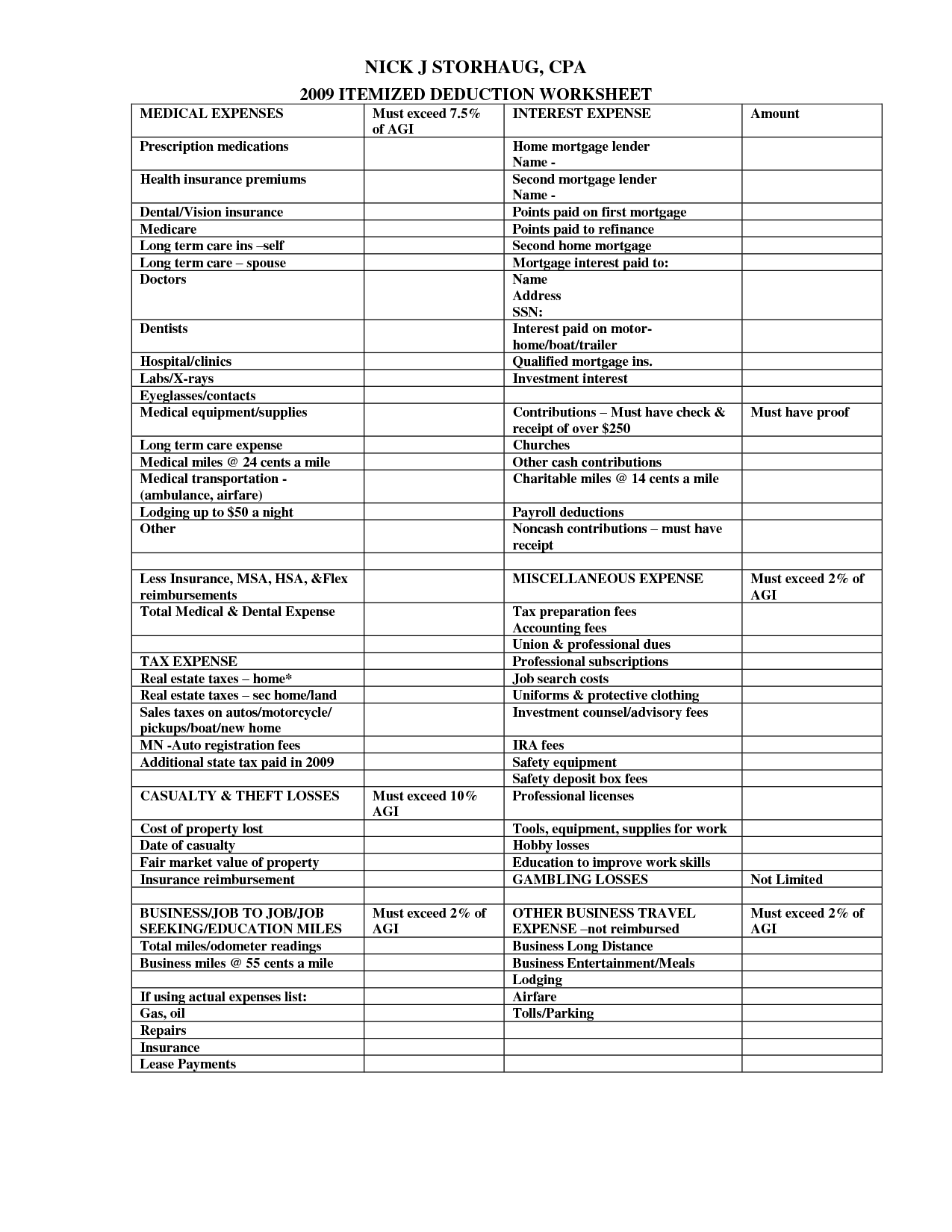

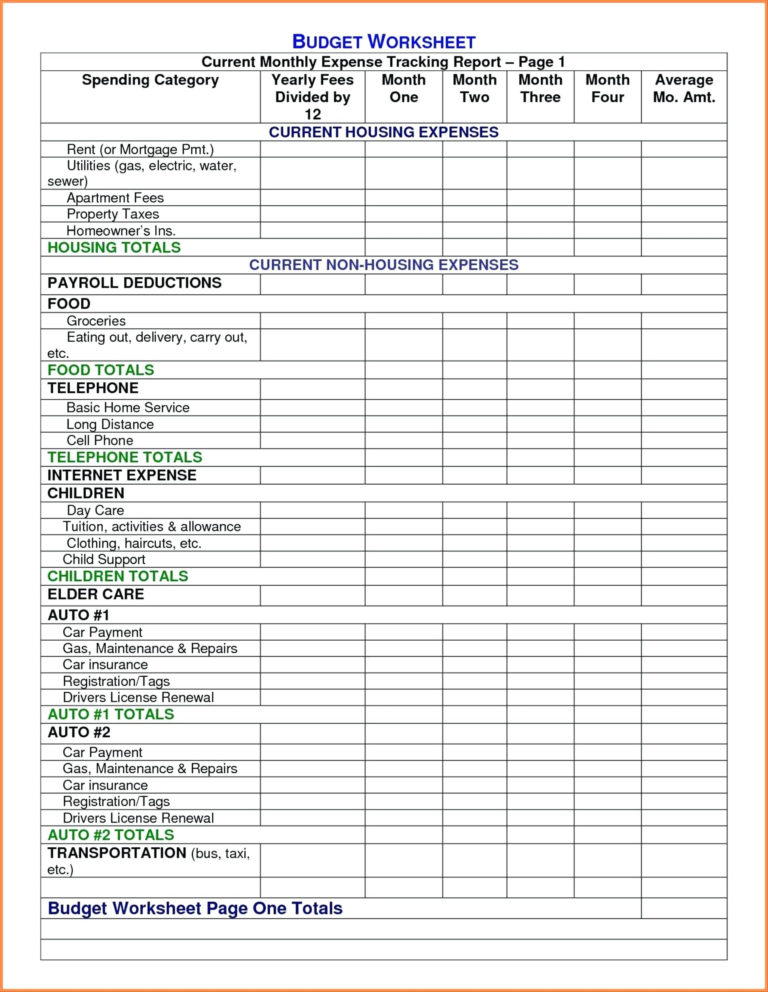

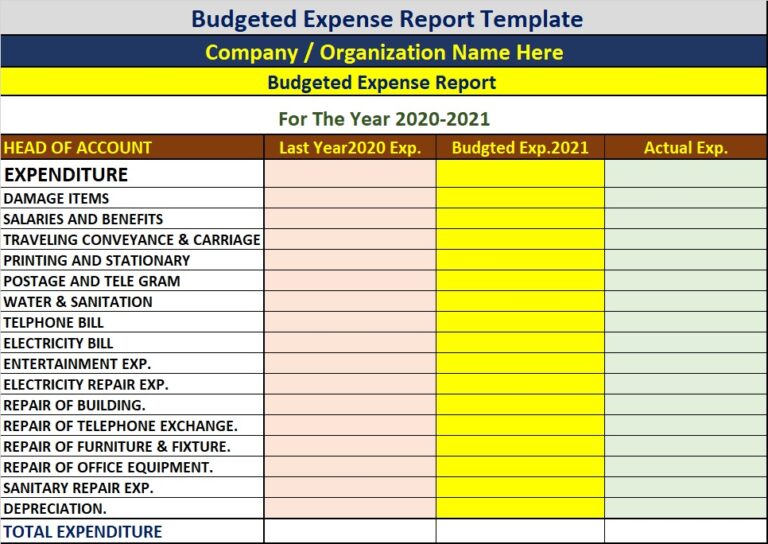

As a piano teacher, you likely have a lot of expenses related to your business. From sheet music to instruments to marketing materials, these costs can add up quickly. However, by setting up a home office in your dining room, you may be able to deduct a portion of these expenses on your taxes.Maximizing Your Deductions as a Piano Teacher

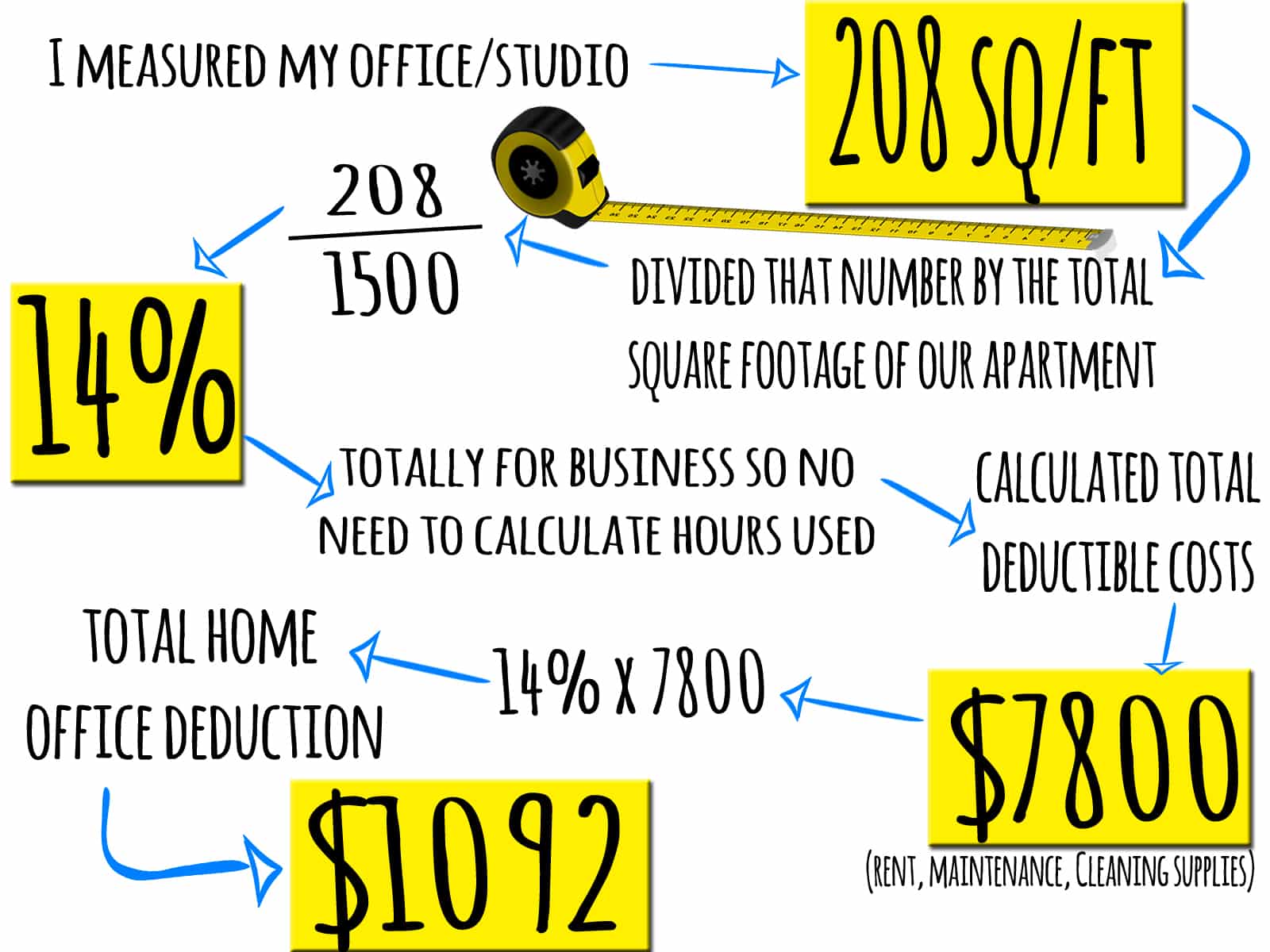

A home office tax deduction allows you to deduct a portion of your home's expenses on your taxes if you use a portion of your home exclusively for business purposes. This means that if you use your dining room solely for giving piano lessons, you may be able to claim a portion of your dining room expenses on your taxes.The Basics: What is a Home Office Tax Deduction?

To qualify for a home office tax deduction, you must meet certain criteria set by the IRS. This includes using a specific portion of your home exclusively for business purposes, having a designated area for your home office, and using it on a regular basis for your business. As a piano teacher, your dining room can serve as your designated home office space as long as you meet these requirements.How to Qualify for a Home Office Tax Deduction

Aside from the tax deduction, having a designated home office space can bring additional benefits to your piano teaching business. It can help you stay organized and focused, improve your productivity, and create a professional atmosphere for your students. Plus, it can save you time and money by eliminating the need for a separate office space outside of your home.The Benefits of Having a Home Office

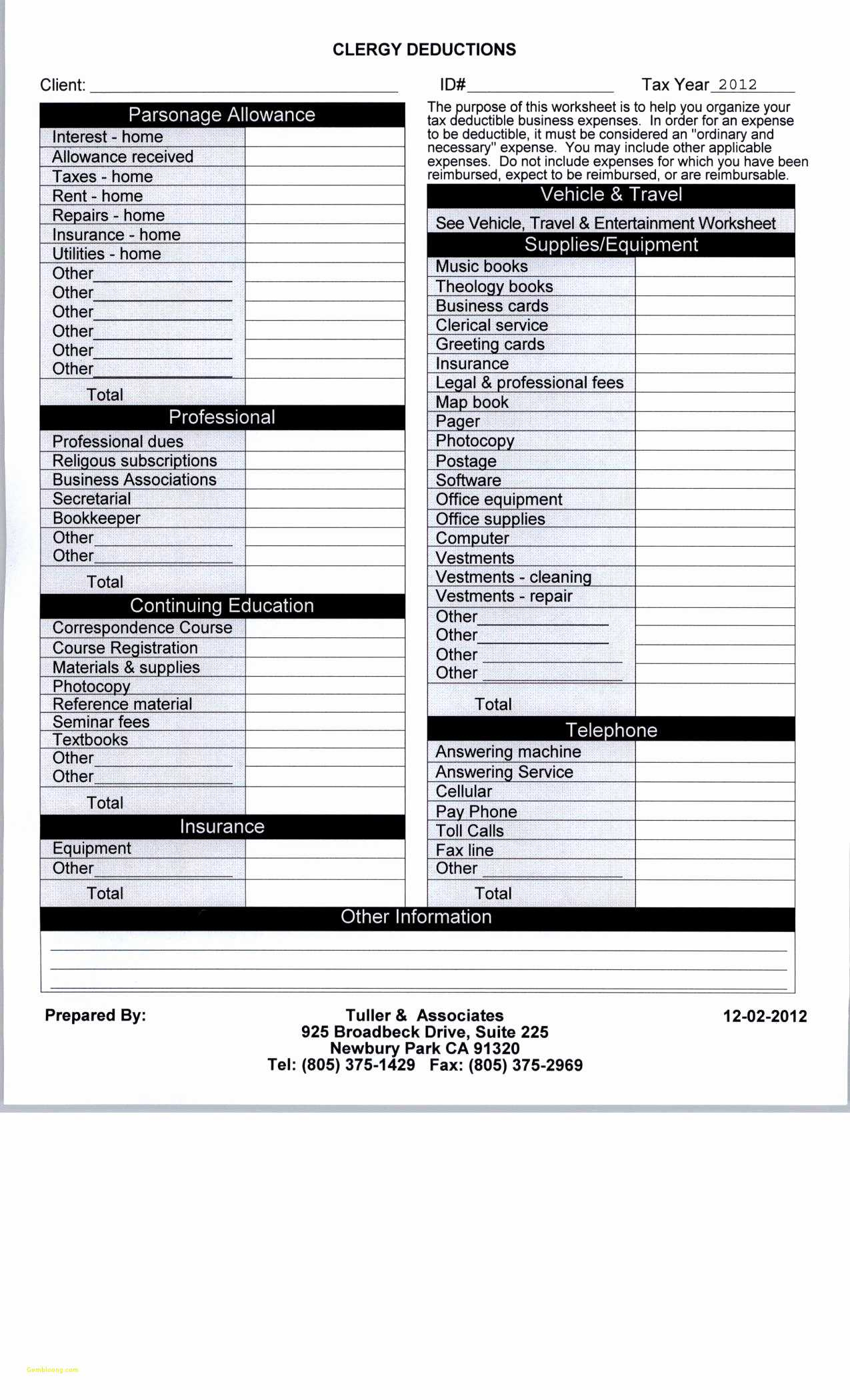

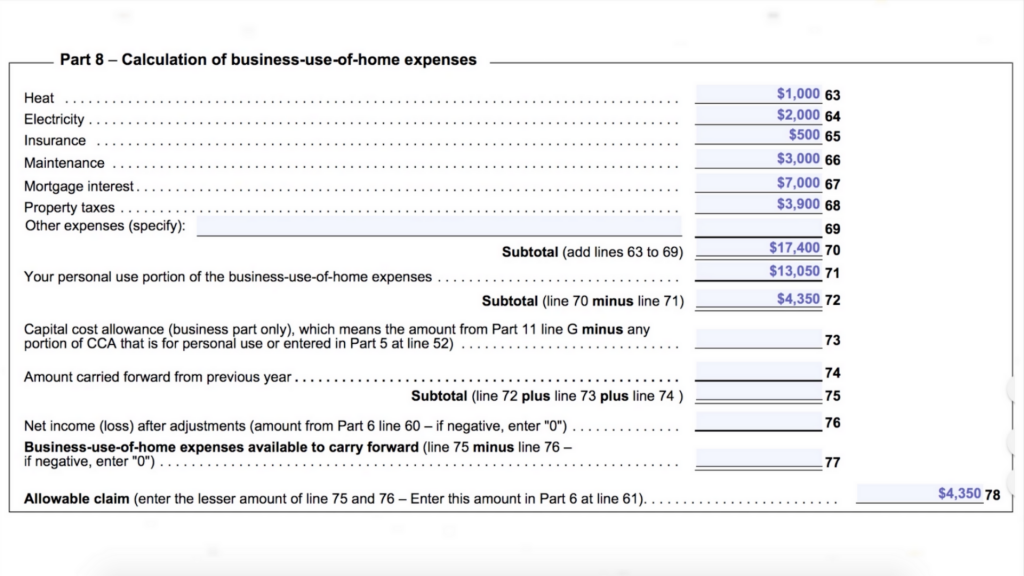

When claiming a home office tax deduction, it's important to understand the rules and regulations set by the IRS. These include the exclusive-use rule, which states that the space must be used solely for business purposes, and the proportionality rule, which requires you to calculate the percentage of your home's expenses that can be attributed to your home office. It's important to keep thorough records and consult with a tax professional to ensure you are claiming the deduction correctly.Tax Deduction Rules for Home Office Expenses

As a piano teacher, giving private lessons from your dining room offers many advantages. It allows you to have a flexible schedule, work from the comfort of your own home, and potentially save money on renting a separate office space. Plus, with the added benefit of a home office tax deduction, it can be a financially savvy choice for your business.Private Piano Instruction: An Ideal Home-Based Business

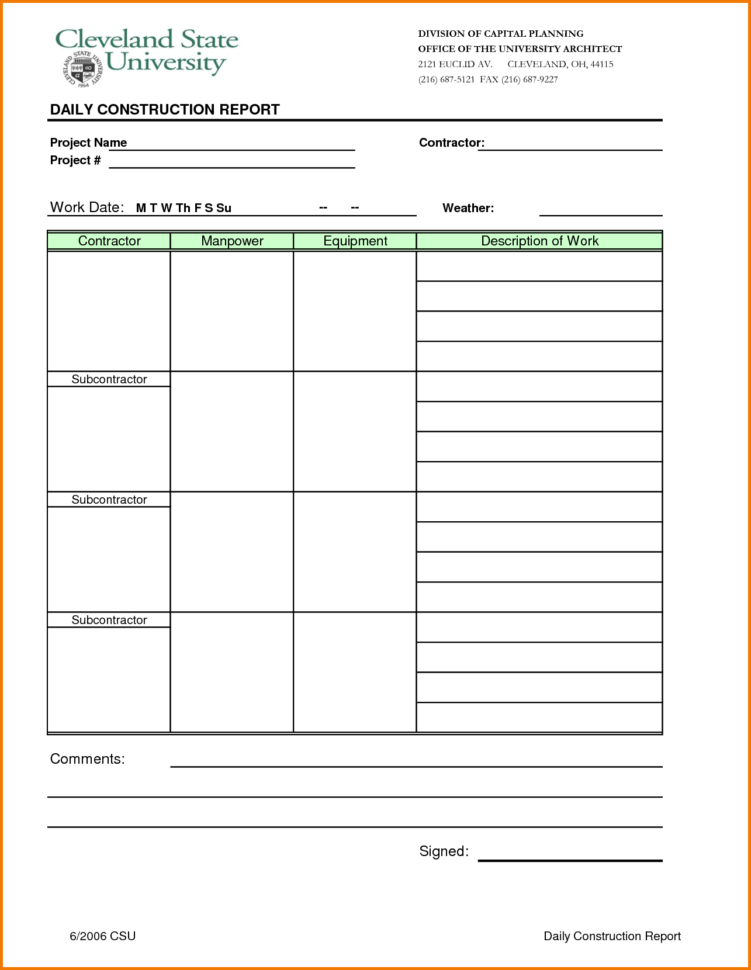

When claiming a home office tax deduction, it's crucial to keep detailed records of your expenses and usage of the space. This includes keeping receipts and invoices for any business-related purchases, as well as tracking the hours you spend in your home office. These records will be necessary in case of an audit and can help ensure you are claiming the correct amount on your taxes.The Importance of Keeping Records

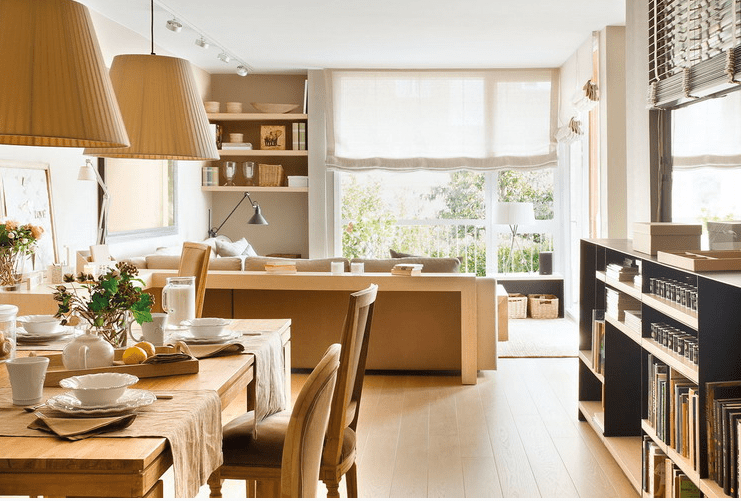

Turning your dining room into a functional home office space may seem daunting, but with some organization and creativity, it can be a smooth transition. Consider investing in a desk, storage solutions, and comfortable seating for you and your students. Also, be sure to keep your dining room clutter-free and professional-looking for a successful home office space.Dining Room Office Space: Tips for Success

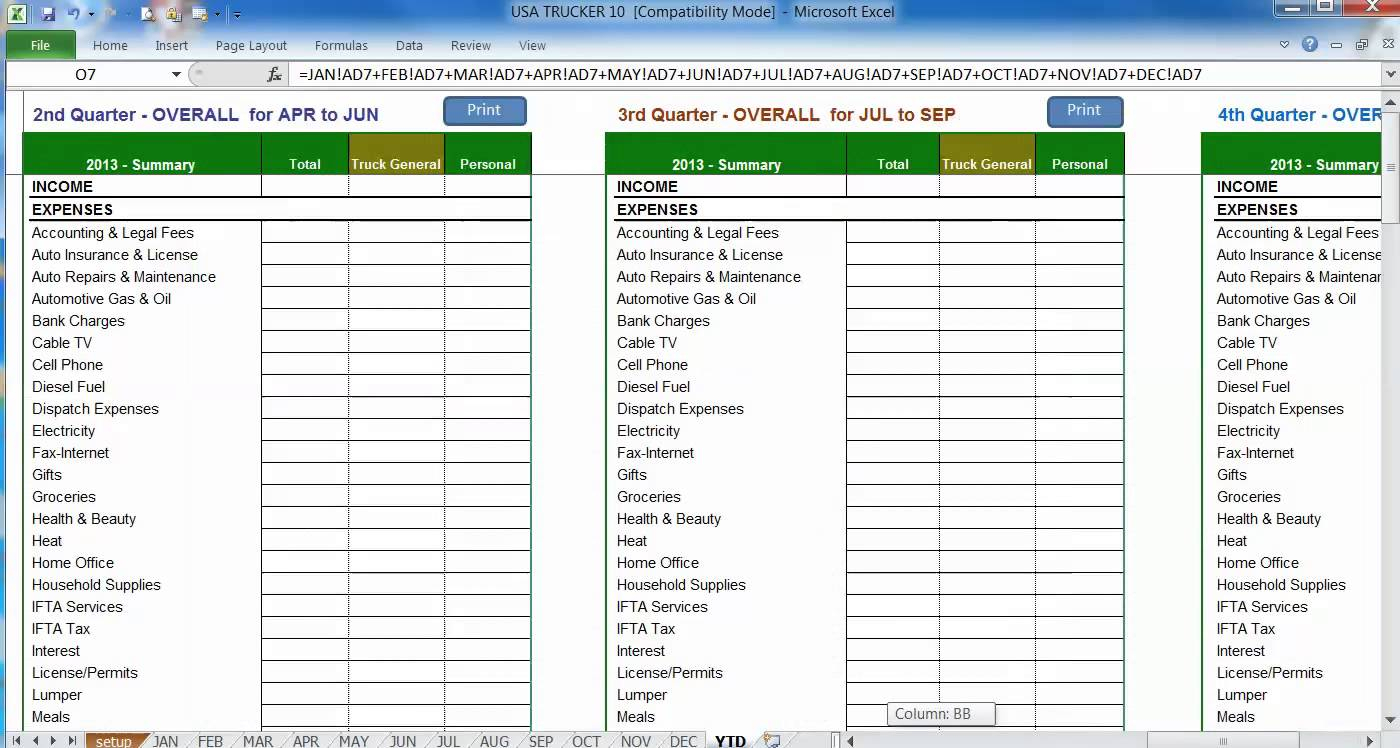

When it comes time to file your taxes, make sure to claim your home office tax deduction correctly. This can be done by filling out Form 8829, which calculates your home office deduction. Be sure to consult with a tax professional or use tax software to ensure you are claiming the correct amount and following all rules and regulations.Claiming a Home Office Tax Deduction on Your Taxes

The Benefits of Having a Home Office as a Piano Teacher

Creating a Functional and Personalized Workspace

As a piano teacher, your home office is not just a place to work, but also a space to showcase your passion for music and teaching. By choosing to have a dedicated workspace in your home, you have the opportunity to design and personalize it according to your needs and preferences. This is especially important for piano teachers, as your workspace should not only be functional but also inspire creativity and learning for your students.

As a piano teacher, your home office is not just a place to work, but also a space to showcase your passion for music and teaching. By choosing to have a dedicated workspace in your home, you have the opportunity to design and personalize it according to your needs and preferences. This is especially important for piano teachers, as your workspace should not only be functional but also inspire creativity and learning for your students.

Home Office Tax Deduction

One of the greatest advantages of having a home office as a piano teacher is the potential tax deductions you can claim. The IRS allows you to deduct expenses related to your home office, including a portion of your utility bills, rent or mortgage, and even office supplies. By claiming these deductions, you can significantly reduce your tax liability and save money in the long run.

Convenience and Flexibility

Having a home office also offers the convenience and flexibility that traditional office spaces cannot provide. As a piano teacher, you have the freedom to schedule your lessons and work hours according to your own availability. This means you can easily take breaks or attend to personal matters without having to worry about leaving your office or disrupting your work schedule.

Having a home office also offers the convenience and flexibility that traditional office spaces cannot provide. As a piano teacher, you have the freedom to schedule your lessons and work hours according to your own availability. This means you can easily take breaks or attend to personal matters without having to worry about leaving your office or disrupting your work schedule.

Piano Teacher Dining Room

Another benefit of having a home office as a piano teacher is the ability to use your dining room as a teaching space. Many piano teachers utilize their dining rooms as a piano studio, allowing them to have a dedicated space for teaching without needing to rent a separate studio. This also gives you the opportunity to decorate and design your dining room to make it more engaging and conducive to learning for your students.

In conclusion, having a home office as a piano teacher offers numerous benefits, including tax deductions, convenience, and flexibility. It also allows you to create a personalized and functional workspace, as well as utilize other areas of your home, such as the dining room, for teaching. So if you're a piano teacher looking to improve your work-life balance and save money, consider setting up a home office today.