When it comes to buying a new mattress, many people may not have the funds readily available to make a large purchase. That's where financing options at mattress stores come in. With the rising costs of mattresses, financing can be a great option for those who need a new mattress but may not have the cash upfront. If you're in need of a new mattress but aren't sure where to start with financing, you've come to the right place. In this article, we'll discuss the ins and outs of mattress financing, including how to finance a mattress purchase and the different financing plans offered at mattress stores.1. Financing Options at Mattress Stores

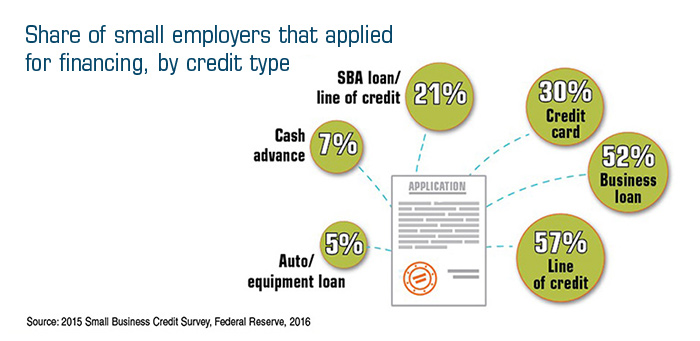

Financing a mattress purchase is similar to financing any other large purchase. The first step is to decide on the mattress you want to buy and then research the available financing options. Many mattress stores offer financing through third-party lenders, while others may have in-house financing options. Before choosing a financing plan, it's important to read all terms and conditions carefully. Make sure you understand the interest rate, monthly payments, and any penalties for late payments. You should also check your credit score beforehand to get an idea of what type of financing you may qualify for.2. How to Finance a Mattress Purchase

Not all mattress stores offer financing options, so it's important to do your research before visiting a store. Some of the top mattress stores that offer financing plans include Mattress Firm, Sleep Number, and Tempur-Pedic. Each store may have different financing options available, so be sure to compare and contrast before making a decision. Some may offer interest-free financing for a certain period of time, while others may have low monthly payments with a longer repayment period.3. Mattress Stores with Financing Plans

Before signing on the dotted line for a financing plan, it's important to know all the details and terms of the agreement. Make sure you understand the total cost of the mattress, including any interest or fees. You should also be aware of the minimum monthly payment and the length of the financing period. It's also important to ask about any penalties for early repayment or late payments. Some financing plans may have a penalty for paying off the balance early, while others may charge a fee for late payments. Knowing these details can help you make an informed decision about which financing plan is right for you.4. Financing Your Mattress: What You Need to Know

In addition to traditional financing options, some mattress stores may also offer payment plans. These plans typically involve making a down payment and then paying off the remaining balance in installments. Payment plans may be a good option for those who don't have the credit score to qualify for financing or for those who prefer to make smaller, more frequent payments. However, it's important to note that payment plans may come with higher interest rates or fees compared to traditional financing options.5. Do Mattress Stores Offer Payment Plans?

While financing a new mattress may seem like a convenient option, it's important to consider the potential drawbacks. The main disadvantage of financing is the additional cost in interest and fees. This means you'll end up paying more for the mattress over time compared to if you were to pay for it upfront with cash. Additionally, if you miss payments or are unable to pay off the balance, it can negatively impact your credit score. Before committing to a financing plan, make sure you have a solid repayment plan in place to avoid any potential financial issues down the road.6. Financing a New Mattress: What to Consider

As with any financial decision, there are pros and cons to consider when it comes to mattress financing. The main advantage is the ability to purchase a new mattress without having to pay the entire cost upfront. This can be especially helpful for those who may not have the funds readily available. On the other hand, the main disadvantage of financing is the additional cost in interest and fees. It's important to carefully consider the total cost of the mattress before deciding on a financing plan. You should also have a solid plan in place for making payments to avoid any potential financial issues.7. Mattress Financing: Pros and Cons

To get approved for mattress financing, it's important to have a good credit score and a stable source of income. Lenders will typically look at your credit history and debt-to-income ratio to determine your eligibility for financing. If you have a lower credit score, you may still be able to qualify for financing, but you may end up with a higher interest rate. It's important to shop around and compare financing options to find the best deal for your specific financial situation.8. How to Get Approved for Mattress Financing

When deciding whether to finance or pay cash for a new mattress, it ultimately comes down to personal preference and financial circumstances. If you have the cash readily available and don't want to pay extra in interest and fees, then paying cash may be the best option for you. However, if you don't have the funds upfront and are in need of a new mattress, then financing may be the better choice. Just be sure to carefully consider all the terms and conditions before signing any financing agreements.9. Financing vs. Paying Cash for a Mattress

Before making a decision on financing a new mattress, it's important to do your research and weigh all your options. Consider your credit score, repayment plan, and the total cost of the mattress before signing on the dotted line. If you do decide to finance your mattress purchase, be sure to make your payments on time and in full to avoid any potential financial issues. With the right financing plan and a comfortable new mattress, you'll be on your way to a better night's sleep in no time.10. Mattress Financing: What You Need to Know Before You Buy

Hassle-free Mattress Shopping with Financing Options

If you are in the market for a new mattress, you may be wondering if

mattress stores finance

their products. The answer is yes, many mattress stores offer financing options to make it easier for customers to purchase a high-quality mattress without breaking the bank. But before you make a decision, it's important to understand the ins and outs of financing a mattress and how it can benefit you in the long run.

If you are in the market for a new mattress, you may be wondering if

mattress stores finance

their products. The answer is yes, many mattress stores offer financing options to make it easier for customers to purchase a high-quality mattress without breaking the bank. But before you make a decision, it's important to understand the ins and outs of financing a mattress and how it can benefit you in the long run.

The Benefits of Financing a Mattress

Financing a mattress can be a great option for those who are looking to upgrade their sleeping experience but may not have the funds to pay for it all at once. By breaking up the cost of the mattress into smaller, more manageable payments, financing allows customers to get the mattress they want without having to compromise on quality. This also allows for more flexibility in budgeting and can help alleviate any financial strain that may come with a large one-time purchase.

Moreover, many mattress stores offer

special financing deals

that can include zero percent interest for a certain period of time or discounted rates for customers with good credit scores. These deals can help customers save money in the long run and make it easier to afford a high-quality mattress.

Financing a mattress can be a great option for those who are looking to upgrade their sleeping experience but may not have the funds to pay for it all at once. By breaking up the cost of the mattress into smaller, more manageable payments, financing allows customers to get the mattress they want without having to compromise on quality. This also allows for more flexibility in budgeting and can help alleviate any financial strain that may come with a large one-time purchase.

Moreover, many mattress stores offer

special financing deals

that can include zero percent interest for a certain period of time or discounted rates for customers with good credit scores. These deals can help customers save money in the long run and make it easier to afford a high-quality mattress.

How to Finance a Mattress

The process of financing a mattress is simple and can be done in-store or online. First, you will need to choose the mattress you want to purchase and determine the total cost. Then, you can inquire about financing options with the store associate or on their website. Typically, you will be asked to fill out an application and provide some personal and financial information. The store will then review your application and determine if you are eligible for financing.

If you are approved, you will be able to choose your payment plan and start enjoying your new mattress right away. It's important to read and understand the terms and conditions of the financing agreement to avoid any surprises later on. Most stores offer flexible payment plans that can range from a few months to a few years, depending on your preference and budget.

The process of financing a mattress is simple and can be done in-store or online. First, you will need to choose the mattress you want to purchase and determine the total cost. Then, you can inquire about financing options with the store associate or on their website. Typically, you will be asked to fill out an application and provide some personal and financial information. The store will then review your application and determine if you are eligible for financing.

If you are approved, you will be able to choose your payment plan and start enjoying your new mattress right away. It's important to read and understand the terms and conditions of the financing agreement to avoid any surprises later on. Most stores offer flexible payment plans that can range from a few months to a few years, depending on your preference and budget.

Conclusion

In today's world,

financing a mattress

has become a popular and convenient option for customers. It allows for a more affordable and stress-free shopping experience, while still getting the high-quality mattress you deserve. So if you are in the market for a new mattress, don't let the price tag hold you back. Explore the financing options available at your local mattress store and sleep soundly knowing you made a smart and budget-friendly choice.

In today's world,

financing a mattress

has become a popular and convenient option for customers. It allows for a more affordable and stress-free shopping experience, while still getting the high-quality mattress you deserve. So if you are in the market for a new mattress, don't let the price tag hold you back. Explore the financing options available at your local mattress store and sleep soundly knowing you made a smart and budget-friendly choice.