Are you considering upgrading your kitchen and bath in your New Jersey home? While these renovations can greatly improve the aesthetics and functionality of your home, it's important to also consider the potential tax implications. In some cases, these upgrades can actually affect your property taxes. Here's what you need to know about how upgrading your kitchen and bath can impact your taxes in NJ.How Upgrading Your Kitchen and Bath Can Affect Your Taxes in NJ

Before you start any major renovations on your kitchen and bath, it's important to understand how it may affect your property taxes. The best way to determine this is by consulting with a tax professional who is familiar with the regulations in your specific county in NJ. They can provide insight into the potential tax implications based on the scope and cost of your planned upgrades.How to Determine the Tax Impact of Upgrading Your Kitchen and Bath in NJ

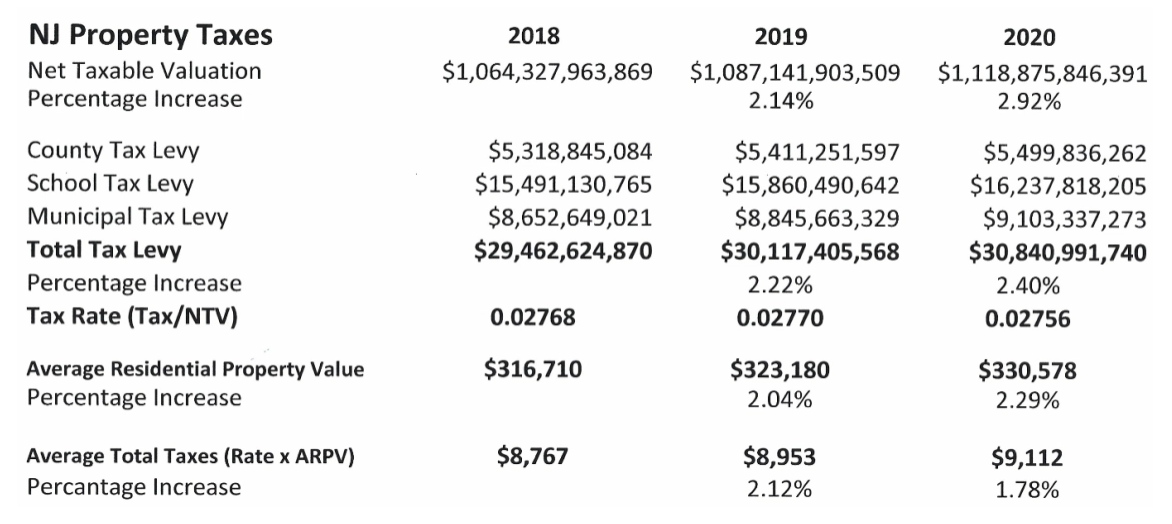

In general, any improvements made to your home can increase its assessed value, which can then lead to an increase in property taxes. This is because property taxes are based on the assessed value of your home, which takes into account factors such as size, age, and condition. Upgrading your kitchen and bath can improve the condition and therefore increase the assessed value of your home.Understanding the Tax Implications of Upgrading Your Kitchen and Bath in NJ

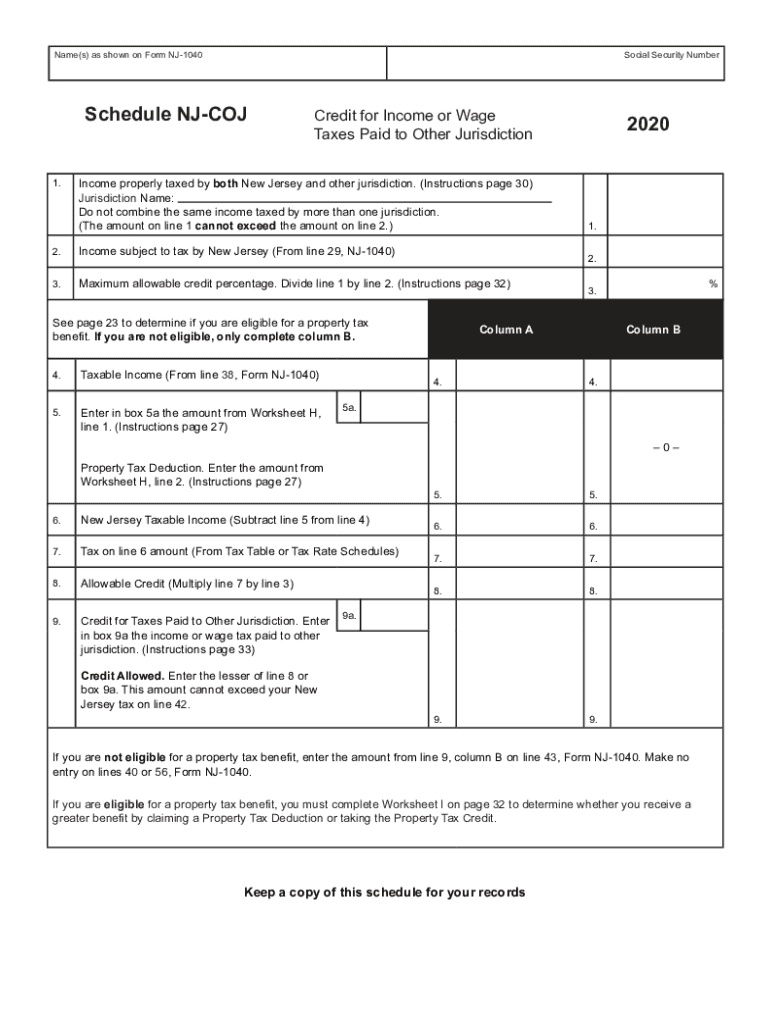

While it's true that upgrading your kitchen and bath can potentially increase your property taxes, there are ways to minimize the impact and even maximize tax savings. One option is to take advantage of any available tax credits or deductions for energy-efficient upgrades. For example, installing energy-efficient appliances or water-saving fixtures can not only save you money on your utility bills, but also earn you tax credits or deductions.Maximizing Tax Savings with Kitchen and Bath Upgrades in NJ

It's also important to keep in mind that not all upgrades will necessarily increase your property taxes. For example, if you are replacing old, worn-out features with new ones of similar value, it may not significantly impact your assessed value. However, if you are making major upgrades that significantly increase the value of your home, it's likely that your property taxes will also increase.What You Need to Know About Taxes and Upgrading Your Kitchen and Bath in NJ

In some cases, homeowners may be hesitant to make upgrades to their kitchen and bath because of the potential increase in property taxes. However, it's important to remember that these upgrades can also increase the resale value of your home. So while you may see a temporary increase in property taxes, you may also see a larger return on investment when it comes time to sell your home.The Connection Between Home Improvements and Property Taxes in NJ

In addition to potential tax credits and deductions, there are other tax benefits to upgrading your kitchen and bath in NJ. For example, if you are planning to sell your home in the near future, any improvements made can be added to your home's cost basis, reducing your capital gains tax when you sell. It's important to keep track of all costs associated with the upgrades in case you need to provide proof of their value.Exploring the Tax Benefits of Upgrading Your Kitchen and Bath in NJ

If you are concerned about the potential increase in property taxes after upgrading your kitchen and bath, there are some steps you can take to minimize the impact. For example, you can spread out the cost of the upgrades over several years, rather than completing them all at once. This can help to minimize the immediate impact on your assessed value and property taxes.How to Minimize the Impact of Kitchen and Bath Upgrades on Your NJ Property Taxes

Navigating the complexities of property taxes and home renovations can be overwhelming for many homeowners. That's why it's important to work with a tax professional who is familiar with the regulations in your specific county in NJ. They can provide guidance and advice on how to minimize the impact of upgrades on your property taxes and potentially save you money in the long run.Navigating the Complexities of NJ Property Taxes and Kitchen and Bath Upgrades

When planning to upgrade your kitchen and bath in NJ, it's important to have a clear understanding of how it may impact your property taxes. Consult with a tax professional, keep track of all costs, and consider taking advantage of any available tax credits or deductions. With proper planning and guidance, you can successfully upgrade your kitchen and bath while minimizing the impact on your property taxes. Tips for Managing Your NJ Property Taxes When Upgrading Your Kitchen and Bath

The Impact of Upgraded Kitchen and Bath on Property Taxes in New Jersey

The Importance of Kitchen and Bath Upgrades in House Design

When it comes to designing a house, the kitchen and bathroom are often considered the most important and heavily used areas. These spaces not only serve functional purposes, but they also greatly contribute to the overall aesthetics and value of a home. This is why many homeowners in New Jersey choose to invest in upgrading their kitchen and bath. However, it is important to consider the potential impact on property taxes before making any major renovations.

Kitchen Upgrades

The kitchen is often referred to as the heart of the home, and for good reason. It is where families gather to cook, eat, and spend quality time together. A well-designed and upgraded kitchen can greatly enhance the functionality and appeal of a home. However, in New Jersey, any upgrades made to the kitchen can also lead to an increase in property taxes. This is because the value of a home is assessed based on its overall condition and amenities.

Bathroom Upgrades

Similar to the kitchen, bathroom upgrades can also have a significant impact on property taxes. In New Jersey, any additions or renovations made to a bathroom can increase the assessed value of a home. This is especially true for luxury upgrades such as high-end fixtures, heated floors, and spa-like features. While these upgrades may be desirable for homeowners, they can also lead to higher property tax bills.

When it comes to designing a house, the kitchen and bathroom are often considered the most important and heavily used areas. These spaces not only serve functional purposes, but they also greatly contribute to the overall aesthetics and value of a home. This is why many homeowners in New Jersey choose to invest in upgrading their kitchen and bath. However, it is important to consider the potential impact on property taxes before making any major renovations.

Kitchen Upgrades

The kitchen is often referred to as the heart of the home, and for good reason. It is where families gather to cook, eat, and spend quality time together. A well-designed and upgraded kitchen can greatly enhance the functionality and appeal of a home. However, in New Jersey, any upgrades made to the kitchen can also lead to an increase in property taxes. This is because the value of a home is assessed based on its overall condition and amenities.

Bathroom Upgrades

Similar to the kitchen, bathroom upgrades can also have a significant impact on property taxes. In New Jersey, any additions or renovations made to a bathroom can increase the assessed value of a home. This is especially true for luxury upgrades such as high-end fixtures, heated floors, and spa-like features. While these upgrades may be desirable for homeowners, they can also lead to higher property tax bills.

The Potential Tax Savings of Renovating Smart

While kitchen and bath upgrades can lead to an increase in property taxes, there are ways to minimize the impact. For example, opting for energy-efficient appliances and fixtures can not only save money on utility bills, but also qualify for tax credits. Additionally, choosing materials and finishes that are durable and easy to maintain can help to avoid costly repairs down the line and potentially lower property taxes.

Consulting with a Professional

Before making any major upgrades to your kitchen and bath, it is important to consult with a tax professional or appraiser. They can provide valuable insight on how certain renovations may affect your property taxes. They can also help you come up with a budget-friendly plan that balances your desired upgrades with potential tax implications.

While kitchen and bath upgrades can lead to an increase in property taxes, there are ways to minimize the impact. For example, opting for energy-efficient appliances and fixtures can not only save money on utility bills, but also qualify for tax credits. Additionally, choosing materials and finishes that are durable and easy to maintain can help to avoid costly repairs down the line and potentially lower property taxes.

Consulting with a Professional

Before making any major upgrades to your kitchen and bath, it is important to consult with a tax professional or appraiser. They can provide valuable insight on how certain renovations may affect your property taxes. They can also help you come up with a budget-friendly plan that balances your desired upgrades with potential tax implications.

In Conclusion

Upgrading your kitchen and bath can greatly enhance the functionality and appeal of your home. However, it is important to consider the potential impact on property taxes. By being strategic with your renovations and consulting with a professional, you can minimize the tax burden while still achieving your desired design goals. So go ahead and create the kitchen and bath of your dreams, just be sure to do so with careful consideration of the potential tax implications.

Upgrading your kitchen and bath can greatly enhance the functionality and appeal of your home. However, it is important to consider the potential impact on property taxes. By being strategic with your renovations and consulting with a professional, you can minimize the tax burden while still achieving your desired design goals. So go ahead and create the kitchen and bath of your dreams, just be sure to do so with careful consideration of the potential tax implications.