Synchrony Bank and Mattress Firm have formed a strategic partnership to provide customers with flexible financing options for their mattress purchases. This collaboration allows customers to enjoy the quality and comfort of a new mattress, while also having the convenience of deferred payments and low interest rates. Synchrony Bank is a trusted financial institution that has been providing financing solutions for over 85 years. They have a strong reputation for offering competitive rates and exceptional customer service. On the other hand, Mattress Firm is one of the largest mattress retailers in the United States, with over 3,500 stores nationwide. With this partnership, customers can expect a seamless shopping experience, as well as convenient payment options.1. Synchrony Bank and Mattress Firm Partnership

One of the main benefits of the Synchrony Bank and Mattress Firm partnership is the variety of financing options available to customers. This includes 0% interest for a set period of time, as well as low monthly payments with a fixed interest rate. These options are ideal for customers who may not have the full amount to purchase a new mattress upfront, but still want to invest in a good night's sleep. In addition to these options, customers can also take advantage of special promotions and deals offered through the Synchrony Bank and Mattress Firm partnership. This can include discounts on specific mattress models or free delivery and set-up services. These promotions are constantly changing, so it's important to keep an eye out for any new offers.2. Financing Options for Mattress Firm Purchases with Synchrony Bank

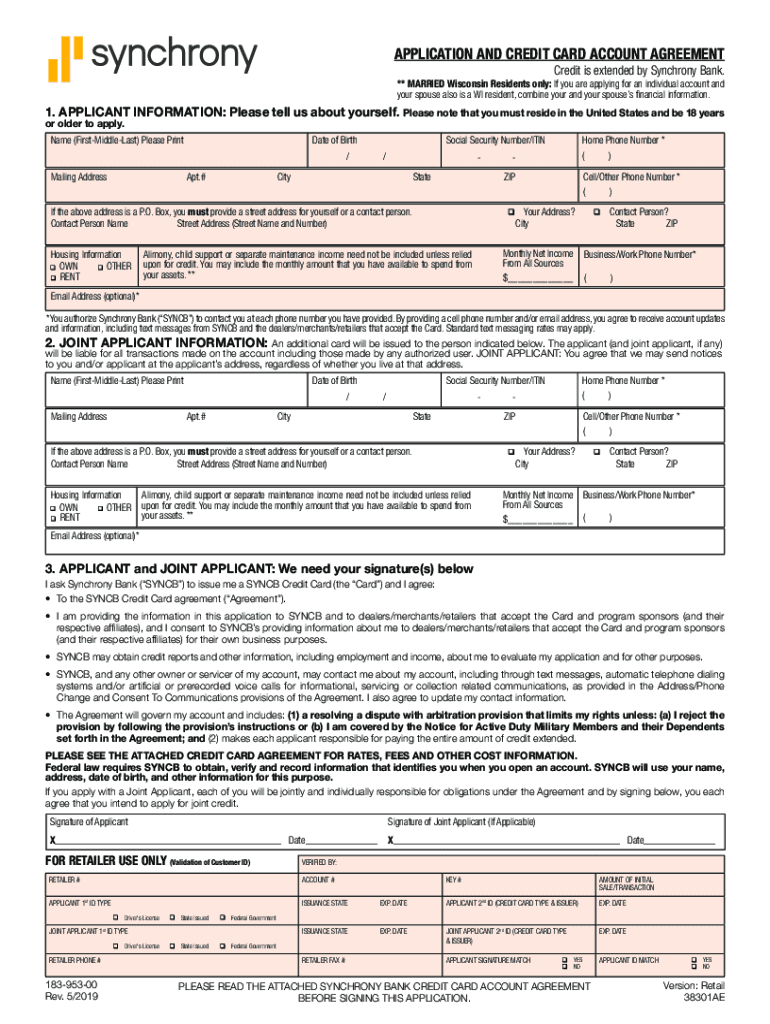

If you're interested in financing your mattress purchase through Synchrony Bank, the first step is to apply for a credit card. The application process is simple and can be done online or in-store at any Mattress Firm location. You will need to provide personal and financial information, and the approval process is usually quick. Once you have been approved, you will receive your credit card in the mail within a few days. You can then use this card to make purchases at any Mattress Firm store or online. It's important to note that the credit card is only valid for purchases at Mattress Firm and cannot be used at other retailers.3. How to Apply for a Synchrony Bank Mattress Firm Credit Card

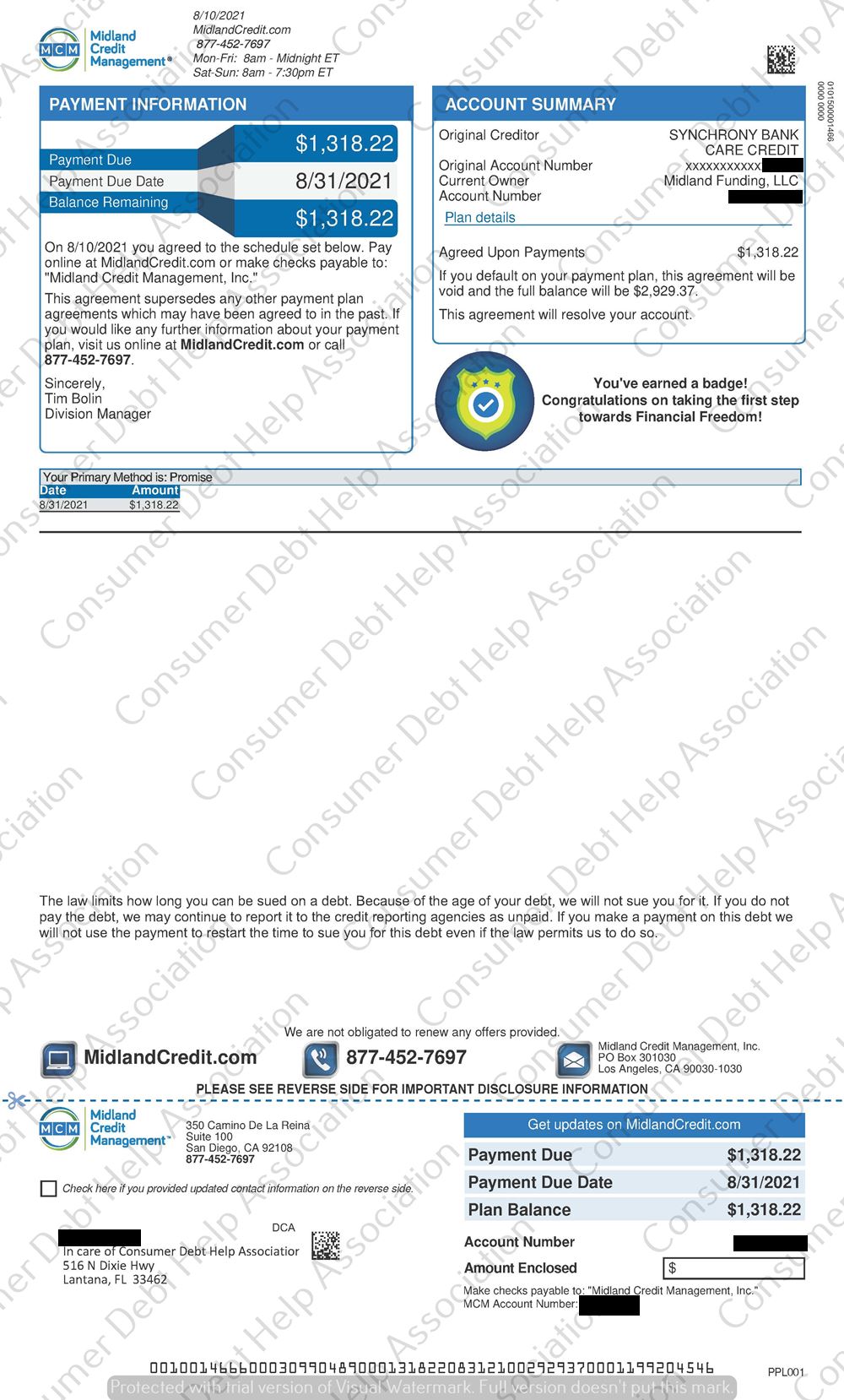

Customer reviews are a great way to gauge the success of a partnership, and the Synchrony Bank and Mattress Firm collaboration has received positive feedback from many customers. Many have praised the flexible financing options and the convenience of the credit card. Others have also shared their satisfaction with the quality of service provided by both Synchrony Bank and Mattress Firm. However, there have also been some negative reviews regarding interest rates and late payment fees. It's important for customers to carefully read and understand the terms and conditions of their credit card to avoid any unexpected charges.4. Synchrony Bank and Mattress Firm Customer Reviews

As mentioned earlier, Mattress Firm offers a variety of financing options through their partnership with Synchrony Bank. This includes 0% interest for a specified period, as well as low monthly payments with a fixed interest rate. Customers can choose the option that best fits their budget and financial situation. In addition, Mattress Firm also offers a 120-night sleep trial for customers to test out their new mattress. If for any reason they are not satisfied with their purchase, they can return it for a full refund or exchange within the trial period. This gives customers peace of mind knowing that their investment in a new mattress is protected.5. Mattress Firm's Financing Options through Synchrony Bank

In 2018, Mattress Firm filed for Chapter 11 bankruptcy, and Synchrony Bank played a significant role in helping the company restructure and emerge from bankruptcy. Synchrony Bank provided financing options for customers during this time, allowing them to continue making purchases at Mattress Firm stores. Thanks to this partnership, Mattress Firm was able to successfully restructure and continue their operations. This further solidifies the strong relationship between the two companies and their commitment to providing customers with quality products and services.6. Synchrony Bank's Role in Mattress Firm's Bankruptcy

The partnership between Mattress Firm and Synchrony Bank goes beyond just financing options. Mattress Firm also offers a co-branded credit card in partnership with Synchrony Bank, giving customers additional benefits and rewards for their purchases. Cardholders can earn points for every purchase made at Mattress Firm, and these points can be redeemed for discounts and other rewards. This is a great way for customers to save even more money on their mattress purchases.7. Mattress Firm's Partnership with Synchrony Bank for Financing

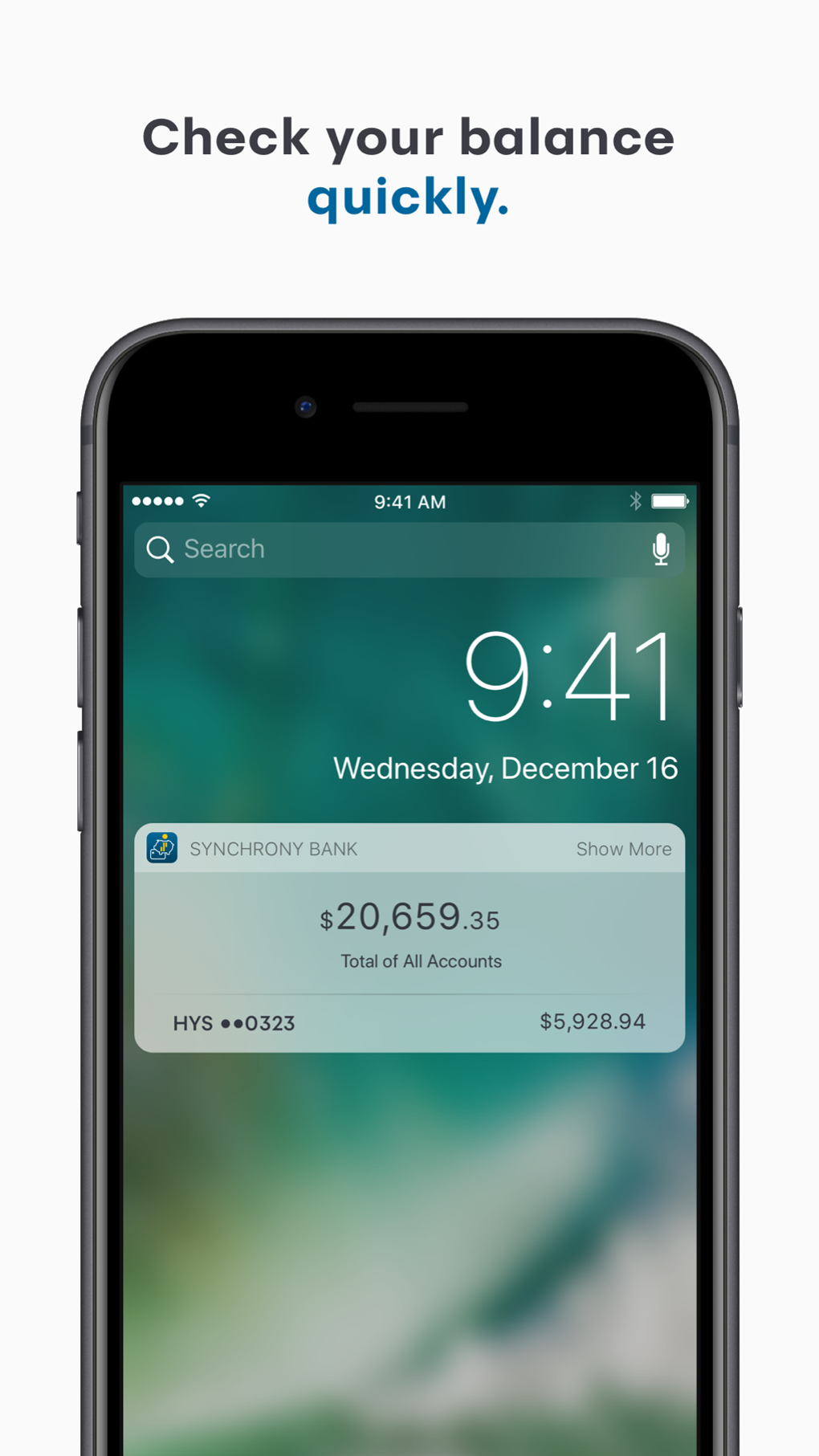

The Synchrony Bank and Mattress Firm credit card offers a range of benefits for customers. In addition to the rewards program, cardholders also have access to special financing options and promotions, as well as online account management and bill payment services. Furthermore, Synchrony Bank offers fraud protection and 24/7 customer service to ensure that customers have a positive experience when using their credit card. With these added benefits, customers can feel confident in their purchases and financial transactions.8. Synchrony Bank's Credit Card Benefits for Mattress Firm Customers

Making payments on a Synchrony Bank Mattress Firm credit card is simple and convenient. Customers can make payments online through their Synchrony Bank account, or they can set up automatic payments to ensure that their bills are paid on time each month. In-store payments are also accepted at any Mattress Firm location. Customers can use cash, check, or debit/credit card to make their payments. It's important to make payments on time to avoid any late fees or negative impacts on credit score.9. How to Make Payments on a Synchrony Bank Mattress Firm Credit Card

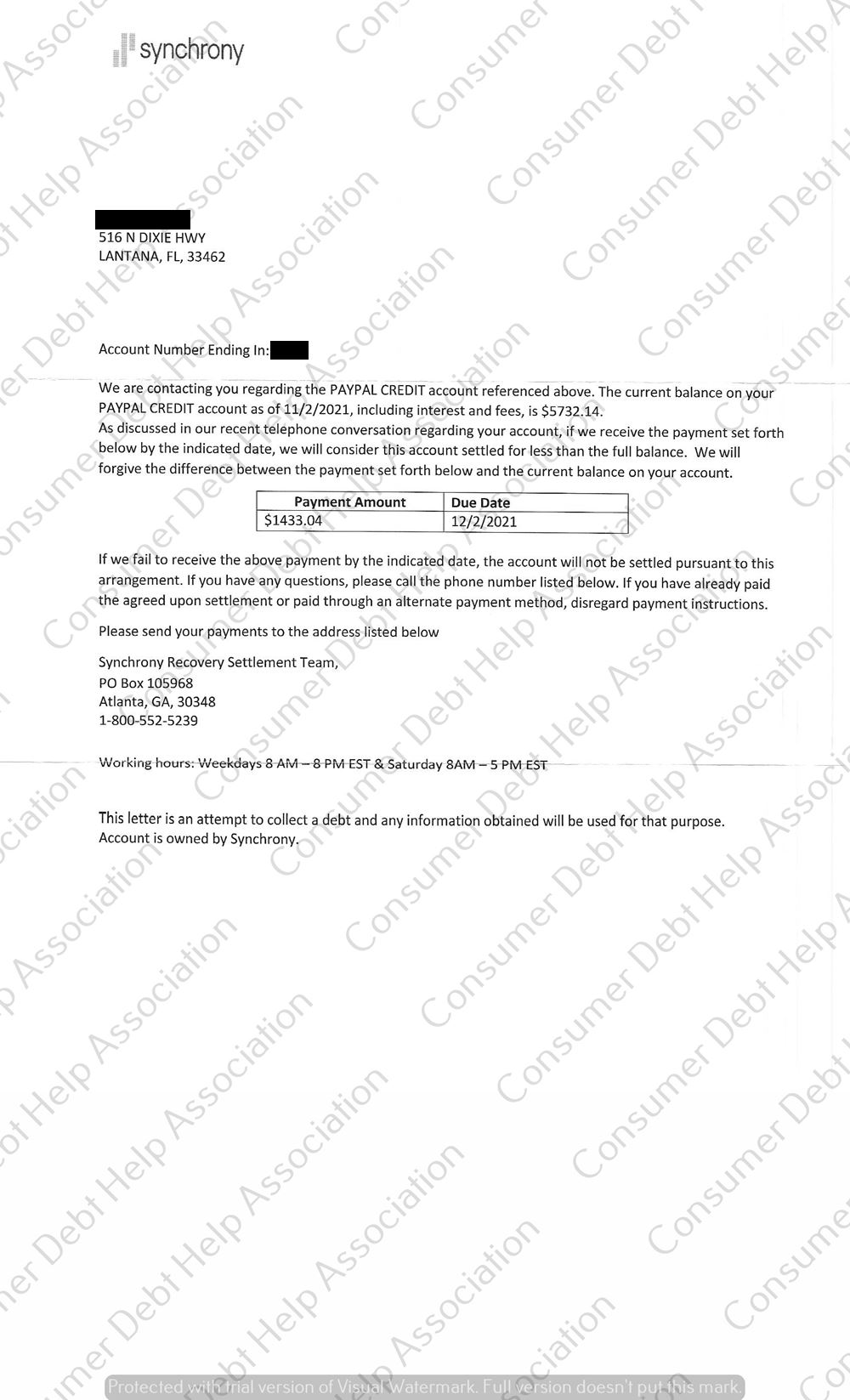

The interest rates for Synchrony Bank credit cards vary depending on the type of financing option chosen and the customer's credit history. The 0% interest option typically has a promotional period of 6 to 12 months, after which a fixed interest rate will apply. Customers with a higher credit score may be eligible for lower interest rates. It's important for customers to carefully consider the interest rates and terms of their financing option before making a purchase. This will help them make an informed decision and avoid any unexpected charges in the future.10. Synchrony Bank's Interest Rates for Mattress Firm Purchases

The Perfect Mattress for Your Dream Home: A Synchrony Bank and Mattress Firm Collaboration

The Importance of Choosing the Right Mattress

When it comes to designing your dream home, every detail matters – including your choice of mattress. A good mattress not only provides comfort and support for a good night's sleep, but it also plays a crucial role in your overall health and well-being. That's why the collaboration between Synchrony Bank and Mattress Firm is a game changer for those looking to create the perfect living space.

Synchrony Bank

is a leading financial institution that offers a variety of consumer financing options, while

Mattress Firm

is one of the largest mattress retailers in the United States. Together, they offer a wide range of mattress options to fit every budget and sleep preference.

When it comes to designing your dream home, every detail matters – including your choice of mattress. A good mattress not only provides comfort and support for a good night's sleep, but it also plays a crucial role in your overall health and well-being. That's why the collaboration between Synchrony Bank and Mattress Firm is a game changer for those looking to create the perfect living space.

Synchrony Bank

is a leading financial institution that offers a variety of consumer financing options, while

Mattress Firm

is one of the largest mattress retailers in the United States. Together, they offer a wide range of mattress options to fit every budget and sleep preference.

Customize Your Comfort with Synchrony Bank and Mattress Firm

With the Synchrony Bank and Mattress Firm collaboration, you can now easily finance your dream mattress and have a say in your comfort preferences. Mattress Firm offers a variety of brands and mattress types, including memory foam, innerspring, and hybrid, to cater to different sleep needs. And with the financing options provided by Synchrony Bank, you can choose the mattress that fits your budget without compromising on quality.

With the Synchrony Bank and Mattress Firm collaboration, you can now easily finance your dream mattress and have a say in your comfort preferences. Mattress Firm offers a variety of brands and mattress types, including memory foam, innerspring, and hybrid, to cater to different sleep needs. And with the financing options provided by Synchrony Bank, you can choose the mattress that fits your budget without compromising on quality.

Expert Guidance for Your Mattress Needs

Choosing the right mattress can be overwhelming, especially with the numerous options available in the market. That's where the expertise of Mattress Firm comes in. Their trained sleep experts can guide you in selecting the perfect mattress based on your sleeping position, body type, and personal preferences. Plus, with the convenience of financing options from Synchrony Bank, you can take your time and make an informed decision without any financial pressure.

Choosing the right mattress can be overwhelming, especially with the numerous options available in the market. That's where the expertise of Mattress Firm comes in. Their trained sleep experts can guide you in selecting the perfect mattress based on your sleeping position, body type, and personal preferences. Plus, with the convenience of financing options from Synchrony Bank, you can take your time and make an informed decision without any financial pressure.

Transform Your Home into a Haven of Comfort

A good night's sleep is essential for a healthy and happy life, and your mattress plays a crucial role in achieving that. With the collaboration between Synchrony Bank and Mattress Firm, you can now easily find the perfect mattress to complete your dream home. So why wait? Transform your home into a haven of comfort with the Synchrony Bank and Mattress Firm collaboration.

A good night's sleep is essential for a healthy and happy life, and your mattress plays a crucial role in achieving that. With the collaboration between Synchrony Bank and Mattress Firm, you can now easily find the perfect mattress to complete your dream home. So why wait? Transform your home into a haven of comfort with the Synchrony Bank and Mattress Firm collaboration.