Steinhoff International Holdings NV is a multinational retail company based in South Africa. Founded in 1964, it has grown to become one of the largest retail groups in the world, with operations in over 30 countries. The company is known for its wide range of products, including furniture, household goods, and clothing.Steinhoff International Holdings NV

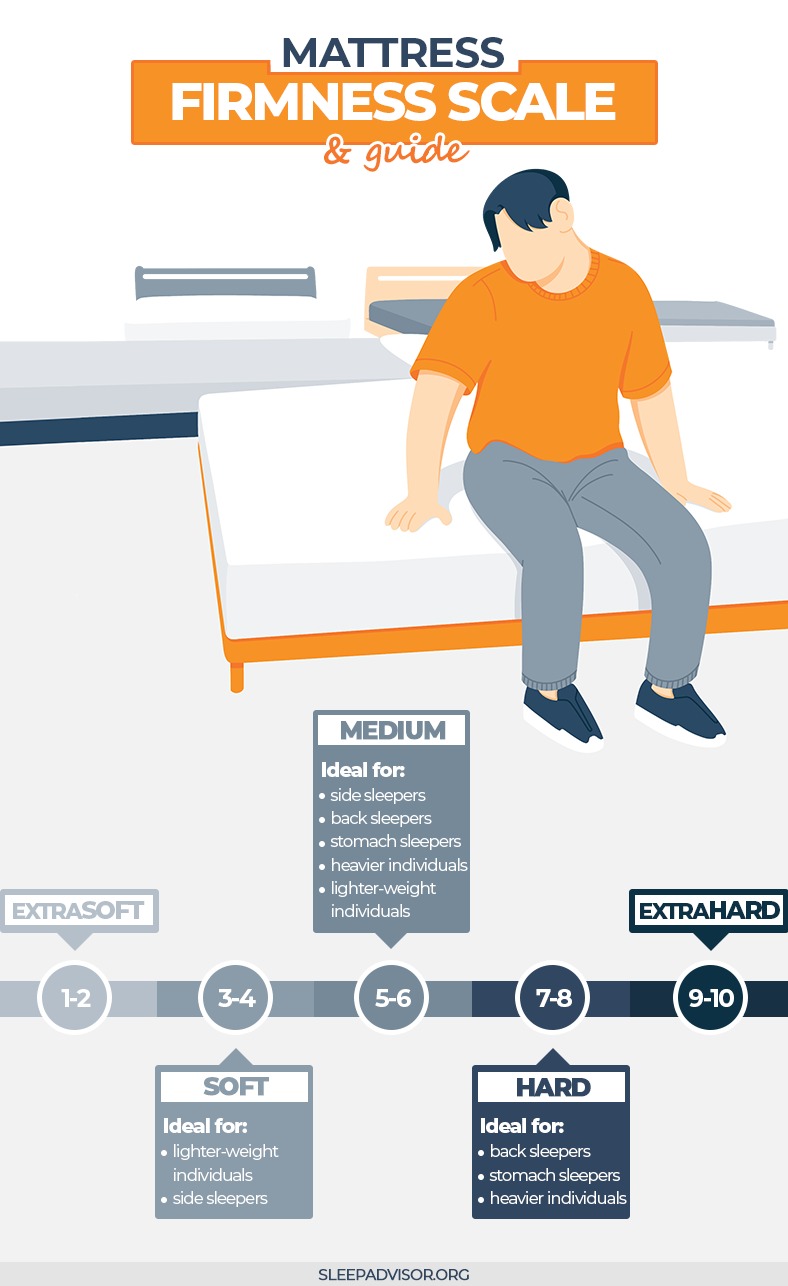

Mattress Firm Holding Corp is a subsidiary of Steinhoff International Holdings NV, specializing in mattresses and bedding products. It was founded in 1986 and has since become the largest mattress retailer in the United States. The company operates over 2,500 stores across the country and offers a variety of brands and styles to meet every customer's needs.Mattress Firm Holding Corp

The stock market refers to the collection of exchanges and markets where stocks and other securities are bought and sold. Steinhoff International Holdings NV and Mattress Firm Holding Corp are both publicly traded companies, meaning their stocks are available for purchase on the stock market. The stock market is a vital part of the global economy, with investors buying and selling stocks to earn profits or build their portfolios.Stock Market

Investing in the stock market is a popular way for individuals and businesses to grow their wealth. By purchasing stocks, investors become partial owners of a company and can benefit from its growth and success. Steinhoff International Holdings NV and Mattress Firm Holding Corp are both attractive options for investors looking to diversify their portfolios and potentially earn profits.Investing

Financial news refers to information and updates about the stock market, companies, and the economy in general. Keeping up with financial news can help investors make informed decisions about their investments. For those interested in Steinhoff International Holdings NV and Mattress Firm Holding Corp, staying updated on financial news can provide valuable insights into the companies' performance and future prospects.Financial News

The stock price is the current value of a company's stock on the stock market. It is affected by various factors, such as company performance, economic conditions, and market trends. The stock price of Steinhoff International Holdings NV and Mattress Firm Holding Corp can fluctuate daily, making it important for investors to regularly monitor and analyze their movements.Stock Price

Shareholders are individuals or entities that own shares in a company. They have a stake in the company's performance and can benefit from its profits through dividends or by selling their shares at a higher price. As shareholders of Steinhoff International Holdings NV and Mattress Firm Holding Corp, investors have a say in the company's decision-making and can potentially earn returns on their investments.Shareholders

The performance of a company refers to its financial and operational success. It is a crucial factor for investors to consider before investing in a company's stock. Steinhoff International Holdings NV and Mattress Firm Holding Corp have had varying performance over the years, with Steinhoff facing challenges due to an accounting scandal and Mattress Firm filing for bankruptcy in 2018. However, both companies have shown resilience and are working towards improving their performance.Company Performance

Acquisitions refer to the process of one company buying another company. Steinhoff International Holdings NV has made several acquisitions over the years, including its purchase of Mattress Firm Holding Corp in 2016. Acquisitions can be a strategic move for companies to expand their market share, product offerings, and customer base.Acquisitions

Bankruptcy is a legal process where a company declares its inability to pay its debts. In 2018, Mattress Firm Holding Corp filed for bankruptcy due to increasing competition and declining sales. However, the company emerged from bankruptcy in 2018 and continues to operate under the ownership of Steinhoff International Holdings NV. While bankruptcy can be a challenging and uncertain time for companies and their shareholders, it can also provide opportunities for restructuring and growth.Bankruptcy

The Impact of Steinhoff's Acquisition of Mattress Firm on the Stock Market

The Rise of Steinhoff

When Steinhoff International Holdings NV, the South African retail conglomerate, acquired Mattress Firm in 2016, it was the latest in a string of high-profile purchases for the company. With a focus on expanding their global presence, Steinhoff's acquisition of Mattress Firm gave them a strong foothold in the lucrative U.S. bedding market. At the time, the deal was seen as a smart move for both companies, with Steinhoff gaining access to Mattress Firm's extensive distribution network and Mattress Firm benefiting from Steinhoff's financial resources and international expertise.

When Steinhoff International Holdings NV, the South African retail conglomerate, acquired Mattress Firm in 2016, it was the latest in a string of high-profile purchases for the company. With a focus on expanding their global presence, Steinhoff's acquisition of Mattress Firm gave them a strong foothold in the lucrative U.S. bedding market. At the time, the deal was seen as a smart move for both companies, with Steinhoff gaining access to Mattress Firm's extensive distribution network and Mattress Firm benefiting from Steinhoff's financial resources and international expertise.

The Impact on the Stock Market

The announcement of the acquisition caused a stir in the stock market, with both Steinhoff and Mattress Firm's stocks experiencing a surge in value. Steinhoff's stock price rose by 6% on the day of the announcement, while Mattress Firm's stock jumped by a whopping 115%. This significant increase in stock value showed investors' confidence in the deal and the potential for growth in the companies.

However, as with any major acquisition, there were also concerns and skepticism surrounding the deal. Some experts questioned the hefty price tag of $3.8 billion that Steinhoff paid for Mattress Firm, which was seen as a premium price for a company that was struggling financially at the time. There were also doubts about Steinhoff's ability to successfully integrate Mattress Firm into their portfolio of brands.

The announcement of the acquisition caused a stir in the stock market, with both Steinhoff and Mattress Firm's stocks experiencing a surge in value. Steinhoff's stock price rose by 6% on the day of the announcement, while Mattress Firm's stock jumped by a whopping 115%. This significant increase in stock value showed investors' confidence in the deal and the potential for growth in the companies.

However, as with any major acquisition, there were also concerns and skepticism surrounding the deal. Some experts questioned the hefty price tag of $3.8 billion that Steinhoff paid for Mattress Firm, which was seen as a premium price for a company that was struggling financially at the time. There were also doubts about Steinhoff's ability to successfully integrate Mattress Firm into their portfolio of brands.

The Aftermath

Despite the initial excitement and positive impact on the stock market, the aftermath of the acquisition has not been without its challenges. In late 2017, Steinhoff was hit by an accounting scandal that rocked the company and caused its stock price to plummet. This had a ripple effect on Mattress Firm, which saw a decline in sales and store closures. As a result, Steinhoff was forced to restructure its debt and sell off some of its assets, including Mattress Firm.

In conclusion, the acquisition of Mattress Firm by Steinhoff had a significant impact on the stock market, with a surge in stock prices and a boost in investor confidence. However, the aftermath of the deal has shown the risks involved in major acquisitions and the need for careful planning and execution. Only time will tell how this acquisition will ultimately play out in the long term.

Despite the initial excitement and positive impact on the stock market, the aftermath of the acquisition has not been without its challenges. In late 2017, Steinhoff was hit by an accounting scandal that rocked the company and caused its stock price to plummet. This had a ripple effect on Mattress Firm, which saw a decline in sales and store closures. As a result, Steinhoff was forced to restructure its debt and sell off some of its assets, including Mattress Firm.

In conclusion, the acquisition of Mattress Firm by Steinhoff had a significant impact on the stock market, with a surge in stock prices and a boost in investor confidence. However, the aftermath of the deal has shown the risks involved in major acquisitions and the need for careful planning and execution. Only time will tell how this acquisition will ultimately play out in the long term.

:max_bytes(150000):strip_icc()/Mergers_and_Acquisitions_MA-962964fad00848c189708fee0702733d.png)