Are you in the market for a new mattress and considering the Sealy Cocoon? Not only is this mattress known for its comfort and support, but it also offers tax benefits. That's right - you may be eligible for a tax exemption when purchasing a Sealy Cocoon mattress. If you are purchasing a mattress for medical reasons, such as back pain or sleep disorders, you may qualify for a tax exemption under the IRS's medical expense deduction. This means that the cost of your Sealy Cocoon mattress can be deducted from your taxable income, reducing the amount of taxes you owe. To qualify for this exemption, you will need a doctor's prescription stating that a new mattress is necessary for your medical condition. Keep this prescription as proof in case you are audited by the IRS.1. Sealy Cocoon Mattress Tax Exemption

It's important to have a basic understanding of how taxes work when purchasing a Sealy Cocoon mattress. The sales tax rate for mattresses varies depending on the state you live in. Some states have no sales tax, while others can have rates as high as 10%. Additionally, many states have a mattress recycling fee that is added to the cost of the mattress. This fee can range from $5 to $25 and is used to fund mattress recycling programs. Be sure to check with your state's laws to see if this fee applies to your purchase. Knowing the sales tax and recycling fee for your state can help you budget for the total cost of your Sealy Cocoon mattress.2. Understanding Taxes on Sealy Cocoon Mattresses

If you are looking to save on taxes when buying a Sealy Cocoon mattress, there are a few strategies you can use. One way is to take advantage of sales tax holidays, which are days or weekends where certain items are exempt from sales tax. Another option is to shop at a store or online retailer that offers tax-free purchases. This means that the retailer will cover the cost of the sales tax, saving you money on your Sealy Cocoon mattress. You can also try negotiating with the retailer for a lower price or additional discounts, which can help offset the cost of taxes.3. How to Save on Taxes When Purchasing a Sealy Cocoon Mattress

Aside from the medical expense deduction mentioned earlier, there may be other tax deductions you can take advantage of when purchasing a Sealy Cocoon mattress. If you work from home and use your mattress for business purposes, you may be able to deduct a portion of the cost as a business expense. This can include self-employed individuals who use their mattress for client meetings or employees who work from home and use their mattress as a workspace. It's important to consult with a tax professional to determine if you qualify for any other deductions related to your Sealy Cocoon mattress purchase.4. Sealy Cocoon Mattress Tax Deductions

Taxes can significantly impact the price of a Sealy Cocoon mattress. Depending on where you live, you may end up paying hundreds of dollars in sales tax and recycling fees. It's important to factor in these costs when budgeting for your mattress purchase. Keep in mind that even if you find a great deal on a Sealy Cocoon mattress, the added taxes and fees can increase the overall cost. However, with the right planning and knowledge of your state's tax laws, you can still get a great deal on a Sealy Cocoon mattress.5. The Impact of Taxes on Sealy Cocoon Mattress Prices

If you're in the market for a Sealy Cocoon mattress, here are a few tax tips to keep in mind: - Research your state's sales tax rate and any applicable recycling fees before making a purchase. - Take advantage of sales tax holidays or tax-free retailers to save on taxes. - Keep all receipts and documentation, including a doctor's prescription if purchasing for medical reasons, in case of an audit. - Consult with a tax professional to determine if you qualify for any tax deductions related to your mattress purchase. By following these tips, you can ensure that you are making the most of your Sealy Cocoon mattress purchase and saving on taxes.6. Tax Tips for Buying a Sealy Cocoon Mattress

The laws and regulations surrounding taxes on mattress purchases can be complex and vary by state. It's important to stay up-to-date on any changes in tax laws that may affect your Sealy Cocoon mattress purchase. For example, some states have recently implemented laws to tax online purchases, including mattresses. This means that even if you purchase your Sealy Cocoon mattress online, you may still be subject to sales tax and recycling fees. Be sure to research your state's tax laws and consult with a tax professional if you have any questions or concerns.7. Sealy Cocoon Mattress Tax Laws and Regulations

If you want to maximize your tax savings when buying a Sealy Cocoon mattress, there are a few things you can do: - Shop during sales tax holidays or at tax-free retailers. - Negotiate with the retailer for a lower price or additional discounts. - Use the mattress for business purposes to potentially qualify for tax deductions. - Keep all necessary documentation for tax purposes. By taking these steps, you can potentially save a significant amount of money on your Sealy Cocoon mattress purchase.8. Maximizing Tax Savings on Your Sealy Cocoon Mattress Purchase

Although taxes may not be the first thing that comes to mind when thinking about purchasing a mattress, they play a significant role in the total cost of a Sealy Cocoon mattress. Understanding how taxes work and taking advantage of any tax exemptions or deductions can help you save money on your purchase. It's important to research your state's tax laws and consult with a tax professional if needed to ensure you are making the most of your mattress purchase.9. The Connection Between Sealy Cocoon Mattresses and Taxes

Calculating taxes on your Sealy Cocoon mattress purchase can be a bit tricky. To get an accurate estimate, you will need to know the sales tax rate and any applicable recycling fees for your state. Once you have this information, simply multiply the cost of the mattress by the sales tax rate and add on any recycling fees. For example, if the sales tax rate is 8% and the recycling fee is $10, a $1000 mattress would have an added cost of $80 in sales tax and $10 for the recycling fee, bringing the total cost to $1090. Keep in mind that if you are eligible for any tax exemptions or deductions, this will lower the total cost of your Sealy Cocoon mattress purchase.10. How to Calculate Taxes on Your Sealy Cocoon Mattress Purchase

The Benefits of Investing in a Sealy Cocoon Mattress

Discover the Perfect Mattress for Your Home

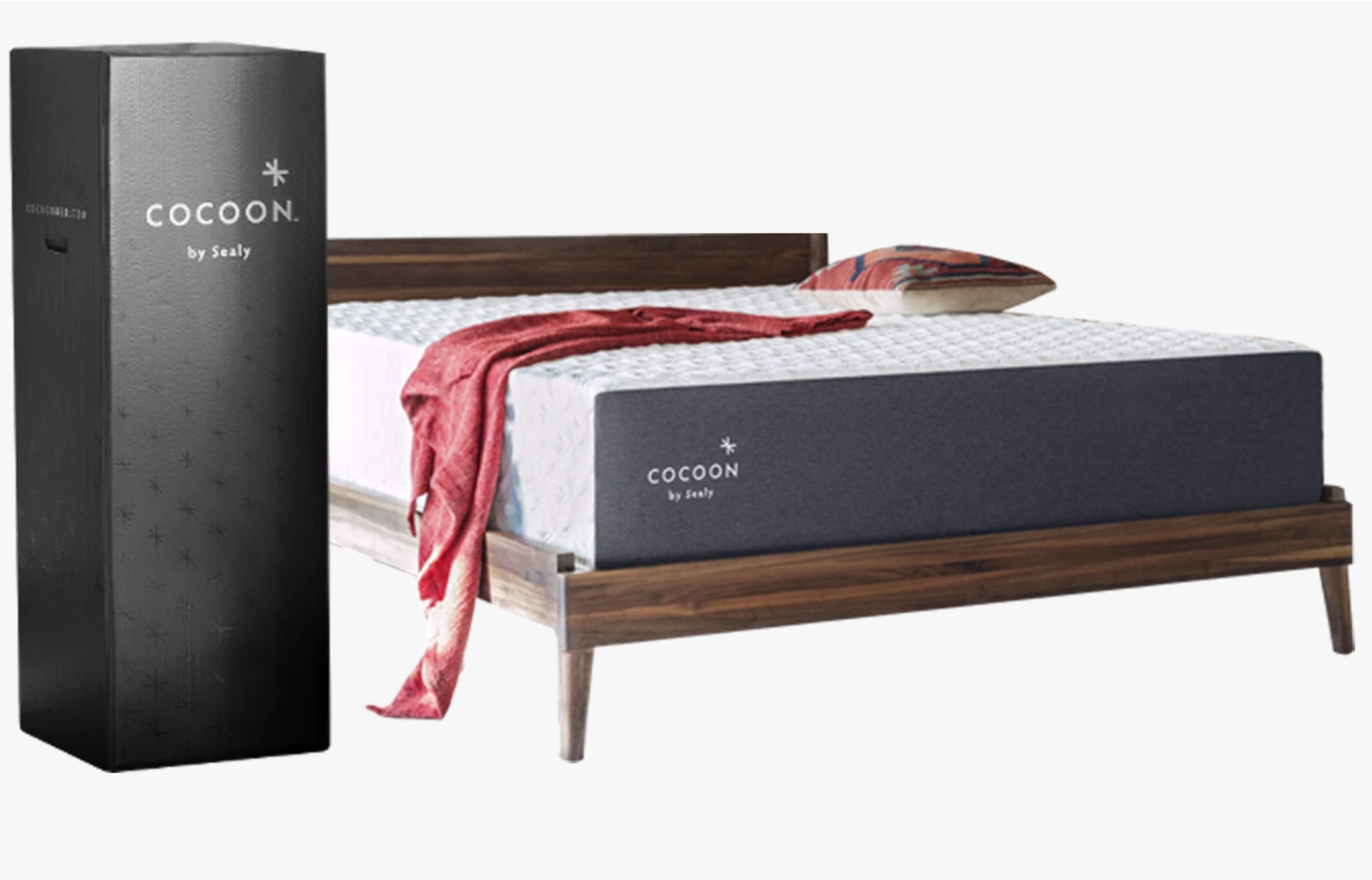

When it comes to designing and decorating your home, the perfect mattress is a crucial element that often gets overlooked. After all, a good night's sleep is essential for our overall health and well-being. That's where the Sealy Cocoon mattress comes in - not only does it provide unmatched comfort and support, but it also offers a range of benefits that make it a smart investment for your home.

Unparalleled Comfort

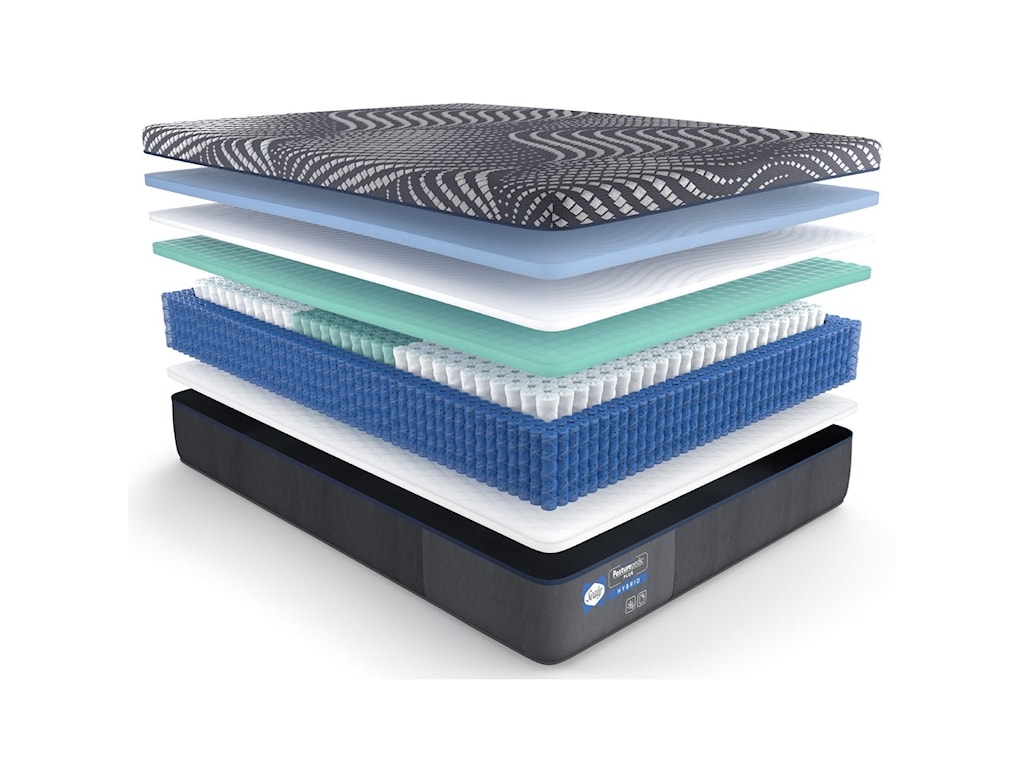

One of the primary reasons why the Sealy Cocoon mattress stands out from the rest is its comfort level. The mattress is designed with premium memory foam, which contours to your body and provides personalized support. This means no more tossing and turning trying to find a comfortable position or waking up with a sore back. The Sealy Cocoon mattress ensures you wake up feeling well-rested and ready to tackle the day ahead.

Optimal Support

Another crucial factor to consider when it comes to mattresses is the level of support they provide. The Sealy Cocoon mattress has been engineered to provide optimal support for your body, no matter your sleeping position. The memory foam not only conforms to your body but also helps distribute your weight evenly, relieving pressure points and reducing the risk of back pain. This level of support is essential for maintaining proper spinal alignment and ensuring a restful night's sleep.

Durability and Longevity

Investing in a quality mattress like the Sealy Cocoon not only benefits your physical well-being but also your wallet. The mattress is made with high-quality materials, ensuring its durability and longevity. Unlike traditional spring mattresses that can wear out over time, the Sealy Cocoon retains its shape and support for years to come. This means you won't have to worry about replacing your mattress every few years, making it a cost-effective choice in the long run.

When it comes to designing and decorating your home, the perfect mattress is a crucial element that often gets overlooked. After all, a good night's sleep is essential for our overall health and well-being. That's where the Sealy Cocoon mattress comes in - not only does it provide unmatched comfort and support, but it also offers a range of benefits that make it a smart investment for your home.

Unparalleled Comfort

One of the primary reasons why the Sealy Cocoon mattress stands out from the rest is its comfort level. The mattress is designed with premium memory foam, which contours to your body and provides personalized support. This means no more tossing and turning trying to find a comfortable position or waking up with a sore back. The Sealy Cocoon mattress ensures you wake up feeling well-rested and ready to tackle the day ahead.

Optimal Support

Another crucial factor to consider when it comes to mattresses is the level of support they provide. The Sealy Cocoon mattress has been engineered to provide optimal support for your body, no matter your sleeping position. The memory foam not only conforms to your body but also helps distribute your weight evenly, relieving pressure points and reducing the risk of back pain. This level of support is essential for maintaining proper spinal alignment and ensuring a restful night's sleep.

Durability and Longevity

Investing in a quality mattress like the Sealy Cocoon not only benefits your physical well-being but also your wallet. The mattress is made with high-quality materials, ensuring its durability and longevity. Unlike traditional spring mattresses that can wear out over time, the Sealy Cocoon retains its shape and support for years to come. This means you won't have to worry about replacing your mattress every few years, making it a cost-effective choice in the long run.

Upgrade Your Sleep with the Sealy Cocoon Mattress

In addition to its unmatched comfort, optimal support, and durability, the Sealy Cocoon mattress also comes with a 100-night trial and a 10-year warranty. This means you can try out the mattress in the comfort of your own home and return it if it doesn't meet your expectations. With its affordable price point and a range of sizes and firmness options, the Sealy Cocoon mattress is the perfect addition to any home and is sure to provide you with the best sleep of your life. So why wait? Upgrade your sleep today with the Sealy Cocoon mattress and experience the difference it can make in your daily life.

In addition to its unmatched comfort, optimal support, and durability, the Sealy Cocoon mattress also comes with a 100-night trial and a 10-year warranty. This means you can try out the mattress in the comfort of your own home and return it if it doesn't meet your expectations. With its affordable price point and a range of sizes and firmness options, the Sealy Cocoon mattress is the perfect addition to any home and is sure to provide you with the best sleep of your life. So why wait? Upgrade your sleep today with the Sealy Cocoon mattress and experience the difference it can make in your daily life.