What is the sales tax on mattresses in PA?

If you're in the market for a new mattress in Pennsylvania, it's important to know the sales tax that will be added to your purchase. This will help you budget for your new bedding and avoid any surprises at the checkout counter. So, what is the sales tax on mattresses in PA?

The sales tax rate for mattresses in Pennsylvania is currently 6%. This means that for every $100 you spend on a mattress, you will be charged an additional $6 in sales tax. This rate applies to all types of mattresses, including traditional innerspring, memory foam, and hybrid mattresses.

How much is the sales tax on mattresses in PA?

As mentioned, the sales tax rate on mattresses in PA is 6%. But how much does this actually add to the cost of your mattress? Let's break it down with an example. If you purchase a mattress for $1,000, the sales tax added would be $60. Keep in mind that this only applies to the cost of the mattress itself, not any additional fees or delivery charges.

PA sales tax on mattresses

The sales tax on mattresses in PA is applied to all retail sales of mattresses within the state. This includes purchases made in-store, online, or through a mail-order catalog. It also applies to mattresses that are shipped or delivered to PA from out-of-state retailers.

PA mattress sales tax rate

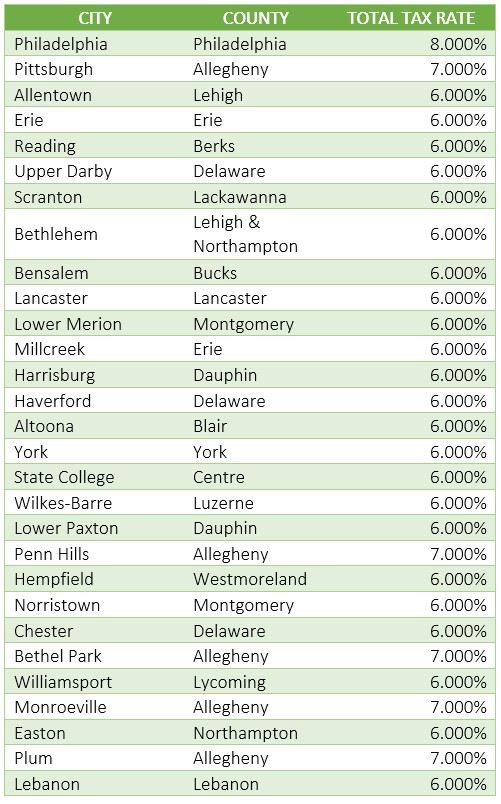

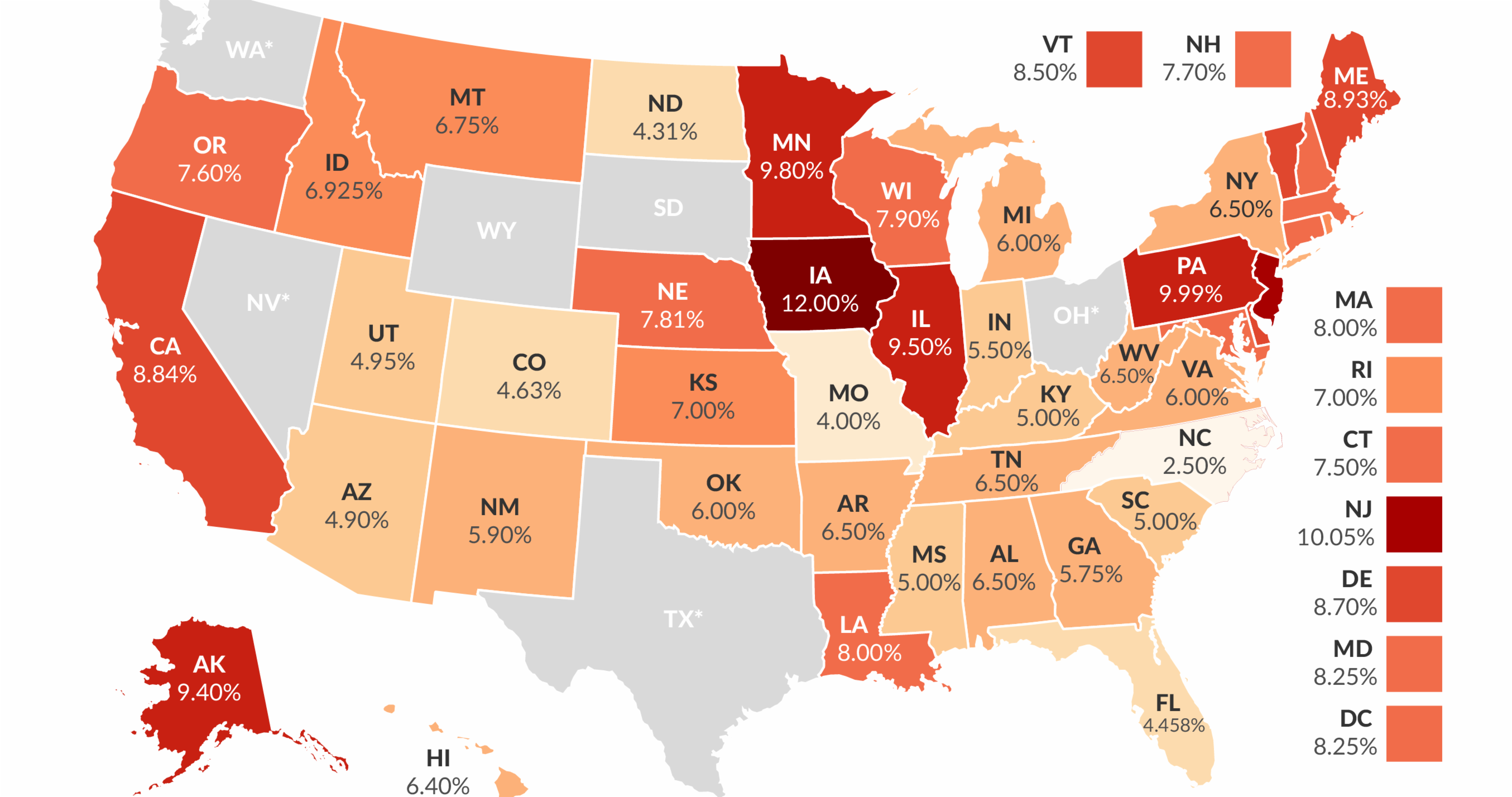

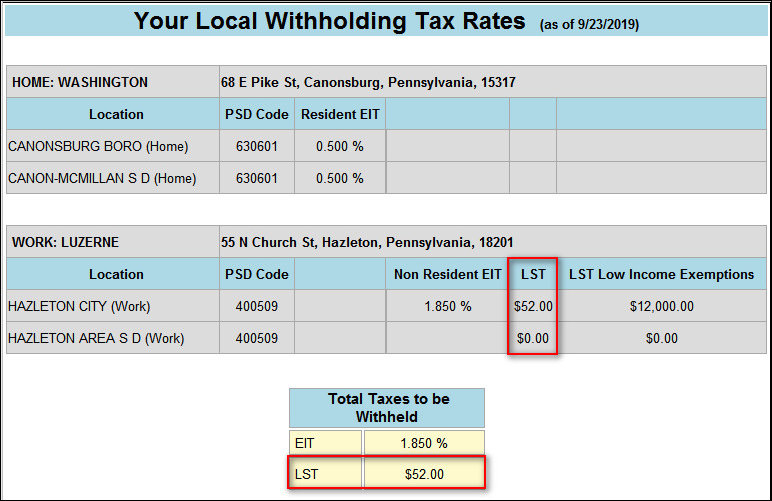

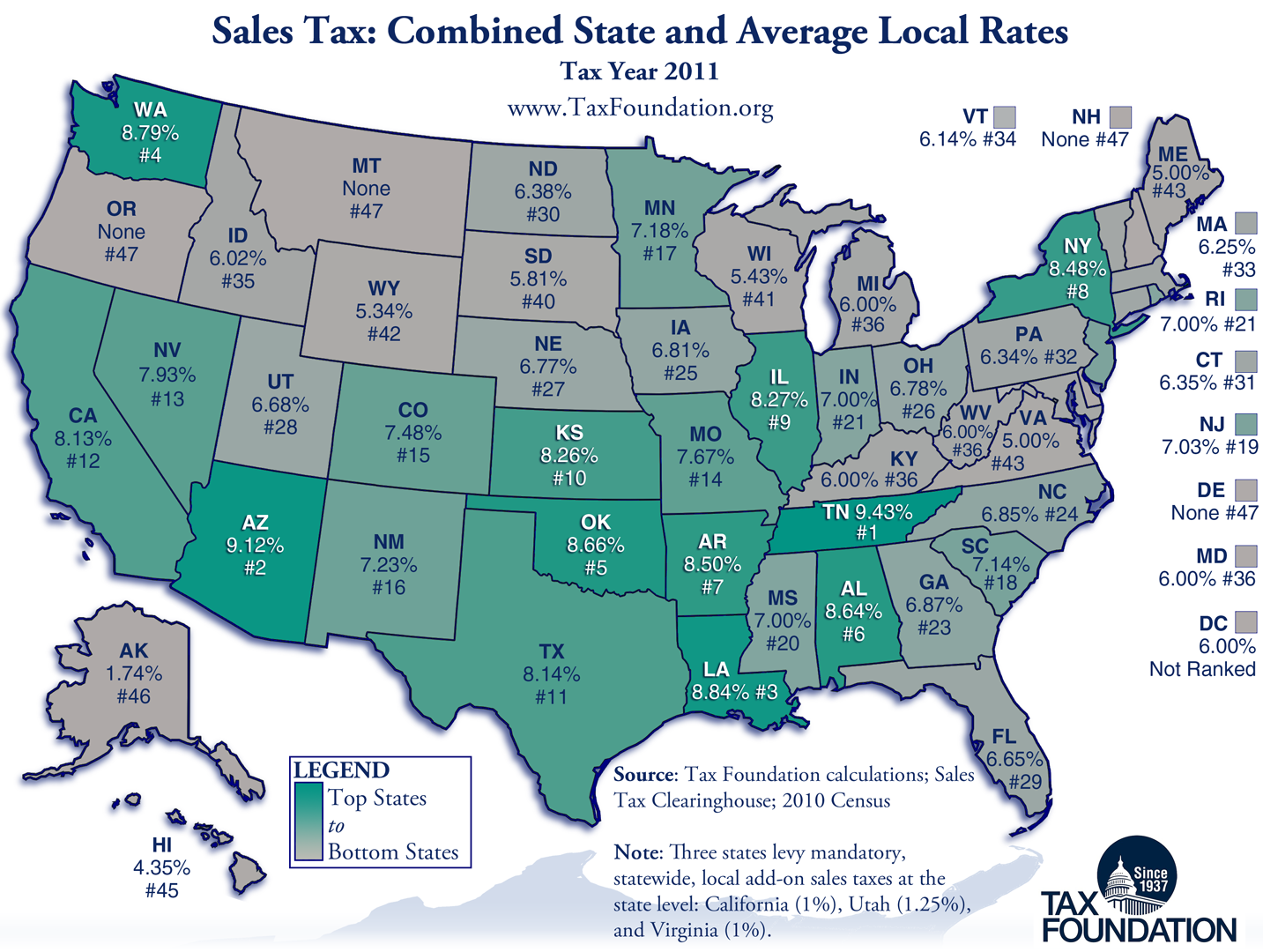

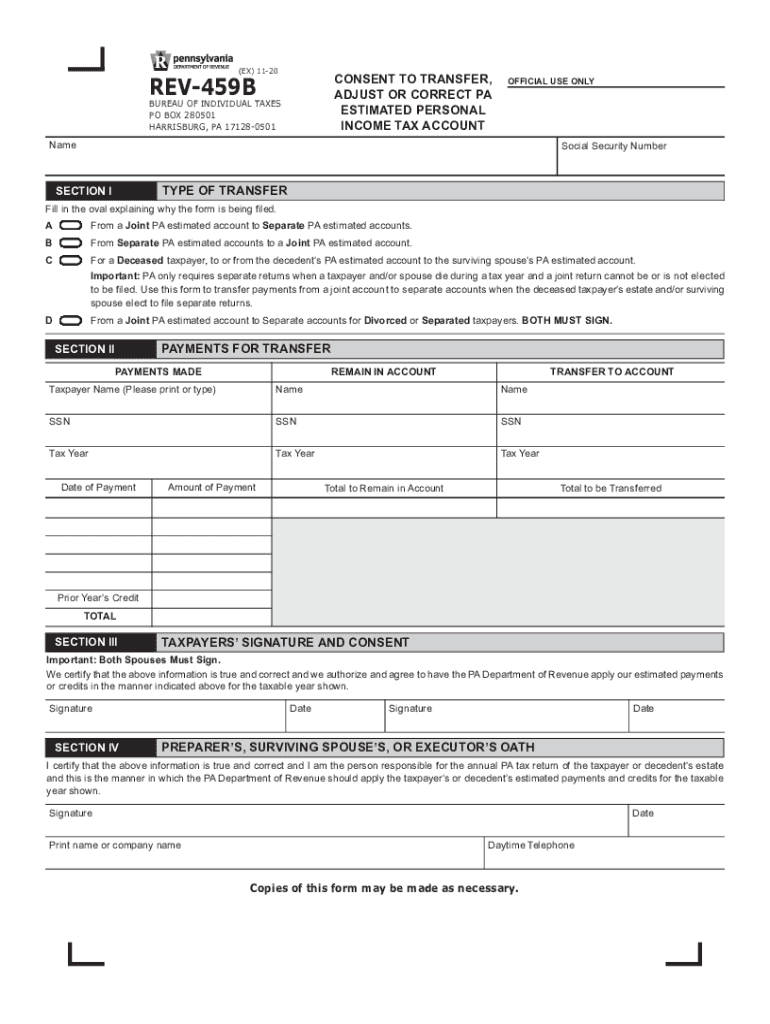

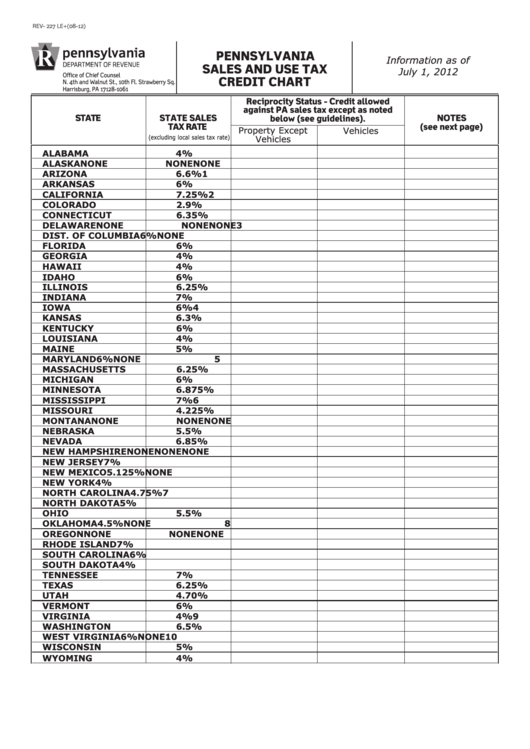

The current sales tax rate on mattresses in PA is 6%. This rate can change over time, so it's always a good idea to check with the PA Department of Revenue for the most up-to-date information. Keep in mind that some cities and counties in PA may have additional local taxes, so be sure to check with your specific area for any additional charges.

PA sales tax for mattresses

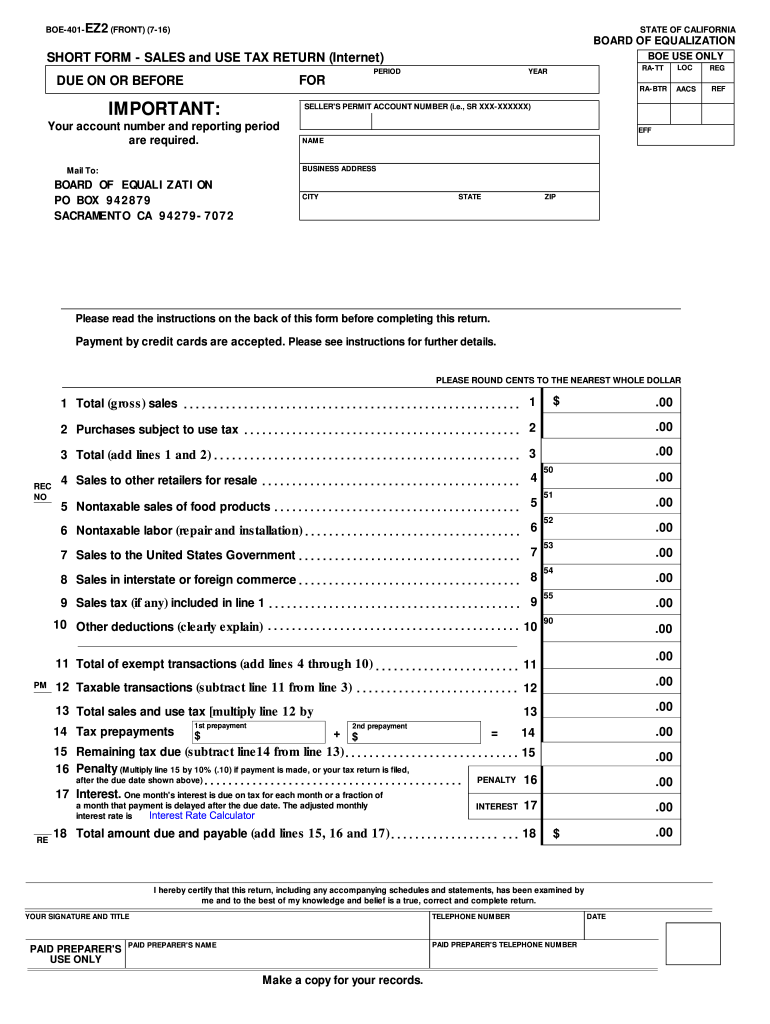

As a consumer, you are responsible for paying the sales tax on mattresses in PA. This means that the retailer should charge you the appropriate sales tax at the time of purchase. If you shop online or through a catalog, the retailer may also be required to collect and remit the sales tax on your behalf.

PA mattress tax rate

The PA mattress tax rate is currently 6%. This rate applies to all types of mattresses, including those sold at traditional mattress retailers, department stores, and online retailers. It's important to note that this rate may change over time, so it's always a good idea to check with the PA Department of Revenue for the most up-to-date information.

PA sales tax for bedding

When it comes to bedding, the sales tax rate in PA is the same as it is for mattresses - 6%. This includes items such as sheets, comforters, and pillows. However, certain items such as bed frames and headboards may be subject to a different sales tax rate, so it's best to check with the retailer or the PA Department of Revenue for specific information.

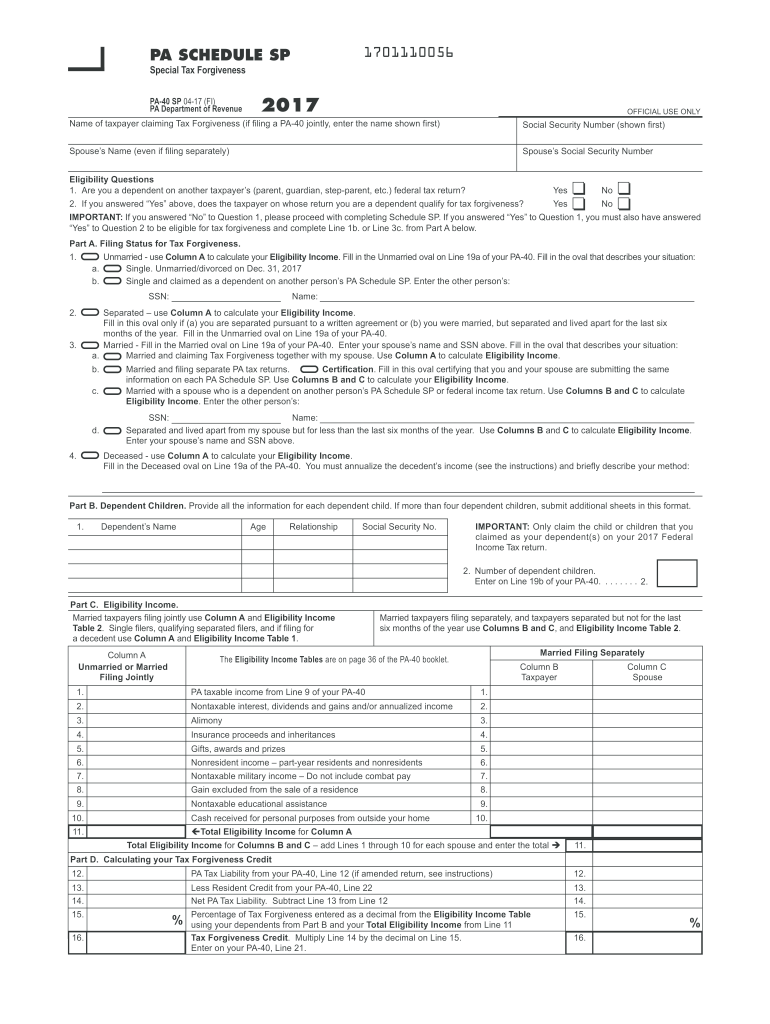

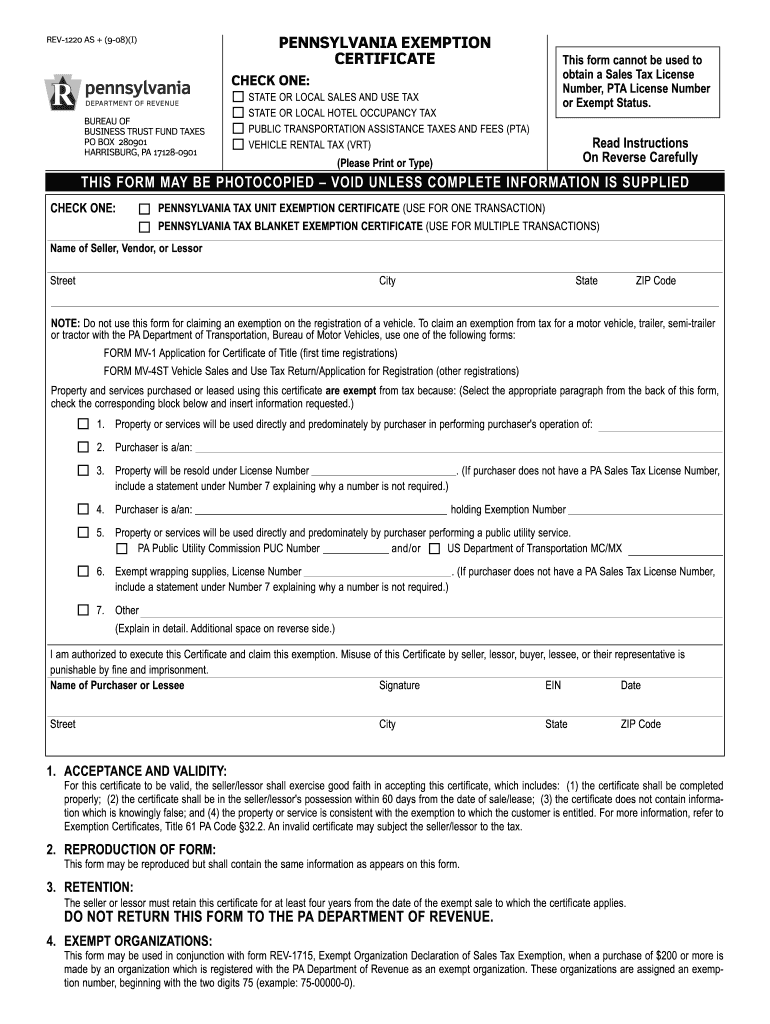

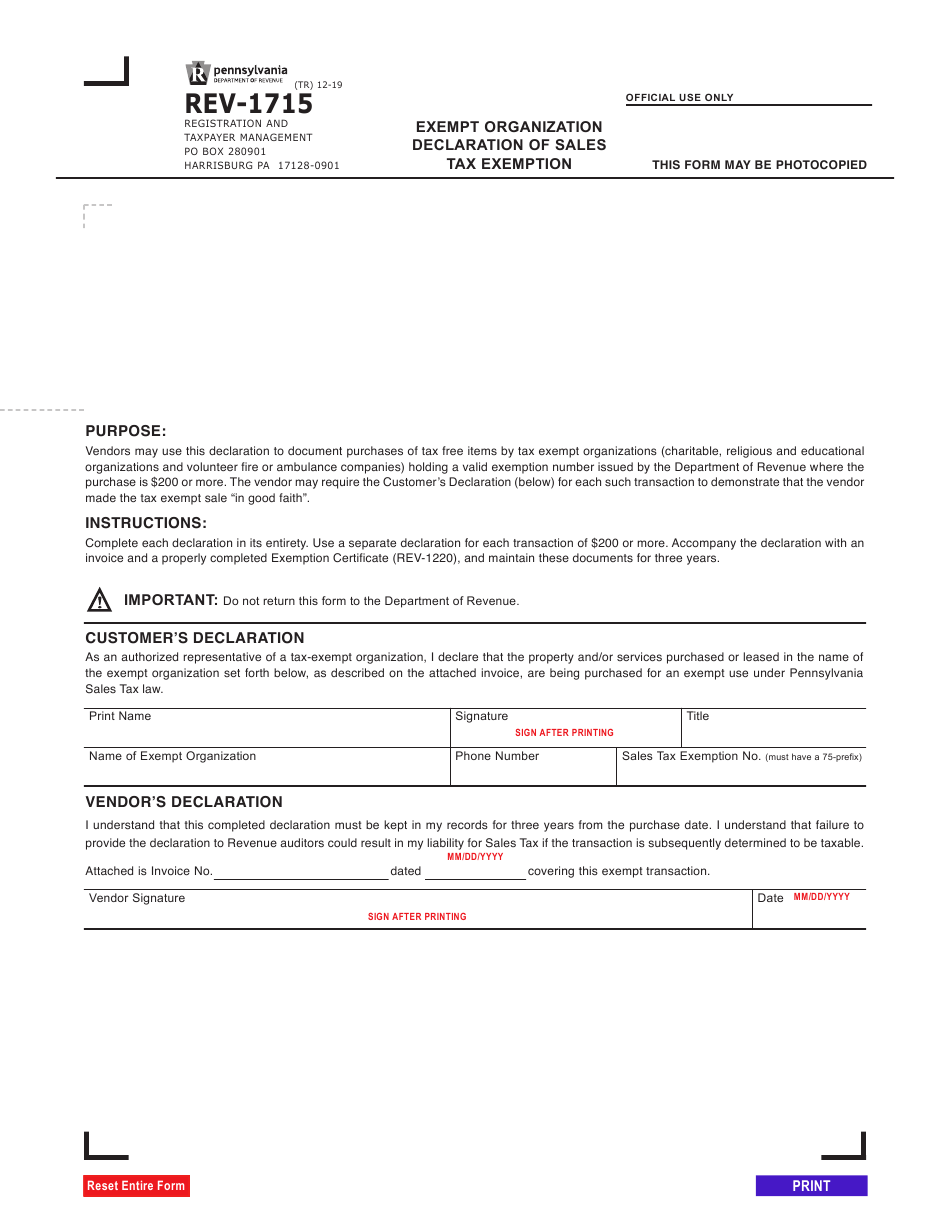

PA mattress tax exemption

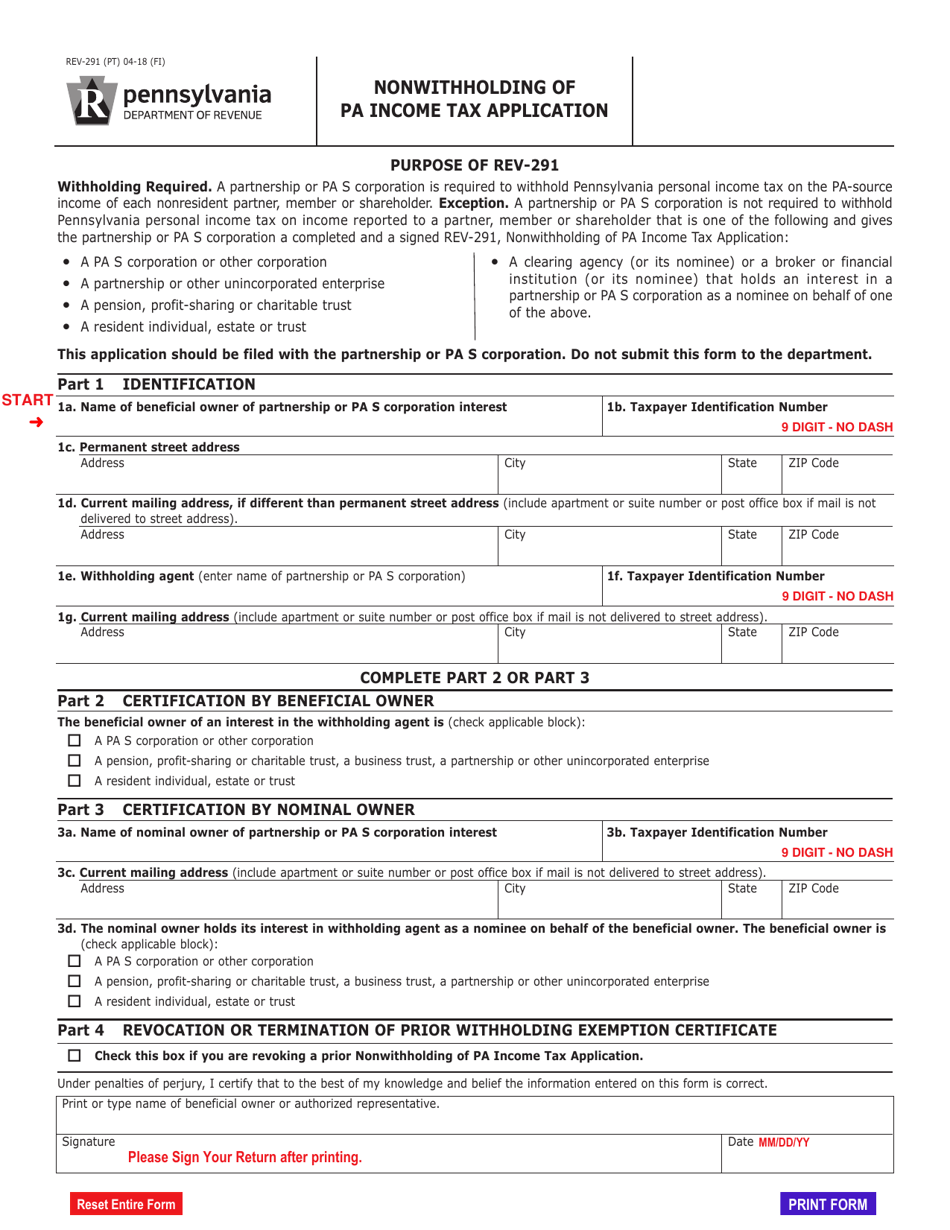

In some cases, you may be eligible for a PA mattress tax exemption. For example, if you are purchasing a mattress for a medical purpose and have a prescription from a doctor, you may be exempt from paying the sales tax. In these cases, you will need to provide the retailer with the appropriate documentation in order to receive the exemption.

PA sales tax on furniture

While this article is focused on the sales tax on mattresses in PA, it's worth mentioning that the sales tax rate for furniture in PA is the same - 6%. This includes items such as bed frames, headboards, and other bedroom furniture. However, if you are purchasing furniture for a medical purpose and have a prescription, you may be eligible for a tax exemption.

PA sales tax on household goods

In addition to mattresses and furniture, the sales tax rate in PA also applies to household goods such as appliances and electronics. The current sales tax rate for these items is also 6%. Keep in mind that some items may be exempt from sales tax, such as groceries and clothing. It's always best to check with the PA Department of Revenue for specific information on sales tax rates for different types of household goods.

The Impact of Sales Tax on Mattresses in PA

Understanding the Sales Tax Laws for Mattresses in Pennsylvania

When shopping for a new mattress in Pennsylvania, it's important to consider the additional cost of sales tax. The state applies a 6% sales tax on most purchases, including mattresses. This means that for every $100 spent on a mattress, an extra $6 will be added to the total cost.

But what exactly does this mean for consumers? How does it affect the mattress industry in Pennsylvania? And are there any exceptions to this sales tax law?

The Impact on Consumers

For consumers, the sales tax on mattresses can significantly impact their budget and purchasing decisions. For example, if a mattress costs $1,000, the sales tax would add an extra $60 to the total cost. This may not seem like a lot, but for those on a tight budget or looking to save money, this added cost can make a difference.

The Impact on the Mattress Industry

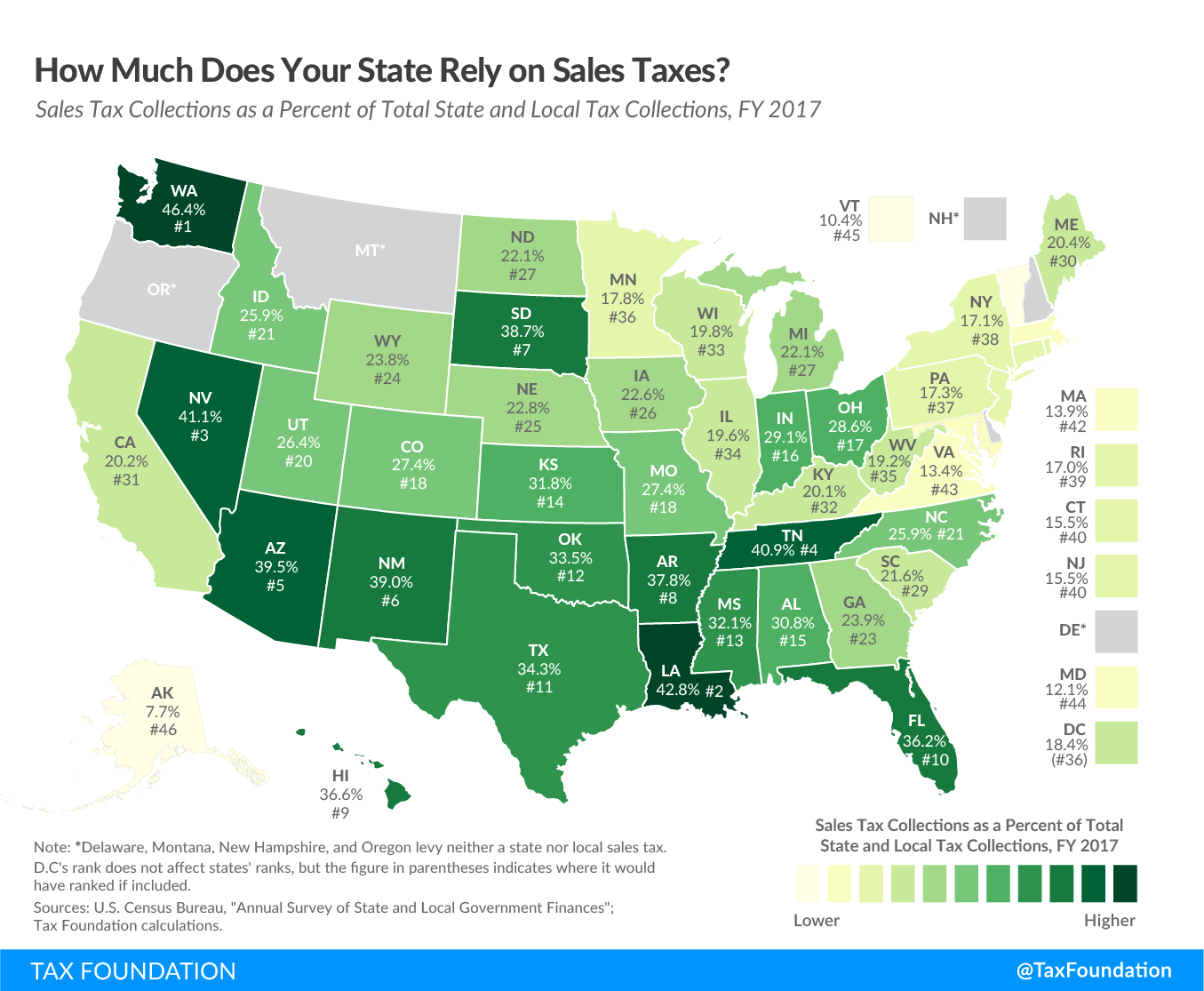

The sales tax on mattresses also affects the mattress industry in Pennsylvania. It can make it more challenging for businesses to compete with online retailers or those in neighboring states with lower sales tax rates. This may result in higher prices for mattresses in Pennsylvania, making it more difficult for local businesses to attract and retain customers.

Exceptions to the Sales Tax Law

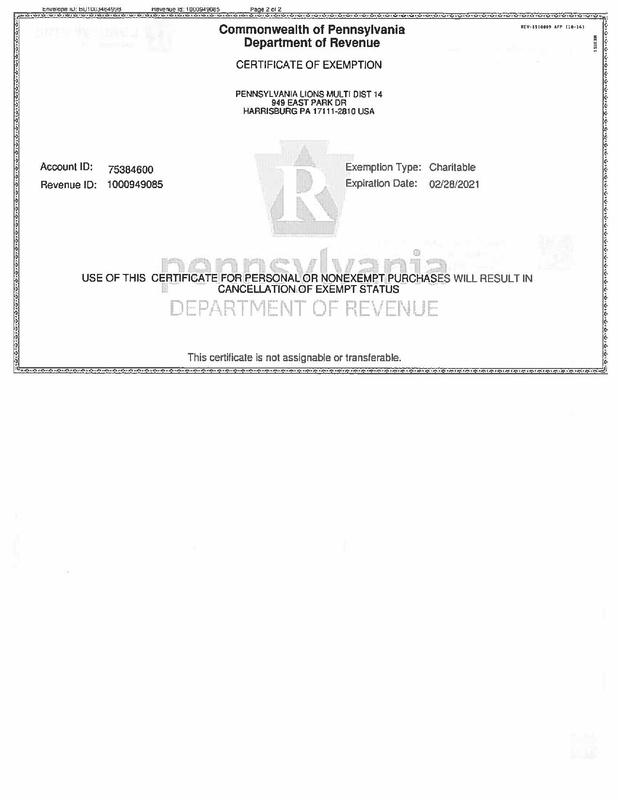

While most mattress purchases are subject to the 6% sales tax in Pennsylvania, there are some exceptions. For example, mattresses sold to government entities or for resale are exempt from sales tax. Additionally, mattresses purchased by nonprofit organizations for charitable purposes are also exempt.

Final Thoughts

The sales tax on mattresses in Pennsylvania is an important factor to consider when shopping for a new mattress. It not only impacts consumers' budgets but also the mattress industry in the state. However, there are exceptions to the sales tax law that may benefit certain organizations. It's essential to be aware of these laws and exceptions to make informed purchasing decisions.

When shopping for a new mattress in Pennsylvania, it's important to consider the additional cost of sales tax. The state applies a 6% sales tax on most purchases, including mattresses. This means that for every $100 spent on a mattress, an extra $6 will be added to the total cost.

But what exactly does this mean for consumers? How does it affect the mattress industry in Pennsylvania? And are there any exceptions to this sales tax law?

The Impact on Consumers

For consumers, the sales tax on mattresses can significantly impact their budget and purchasing decisions. For example, if a mattress costs $1,000, the sales tax would add an extra $60 to the total cost. This may not seem like a lot, but for those on a tight budget or looking to save money, this added cost can make a difference.

The Impact on the Mattress Industry

The sales tax on mattresses also affects the mattress industry in Pennsylvania. It can make it more challenging for businesses to compete with online retailers or those in neighboring states with lower sales tax rates. This may result in higher prices for mattresses in Pennsylvania, making it more difficult for local businesses to attract and retain customers.

Exceptions to the Sales Tax Law

While most mattress purchases are subject to the 6% sales tax in Pennsylvania, there are some exceptions. For example, mattresses sold to government entities or for resale are exempt from sales tax. Additionally, mattresses purchased by nonprofit organizations for charitable purposes are also exempt.

Final Thoughts

The sales tax on mattresses in Pennsylvania is an important factor to consider when shopping for a new mattress. It not only impacts consumers' budgets but also the mattress industry in the state. However, there are exceptions to the sales tax law that may benefit certain organizations. It's essential to be aware of these laws and exceptions to make informed purchasing decisions.