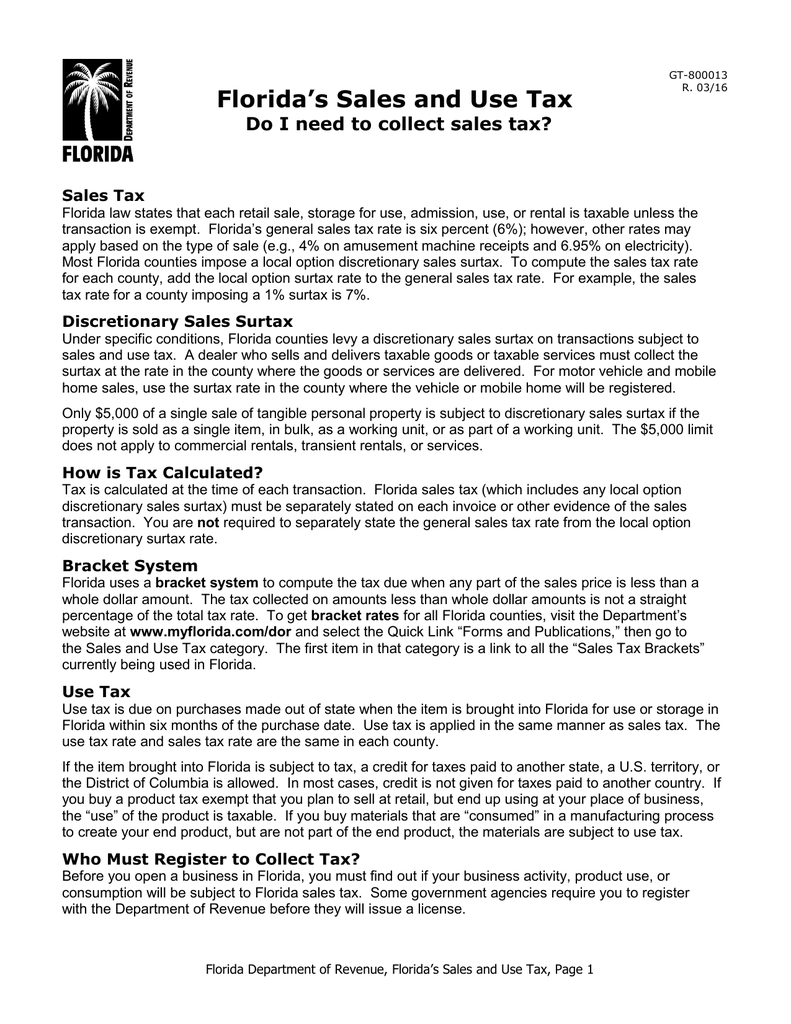

If you suffer from a medical condition that requires a specialized mattress, you may be eligible for a sales tax exemption in the state of Florida. This exemption is available for prescription mattresses, which are specifically designed to meet the needs of individuals with certain medical conditions. By understanding the criteria for this exemption and how to claim it, you can save money on your purchase and ease the financial burden of managing your medical condition.Florida Sales Tax Exemption for Prescription Mattresses

In addition to prescription mattresses, Florida also offers a sales tax exemption for a wide range of medical equipment. This includes items such as wheelchairs, crutches, and hospital beds. The state considers these items to be essential for managing a medical condition and therefore does not require them to be subject to sales tax. This exemption applies to both purchases and rentals of medical equipment, making it easier for individuals to access the necessary equipment for their health needs.Florida Sales Tax Exemption for Medical Equipment

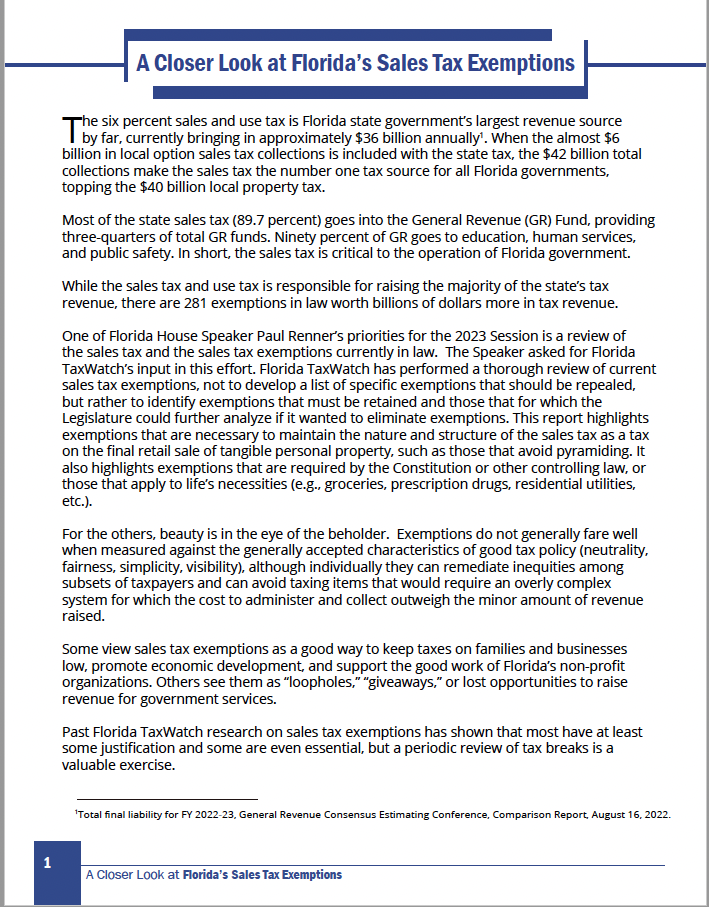

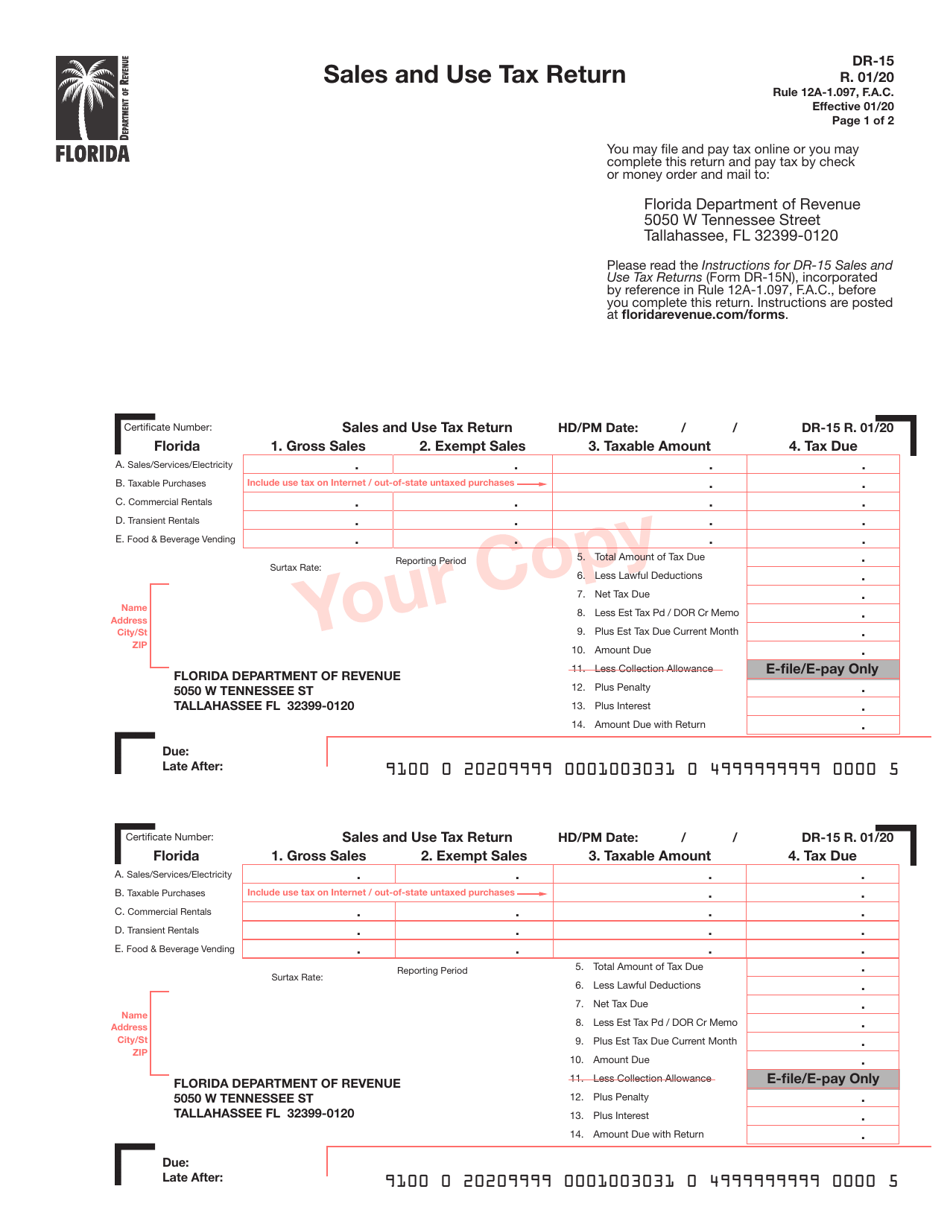

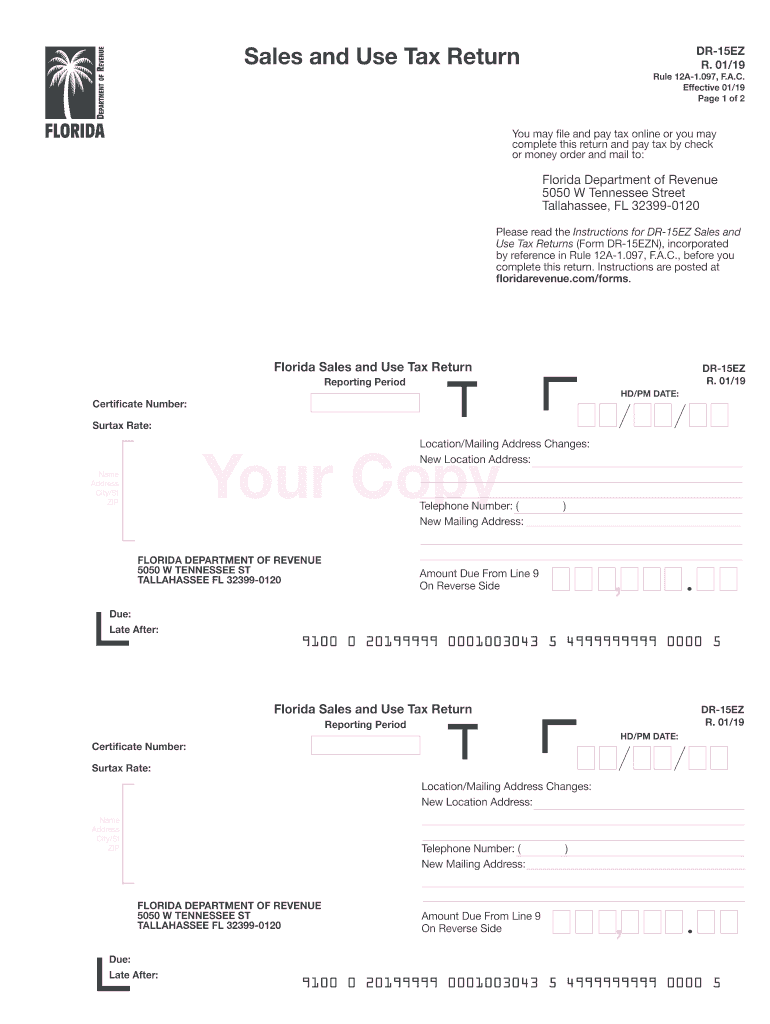

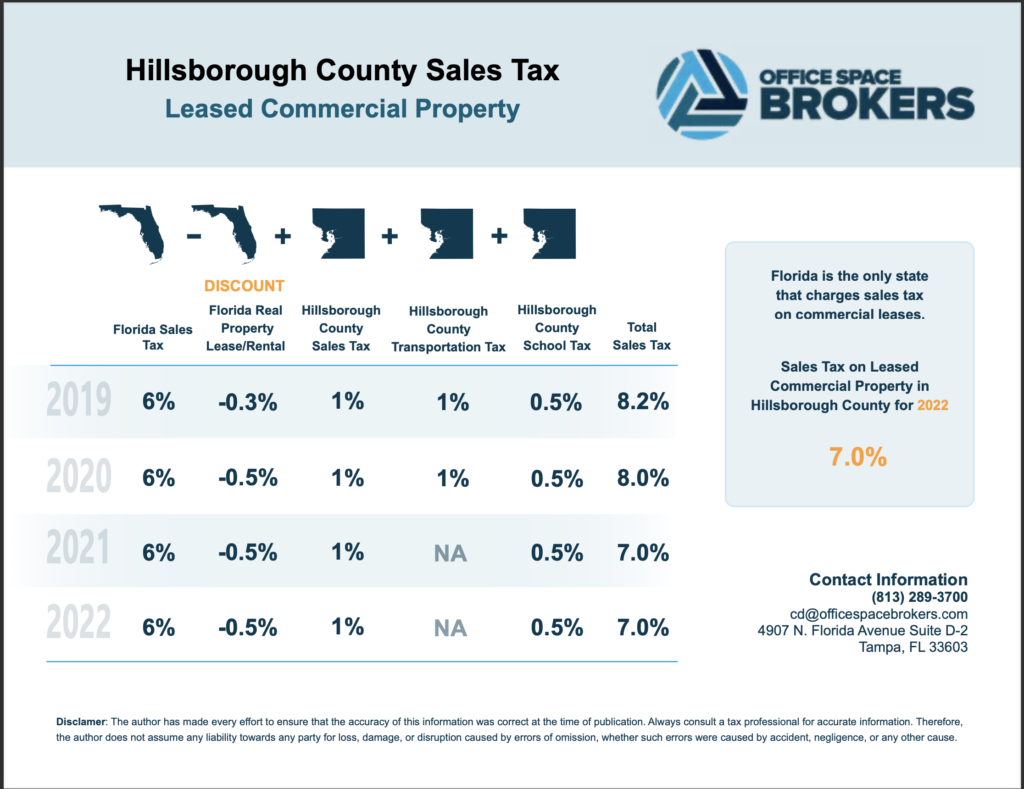

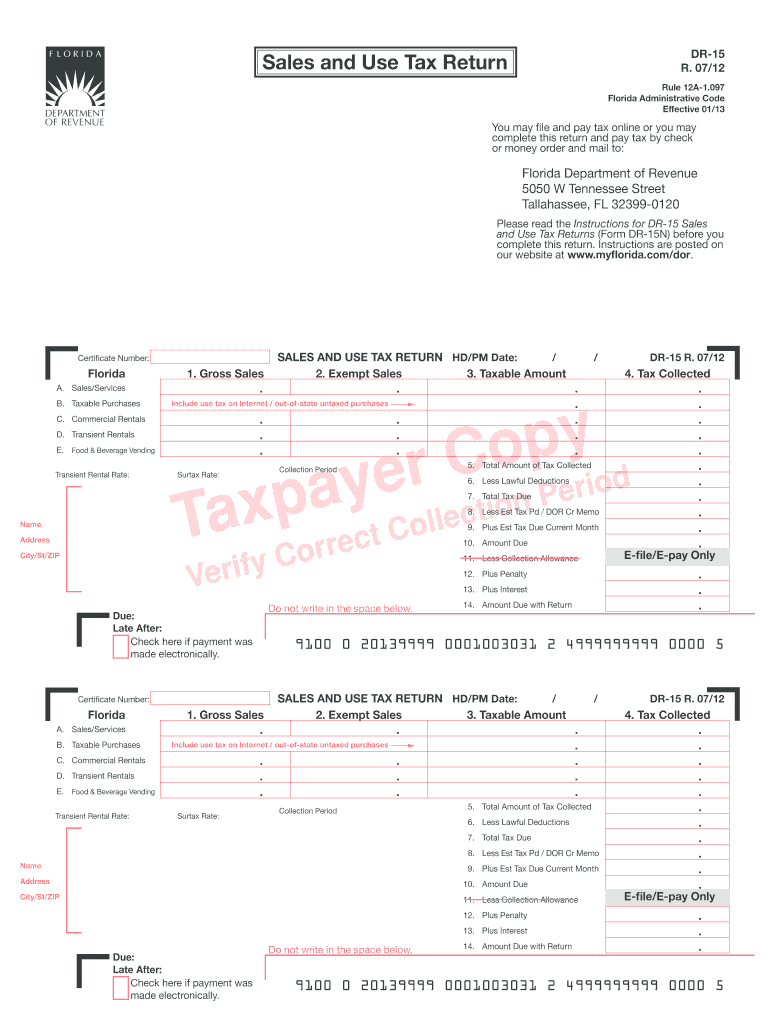

The Florida Department of Revenue oversees the sales and use tax on medical equipment in the state. This tax is imposed on the purchase or use of medical equipment, including prescription mattresses, by individuals or businesses. However, as mentioned earlier, there are exemptions available for certain medical equipment, which can help reduce the overall cost for those in need of these items. It is important to consult with the Florida Department of Revenue for specific guidelines and regulations regarding the sales tax on medical equipment.Florida Department of Revenue - Sales and Use Tax on Medical Equipment

In addition to prescription mattresses and medical equipment, Florida also offers sales tax exemptions for medical supplies. This includes items such as bandages, catheters, and oxygen supplies. These items are considered essential for managing medical conditions and are therefore exempt from sales tax. This exemption can provide much-needed relief for individuals who rely on these supplies for their health needs.Florida Sales Tax Exemptions for Medical Equipment and Supplies

Florida offers a sales tax exemption for both prescription drugs and medical devices. This exemption applies to the purchase of prescription drugs by individuals and businesses, as well as the purchase of medical devices by physicians and hospitals. By exempting these essential items from sales tax, Florida aims to make healthcare more affordable for its residents.Florida Sales Tax Exemption for Prescription Drugs and Medical Devices

Durable medical equipment, such as walkers, canes, and blood glucose monitors, are also eligible for a sales tax exemption in Florida. These items are essential for managing a medical condition and are therefore exempt from sales tax. This exemption applies to both purchases and rentals of durable medical equipment, making it easier for individuals to access the equipment they need to maintain their health.Florida Sales Tax Exemption for Durable Medical Equipment

In addition to exemptions for medical equipment and supplies, Florida also offers a sales tax exemption for items used in home health care. This includes items such as hospital beds, lift chairs, and oxygen tanks. These items are essential for individuals who require home health care and are therefore exempt from sales tax. This exemption can provide much-needed relief for individuals and families who are caring for a loved one at home.Florida Sales Tax Exemption for Medical Equipment and Supplies Used in Home Health Care

One of the more specific exemptions offered by Florida is for prescription mattresses for disabled individuals. These specialized mattresses are designed to provide comfort and support for individuals with disabilities, making them an essential medical item. By exempting these mattresses from sales tax, Florida aims to make it easier for disabled individuals to access the necessary equipment for their health needs.Florida Sales Tax Exemption for Prescription Mattresses for Disabled Individuals

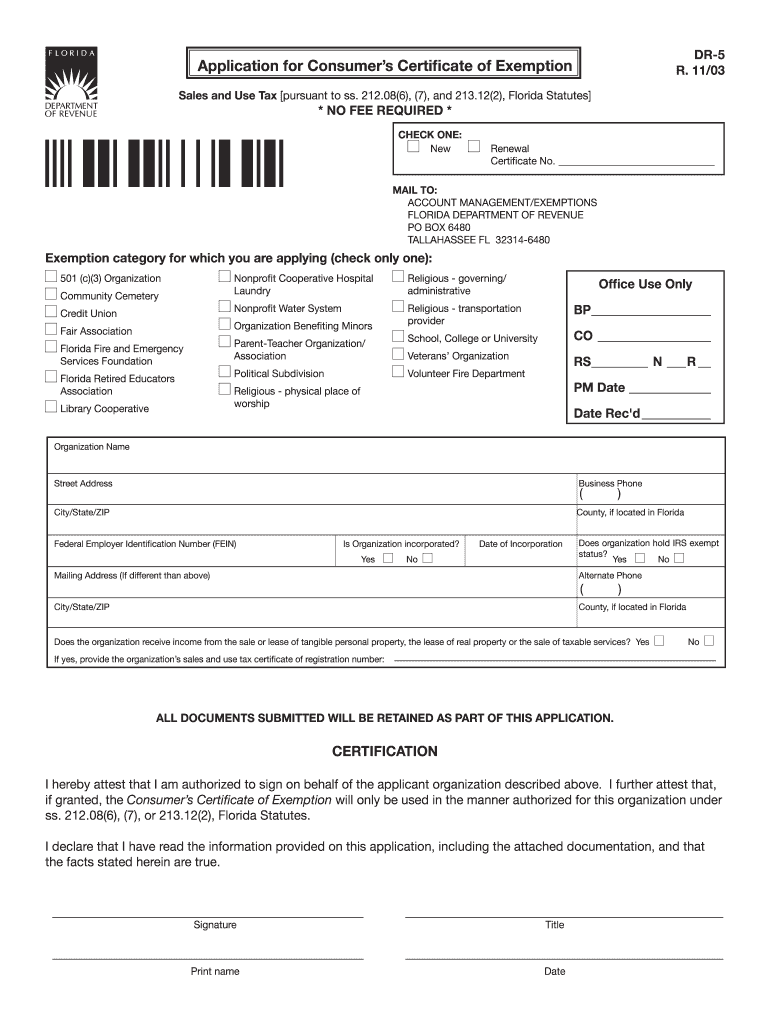

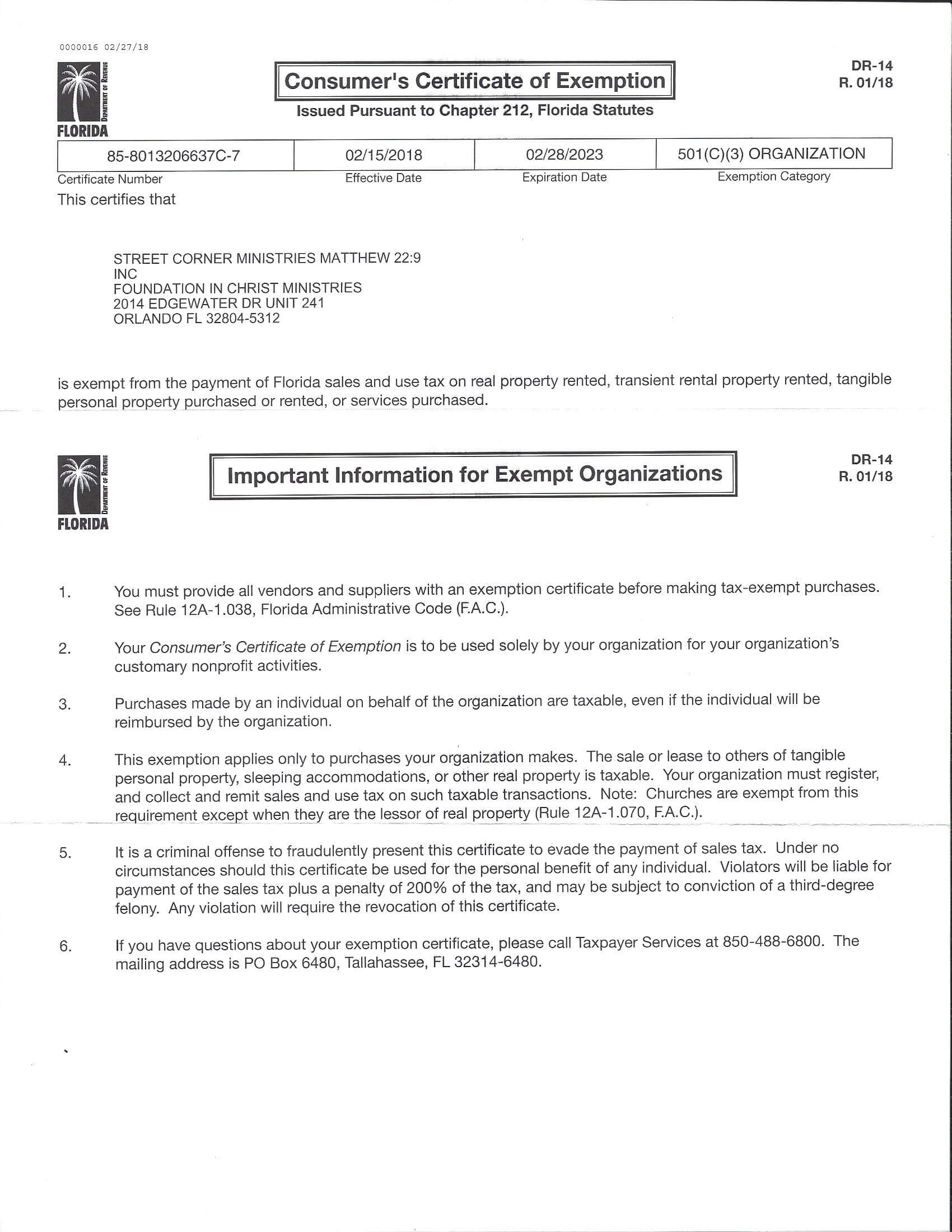

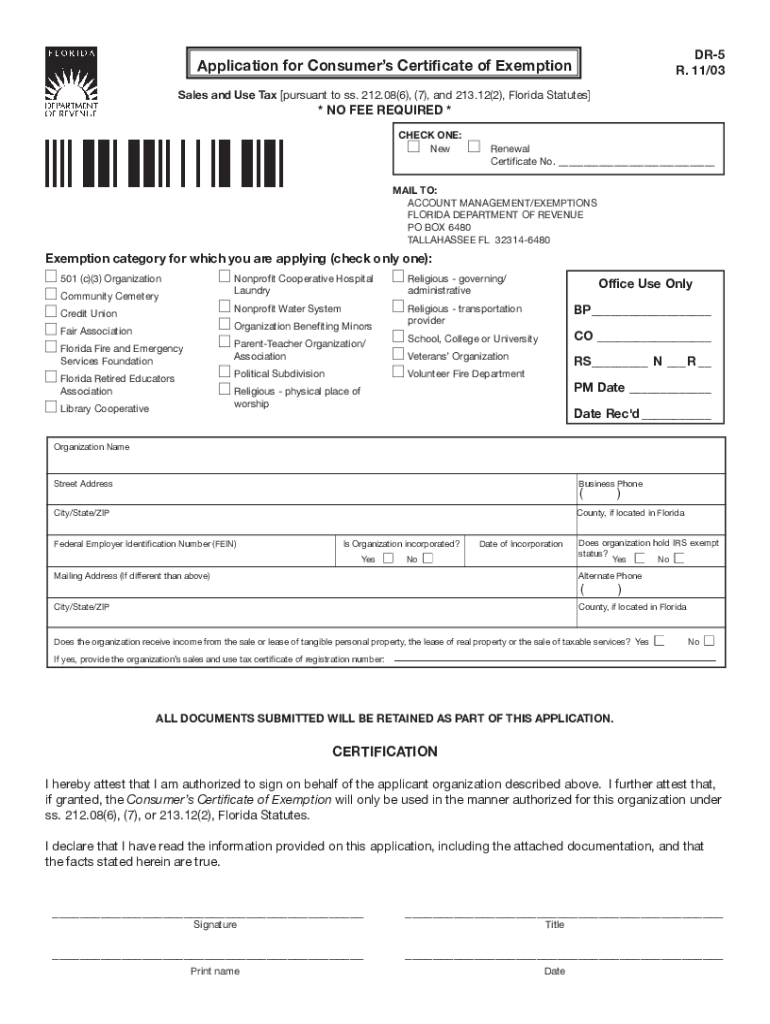

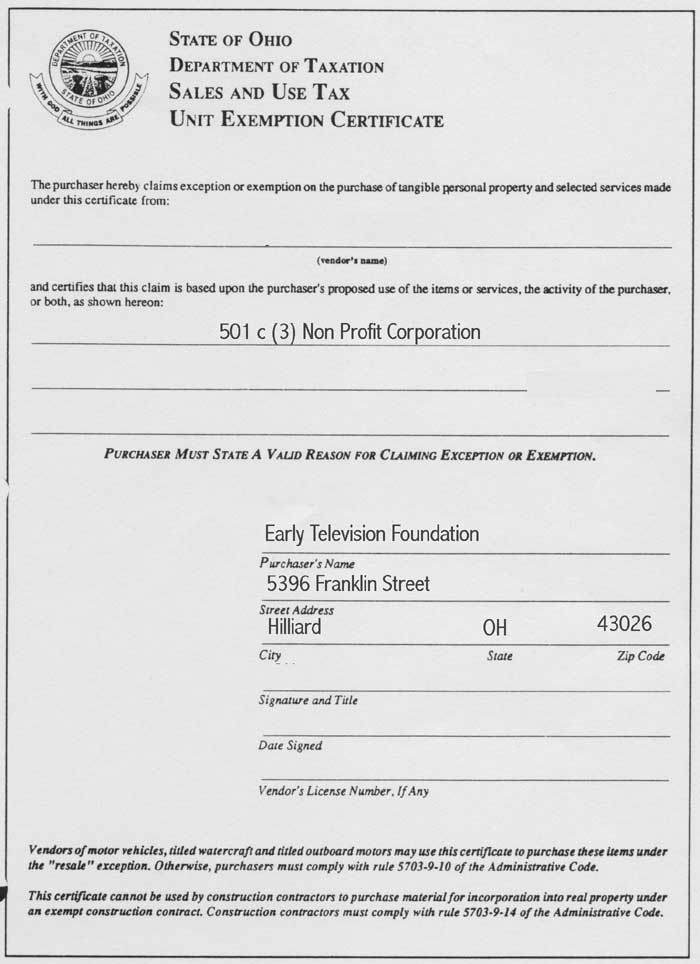

Nonprofit organizations that purchase medical equipment for charitable purposes may also be eligible for a sales tax exemption in Florida. This exemption applies to both purchases and rentals of medical equipment and can help nonprofit organizations save money as they work to support those in need of medical care.Florida Sales Tax Exemption for Medical Equipment Purchased by Nonprofit Organizations

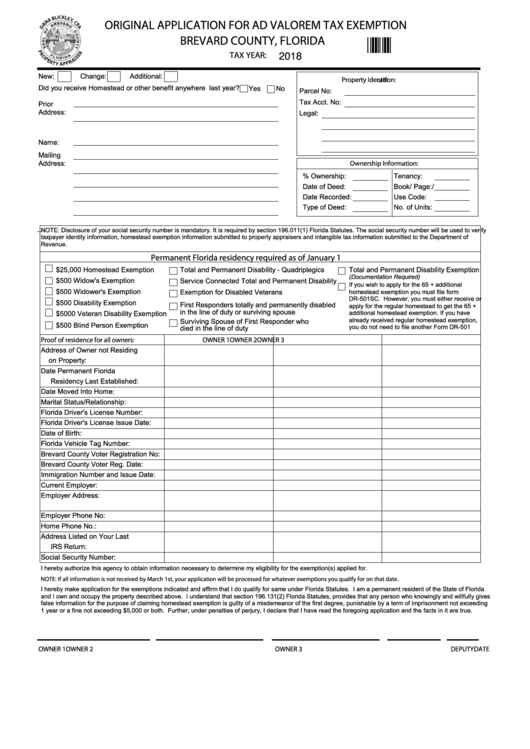

Finally, Florida offers a sales tax exemption for prescription mattresses for veterans. This exemption applies to veterans who receive healthcare through the Department of Veterans Affairs and require a specialized mattress for their medical condition. By exempting these mattresses from sales tax, Florida aims to show its support for those who have served our country and ensure they have access to the medical equipment they need.Florida Sales Tax Exemption for Prescription Mattresses for Veterans

Understanding the Importance of a Quality Mattress for Your Home

Why You Should Invest in a Prescription Mattress in Florida

When it comes to designing and furnishing your home, one of the most important aspects to consider is your mattress. After all, we spend one-third of our lives sleeping, and a good night's rest is crucial for our physical and mental well-being. That's why it's essential to invest in a quality mattress that is tailored to your specific needs. And in Florida, where the weather can be hot and humid, a prescription mattress is a must-have for your home.

Prescription mattresses are specially designed to meet the unique needs of each individual

, taking into account factors such as body type, sleeping position, and any existing medical conditions. This personalized approach to mattress design ensures that you get the best support and comfort for your body, resulting in a better night's sleep.

But why should you consider a prescription mattress specifically in Florida? For starters, the state's warm climate can make it challenging to get a good night's sleep. The high humidity levels can cause discomfort and disrupt your sleep, leading to a restless night and a less productive day. A prescription mattress, however, addresses this issue with features such as cooling gel-infused foam and breathable fabrics that help regulate your body temperature and keep you comfortable throughout the night.

Additionally, Florida's diverse population means that there is a wide range of body types and medical conditions that need to be considered when it comes to selecting a mattress. Prescription mattresses take into account these individual needs, providing the necessary support and comfort for a restful sleep. Whether you have back pain, joint problems, or other health concerns, a prescription mattress can be customized to accommodate your specific needs.

Aside from the physical benefits, a prescription mattress can also be a wise financial investment in the long run. A good quality mattress can last for up to 10 years, and with a prescription mattress, you can be sure that it is designed to fit your needs for an extended period. This means you won't have to replace your mattress frequently, saving you money in the long term.

In conclusion, while the idea of a prescription mattress may seem like a luxury, it is a crucial investment for your health and well-being. And in a place like Florida, where the climate and diverse population can make a good night's sleep a challenge, a prescription mattress can make all the difference. So if you're in the market for a new mattress, consider investing in a prescription mattress and experience the benefits firsthand.

When it comes to designing and furnishing your home, one of the most important aspects to consider is your mattress. After all, we spend one-third of our lives sleeping, and a good night's rest is crucial for our physical and mental well-being. That's why it's essential to invest in a quality mattress that is tailored to your specific needs. And in Florida, where the weather can be hot and humid, a prescription mattress is a must-have for your home.

Prescription mattresses are specially designed to meet the unique needs of each individual

, taking into account factors such as body type, sleeping position, and any existing medical conditions. This personalized approach to mattress design ensures that you get the best support and comfort for your body, resulting in a better night's sleep.

But why should you consider a prescription mattress specifically in Florida? For starters, the state's warm climate can make it challenging to get a good night's sleep. The high humidity levels can cause discomfort and disrupt your sleep, leading to a restless night and a less productive day. A prescription mattress, however, addresses this issue with features such as cooling gel-infused foam and breathable fabrics that help regulate your body temperature and keep you comfortable throughout the night.

Additionally, Florida's diverse population means that there is a wide range of body types and medical conditions that need to be considered when it comes to selecting a mattress. Prescription mattresses take into account these individual needs, providing the necessary support and comfort for a restful sleep. Whether you have back pain, joint problems, or other health concerns, a prescription mattress can be customized to accommodate your specific needs.

Aside from the physical benefits, a prescription mattress can also be a wise financial investment in the long run. A good quality mattress can last for up to 10 years, and with a prescription mattress, you can be sure that it is designed to fit your needs for an extended period. This means you won't have to replace your mattress frequently, saving you money in the long term.

In conclusion, while the idea of a prescription mattress may seem like a luxury, it is a crucial investment for your health and well-being. And in a place like Florida, where the climate and diverse population can make a good night's sleep a challenge, a prescription mattress can make all the difference. So if you're in the market for a new mattress, consider investing in a prescription mattress and experience the benefits firsthand.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/JB55YLQWQ5DLTL3ZBVZZ2FWXDY.png)

.jpg)

-1920w.jpg)