Understanding Pennsylvania's Sales Tax on Mattresses

When shopping for a new mattress in Pennsylvania, it's important to understand the state's sales tax laws. Like most states, Pennsylvania imposes a sales tax on the purchase of goods, including mattresses. This means that when you buy a mattress in Pennsylvania, you will have to pay an additional percentage of the purchase price in taxes. This sales tax applies to both in-store and online purchases, so it's essential to know how to calculate and pay these taxes properly.

How to Calculate Sales Tax on Mattresses in Pennsylvania

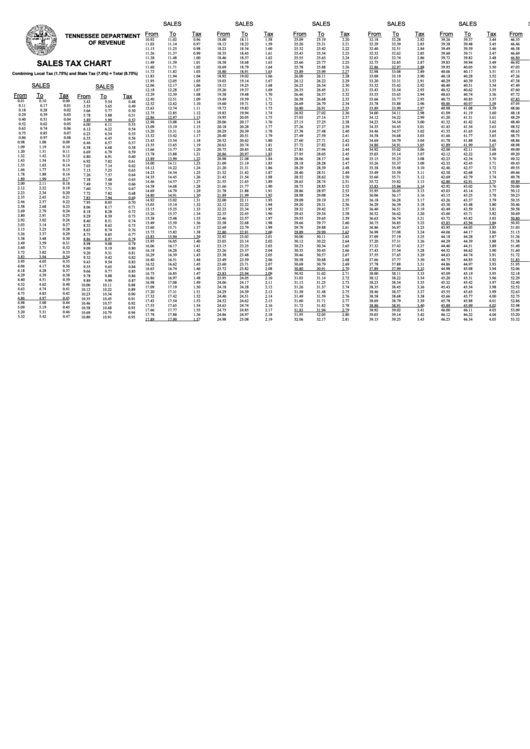

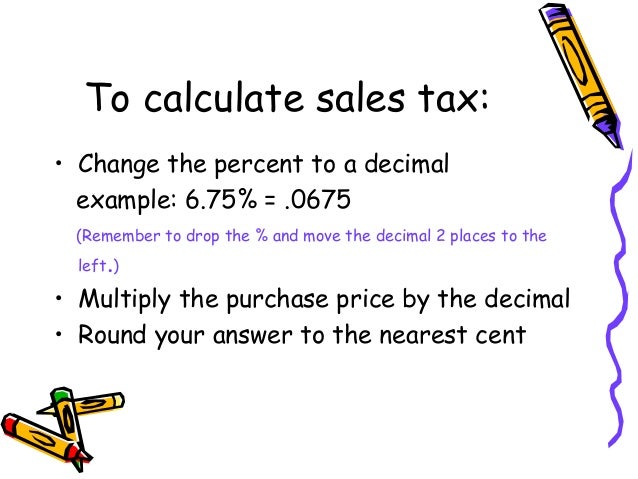

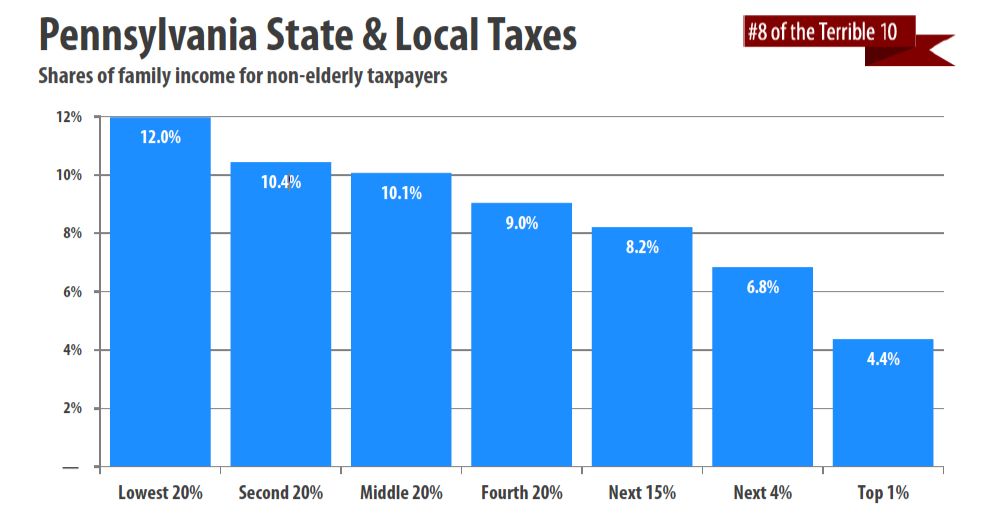

Calculating sales tax on a mattress purchase in Pennsylvania is relatively straightforward. The state's sales tax rate is currently 6%, which means you will pay an additional 6% of the purchase price in taxes. For example, if you buy a mattress for $1000, you will have to pay an additional $60 in sales tax. This percentage may vary depending on your location within the state, as some counties and cities may have additional local sales tax rates.

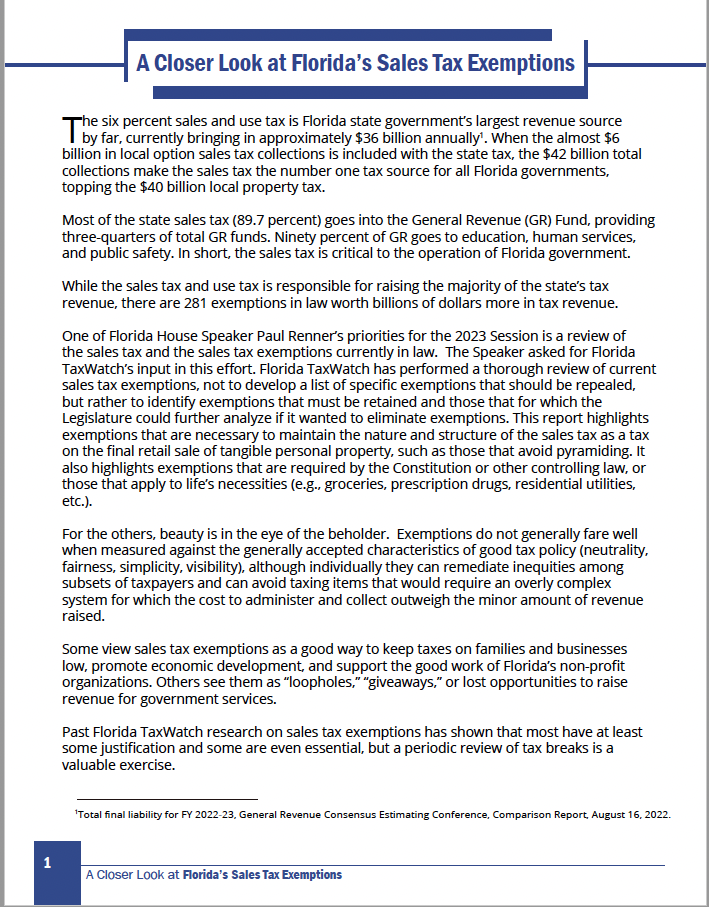

Exemptions from Sales Tax on Mattresses in Pennsylvania

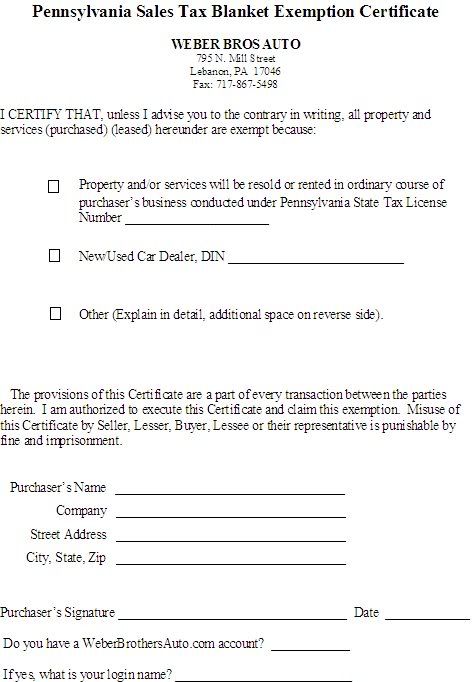

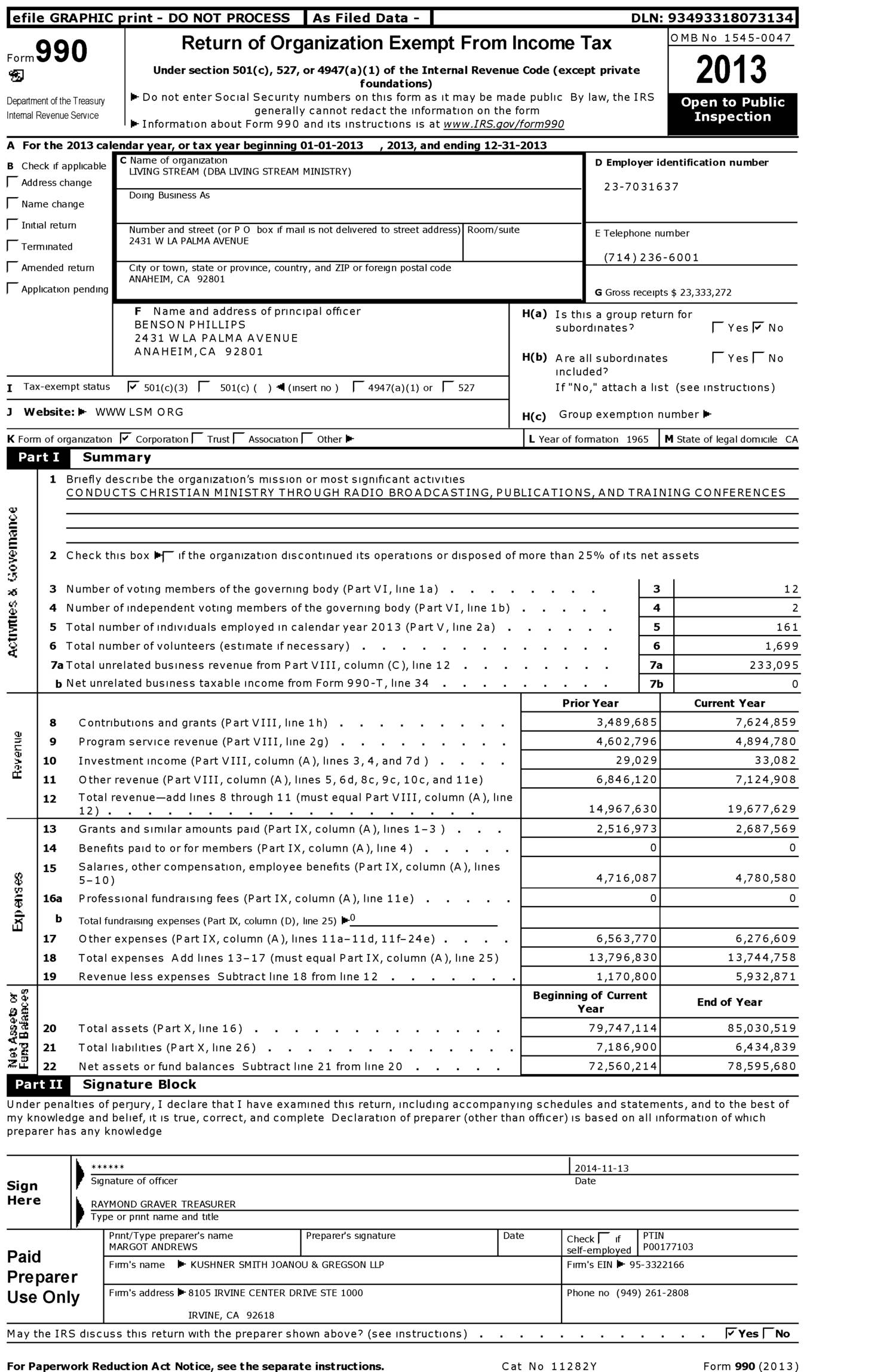

While most mattress purchases in Pennsylvania are subject to sales tax, there are some exemptions. One of the most common exemptions is for purchases made with medical necessity. If you have a valid prescription from a doctor for a specific type of mattress to treat a medical condition, you may be exempt from paying sales tax on that purchase. Additionally, there are exemptions for certain organizations, such as religious and charitable institutions, as well as sales made to the federal government.

Where to Buy Mattresses without Sales Tax in Pennsylvania

If you're looking to save some money on your mattress purchase, there are a few options for buying without paying sales tax in Pennsylvania. One option is to shop at a retailer that offers a price match guarantee. Some retailers will match the price of a competitor, including any taxes. This means that if you find a lower price on a mattress at another store that doesn't charge sales tax, you can get the same price at the retailer that does charge sales tax.

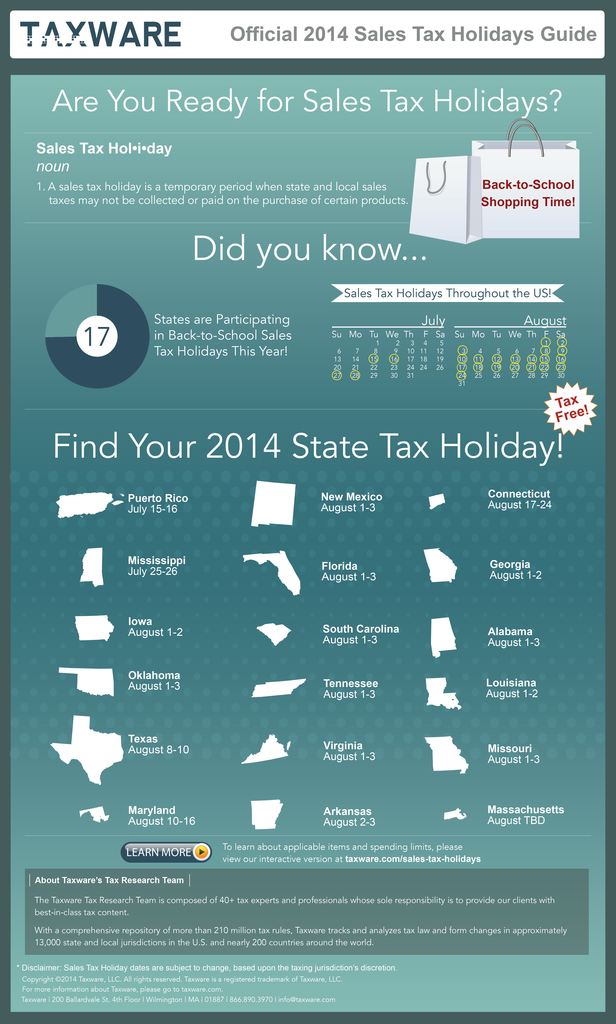

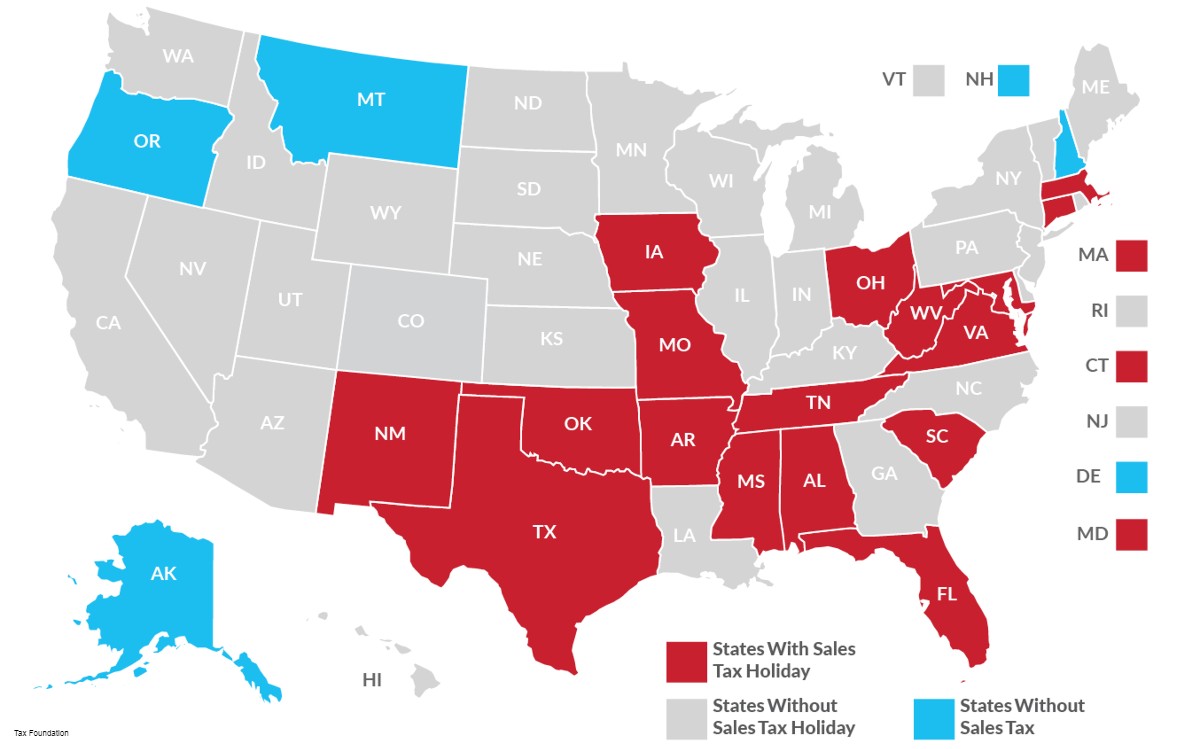

Another option is to shop at a retailer that offers a sales tax holiday. In Pennsylvania, there is an annual sales tax holiday in August where certain items, including mattresses, are exempt from sales tax. This is a great opportunity to save money on a new mattress purchase, but keep in mind that this holiday only happens once a year.

Pennsylvania's Sales Tax Rate for Mattresses

As mentioned earlier, the current sales tax rate in Pennsylvania for mattresses is 6%. This rate may differ depending on your location within the state, as some counties and cities have additional local sales tax rates. It's essential to research the sales tax rates in your specific area before making a mattress purchase to ensure you are paying the correct amount.

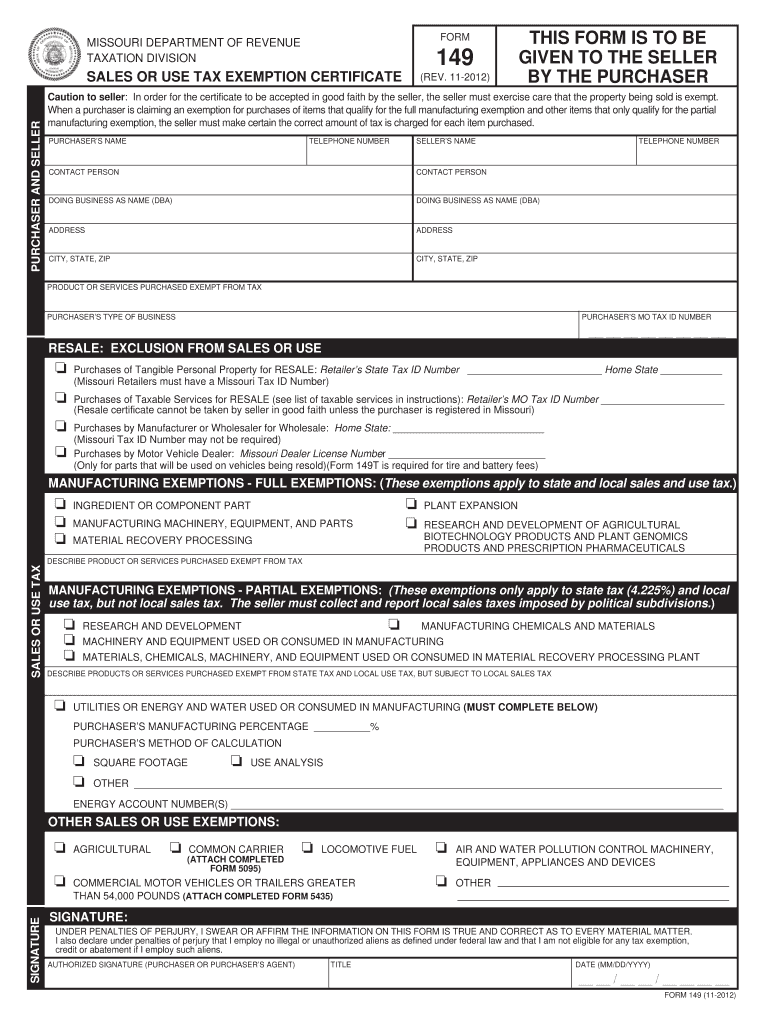

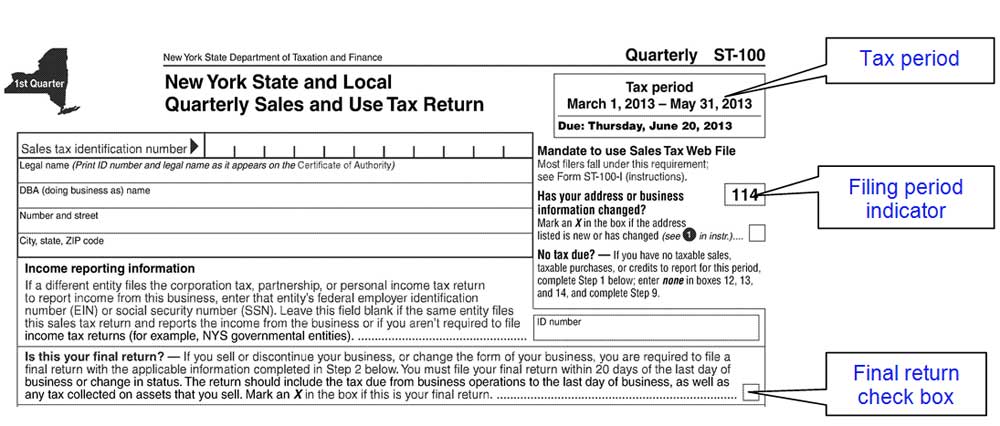

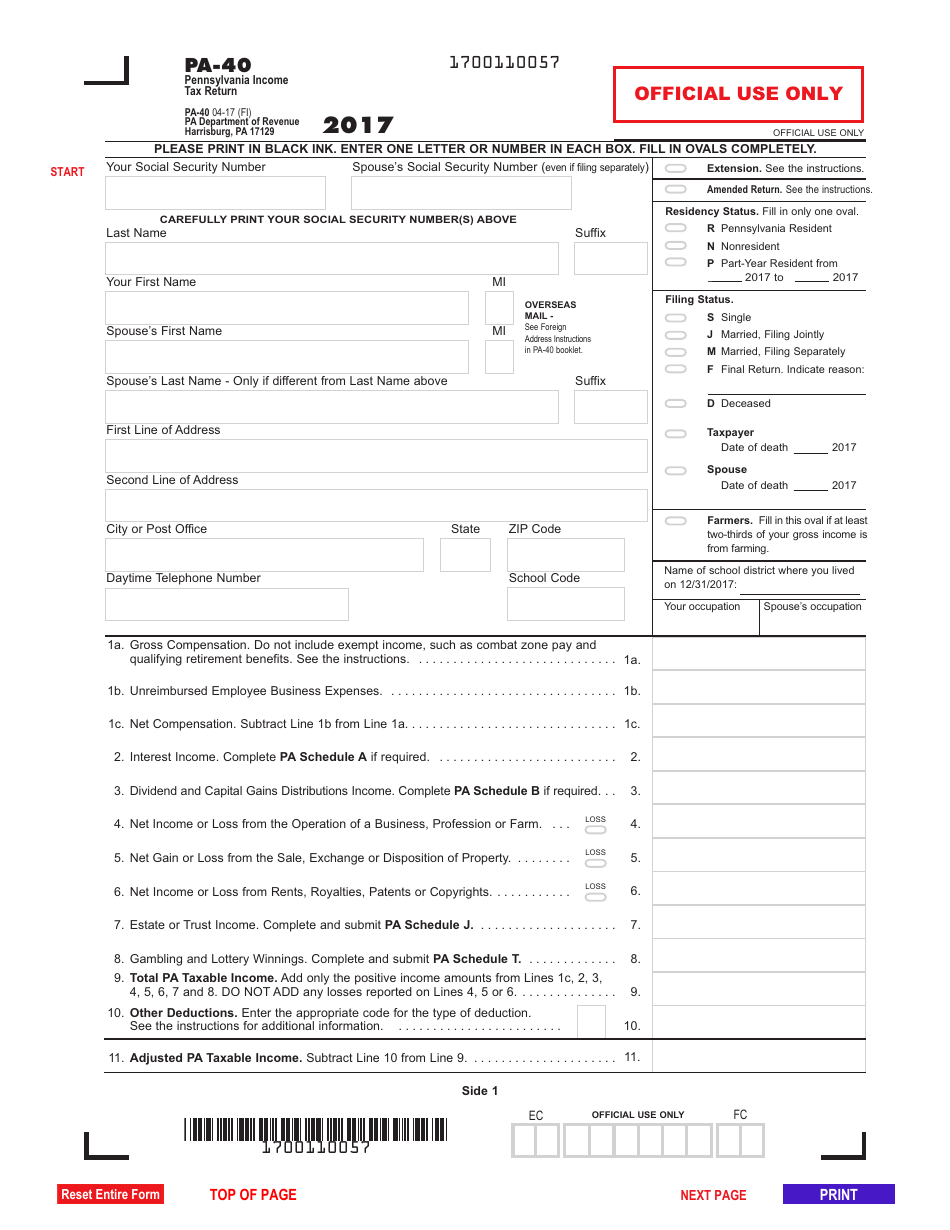

How to File Sales Tax for Mattresses in Pennsylvania

If you are a retailer selling mattresses in Pennsylvania, you are responsible for collecting and remitting sales tax to the state. This means you will need to register for a sales tax permit with the Pennsylvania Department of Revenue and file regular sales tax returns. You can file these returns online, and it's important to keep accurate records of all sales made to ensure you are reporting the correct amount of sales tax owed.

Pennsylvania's Use Tax for Out-of-State Mattress Purchases

If you purchase a mattress from an out-of-state retailer that does not collect sales tax, you may still be required to pay use tax on that purchase. Use tax is similar to sales tax, but it is paid directly by the consumer rather than collected by the retailer. The use tax rate in Pennsylvania is also 6%, and it applies to all taxable items purchased for use in the state, including mattresses.

Common Misconceptions about Sales Tax on Mattresses in Pennsylvania

There are a few common misconceptions about sales tax on mattresses in Pennsylvania that are important to clear up. One of these is that you don't have to pay sales tax if you buy a mattress from a private individual rather than a retailer. However, this is not the case. Whether you buy a mattress from a retailer or an individual, you are still required to pay sales tax on the purchase.

Another misconception is that if you buy a mattress and have it shipped to a state with a lower sales tax rate, you only have to pay the lower rate. However, this is not true either. The sales tax rate is determined by the location where the purchase is made, not the location where the item is shipped.

Pennsylvania's Sales Tax Holiday for Mattresses

As mentioned earlier, Pennsylvania has an annual sales tax holiday in August where certain items, including mattresses, are exempt from sales tax. This holiday is a great opportunity to save money on a new mattress purchase, but keep in mind that it only happens once a year. If you miss the sales tax holiday, there are still other ways to save money on a mattress purchase, such as price matching or purchasing from a retailer that offers free delivery and installation.

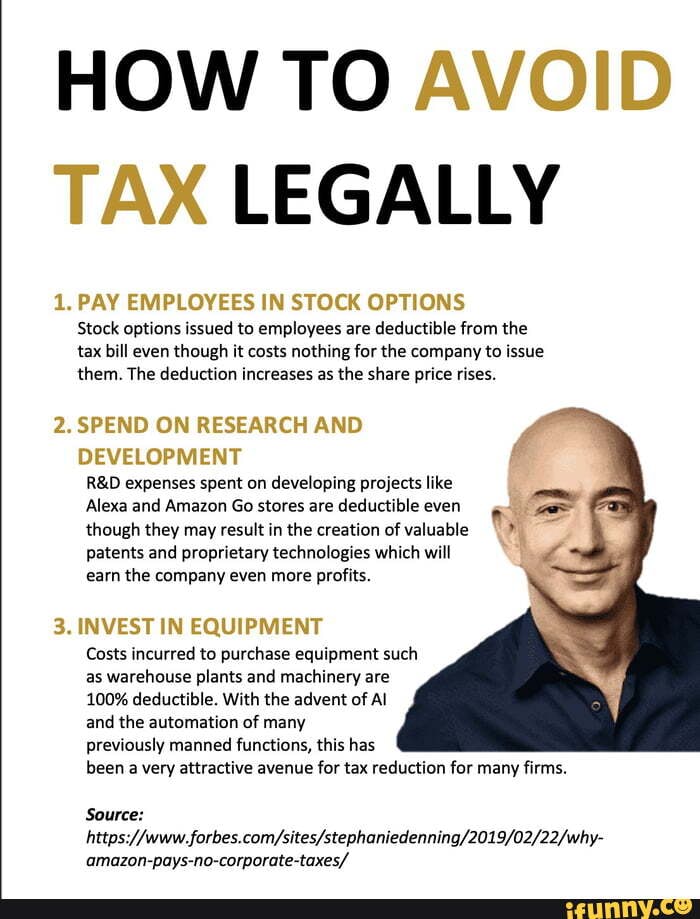

How to Avoid Paying Sales Tax on Mattresses in Pennsylvania

While it may be tempting to try and avoid paying sales tax on a mattress purchase in Pennsylvania, it's essential to follow the state's laws and pay the appropriate taxes. Attempting to evade taxes can lead to penalties and fines, so it's not worth the risk. Instead, focus on finding ways to save money on your mattress purchase, such as taking advantage of sales tax holidays or shopping at retailers that offer price matching.

In conclusion, understanding Pennsylvania's sales tax on mattresses is crucial when making a new mattress purchase. From knowing how to calculate and pay sales tax to understanding exemptions and ways to save money, being informed can help you navigate the process and ensure you are paying the correct amount of taxes. So, the next time you're in the market for a new mattress, remember these tips to make the buying process as smooth as possible.

Why Choosing the Right Mattress is Essential for Your Home Design

Creating the Perfect Space

Choosing the right mattress for your home may seem like a small detail, but it can actually have a big impact on the overall design and functionality of your space. A mattress is not just a place to sleep, it's also a statement piece in your bedroom.

Pa sales tax mattress

may not be the first thing that comes to mind when thinking about house design, but it is an important factor to consider. Here's why.

Choosing the right mattress for your home may seem like a small detail, but it can actually have a big impact on the overall design and functionality of your space. A mattress is not just a place to sleep, it's also a statement piece in your bedroom.

Pa sales tax mattress

may not be the first thing that comes to mind when thinking about house design, but it is an important factor to consider. Here's why.

Comfort and Support

A good night's sleep is crucial for our physical and mental well-being, and a comfortable mattress plays a significant role in achieving that. When designing your home, it's important to prioritize comfort and functionality.

Pa sales tax mattress

can offer a variety of options to suit your specific needs. Whether you prefer a firm or plush mattress, there are options available that can provide the right amount of support for your body.

A good night's sleep is crucial for our physical and mental well-being, and a comfortable mattress plays a significant role in achieving that. When designing your home, it's important to prioritize comfort and functionality.

Pa sales tax mattress

can offer a variety of options to suit your specific needs. Whether you prefer a firm or plush mattress, there are options available that can provide the right amount of support for your body.

Aesthetics

In addition to comfort and support, a mattress can also add to the aesthetic appeal of your bedroom. With various designs, materials, and colors to choose from, you can find a mattress that complements your overall home design.

Pa sales tax mattress

offers a wide selection of mattresses that can fit any style, from modern and minimalist to traditional and luxurious.

In addition to comfort and support, a mattress can also add to the aesthetic appeal of your bedroom. With various designs, materials, and colors to choose from, you can find a mattress that complements your overall home design.

Pa sales tax mattress

offers a wide selection of mattresses that can fit any style, from modern and minimalist to traditional and luxurious.

Quality and Durability

Investing in a good quality mattress not only ensures a good night's sleep but also adds value to your home. A high-quality mattress can last for years, making it a wise investment for your home's design. With

pa sales tax mattress

, you can find top-rated brands and models that are known for their durability and longevity, ensuring that your mattress will withstand the test of time.

Investing in a good quality mattress not only ensures a good night's sleep but also adds value to your home. A high-quality mattress can last for years, making it a wise investment for your home's design. With

pa sales tax mattress

, you can find top-rated brands and models that are known for their durability and longevity, ensuring that your mattress will withstand the test of time.

The Final Touch

When it comes to designing your home, the small details can make a big difference. Choosing the right mattress is the final touch that can tie together the overall design and functionality of your space. With

pa sales tax mattress

, you can find the perfect mattress that not only meets your specific needs but also enhances the look and feel of your home.

When it comes to designing your home, the small details can make a big difference. Choosing the right mattress is the final touch that can tie together the overall design and functionality of your space. With

pa sales tax mattress

, you can find the perfect mattress that not only meets your specific needs but also enhances the look and feel of your home.

In Conclusion

When designing your home, don't overlook the importance of choosing the right mattress. It may seem like a small detail, but it can greatly impact the comfort, aesthetics, and value of your space. With

pa sales tax mattress

, you can find a wide range of options that can meet your specific needs and elevate your home design to the next level. So why settle for a mediocre mattress when you can have one that enhances your home in every way?

When designing your home, don't overlook the importance of choosing the right mattress. It may seem like a small detail, but it can greatly impact the comfort, aesthetics, and value of your space. With

pa sales tax mattress

, you can find a wide range of options that can meet your specific needs and elevate your home design to the next level. So why settle for a mediocre mattress when you can have one that enhances your home in every way?