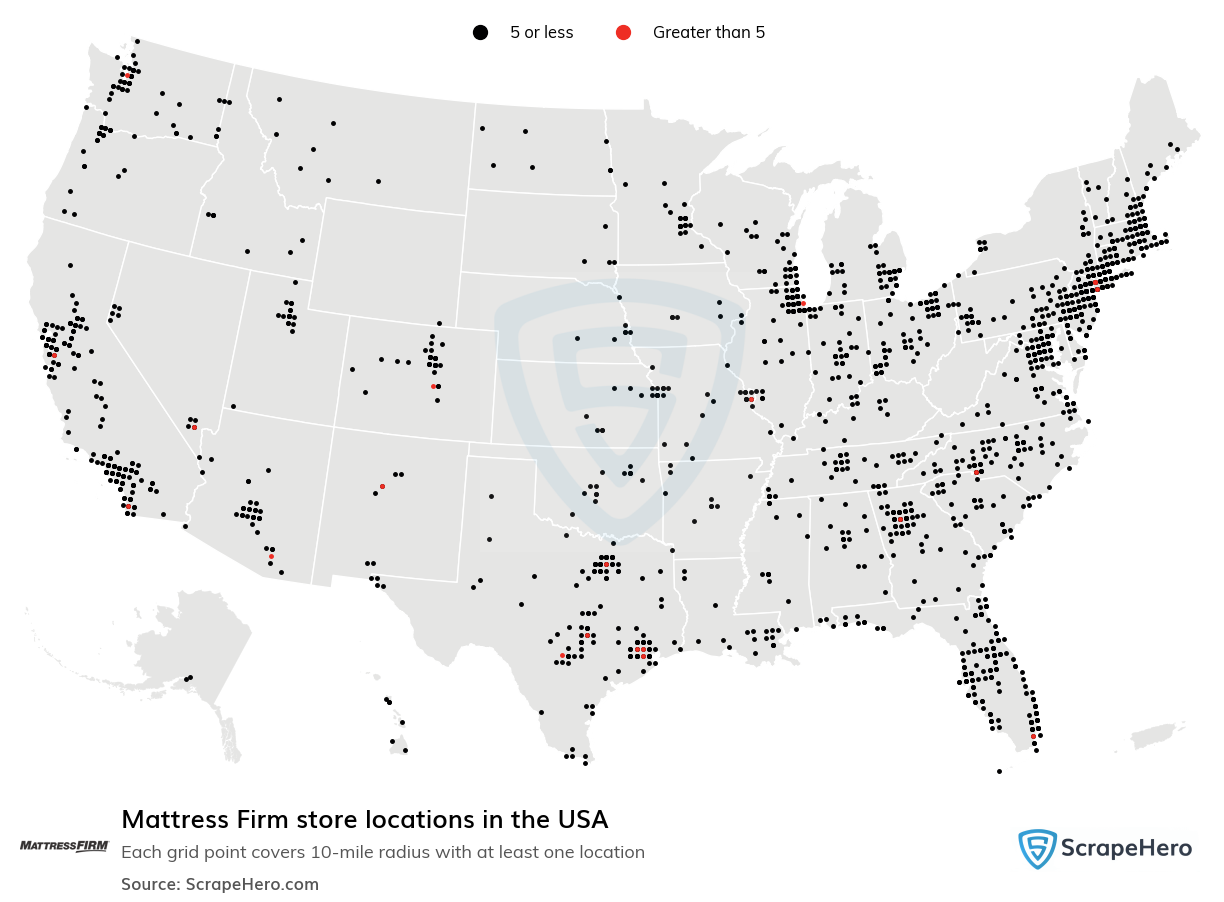

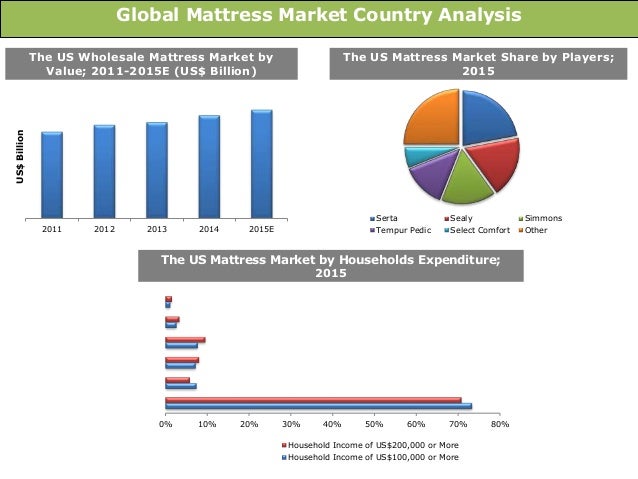

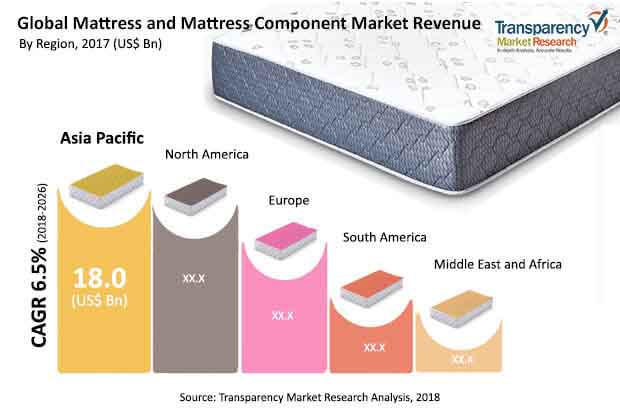

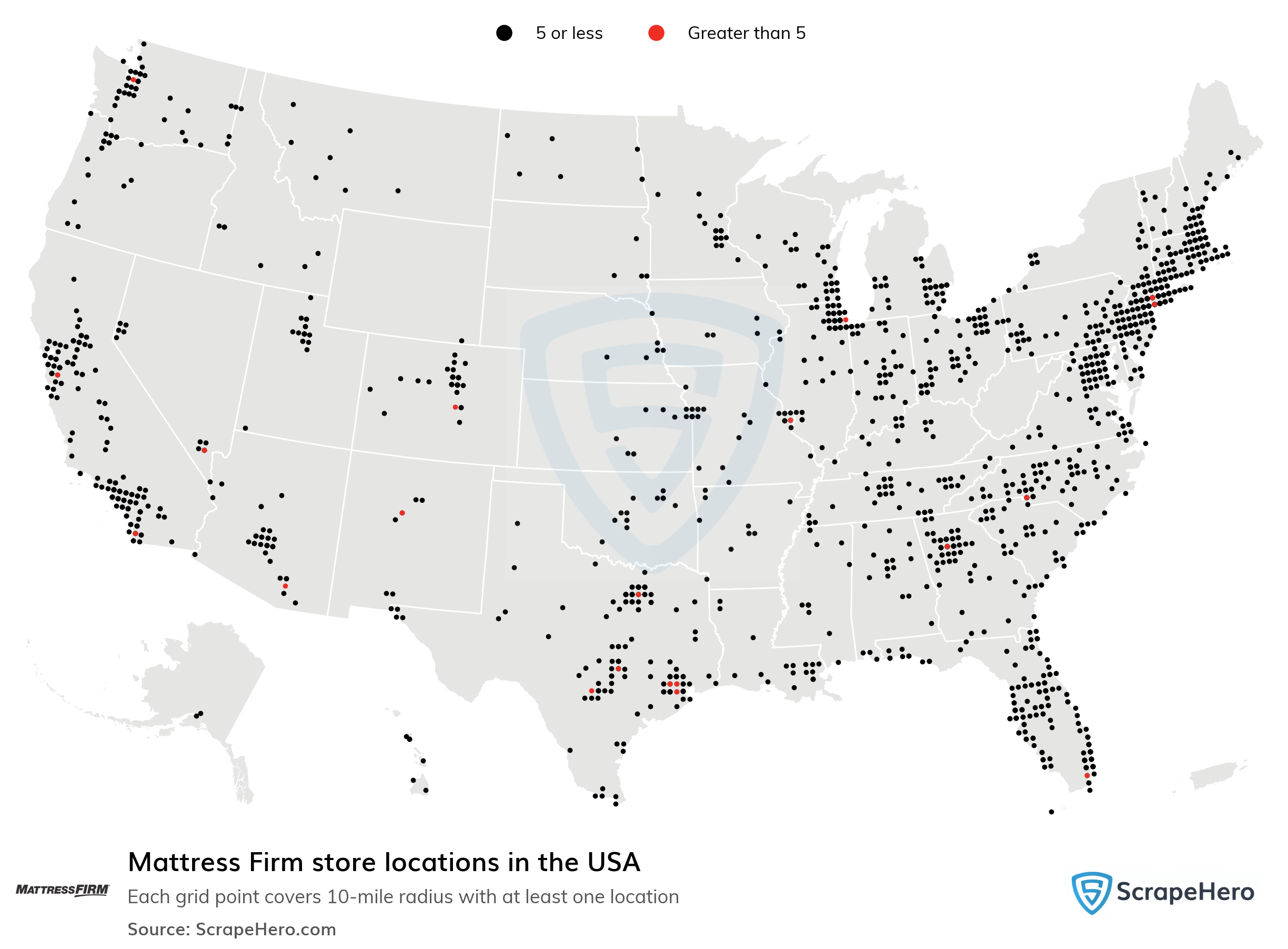

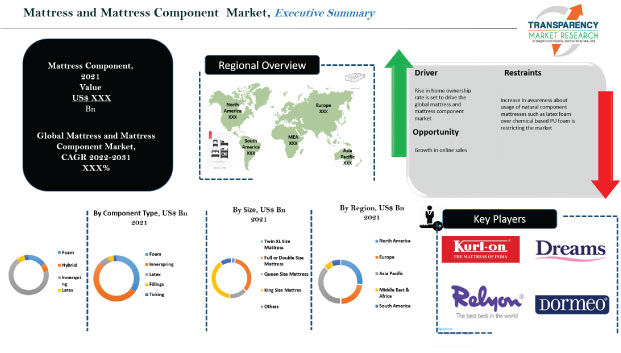

The first heading of our list is dedicated to the biggest player in the US mattress industry - Mattress Firm. With over 2,500 stores across the country, Mattress Firm holds a significant share of the US mattress market. The company offers a wide range of mattresses from various brands, making it a popular choice among consumers. Its success can be attributed to its aggressive expansion strategy and partnerships with major mattress manufacturers. The US mattress market is a highly competitive and lucrative industry, with an estimated worth of over $16 billion. It is driven by factors such as rising disposable income, increasing awareness about the importance of quality sleep, and the introduction of innovative mattress technologies. The mattress industry in the US has also seen a shift towards online sales, with the rise of direct-to-consumer brands such as Casper and Purple. However, brick-and-mortar mattress stores like Mattress Firm still dominate the market, making it a crucial player in the industry.1. "Mattress Firm" | "US mattress market" | "Mattress industry in the US"

According to data from IBISWorld, there are over 11,000 mattress stores in the United States, with an annual growth rate of 0.9%. The majority of these stores are chains, with the top 50 companies accounting for about 80% of the market share. The US mattress retail landscape is dominated by established players such as Mattress Firm, Sleep Number, and Tempur Sealy. These companies have a strong presence across the country and offer a wide range of products to cater to different consumer needs. In recent years, there has been a rise in the number of specialty mattress stores, focusing on niche markets such as eco-friendly mattresses, luxury mattresses, and adjustable beds. This diversification has added to the competitive landscape and provided consumers with more options when shopping for a mattress.2. "Number of mattress stores in the United States" | "Mattress store chains in the US" | "US mattress retail landscape"

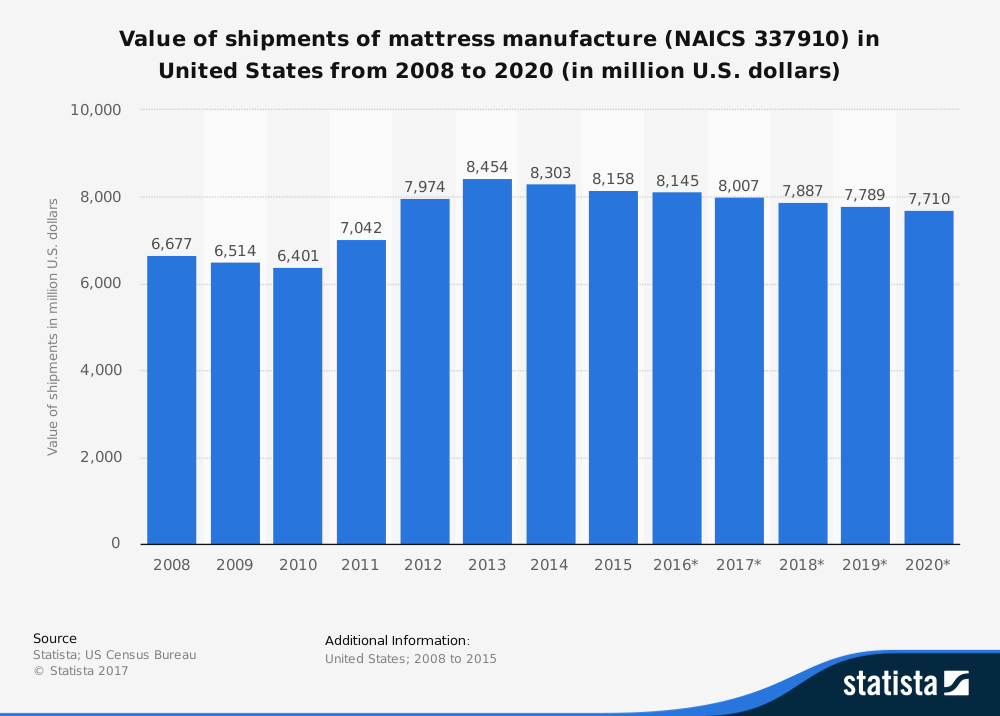

As mentioned earlier, Mattress Firm is the leading mattress retailer in the US, with a store count of over 2,500. It is followed by Sleep Number with over 600 stores and Tempur Sealy with over 400 stores. These top three players alone account for about 50% of the US mattress store count. Other notable mattress retailers in the US include Mattress Warehouse, Ashley HomeStore, and Denver Mattress Company. These companies have a strong regional presence and contribute to the overall growth of the industry. According to a report by Statista, the average annual revenue per mattress store in the US in 2020 was approximately $1.3 million. This indicates the significant potential for growth and profitability in the mattress retail sector.3. "Top mattress retailers in the US" | "Mattress store count in the US" | "US mattress store statistics"

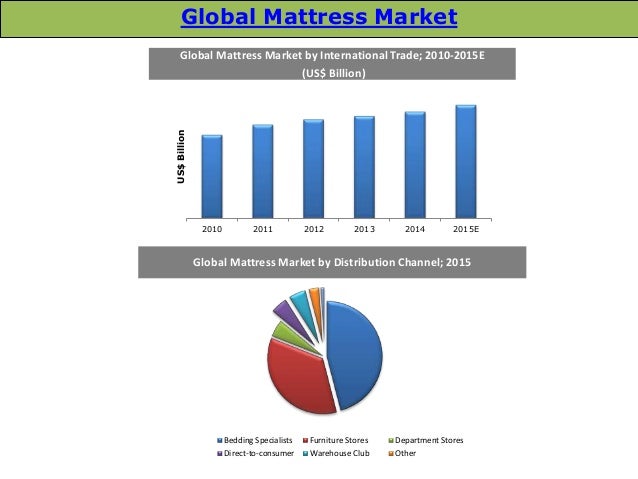

The US mattress store market has been experiencing steady growth in recent years, with an annual growth rate of 4.3%. This growth can be attributed to factors such as increasing demand for quality sleep products and the rising popularity of online mattress sales. Despite the growth of e-commerce, brick-and-mortar mattress stores still hold a significant share of the market, with an estimated 85% market share. This can be attributed to consumers' preference for trying out a mattress before making a purchase, as well as the convenience of in-store financing options. The density of mattress stores in the US varies by state, with California having the highest number of stores at over 1,000, followed by Texas and Florida. This is reflective of the population distribution and demand for mattresses in these states.4. "Mattress store growth in the US" | "US mattress store market share" | "Mattress store density in the US"

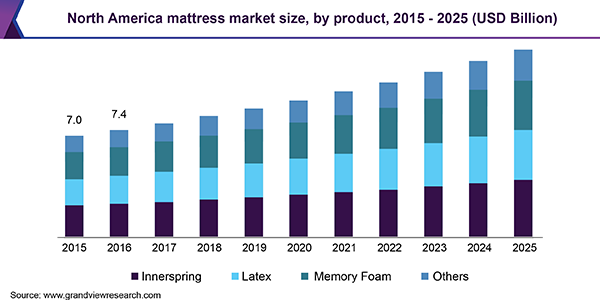

An analysis of the US mattress store industry reveals a highly competitive and fragmented market. The top three players, Mattress Firm, Sleep Number, and Tempur Sealy, hold a combined market share of 38.5%, leaving a significant portion of the market for smaller regional and specialty retailers. The market size of the US mattress store industry is expected to reach over $17 billion by 2024, with a growth rate of 3.5%. This growth can be attributed to the increasing demand for mattresses due to factors such as an aging population and a growing awareness of the importance of sleep for overall health and wellness. The revenue of mattress stores in the US is dependent on factors such as the number of stores, average store sales, and product mix. With the increasing demand for higher-quality mattresses and the rise of specialty stores, the average store sales and revenue of mattress stores are expected to continue to grow in the coming years.5. "US mattress store industry analysis" | "Mattress store market size in the US" | "US mattress store revenue"

As mentioned earlier, the US mattress store industry is highly competitive, with both established players and new entrants vying for a share of the market. This competition has led to a focus on innovation and differentiation, with companies offering unique products and services to attract consumers. The demographics of mattress store customers in the US vary, with a significant share of sales coming from the 35-54 age group. However, with the rise of online mattress sales and the preference for convenience among younger consumers, there has been a shift towards targeting millennials and Gen Z buyers through digital marketing and social media. Some of the current trends in the US mattress store industry include the rise of eco-friendly and organic mattresses, the popularity of adjustable beds, and the use of technology to enhance the mattress shopping experience. Companies that are quick to adapt to these trends are likely to have a competitive advantage in the market.6. "Mattress store competition in the US" | "US mattress store demographics" | "Mattress store trends in the US"

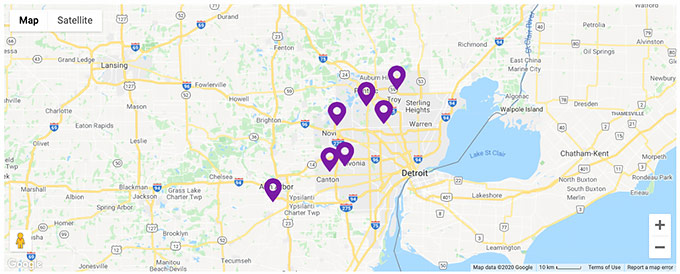

As a highly competitive industry, the location of mattress stores plays a crucial role in their success. The top players in the market have a strong presence in major cities and suburban areas, allowing them to reach a wider customer base. Many mattress store chains in the US also offer franchise opportunities, providing entrepreneurs with a chance to enter the market with an established brand and support system. Some popular franchise options in the mattress industry include Mattress Firm, Sleep Number, and Mattress Warehouse. Franchising allows for quick expansion and growth, contributing to the overall increase in the number of mattress stores in the US. However, with the rise of online sales, traditional brick-and-mortar stores may face challenges in the future, making it crucial for franchisees to stay updated with consumer trends and preferences.7. "US mattress store locations" | "Mattress store chains in the US" | "Mattress store franchise opportunities in the US"

The mattress store industry in the US has also seen its share of closures and bankruptcies in recent years. As the industry becomes more competitive, smaller retailers and independent stores may struggle to keep up with larger chains and online sales. In 2020, Mattress Firm announced the closure of about 200 stores as part of its restructuring plan. Other companies that have faced financial difficulties include Sleepy's, which was acquired by Mattress Firm in 2016, and Mattress Warehouse, which filed for bankruptcy in 2018. The consolidation of the mattress store industry is expected to continue in the coming years, with larger players acquiring struggling retailers and increasing their market share.8. "US mattress store closures" | "Mattress store consolidation in the US" | "Mattress store bankruptcies in the US"

The US mattress store industry provides employment opportunities for thousands of people across the country. In 2020, the industry employed over 65,000 people, with an average growth rate of 1.3% annually. The job growth in the US mattress store industry is primarily driven by the expansion of major players and the opening of new stores in emerging markets. However, as online sales continue to grow, there may be a shift towards e-commerce roles in the industry. The average salary for a mattress store employee in the US is around $35,000 per year. This can vary depending on factors such as job role, experience, and location. With the increasing demand for higher-quality mattresses, there may be opportunities for higher-paying sales roles in the industry.9. "US mattress store employment" | "Mattress store job growth in the US" | "Mattress store salaries in the US"

The future of mattress stores in the US is expected to be shaped by consumer preferences and technological advancements. With the rise of online sales and the introduction of new mattress technologies, traditional brick-and-mortar stores may face challenges in the coming years. However, with the increasing demand for quality sleep products and the growing awareness of the importance of sleep, there is still significant potential for growth in the industry. Companies that are quick to adapt to changing consumer trends and invest in digital marketing and e-commerce may have a competitive advantage in the market. Some challenges that the US mattress store industry may face in the future include increased competition from online sales, rising costs of real estate, and the need to continuously innovate and differentiate to attract consumers. By addressing these challenges and staying updated with industry trends, mattress stores can continue to thrive in the US market.10. "Future of mattress stores in the US" | "US mattress store market forecast" | "Mattress store industry challenges in the US"

The Surprising Number of Mattress Stores in the US

Mattress stores have become a common sight in cities and towns across the United States. From big-name chains to local boutiques, it seems like there is a mattress store on every corner. But have you ever stopped to think about just how many mattress stores there are in the US? The answer may surprise you.

Mattress stores have become a common sight in cities and towns across the United States. From big-name chains to local boutiques, it seems like there is a mattress store on every corner. But have you ever stopped to think about just how many mattress stores there are in the US? The answer may surprise you.

The Rise of the Mattress Store

The number of mattress stores in the US has been steadily increasing over the years. In fact, according to data from IBIS World, there are currently over

14,000

mattress stores in the US. This is a significant increase from just a decade ago when there were

only 9,300

mattress stores. So why the sudden surge in mattress stores?

The number of mattress stores in the US has been steadily increasing over the years. In fact, according to data from IBIS World, there are currently over

14,000

mattress stores in the US. This is a significant increase from just a decade ago when there were

only 9,300

mattress stores. So why the sudden surge in mattress stores?

The Boom in Online Mattress Companies

One of the main reasons for the increase in mattress stores is the rise of online mattress companies. With the convenience of online shopping and the promise of a better night's sleep, these companies have become hugely popular. Many of these companies, such as

Casper

,

Purple

, and

Tuft & Needle

, have opened brick-and-mortar stores in addition to their online presence. This has contributed to the overall increase in mattress stores in the US.

One of the main reasons for the increase in mattress stores is the rise of online mattress companies. With the convenience of online shopping and the promise of a better night's sleep, these companies have become hugely popular. Many of these companies, such as

Casper

,

Purple

, and

Tuft & Needle

, have opened brick-and-mortar stores in addition to their online presence. This has contributed to the overall increase in mattress stores in the US.

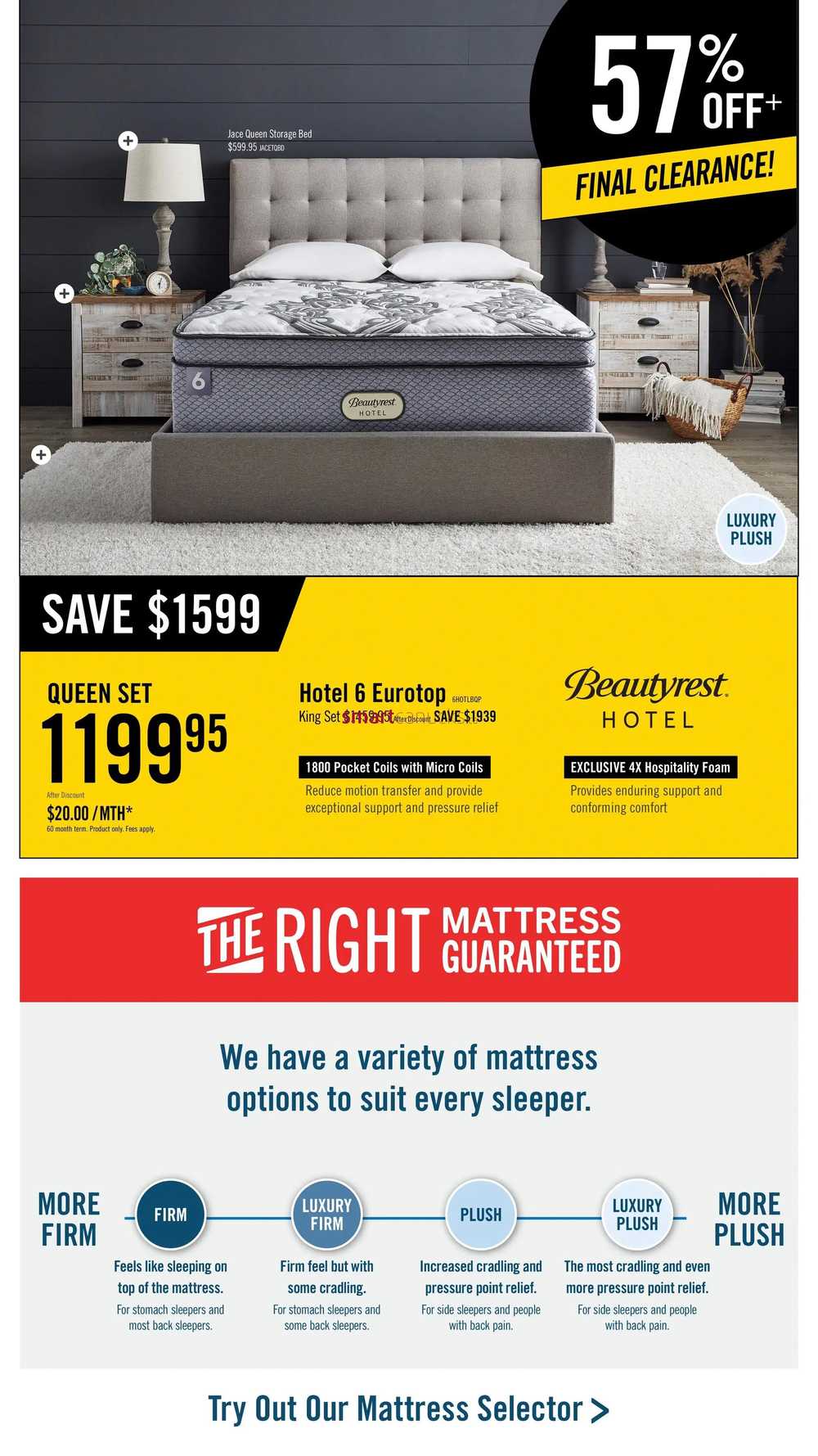

Competition and Consumer Demand

Another factor driving the increase in mattress stores is competition and consumer demand. With so many options available, mattress stores have to compete for customers by offering a wide range of products and services. This has led to the rise of specialty mattress stores, such as

Tempur-Pedic

and

Sleep Number

, which cater to specific needs and preferences. Additionally, consumers are becoming more aware of the importance of a good night's sleep and are willing to invest in a quality mattress, leading to a higher demand for mattress stores.

Another factor driving the increase in mattress stores is competition and consumer demand. With so many options available, mattress stores have to compete for customers by offering a wide range of products and services. This has led to the rise of specialty mattress stores, such as

Tempur-Pedic

and

Sleep Number

, which cater to specific needs and preferences. Additionally, consumers are becoming more aware of the importance of a good night's sleep and are willing to invest in a quality mattress, leading to a higher demand for mattress stores.

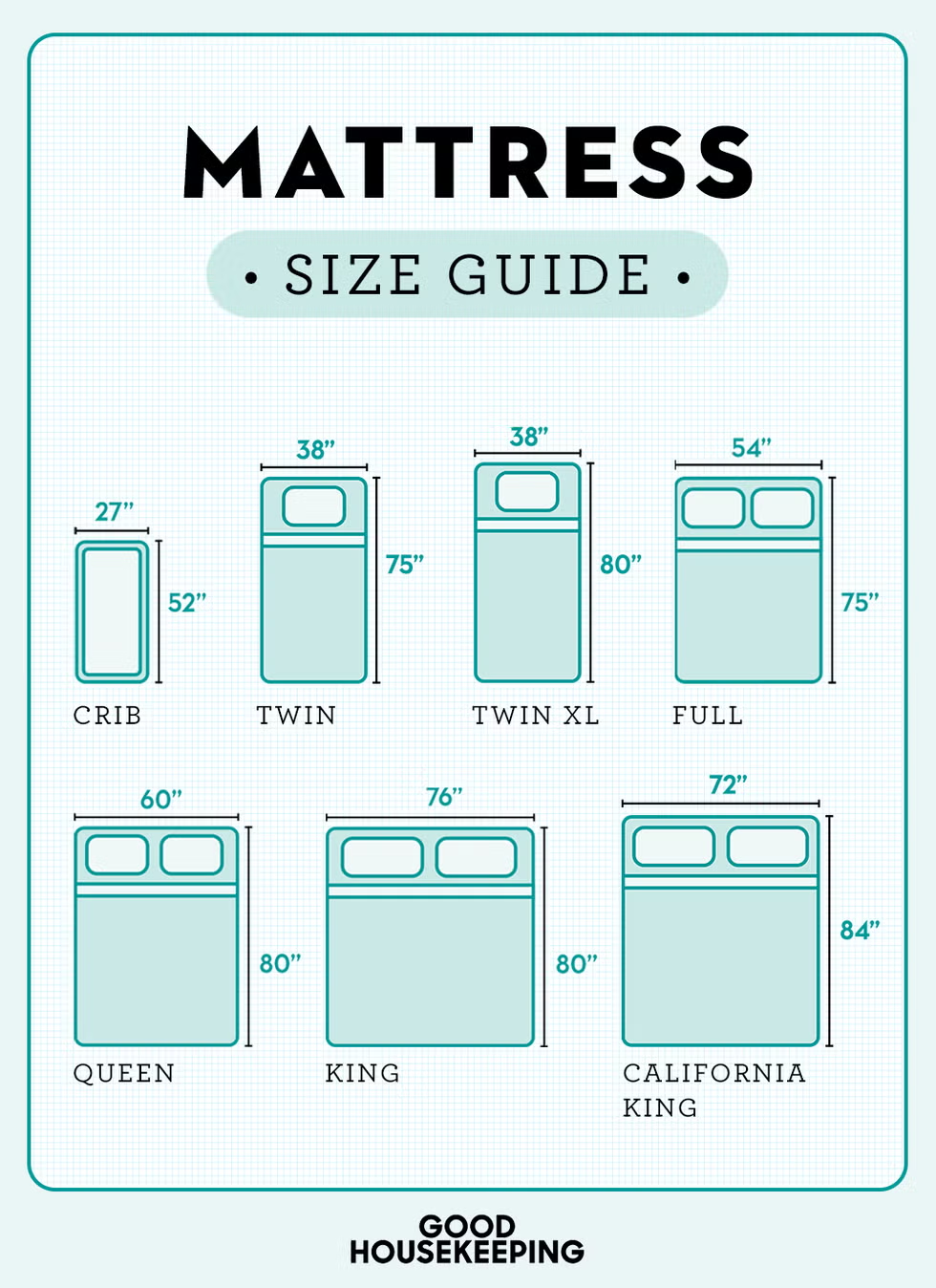

The Impact on House Design

The rise of mattress stores in the US has not only impacted the retail industry but also house design. With the increasing popularity of larger mattresses, such as

king

and

California king

sizes, bedrooms are now being designed to accommodate these larger beds. This has led to larger master bedrooms and the inclusion of features like built-in headboards and storage space for mattresses and box springs.

In conclusion, the number of mattress stores in the US has seen a significant increase in recent years, driven by the rise of online companies, competition, and consumer demand. This trend has also had an impact on house design, with larger beds becoming more common and bedrooms being designed to accommodate them. With the mattress industry continuing to grow, it's safe to say that we can expect to see even more mattress stores in the US in the future.

The rise of mattress stores in the US has not only impacted the retail industry but also house design. With the increasing popularity of larger mattresses, such as

king

and

California king

sizes, bedrooms are now being designed to accommodate these larger beds. This has led to larger master bedrooms and the inclusion of features like built-in headboards and storage space for mattresses and box springs.

In conclusion, the number of mattress stores in the US has seen a significant increase in recent years, driven by the rise of online companies, competition, and consumer demand. This trend has also had an impact on house design, with larger beds becoming more common and bedrooms being designed to accommodate them. With the mattress industry continuing to grow, it's safe to say that we can expect to see even more mattress stores in the US in the future.

.webp)