If you're in the market for a new home, you may be wondering how a damaged kitchen sink will affect your chances of getting a mortgage loan. While it may seem like a major obstacle, there are actually several options available to help you secure the financing you need. One option is to repair the sink before applying for a mortgage loan. This not only improves the overall value of the home, but it also shows the lender that you are proactive in maintaining the property. Another option is to negotiate a lower price on the home to account for the cost of a kitchen sink replacement. This can be done during the home buying process or after the appraisal has been completed. No matter which route you choose, it's important to understand the impact a damaged kitchen sink can have on your mortgage loan approval.1. How to Get a Mortgage Loan with a Torn Out Kitchen Sink

When it comes to financing a kitchen sink replacement during a mortgage loan process, there are a few options to consider. If you have enough equity in the home, you may be able to take out a home equity loan or line of credit to cover the cost of the replacement. This can be a good option if you have a good credit score and a low debt-to-income ratio. Another option is to include the cost of the replacement in your mortgage loan. This may require a larger down payment or a higher interest rate, but it can be a convenient way to cover the cost without taking on additional loans. Lastly, you may be able to negotiate with the seller to have them cover the cost of the replacement before closing on the home. This can be a win-win situation, as the seller can deduct the cost of the replacement from the sale price and you can avoid taking on more debt.2. Financing Options for a Kitchen Sink Replacement During a Mortgage Loan

When you apply for a mortgage loan, the lender will typically require a home appraisal to determine the value of the property. During this process, the appraiser will assess any damages to the home, including a damaged kitchen sink. If the appraiser determines that the damage is significant and will decrease the value of the home, the lender may require the issue to be resolved before approving the loan. This is to protect their investment and ensure that the home is a sound investment. However, if the damage is minimal and does not significantly affect the value of the home, the lender may still approve the loan but require the issue to be fixed before closing on the home.3. Kitchen Sink Damage and Your Mortgage Loan: What You Need to Know

The short answer is yes, you can still get a mortgage loan with a damaged kitchen sink. As mentioned earlier, there are several options available to help you secure the financing you need. However, it's important to keep in mind that a damaged kitchen sink may also be a sign of larger issues with the plumbing or overall condition of the home. This can affect the lender's decision and may require additional repairs to be made before the loan is approved. It's always best to communicate openly with your lender and be prepared to provide documentation and proof of any repairs or negotiations you have made regarding the damaged sink.4. Can You Get a Mortgage Loan with a Damaged Kitchen Sink?

When a kitchen sink is torn out, it can have a significant impact on your mortgage loan approval. Not only does it affect the value of the home, but it also raises concerns about the overall condition of the property. In some cases, a torn out kitchen sink may be a sign of more serious structural issues with the home. This can make lenders hesitant to approve a mortgage loan, as it poses a higher risk for them. However, by addressing the issue promptly and providing proof of repairs or negotiations, you can increase your chances of getting approved for a mortgage loan with a torn out kitchen sink.5. The Impact of a Torn Out Kitchen Sink on Your Mortgage Loan Approval

If you decide to repair the kitchen sink before applying for a mortgage loan, there are a few things you can do to ensure the process goes smoothly. First, make sure to research and hire a reputable contractor to do the repairs. This not only ensures the job is done correctly, but it also provides documentation for the lender to show that the issue has been addressed. Next, keep all receipts and documentation related to the repairs. This will be important to show the lender and appraiser that the issue has been resolved and the sink is now in good working condition. Lastly, communicate openly and frequently with your lender about the repairs and provide any necessary updates or documentation they may require.6. How to Repair a Kitchen Sink Before Applying for a Mortgage Loan

As mentioned earlier, the appraisal process for a mortgage loan with a damaged kitchen sink will involve the appraiser assessing the condition and value of the home. During the appraisal, the appraiser will look at the overall condition of the sink, as well as any visible damage or signs of leakage. They may also check for any underlying plumbing issues or damage to the surrounding area. It's important to keep in mind that the appraiser's assessment will have a direct impact on the lender's decision to approve the loan. Therefore, it's important to address any issues with the sink before the appraisal takes place.7. Understanding the Appraisal Process for a Mortgage Loan with a Damaged Kitchen Sink

If you're interested in a home with a torn out kitchen sink, it's important to negotiate a lower price to account for the cost of a replacement. Here are a few tips for negotiating a lower price: 1. Research the cost of a new kitchen sink and use this as a starting point for your negotiations. 2. Point out any other issues with the home that may have an impact on the value, such as outdated appliances or structural issues. 3. Be prepared to walk away if the seller is not willing to negotiate. There are always other homes on the market and it's important to not overpay for a property.8. Tips for Negotiating a Lower Price on a Home with a Torn Out Kitchen Sink

Before purchasing a home with a damaged kitchen sink, it's important to have a professional home inspection done. This will provide a comprehensive report of any issues with the home, including the sink. Home inspections can uncover hidden issues that may not be visible during a regular appraisal. This can help you make an informed decision about whether or not to move forward with the purchase. If any issues are found during the inspection, you can use this as leverage to negotiate a lower price or request that the seller make repairs before closing on the home.9. The Importance of Home Inspections for a Mortgage Loan with a Damaged Kitchen Sink

If you decide to include the cost of a kitchen sink replacement in your mortgage loan, there are a few things you need to keep in mind. First, the lender will require documentation and proof of the cost of the replacement. This may include estimates from contractors or receipts for materials and labor. Second, you will likely need to provide a larger down payment or accept a higher interest rate to cover the cost of the replacement. This is because the lender is taking on more risk by financing the replacement along with the rest of the mortgage loan. Lastly, be prepared for a longer approval process as the lender will need to review and approve the additional costs. However, this can be a convenient option if you do not have the funds available for a separate loan or the ability to negotiate with the seller.10. How to Include the Cost of a Kitchen Sink Replacement in Your Mortgage Loan

The Impact of a Missing Sink on Your Mortgage Loan and House Design

Why a Missing Sink Matters

When it comes to the design and functionality of a home, the kitchen is often considered the heart of the house. It is a space where meals are prepared, memories are made, and daily tasks are completed. So, it's no surprise that the kitchen is one of the most important rooms for potential homebuyers. However, what happens if the kitchen is missing a crucial element like a sink? As odd as it may seem, a missing sink can have a significant impact on your mortgage loan and house design.

When it comes to the design and functionality of a home, the kitchen is often considered the heart of the house. It is a space where meals are prepared, memories are made, and daily tasks are completed. So, it's no surprise that the kitchen is one of the most important rooms for potential homebuyers. However, what happens if the kitchen is missing a crucial element like a sink? As odd as it may seem, a missing sink can have a significant impact on your mortgage loan and house design.

The Role of a Sink in House Design

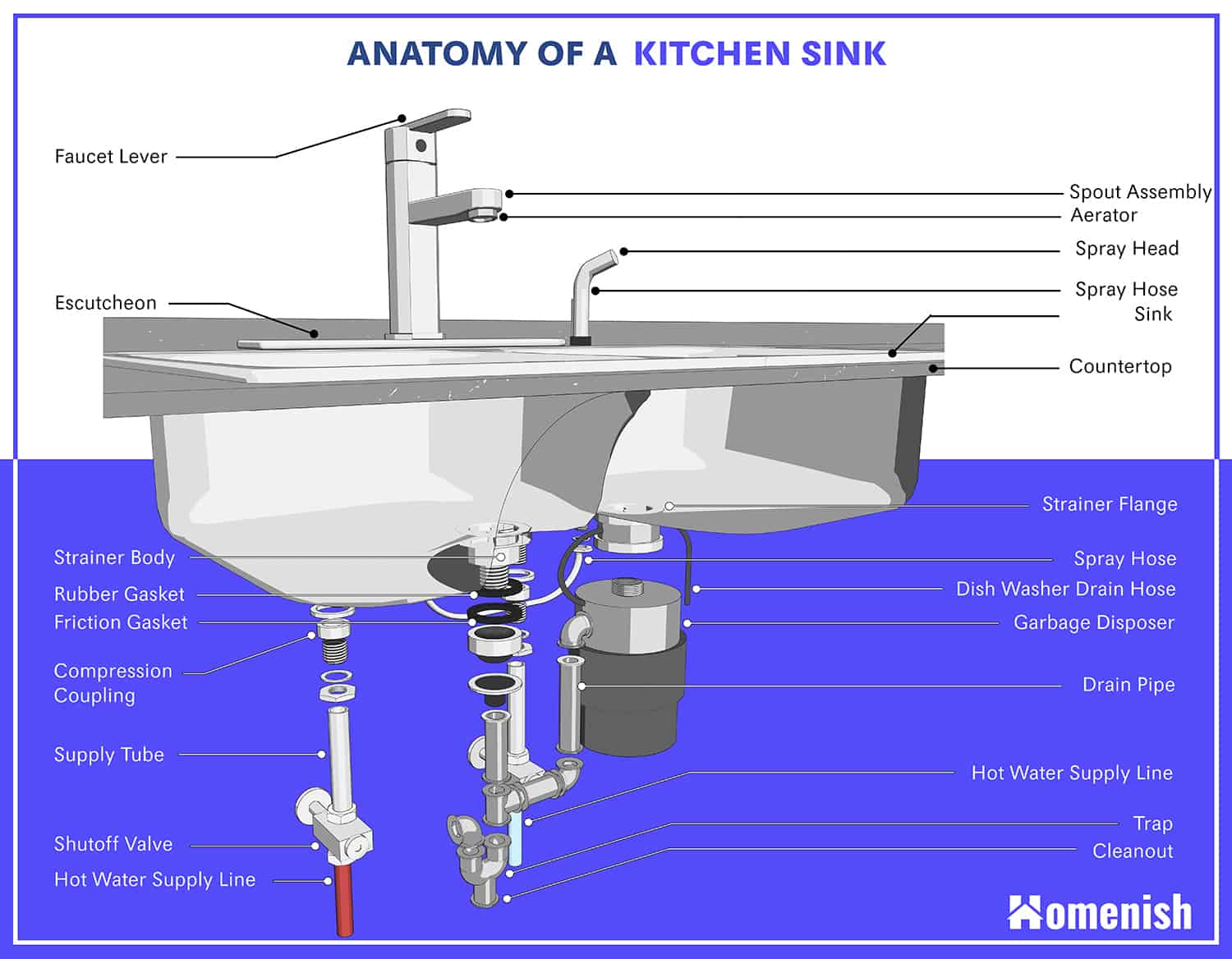

A sink may seem like a small and insignificant part of a kitchen, but it plays a crucial role in the overall design and functionality of the space. Not only is a sink necessary for washing dishes and preparing food, but it also serves as a focal point in the kitchen. The style, size, and placement of a sink can greatly affect the flow and aesthetic of the room. A sink can also be a reflection of the homeowner's personal style, with options ranging from traditional farmhouse to sleek and modern.

A sink may seem like a small and insignificant part of a kitchen, but it plays a crucial role in the overall design and functionality of the space. Not only is a sink necessary for washing dishes and preparing food, but it also serves as a focal point in the kitchen. The style, size, and placement of a sink can greatly affect the flow and aesthetic of the room. A sink can also be a reflection of the homeowner's personal style, with options ranging from traditional farmhouse to sleek and modern.

The Impact on Your Mortgage Loan

When applying for a mortgage loan, lenders take a close look at the condition and features of the home. They want to ensure that the property is a good investment and that it meets certain standards. A missing sink can raise red flags for lenders as it may indicate larger issues with the property's plumbing or overall upkeep. This could result in a higher interest rate or even a denial of the loan.

When applying for a mortgage loan, lenders take a close look at the condition and features of the home. They want to ensure that the property is a good investment and that it meets certain standards. A missing sink can raise red flags for lenders as it may indicate larger issues with the property's plumbing or overall upkeep. This could result in a higher interest rate or even a denial of the loan.

The Importance of a Functional Kitchen

Aside from the impact on your mortgage loan, a missing sink can also affect the functionality of your kitchen. Without a sink, daily tasks such as washing dishes and preparing meals become much more difficult. This can be a major inconvenience for homeowners and can also decrease the value of the home. A well-designed and functional kitchen is highly desirable for potential buyers, and a missing sink can be a major turnoff.

Aside from the impact on your mortgage loan, a missing sink can also affect the functionality of your kitchen. Without a sink, daily tasks such as washing dishes and preparing meals become much more difficult. This can be a major inconvenience for homeowners and can also decrease the value of the home. A well-designed and functional kitchen is highly desirable for potential buyers, and a missing sink can be a major turnoff.

In Conclusion

It's clear that a missing sink can have a significant impact on both your mortgage loan and house design. Not only does it affect the functionality and overall appeal of the kitchen, but it can also raise concerns for lenders. So, if you're in the market for a new home, be sure to pay close attention to the kitchen and ensure that all necessary features are present. And if you're a homeowner planning a kitchen renovation, be sure to include a sink in your design plans to avoid any potential issues in the future.

It's clear that a missing sink can have a significant impact on both your mortgage loan and house design. Not only does it affect the functionality and overall appeal of the kitchen, but it can also raise concerns for lenders. So, if you're in the market for a new home, be sure to pay close attention to the kitchen and ensure that all necessary features are present. And if you're a homeowner planning a kitchen renovation, be sure to include a sink in your design plans to avoid any potential issues in the future.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

:max_bytes(150000):strip_icc()/mortgage-69f02f04cdae4863806bd0455255106e.png)