If you're in the market for a new mattress, but don't quite have the funds to pay for it upfront, don't worry - Mattress Firm has you covered. With a variety of financing options available, you can find a plan that works for your budget and lifestyle. Keep reading to learn more about the top 10 financing requirements for purchasing a mattress from Mattress Firm.1. Mattress Firm Financing Options

One of the first things to consider when applying for financing with Mattress Firm is your credit score. While there is no specific credit score requirement, having a good credit score will increase your chances of being approved for financing. It's recommended to have a credit score of at least 650 to qualify for financing with Mattress Firm.2. Mattress Firm Credit Requirements

In addition to having a good credit score, there are a few other qualifications you'll need to meet in order to be eligible for financing with Mattress Firm. These include being at least 18 years old, having a valid government-issued ID, and having a stable source of income.3. Mattress Firm Financing Qualifications

Applying for financing through Mattress Firm is a quick and easy process. You can either fill out an application online or in-store. You'll need to provide personal information such as your name, address, and income, as well as information about the mattress you wish to purchase.4. Mattress Firm Financing Application Process

Once you've submitted your application, it will be reviewed by the financing provider. They will consider your credit score, income, and other factors to determine if you are eligible for financing. If you meet the criteria, you will be approved for financing and can move forward with your purchase.5. Mattress Firm Financing Approval Criteria

Before signing on the dotted line, make sure you read and understand the terms and conditions of your financing agreement. This will include information about interest rates, payment plans, and any fees or penalties that may apply. It's important to know exactly what you're agreeing to before making a commitment.6. Mattress Firm Financing Terms and Conditions

Your credit score will play a significant role in determining your interest rate for financing with Mattress Firm. The higher your credit score, the lower your interest rate will be. It's important to maintain a good credit score to ensure you get the best financing terms possible.7. Mattress Firm Financing Credit Score Requirements

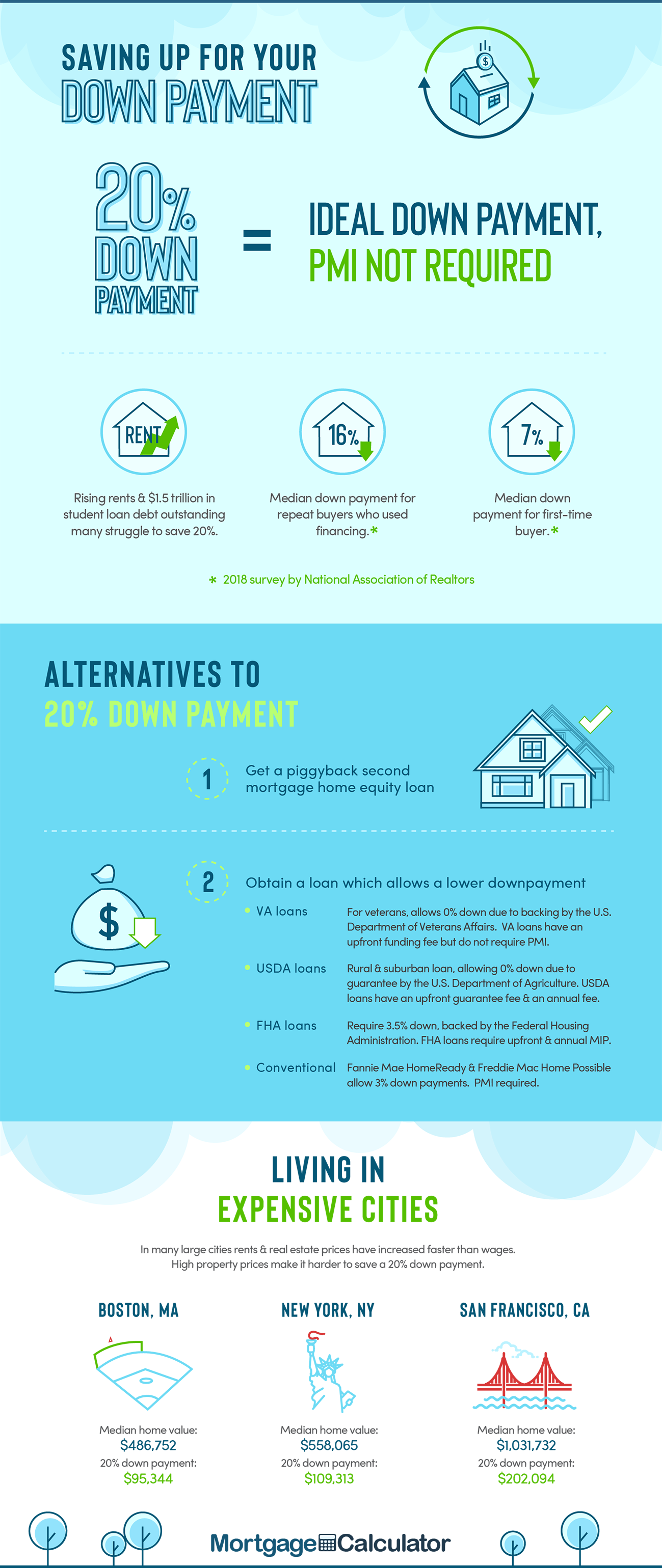

In some cases, you may be required to make a down payment in order to secure financing for your mattress purchase. This amount will vary based on the cost of the mattress and your credit history. It's important to budget for a potential down payment when considering financing options.8. Mattress Firm Financing Down Payment Requirements

The interest rate for your financing agreement will depend on your credit score and the length of your payment plan. Typically, the higher your credit score, the lower your interest rate will be. It's important to compare interest rates when considering different financing options to ensure you get the best deal.9. Mattress Firm Financing Interest Rates

Mattress Firm offers a variety of payment plans to fit your budget and lifestyle. These include short-term plans with no interest if paid in full within a certain timeframe, as well as longer-term plans with low interest rates. Be sure to carefully review and compare payment plans to determine which one is the best fit for you. With these top 10 financing requirements in mind, you can confidently shop for your new mattress at Mattress Firm. Remember to carefully consider your options and choose a plan that fits within your budget and financial goals. Happy sleeping!10. Mattress Firm Financing Payment Plans

The Importance of Proper Financing for Your Mattress Purchase

Why Financing Matters

When it comes to purchasing a new mattress, financing may not be the first thing that comes to mind. However, it is an important aspect to consider when making such a significant investment. Not all mattresses are created equal, and neither are their prices. The perfect mattress for you may come with a higher price tag than you initially anticipated. This is where financing comes in, allowing you to spread out the cost of your mattress over time. This can make the purchase more manageable and affordable for many individuals and families.

When it comes to purchasing a new mattress, financing may not be the first thing that comes to mind. However, it is an important aspect to consider when making such a significant investment. Not all mattresses are created equal, and neither are their prices. The perfect mattress for you may come with a higher price tag than you initially anticipated. This is where financing comes in, allowing you to spread out the cost of your mattress over time. This can make the purchase more manageable and affordable for many individuals and families.

Qualifying for Financing at Mattress Firm

Mattress Firm offers financing options to help customers purchase their dream mattress without breaking the bank. The financing requirements at Mattress Firm are fairly straightforward. To qualify, you must be at least 18 years old and have a valid government-issued ID. You must also have a steady source of income, preferably a job or regular source of income. This shows that you have the means to make regular payments towards your mattress purchase. Additionally, a credit check may be conducted to determine your creditworthiness, but this is not always a deciding factor.

Mattress Firm offers financing options to help customers purchase their dream mattress without breaking the bank. The financing requirements at Mattress Firm are fairly straightforward. To qualify, you must be at least 18 years old and have a valid government-issued ID. You must also have a steady source of income, preferably a job or regular source of income. This shows that you have the means to make regular payments towards your mattress purchase. Additionally, a credit check may be conducted to determine your creditworthiness, but this is not always a deciding factor.

Benefits of Financing at Mattress Firm

One of the main benefits of financing your mattress purchase at Mattress Firm is the convenience and flexibility it offers. Not everyone has the immediate funds to pay for a large purchase upfront, and financing allows you to spread out the cost into manageable monthly payments. This can also help you budget and plan your finances more effectively. Furthermore, financing at Mattress Firm often comes with promotional offers such as 0% APR for a certain period of time, making it an even more attractive option for those looking to purchase a new mattress.

One of the main benefits of financing your mattress purchase at Mattress Firm is the convenience and flexibility it offers. Not everyone has the immediate funds to pay for a large purchase upfront, and financing allows you to spread out the cost into manageable monthly payments. This can also help you budget and plan your finances more effectively. Furthermore, financing at Mattress Firm often comes with promotional offers such as 0% APR for a certain period of time, making it an even more attractive option for those looking to purchase a new mattress.

Final Thoughts

Financing your mattress purchase at Mattress Firm can be a smart and practical decision. It allows you to purchase a high-quality mattress that may have otherwise been out of your budget. With simple requirements and flexible payment options, Mattress Firm makes it easy for customers to finance their mattress purchase. So, if you're in the market for a new mattress, consider financing at Mattress Firm to help make your dream mattress a reality.

Financing your mattress purchase at Mattress Firm can be a smart and practical decision. It allows you to purchase a high-quality mattress that may have otherwise been out of your budget. With simple requirements and flexible payment options, Mattress Firm makes it easy for customers to finance their mattress purchase. So, if you're in the market for a new mattress, consider financing at Mattress Firm to help make your dream mattress a reality.