When it comes to getting a good night's sleep, having a comfortable and supportive mattress is key. However, if you have bad credit, it can be difficult to find a financing option that allows you to purchase the mattress you need. Luckily, mattress firm financing options are available for those with less-than-perfect credit.Financing Options for Mattress Firm with Bad Credit

If you have bad credit, you may be wondering how you can get financing for a mattress at Mattress Firm. The first step is to check your credit score and credit report. This will give you an idea of where you stand and what lenders will see when reviewing your application. If your credit score is low, you may want to work on improving it before applying for financing. Next, research different financing options available at Mattress Firm. Some options may be specifically tailored for those with bad credit, while others may require a down payment or a co-signer. It's important to understand the terms and conditions of each option and choose the one that best fits your needs and financial situation.How to Get Mattress Firm Financing with Bad Credit

When it comes to financing a mattress at Mattress Firm with bad credit, there are a few options that may be best suited for you. One option is a lease-to-own program, where you make monthly payments on the mattress until it's paid off. Another option is a credit card specifically for financing purchases at Mattress Firm, which may offer lower interest rates for those with bad credit. Additionally, some mattress firm locations may offer in-house financing options for customers with bad credit. These options may have more flexible terms and requirements, making it easier for you to get approved.Best Mattress Firm Financing for Bad Credit

If you have bad credit, you may be worried about your chances of getting approved for financing at Mattress Firm. However, the company understands that not everyone has perfect credit and offers options for those with lower credit scores. You may need to provide additional documentation or pay a higher interest rate, but it is possible to get financing for your mattress purchase at Mattress Firm.Bad Credit Mattress Financing at Mattress Firm

Having a low credit score can make it challenging to get approved for financing, but it's not impossible. Mattress Firm offers options for customers with low credit scores, such as lease-to-own programs, in-house financing, and credit cards specifically for mattress purchases. By understanding your credit score and researching different options, you can find the best financing option for your needs.Mattress Firm Financing for Low Credit Scores

When it comes to financing a mattress at Mattress Firm with bad credit, you have several options to choose from. In addition to the options mentioned above, you may also be able to use a third-party financing company that specializes in financing for those with bad credit. These companies may offer more flexible terms and may be easier to get approved through.Options for Financing a Mattress at Mattress Firm with Bad Credit

Qualifying for financing with bad credit may seem daunting, but there are steps you can take to increase your chances of approval. First, make sure to check your credit score and report for any errors or discrepancies. Dispute them if necessary to improve your score. Next, have a steady source of income and be able to provide proof of it. This will show lenders that you have the means to make your monthly payments. You may also want to consider applying with a co-signer who has good credit, as this can increase your chances of approval.How to Qualify for Mattress Firm Financing with Bad Credit

Before you apply for financing with bad credit at Mattress Firm, it's important to know the ins and outs of the process. Make sure to research the different financing options available and understand the terms and conditions of each. You'll also want to have a budget in place to ensure you can make your monthly payments on time. Additionally, be aware that some financing options may come with higher interest rates or fees for those with bad credit. Make sure to factor these into your budget and shop around to find the best option for your needs.Bad Credit Mattress Financing: What You Need to Know

If you have poor credit, you may still be able to get financing for your mattress purchase at Mattress Firm. The company offers options for customers with all types of credit, including those with poor credit. By doing your research and understanding your options, you can find a financing option that meets your needs and helps you get the mattress you need for a good night's sleep.Mattress Firm Financing for Customers with Poor Credit

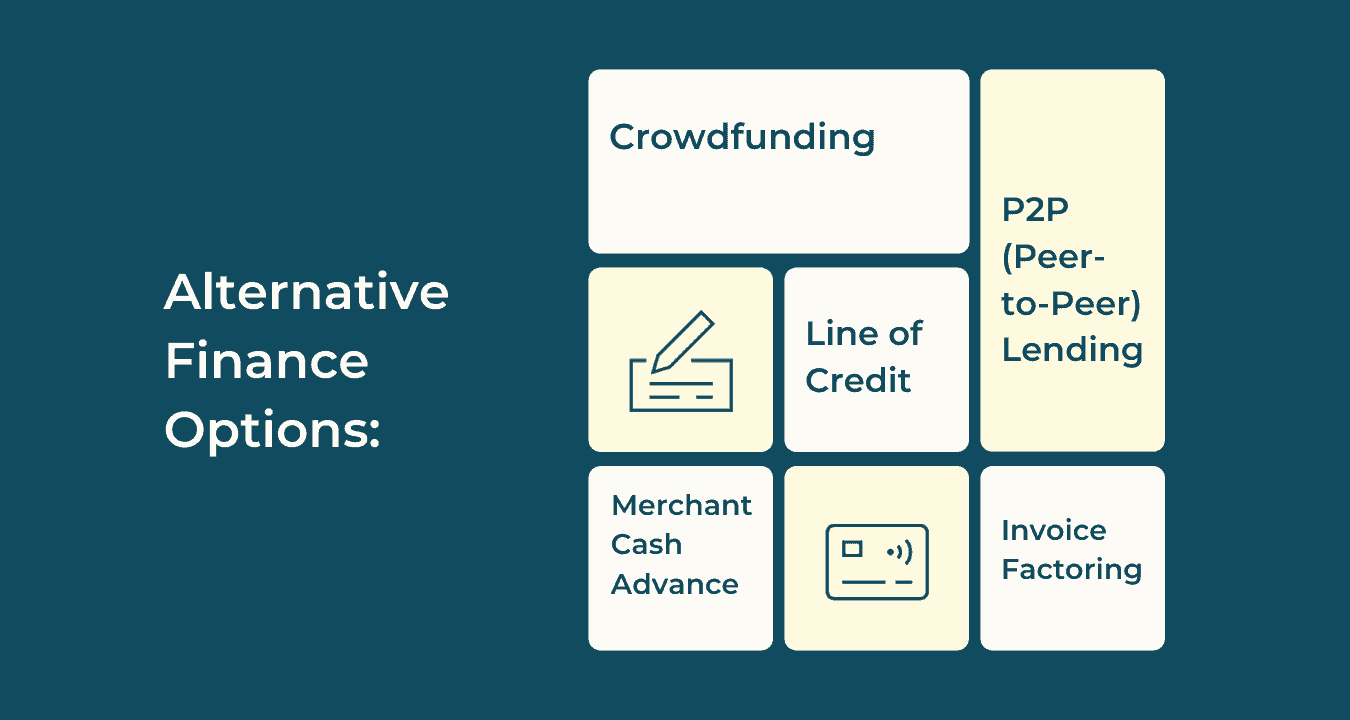

If you're having trouble getting approved for financing at Mattress Firm with bad credit, there are alternative options you can explore. This may include using a credit card or personal loan from a different lender, or even saving up for the mattress and paying for it in full upfront. It's important to weigh the pros and cons of each option and choose the one that makes the most sense for your financial situation.Alternative Financing Options for Mattress Firm with Bad Credit

The Importance of a Quality Mattress for a Good Night's Sleep

Why a mattress is more than just a piece of furniture

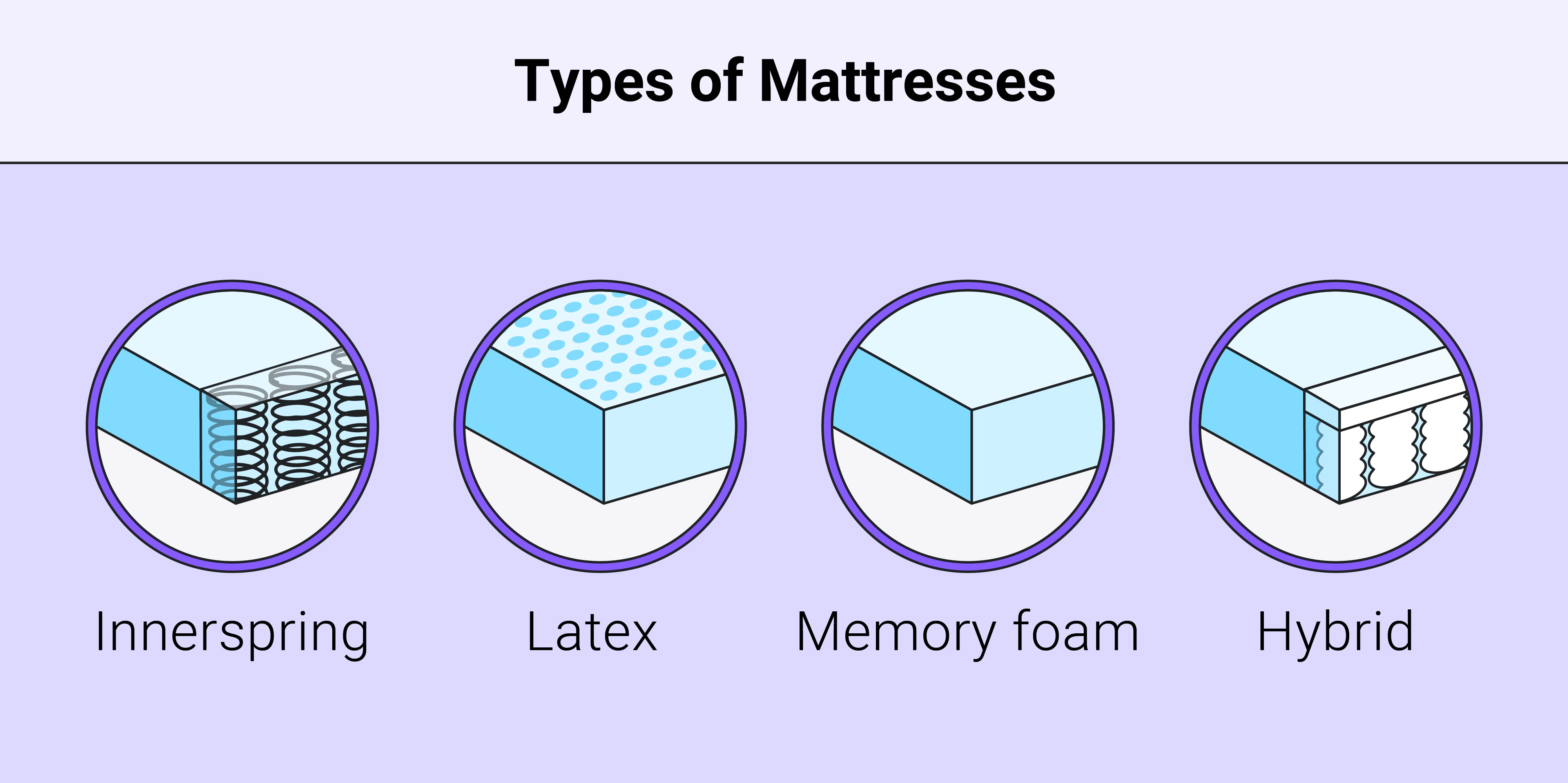

When it comes to designing our homes, we often focus on the aesthetic appeal of the furniture and decor. However, one of the most important aspects of a well-designed home is often overlooked – the quality of our mattresses . We spend about a third of our lives sleeping, and a good night's sleep is essential for our overall health and well-being. This is why investing in a quality mattress is crucial, even if you have bad credit .

The impact of a poor mattress on your sleep

A bad credit score shouldn't stop you from getting a good night's sleep. In fact, sleeping on an old or poor-quality mattress can have a negative impact on your health and daily life. An uncomfortable mattress can cause back pain, stiffness, and even disturb your sleep, leading to fatigue and irritability throughout the day. Moreover, an old or worn-out mattress can harbor dust mites, allergens, and bacteria, posing a risk to your respiratory health.

The benefits of financing for a quality mattress

If you have bad credit , you may think that purchasing a new, high-quality mattress is out of reach. However, many mattress companies offer financing options for customers with bad credit . This allows you to spread out the cost of a quality mattress over a period of time, making it more affordable and manageable. Plus, investing in a good mattress can save you money in the long run by improving your sleep and overall health.

Choosing the right financing option for your needs

When it comes to financing a mattress with bad credit , it's important to choose the right option for your needs. Some companies may offer in-house financing with no credit check, while others may work with third-party lenders. It's important to research and compare different financing options to find the best terms and interest rates for your situation. Make sure to also read the fine print and understand all fees and penalties before signing up for financing.

Final thoughts

Don't let bad credit stop you from investing in a quality mattress for a good night's sleep. With the variety of financing options available, you can find a solution that works for your budget and needs. Remember, a good mattress is not just a piece of furniture – it's an investment in your health and well-being.