Are you a frequent shopper at Mattress Firm? If so, you may be interested in increasing your Mattress Firm credit limit. A higher credit limit can provide you with more purchasing power and potentially improve your credit score. However, the process of increasing your credit limit may seem daunting. In this article, we will discuss everything you need to know about Mattress Firm credit increases and how to go about requesting one. Mattress Firm Credit Increase: What You Need to Know

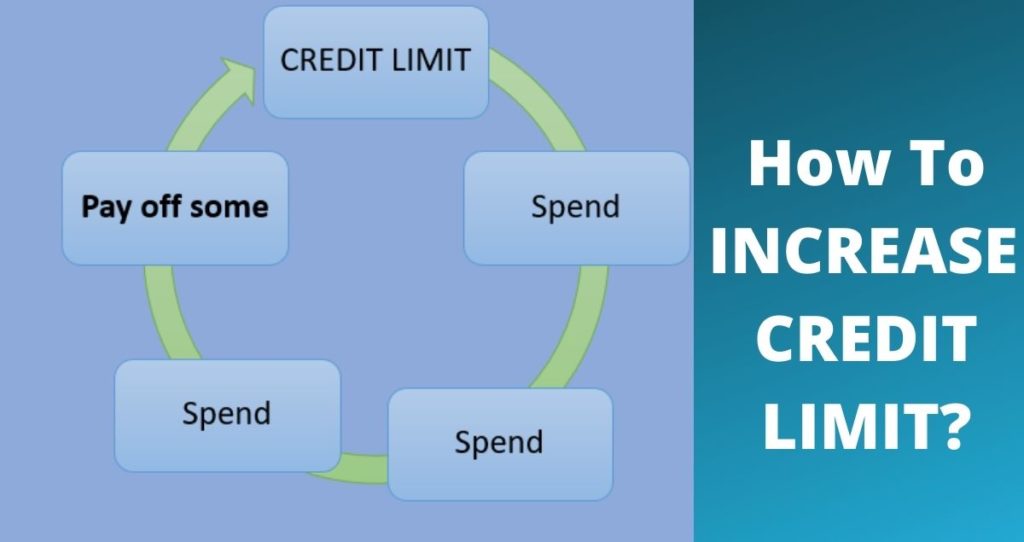

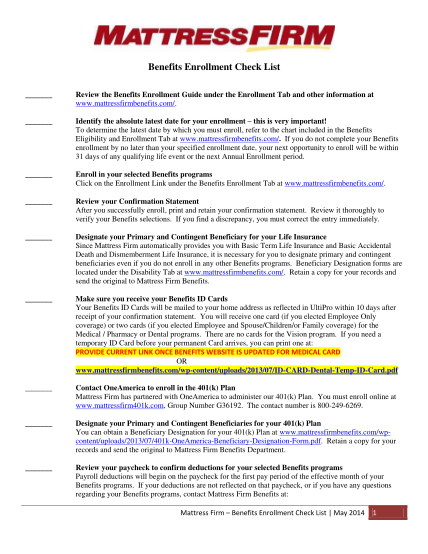

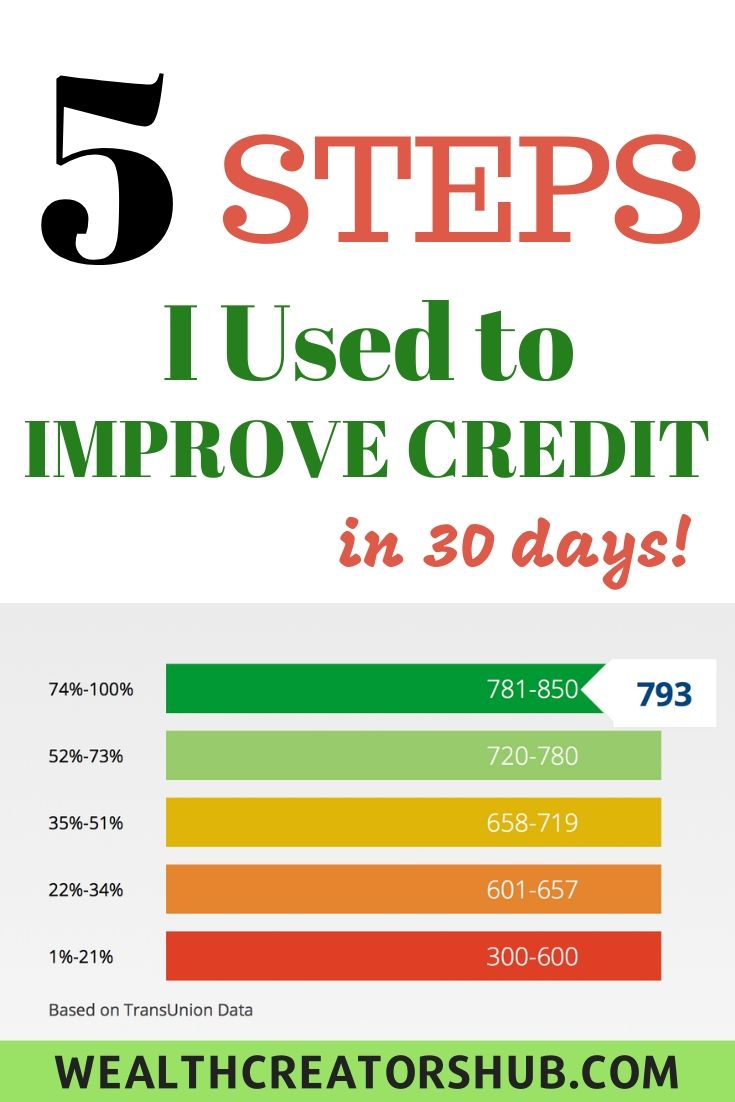

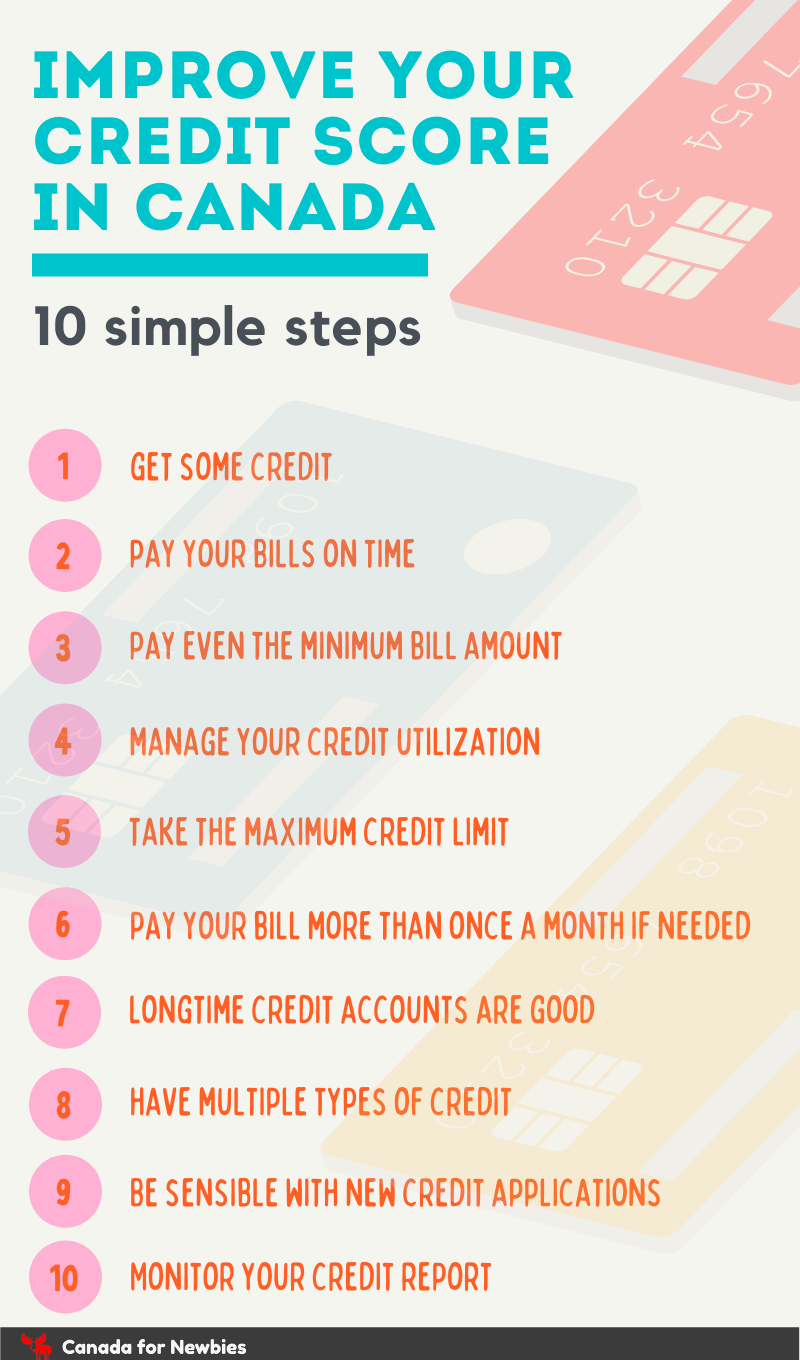

If you have a Mattress Firm credit card, you may be wondering how to increase your credit limit. The first step is to assess your current credit score and credit utilization ratio. A higher credit score and lower credit utilization ratio can increase your chances of being approved for a credit limit increase. It is also important to have a good payment history with Mattress Firm, as this shows responsible credit management. To request a credit limit increase, you can either call the customer service number on the back of your card or visit the Mattress Firm website and submit a request online. Be prepared to provide information such as your income, employment status, and reason for the credit limit increase. You may also be asked to provide a recent credit report. How to Increase Your Mattress Firm Credit Limit

Here are some tips to increase your chances of getting a higher Mattress Firm credit limit: Tips for Getting a Higher Mattress Firm Credit Limit

When you request a Mattress Firm credit increase, the company will review your credit history and financial information to determine your creditworthiness. This process may take a few days, and you will receive a notification of the decision via mail or email. If your request is approved, you will receive a new credit limit, and your credit card statement will reflect the change. If your request is denied, you can wait a few months and try again. In the meantime, focus on improving your credit score and credit utilization ratio. Understanding the Mattress Firm Credit Increase Process

Having a higher credit limit with Mattress Firm can provide several benefits, including: The Benefits of a Higher Mattress Firm Credit Limit

There are several reasons why your request for a Mattress Firm credit increase may be denied, including: Common Reasons for a Mattress Firm Credit Increase Denial

As mentioned earlier, a higher credit limit can improve your credit score by lowering your credit utilization ratio. Your credit utilization ratio is the amount of credit you are currently using compared to your total credit limit. A lower ratio can show that you are responsible with credit and can positively impact your credit score. Additionally, if you have a history of on-time payments and responsible credit management, a higher credit limit can reflect positively on your credit report and potentially increase your credit score. How a Mattress Firm Credit Increase Can Improve Your Credit Score

If you are unable to secure a Mattress Firm credit increase, there are other alternatives you can consider: Alternatives to a Mattress Firm Credit Increase

Here are some commonly asked questions about Mattress Firm credit increases: Frequently Asked Questions About Mattress Firm Credit Increases

The Importance of a Good Mattress for Your Home Design

Investing in Quality Sleep

When it comes to designing your home, many people focus on the aesthetics and functionality of the furniture and decor. However, one crucial aspect that is often overlooked is the quality of your mattress. Your mattress is not just a piece of furniture; it is an investment in your health and well-being. This is why

mattress firm credit increase

is an important topic to consider.

When it comes to designing your home, many people focus on the aesthetics and functionality of the furniture and decor. However, one crucial aspect that is often overlooked is the quality of your mattress. Your mattress is not just a piece of furniture; it is an investment in your health and well-being. This is why

mattress firm credit increase

is an important topic to consider.

Comfort and Support for Your Body

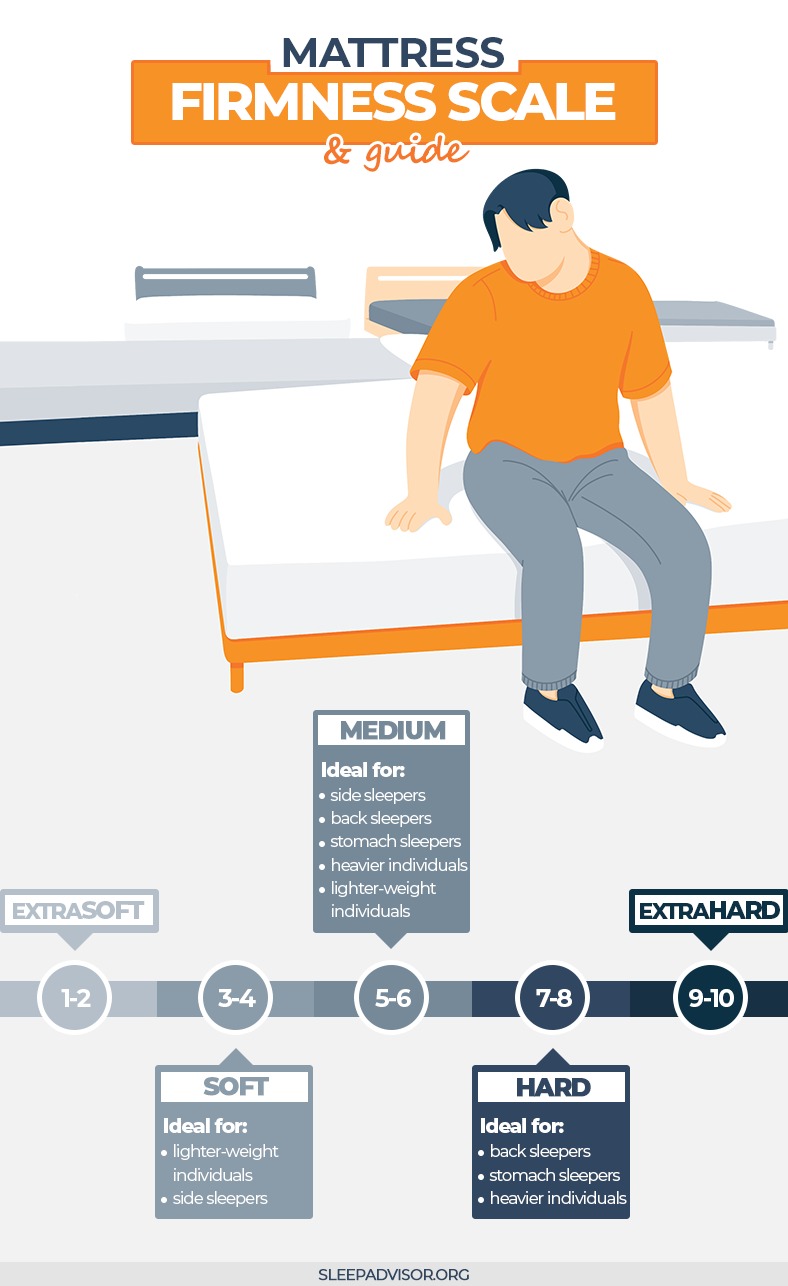

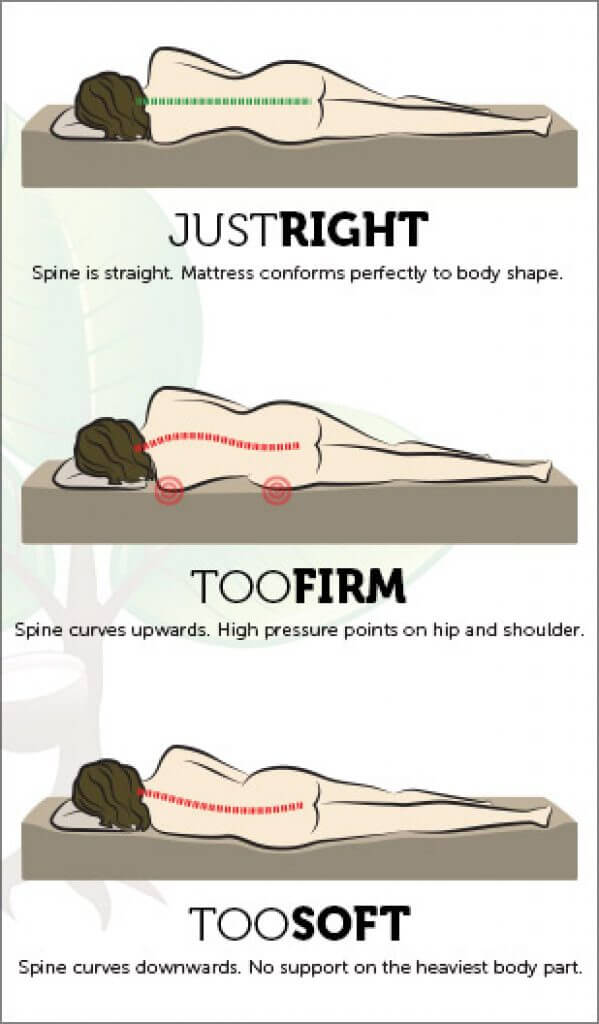

Not all mattresses are created equal, and choosing the right one for your needs is essential. A good mattress should provide both comfort and support for your body. This means finding a balance between softness and firmness, depending on your personal preferences and any health issues. A poor-quality mattress can lead to aches and pains, poor sleep quality, and even long-term health problems. This is why it is worth investing in a high-quality mattress that will provide the necessary support for your body.

Not all mattresses are created equal, and choosing the right one for your needs is essential. A good mattress should provide both comfort and support for your body. This means finding a balance between softness and firmness, depending on your personal preferences and any health issues. A poor-quality mattress can lead to aches and pains, poor sleep quality, and even long-term health problems. This is why it is worth investing in a high-quality mattress that will provide the necessary support for your body.

Enhancing Your Sleep Quality

According to the National Sleep Foundation, adults should aim for 7-9 hours of sleep each night. However, the quality of your sleep is just as important as the quantity. A good mattress can significantly impact your sleep quality, leading to better overall health and well-being. With the right level of comfort and support, you can experience deeper and more restful sleep, allowing you to wake up feeling refreshed and rejuvenated.

According to the National Sleep Foundation, adults should aim for 7-9 hours of sleep each night. However, the quality of your sleep is just as important as the quantity. A good mattress can significantly impact your sleep quality, leading to better overall health and well-being. With the right level of comfort and support, you can experience deeper and more restful sleep, allowing you to wake up feeling refreshed and rejuvenated.

Creating a Peaceful and Relaxing Bedroom

Your bedroom should be a sanctuary, a place where you can relax and unwind after a long day. A good mattress plays a crucial role in creating a peaceful and comfortable atmosphere in your bedroom. It can also help reduce any disruptive noise or movement, ensuring you have a restful night's sleep. With the right mattress, you can create a space that promotes relaxation and rejuvenation, making it the perfect addition to your home design.

Your bedroom should be a sanctuary, a place where you can relax and unwind after a long day. A good mattress plays a crucial role in creating a peaceful and comfortable atmosphere in your bedroom. It can also help reduce any disruptive noise or movement, ensuring you have a restful night's sleep. With the right mattress, you can create a space that promotes relaxation and rejuvenation, making it the perfect addition to your home design.

The Long-Term Benefits of a High-Quality Mattress

Investing in a high-quality mattress not only benefits your immediate sleep quality, but it also has long-term benefits. A good mattress can last for many years, providing consistent comfort and support. This means fewer replacements and expenses in the long run. Additionally, a good mattress can also improve your overall health and well-being, leading to a happier and more productive life.

In conclusion, a good mattress is an essential aspect of your home design that should not be overlooked. It not only adds to the aesthetics of your bedroom but also plays a crucial role in your physical and mental well-being. Consider

mattress firm credit increase

as a way to invest in a high-quality mattress that will enhance your sleep quality and overall quality of life.

Investing in a high-quality mattress not only benefits your immediate sleep quality, but it also has long-term benefits. A good mattress can last for many years, providing consistent comfort and support. This means fewer replacements and expenses in the long run. Additionally, a good mattress can also improve your overall health and well-being, leading to a happier and more productive life.

In conclusion, a good mattress is an essential aspect of your home design that should not be overlooked. It not only adds to the aesthetics of your bedroom but also plays a crucial role in your physical and mental well-being. Consider

mattress firm credit increase

as a way to invest in a high-quality mattress that will enhance your sleep quality and overall quality of life.