Running a kitchen and bath distribution business comes with its own set of risks. Whether you are a small distributor or a large supplier, you are still vulnerable to accidents and mishaps that could result in financial loss. That's why it's crucial for kitchen and bath distributors to have general liability insurance. This type of insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injuries. Let's take a closer look at why kitchen and bath distributors should have general liability insurance.General Liability Insurance for Kitchen and Bath Distributors

General liability insurance for kitchen and bath distributors typically includes coverage for bodily injury and property damage caused by your products or operations. For example, if a customer slips and falls in your showroom or warehouse, your general liability insurance would cover the medical expenses and legal fees if the customer decides to sue. It also provides coverage for property damage caused by your products or services, such as if a customer's kitchen or bathroom remodel goes wrong.Kitchen and Bath Distributors Insurance Coverage

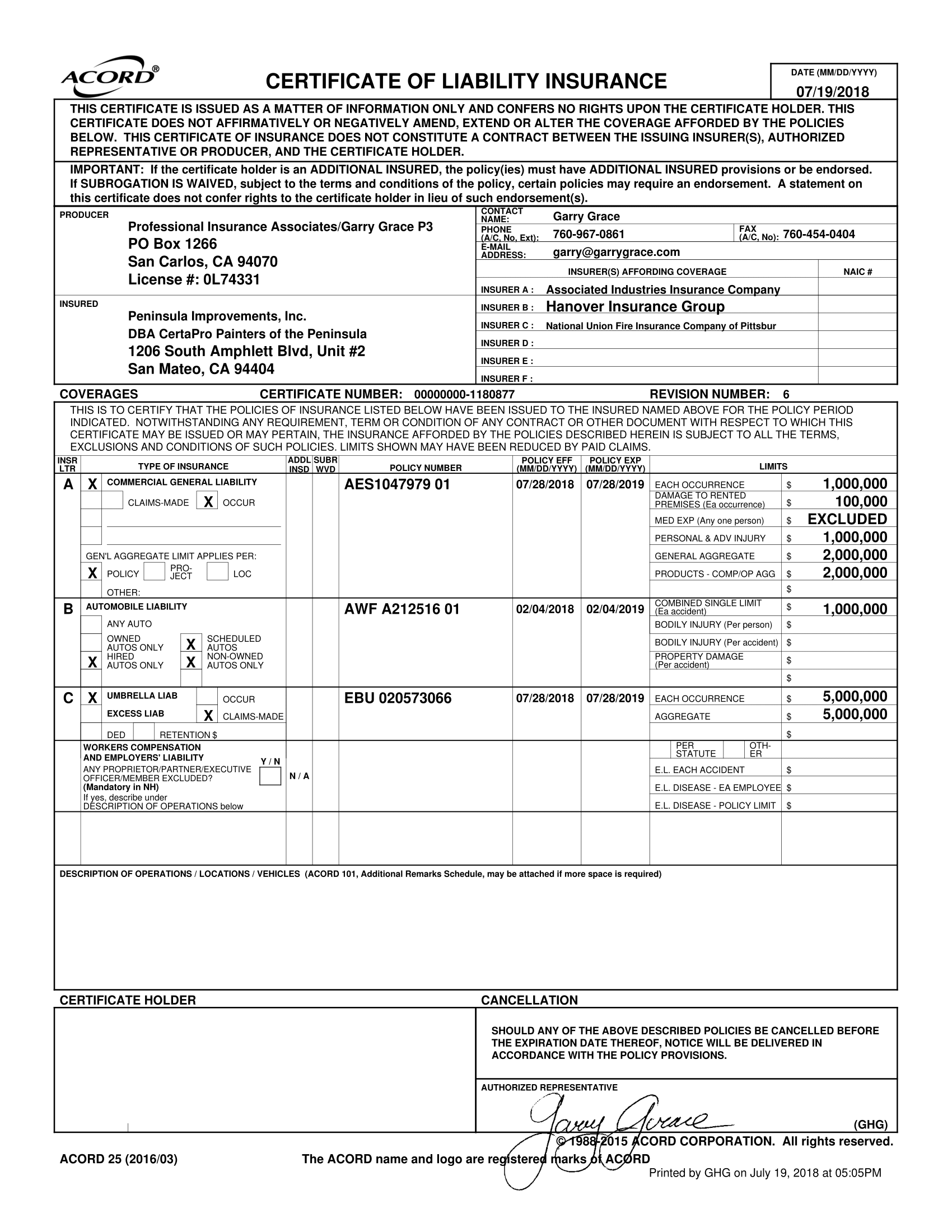

In most states, kitchen and bath distributors are required to have general liability insurance. It is also often a requirement for obtaining a business license or entering into contracts with clients. Additionally, having general liability insurance can help build trust with potential customers as it shows that you are a responsible and professional business owner.Kitchen and Bath Distributors Insurance Requirements

Class codes are used by insurance companies to classify and rate businesses based on their level of risk. For kitchen and bath distributors, the class code is typically 8017. This code encompasses businesses that primarily distribute plumbing and heating supplies, including kitchen and bath fixtures and appliances. It's important to make sure your insurance policy includes this specific class code to ensure proper coverage.Class Codes for Kitchen and Bath Distributors

If you have a kitchen and bath showroom, it's essential to have general liability insurance. Showrooms are where customers come to browse and make purchases, increasing the risk of accidents and potential property damage. General liability insurance can provide coverage for slip and fall accidents, as well as any damage caused to your showroom by customers or employees.General Liability Insurance for Kitchen and Bath Showrooms

As a kitchen and bath designer, you are responsible for creating functional and aesthetically pleasing spaces for your clients. However, if something goes wrong during the design process, you could be held liable. General liability insurance can protect you from financial loss if a client claims that your design caused bodily injury or property damage.Insurance for Kitchen and Bath Designers

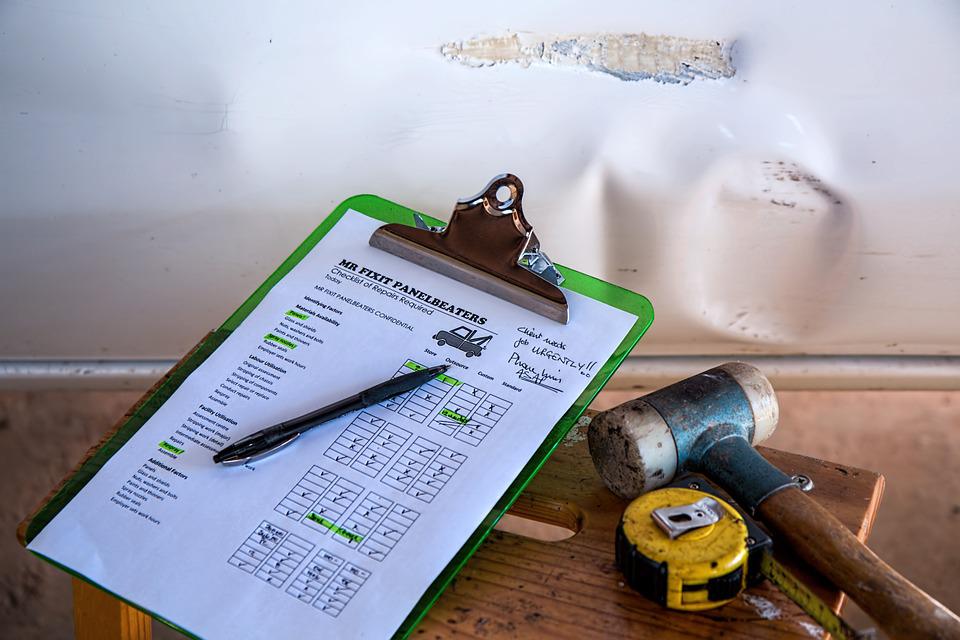

Kitchen and bath contractors are responsible for the physical work involved in remodeling or installing new kitchens and bathrooms. This type of work comes with many risks, such as accidents, property damage, and even faulty workmanship. General liability insurance can provide coverage for these risks, giving contractors peace of mind and financial protection.General Liability Insurance for Kitchen and Bath Contractors

The class code for kitchen and bath contractors is typically 9134. This code includes businesses that install, service, or repair kitchen and bathroom fixtures and appliances. It's crucial to make sure your insurance policy includes this specific class code to ensure proper coverage for your business.Class Codes for Kitchen and Bath Contractors

Remodeling a kitchen or bathroom involves a lot of hard work and potential hazards. As a kitchen and bath remodeler, you are responsible for any injuries or damages that may occur during the remodeling process. General liability insurance can provide coverage for accidents or damage caused by your services, such as if a client's property is damaged during a remodel.Insurance for Kitchen and Bath Remodelers

Suppliers play a crucial role in the kitchen and bath industry, providing the products and materials needed for construction and remodeling projects. However, suppliers can also be held liable for any damages or injuries caused by their products. General liability insurance can provide coverage for these risks, protecting suppliers from financial loss. In conclusion, general liability insurance is an essential investment for kitchen and bath distributors, showrooms, designers, contractors, remodelers, and suppliers. It can provide financial protection and peace of mind in the event of accidents, injuries, or property damage. Make sure to carefully review your insurance policy to ensure it includes the proper coverage for your specific business needs.General Liability Insurance for Kitchen and Bath Suppliers

The Importance of General Liability Insurance for Kitchen and Bath Distributors

Protecting Your Business and Your Customers

As a kitchen and bath distributor, you know that your business is more than just selling products. You are also responsible for ensuring that the products you sell are safe and meet the necessary standards. This is why having general liability insurance is crucial for your business.

General liability insurance

is a type of insurance that protects your business from financial losses resulting from third-party claims of property damage or bodily injury. In the kitchen and bath distribution industry, this can occur if a customer slips and falls in your showroom or if a product you sold causes damage to a customer's property.

Without proper insurance coverage, your business could face significant financial losses and damage to your reputation.

Lawsuits and legal fees can quickly add up, and without insurance, you would be responsible for paying these costs out of pocket. This could potentially bankrupt your business and force you to close your doors.

As a kitchen and bath distributor, you know that your business is more than just selling products. You are also responsible for ensuring that the products you sell are safe and meet the necessary standards. This is why having general liability insurance is crucial for your business.

General liability insurance

is a type of insurance that protects your business from financial losses resulting from third-party claims of property damage or bodily injury. In the kitchen and bath distribution industry, this can occur if a customer slips and falls in your showroom or if a product you sold causes damage to a customer's property.

Without proper insurance coverage, your business could face significant financial losses and damage to your reputation.

Lawsuits and legal fees can quickly add up, and without insurance, you would be responsible for paying these costs out of pocket. This could potentially bankrupt your business and force you to close your doors.

Meeting Legal Requirements

Many states require businesses to have general liability insurance to operate legally. This is because of the potential risks involved in running a business, especially in the kitchen and bath industry where accidents and mishaps can happen.

Having

general liability insurance not only protects your business but also ensures that you are meeting legal requirements.

This can help you avoid fines and penalties that could result from not having proper insurance coverage.

Many states require businesses to have general liability insurance to operate legally. This is because of the potential risks involved in running a business, especially in the kitchen and bath industry where accidents and mishaps can happen.

Having

general liability insurance not only protects your business but also ensures that you are meeting legal requirements.

This can help you avoid fines and penalties that could result from not having proper insurance coverage.

Peace of Mind for You and Your Customers

As a kitchen and bath distributor, your customers trust you to provide them with safe and reliable products. Having general liability insurance not only protects your business but also gives your customers peace of mind knowing that they are doing business with a responsible and reputable company.

In the event of an accident or injury, your customers will be covered by your insurance, which can help build trust and loyalty with your business.

This can also give them the assurance that their investment in your products is protected.

As a kitchen and bath distributor, your customers trust you to provide them with safe and reliable products. Having general liability insurance not only protects your business but also gives your customers peace of mind knowing that they are doing business with a responsible and reputable company.

In the event of an accident or injury, your customers will be covered by your insurance, which can help build trust and loyalty with your business.

This can also give them the assurance that their investment in your products is protected.

Conclusion

In the highly competitive kitchen and bath distribution industry, having general liability insurance is essential for the success and longevity of your business. It not only protects your business from financial losses but also gives your customers peace of mind and helps you meet legal requirements. Don't wait until it's too late, make sure your business is properly covered with general liability insurance.

In the highly competitive kitchen and bath distribution industry, having general liability insurance is essential for the success and longevity of your business. It not only protects your business from financial losses but also gives your customers peace of mind and helps you meet legal requirements. Don't wait until it's too late, make sure your business is properly covered with general liability insurance.