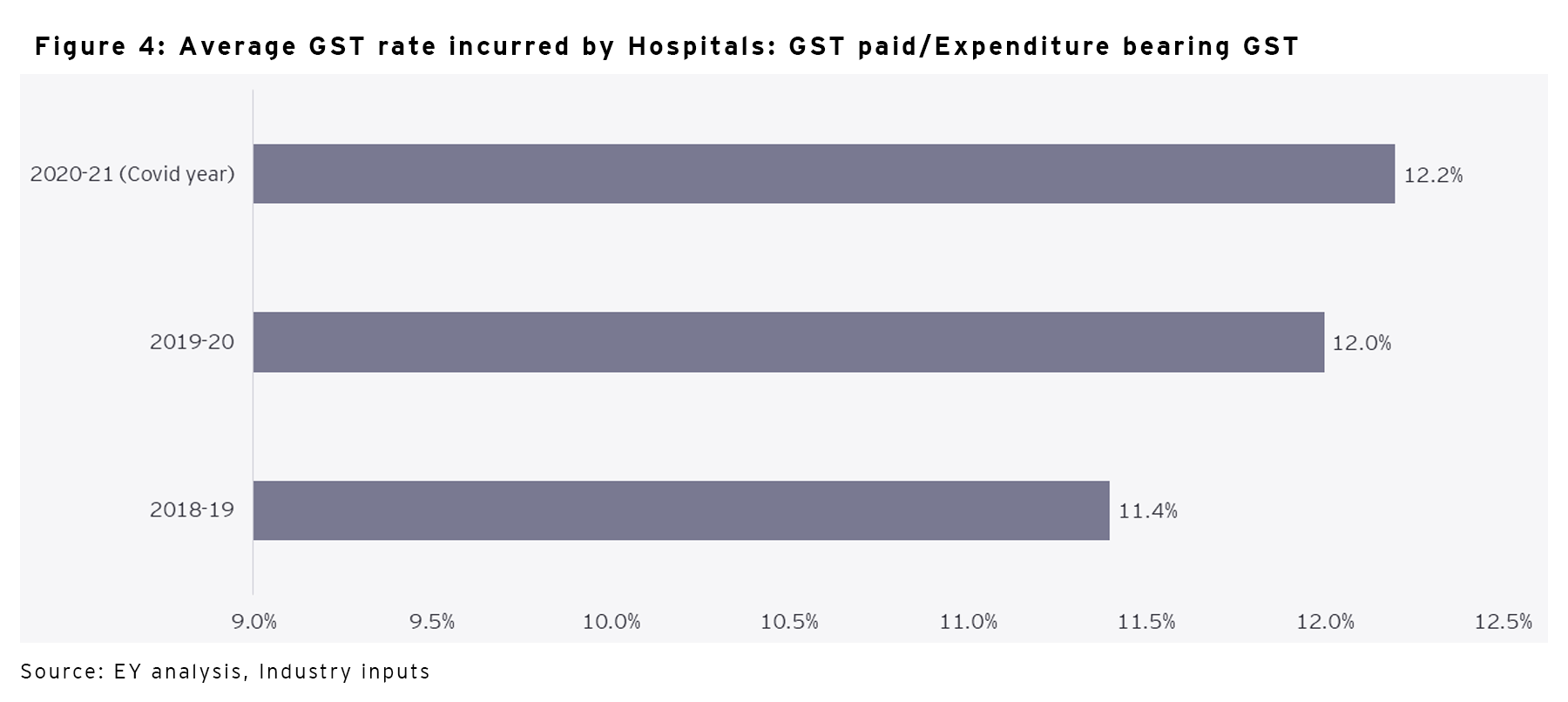

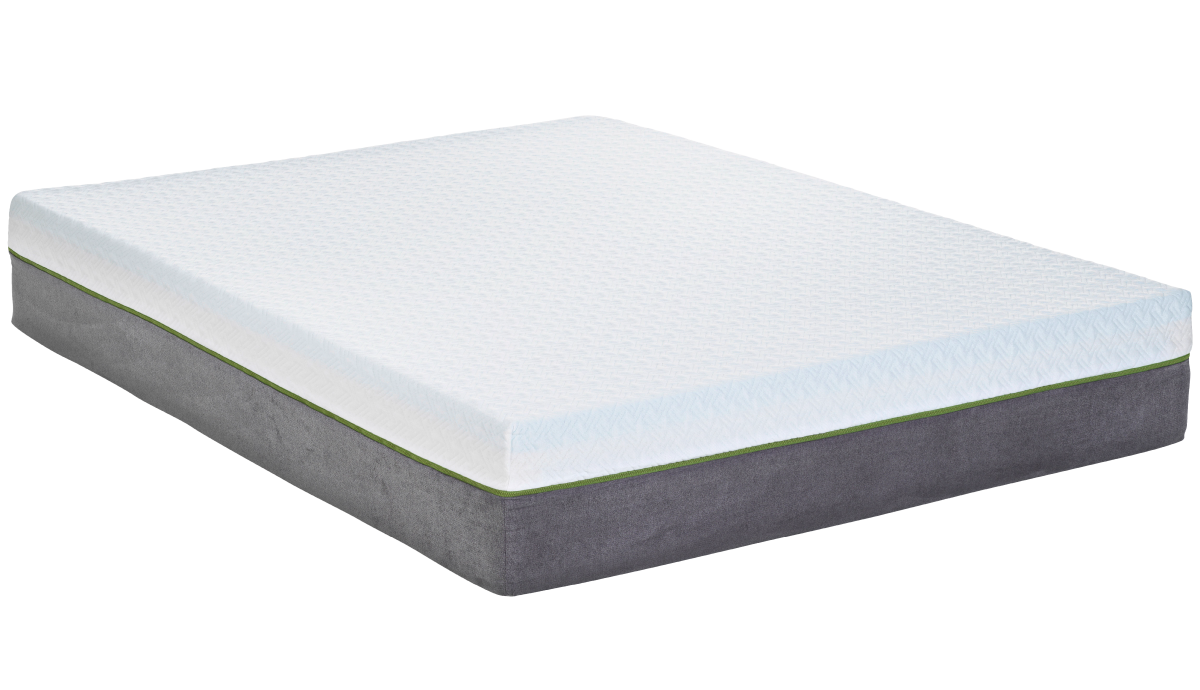

Welcome to our comprehensive guide on the GST rate for foam mattresses in India. As a consumer, it is important to understand the taxation system when purchasing a mattress. This will not only help you make an informed decision, but also ensure that you are not overpaying. In this article, we will delve into the details of the GST rate for foam mattresses and answer some commonly asked questions.Foam Mattress GST Rate

The GST (Goods and Services Tax) rate for foam mattresses in India is 12%. This rate is applicable to all types and sizes of foam mattresses, whether they are made of polyurethane foam, memory foam, or any other type of foam. This rate was implemented in July 2017, when the GST system was introduced in India to replace the previous taxation system.GST Rate for Foam Mattresses

The foam mattress tax rate is the same as the GST rate, which is 12%. This is a significant change from the previous tax rate, which used to be around 15-18%. The introduction of GST has resulted in a lower tax burden for consumers, making foam mattresses more affordable.Foam Mattress Tax Rate

GST on foam mattresses is calculated at 12% on the total value of the mattress, including the cost of materials, manufacturing, and profit margin. This means that if you purchase a foam mattress for Rs. 10,000, the GST amount will be Rs. 1,200, making the total cost of the mattress Rs. 11,200.GST on Foam Mattresses

The foam mattress GST percentage is 12%, as mentioned earlier. This is the standard GST rate for most goods and services in India. However, there are some special categories of foam mattresses, such as orthopedic mattresses, which may have a different GST rate. It is always best to check with your mattress retailer to confirm the exact GST percentage before making a purchase.Foam Mattress GST Percentage

The foam mattress tax rate in India used to be much higher before the implementation of GST. With the introduction of the new taxation system, the tax burden has reduced significantly, making it more affordable for consumers to purchase foam mattresses. This has also resulted in a boost to the mattress industry, with more people now opting for foam mattresses due to the lower tax rate.Foam Mattress Tax Rate in India

GST on foam mattress in India is applicable to all types and sizes of foam mattresses, including single, double, queen, and king sizes. The GST rate of 12% is the same for all sizes, and it is advisable to check the GST amount on your invoice to ensure that you are not being overcharged. In case of any discrepancies, you can contact the retailer or the GST helpline for assistance.GST on Foam Mattress in India

The foam mattress GST slab is 12%, which is the same as the standard GST rate for most goods and services. This slab was decided upon by the GST Council when the new taxation system was introduced. The aim was to streamline the tax structure and bring down the tax burden for consumers.Foam Mattress GST Slab

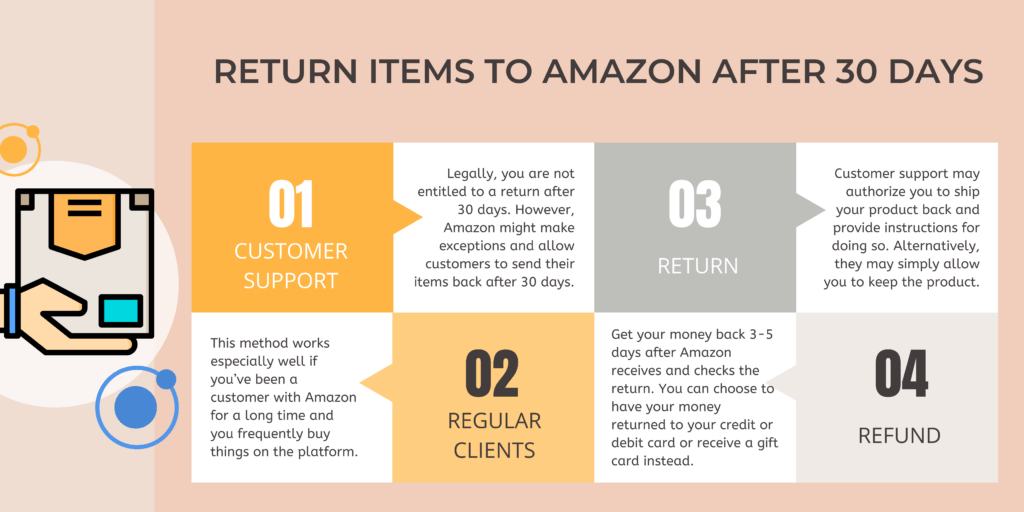

In 2021, the GST rate for foam mattresses remains unchanged at 12%. However, it is important to note that the GST Council may revise the rates from time to time, so it is always best to check the current rates before making a purchase. You can also use the GST calculator to get an estimate of the GST amount on your foam mattress purchase.GST on Foam Mattress in 2021

If you are unsure about how much GST you will be charged on your foam mattress purchase, you can use the GST calculator to get an estimate. All you need to do is enter the cost of the mattress, and the calculator will give you the GST amount and the total cost. This will help you plan your budget and make an informed decision. In conclusion, the GST rate for foam mattresses in India is 12%, and this applies to all types and sizes of foam mattresses. With the implementation of GST, the tax burden on consumers has reduced, making foam mattresses more affordable. We hope this article has provided you with all the information you need to know about the GST rate for foam mattresses.Foam Mattress GST Calculator

The Benefits of Investing in a Foam Mattress for Your Home Design

Why Foam Mattresses are Gaining Popularity

When it comes to creating a comfortable and stylish living space, choosing the right

mattress

is essential. While traditional

mattresses

have been the go-to for many years, foam

mattresses

have been gaining popularity in recent years. This is not only due to their

comfort

and

durability

, but also because of their

affordability

and

environmentally-friendly

qualities. As a result, the government has also taken notice and implemented a

GST rate

on foam

mattresses

in order to promote the use of sustainable and eco-friendly materials in house design.

When it comes to creating a comfortable and stylish living space, choosing the right

mattress

is essential. While traditional

mattresses

have been the go-to for many years, foam

mattresses

have been gaining popularity in recent years. This is not only due to their

comfort

and

durability

, but also because of their

affordability

and

environmentally-friendly

qualities. As a result, the government has also taken notice and implemented a

GST rate

on foam

mattresses

in order to promote the use of sustainable and eco-friendly materials in house design.

The Impact of the GST Rate on Foam Mattresses

With the implementation of a

GST rate

on foam

mattresses

, consumers are now more encouraged to invest in this type of

mattress

for their homes. This is because the

GST rate

has made foam

mattresses

more affordable compared to traditional

mattresses

, making it a feasible option for those on a budget. Additionally, the

GST rate

serves as a

green tax

, promoting the use of sustainable materials in house design. This not only benefits the environment, but also contributes to creating a healthier living space for individuals and families.

With the implementation of a

GST rate

on foam

mattresses

, consumers are now more encouraged to invest in this type of

mattress

for their homes. This is because the

GST rate

has made foam

mattresses

more affordable compared to traditional

mattresses

, making it a feasible option for those on a budget. Additionally, the

GST rate

serves as a

green tax

, promoting the use of sustainable materials in house design. This not only benefits the environment, but also contributes to creating a healthier living space for individuals and families.

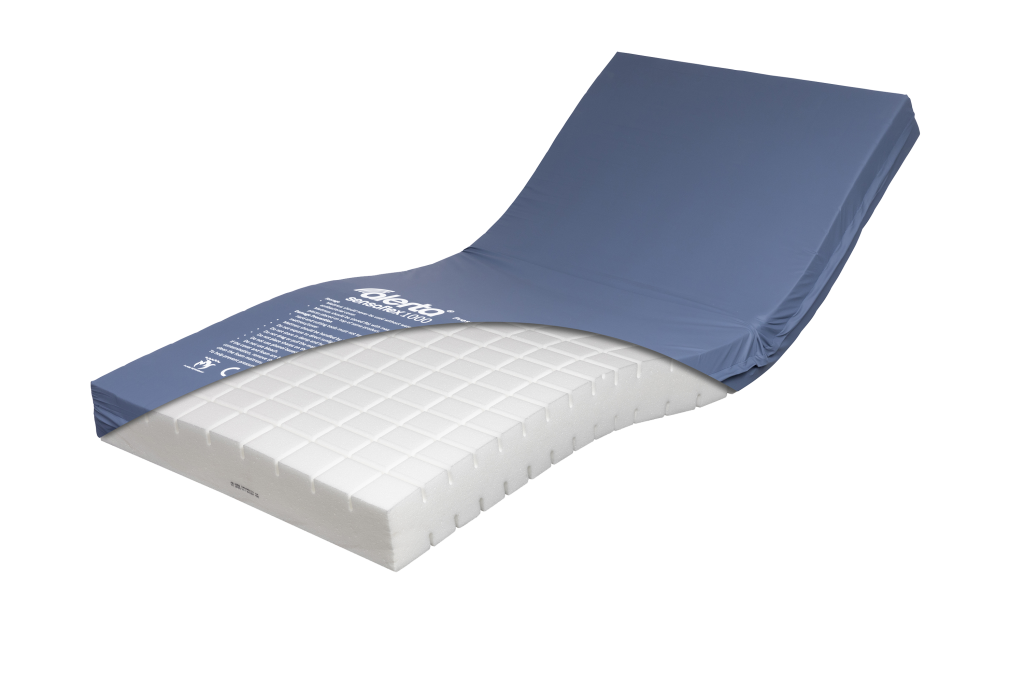

Other Benefits of Foam Mattresses for House Design

Aside from their affordability and environmental impact, foam

mattresses

also offer a host of other benefits for house design. For one, they are highly

versatile

and can be easily incorporated into various design styles. This is due to their

flexibility

and ability to conform to different body shapes, providing

optimal support

and

comfort

for individuals. Foam

mattresses

are also

hypoallergenic

, making them a great option for those with allergies or sensitive skin. Additionally, their

durability

means they can last for years, making them a worthwhile investment for any home.

In conclusion, the implementation of a

GST rate

on foam

mattresses

not only promotes the use of eco-friendly materials in house design, but also offers a host of other benefits for consumers. From affordability to versatility and health benefits, foam

mattresses

are a great addition to any home. So why not consider investing in a foam

mattress

for your next home design project? Your wallet, your health, and the environment will thank you.

Aside from their affordability and environmental impact, foam

mattresses

also offer a host of other benefits for house design. For one, they are highly

versatile

and can be easily incorporated into various design styles. This is due to their

flexibility

and ability to conform to different body shapes, providing

optimal support

and

comfort

for individuals. Foam

mattresses

are also

hypoallergenic

, making them a great option for those with allergies or sensitive skin. Additionally, their

durability

means they can last for years, making them a worthwhile investment for any home.

In conclusion, the implementation of a

GST rate

on foam

mattresses

not only promotes the use of eco-friendly materials in house design, but also offers a host of other benefits for consumers. From affordability to versatility and health benefits, foam

mattresses

are a great addition to any home. So why not consider investing in a foam

mattress

for your next home design project? Your wallet, your health, and the environment will thank you.