If you're in the market for a new mattress, you may be wondering about financing options. Many people choose to finance their mattress purchase to spread out the cost over time. However, this often involves a credit check. If you're considering buying a mattress from Mattress Firm, you may be wondering: does Mattress Firm do credit checks?Does Mattress Firm do credit checks?

Unfortunately, the answer is yes. Mattress Firm does require a credit check for financing options. This means that they will pull your credit report to determine your creditworthiness before approving you for financing. While this may seem daunting, it's important to understand the reasons behind this policy.Yes, Mattress Firm does credit checks.

The short answer is yes, but the longer answer is a bit more complicated. While Mattress Firm does require a credit check for financing, they do not require one for all purchases. If you plan on paying for your mattress upfront, you will not need to undergo a credit check. However, if you choose to finance your purchase, a credit check will be necessary.Does Mattress Firm require a credit check?

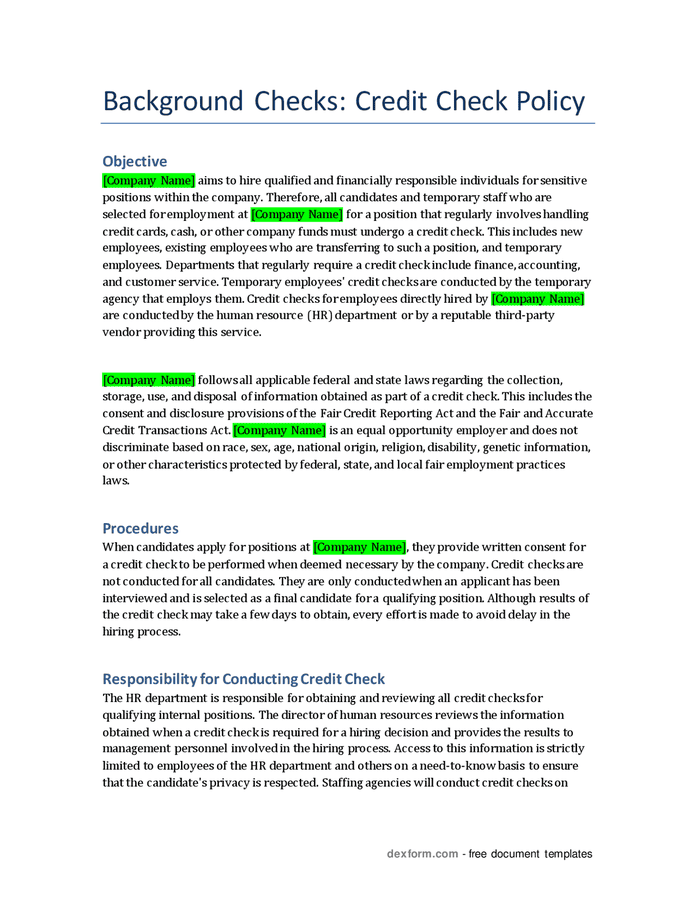

Now that we know that Mattress Firm does require a credit check for financing, let's take a closer look at their credit check policy. When you apply for financing, they will pull your credit report from one of the major credit bureaus (Equifax, Experian, or TransUnion). This is a standard practice for most companies that offer financing options.Mattress Firm credit check policy

Mattress Firm checks credit by pulling a copy of your credit report from one of the major credit bureaus. They will use this report to evaluate your creditworthiness and determine if you are a good candidate for financing. This process is quick and easy, and typically takes less than a minute.How does Mattress Firm check credit?

Now that we know Mattress Firm does credit checks, let's take a look at their financing options. Mattress Firm offers a variety of financing options, including 0% APR for a set period of time or low monthly payments with interest. Depending on your credit score, you may qualify for one or both of these financing options.Mattress Firm financing options

So, how does the credit approval process work at Mattress Firm? Once you fill out the credit application and undergo a credit check, Mattress Firm will evaluate your credit history and credit score. They will also consider your income and other factors. If you meet their credit score and income requirements, you will likely be approved for financing.Mattress Firm credit approval process

While Mattress Firm does not disclose their specific credit score requirements, it's safe to assume that they will want to see a good credit score. This typically means a score of 670 or higher. However, even if you have a lower credit score, you may still be approved for financing. It's always worth applying and seeing what options are available to you.Mattress Firm credit score requirements

If you're ready to apply for financing at Mattress Firm, you can easily do so online or in-store. You will need to provide personal information such as your name, address, and social security number. You will also need to disclose your income and employment information. Once you submit your application, you should receive a decision within a few minutes.Mattress Firm credit application

As we've discussed, a credit check is necessary for financing at Mattress Firm. This is because financing involves borrowing money, and Mattress Firm wants to ensure that you have a good credit history and are able to repay the loan. While it may seem like an inconvenience, a credit check is a standard practice for most companies that offer financing options.Mattress Firm credit check for financing

The Importance of a Comfortable Mattress for a Good Night's Sleep

How Mattress Firm Can Help You Find the Perfect Mattress

When it comes to designing and decorating your house, the furniture and decor are not the only things that need to be carefully chosen. Your bedding, specifically your

mattress

, plays a crucial role in ensuring you get a good night's sleep. However, finding the right mattress can be a daunting task, especially if you are on a tight budget or have a less-than-perfect credit score. This is where

Mattress Firm

comes in.

When it comes to designing and decorating your house, the furniture and decor are not the only things that need to be carefully chosen. Your bedding, specifically your

mattress

, plays a crucial role in ensuring you get a good night's sleep. However, finding the right mattress can be a daunting task, especially if you are on a tight budget or have a less-than-perfect credit score. This is where

Mattress Firm

comes in.

Do Credit Checks Affect Your Mattress Shopping Experience?

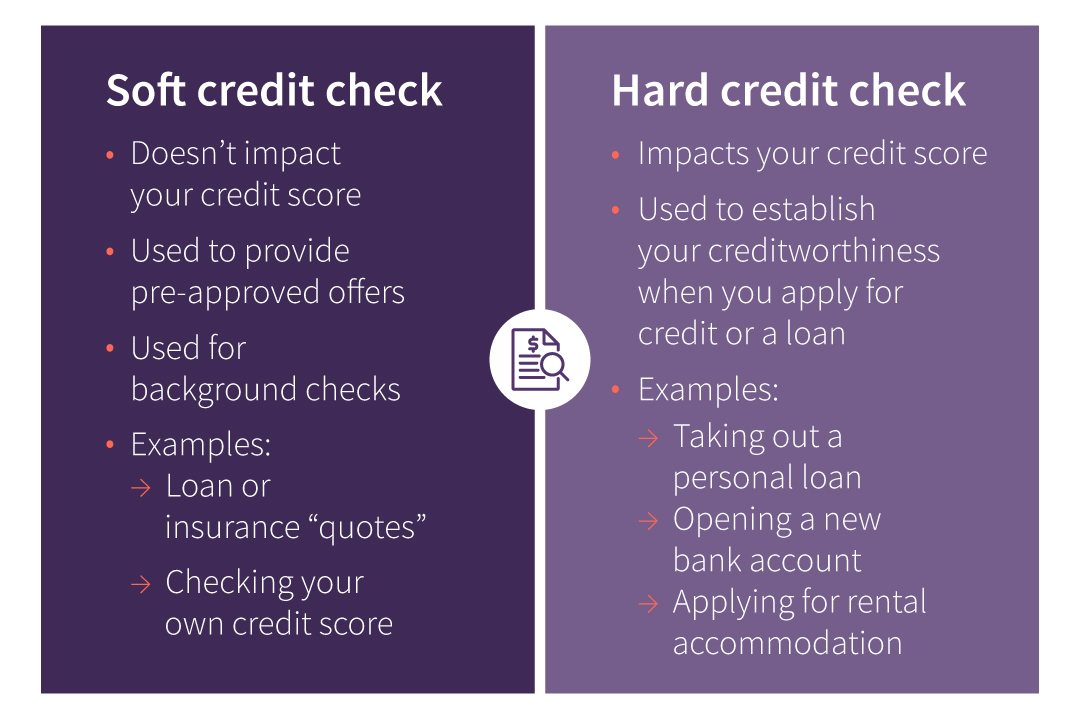

One of the common concerns among customers is whether

Mattress Firm

performs credit checks when purchasing a mattress. The answer is yes, but it may not be what you think. Unlike other retailers,

Mattress Firm

does not perform a traditional credit check that can impact your credit score. Instead, they use a soft credit check, which does not affect your credit score or appear on your credit report. This allows them to assess your creditworthiness and provide you with financing options that best suit your financial situation.

One of the common concerns among customers is whether

Mattress Firm

performs credit checks when purchasing a mattress. The answer is yes, but it may not be what you think. Unlike other retailers,

Mattress Firm

does not perform a traditional credit check that can impact your credit score. Instead, they use a soft credit check, which does not affect your credit score or appear on your credit report. This allows them to assess your creditworthiness and provide you with financing options that best suit your financial situation.

How Does Financing Work at Mattress Firm?

At

Mattress Firm

, they understand that not everyone has the means to pay for a mattress upfront. That's why they offer financing options to make your mattress shopping experience more convenient and affordable. With their financing options, you can choose to make payments over a period of time instead of paying the full amount at once. This allows you to find the perfect mattress for your needs without breaking the bank.

At

Mattress Firm

, they understand that not everyone has the means to pay for a mattress upfront. That's why they offer financing options to make your mattress shopping experience more convenient and affordable. With their financing options, you can choose to make payments over a period of time instead of paying the full amount at once. This allows you to find the perfect mattress for your needs without breaking the bank.

Why Choose Mattress Firm for Your Mattress Needs?

Aside from their financing options,

Mattress Firm

also offers a wide selection of

mattresses

from top brands, ensuring that you find the perfect fit for your comfort and budget. They also have knowledgeable and friendly staff who can guide you in choosing the right mattress for your needs and preferences. Moreover, their commitment to providing excellent customer service and quality products has made them a trusted name in the mattress industry.

In conclusion,

Mattress Firm

understands the importance of a comfortable mattress in ensuring you get a good night's sleep. They offer convenient financing options and a wide selection of top-quality mattresses to cater to everyone's needs and budget. So if you're looking for a reliable and reputable retailer to help you find the perfect mattress, look no further than

Mattress Firm

.

Aside from their financing options,

Mattress Firm

also offers a wide selection of

mattresses

from top brands, ensuring that you find the perfect fit for your comfort and budget. They also have knowledgeable and friendly staff who can guide you in choosing the right mattress for your needs and preferences. Moreover, their commitment to providing excellent customer service and quality products has made them a trusted name in the mattress industry.

In conclusion,

Mattress Firm

understands the importance of a comfortable mattress in ensuring you get a good night's sleep. They offer convenient financing options and a wide selection of top-quality mattresses to cater to everyone's needs and budget. So if you're looking for a reliable and reputable retailer to help you find the perfect mattress, look no further than

Mattress Firm

.