Depreciation of a New Kitchen Sink Rental

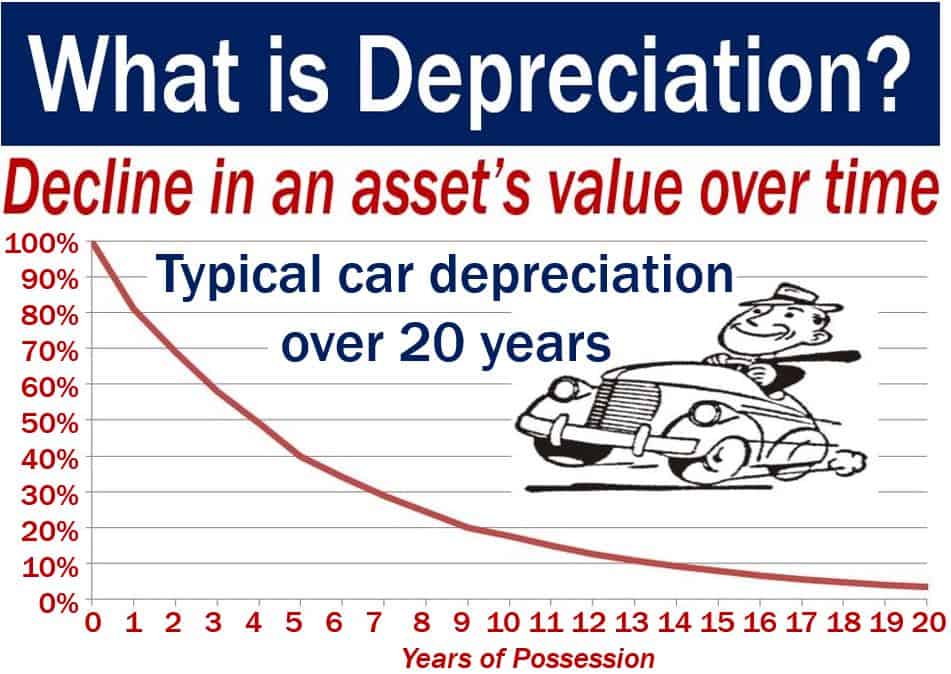

When it comes to owning a rental property, there are many expenses that need to be taken into consideration. One of these expenses is the depreciation of assets, such as a new kitchen sink rental. Depreciation is a tax deduction that allows landlords to recoup the cost of an asset over time. In this article, we will discuss the top 10 things you need to know about the depreciation of a new kitchen sink rental.

How to Calculate Depreciation for a Rental Property

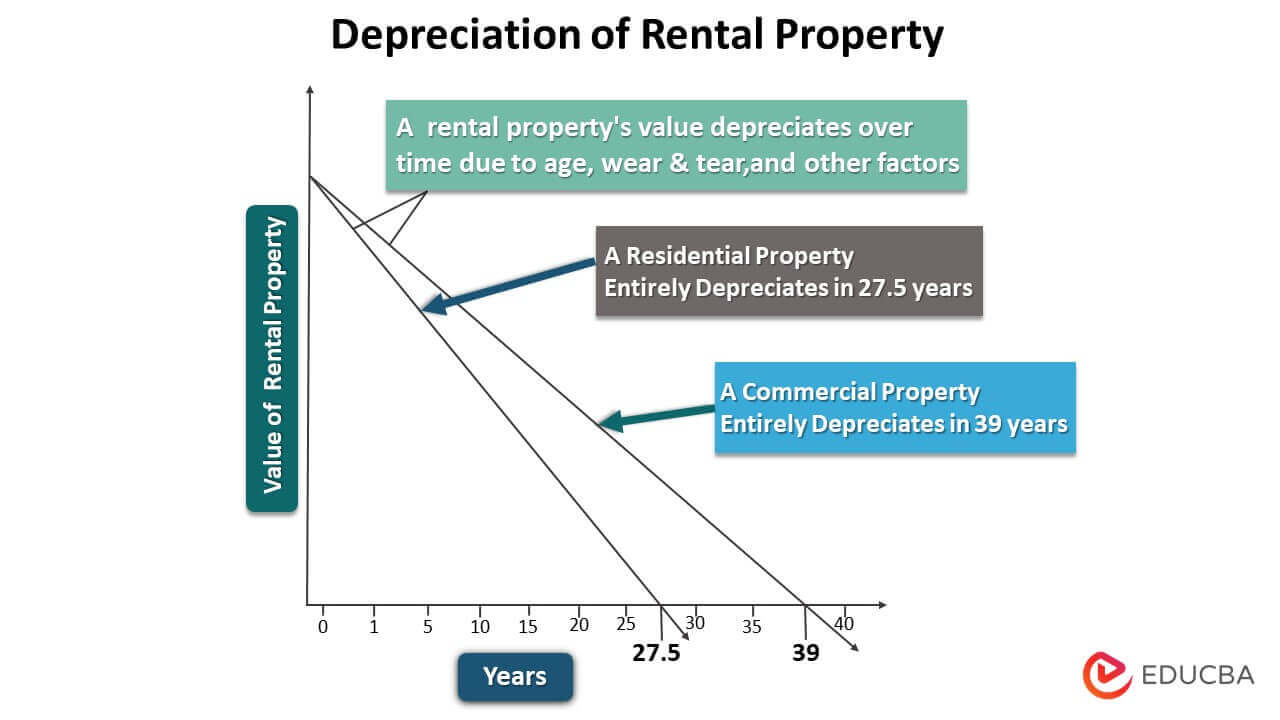

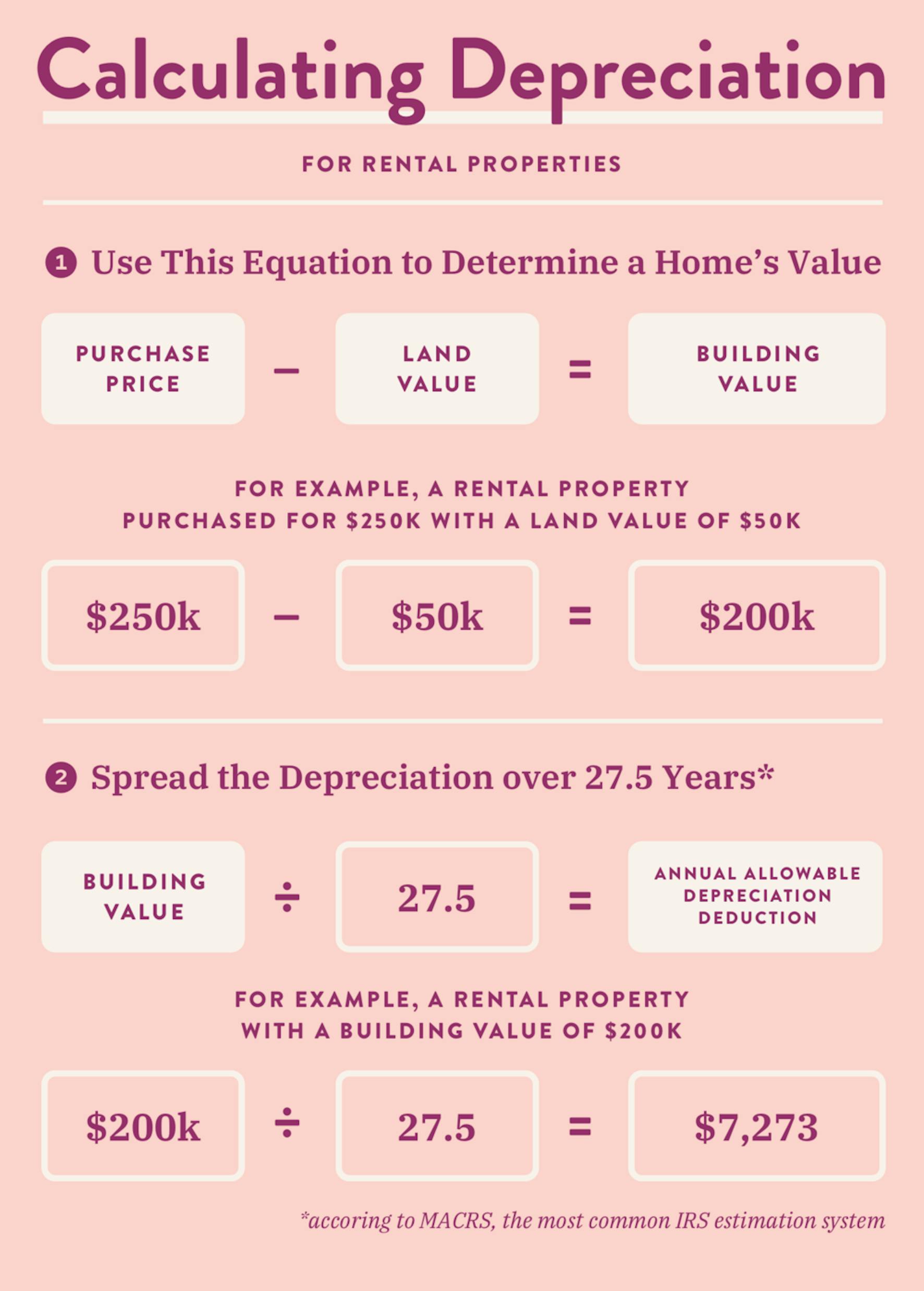

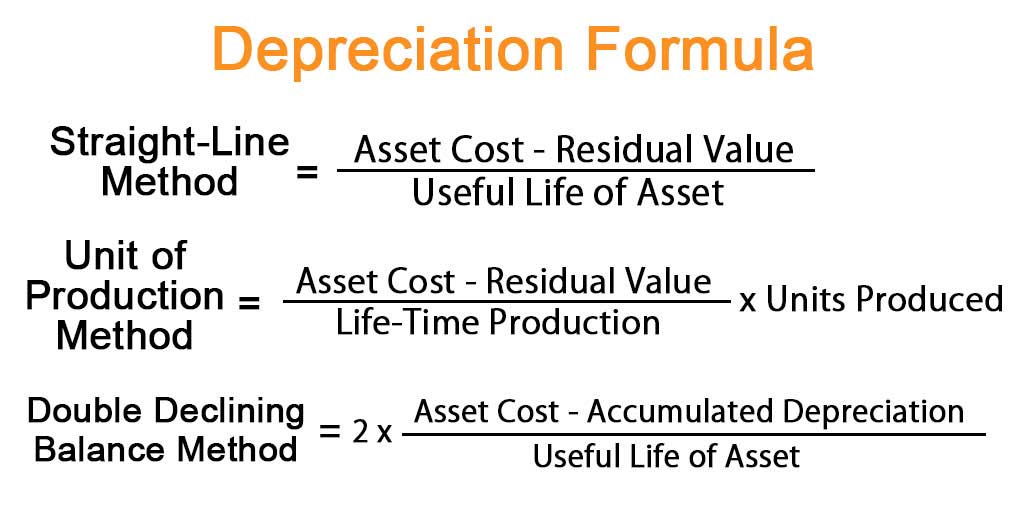

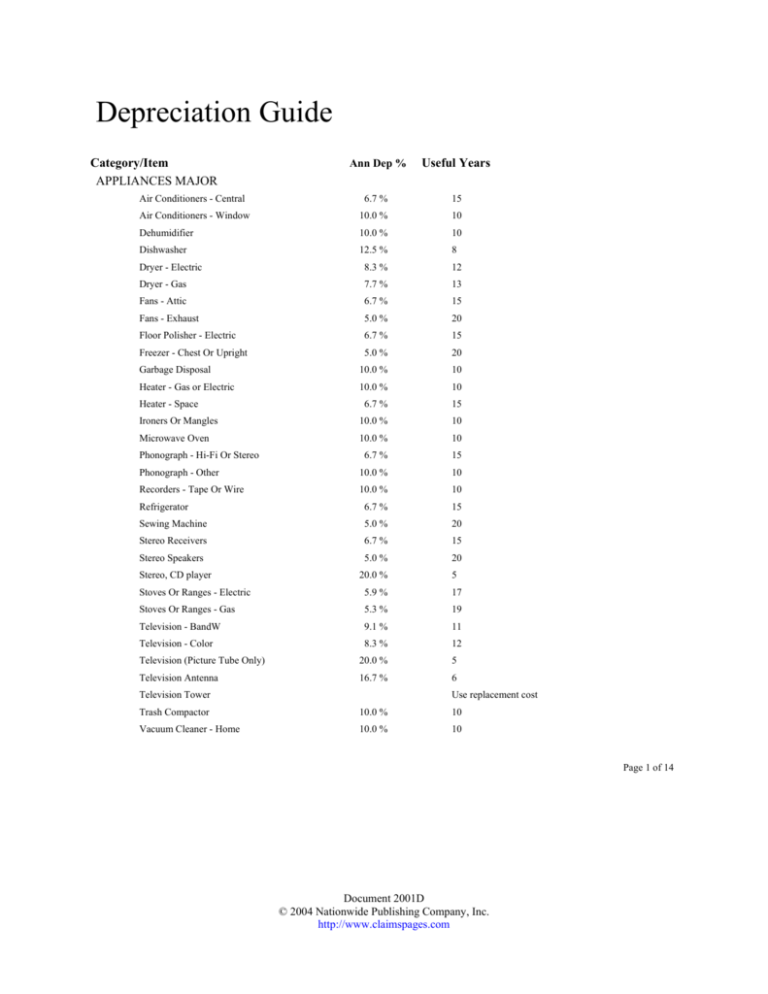

Calculating depreciation for a rental property, including a new kitchen sink, can be a bit complicated. Generally, you can calculate the depreciation by dividing the cost of the asset by its useful life. However, there are specific rules and methods that must be followed for rental properties. It is recommended to consult with a tax professional or use a depreciation calculator to ensure accuracy.

Factors That Affect Rental Property Depreciation

The depreciation of a new kitchen sink rental is affected by several factors. The first factor is the cost of the asset, which includes the purchase and installation costs. The second factor is the useful life of the asset, which is determined by the IRS. The third factor is the depreciation method used, which can affect the amount of depreciation deduction you can take each year.

Claiming Depreciation on a Rental Property

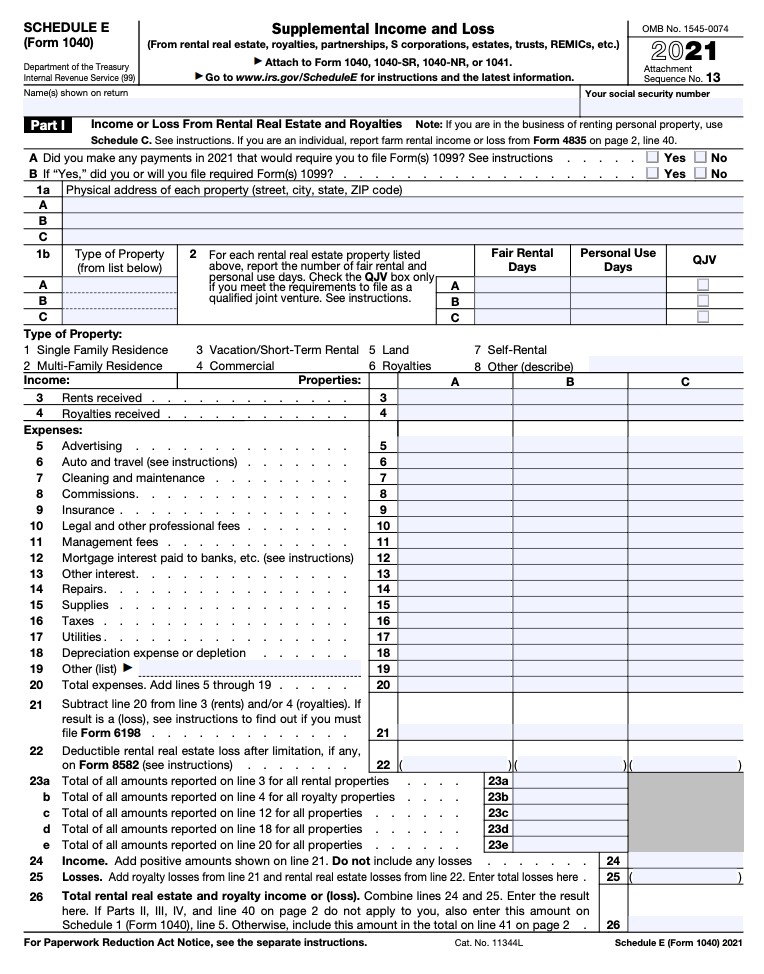

In order to claim depreciation on a rental property, including a new kitchen sink, you must first determine if it is eligible for depreciation. The IRS states that in order to be eligible for depreciation, the property must be used in a business or held for the production of income. Once eligibility is determined, you can claim depreciation on your tax return using Form 4562.

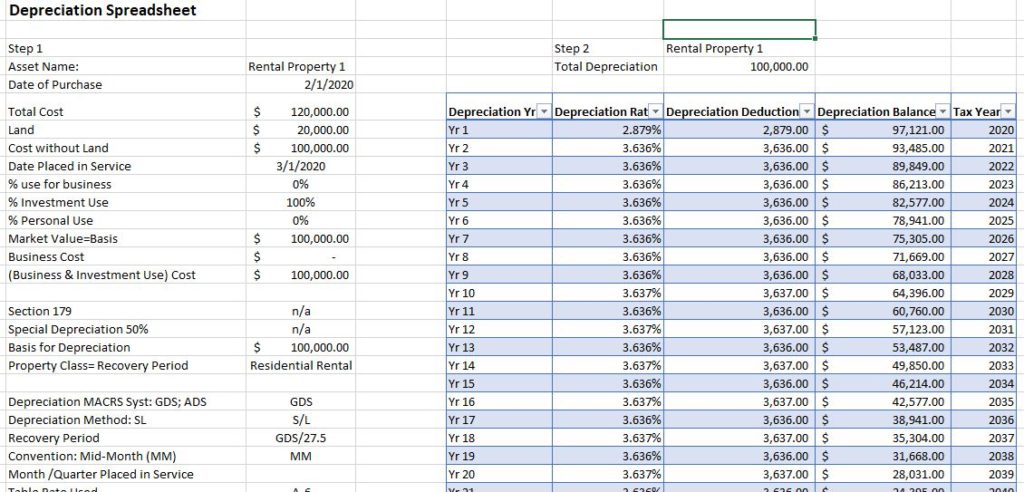

Depreciation Schedule for a Kitchen Sink

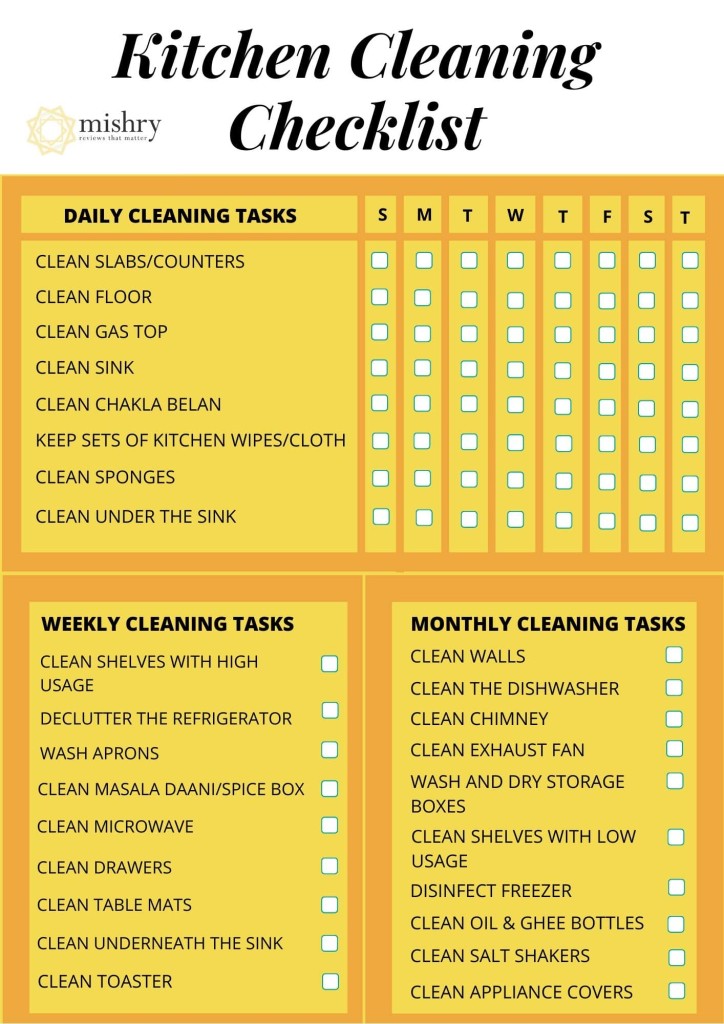

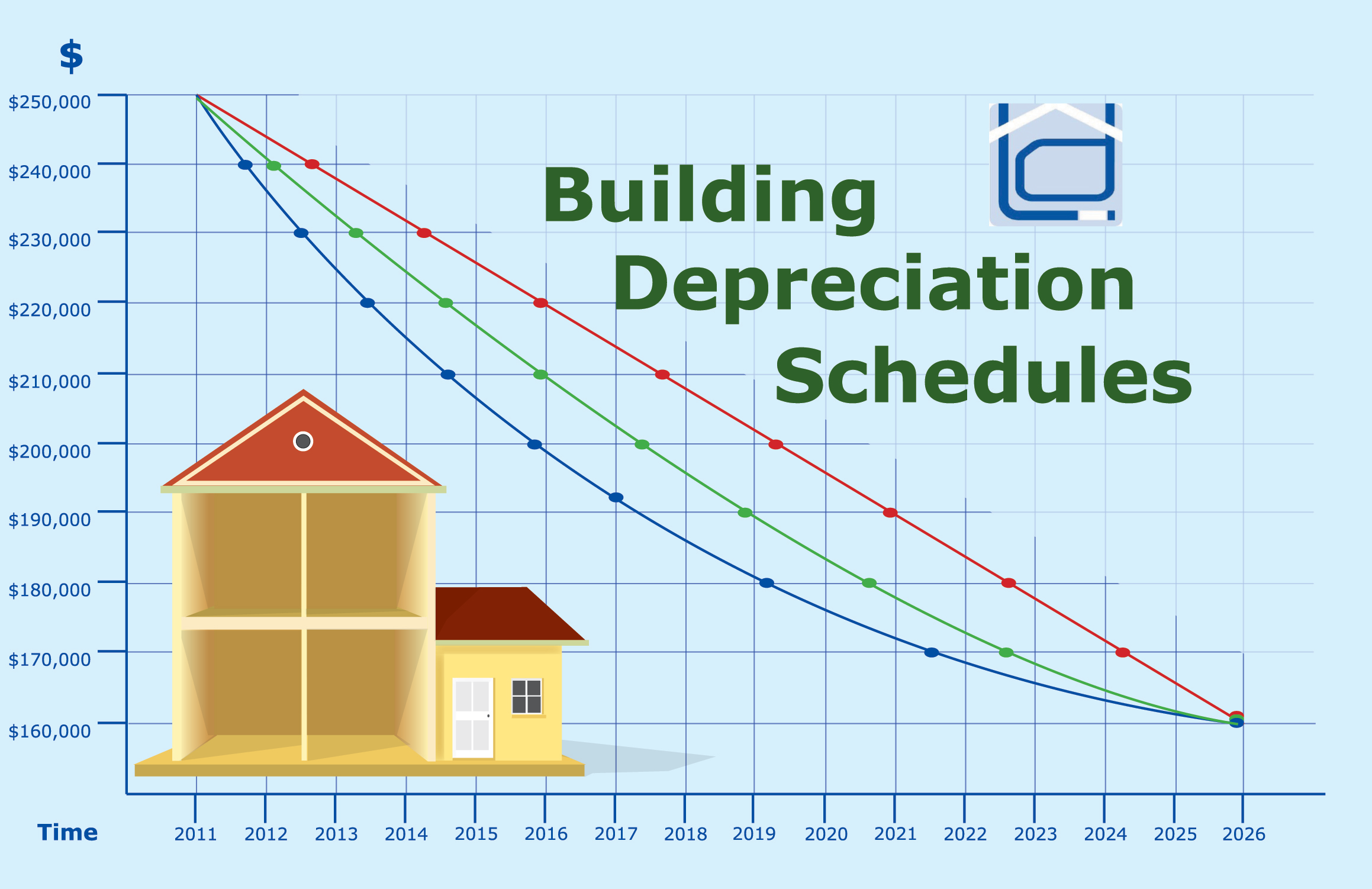

A depreciation schedule is a record of the depreciation deductions taken each year for an asset. This is important for rental properties, as it helps to track the depreciation of assets such as a new kitchen sink. The schedule must include the date the asset was placed in service, the cost of the asset, the depreciation method used, and the amount of depreciation deducted each year.

Maximizing Depreciation Deductions for Rental Properties

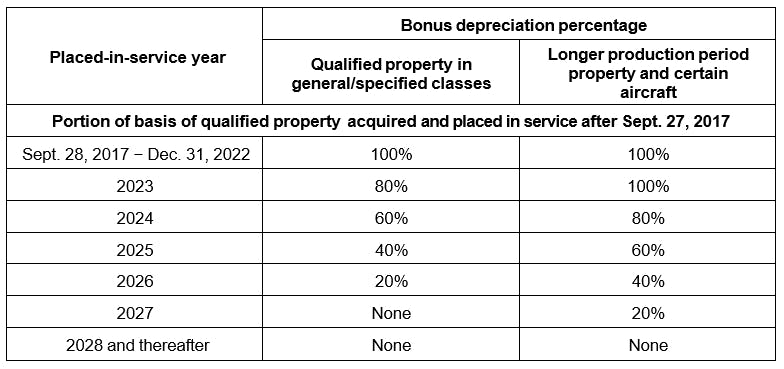

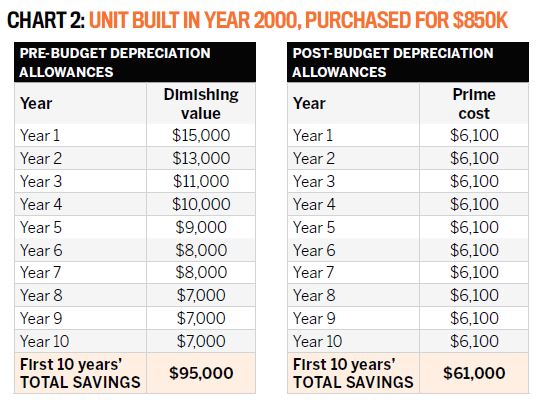

There are certain strategies that can be used to maximize the depreciation deductions for rental properties. One strategy is to use the accelerated method of depreciation, which allows for larger deductions in the earlier years of the asset's useful life. Another strategy is to take advantage of bonus depreciation, which allows for an immediate deduction of a percentage of the asset's cost.

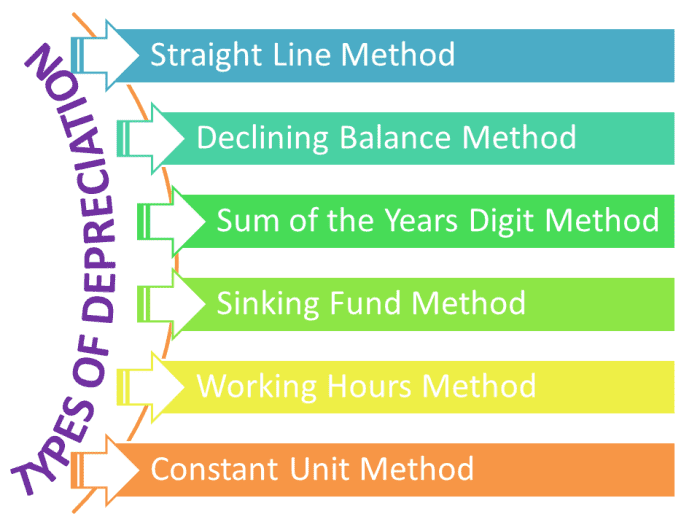

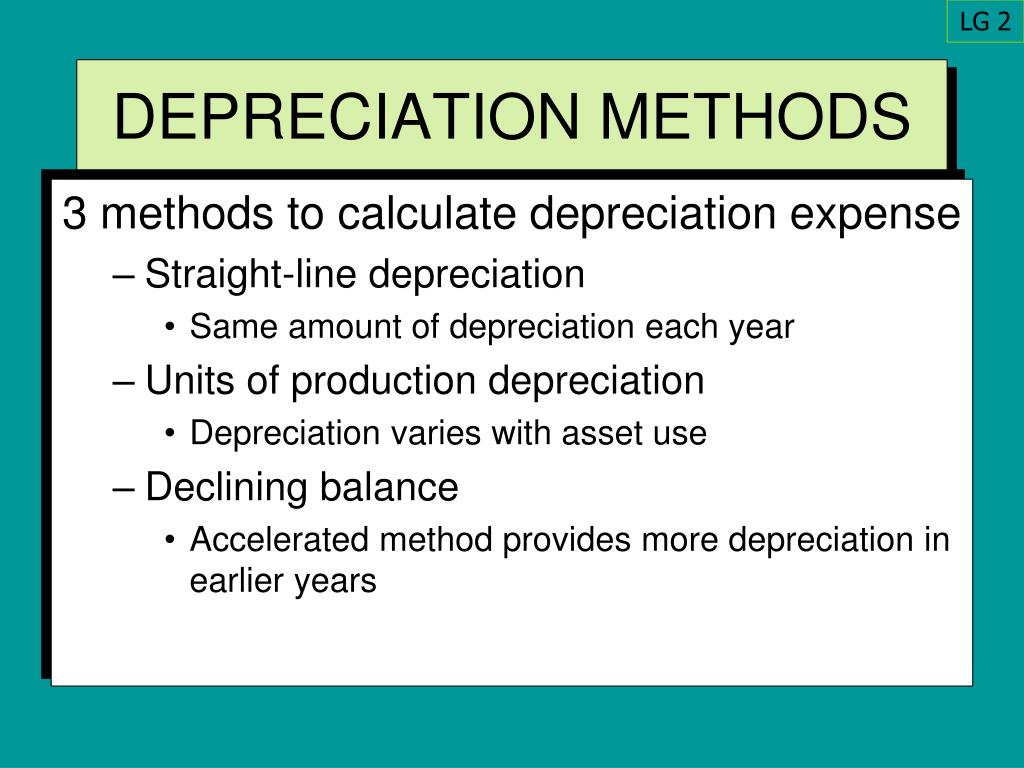

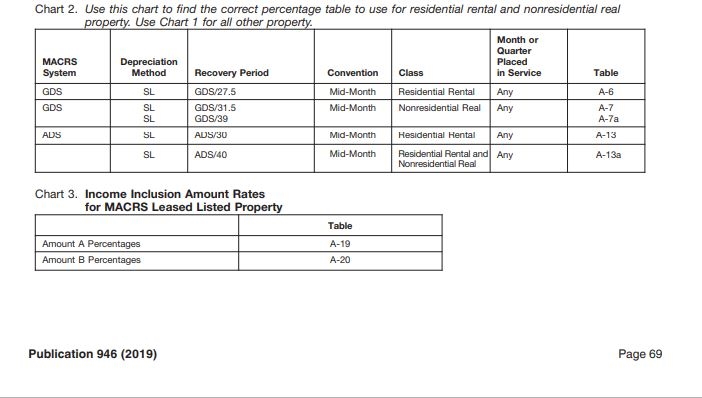

Depreciation Methods for Rental Properties

There are two main depreciation methods that can be used for rental properties: straight-line and accelerated. Straight-line depreciation spreads the cost of the asset evenly over its useful life. Accelerated depreciation methods, such as the double declining balance or the sum-of-years-digits, allow for larger deductions in earlier years. It is important to choose the method that best fits your specific situation.

Understanding Depreciation for Rental Properties

Understanding depreciation for rental properties, including a new kitchen sink, is crucial for maximizing tax deductions and minimizing tax liability. It is important to stay updated on the current tax laws and regulations regarding depreciation, as they can change from year to year. Seeking the advice of a tax professional can also help in understanding the complexities of depreciation for rental properties.

Depreciation Rules for Rental Properties

There are specific rules that must be followed when it comes to depreciating assets for rental properties. One important rule is the mid-month convention, which requires depreciation to be calculated as if the asset was placed in service in the middle of the month. Another rule is the recapture of depreciation, which requires any depreciation deductions taken to be recaptured and taxed when the property is sold.

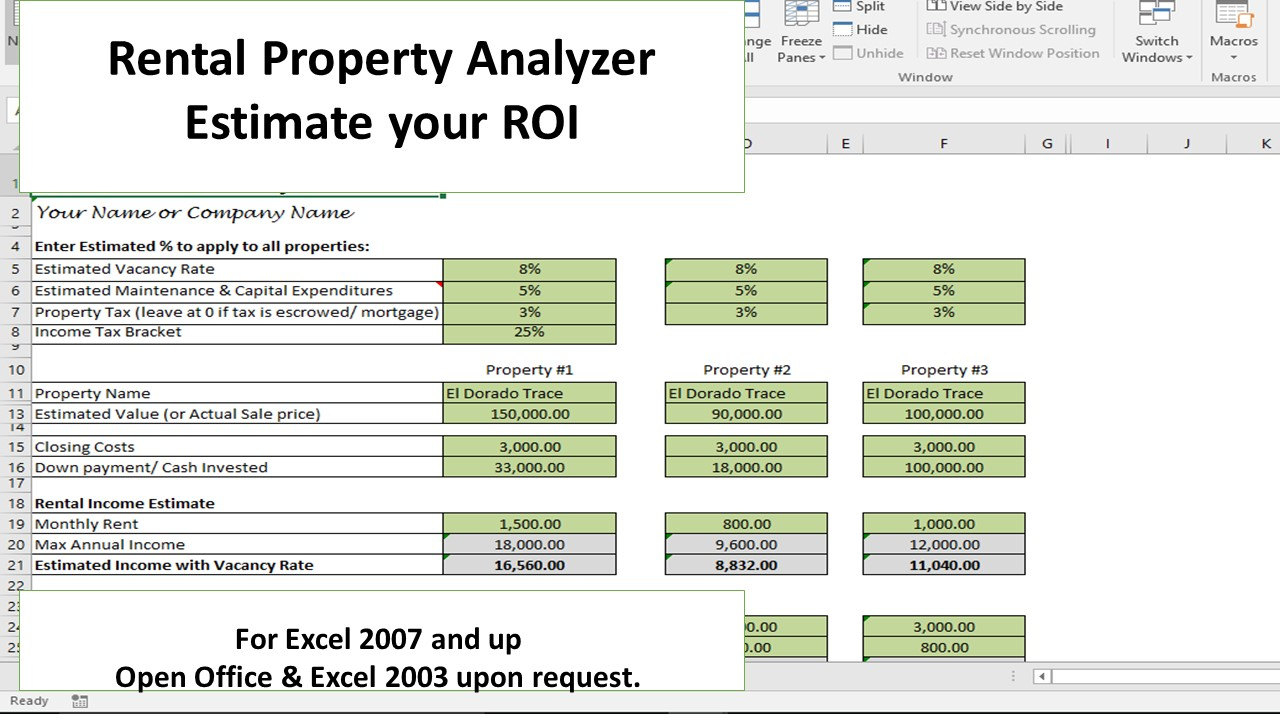

Depreciation Calculator for Rental Properties

A depreciation calculator can be a useful tool for rental property owners when it comes to calculating depreciation. It can help you determine the depreciation deductions for each year and track the depreciation of assets such as a new kitchen sink. There are many online calculators available, but it is important to make sure they are up-to-date and accurate.

Why Depreciating Your New Kitchen Sink Rental Can Save You Money in the Long Run

Efficiency and Cost Savings

When it comes to designing your dream home, the kitchen is one of the most important areas to consider. Not only is it the heart of the home, but it is also where you and your family spend a significant amount of time. As a result, it is crucial to have a functional and efficient kitchen that meets your needs and enhances your daily activities. However, designing a kitchen can also be a costly endeavor, and every penny counts. This is where the concept of depreciating your new kitchen sink rental comes in.

Depreciation

is an accounting method that allows you to deduct the cost of your

kitchen sink

over a certain period, typically the expected useful life of the asset. This means that instead of deducting the full cost of your new kitchen sink in the year of purchase, you can spread out the cost and deduct a portion of it each year. This can result in significant tax savings and help you manage your expenses more efficiently.

When it comes to designing your dream home, the kitchen is one of the most important areas to consider. Not only is it the heart of the home, but it is also where you and your family spend a significant amount of time. As a result, it is crucial to have a functional and efficient kitchen that meets your needs and enhances your daily activities. However, designing a kitchen can also be a costly endeavor, and every penny counts. This is where the concept of depreciating your new kitchen sink rental comes in.

Depreciation

is an accounting method that allows you to deduct the cost of your

kitchen sink

over a certain period, typically the expected useful life of the asset. This means that instead of deducting the full cost of your new kitchen sink in the year of purchase, you can spread out the cost and deduct a portion of it each year. This can result in significant tax savings and help you manage your expenses more efficiently.

Save on Taxes

One of the most significant benefits of depreciating your new kitchen sink rental is the potential tax savings. By deducting the cost of your sink over several years, you can reduce your taxable income and potentially lower your tax bill. This can be especially beneficial for homeowners who are already stretched thin with other expenses related to purchasing or renovating their home. Additionally, since the kitchen sink is considered a

capital expense

, it can be depreciated over a longer period, resulting in greater tax savings.

One of the most significant benefits of depreciating your new kitchen sink rental is the potential tax savings. By deducting the cost of your sink over several years, you can reduce your taxable income and potentially lower your tax bill. This can be especially beneficial for homeowners who are already stretched thin with other expenses related to purchasing or renovating their home. Additionally, since the kitchen sink is considered a

capital expense

, it can be depreciated over a longer period, resulting in greater tax savings.

Long-Term Savings

While it may seem counterintuitive to spend money on something you plan to deduct, depreciating your new kitchen sink rental can actually save you money in the long run. By spreading out the cost over several years, you can free up more cash flow in the short term, allowing you to invest in other areas of your home. Additionally, by taking advantage of tax savings, you can reduce the overall cost of your kitchen design and potentially save thousands of dollars in the long run.

While it may seem counterintuitive to spend money on something you plan to deduct, depreciating your new kitchen sink rental can actually save you money in the long run. By spreading out the cost over several years, you can free up more cash flow in the short term, allowing you to invest in other areas of your home. Additionally, by taking advantage of tax savings, you can reduce the overall cost of your kitchen design and potentially save thousands of dollars in the long run.

Final Thoughts

When designing your dream kitchen, every expense matters. By depreciating your new kitchen sink rental, you can save money on taxes and free up cash flow in the short term. As a result, you can invest in other areas of your home and potentially save thousands of dollars in the long run. So, before you make any big purchases for your kitchen design, consider the benefits of depreciating your new kitchen sink rental and consult with a tax professional to determine the best approach for your specific situation.

When designing your dream kitchen, every expense matters. By depreciating your new kitchen sink rental, you can save money on taxes and free up cash flow in the short term. As a result, you can invest in other areas of your home and potentially save thousands of dollars in the long run. So, before you make any big purchases for your kitchen design, consider the benefits of depreciating your new kitchen sink rental and consult with a tax professional to determine the best approach for your specific situation.

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)