Can I Finance a Mattress?

Are you in need of a new mattress but worried about the cost? You’re not alone. Many people struggle with the expense of buying a new mattress, especially if they’re looking for a high-quality option. Fortunately, there are options for financing a mattress that can make this purchase more manageable. In this article, we’ll discuss everything you need to know about financing a mattress and how to make it work for you.

Financing a Mattress: What You Need to Know

Before diving into the details of how to finance a mattress, it’s important to understand what it means and what you should expect. Financing a mattress means breaking up the total cost of the mattress into smaller, more manageable payments over time. This can make it easier for you to afford a higher-priced mattress without having to pay for it in full upfront.

It’s important to note that financing a mattress is essentially taking out a loan, so you will need to go through a credit check and be approved for financing. This means you’ll need to have a good credit score to qualify for most financing options. In some cases, you may also be required to make a down payment or pay interest on your financing.

How to Finance a Mattress

If you’ve decided that financing a mattress is the best option for you, here are the steps you can take to make it happen:

1. Research your options. The first step is to research different mattress financing options available to you. This can include financing options through the mattress company, as well as third-party financing companies.

2. Compare interest rates. When researching your options, be sure to compare the interest rates offered by different financing companies. A lower interest rate means you’ll end up paying less in the long run.

3. Check for any hidden fees. Some financing companies may have hidden fees or charges, so be sure to carefully read the terms and conditions before signing anything.

4. Get pre-approved. Before committing to a financing option, it’s a good idea to get pre-approved. This will give you a better idea of what your interest rate and monthly payments will be.

5. Make a budget. Once you know the interest rate and monthly payments, make sure you can afford them by creating a budget. You don’t want to end up in a situation where you can’t make your payments and damage your credit score.

Options for Financing a Mattress

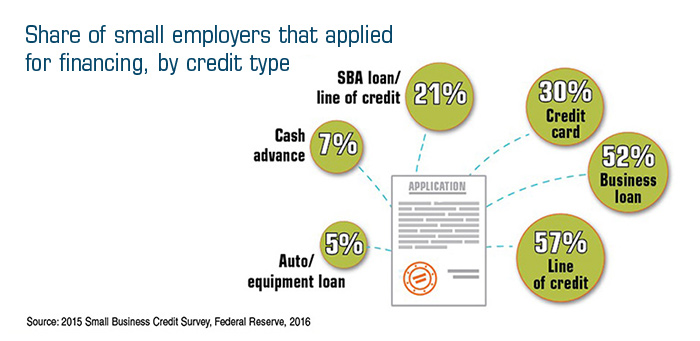

There are a few different options for financing a mattress, including:

In-store financing. Many mattress companies offer their own financing options, which can be convenient since you’re making the purchase in the same place. However, be sure to compare their interest rates and fees with other options to ensure you’re getting the best deal.

Third-party financing. There are also third-party financing companies that specialize in financing large purchases like mattresses. These companies may have lower interest rates, but they may also have stricter credit requirements.

Paypal Credit. If you already have a Paypal account, you may qualify for Paypal Credit, which allows you to finance purchases over $99. This can be a convenient option if you prefer to manage your financing through your Paypal account.

Financing a Mattress: Pros and Cons

As with any financial decision, there are pros and cons to financing a mattress. Some potential benefits of financing a mattress include:

More manageable payments. By breaking up the cost of the mattress into smaller payments, you can make it more affordable to purchase a higher-quality mattress.

Build your credit. Making regular, on-time payments towards your mattress financing can help improve your credit score.

Instant gratification. If you need a new mattress urgently but don’t have the funds to pay for it in full, financing can allow you to get the mattress you need right away.

However, there are also some potential downsides to financing a mattress, including:

Interest rates and fees. Depending on the financing option you choose, you may end up paying more in the long run due to interest rates and fees.

Damage to credit score. If you miss payments or are unable to keep up with your payments, it can negatively impact your credit score.

Best Mattress Financing Options

So, what are the best mattress financing options available? This can vary depending on your credit score and financial situation, but some popular options include:

0% APR financing. Some mattress companies offer 0% APR financing for a set period of time, which can be a great option if you’re able to pay off the mattress within that timeframe.

Personal loans. If you have good credit, you may be able to get a personal loan with a low interest rate to finance your mattress purchase.

Credit cards. If you have a credit card with a low interest rate, you may be able to use it to finance your mattress purchase. Just be sure to make your payments on time to avoid high interest charges.

How to Get Approved for Mattress Financing

If you’re interested in financing a mattress, here are some tips to help you get approved:

Improve your credit score. The better your credit score, the more likely you are to be approved for financing. Work on improving your credit score before applying for financing to increase your chances of approval.

Have a stable income. Lenders want to see that you have a stable source of income to ensure you’ll be able to make your payments on time.

Make a down payment. Some financing companies may require a down payment to secure the financing. This can also help lower your monthly payments.

Financing a Mattress with Bad Credit

If you have a less-than-perfect credit score, you may still be able to finance a mattress. Some options for financing with bad credit include:

No credit check financing. Some companies offer financing options that don’t require a credit check. However, these may come with higher interest rates and fees.

Cosigner. If you have a friend or family member with good credit, they may be able to cosign on a loan or financing agreement for you.

Pay in full options. If you’re unable to get approved for financing, you may need to consider other payment options, such as saving up for the mattress or finding a lower-priced option.

Mattress Financing vs. Paying in Full: Which is Better?

So, which option is better – financing a mattress or paying for it in full? It really depends on your financial situation and preferences. Financing can make a high-quality mattress more affordable, but it also means you’ll be paying more in the long run due to interest rates and fees. Paying for the mattress in full means you won’t have to worry about making monthly payments or paying interest, but it may not be feasible for everyone.

Tips for Financing a Mattress

To ensure a smooth financing process, here are some tips to keep in mind:

Read the fine print. Before signing any financing agreement, be sure to thoroughly read the terms and conditions to understand the interest rates, fees, and any other important details.

Make on-time payments. To avoid damaging your credit score, be sure to make your monthly payments on time and in full.

Prioritize your budget. Make sure you can afford your monthly payments by prioritizing them in your budget and cutting back on unnecessary expenses.

Consider the long-term cost. Remember, financing a mattress means you’ll end up paying more in the long run due to interest rates and fees. Be sure to consider this when making your decision.

Overall, financing a mattress can be a great option for those who need a new mattress but can’t afford to pay for it in full upfront. Just be sure to do your research, compare your options, and make a budget to ensure you can comfortably make your payments. With the right approach, financing a mattress can help you get the comfortable and supportive sleep surface you need without breaking the bank.

The Benefits of Financing a Mattress for Your House Design

Why Financing a Mattress is a Good Idea

When it comes to designing your dream house, every detail matters. From the paint on the walls to the furniture you choose, each element contributes to creating a comfortable and stylish living space.

One often overlooked aspect of house design is the mattress.

While it may seem like a small detail, the type of mattress you choose can greatly impact your overall comfort and well-being.

However, purchasing a high-quality mattress can be a significant investment, and many people may not have the funds readily available to make such a purchase.

This is where financing comes in.

When it comes to designing your dream house, every detail matters. From the paint on the walls to the furniture you choose, each element contributes to creating a comfortable and stylish living space.

One often overlooked aspect of house design is the mattress.

While it may seem like a small detail, the type of mattress you choose can greatly impact your overall comfort and well-being.

However, purchasing a high-quality mattress can be a significant investment, and many people may not have the funds readily available to make such a purchase.

This is where financing comes in.

What is Mattress Financing?

Mattress financing is a payment option that allows you to pay for your mattress over time, instead of all at once.

This means that you can choose the mattress you want and pay for it in installments, making it more affordable and manageable for your budget. Many mattress retailers offer financing options, and some even have zero down payment plans or interest-free financing for a certain period.

Mattress financing is a payment option that allows you to pay for your mattress over time, instead of all at once.

This means that you can choose the mattress you want and pay for it in installments, making it more affordable and manageable for your budget. Many mattress retailers offer financing options, and some even have zero down payment plans or interest-free financing for a certain period.

The Advantages of Financing a Mattress

The most obvious advantage of financing a mattress is the ability to purchase a high-quality mattress without breaking the bank.

This is especially beneficial for those who are on a tight budget or have unexpected expenses to deal with. By spreading out the cost of the mattress over a period of time, you can make smaller, more manageable payments that fit into your budget.

Furthermore,

financing a mattress can also help improve your credit score.

By making timely payments, you can demonstrate responsible financial behavior and potentially improve your credit score. This can be beneficial for future major purchases, such as buying a house or a car.

The most obvious advantage of financing a mattress is the ability to purchase a high-quality mattress without breaking the bank.

This is especially beneficial for those who are on a tight budget or have unexpected expenses to deal with. By spreading out the cost of the mattress over a period of time, you can make smaller, more manageable payments that fit into your budget.

Furthermore,

financing a mattress can also help improve your credit score.

By making timely payments, you can demonstrate responsible financial behavior and potentially improve your credit score. This can be beneficial for future major purchases, such as buying a house or a car.

Choosing the Right Financing Option

When considering financing options for a mattress, it is essential to do your research and choose the option that best fits your needs and budget.

Be sure to read the terms and conditions carefully, including the interest rate and any additional fees.

Some financing plans may have hidden costs, so it is crucial to understand exactly what you are agreeing to before signing any contracts.

In conclusion,

mattress financing is a smart and practical option for those looking to upgrade their house design with a high-quality mattress.

With the ability to make smaller, more manageable payments, improve your credit score, and choose from a variety of financing options, there has never been a better time to invest in a comfortable and stylish mattress for your dream house. So why wait? Start researching your options and find the perfect mattress for your house design today.

When considering financing options for a mattress, it is essential to do your research and choose the option that best fits your needs and budget.

Be sure to read the terms and conditions carefully, including the interest rate and any additional fees.

Some financing plans may have hidden costs, so it is crucial to understand exactly what you are agreeing to before signing any contracts.

In conclusion,

mattress financing is a smart and practical option for those looking to upgrade their house design with a high-quality mattress.

With the ability to make smaller, more manageable payments, improve your credit score, and choose from a variety of financing options, there has never been a better time to invest in a comfortable and stylish mattress for your dream house. So why wait? Start researching your options and find the perfect mattress for your house design today.