1. "Mattress financing options: How to choose the best one for you"

When it comes to purchasing a new mattress, the cost can often be a barrier for many people. However, with the right financing option, you can get the mattress of your dreams without breaking the bank. But with so many different financing options available, how do you choose the best one for you? Let's take a look at some factors to consider when making your decision.

First, determine how much you can afford to pay each month. This will help you narrow down the financing options that fit within your budget. Keep in mind that some financing plans may have a deferred interest period, meaning you won't have to make payments for a certain amount of time, but interest will accrue during that time. If you choose this option, make sure you can afford to pay off the balance before the interest kicks in.

Next, consider your credit score. If you have good credit, you may qualify for 0% interest financing or low monthly payments. However, if your credit score is not as strong, you may have to pay a higher interest rate. Some financing options also offer 0% financing for a set period of time, so make sure to read the fine print and understand the terms.

You should also consider the length of the financing plan. A longer term may result in lower monthly payments, but you may end up paying more in interest over time. On the other hand, a shorter term may have higher monthly payments but a lower overall cost.

Lastly, think about the type of mattress you want to finance. Some financing options may only be available for certain types of mattresses or brands. If you have your heart set on a specific mattress, make sure to check if it is eligible for financing before making your decision.

2. "Top 10 mattress financing options for a good night's sleep"

Are you ready to upgrade your old mattress for a better night's sleep? We've compiled a list of the top 10 financing options to help make your dream mattress a reality.

1. Credit card financing: If you have a credit card with a low interest rate, this may be a good option for financing your mattress. Just make sure you can pay off the balance before the interest kicks in.

2. In-store financing: Many mattress stores offer their own financing plans with 0% interest for a set period of time. Just be aware of any deferred interest or hidden fees.

3. Personal loans: You can take out a personal loan from a bank or online lender to finance your mattress purchase. Interest rates and terms will vary, so make sure to shop around for the best deal.

4. Layaway: Some stores offer a layaway option, where you can make payments over time and take home the mattress once it's paid off. This may be a good option if you have trouble getting approved for financing.

5. Rent-to-own: This option allows you to take the mattress home and make payments, with the option to buy it at the end of the term. Just be aware that the total cost may be higher than purchasing outright.

6. Health care financing: If you have a health-related reason for needing a new mattress, you may be able to finance it through a health care financing program with lower interest rates.

7. Home equity loan: If you own your home, you may be able to take out a home equity loan to finance your mattress purchase. Just be aware that this puts your home at risk if you are unable to make payments.

8. Peer-to-peer lending: This option allows you to borrow money from individuals instead of a traditional lender. Interest rates and terms will vary, so make sure to do your research.

9. 401(k) loan: If you have a 401(k) account, you may be able to take out a loan against it to finance your mattress. Just be aware of any penalties or taxes for early withdrawal.

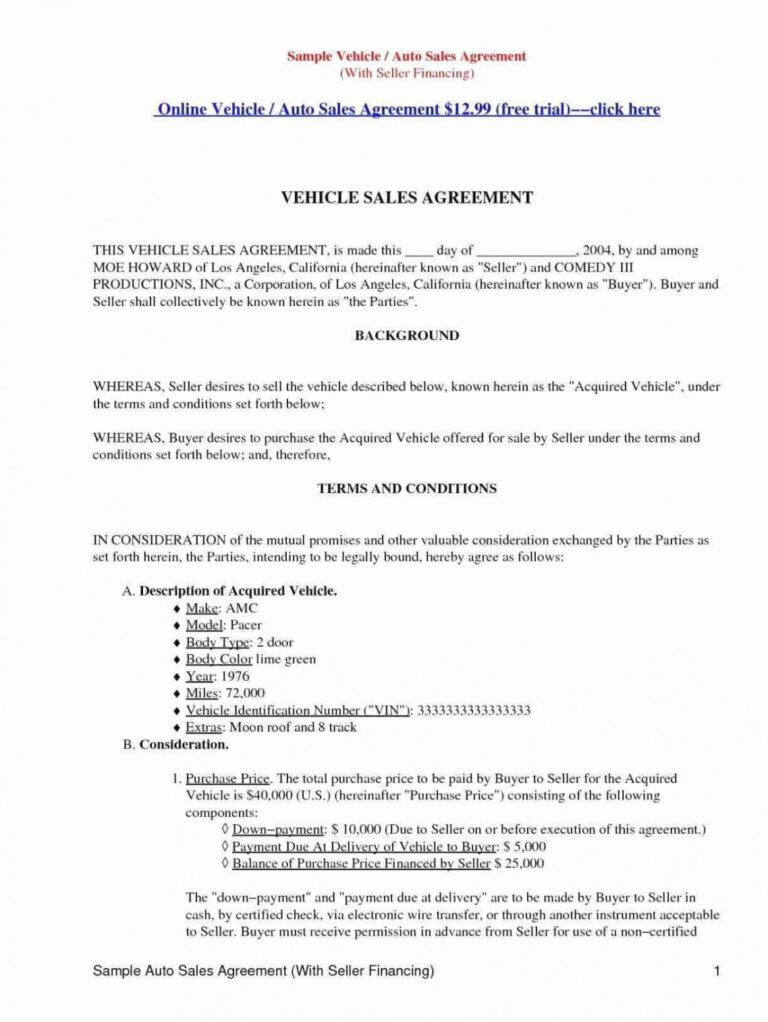

10. Family or friend loan: If you have a family member or friend who is willing to lend you money, this may be a good option. Just make sure to have a written agreement in place to avoid any issues in the future.

3. "Best financing options for buying a new mattress"

Now that you are aware of the different types of financing options available, let's take a closer look at some of the best options for buying a new mattress.

1. 0% interest credit cards: If you have good credit, you may qualify for a credit card with 0% interest for a set period of time. Just make sure to pay off the balance before the interest kicks in.

2. Store financing: Many mattress stores offer their own financing plans with 0% interest for a set period of time. Just be aware of any deferred interest or hidden fees.

3. Personal loans: You can take out a personal loan from a bank or online lender to finance your mattress purchase. Interest rates and terms will vary, so make sure to shop around for the best deal.

4. Layaway: Some stores offer a layaway option, where you can make payments over time and take home the mattress once it's paid off. This may be a good option if you have trouble getting approved for financing.

5. Health care financing: If you have a health-related reason for needing a new mattress, you may be able to finance it through a health care financing program with lower interest rates.

4. "Mattress financing 101: Understanding your options"

Financing a mattress can seem overwhelming, but understanding the different options available can help make the process easier. Here are some key things to know about mattress financing:

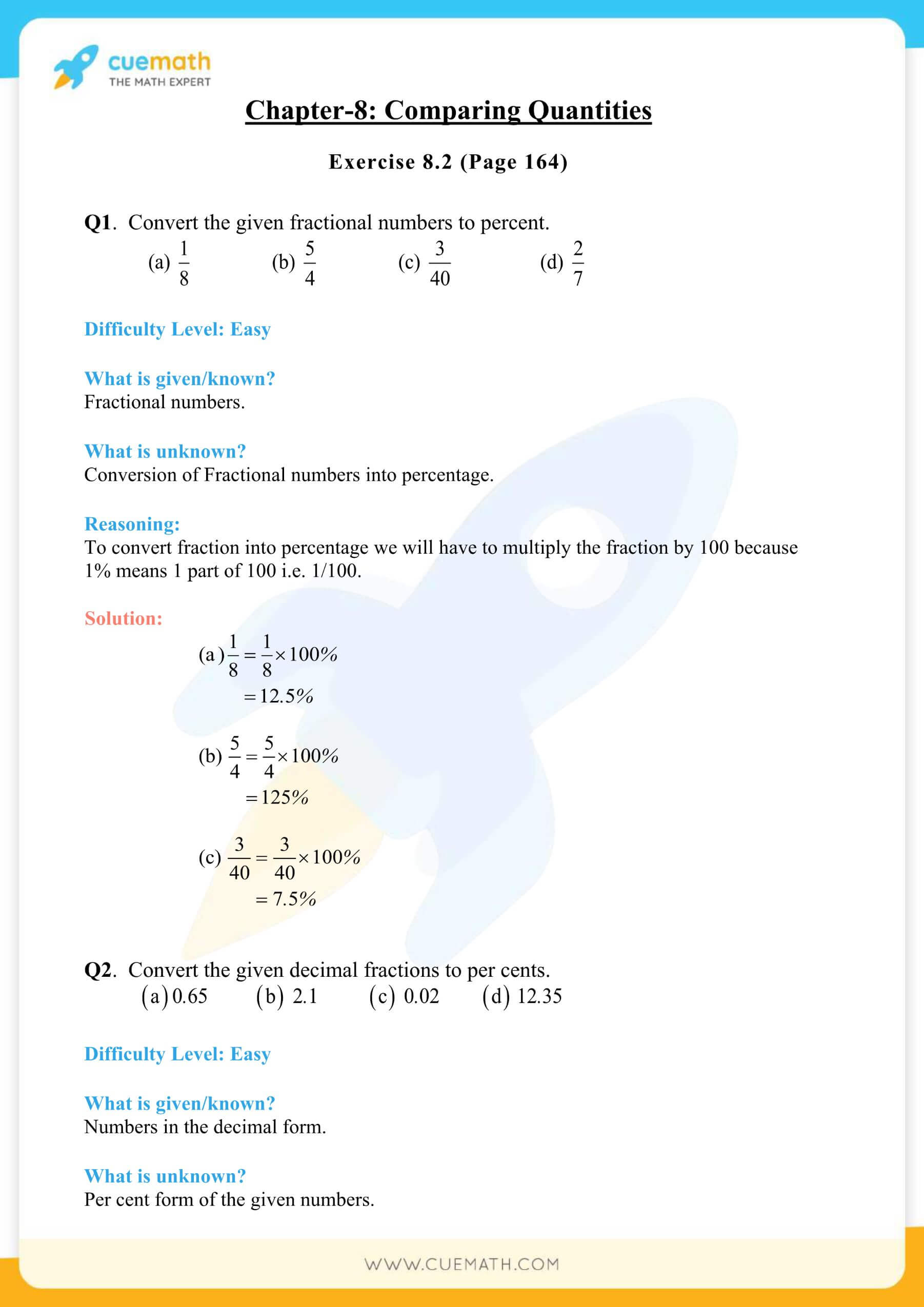

1. Interest rates: When financing a mattress, you will be charged interest on the amount you borrow. Make sure to compare interest rates and choose the lowest one to save money in the long run.

2. Credit score: Your credit score plays a big role in what financing options you qualify for and the interest rate you will be charged. Make sure to check your credit score before applying for financing.

3. Terms: The term of your financing plan refers to the length of time you have to pay off the balance. A longer term may have lower monthly payments, but a higher overall cost due to interest.

4. Eligibility: Some financing options may only be available for certain types of mattresses or brands. Make sure to check if the mattress you want to finance is eligible before making your decision.

5. Hidden fees: Make sure to read the fine print of any financing plan to avoid any hidden fees or deferred interest. These can significantly increase the total cost of your mattress purchase.

5. "The pros and cons of different mattress financing options"

Before making a decision on which financing option to choose, it's important to consider the pros and cons of each. Here are some advantages and disadvantages of the most common mattress financing options:

1. Credit card financing: Pros: Can be used for other purchases, may have 0% interest for a set period of time. Cons: High interest rates if not paid off in time, may affect credit score.

2. In-store financing: Pros: 0% interest for a set period of time, convenient. Cons: Deferred interest, may not be eligible for certain mattresses.

3. Personal loans: Pros: Can be used for other purchases, may have lower interest rates. Cons: Requires good credit, may affect credit score, may have origination fees.

4. Layaway: Pros: No interest, no credit check. Cons: May have additional fees, have to wait to take home the mattress.

5. Rent-to-own: Pros: No credit check, option to buy at the end of the term. Cons: Higher overall cost, may not be eligible for certain mattresses.

6. "How to get the best financing deal on a new mattress"

Now that you know the different financing options and their pros and cons, here are some tips on how to secure the best deal for your mattress purchase:

1. Check your credit score: A higher credit score can help you qualify for lower interest rates and better financing options.

2. Shop around: Don't settle for the first financing option you come across. Compare interest rates, terms, and eligibility requirements from different lenders.

3. Negotiate: Don't be afraid to negotiate for a lower interest rate or better terms. You may be able to get a better deal by simply asking.

4. Read the fine print: Make sure to read the terms and conditions of any financing plan before signing up to avoid any hidden fees or surprises.

5. Consider all costs: When comparing financing options, don't just look at the monthly payment. Consider the total cost, including interest, to determine which option is truly the best deal.

7. "Comparing mattress financing options: Which one is right for you?"

With so many different financing options available, it can be overwhelming to choose the right one for you. Here are some factors to consider when comparing financing options:

1. Interest rates: Compare the interest rates of each financing option to determine which one will cost you the least in the long run.

2. Eligibility: Make sure the financing option you choose is available for the mattress you want to purchase.

3. Terms: Consider the length of the financing plan and if you can afford the monthly payments.

4. Credit score: If you have a good credit score, you may qualify for lower interest rates and better financing options. If your credit score is not as strong, you may have to pay a higher interest rate.

5. Hidden fees: Make sure to read the fine print to avoid any hidden fees or deferred interest that can significantly increase the total cost of your mattress purchase.

8. "Mattress financing options for bad credit: What are your options?"

Having bad credit doesn't mean you can't finance a new mattress. While it may be more challenging, there are still options available to you:

1. Layaway: This option allows you to make payments over time and take home the mattress once it's fully paid off. No credit check is required.

2. Rent-to-own: Similar to layaway, this option allows you to make payments and take ownership of the mattress at the end of the term. No credit check is required, but the total cost may be higher.

3. Personal loans: Some lenders offer personal loans specifically for those with bad credit. The interest rates may be higher, but it can still be a good option for financing a mattress.

4. Peer-to-peer lending: This option allows you to borrow money from individuals instead of a traditional lender. Interest rates and terms will vary, so make sure to do your research.

5. Family or friend loan: If you have someone willing to lend you money, this can be a good option. Just make sure to have a written agreement in place to avoid any issues in the future.

9. "The best financing options for luxury mattresses"

If you're in the market for a luxury mattress, you may be wondering which financing options are available. Here are some of the best options for financing a luxury mattress:

1. 0% interest credit cards: If you have a good credit score, you may qualify for a credit card with 0% interest for a set period of time. This can be a great option for financing a luxury mattress.

2. Store financing: Many luxury mattress brands offer their own financing plans with 0% interest for a set period of time. Just make sure to read the fine print for any hidden fees or deferred interest.

3. Personal loans: You can take out a personal loan from a bank or online lender to finance your luxury mattress purchase. Just make sure to shop around for the best interest rates and terms.

4. Home equity loan: If you own your home, you may be able to take out a home equity loan to finance your luxury mattress purchase. Just be aware that this puts your home at risk if you are unable to make payments.

5. Health care financing: Some luxury mattress brands offer financing through a health care financing program with lower interest rates. This can be a good option if you have a health-related reason for needing a new mattress.

10. "How to save money on your mattress purchase with financing options"

Financing a mattress can be a great way to make a large purchase more affordable. Here are some tips on how to save money on your mattress purchase with financing options:

Best Financing Options for Mattresses

Introduction

When it comes to designing your dream home, every detail matters. From the furniture to the decor, every aspect plays a crucial role in creating a space that reflects your personality and style. One essential element that often gets overlooked is the mattress. A good mattress is the key to a good night's sleep, and investing in one is crucial for your overall well-being. However, mattresses can be expensive, and not everyone has the budget to purchase one outright. This is where financing options come in. In this article, we will discuss the best financing options for mattresses, so you can get the sleep of your dreams without breaking the bank.

When it comes to designing your dream home, every detail matters. From the furniture to the decor, every aspect plays a crucial role in creating a space that reflects your personality and style. One essential element that often gets overlooked is the mattress. A good mattress is the key to a good night's sleep, and investing in one is crucial for your overall well-being. However, mattresses can be expensive, and not everyone has the budget to purchase one outright. This is where financing options come in. In this article, we will discuss the best financing options for mattresses, so you can get the sleep of your dreams without breaking the bank.

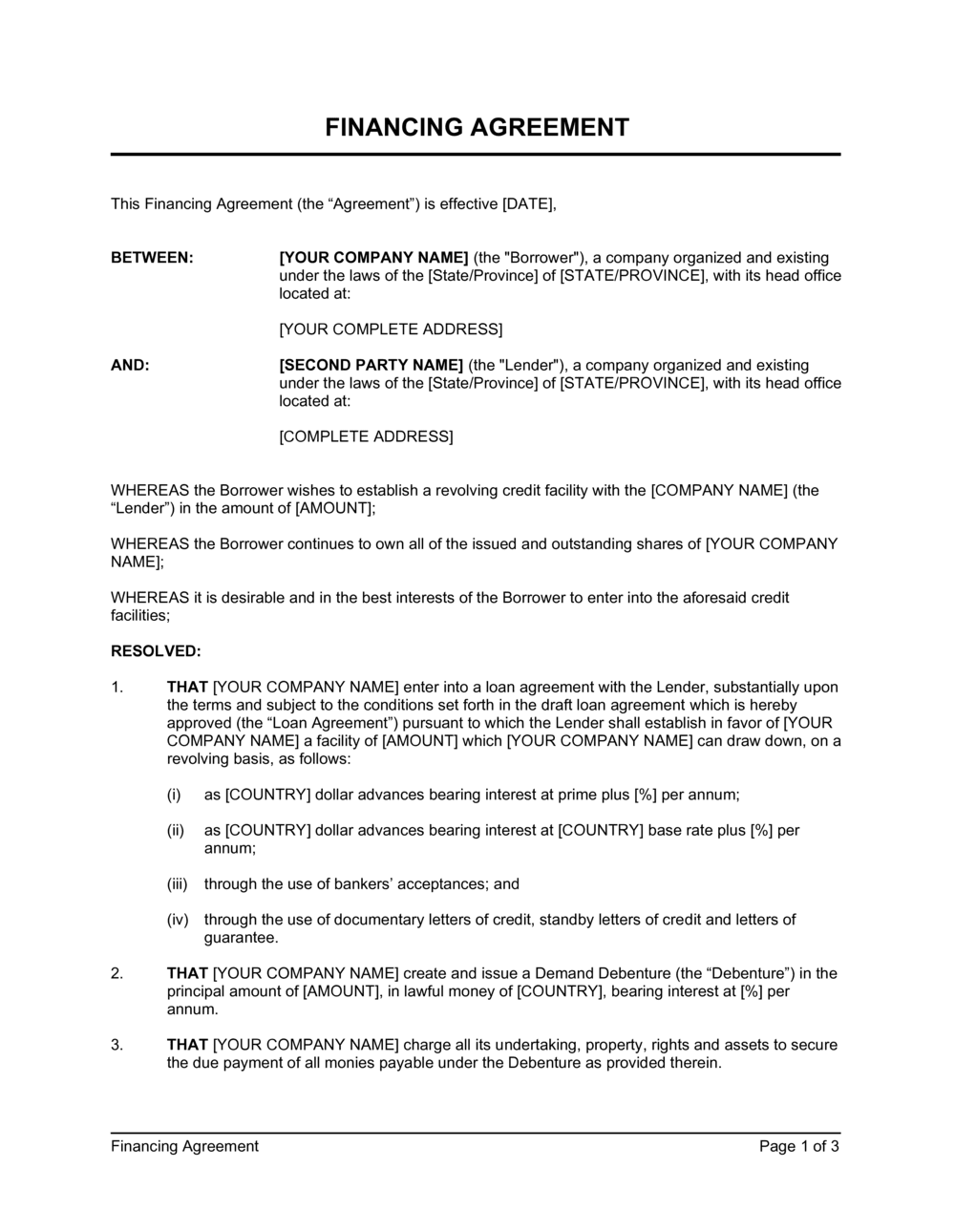

1. Retailer Financing

Many mattress retailers offer financing options for their customers. This can be a convenient and hassle-free way of purchasing a mattress as you can do it all in one place. Retailer financing often comes with low-interest rates and flexible payment plans, making it an attractive option for those on a budget. However, it is essential to read the terms and conditions carefully and ensure that you will be able to make the payments on time.

Many mattress retailers offer financing options for their customers. This can be a convenient and hassle-free way of purchasing a mattress as you can do it all in one place. Retailer financing often comes with low-interest rates and flexible payment plans, making it an attractive option for those on a budget. However, it is essential to read the terms and conditions carefully and ensure that you will be able to make the payments on time.

2. Credit Cards

Using a credit card to finance your mattress purchase is another popular option. Some credit card companies offer promotional deals such as 0% interest for a certain period, making it an attractive option for those looking to save money. However, it is crucial to be mindful of the interest rates once the promotional period ends and to make sure you can make the payments on time to avoid any additional charges.

Using a credit card to finance your mattress purchase is another popular option. Some credit card companies offer promotional deals such as 0% interest for a certain period, making it an attractive option for those looking to save money. However, it is crucial to be mindful of the interest rates once the promotional period ends and to make sure you can make the payments on time to avoid any additional charges.

3. In-House Financing

Some mattress companies offer in-house financing, which means they provide financing directly to customers without involving a third party. This option can be beneficial for those with less-than-stellar credit scores as in-house financing often has more lenient approval criteria. However, it is essential to be aware of any hidden fees or high-interest rates that may come with this option.

Some mattress companies offer in-house financing, which means they provide financing directly to customers without involving a third party. This option can be beneficial for those with less-than-stellar credit scores as in-house financing often has more lenient approval criteria. However, it is essential to be aware of any hidden fees or high-interest rates that may come with this option.

4. Personal Loans

Taking out a personal loan from a bank or credit union is another way to finance your mattress purchase. Personal loans often come with lower interest rates compared to credit cards, making it a more affordable option in the long run. However, it is crucial to shop around and compare interest rates and repayment terms to find the best deal.

Taking out a personal loan from a bank or credit union is another way to finance your mattress purchase. Personal loans often come with lower interest rates compared to credit cards, making it a more affordable option in the long run. However, it is crucial to shop around and compare interest rates and repayment terms to find the best deal.

Conclusion

A good mattress is a valuable investment in your health and well-being. With the above financing options, you can find a way to purchase your dream mattress without putting a strain on your budget. Whichever option you choose, make sure to read the terms and conditions carefully and only commit to a payment plan that you can comfortably manage. Happy shopping!

A good mattress is a valuable investment in your health and well-being. With the above financing options, you can find a way to purchase your dream mattress without putting a strain on your budget. Whichever option you choose, make sure to read the terms and conditions carefully and only commit to a payment plan that you can comfortably manage. Happy shopping!

:max_bytes(150000):strip_icc()/_hero_4109254-feathertop-5c7d415346e0fb0001a5f085.jpg)