If you're in the business of importing or exporting bathroom vanities, you'll need to familiarize yourself with the correct Bathroom Vanity Hs Code. Hs codes, also known as Harmonized System codes, are a standardized system used to classify products for international trade. Each product is assigned a unique code based on its characteristics and intended use. In this article, we'll explore the top 10 Bathroom Vanity Hs Codes and how to use them for your import or export needs.Bathroom Vanity Hs Code: Understanding the Basics

When importing bathroom vanities, you'll need to use the correct Hs code to clear customs and ensure your products are properly classified and taxed. The most commonly used Bathroom Vanity Hs Code for import is 9403.60.00, which covers wooden furniture for bathrooms. However, if your bathroom vanities are made from materials other than wood, you'll need to use a different Hs code. It's important to double-check with your country's customs agency to ensure you're using the correct code for your specific products.Bathroom Vanity Hs Code for Import: Bringing Products Into Your Country

If you're an exporter of bathroom vanities, you'll also need to use the correct Hs code to comply with international trade regulations. The most commonly used Bathroom Vanity Hs Code for export is 9403.60.00, which covers wooden furniture for bathrooms. However, as with imports, if your products are made from materials other than wood, you'll need to use a different Hs code. It's important to research the Hs codes for your export destination to ensure you're using the correct code for your products.Bathroom Vanity Hs Code for Export: Shipping Your Products Internationally

With thousands of Hs codes in use, it can be challenging to find the right one for your bathroom vanities. Fortunately, there are online resources available to help you find the correct code for your products. The World Customs Organization and various government websites offer Hs code lookup tools that allow you to search for the correct code based on the characteristics and intended use of your bathroom vanities.Bathroom Vanity Hs Code Lookup: Finding the Right Code for Your Products

In addition to the Hs code, your bathroom vanities will also fall into a specific category based on their characteristics. This classification is known as the Commodity Classification Code. The code is used to determine the duty and tax rates for your products. It's important to properly classify your bathroom vanities to ensure you're paying the correct fees and avoiding any penalties or delays in customs.Bathroom Vanity Hs Code Classification: Categorizing Your Products

Once you have determined the correct Hs code and classification for your bathroom vanities, you'll need to understand the associated tariffs. Tariffs, also known as customs duties, are taxes applied to imported or exported goods. The tariff rate for your bathroom vanities will depend on their country of origin, their classification, and any trade agreements in place between your country and the exporting country. It's important to research and understand the tariff rates for your products to avoid any surprises or unexpected costs.Bathroom Vanity Hs Code Tariff: Understanding the Rates and Taxes

As an importer or exporter of bathroom vanities, you'll be responsible for paying the applicable duties and taxes. These fees can add up, so it's important to plan and budget accordingly. If you're unsure of the fees, it's best to consult with a customs broker or your country's customs agency for an accurate estimate.Bathroom Vanity Hs Code Duty: Paying Your Import or Export Fees

In addition to tariffs and duties, there may be other taxes and fees associated with your bathroom vanities. These can include value-added tax (VAT), sales tax, and excise taxes. The specific taxes and fees will depend on your country's regulations and the country of origin for your products. It's important to research and understand these additional costs to ensure you're properly budgeting for your import or export.Bathroom Vanity Hs Code Tax: Additional Taxes and Fees to Consider

As an importer or exporter, it's essential to stay compliant with all trade laws and regulations. This includes using the correct Hs code, properly classifying your products, and paying the applicable duties and taxes. Failure to comply with these regulations can result in penalties, delays, and even legal consequences. It's crucial to stay up-to-date on any changes to trade laws and regulations to ensure your business remains compliant.Bathroom Vanity Hs Code Regulations: Staying Compliant with Trade Laws

To ensure compliance with trade laws and regulations, there are some best practices that importers and exporters should follow when using Hs codes for bathroom vanities. These include keeping accurate records, properly declaring your products, and staying informed about any changes to trade laws and regulations. It's also recommended to work with a customs broker or seek guidance from your country's customs agency to ensure you're following all necessary procedures. Now that you have a better understanding of the top 10 Bathroom Vanity Hs Codes, you'll be better equipped to import or export your products successfully. Remember to research and use the correct Hs code, properly classify your products, and comply with all trade laws and regulations. With the right knowledge and preparation, your bathroom vanity business can thrive in the international market.Bathroom Vanity Hs Code Compliance: Best Practices for Importers and Exporters

Bathroom Vanity HS Code: An Essential Element in House Design

The Importance of Choosing the Right Bathroom Vanity HS Code

When it comes to designing a house, every detail matters. From the overall layout to the smallest accessories, each element plays a crucial role in creating a cohesive and functional space. One of the essential components of house design is the bathroom vanity. Not only does it provide storage and functionality, but it also adds aesthetic value to the bathroom. However, selecting the right bathroom vanity can be overwhelming, especially with the numerous options available in the market. This is where the Bathroom Vanity HS Code comes into play, providing a standardized system for identifying and classifying various bathroom vanities.

When it comes to designing a house, every detail matters. From the overall layout to the smallest accessories, each element plays a crucial role in creating a cohesive and functional space. One of the essential components of house design is the bathroom vanity. Not only does it provide storage and functionality, but it also adds aesthetic value to the bathroom. However, selecting the right bathroom vanity can be overwhelming, especially with the numerous options available in the market. This is where the Bathroom Vanity HS Code comes into play, providing a standardized system for identifying and classifying various bathroom vanities.

The Role of HS Codes in House Design

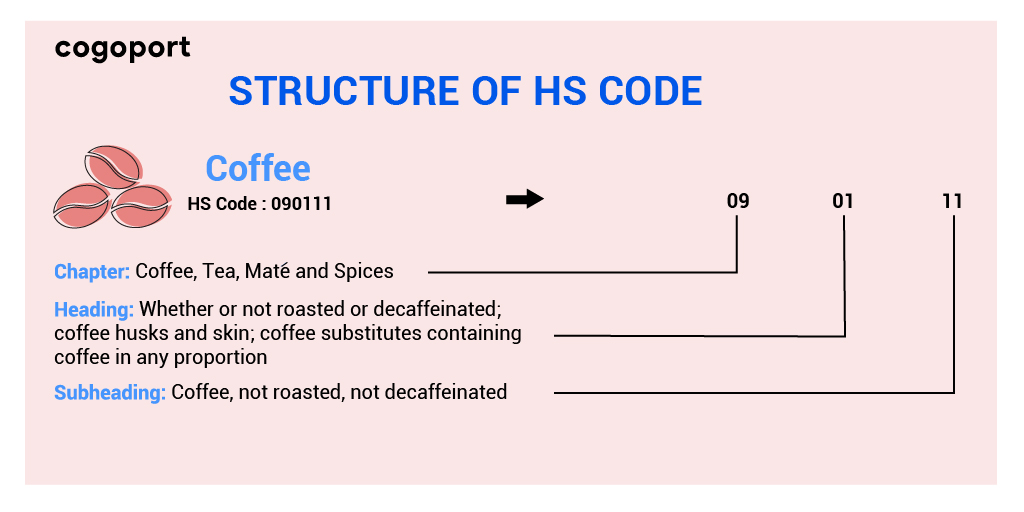

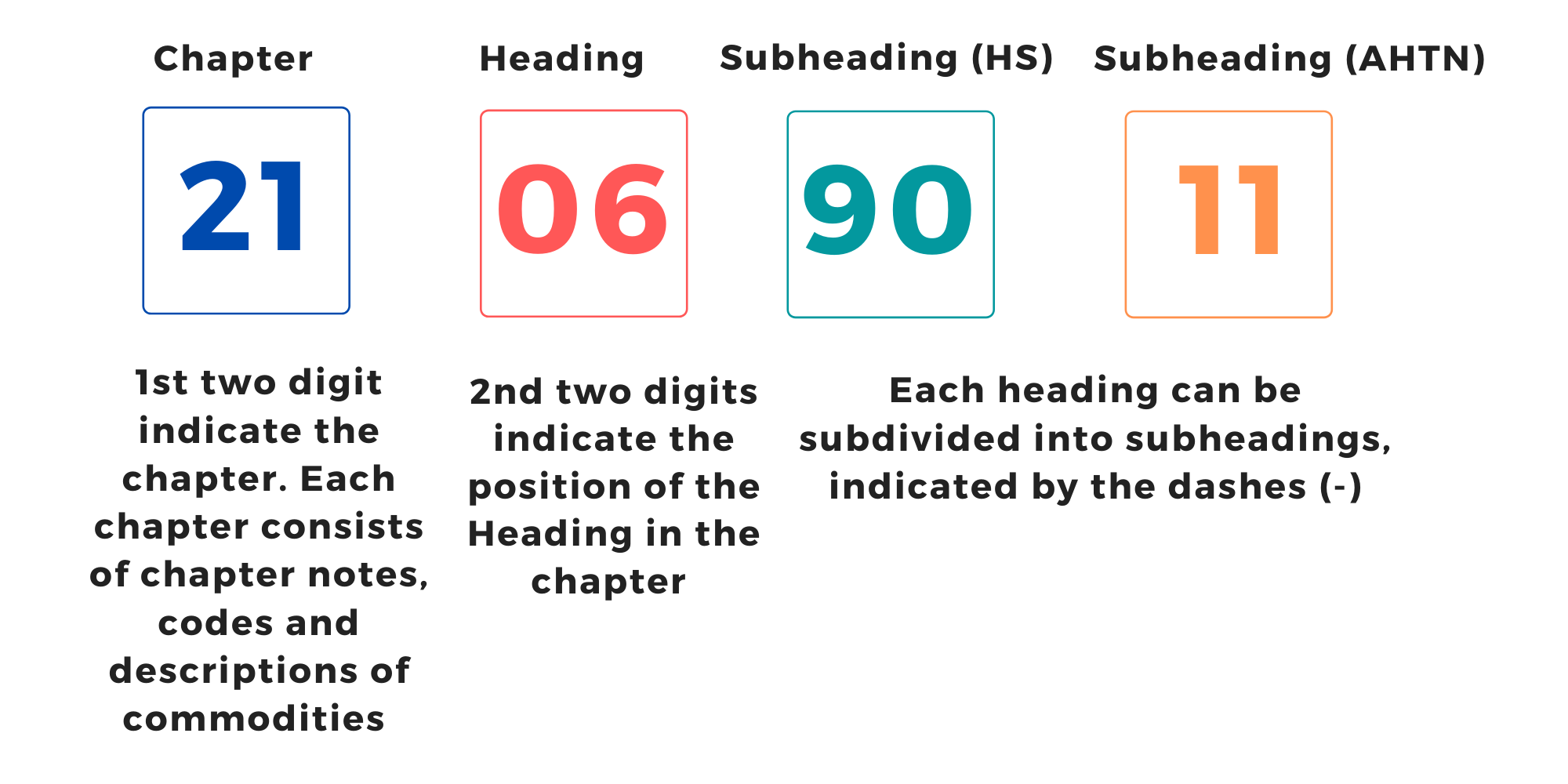

HS Code, or Harmonized System Code, is a six-digit code used by countries worldwide to classify and track goods for international trade. The first two digits represent the product's chapter, followed by two digits for the headings, and the last two digits for the subheadings. This system ensures uniformity and consistency in identifying and categorizing products, including bathroom vanities.

Choosing the right Bathroom Vanity HS Code is crucial in house design for several reasons:

HS Code, or Harmonized System Code, is a six-digit code used by countries worldwide to classify and track goods for international trade. The first two digits represent the product's chapter, followed by two digits for the headings, and the last two digits for the subheadings. This system ensures uniformity and consistency in identifying and categorizing products, including bathroom vanities.

Choosing the right Bathroom Vanity HS Code is crucial in house design for several reasons:

1. Easy Identification and Tracking

Having a standardized code for bathroom vanities makes it easier for manufacturers, suppliers, and buyers to identify and track products. This is particularly useful for those involved in international trade, where different countries may use different names or specifications for the same product. With the HS Code, everyone involved can easily identify and classify the product, making the buying and selling process more efficient.

Having a standardized code for bathroom vanities makes it easier for manufacturers, suppliers, and buyers to identify and track products. This is particularly useful for those involved in international trade, where different countries may use different names or specifications for the same product. With the HS Code, everyone involved can easily identify and classify the product, making the buying and selling process more efficient.

2. Ensures Quality and Compliance

The HS Code system also helps ensure that the bathroom vanities being imported or exported meet the necessary quality and safety standards. Each HS Code is assigned to a specific product, which indicates its materials, design, and purpose. This allows authorities to regulate and monitor the products being traded, ensuring they meet the required standards.

The HS Code system also helps ensure that the bathroom vanities being imported or exported meet the necessary quality and safety standards. Each HS Code is assigned to a specific product, which indicates its materials, design, and purpose. This allows authorities to regulate and monitor the products being traded, ensuring they meet the required standards.

3. Simplifies the Design Process

For interior designers and homeowners, knowing the Bathroom Vanity HS Code can simplify the design process. By understanding the code, they can easily identify the type, size, and material of the bathroom vanity they need. This saves time and effort in searching for the perfect vanity and ensures that it will fit and function well in the bathroom.

In conclusion, the Bathroom Vanity HS Code is an essential element in house design. It provides a standardized system for identifying and categorizing bathroom vanities, making it easier for manufacturers, suppliers, and buyers to trade and track products. Moreover, it simplifies the design process, ensuring that the chosen bathroom vanity meets the necessary quality and safety standards. So, the next time you're renovating or designing your bathroom, make sure to consider the Bathroom Vanity HS Code for a seamless and efficient process.

For interior designers and homeowners, knowing the Bathroom Vanity HS Code can simplify the design process. By understanding the code, they can easily identify the type, size, and material of the bathroom vanity they need. This saves time and effort in searching for the perfect vanity and ensures that it will fit and function well in the bathroom.

In conclusion, the Bathroom Vanity HS Code is an essential element in house design. It provides a standardized system for identifying and categorizing bathroom vanities, making it easier for manufacturers, suppliers, and buyers to trade and track products. Moreover, it simplifies the design process, ensuring that the chosen bathroom vanity meets the necessary quality and safety standards. So, the next time you're renovating or designing your bathroom, make sure to consider the Bathroom Vanity HS Code for a seamless and efficient process.

.png)