One of the most common questions people have when purchasing a new mattress is whether or not their insurance will cover it. After all, mattresses can be expensive and having insurance coverage can help ease the financial burden. However, the answer to this question is not a straightforward yes or no. It depends on several factors, such as the type of insurance you have and the reason for needing a new mattress. In this article, we will explore the different aspects of insurance coverage for mattresses and how you can potentially get your insurance to cover a new mattress.Will insurance cover a mattress?

The first step to determining if your insurance will cover a new mattress is to check your policy. Most insurance policies have a section that outlines what is covered and what is not. If your policy does not explicitly mention mattresses, then you may need to dig a little deeper and contact your insurance provider for clarification. It is important to note that not all insurance policies cover mattresses, so it is essential to know the details of your policy before making a claim.Will my insurance cover a new mattress?

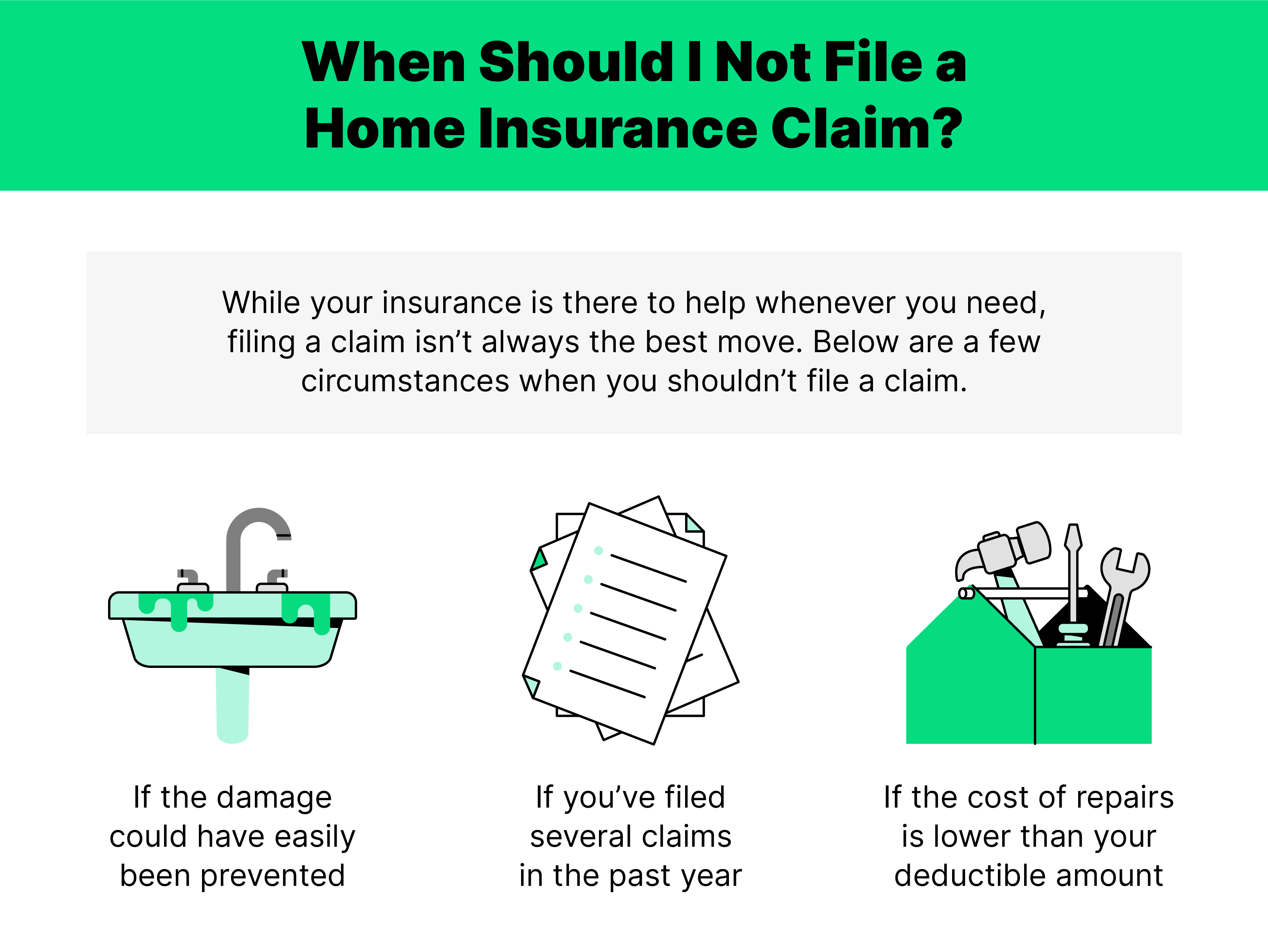

In general, insurance policies cover items that are damaged or destroyed due to unforeseen circumstances. This means that if your mattress is damaged in a fire, flood, or other natural disaster, your insurance may cover the cost of a new one. However, if your mattress is simply worn out from everyday use, it is unlikely that your insurance will cover it. It is always best to check with your insurance provider to be sure.Does insurance cover a mattress?

If your insurance policy does cover mattresses, there are some factors to keep in mind. The type of mattress you have may affect your coverage. For example, some insurance policies may only cover basic mattresses, while others may cover more expensive models. Additionally, the age of your mattress may also be a factor. If your mattress is relatively new, your insurance may cover the full cost of a replacement. However, if your mattress is old, your insurance may only cover a portion of the cost.Insurance coverage for a mattress

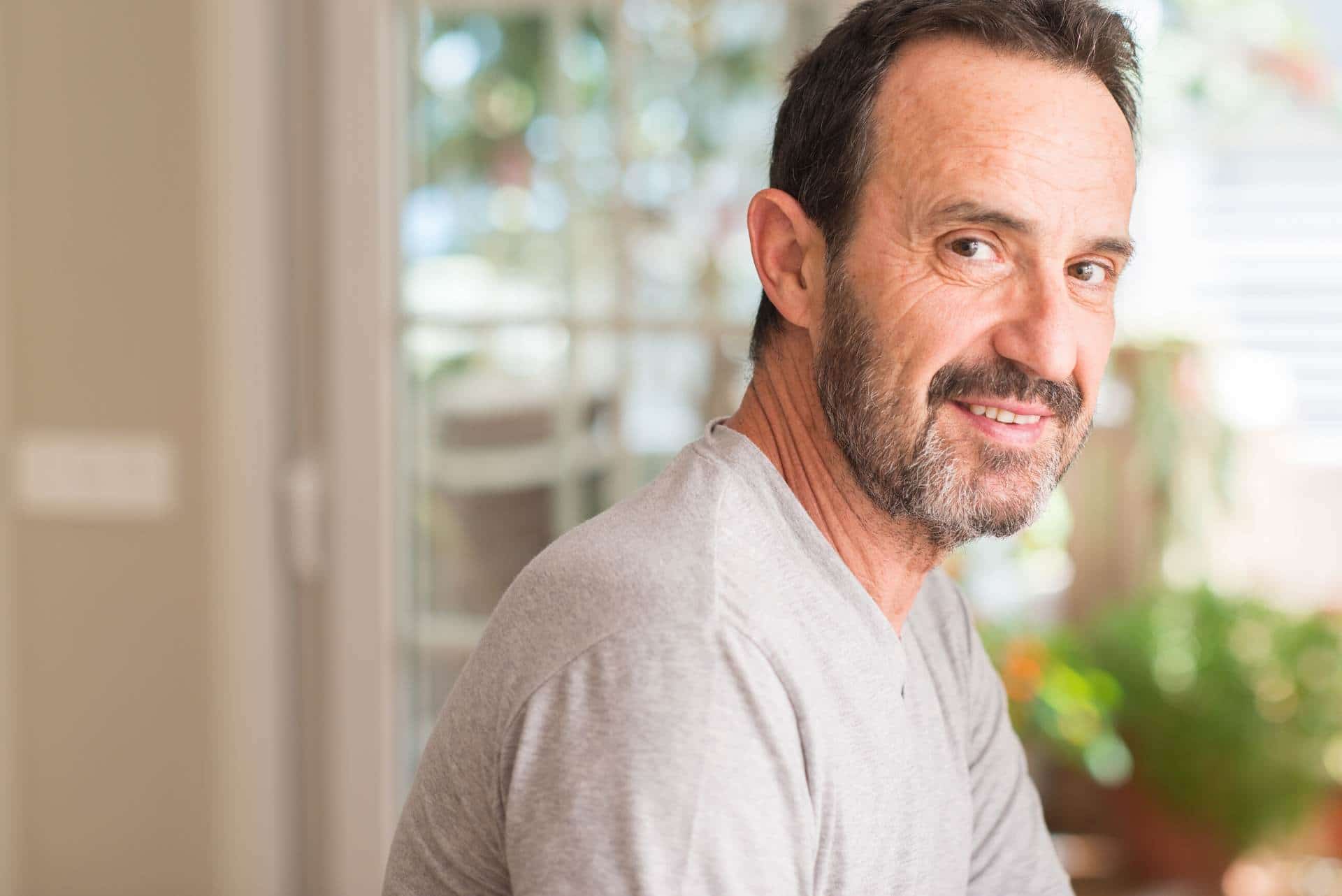

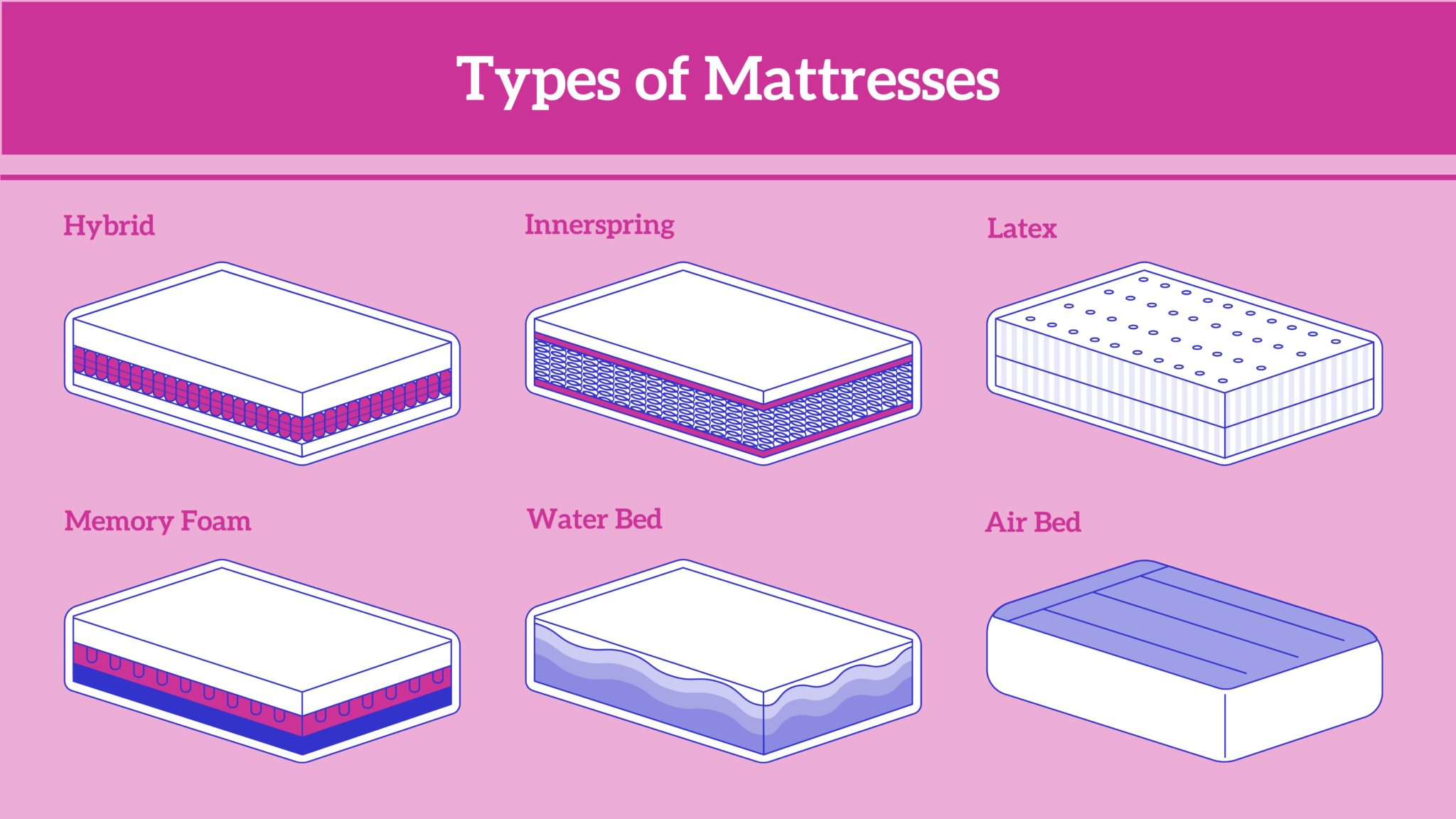

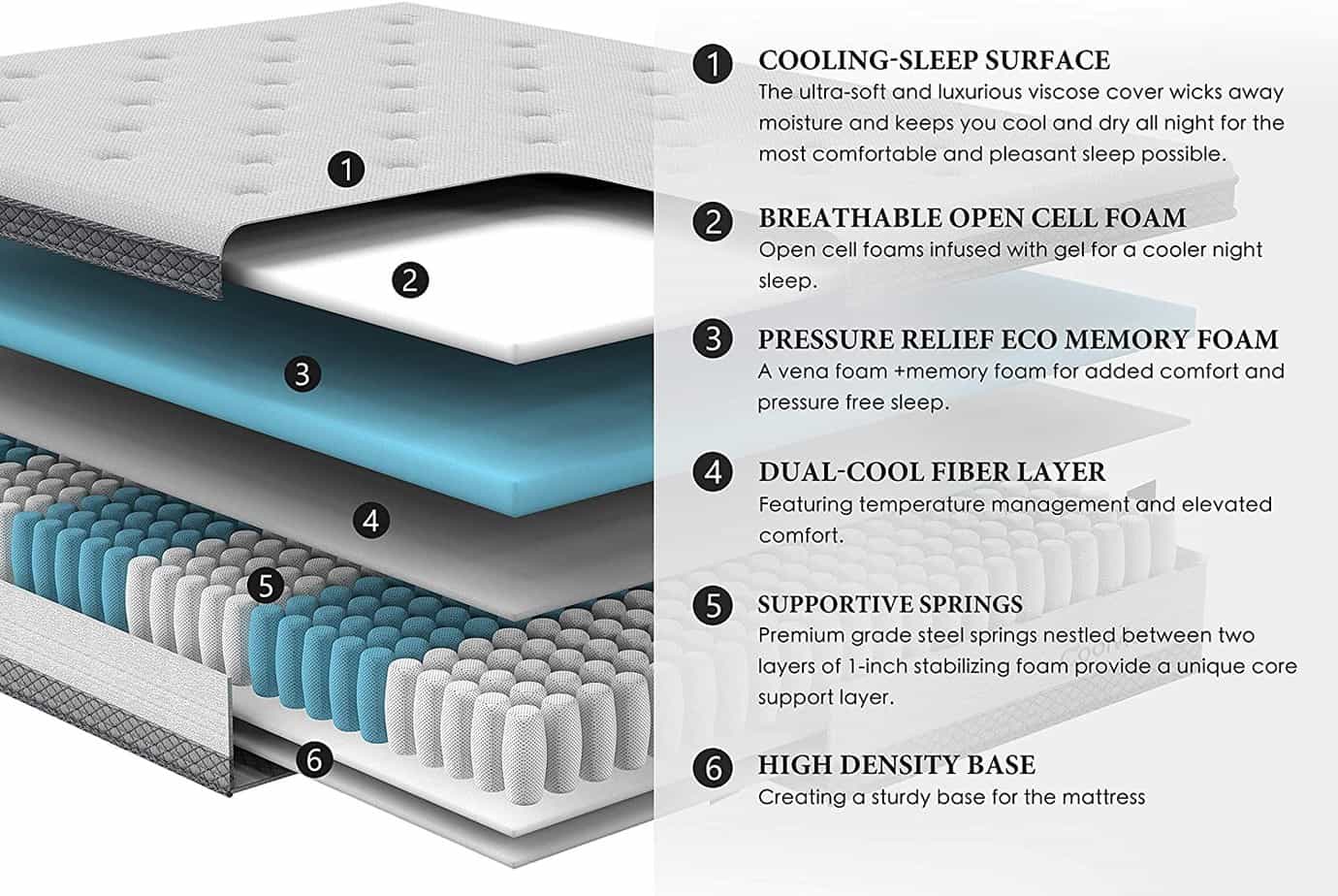

As mentioned earlier, the type of mattress you have may affect your insurance coverage. Some insurance policies may only cover traditional inner-spring mattresses, while others may also cover memory foam or hybrid mattresses. It is important to check with your insurance provider to see what types of mattresses are covered under your policy.What types of mattresses are covered by insurance?

If your insurance policy does not explicitly mention mattresses, there are some steps you can take to potentially get your insurance to cover the cost of a new one. Firstly, document any damage to your current mattress and take pictures. If you have a warranty, check to see if it covers damage that is not caused by manufacturing defects. You can also try contacting your insurance provider and explaining the situation to see if they can make an exception. Lastly, if you have a homeowner's or renter's insurance policy, check to see if it includes coverage for personal belongings, as your mattress may fall under this category.How to get insurance to cover a mattress

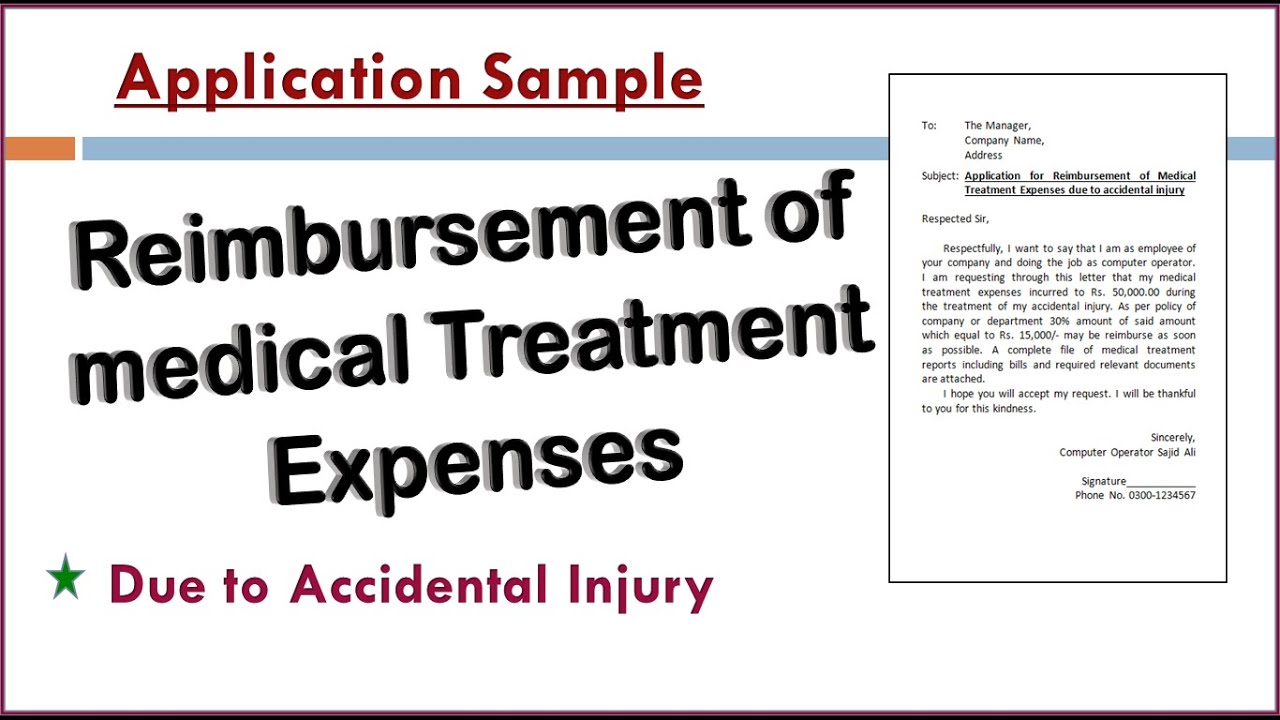

If your insurance does cover a new mattress, you may be wondering how the reimbursement process works. The first step is to file a claim with your insurance provider, providing all necessary documentation and evidence. Once your claim is approved, your insurance may either reimburse you for the full cost of the mattress or provide a partial reimbursement, depending on your policy. It is essential to keep in mind that you may be required to pay a deductible before receiving reimbursement.Insurance reimbursement for a mattress

Some people may wonder if their health insurance will cover a new mattress, especially if they have a medical condition that requires a specific type of mattress. In most cases, health insurance does not cover mattresses unless they are deemed medically necessary by a doctor. However, it is always best to check with your health insurance provider to see if they have any coverage for mattresses.Will my health insurance cover a new mattress?

Finally, it is essential to note that insurance coverage for a mattress may also depend on the type of bed you have. If you have a basic bed frame, your insurance may only cover the cost of the mattress. However, if you have a more expensive adjustable bed or one with built-in features like massage or heating, your insurance may cover the cost of the entire bed. Again, it is important to check with your insurance provider to see what is covered under your policy.Insurance coverage for a new bed

If you need to file an insurance claim for a mattress, it is best to follow these steps:How to file an insurance claim for a mattress

Can Homeowner's Insurance Cover a New Mattress?

The Importance of a Good Mattress

When it comes to designing a comfortable and inviting home,

mattresses

play a crucial role. Not only do they provide a place to rest and recharge after a long day, but they also contribute to our overall health and well-being. A good

mattress

can alleviate back pain, improve sleep quality, and enhance our daily productivity. However,

mattresses

can be quite expensive, and many homeowners wonder if their

homeowner's insurance

will cover the cost of a new

mattress

in case of damage or loss.

When it comes to designing a comfortable and inviting home,

mattresses

play a crucial role. Not only do they provide a place to rest and recharge after a long day, but they also contribute to our overall health and well-being. A good

mattress

can alleviate back pain, improve sleep quality, and enhance our daily productivity. However,

mattresses

can be quite expensive, and many homeowners wonder if their

homeowner's insurance

will cover the cost of a new

mattress

in case of damage or loss.

Understanding Your Homeowner's Insurance Policy

Before we dive into the question of whether

insurance

will cover a new

mattress

, it's essential to understand the details of your

homeowner's insurance

policy. Most policies cover structural damage to your home, as well as personal property damage or loss.

Mattresses

fall under personal property, and therefore, may be covered under your policy depending on the circumstances.

Before we dive into the question of whether

insurance

will cover a new

mattress

, it's essential to understand the details of your

homeowner's insurance

policy. Most policies cover structural damage to your home, as well as personal property damage or loss.

Mattresses

fall under personal property, and therefore, may be covered under your policy depending on the circumstances.

Damage vs. Wear and Tear

If your

mattress

is damaged in a covered event, such as a fire, storm, or burglary, your

insurance

may provide coverage for a new one. However, if your

mattress

is simply worn out from regular use, it will not be covered. It's important to note that

mattresses

have a limited lifespan, and most

insurances

will not cover the cost of a replacement due to normal wear and tear.

If your

mattress

is damaged in a covered event, such as a fire, storm, or burglary, your

insurance

may provide coverage for a new one. However, if your

mattress

is simply worn out from regular use, it will not be covered. It's important to note that

mattresses

have a limited lifespan, and most

insurances

will not cover the cost of a replacement due to normal wear and tear.

Additional Coverage Options

While your standard

homeowner's insurance

policy may not cover a new

mattress

for regular wear and tear, there may be additional coverage options available. Some

insurance

companies offer endorsements or riders that can be added to your policy to cover specific items, such as

mattresses

. However, these endorsements may come at an additional cost, so it's essential to discuss your options with your

insurance

provider.

While your standard

homeowner's insurance

policy may not cover a new

mattress

for regular wear and tear, there may be additional coverage options available. Some

insurance

companies offer endorsements or riders that can be added to your policy to cover specific items, such as

mattresses

. However, these endorsements may come at an additional cost, so it's essential to discuss your options with your

insurance

provider.

The Importance of Keeping Records

In the event that your

mattress

is damaged or lost, it's crucial to have records and receipts of the purchase. This will help your

insurance

provider determine the value of your

mattress

and whether it is eligible for coverage. It's also a good idea to take photos of your

mattress

and keep them with your records.

In the event that your

mattress

is damaged or lost, it's crucial to have records and receipts of the purchase. This will help your

insurance

provider determine the value of your

mattress

and whether it is eligible for coverage. It's also a good idea to take photos of your

mattress

and keep them with your records.

Final Thoughts

While it's always best to check with your specific

insurance

provider,

homeowner's insurance

typically does not cover the cost of a new

mattress

due to regular wear and tear. However, in the case of a covered event, your

mattress

may be eligible for replacement. It's important to review your policy and consider additional coverage options if necessary. And remember to keep records of your

mattress

purchase, just in case.

While it's always best to check with your specific

insurance

provider,

homeowner's insurance

typically does not cover the cost of a new

mattress

due to regular wear and tear. However, in the case of a covered event, your

mattress

may be eligible for replacement. It's important to review your policy and consider additional coverage options if necessary. And remember to keep records of your

mattress

purchase, just in case.

.jpg?format=1500w)