How to Calculate Sales Tax on a Purple Mattress

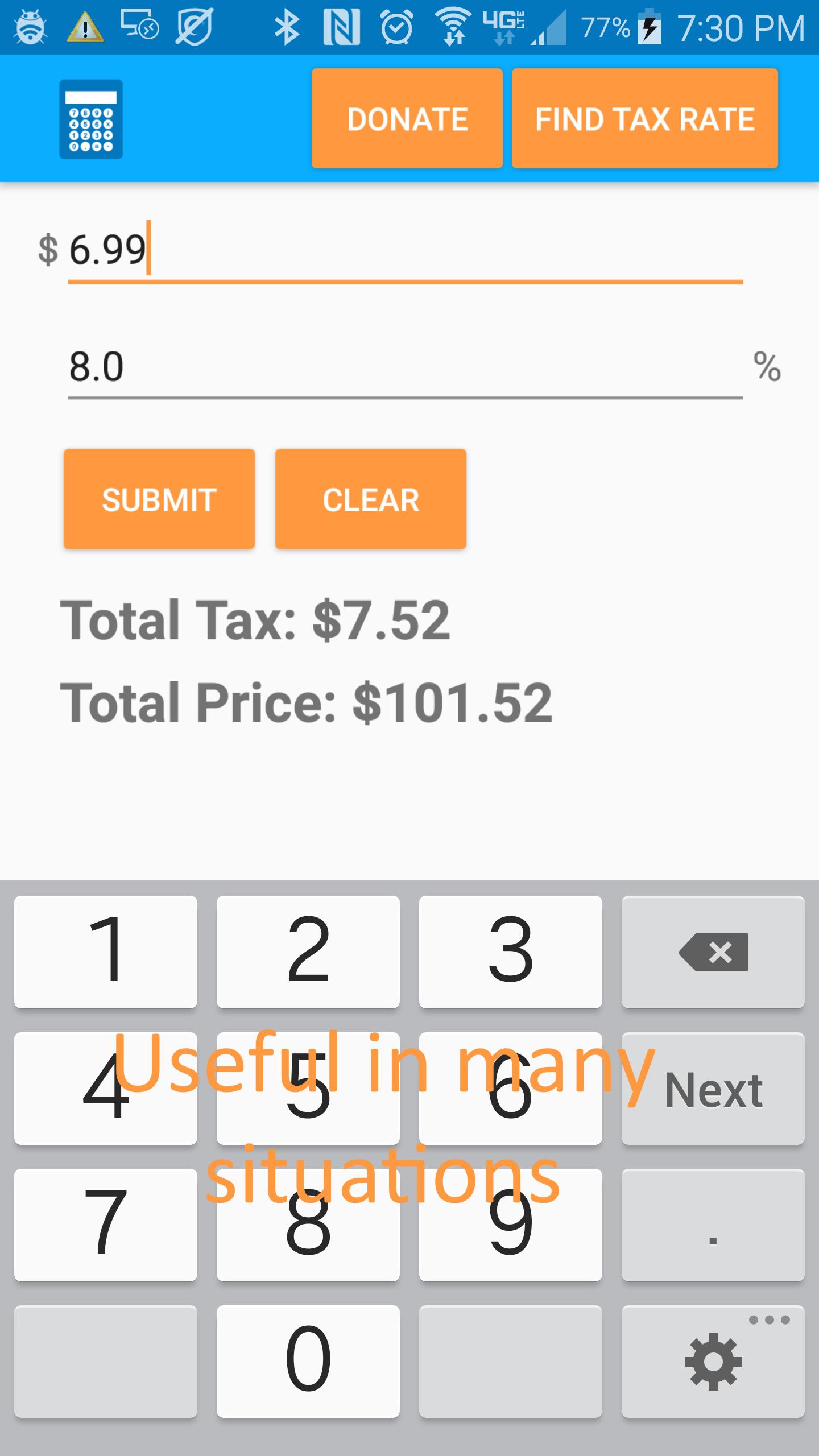

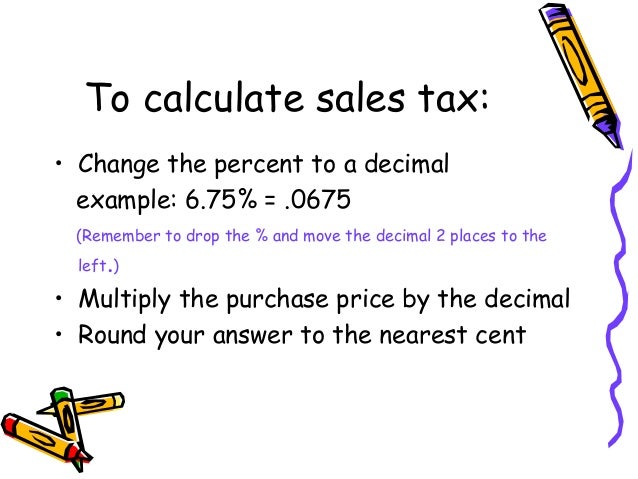

When purchasing a new mattress, it's important to factor in sales tax to your budget. For purple mattresses, the sales tax rate will vary depending on the state you live in. To calculate the sales tax on your purple mattress, you will need to know the state sales tax rate and the purchase price of the mattress.

First, look up the state sales tax rate for your state. This information can usually be found on your state's government website. For example, if the sales tax rate in your state is 6%, and the purple mattress you want to purchase costs $1,000, the sales tax would be $60.

Featured keyword: calculate sales tax

How to Save Money on Taxes When Buying a Purple Mattress

Purchasing a new mattress can be a big expense, so it's important to find ways to save money wherever possible. When buying a purple mattress, there are a few ways you can potentially save money on taxes.

One option is to take advantage of tax-free weekends, which some states offer during certain times of the year. This allows you to make purchases without paying sales tax, including on mattresses. Check your state's government website to see if they offer tax-free weekends and when they occur.

Featured keyword: save money on taxes

Understanding State Sales Tax Laws for Purple Mattress Purchases

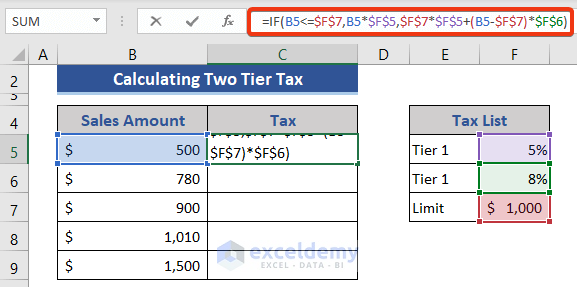

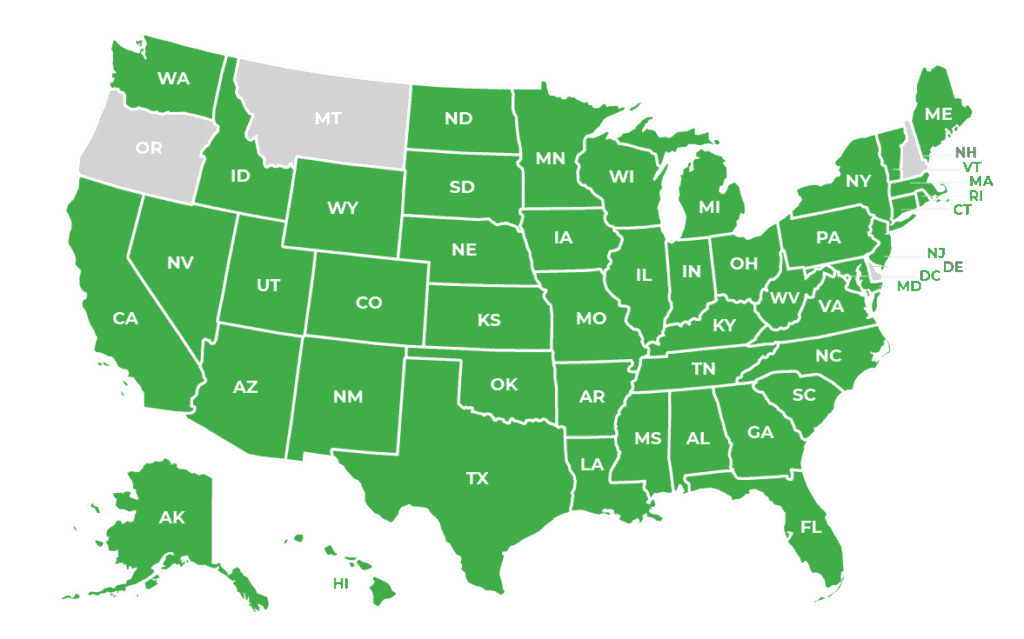

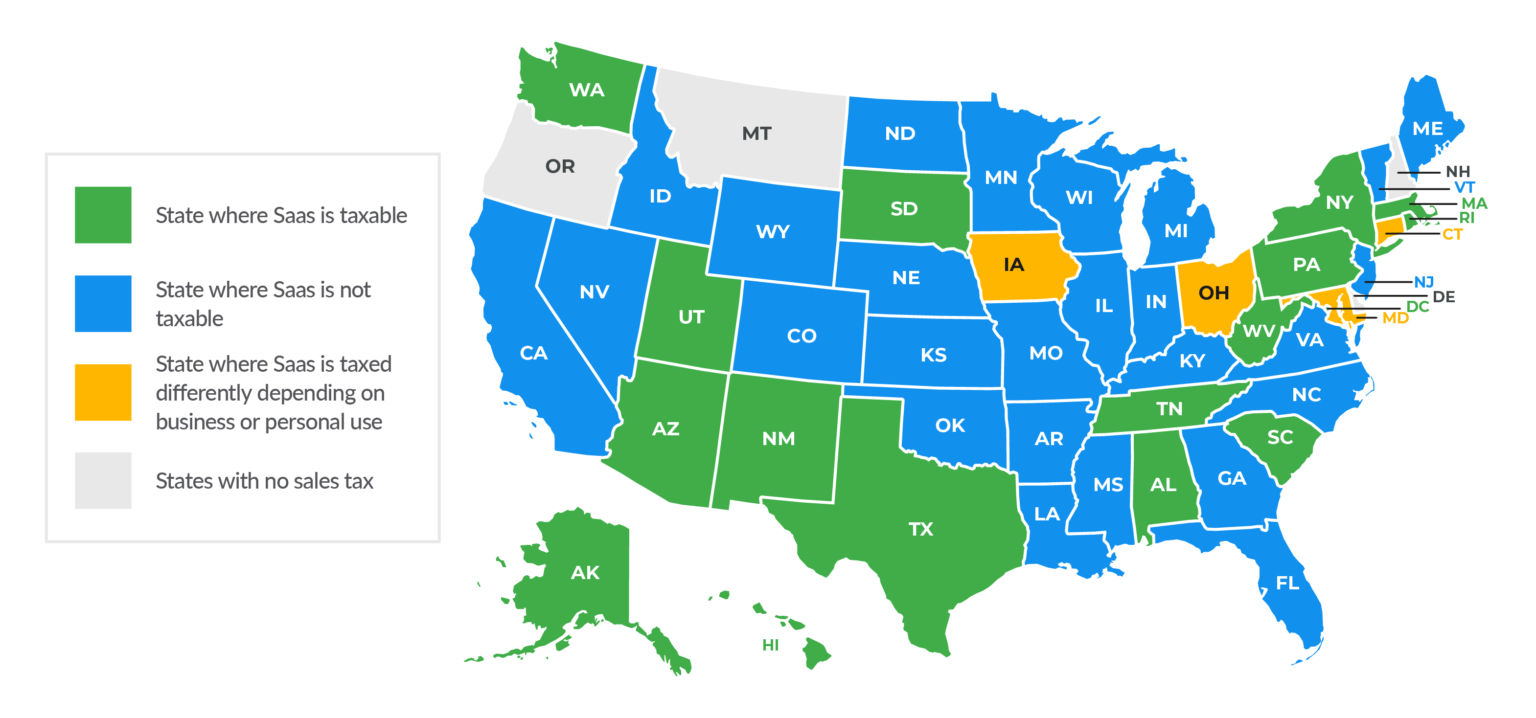

State sales tax laws can be complicated and vary from state to state. It's important to understand the sales tax laws in your state when making a purchase, especially for a big-ticket item like a purple mattress.

Some states have a flat sales tax rate, while others have a varying rate based on the county or city you live in. It's important to research the sales tax laws in your specific location to ensure you are paying the correct amount of sales tax on your purple mattress purchase.

Featured keyword: state sales tax laws

Do I Have to Pay Taxes on My Purple Mattress?

One common question when making a big purchase like a mattress is whether or not you have to pay taxes on it. The answer is yes, you will likely have to pay sales tax on your purple mattress purchase.

Sales tax is a consumption tax, meaning it is applied to the sale of goods and services. Since a purple mattress is considered a tangible good, it is subject to sales tax in most states.

Featured keyword: pay taxes on purple mattress

How to Claim a Tax Deduction for Your Purple Mattress Purchase

If you are using your purple mattress for medical purposes, you may be able to claim a tax deduction for the purchase. In order to do so, you will need to have a prescription from your doctor stating that the mattress is necessary for your health.

Keep in mind that in order to claim a tax deduction for medical expenses, they must exceed a certain amount of your income. It's important to consult with a tax professional to determine if you are eligible for a deduction on your purple mattress purchase.

Featured keyword: tax deduction for purple mattress

State Sales Tax Rates for Purple Mattress Purchases

As mentioned earlier, the state sales tax rate for purple mattress purchases will vary depending on the state you live in. To give you an idea of what to expect, here are the current sales tax rates for a few popular states:

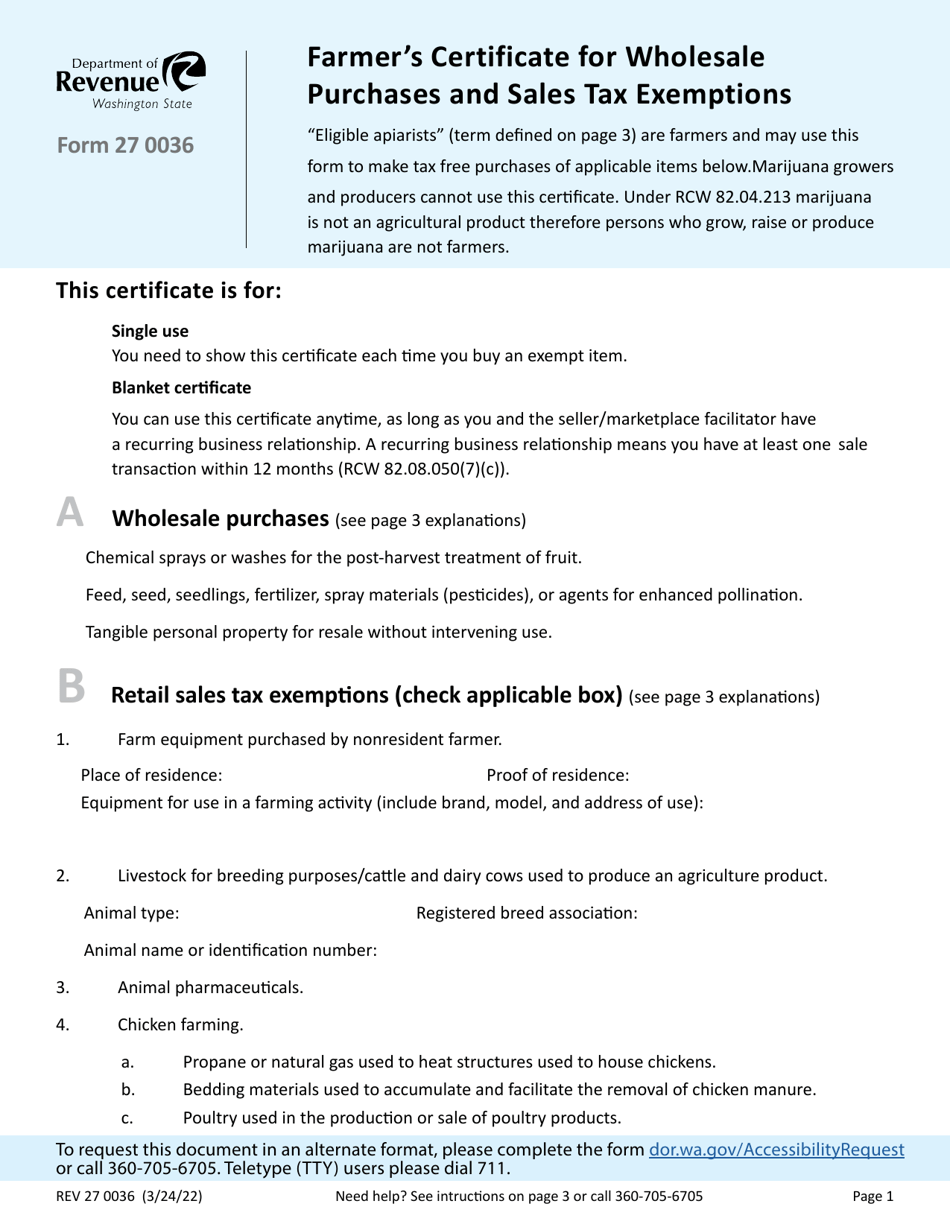

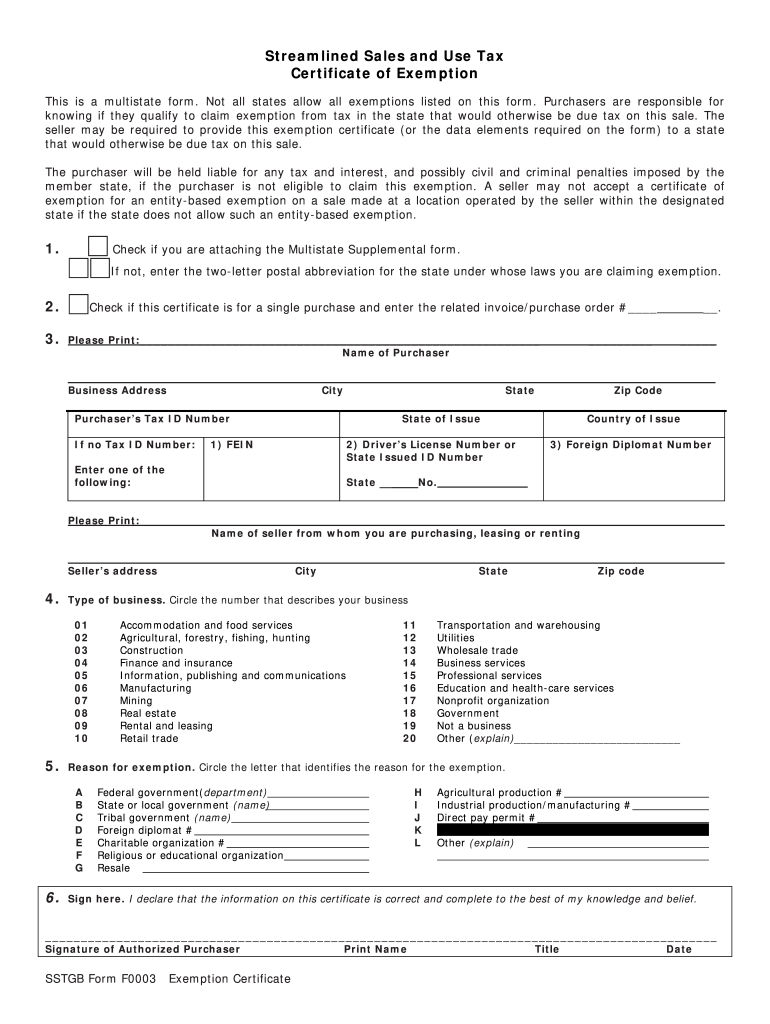

Tax Exemptions for Purple Mattress Purchases

In some cases, you may be eligible for a tax exemption on your purple mattress purchase. This could be due to a variety of reasons, such as purchasing for a non-profit organization or using the mattress for business purposes.

It's important to research the tax laws in your state to determine if any exemptions apply to your situation. If you think you may qualify for an exemption, be sure to keep all necessary documentation and receipts for your purchase.

Featured keyword: tax exemptions for purple mattress

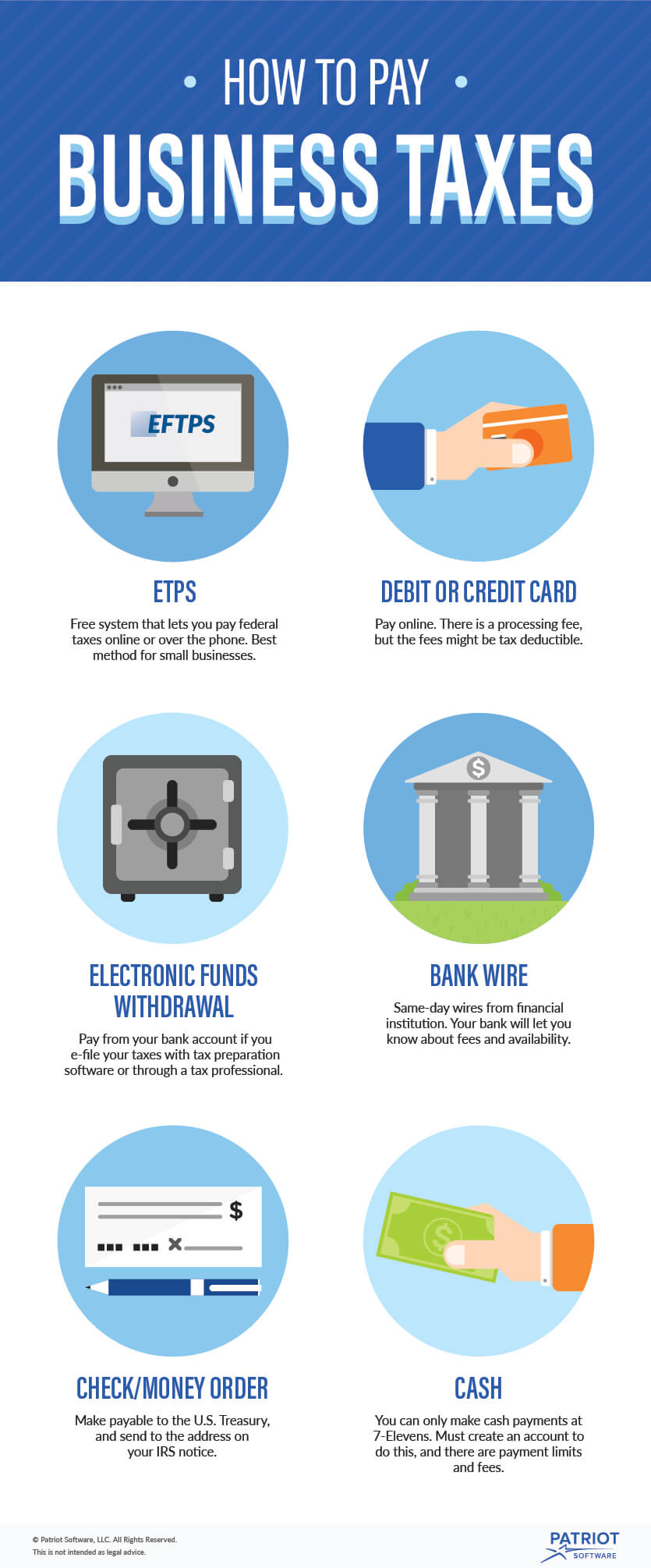

How to File Taxes for Your Purple Mattress Business

If you are purchasing a purple mattress for your business, the tax process may be a bit different than for personal purchases. In addition to paying sales tax, you will also need to report the purchase on your business tax return.

Be sure to keep accurate records of all business purchases, including your purple mattress, for tax purposes. It's also a good idea to consult with a tax professional to ensure you are properly filing and reporting your business taxes.

Featured keyword: file taxes for purple mattress business

Common Tax Mistakes to Avoid When Buying a Purple Mattress

When it comes to taxes, it's important to be diligent and avoid making any mistakes that could result in penalties or fines. When purchasing a purple mattress, here are some common tax mistakes to avoid:

Tax Tips for Purple Mattress Owners

As a purple mattress owner, there are a few tax tips you should keep in mind to ensure you are staying compliant and potentially saving money:

The Importance of Properly Paying Taxes for Your Purple Mattress

Why Taxes Matter for Your Purple Mattress

When it comes to purchasing a new mattress, the last thing on most people's minds is taxes. However, it is important to understand the impact that taxes have on the overall cost of your

Purple Mattress

. Many consumers are surprised to find out that they may be paying more in taxes than necessary, and this can significantly affect their budget for home design.

When it comes to purchasing a new mattress, the last thing on most people's minds is taxes. However, it is important to understand the impact that taxes have on the overall cost of your

Purple Mattress

. Many consumers are surprised to find out that they may be paying more in taxes than necessary, and this can significantly affect their budget for home design.

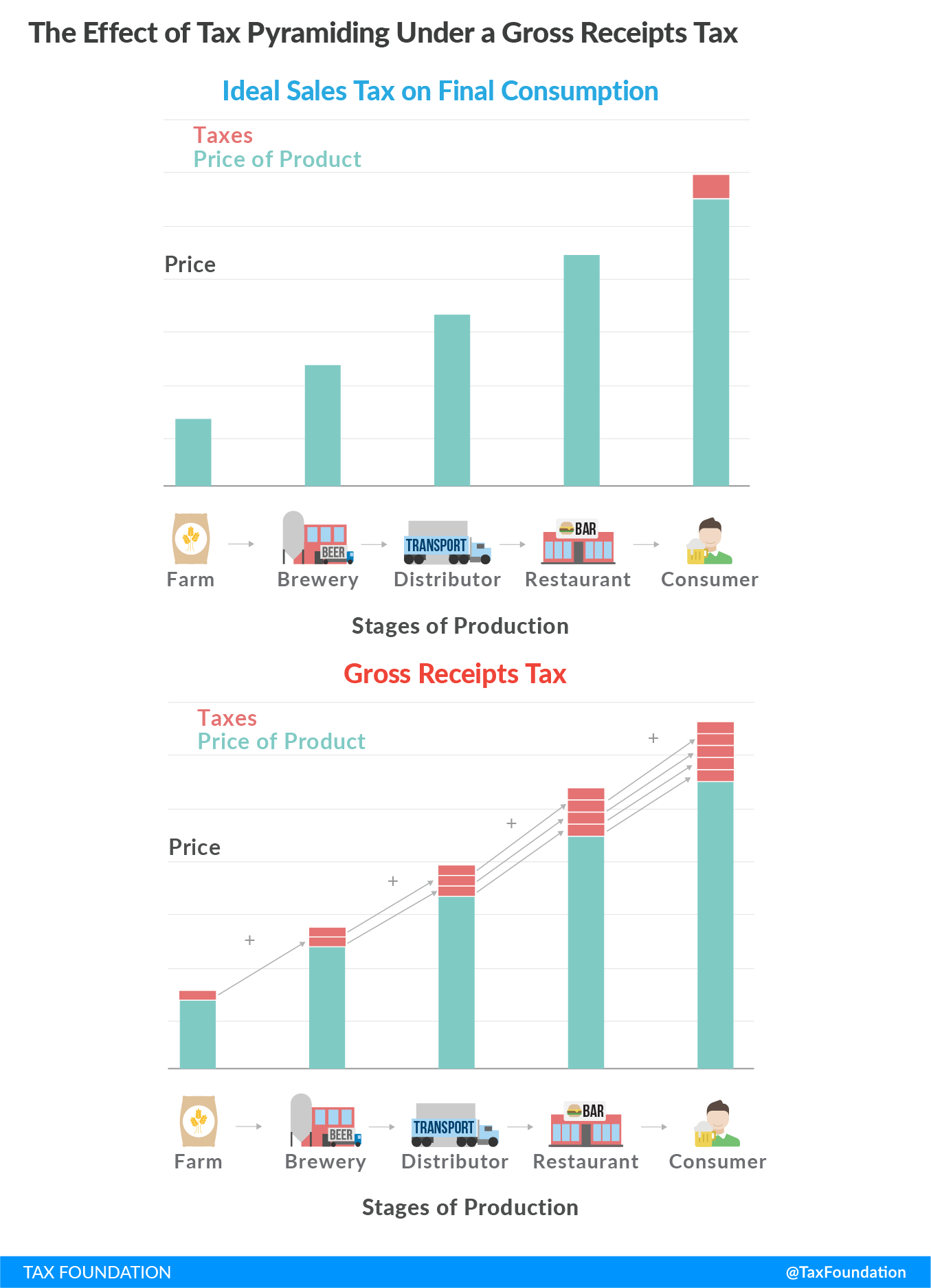

The Sales Tax Dilemma

The majority of states in the US require businesses to collect sales tax on their merchandise, including mattresses. This means that when you purchase your

Purple Mattress

, you are not only paying for the cost of the mattress itself, but also for the added sales tax. Depending on where you live, this can add up to a substantial amount, making it important to properly factor these taxes into your budget.

The majority of states in the US require businesses to collect sales tax on their merchandise, including mattresses. This means that when you purchase your

Purple Mattress

, you are not only paying for the cost of the mattress itself, but also for the added sales tax. Depending on where you live, this can add up to a substantial amount, making it important to properly factor these taxes into your budget.

Online Purchases and Use Tax

In recent years, online shopping has become increasingly popular, and many consumers are now opting to purchase their

Purple Mattress

online. While this may seem like a convenient and cost-effective option, it is important to note that most states also have a use tax, which requires individuals to pay sales tax on out-of-state purchases. This means that even if you purchase your mattress online from a state that does not collect sales tax, you are still responsible for paying the use tax in your own state.

In recent years, online shopping has become increasingly popular, and many consumers are now opting to purchase their

Purple Mattress

online. While this may seem like a convenient and cost-effective option, it is important to note that most states also have a use tax, which requires individuals to pay sales tax on out-of-state purchases. This means that even if you purchase your mattress online from a state that does not collect sales tax, you are still responsible for paying the use tax in your own state.

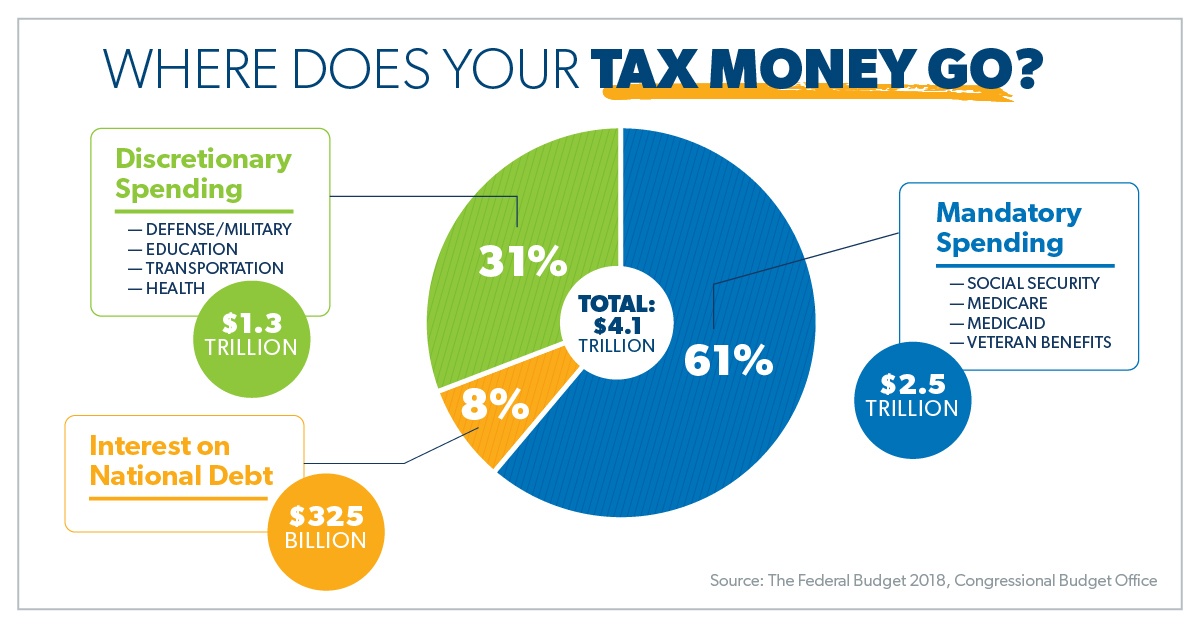

Why You Should Pay Your Taxes

Aside from it being the law, there are several reasons why it is important to properly pay your taxes for your

Purple Mattress

. Firstly, paying your taxes ensures that you are contributing to your local community and supporting necessary services such as schools and infrastructure. Additionally, not paying taxes can result in penalties and fines, which can ultimately end up costing you more in the long run.

Aside from it being the law, there are several reasons why it is important to properly pay your taxes for your

Purple Mattress

. Firstly, paying your taxes ensures that you are contributing to your local community and supporting necessary services such as schools and infrastructure. Additionally, not paying taxes can result in penalties and fines, which can ultimately end up costing you more in the long run.

How to Save on Taxes for Your Purple Mattress

While it may not be possible to completely avoid paying taxes on your

Purple Mattress

, there are ways to minimize the impact on your budget. One option is to purchase your mattress during a sales tax holiday, which some states offer at certain times throughout the year. You can also check if your state offers any tax exemptions or credits for home improvements, which a new mattress may fall under.

While it may not be possible to completely avoid paying taxes on your

Purple Mattress

, there are ways to minimize the impact on your budget. One option is to purchase your mattress during a sales tax holiday, which some states offer at certain times throughout the year. You can also check if your state offers any tax exemptions or credits for home improvements, which a new mattress may fall under.

In Conclusion

In conclusion, while paying taxes may not be the most exciting part of purchasing a

Purple Mattress

, it is important to understand the impact they have on the overall cost. By properly factoring in taxes and exploring ways to save, you can ensure that your home design budget stays on track and you can enjoy your new mattress without any added financial stress.

In conclusion, while paying taxes may not be the most exciting part of purchasing a

Purple Mattress

, it is important to understand the impact they have on the overall cost. By properly factoring in taxes and exploring ways to save, you can ensure that your home design budget stays on track and you can enjoy your new mattress without any added financial stress.