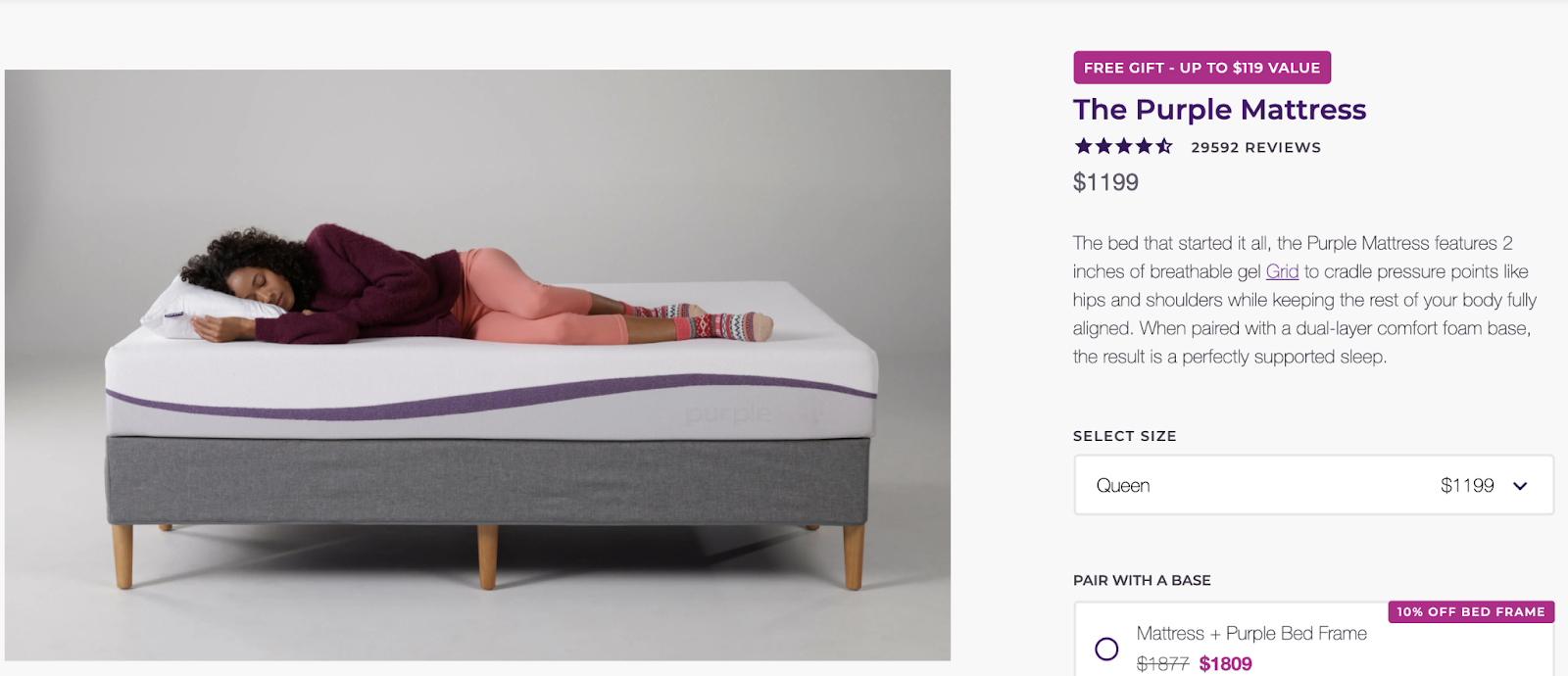

If you’re in the market for a new mattress, you may have heard about the many benefits of a Purple mattress. From its innovative design to its superior comfort, it’s no wonder why so many people are choosing to upgrade their sleep with a Purple mattress. But before you make your purchase, it’s important to understand the sales tax implications. Let’s take a look at how to calculate sales tax on a Purple mattress and what you can expect to pay.How to Calculate Sales Tax on a Purple Mattress

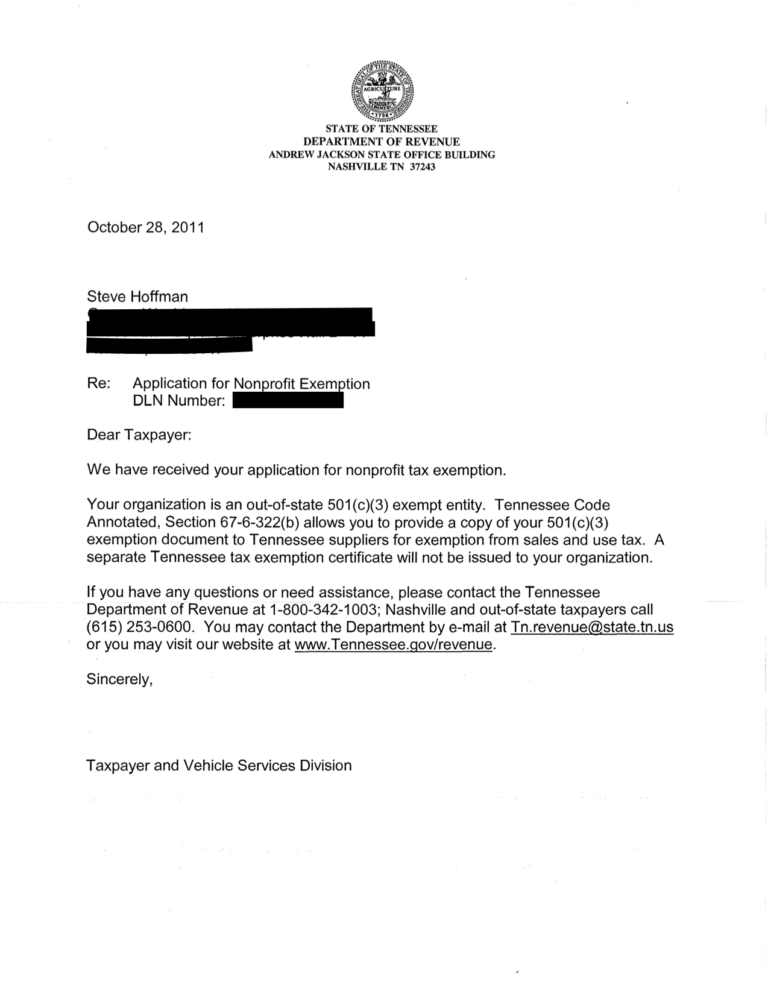

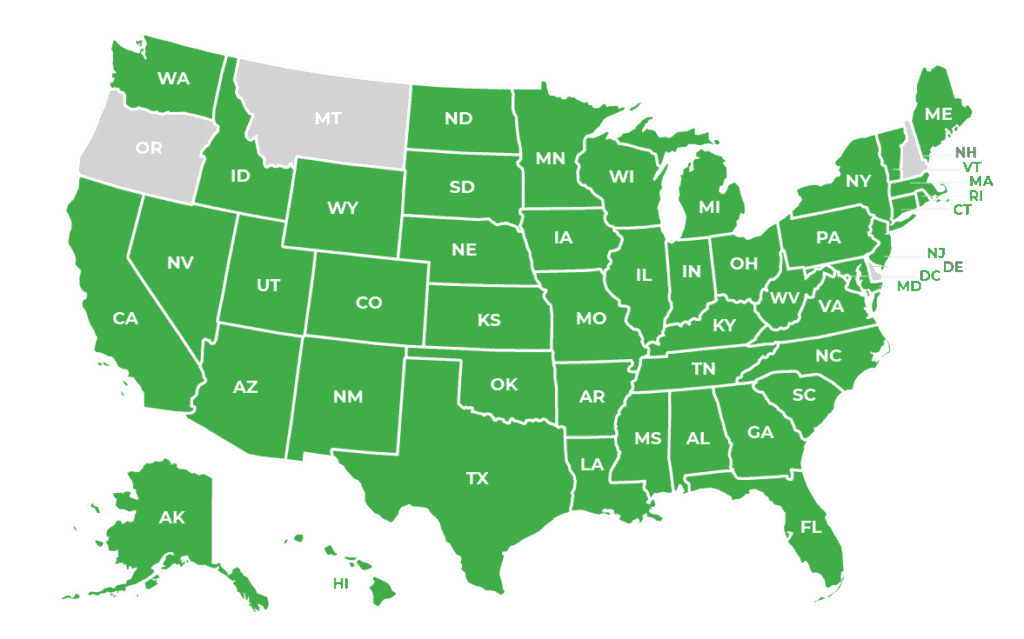

One way to save money on your Purple mattress purchase is by avoiding sales tax altogether. This can be done by purchasing your mattress from a state that does not charge sales tax on mattresses. This may require some research and potentially purchasing from a different state, but the savings can be significant. Keep in mind, however, that you may still be required to pay use tax in your home state.How to Save Money on a Purple Mattress by Avoiding Sales Tax

In recent years, the rise of online shopping has made it easier than ever to purchase a mattress from the comfort of your own home. However, this also means navigating the sometimes confusing world of sales tax laws. In general, if the online retailer has a physical presence in your state, they are required to charge sales tax. However, if they do not have a physical presence in your state, you may be responsible for paying use tax on your purchase.Understanding Sales Tax Laws for Online Mattress Purchases

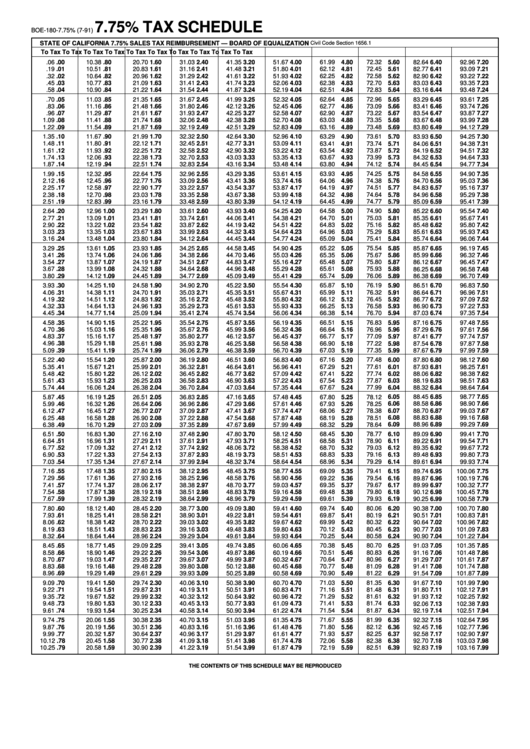

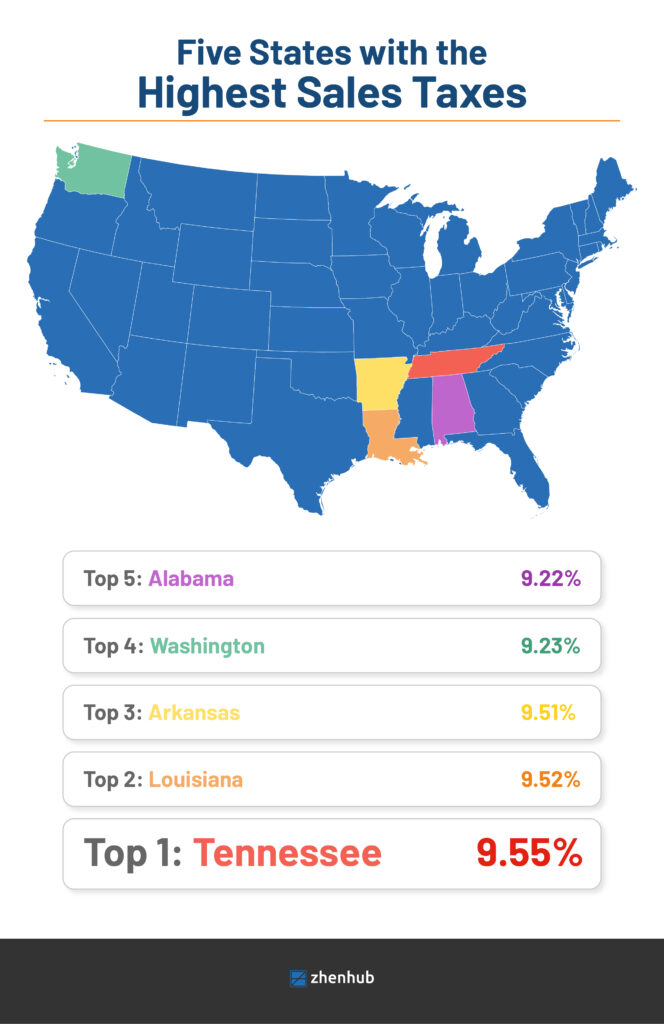

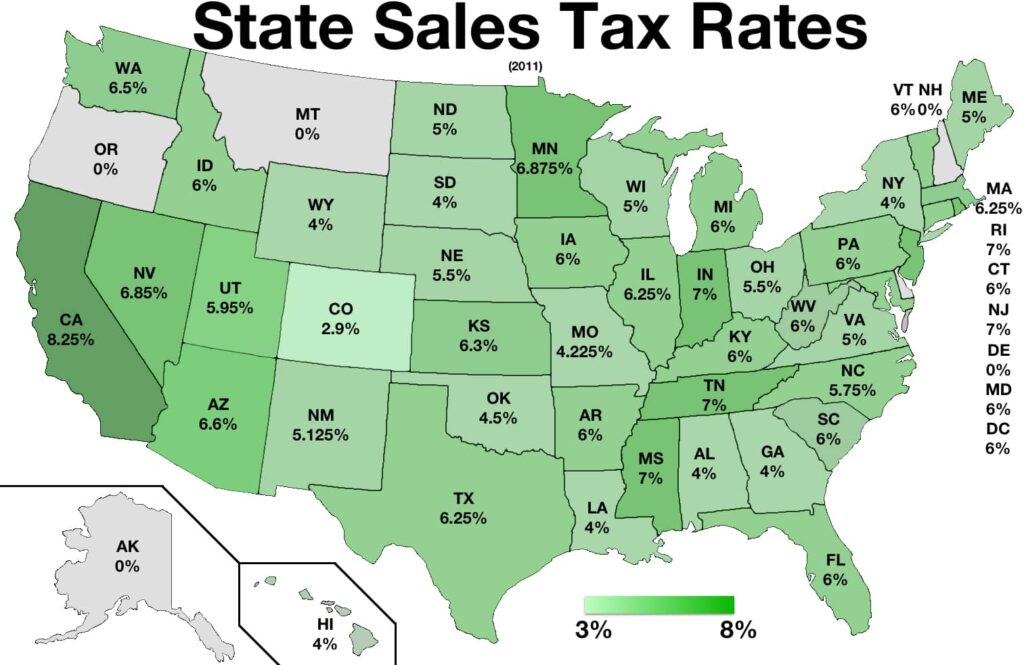

The amount of sales tax you’ll pay on your Purple mattress purchase will depend on the state in which you reside. Sales tax rates can vary significantly from state to state, with some states having no sales tax at all. It’s important to research the sales tax rate in your state to determine how much you can expect to pay on your Purple mattress purchase.State Sales Tax Rates for Purple Mattress Purchases

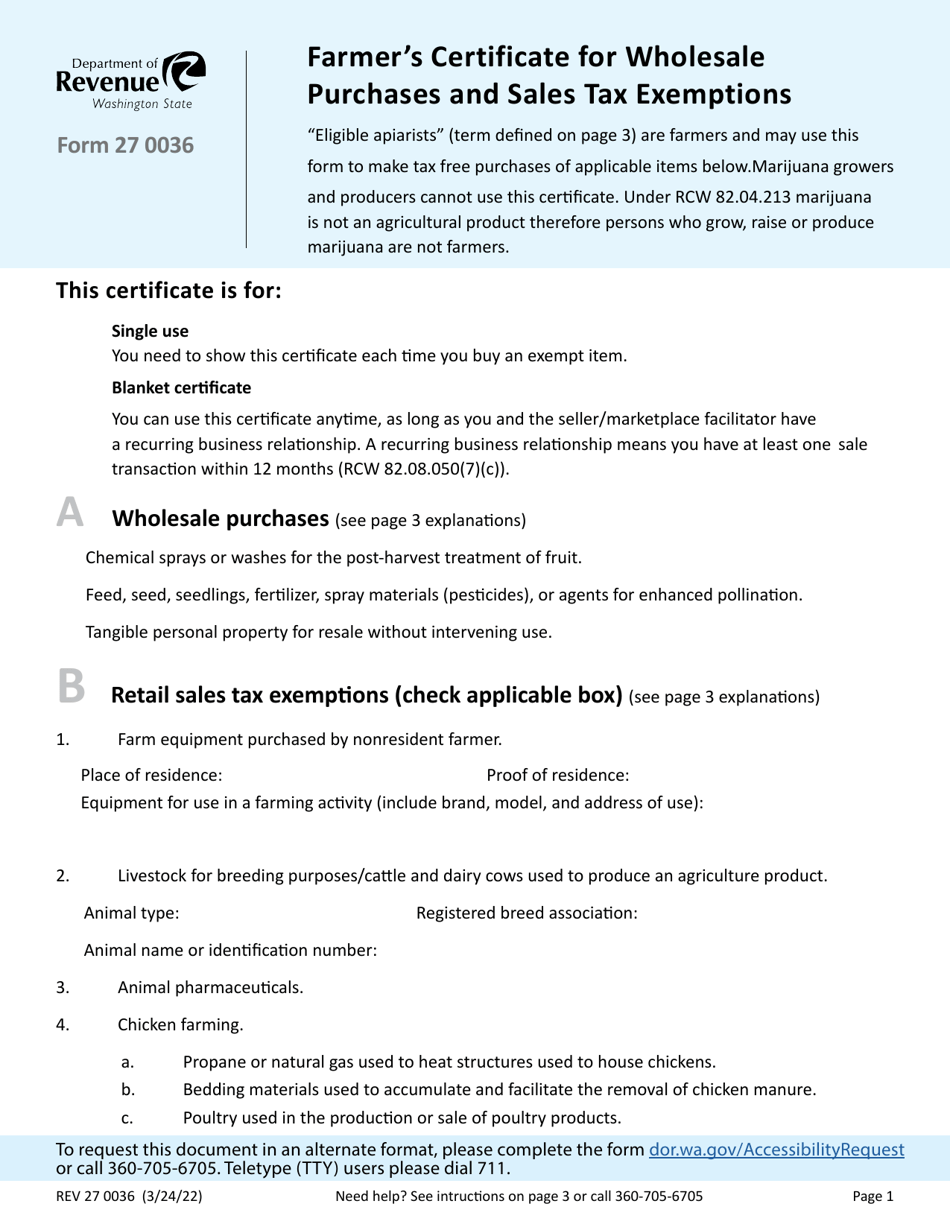

In some cases, there may be exemptions to sales tax on mattress purchases. For example, some states may offer a tax exemption for medical or therapeutic mattresses that are deemed necessary for a person’s health. However, these exemptions can vary by state, so it’s important to research your specific state’s laws to see if you qualify for any exemptions.Are There Any Exemptions to Sales Tax on Mattress Purchases?

If you are required to pay sales tax on your Purple mattress purchase, you will need to file and pay the tax to your state’s tax agency. This can typically be done through an online portal or by mail. It’s important to keep records of your purchase and any sales tax paid for potential tax deductions in the future.How to File Sales Tax for Your Purple Mattress Purchase

In some cases, you may be able to negotiate the sales tax on your Purple mattress purchase. This can be done by speaking with a sales representative and explaining your situation. For example, if you are purchasing a mattress for medical purposes, you may be able to negotiate a lower sales tax rate or exemption. It never hurts to ask, and you may be able to save some money in the process.Tips for Negotiating Sales Tax on a Purple Mattress

If you have the flexibility to purchase your Purple mattress from a different state, it’s worth comparing sales tax rates to see if you can save some money. As mentioned before, some states may not charge sales tax on mattresses, while others may have significantly lower rates. This can make a big difference in the overall cost of your purchase.Comparing Sales Tax Rates for Purple Mattress Purchases in Different States

If you want to avoid paying sales tax on your Purple mattress altogether, there are a few options. As mentioned before, you can purchase from a state with no sales tax on mattresses, but this may require some extra effort. Another option is to purchase a floor model or demo model from a retail store. These mattresses are often sold at a discounted price and may not be subject to sales tax.How to Avoid Paying Sales Tax on a Purple Mattress

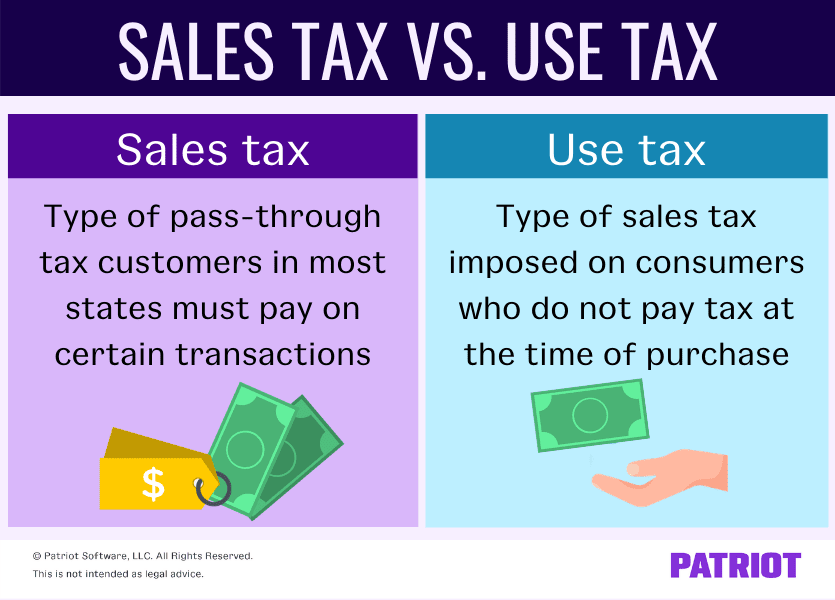

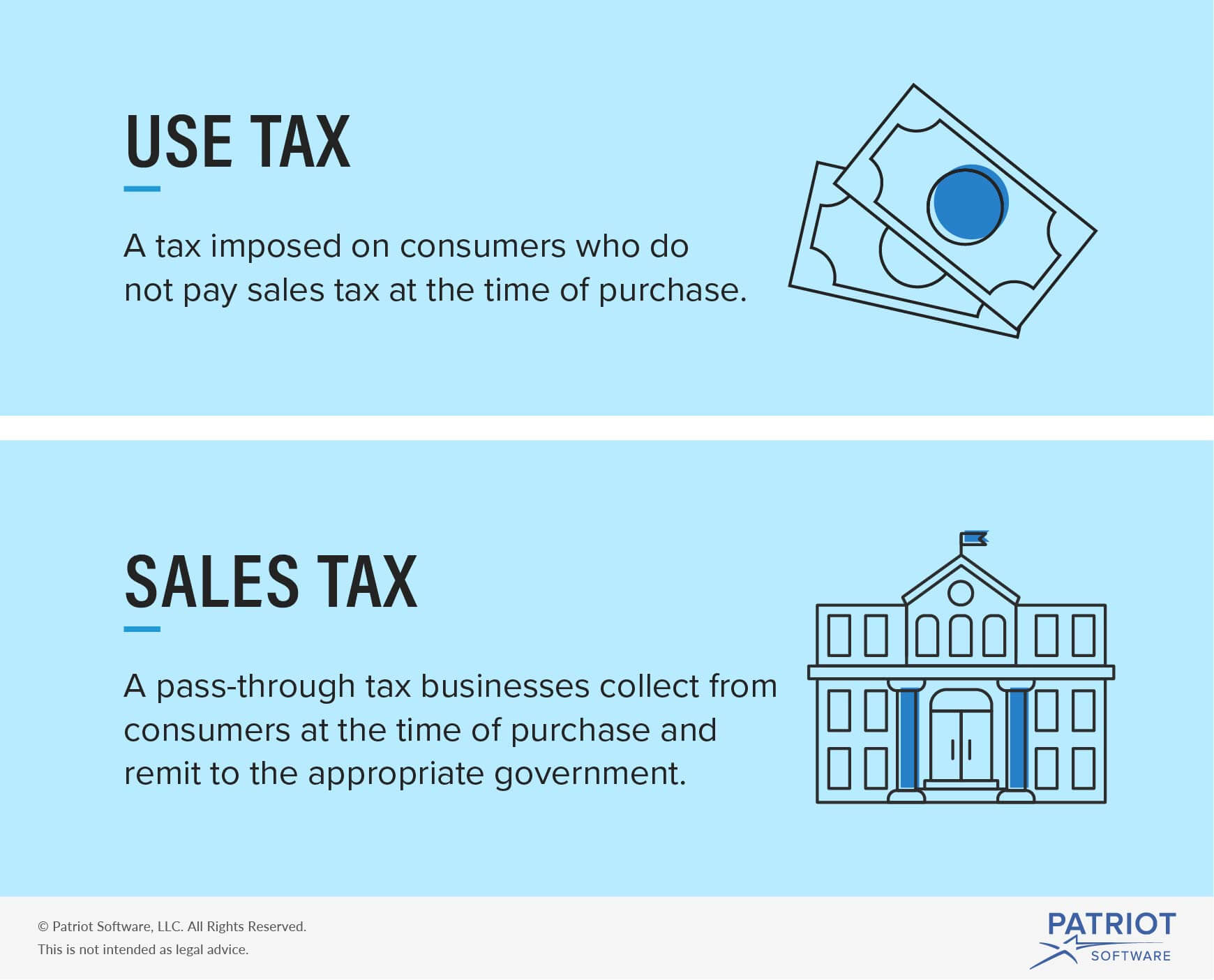

Finally, it’s important to understand the difference between sales tax and use tax for Purple mattress purchases. Sales tax is charged at the time of purchase, while use tax is a tax on the use or possession of a product. If you are required to pay use tax, it is typically paid to your state’s tax agency on your annual tax return. In conclusion, while sales tax may not be the most exciting aspect of purchasing a Purple mattress, it’s important to understand the implications and potential ways to save money. By doing your research and understanding your state’s laws, you can make an informed decision and potentially save some money on your purchase. Sweet dreams on your new Purple mattress!Understanding the Difference Between Sales Tax and Use Tax for Purple Mattress Purchases

Tax on Purple Mattress: How it Affects Your Home Design Budget

Understanding the Impact of Taxes on Home Design

When it comes to designing and decorating your home, budgeting is an essential factor to consider. You want to create a beautiful and functional space without breaking the bank. However, it's important to note that the cost of home design goes beyond just the price of furniture and décor. Taxes can also have a significant impact on your budget, especially when it comes to big-ticket items like mattresses.

Purple mattresses

have become increasingly popular in recent years due to their unique design and comfort. However, many consumers are surprised to find out that there is a

tax on Purple mattresses

in some states. This additional expense can significantly affect your budget and overall cost of home design.

When it comes to designing and decorating your home, budgeting is an essential factor to consider. You want to create a beautiful and functional space without breaking the bank. However, it's important to note that the cost of home design goes beyond just the price of furniture and décor. Taxes can also have a significant impact on your budget, especially when it comes to big-ticket items like mattresses.

Purple mattresses

have become increasingly popular in recent years due to their unique design and comfort. However, many consumers are surprised to find out that there is a

tax on Purple mattresses

in some states. This additional expense can significantly affect your budget and overall cost of home design.

The Different Types of Taxes on Purple Mattresses

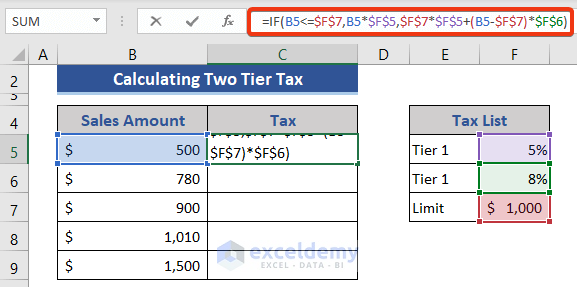

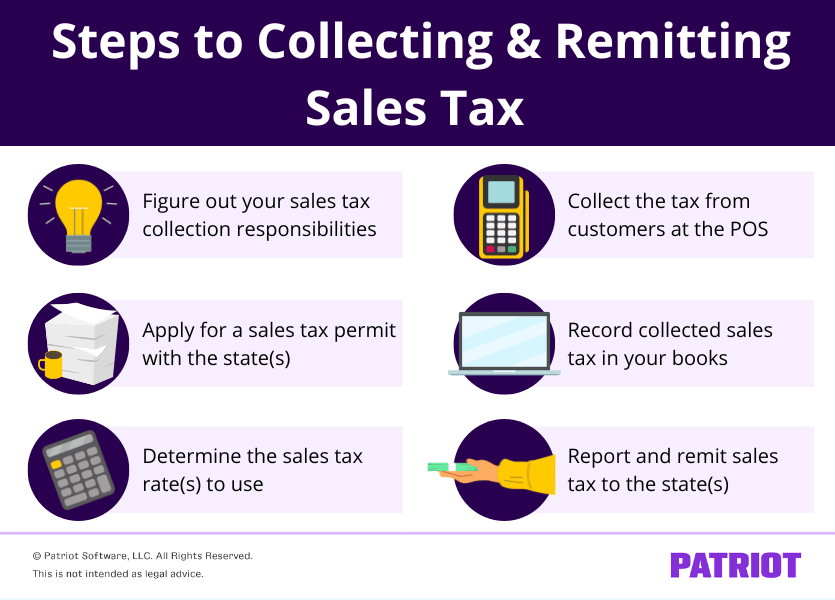

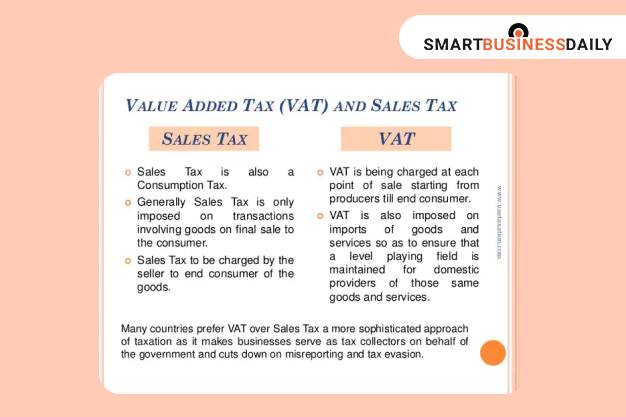

There are two main types of taxes that can apply to your Purple mattress purchase: sales tax and use tax. Sales tax is a percentage added to the retail price of a product at the time of purchase. This tax is based on the state and local tax rates and can vary depending on where you live. Use tax, on the other hand, is a tax on items purchased out of state and brought into your state for use.

Many states

have a sales tax on Purple mattresses, ranging from 4% to 10%. Some states, such as California and Maryland, also have a use tax on out-of-state purchases. This means that if you live in one of these states and purchase a Purple mattress online or from a retailer located outside of your state, you may still be responsible for paying the use tax.

There are two main types of taxes that can apply to your Purple mattress purchase: sales tax and use tax. Sales tax is a percentage added to the retail price of a product at the time of purchase. This tax is based on the state and local tax rates and can vary depending on where you live. Use tax, on the other hand, is a tax on items purchased out of state and brought into your state for use.

Many states

have a sales tax on Purple mattresses, ranging from 4% to 10%. Some states, such as California and Maryland, also have a use tax on out-of-state purchases. This means that if you live in one of these states and purchase a Purple mattress online or from a retailer located outside of your state, you may still be responsible for paying the use tax.

The Impact on Your Home Design Budget

The cost of taxes on Purple mattresses can add up quickly, especially if you live in a state with high tax rates. For example, if you purchase a $1,000 Purple mattress in California, you can expect to pay an additional $90 in sales tax. This may not seem like a significant amount, but when you factor in other home design expenses, such as furniture, décor, and renovations, these taxes can make a big difference in your overall budget.

It's important to consider these taxes

when planning out your home design budget. You may need to adjust your budget or prioritize certain purchases to accommodate for these additional expenses. It's also a good idea to research the tax rates in your state and consider purchasing from a retailer located within your state to avoid paying use tax.

The cost of taxes on Purple mattresses can add up quickly, especially if you live in a state with high tax rates. For example, if you purchase a $1,000 Purple mattress in California, you can expect to pay an additional $90 in sales tax. This may not seem like a significant amount, but when you factor in other home design expenses, such as furniture, décor, and renovations, these taxes can make a big difference in your overall budget.

It's important to consider these taxes

when planning out your home design budget. You may need to adjust your budget or prioritize certain purchases to accommodate for these additional expenses. It's also a good idea to research the tax rates in your state and consider purchasing from a retailer located within your state to avoid paying use tax.

In Conclusion

Taxes are an inevitable part of making any purchase, and home design is no exception. When it comes to

taxes on Purple mattresses

, it's crucial to be aware of the different types of taxes and how they can affect your budget. By understanding the impact of these taxes, you can make more informed decisions about your home design purchases and stay within your budget.

Taxes are an inevitable part of making any purchase, and home design is no exception. When it comes to

taxes on Purple mattresses

, it's crucial to be aware of the different types of taxes and how they can affect your budget. By understanding the impact of these taxes, you can make more informed decisions about your home design purchases and stay within your budget.