When it comes to purchasing a new mattress, many people opt for financing options to make the cost more manageable. One popular option is through Synchrony Bank, which partners with various retailers such as Mattress Firm. In this article, we will discuss the top 10 things you need to know about using Synchrony Bank for your Mattress Firm payments. Introduction

Synchrony Bank is a consumer financial services company that offers credit cards, loans, and other financing options for various retailers. It is a popular choice for mattress purchases because of its partnerships with major mattress retailers like Mattress Firm. Synchrony Bank

Mattress Firm is one of the largest mattress retailers in the United States, with over 2,500 locations nationwide. They offer a wide selection of mattresses from top brands, as well as bedding and furniture. Mattress Firm

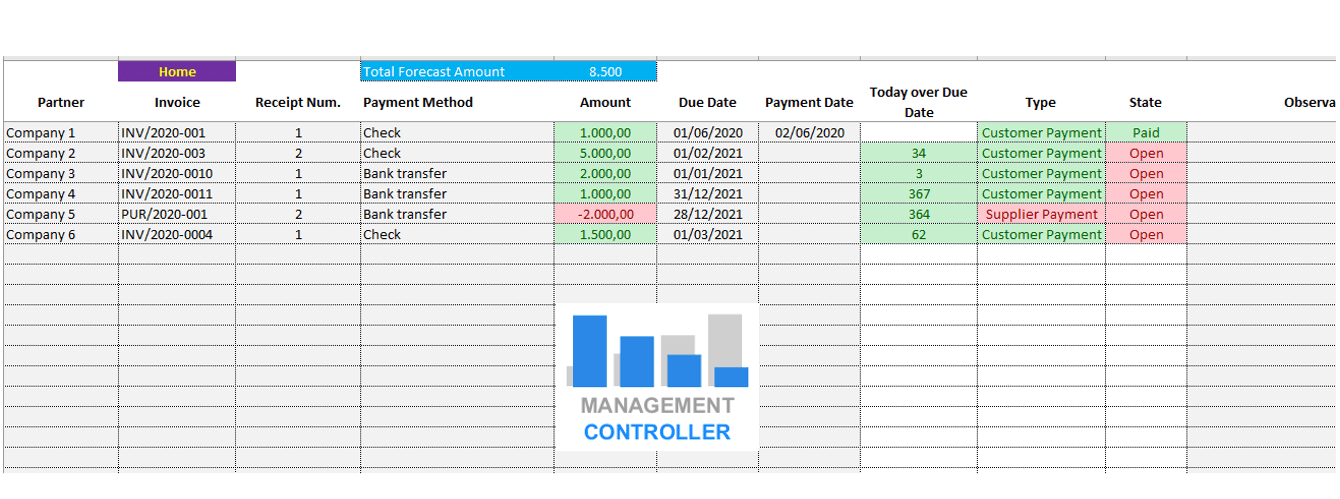

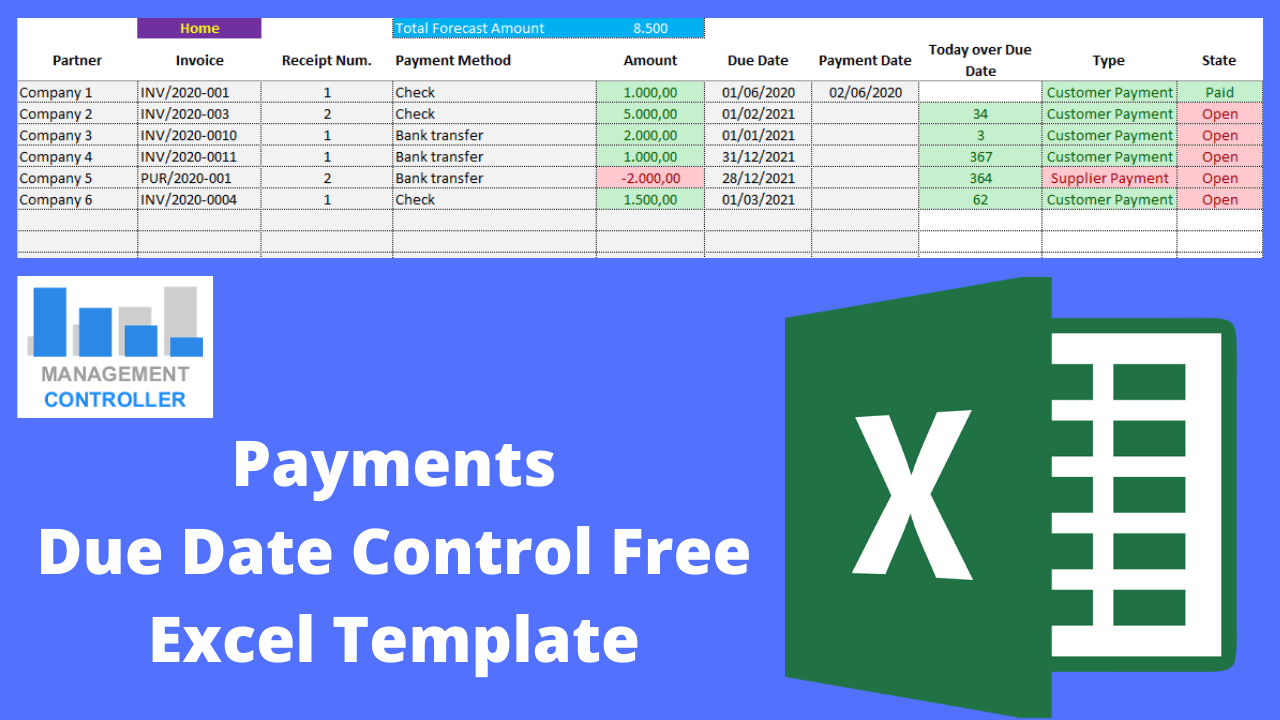

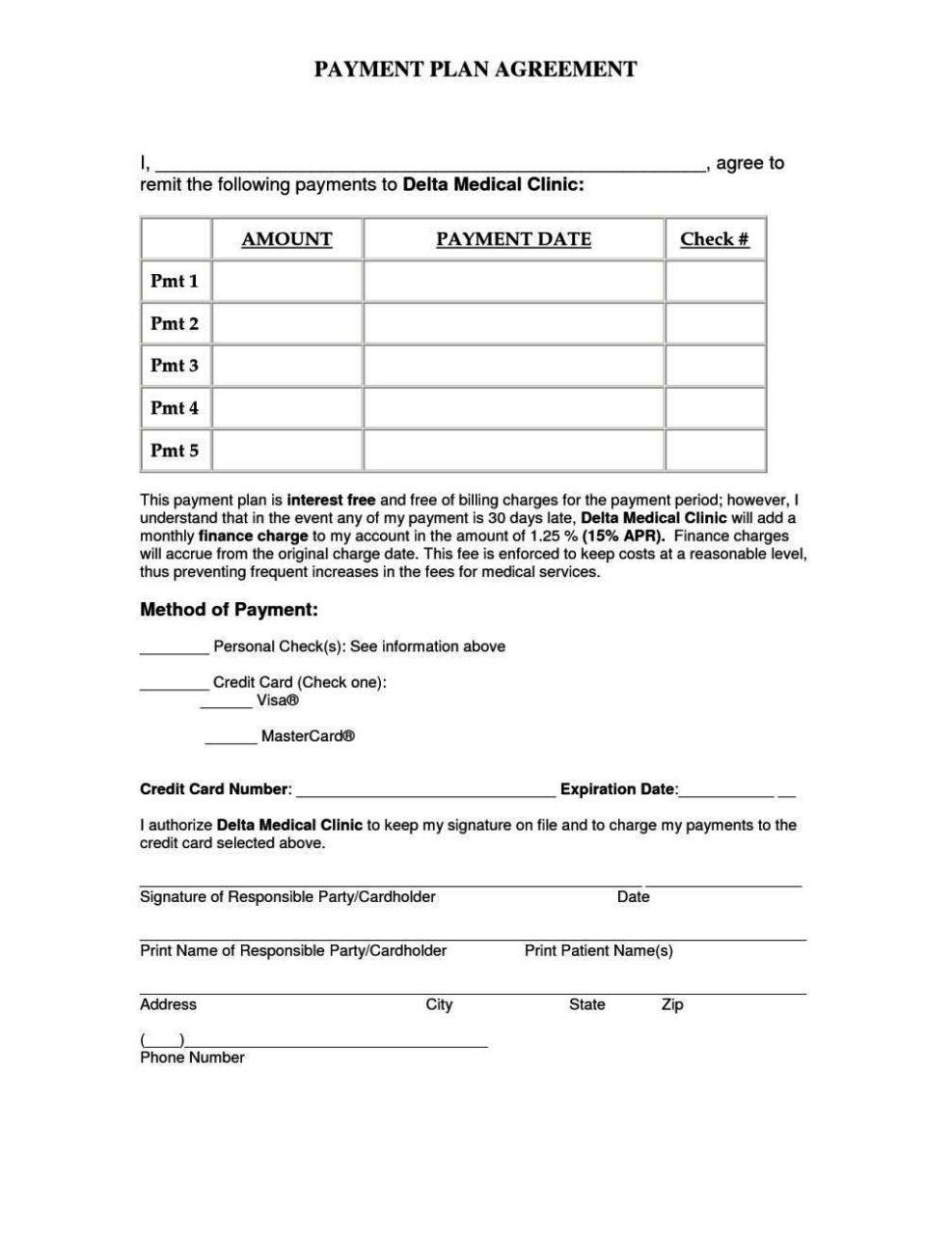

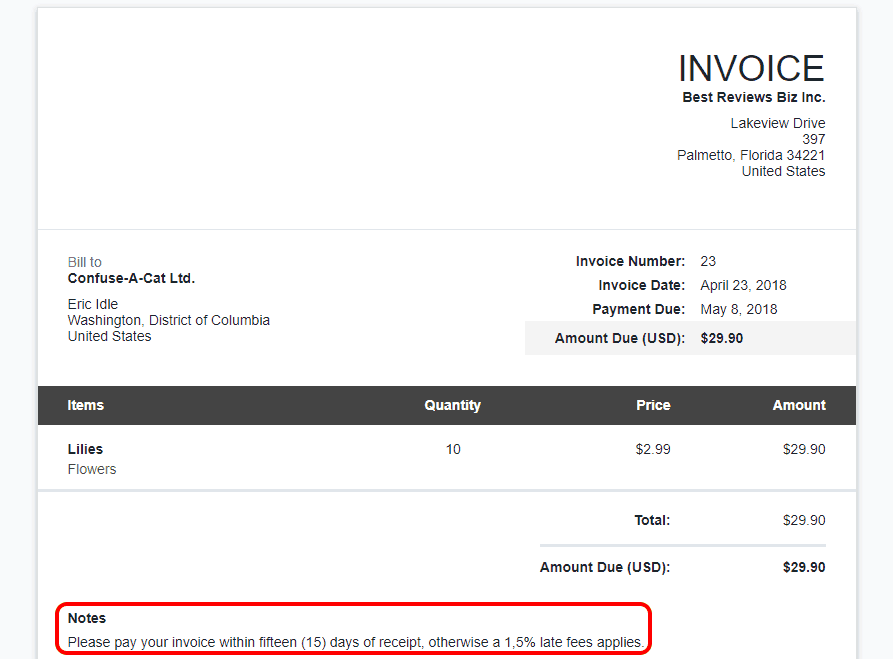

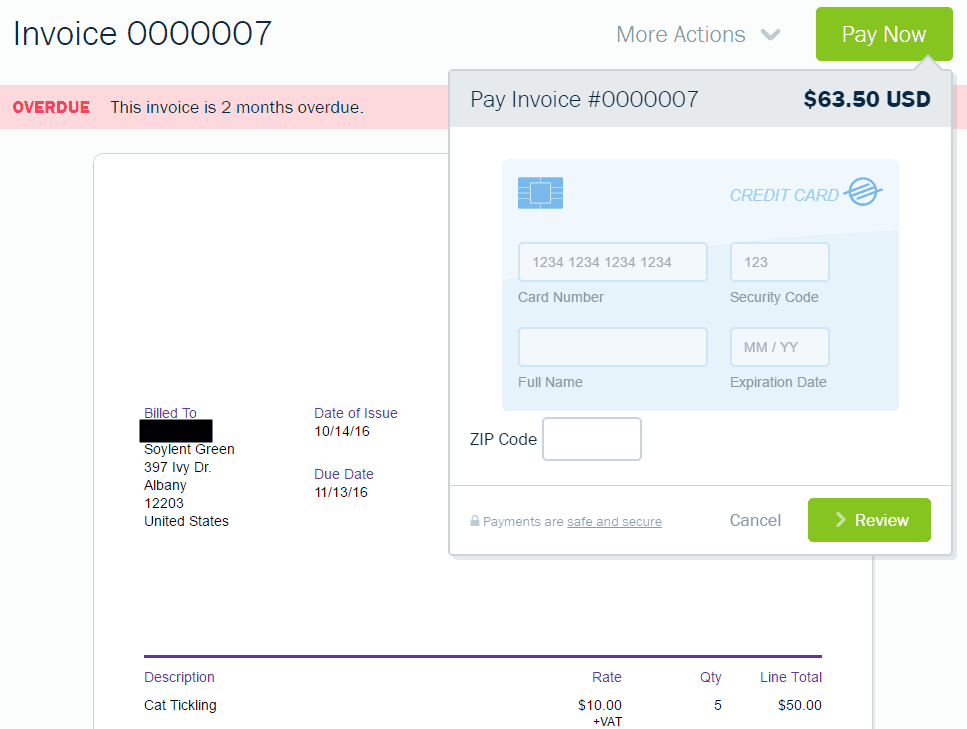

When financing a mattress through Synchrony Bank at Mattress Firm, you will make monthly payments towards the total cost of your purchase. These payments can be made online, through the Synchrony Bank website, or by mail. Payments

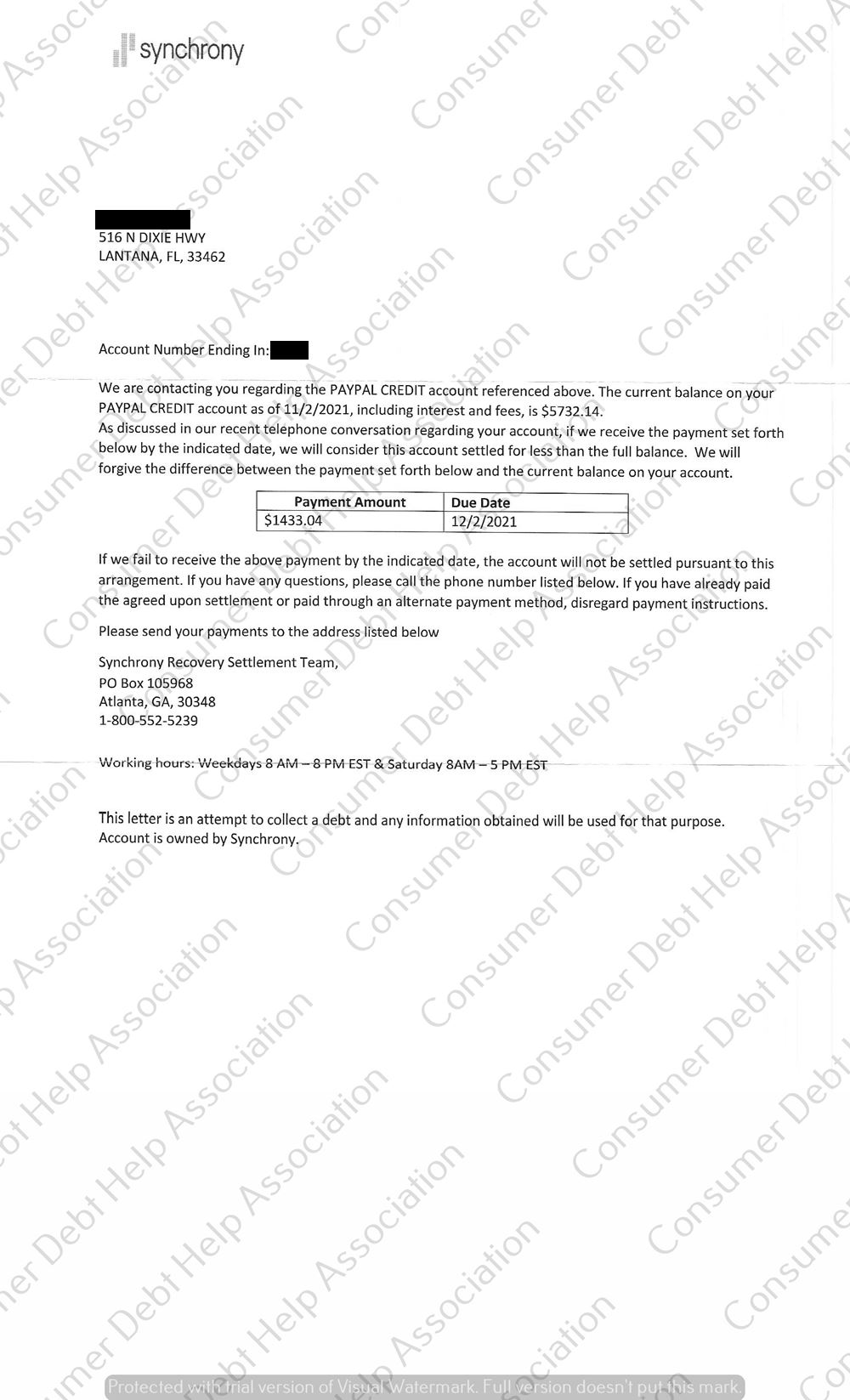

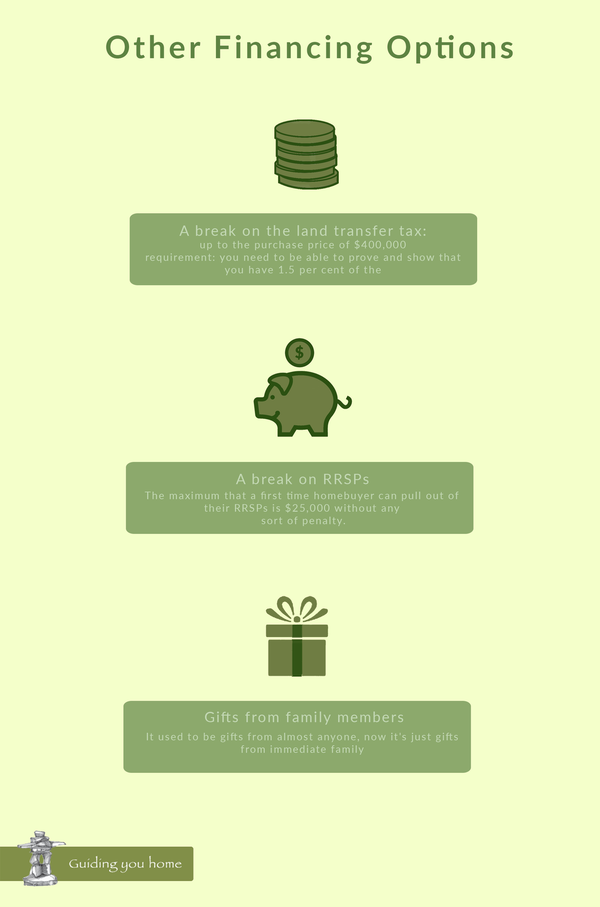

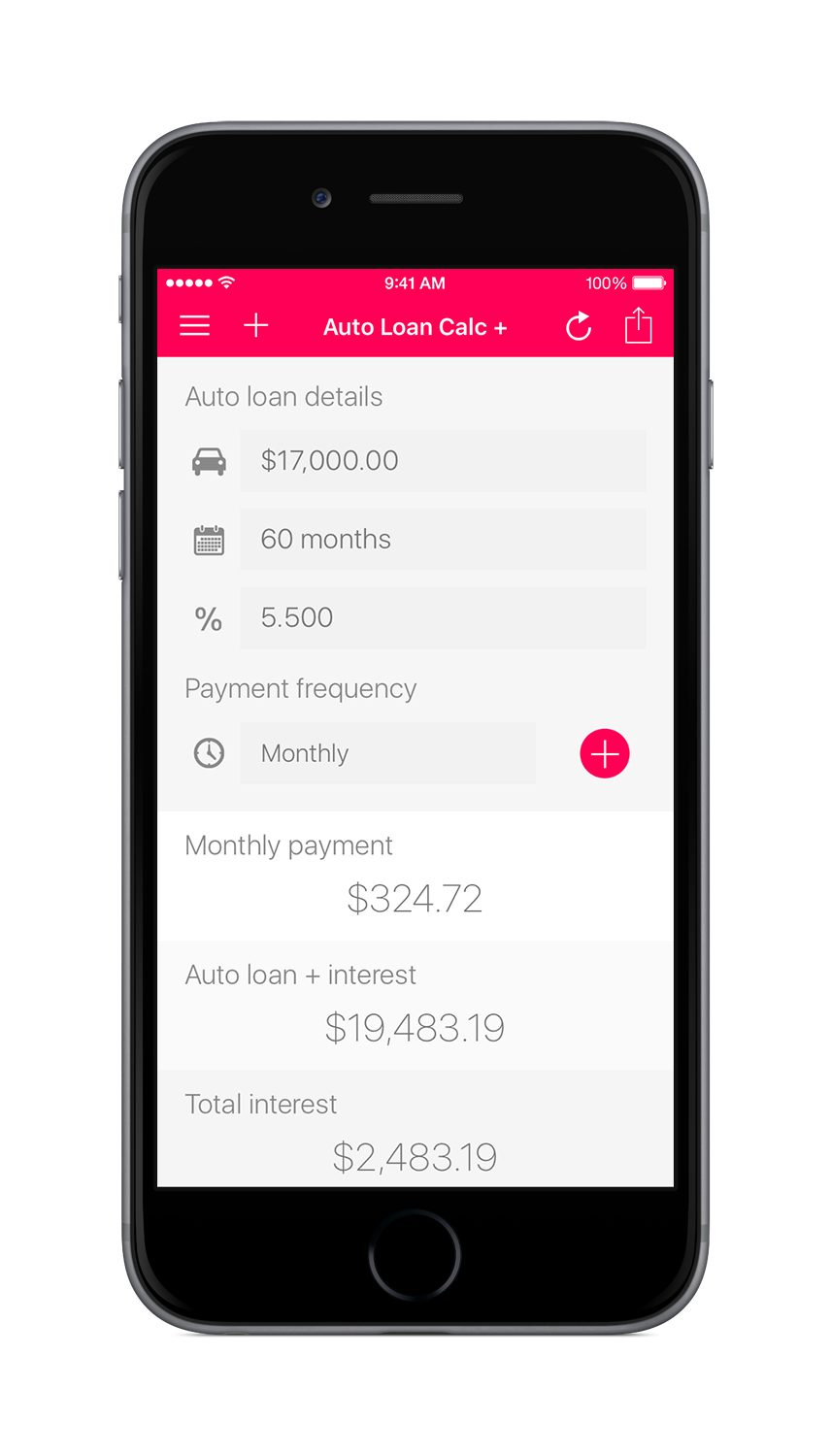

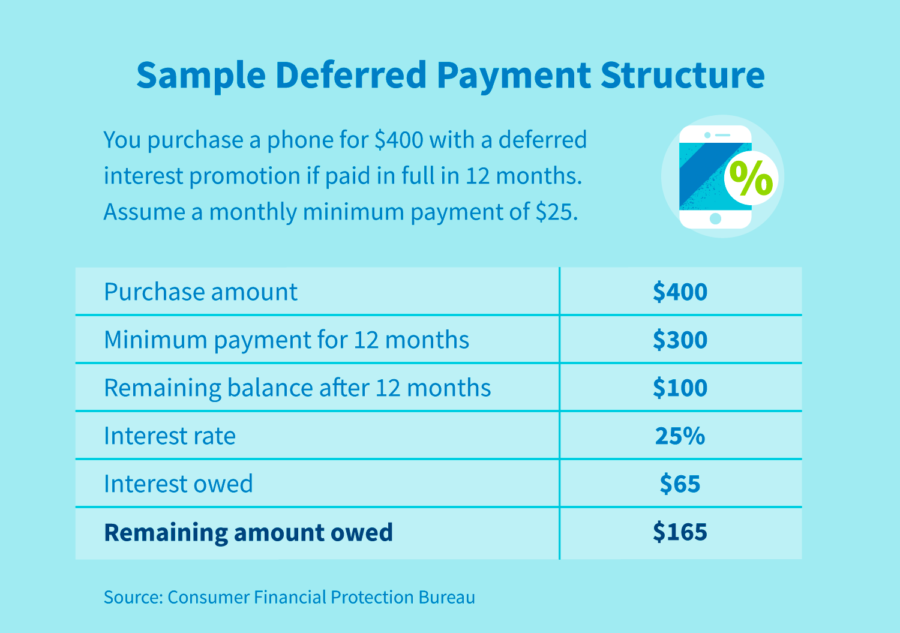

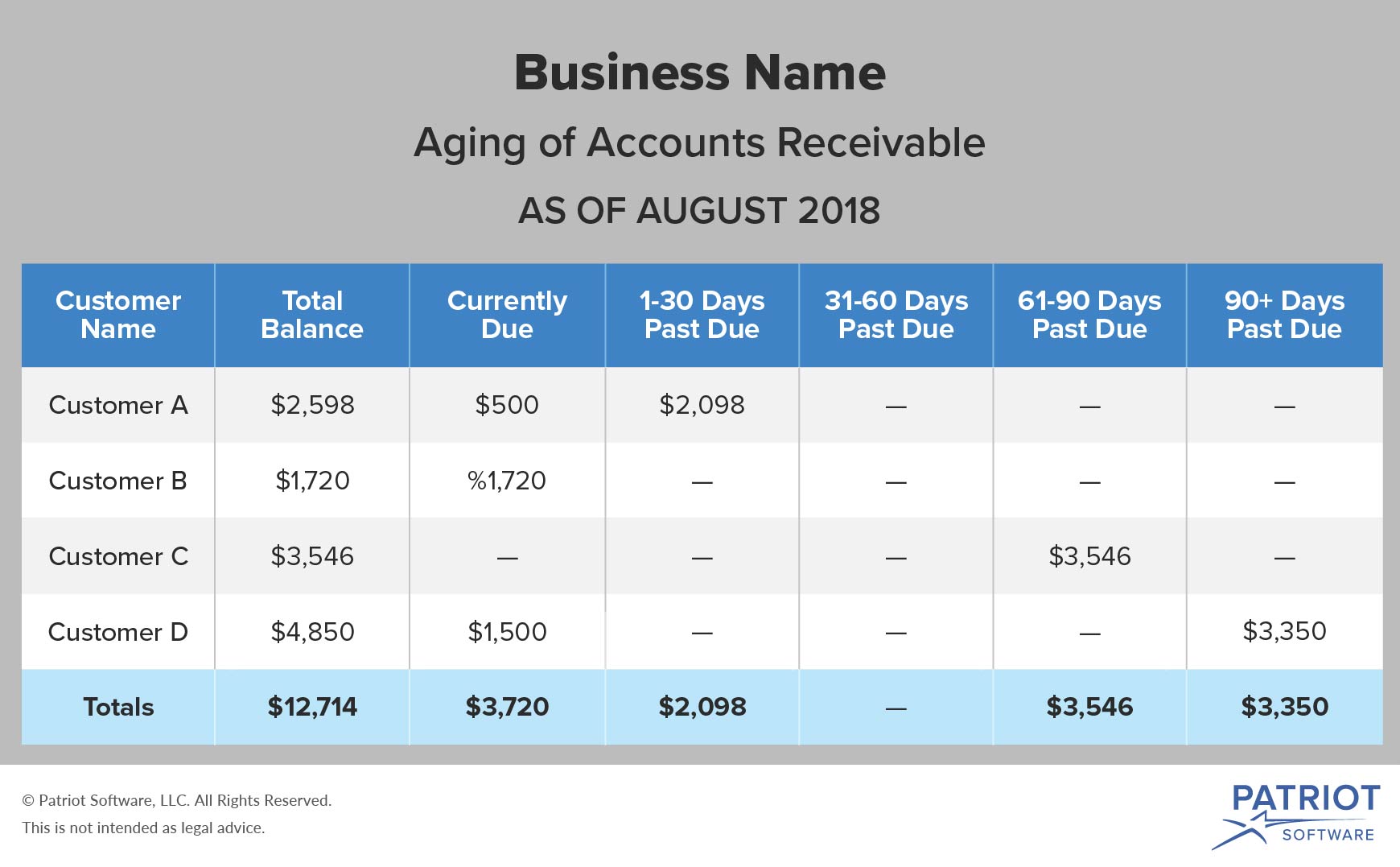

Synchrony Bank offers a variety of financing options for mattress purchases at Mattress Firm. These include 0% interest for a certain period, deferred interest, and fixed monthly payments. The financing options available may vary depending on your credit score and the current promotions at Mattress Firm. Financing Options

One of the benefits of using Synchrony Bank for your Mattress Firm payments is the ability to manage your account online. You can view your statements, make payments, and track your financing plan all in one place. Online Account Management

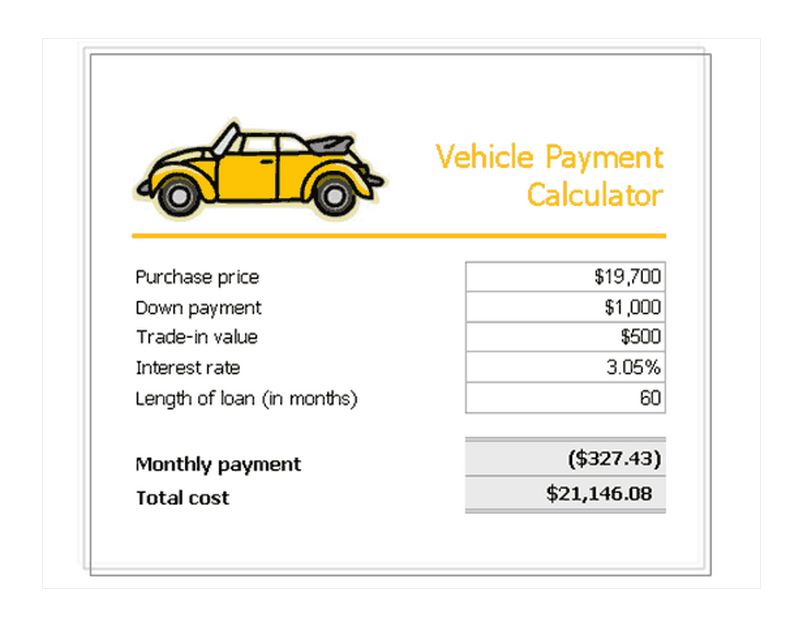

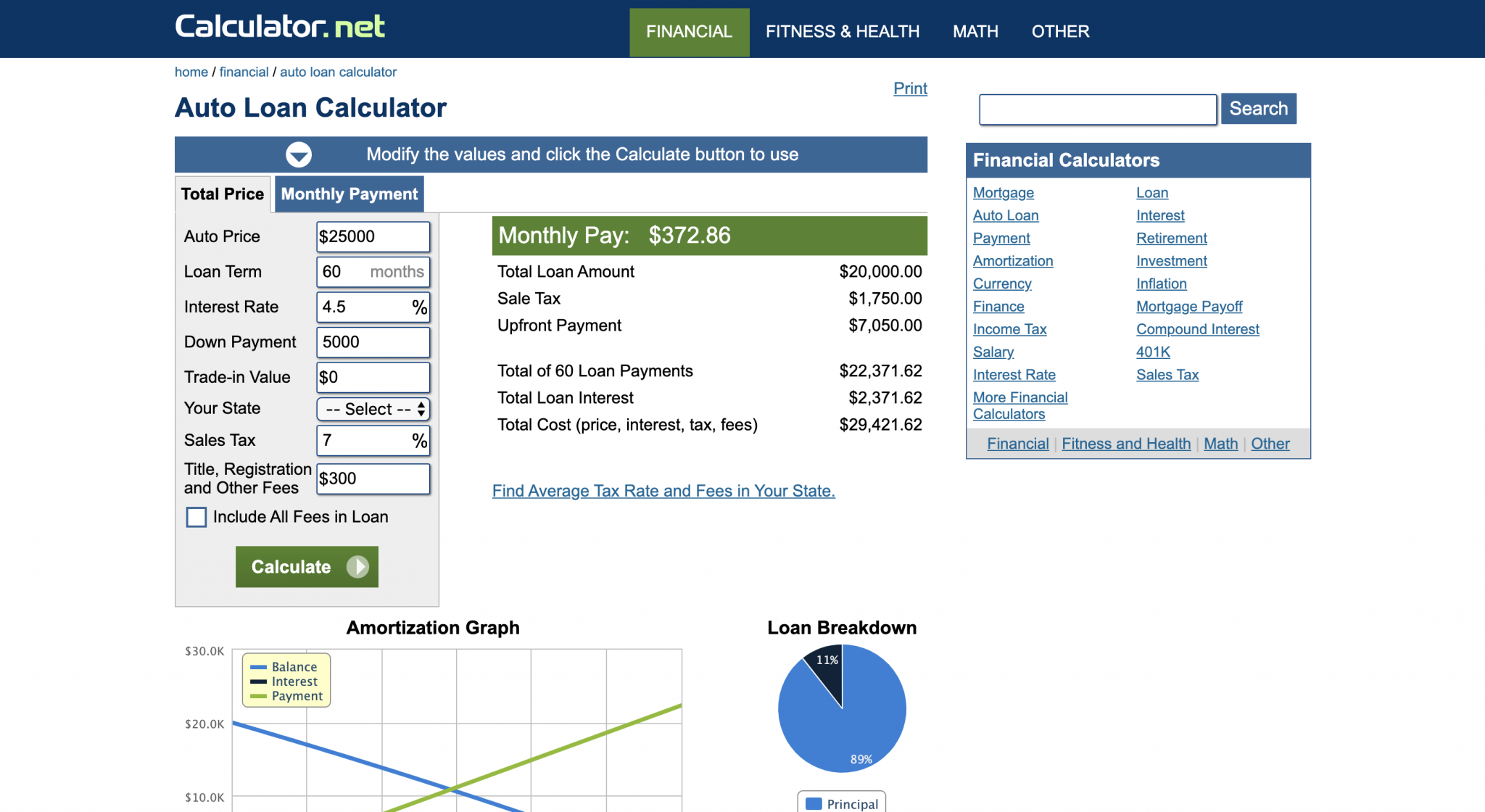

Synchrony Bank has a payment calculator on their website to help you determine how much your monthly payments will be based on your financing plan. This can be a useful tool when budgeting for your mattress purchase at Mattress Firm. Payment Calculator

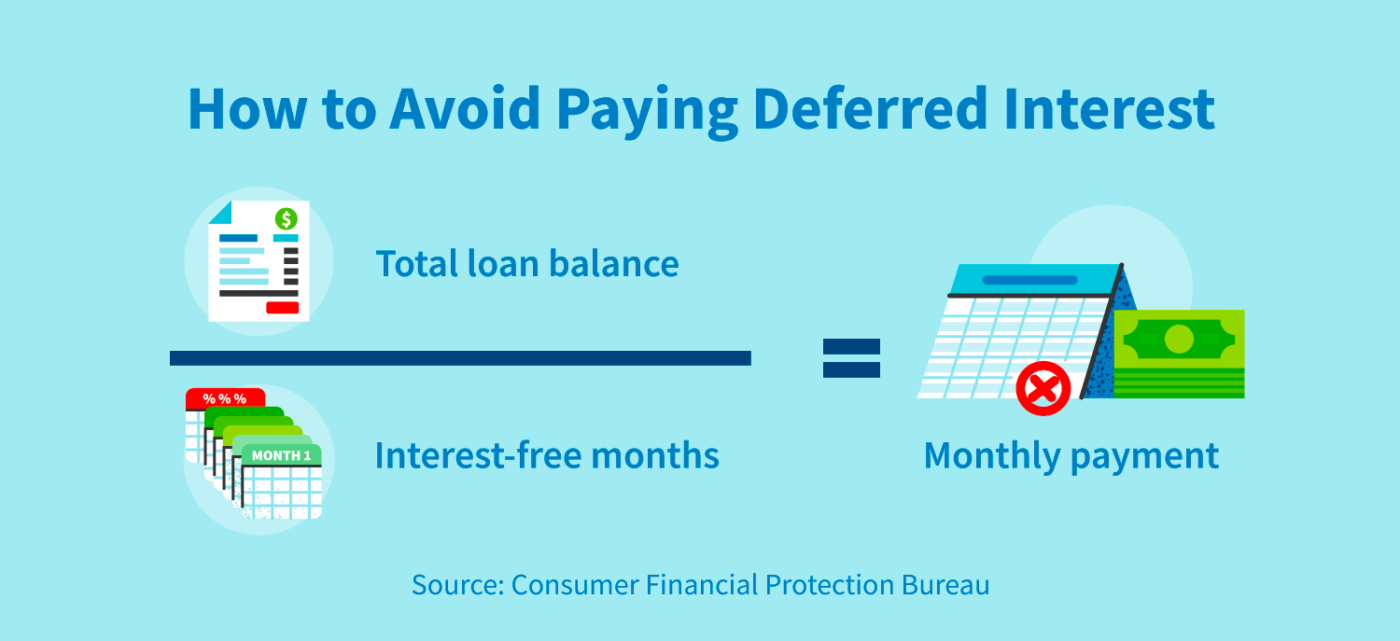

One financing option offered by Synchrony Bank is deferred interest. This means that you will not be charged any interest on your purchase as long as you make your monthly payments on time and pay off the total balance before the promotional period ends. Deferred Interest

If you miss a payment or are late on your monthly payment, Synchrony Bank may charge you a late payment fee. This fee can vary depending on the terms of your financing plan, so it is important to make your payments on time to avoid any additional charges. Late Payment Fees

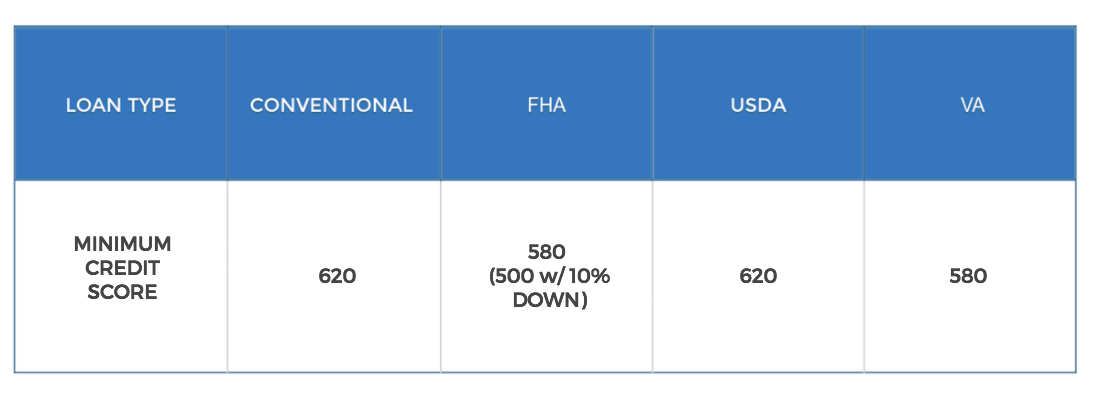

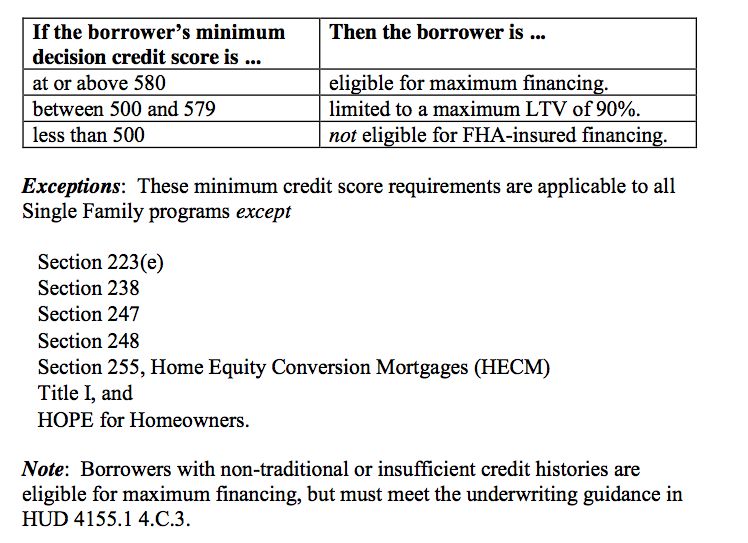

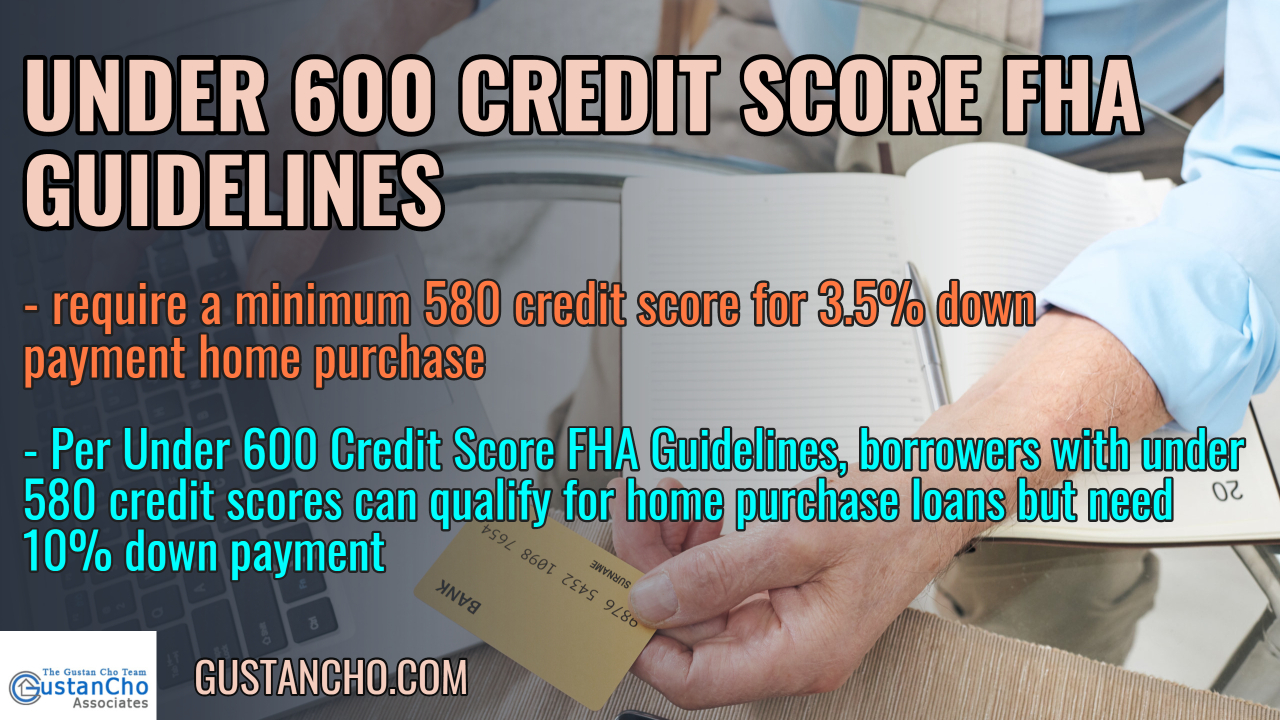

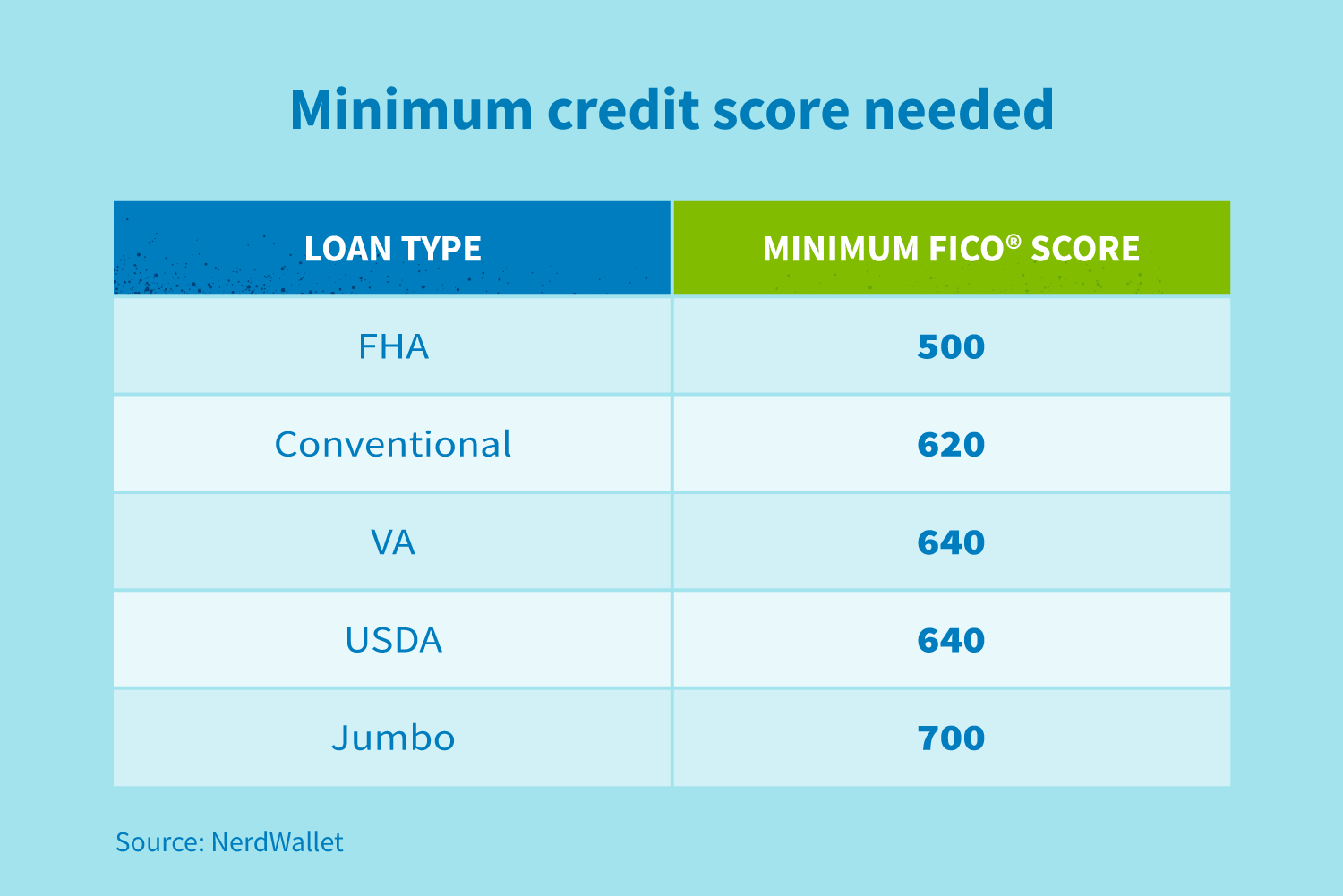

Synchrony Bank may require a certain credit score in order to be approved for financing at Mattress Firm. It is important to check your credit score before applying to make sure you meet the requirements. Credit Score Requirements

Synchrony Bank and Mattress Firm: Making Payments Easier for Your Dream Mattress

Why Choose Synchrony Bank?

Synchrony Bank is a premier consumer financial services company that specializes in providing payment solutions for major retailers, including Mattress Firm. With over 80 years of experience in the industry, Synchrony Bank is known for its innovative and secure payment options, making it a trusted partner for millions of Americans.

Synchrony Bank is a premier consumer financial services company that specializes in providing payment solutions for major retailers, including Mattress Firm. With over 80 years of experience in the industry, Synchrony Bank is known for its innovative and secure payment options, making it a trusted partner for millions of Americans.

Convenience at Your Fingertips

Gone are the days of standing in long lines or mailing checks for your monthly mattress payments. With Synchrony Bank, you can conveniently manage and make

online payments

for your Mattress Firm purchases. Simply log into your account on the Synchrony Bank website or download the mobile app and easily make payments at your own convenience.

Gone are the days of standing in long lines or mailing checks for your monthly mattress payments. With Synchrony Bank, you can conveniently manage and make

online payments

for your Mattress Firm purchases. Simply log into your account on the Synchrony Bank website or download the mobile app and easily make payments at your own convenience.

Flexible Payment Plans

Synchrony Bank offers a wide range of flexible payment plans to suit your budget and needs. Whether you prefer to pay in full or spread out your payments over time, Synchrony Bank has options for you. Plus, with competitive

interest rates

, you can easily manage your payments without breaking the bank.

Synchrony Bank offers a wide range of flexible payment plans to suit your budget and needs. Whether you prefer to pay in full or spread out your payments over time, Synchrony Bank has options for you. Plus, with competitive

interest rates

, you can easily manage your payments without breaking the bank.

Secure and Reliable

At Synchrony Bank, the security of your personal and financial information is of utmost importance. That's why they use the latest

encryption technology

to ensure your data is protected. You can rest easy knowing that your payments and personal information are in safe hands.

At Synchrony Bank, the security of your personal and financial information is of utmost importance. That's why they use the latest

encryption technology

to ensure your data is protected. You can rest easy knowing that your payments and personal information are in safe hands.

Exclusive Financing Offers

As a Mattress Firm customer, you can take advantage of exclusive financing offers through Synchrony Bank. These offers may include

zero percent interest

for a set period of time or special financing options for larger purchases. With these offers, you can get your dream mattress without the added stress of high interest rates.

In conclusion, Synchrony Bank and Mattress Firm make a great team when it comes to providing easy and convenient payment options for your new mattress. With their secure and flexible payment plans, you can finally get the good night's sleep you deserve. So why wait? Start making your payments with Synchrony Bank today and sleep soundly on your new Mattress Firm mattress.

As a Mattress Firm customer, you can take advantage of exclusive financing offers through Synchrony Bank. These offers may include

zero percent interest

for a set period of time or special financing options for larger purchases. With these offers, you can get your dream mattress without the added stress of high interest rates.

In conclusion, Synchrony Bank and Mattress Firm make a great team when it comes to providing easy and convenient payment options for your new mattress. With their secure and flexible payment plans, you can finally get the good night's sleep you deserve. So why wait? Start making your payments with Synchrony Bank today and sleep soundly on your new Mattress Firm mattress.

/synchrony_inv-04e10bc2d0ce451b932c26efc2c62fdf.png)

/GettyImages-470934762-dfeff177128a45e9b7f60bce8154e481.jpg)

(1).png)

:strip_icc()/payment-due-date-info-960750_FINAL-18d56a60e0c64eb986b06bd742509079.png)