Steinhoff International Holdings was once a leading retail conglomerate, with a presence in over 30 countries and a portfolio of well-known brands. However, in 2017, the company was hit by a major scandal that sent shockwaves throughout the business world. Here's a closer look at the story of Steinhoff and its subsidiary, Mattress Firm.Steinhoff International Holdings: The Rise and Fall of a Corporate Giant

In 2016, Steinhoff International Holdings acquired Mattress Firm, the largest mattress retailer in the United States. This move was part of Steinhoff's global expansion strategy, which aimed to diversify its operations and increase its market share. The acquisition was seen as a strategic move, as the mattress industry was considered to be recession-proof and had a steady demand.The Acquisition of Mattress Firm

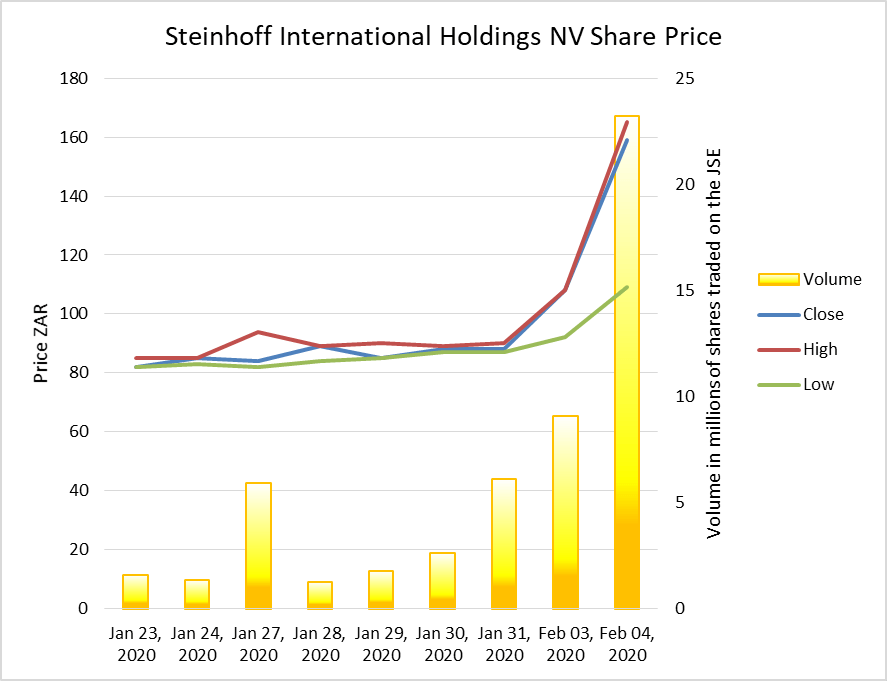

Less than a year after the acquisition, Steinhoff International Holdings was hit by a scandal that revealed massive accounting irregularities and financial misstatements. The company's stock plummeted, losing over 90% of its value in just a few days. The scandal also had a ripple effect on Mattress Firm, as its parent company's financial troubles affected its operations.The Steinhoff International Holdings Scandal

In 2018, Mattress Firm filed for bankruptcy, citing the financial troubles of its parent company as one of the main reasons. The company had over 3,200 stores at the time, and it announced plans to close around 700 stores as part of its restructuring efforts. The bankruptcy and store closures were a significant blow to the mattress industry, as Mattress Firm was a dominant player in the market.The Aftermath and Bankruptcy of Mattress Firm

In the aftermath of the scandal, numerous lawsuits were filed against Steinhoff International Holdings, including a class-action lawsuit by shareholders. The lawsuits alleged that the company had engaged in fraudulent accounting practices, which led to significant losses for investors. As of 2021, the legal proceedings are still ongoing, and the full extent of the financial damage caused by the scandal is yet to be determined.The Lawsuits Against Steinhoff International Holdings

After several years of turmoil, Steinhoff International Holdings is still struggling to recover. The company's stock price has not fully recovered, and its reputation has been severely damaged. In 2020, the company announced plans to restructure its debt and implement cost-cutting measures to improve its financial position. However, the effects of the scandal are still being felt, and it remains to be seen if Steinhoff can regain its former status as a corporate giant.The Future of Steinhoff International Holdings

The Steinhoff International Holdings scandal serves as a reminder of the importance of good corporate governance. The company's downfall was a result of poor oversight and lack of transparency, which allowed fraudulent activities to go undetected. The scandal also highlighted the need for companies to conduct thorough due diligence when making acquisitions and to have proper risk management protocols in place.The Lesson Learned: The Importance of Corporate Governance

The story of Steinhoff International Holdings and Mattress Firm is a cautionary tale of how quickly a company's fortunes can change. The scandal not only had a significant impact on the companies involved but also on the wider business community. It serves as a reminder that businesses must operate with integrity and transparency to maintain the trust of their stakeholders and avoid potential catastrophes. Only time will tell if Steinhoff can make a comeback and regain its former glory in the retail world.In Conclusion

The Importance of Quality Mattresses in House Design

Creating a Comfortable and Healthy Home

When it comes to designing a house, there are many elements to consider. From the layout and color scheme to furniture and décor, every detail plays a role in creating the perfect space. However, one aspect that is often overlooked is the quality of the mattresses we choose. A good night's sleep is vital for our overall health and well-being, and the right mattress can make all the difference. This is where Steinoff International Holdings and their subsidiary, Mattress Firm, come into play.

When it comes to designing a house, there are many elements to consider. From the layout and color scheme to furniture and décor, every detail plays a role in creating the perfect space. However, one aspect that is often overlooked is the quality of the mattresses we choose. A good night's sleep is vital for our overall health and well-being, and the right mattress can make all the difference. This is where Steinoff International Holdings and their subsidiary, Mattress Firm, come into play.

The Impact of Quality Mattresses on Our Health

It's no secret that lack of sleep can have a negative impact on our physical and mental health. It can lead to fatigue, mood swings, and even chronic health issues. This is why investing in a high-quality mattress is crucial for our overall well-being. Not only does a good mattress provide comfort and support for our bodies, but it also promotes proper spinal alignment, reduces pressure points, and helps to regulate body temperature. This means we can wake up feeling refreshed and rejuvenated, ready to take on the day.

Steinoff International Holdings

is a global retail company that specializes in home goods, including mattresses. With a strong focus on quality and innovation, they have become a trusted name in the industry. Their subsidiary,

Mattress Firm

, is the largest specialty mattress retailer in the United States, offering a wide range of top-quality mattresses from leading brands. This partnership allows customers to have access to the latest technology and advancements in mattress design.

It's no secret that lack of sleep can have a negative impact on our physical and mental health. It can lead to fatigue, mood swings, and even chronic health issues. This is why investing in a high-quality mattress is crucial for our overall well-being. Not only does a good mattress provide comfort and support for our bodies, but it also promotes proper spinal alignment, reduces pressure points, and helps to regulate body temperature. This means we can wake up feeling refreshed and rejuvenated, ready to take on the day.

Steinoff International Holdings

is a global retail company that specializes in home goods, including mattresses. With a strong focus on quality and innovation, they have become a trusted name in the industry. Their subsidiary,

Mattress Firm

, is the largest specialty mattress retailer in the United States, offering a wide range of top-quality mattresses from leading brands. This partnership allows customers to have access to the latest technology and advancements in mattress design.

Choosing the Right Mattress for Your Space

In addition to promoting better sleep and overall health, a high-quality mattress can also enhance the overall design of your home. With a variety of styles, materials, and sizes to choose from, you can find the perfect mattress to complement your space. Whether you prefer a luxurious pillow-top or a sleek and modern memory foam, Steinoff International Holdings and Mattress Firm have you covered.

In conclusion, when designing your dream house, don't forget the importance of choosing a quality mattress. It's not just about comfort, but also about creating a healthy and inviting space. Trust in

Steinoff International Holdings

and

Mattress Firm

to provide you with the best options for your home. Invest in a good night's sleep and see the positive impact it has on your life.

In addition to promoting better sleep and overall health, a high-quality mattress can also enhance the overall design of your home. With a variety of styles, materials, and sizes to choose from, you can find the perfect mattress to complement your space. Whether you prefer a luxurious pillow-top or a sleek and modern memory foam, Steinoff International Holdings and Mattress Firm have you covered.

In conclusion, when designing your dream house, don't forget the importance of choosing a quality mattress. It's not just about comfort, but also about creating a healthy and inviting space. Trust in

Steinoff International Holdings

and

Mattress Firm

to provide you with the best options for your home. Invest in a good night's sleep and see the positive impact it has on your life.

:max_bytes(150000):strip_icc()/lavender3-59d5677b685fbe0011f670f3.jpg)