If you are in the market for a new mattress, you might have come across the term "HSN code for spring mattress." But what exactly does this code mean and why is it important? In this article, we will delve into the world of HSN codes and how they apply to spring mattresses.HSN Code for Spring Mattress

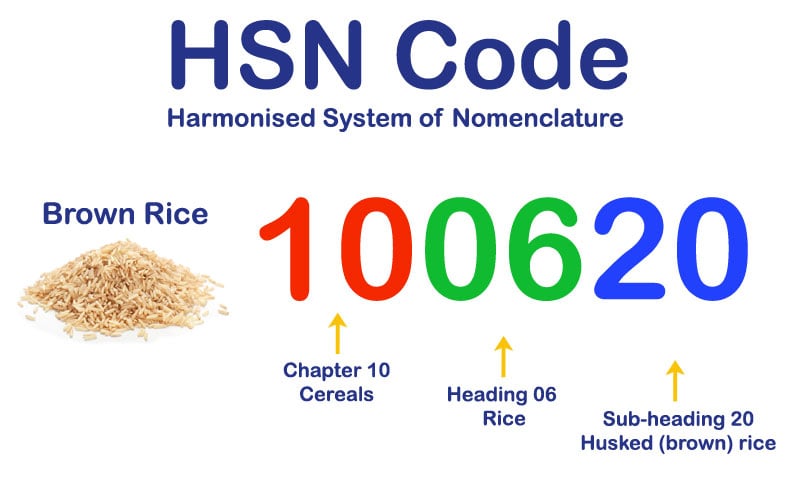

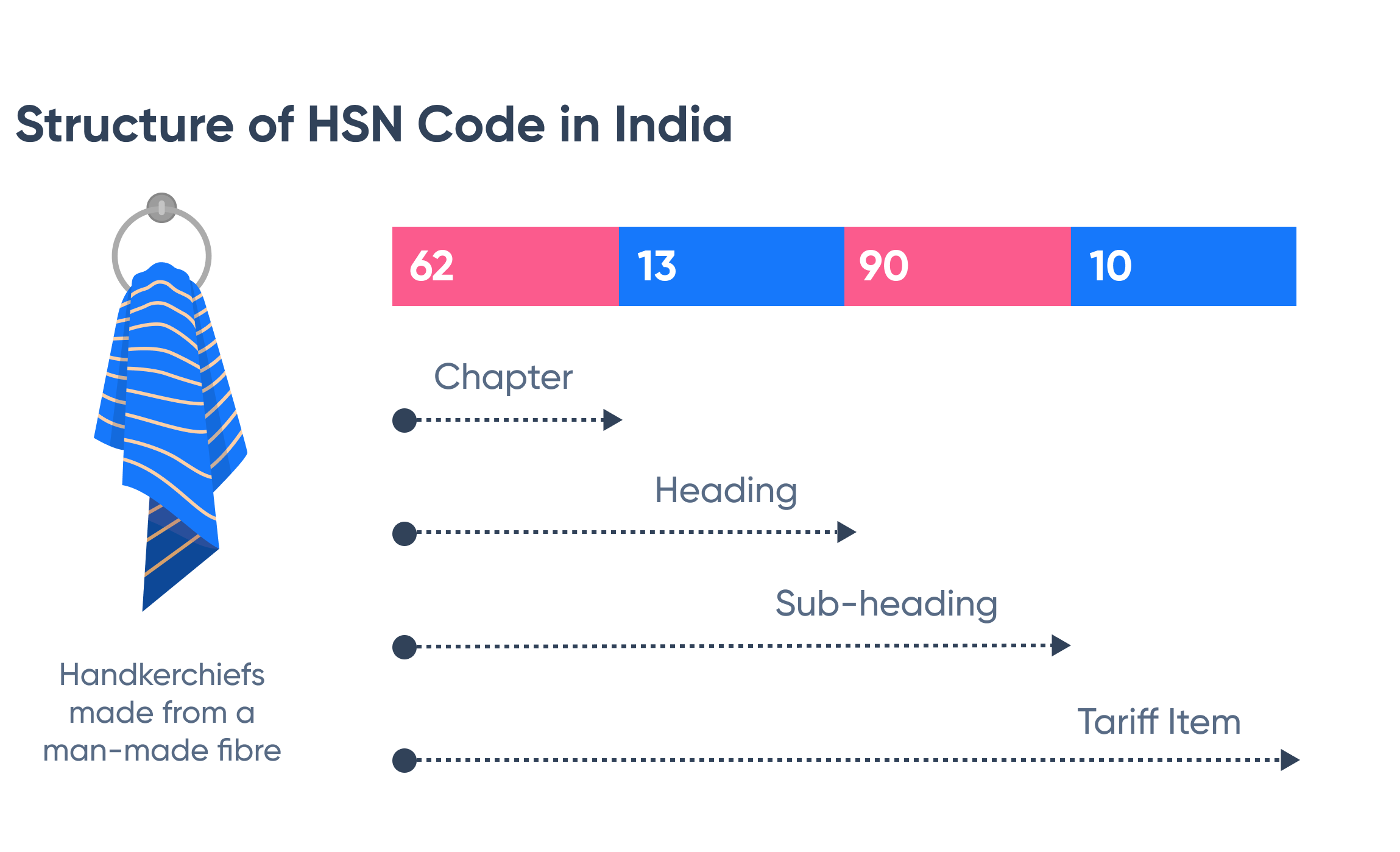

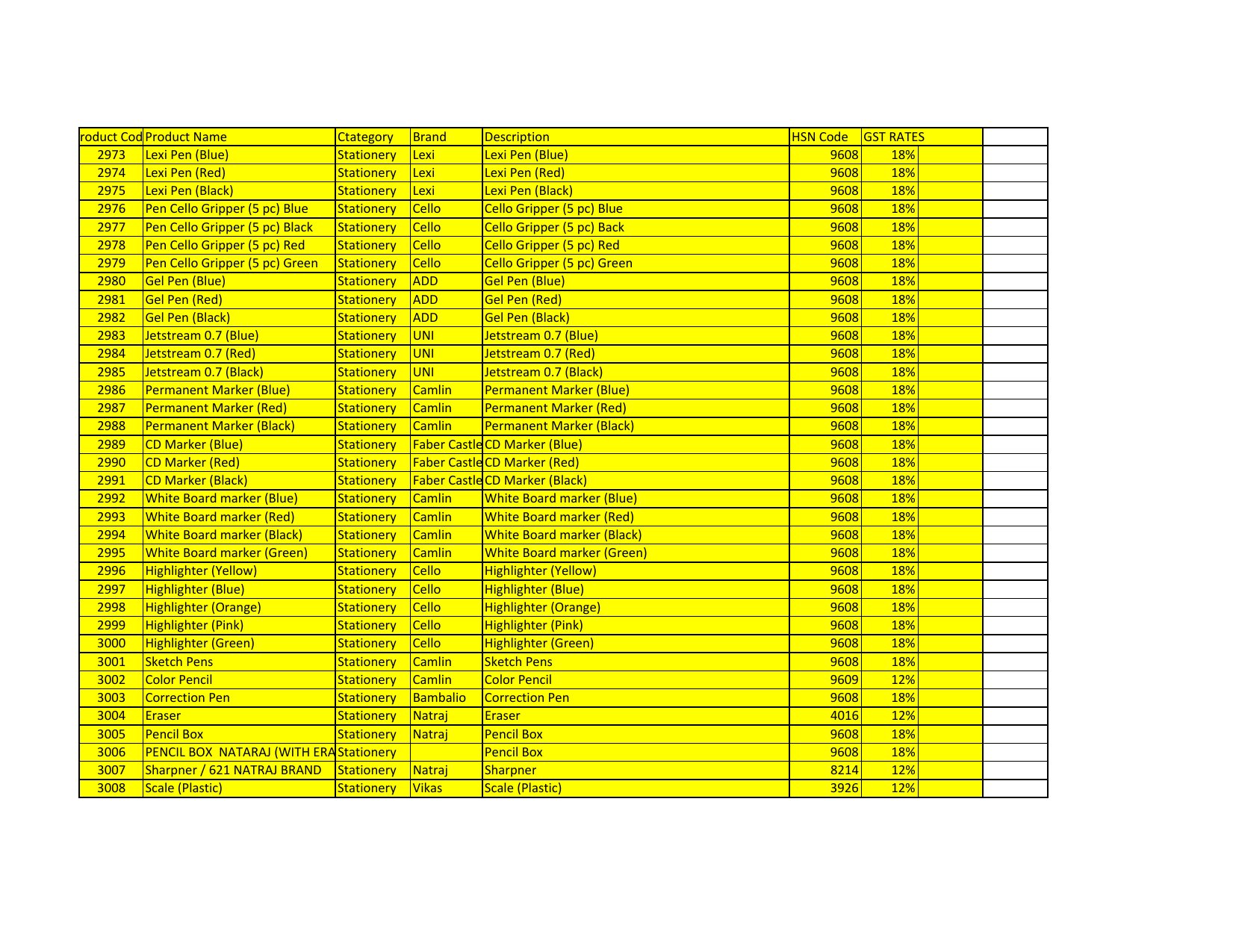

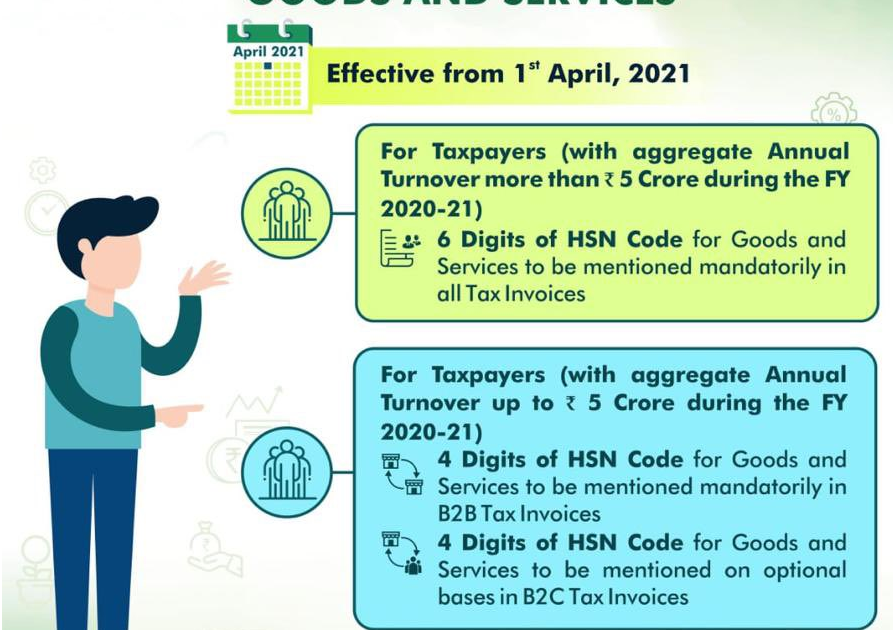

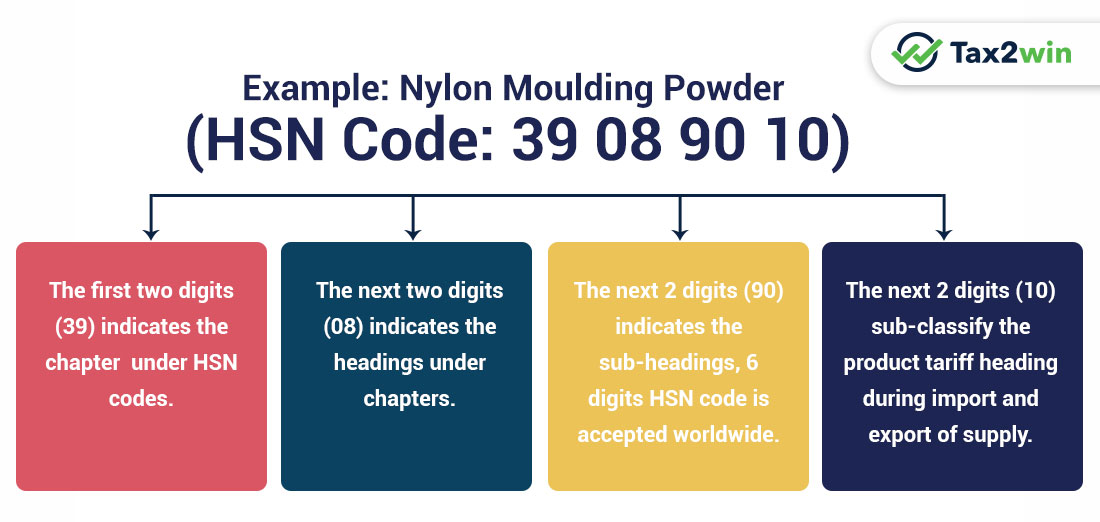

Before we dive into the specifics of HSN codes for spring mattresses, let's first understand what an HSN code is. HSN stands for Harmonized System of Nomenclature and is a code used to classify goods in the international trade market. These codes are used to streamline the process of importing and exporting goods, and every product is assigned a unique HSN code based on its characteristics.HSN Code for Mattress

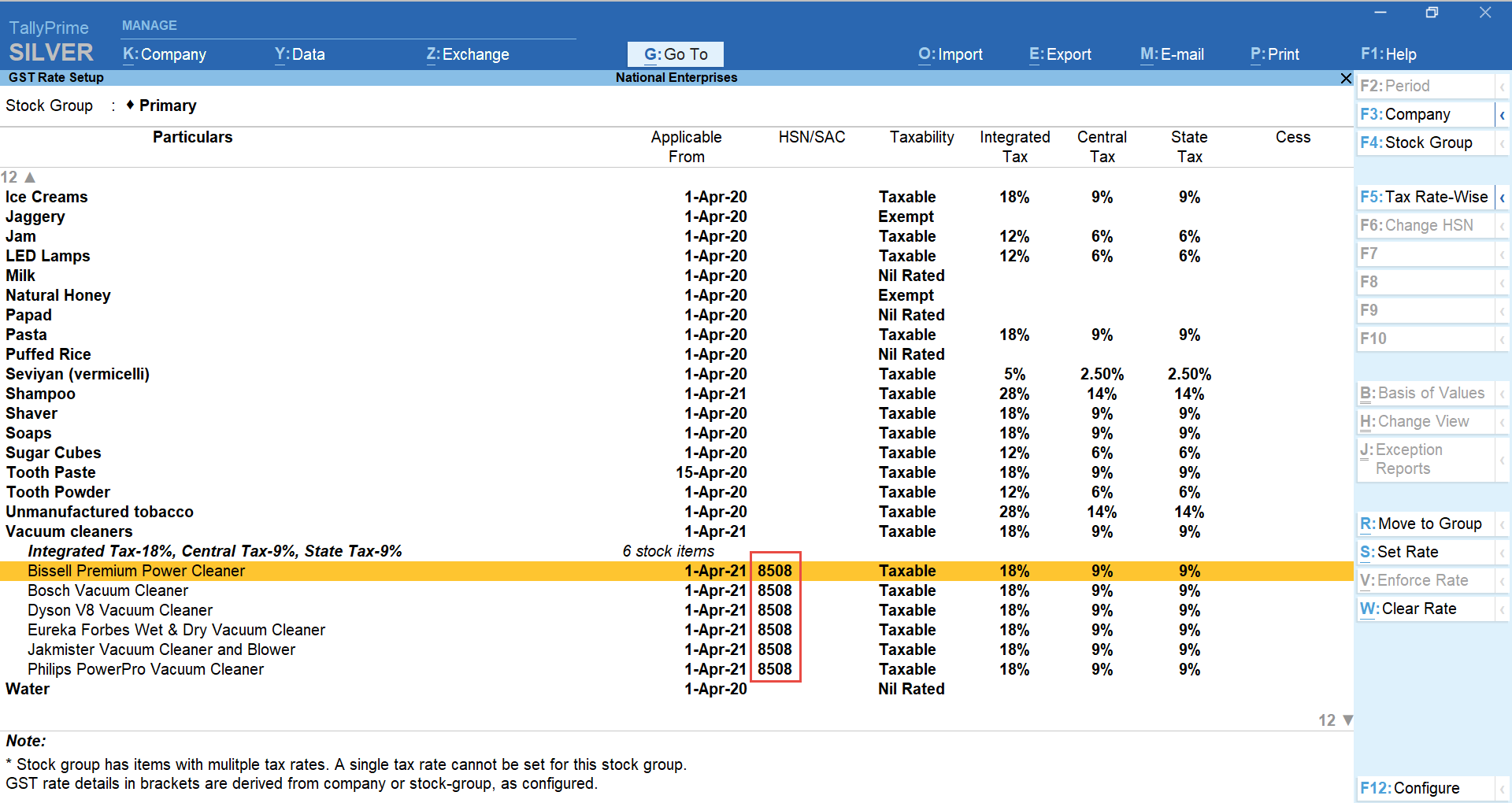

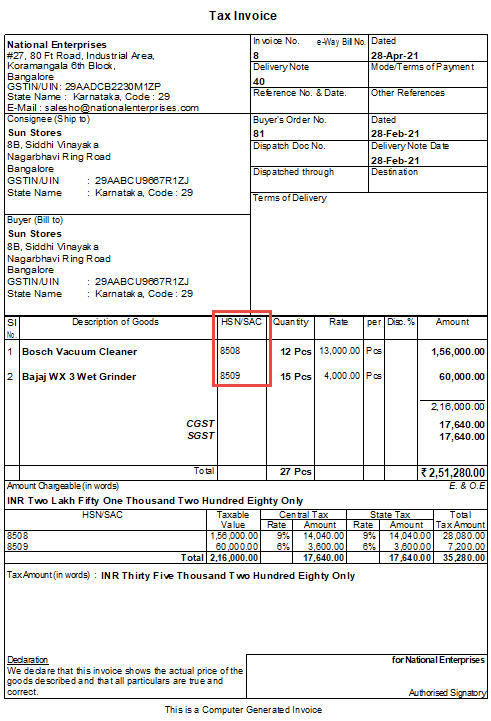

In India, the HSN code for spring mattresses falls under the category of "Furniture, bedding, mattresses, cushions, and similar stuffed furnishings." The HSN code for spring mattresses in India is 9404. This code covers all types of mattresses, including spring, foam, and coir mattresses.HSN Code for Spring Mattress in India

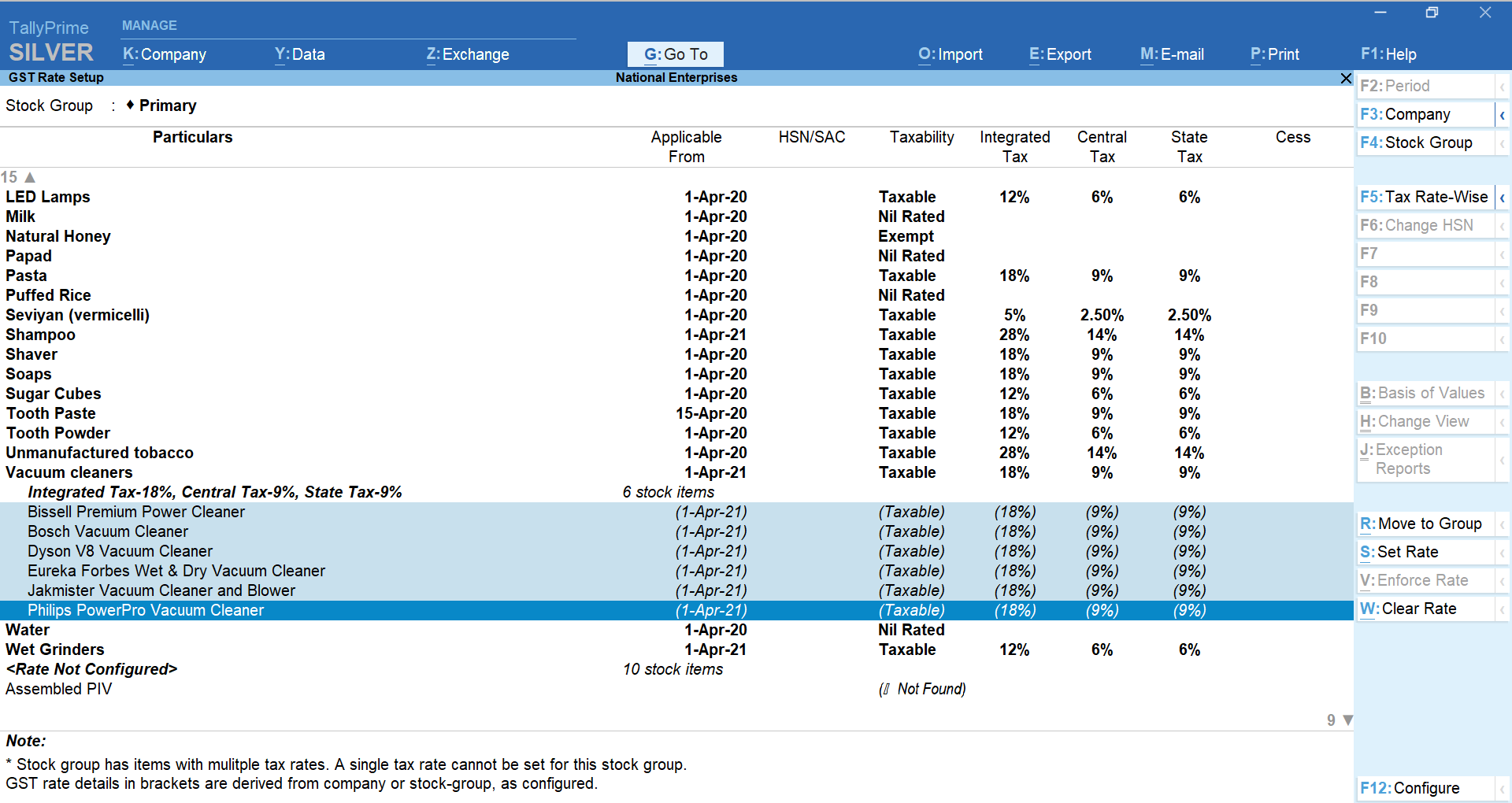

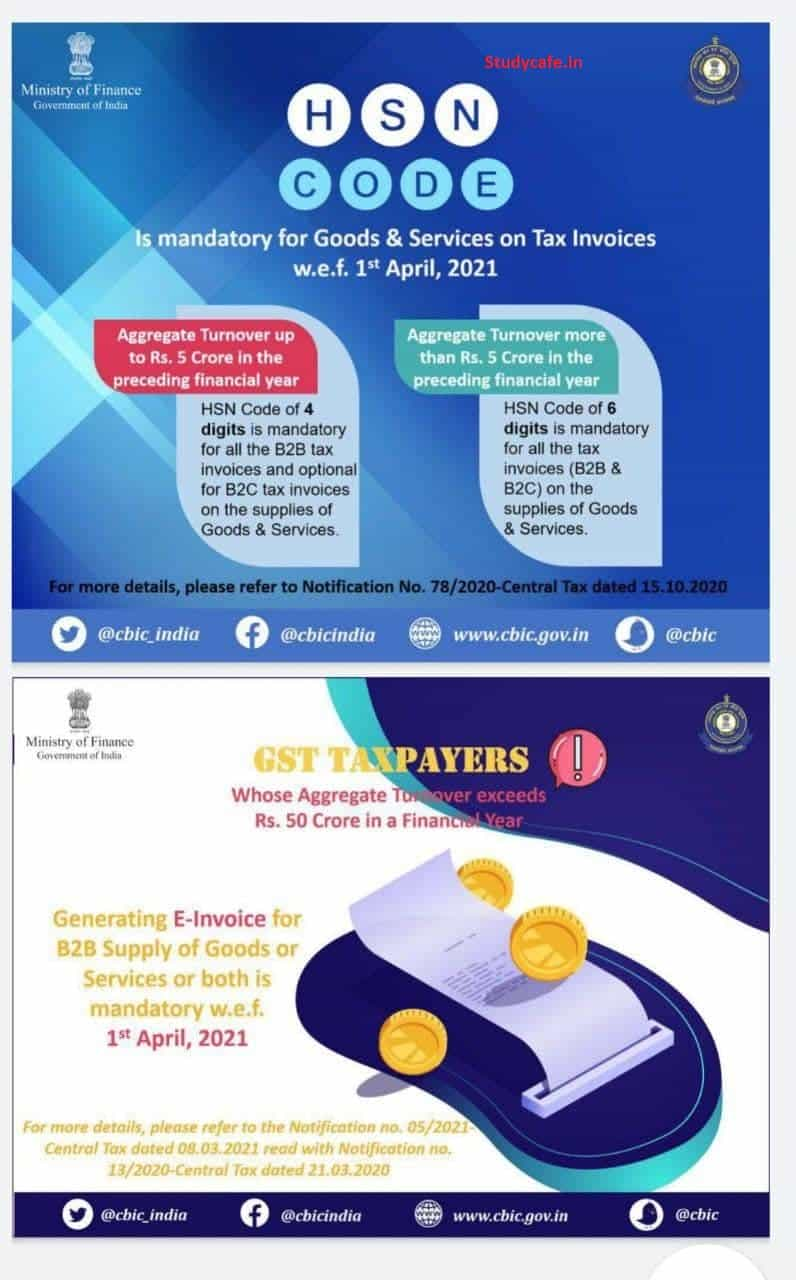

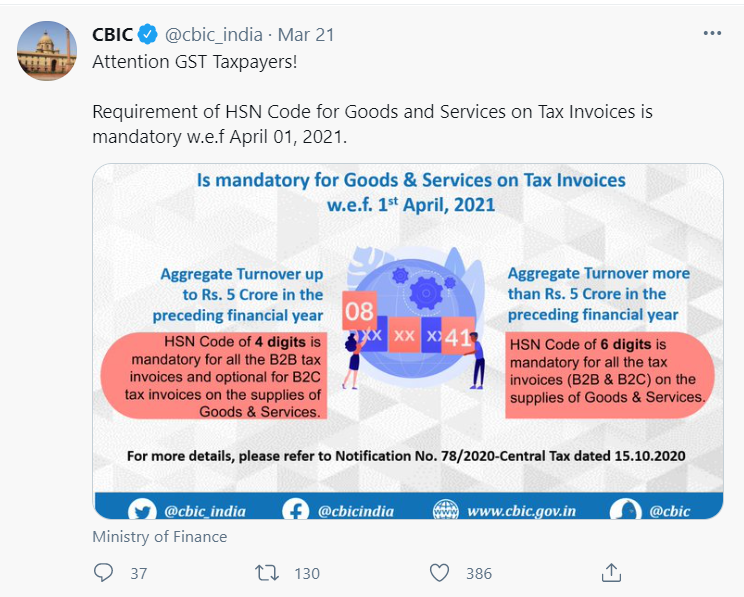

Under the Goods and Services Tax (GST) regime in India, the HSN code for spring mattresses remains the same. However, the tax rate may vary depending on the type of mattress. For example, spring mattresses are taxed at 12%, while foam and coir mattresses are taxed at 18%. This makes it important to correctly identify the type of mattress to ensure the correct HSN code is used for GST purposes.HSN Code for Spring Mattress in GST

The HSN code for spring mattresses in India has remained the same since the implementation of GST in 2017. However, it is always recommended to double-check the code to ensure it is up-to-date. As of 2021, the HSN code for spring mattresses in India remains 9404.HSN Code for Spring Mattress in India 2021

Similar to the HSN code, the GST rates for spring mattresses have also remained the same since 2017. As of 2021, the GST rate for spring mattresses is 12%. However, it is important to note that the GST rates are subject to change and it is always best to check the latest rates before making a purchase.HSN Code for Spring Mattress in GST 2021

As we move into 2022, the HSN code for spring mattresses in India is expected to remain the same. However, with the ever-changing tax laws, it is always advisable to stay updated and check the latest HSN codes and GST rates before making a purchase.HSN Code for Spring Mattress in India 2021-22

The GST rates for spring mattresses in 2021-22 are also expected to remain the same. However, with the government constantly reviewing and revising tax rates, it is always important to stay informed and check the latest rates before making a purchase.HSN Code for Spring Mattress in GST 2021-22

For a comprehensive list of all HSN codes for various products, including spring mattresses, you can refer to the official PDF released by the Central Board of Indirect Taxes and Customs (CBIC). This document is regularly updated and can be easily accessed online.HSN Code for Spring Mattress in India 2021-22 PDF

Similarly, the GST rates for spring mattresses can also be found in the official PDF released by the CBIC. This document is a useful resource for businesses and individuals involved in the import and export of goods.HSN Code for Spring Mattress in GST 2021-22 PDF

Why Spring Mattresses are the Perfect Choice for Your Home

Experience Ultimate Comfort and Support

When it comes to choosing a mattress for your home, it is important to consider both comfort and support. After all, a good night's sleep is crucial for your overall well-being and productivity. This is where spring mattresses come in. These mattresses are designed to provide the perfect balance of comfort and support, ensuring that you wake up feeling fully rested and rejuvenated.

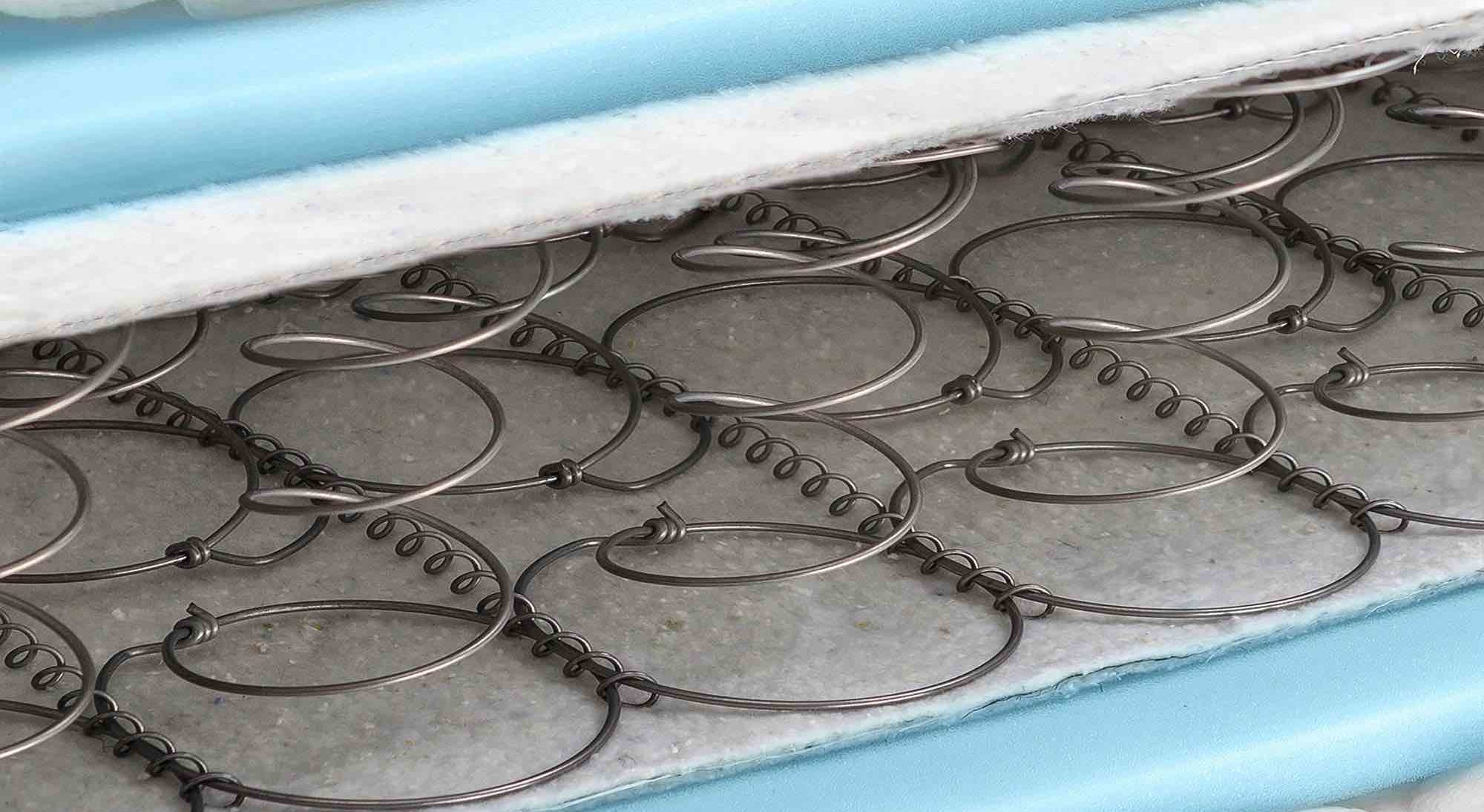

One of the main reasons why spring mattresses are such a popular choice is because of their unique construction. They are made up of multiple layers of coiled springs, each one individually encased in fabric. This allows the mattress to contour to your body shape, providing customized support for your pressure points. The result is a comfortable and supportive sleeping surface that conforms to your body and promotes proper spinal alignment.

Spring mattresses are also known for their durability and longevity.

The coiled springs in these mattresses are made of high-quality steel, making them highly resilient and able to withstand years of use. This means that you can enjoy the same level of comfort and support for many years to come, without having to worry about sagging or other signs of wear and tear.

When it comes to choosing a mattress for your home, it is important to consider both comfort and support. After all, a good night's sleep is crucial for your overall well-being and productivity. This is where spring mattresses come in. These mattresses are designed to provide the perfect balance of comfort and support, ensuring that you wake up feeling fully rested and rejuvenated.

One of the main reasons why spring mattresses are such a popular choice is because of their unique construction. They are made up of multiple layers of coiled springs, each one individually encased in fabric. This allows the mattress to contour to your body shape, providing customized support for your pressure points. The result is a comfortable and supportive sleeping surface that conforms to your body and promotes proper spinal alignment.

Spring mattresses are also known for their durability and longevity.

The coiled springs in these mattresses are made of high-quality steel, making them highly resilient and able to withstand years of use. This means that you can enjoy the same level of comfort and support for many years to come, without having to worry about sagging or other signs of wear and tear.

Enjoy a Cool and Breathable Sleeping Surface

Another advantage of spring mattresses is their ability to provide a cool and breathable sleeping surface. The open structure of the coiled springs allows for better air circulation, preventing heat from getting trapped and keeping you cool throughout the night. This is especially beneficial for those who tend to sleep hot or live in warmer climates.

Moreover, spring mattresses are designed to be moisture-wicking, which means they can absorb and dissipate any sweat or moisture from your body, keeping you dry and comfortable. This not only helps to improve the quality of your sleep, but it also helps to prevent the growth of mold and bacteria, making your mattress more hygienic.

Spring mattresses are also a great choice for those with allergies.

The open structure of the coils allows for better ventilation, preventing the accumulation of dust mites, pet dander, and other allergens. This can help to alleviate symptoms for those who suffer from allergies, allowing them to get a more restful and comfortable night's sleep.

In conclusion,

spring mattresses are the perfect choice for your home

if you are looking for a comfortable, supportive, and durable sleeping surface that promotes better sleep and overall health. So, why wait? Upgrade your bedroom with a spring mattress today and experience the ultimate in comfort and support.

Another advantage of spring mattresses is their ability to provide a cool and breathable sleeping surface. The open structure of the coiled springs allows for better air circulation, preventing heat from getting trapped and keeping you cool throughout the night. This is especially beneficial for those who tend to sleep hot or live in warmer climates.

Moreover, spring mattresses are designed to be moisture-wicking, which means they can absorb and dissipate any sweat or moisture from your body, keeping you dry and comfortable. This not only helps to improve the quality of your sleep, but it also helps to prevent the growth of mold and bacteria, making your mattress more hygienic.

Spring mattresses are also a great choice for those with allergies.

The open structure of the coils allows for better ventilation, preventing the accumulation of dust mites, pet dander, and other allergens. This can help to alleviate symptoms for those who suffer from allergies, allowing them to get a more restful and comfortable night's sleep.

In conclusion,

spring mattresses are the perfect choice for your home

if you are looking for a comfortable, supportive, and durable sleeping surface that promotes better sleep and overall health. So, why wait? Upgrade your bedroom with a spring mattress today and experience the ultimate in comfort and support.