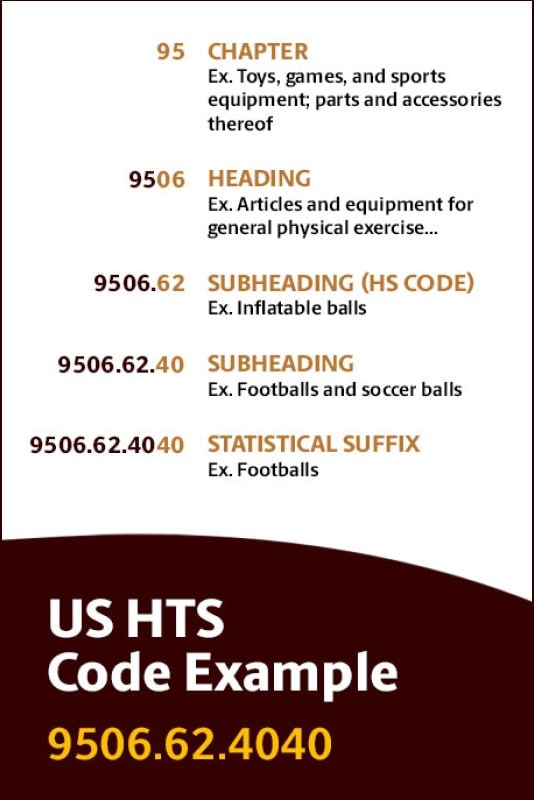

When it comes to importing or exporting spring mattresses, the first thing you need to know is the HS code. This code is used to classify products for customs purposes and determine the appropriate tariff. The HS code for spring mattresses is 9404.29, which falls under the category of articles of bedding and similar furnishing.HS Code for Spring Mattress

The spring mattress HS code is 9404.29, which is used for both importing and exporting spring mattresses. This code is part of the Harmonized System (HS) developed by the World Customs Organization (WCO) and is used by over 200 countries. It is a standardized code system that ensures uniformity in trade and customs procedures.Spring Mattress HS Code

The tariff code for spring mattresses, also known as the Harmonized Tariff Schedule (HTS) code, is 9404.29.0000. This code is used to determine the duty rate and any additional taxes or fees for importing or exporting spring mattresses. It is important to use the correct tariff code to avoid delays and potential fines.Spring Mattress Tariff Code

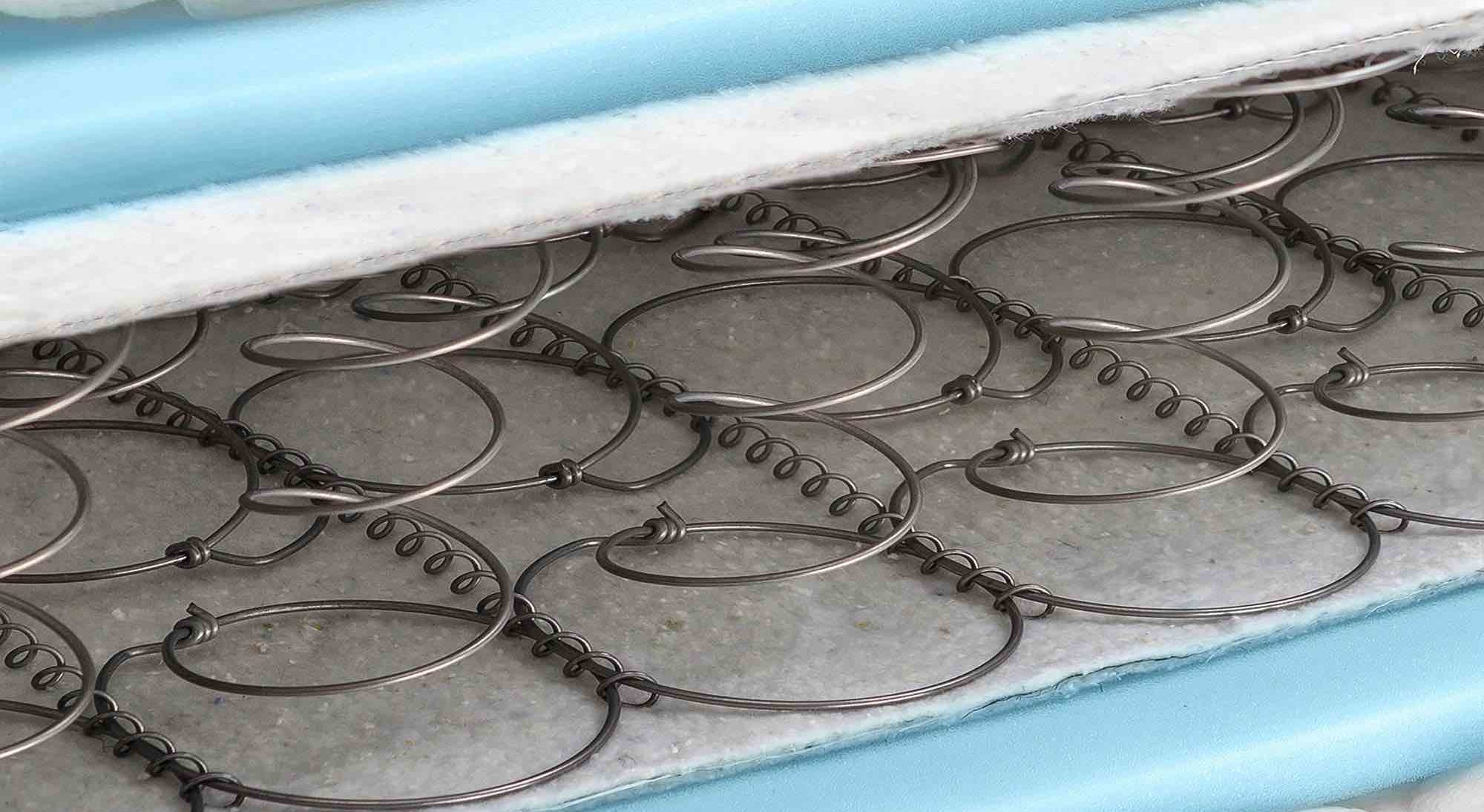

For those looking to import or export mattress springs, the HS code is 7320.20. This code falls under the category of springs and leaves for springs, of iron or steel. Mattress springs are classified as a separate category from spring mattresses, so it is important to use the correct code for customs purposes.HS Code for Mattress Springs

The tariff code for mattress springs, also known as the Harmonized Tariff Schedule (HTS) code, is 7320.20.0000. This code is used to determine the duty rate and any additional taxes or fees for importing or exporting mattress springs. It is important to use the correct tariff code to avoid delays and potential fines.Mattress Spring Tariff Code

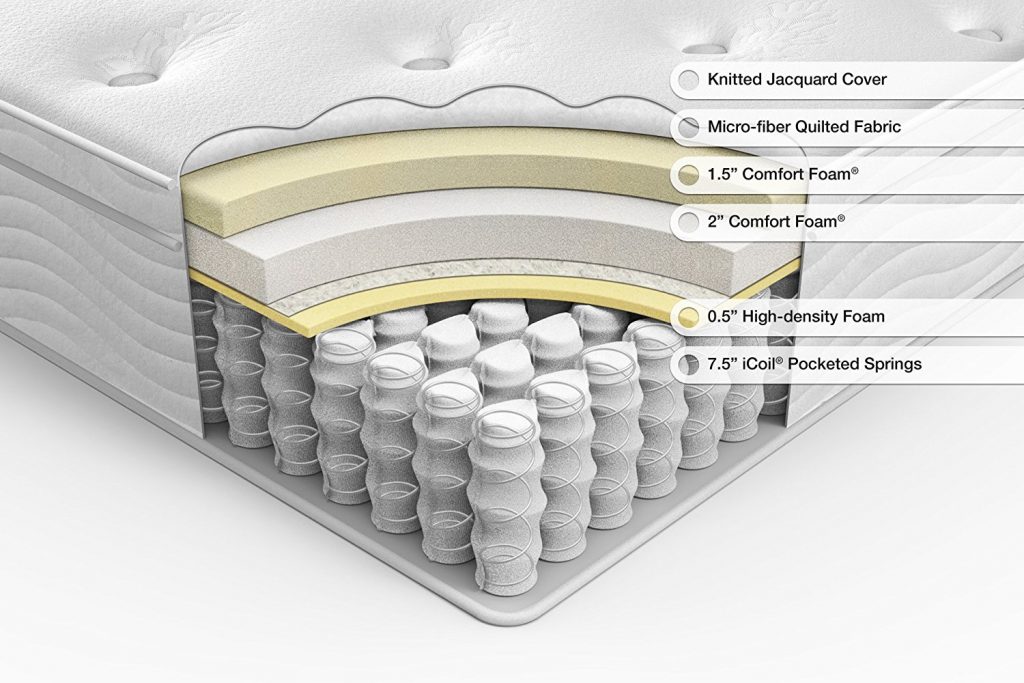

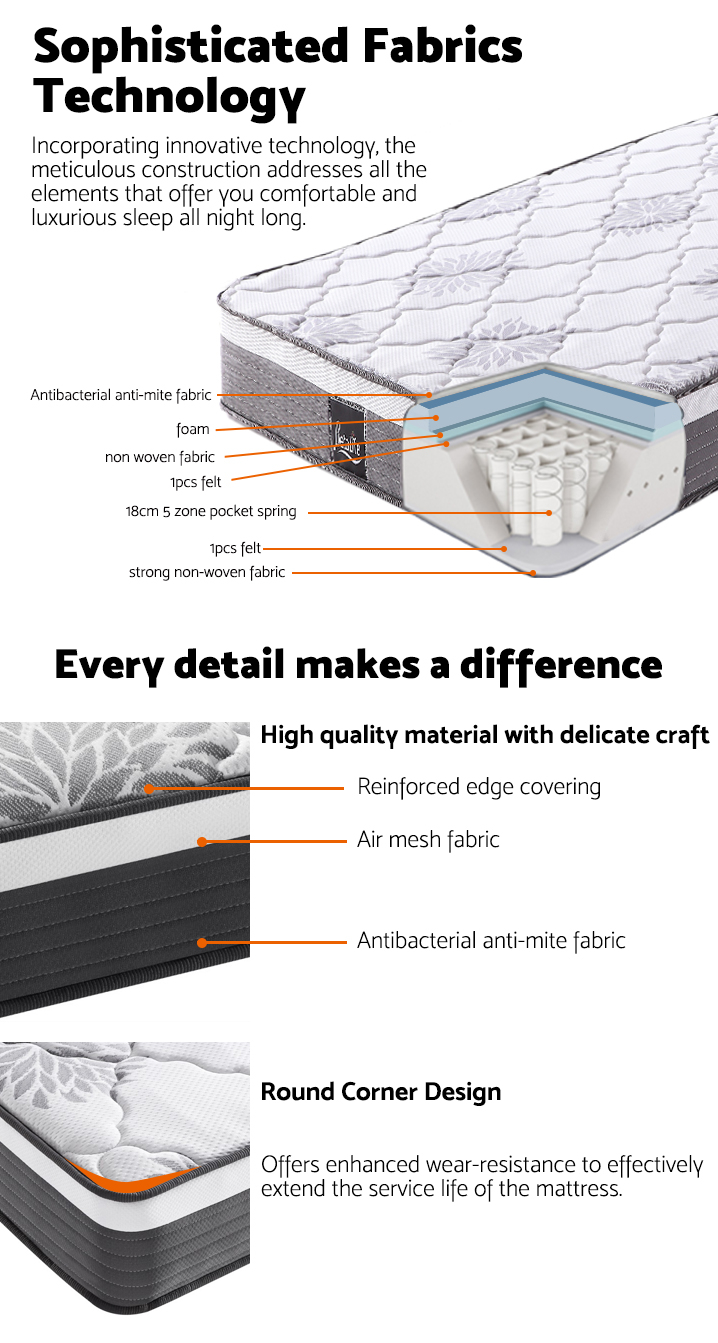

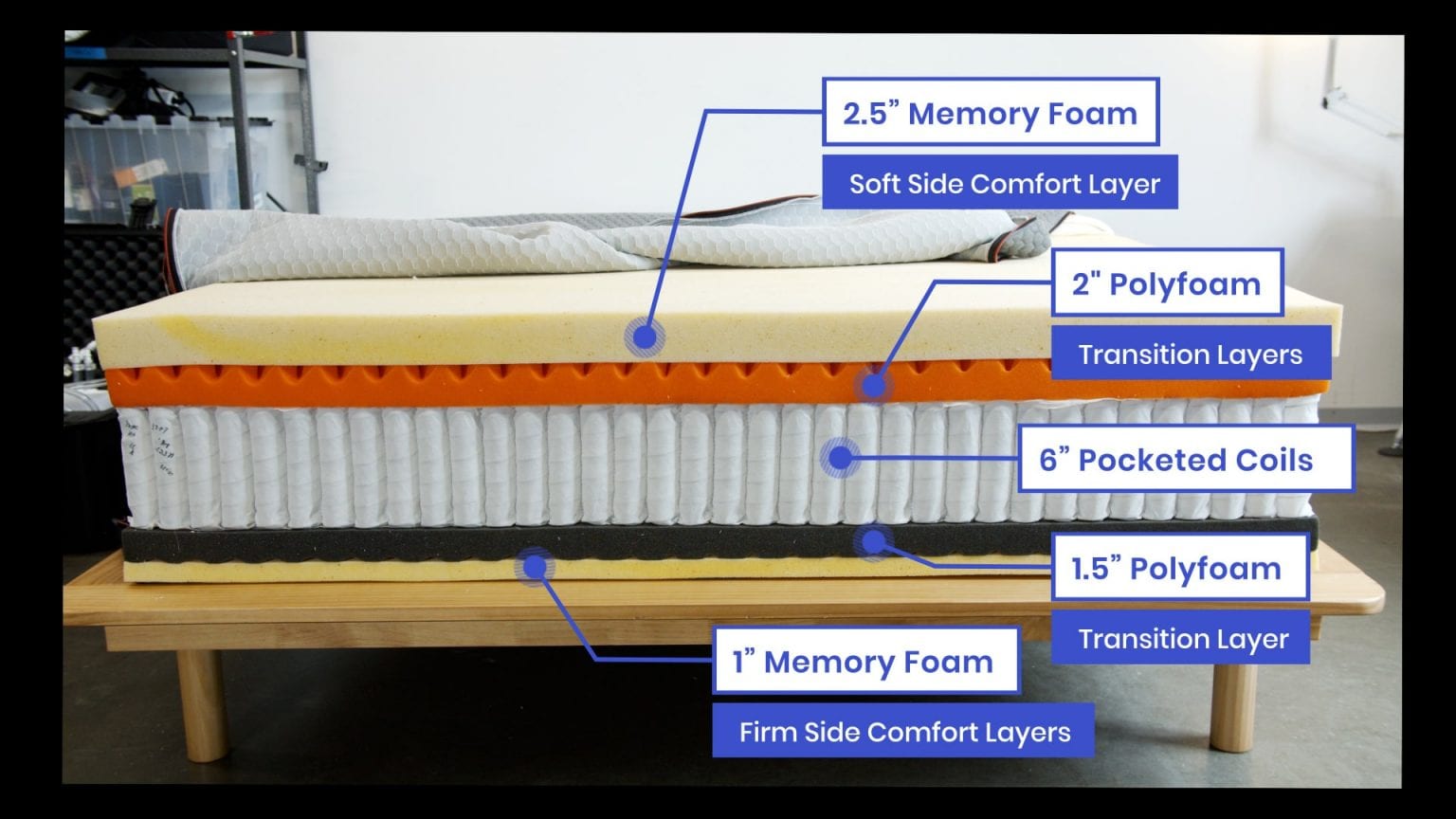

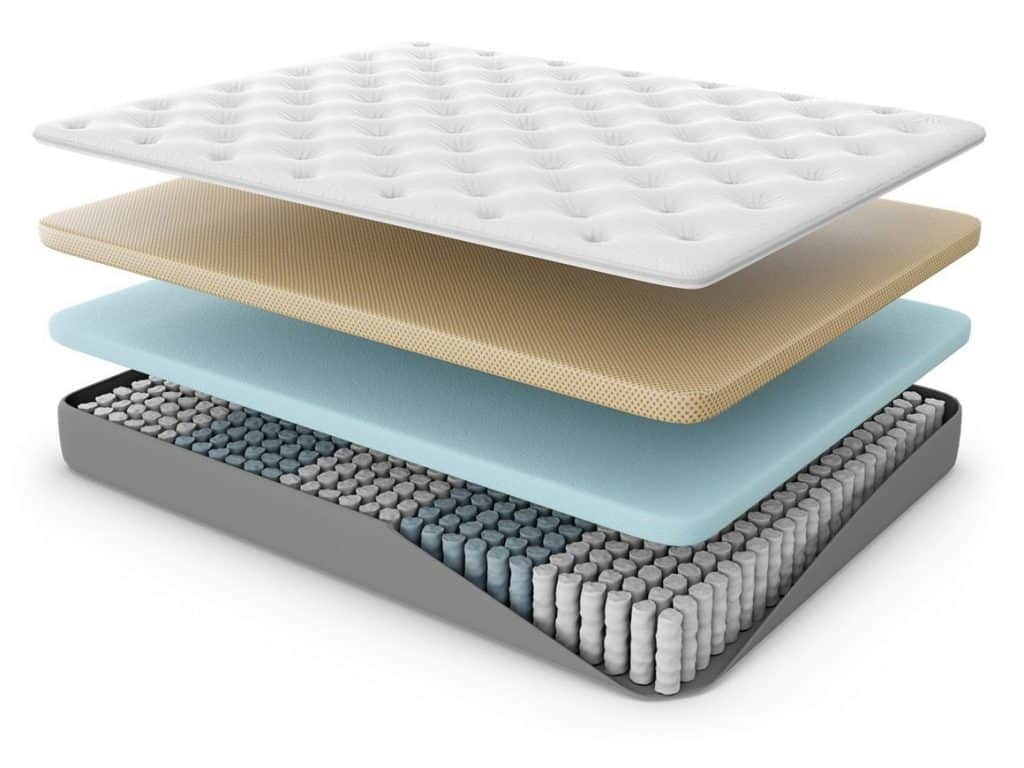

In addition to the main body of the spring mattress, there are also various components that make up the mattress. These components include the springs, foam layers, and fabric cover. The HS code for spring mattress components varies depending on the material and type of component. For example, the HS code for foam layers is 3921.90, while the HS code for fabric covers is 6307.90.HS Code for Spring Mattress Components

For those looking to import or export individual parts of a spring mattress, the HS code is 9404.90. This code falls under the category of articles of bedding and similar furnishing, and includes parts such as springs, foam layers, and fabric covers. It is important to use the correct code for each individual part to avoid any issues with customs.Spring Mattress Parts HS Code

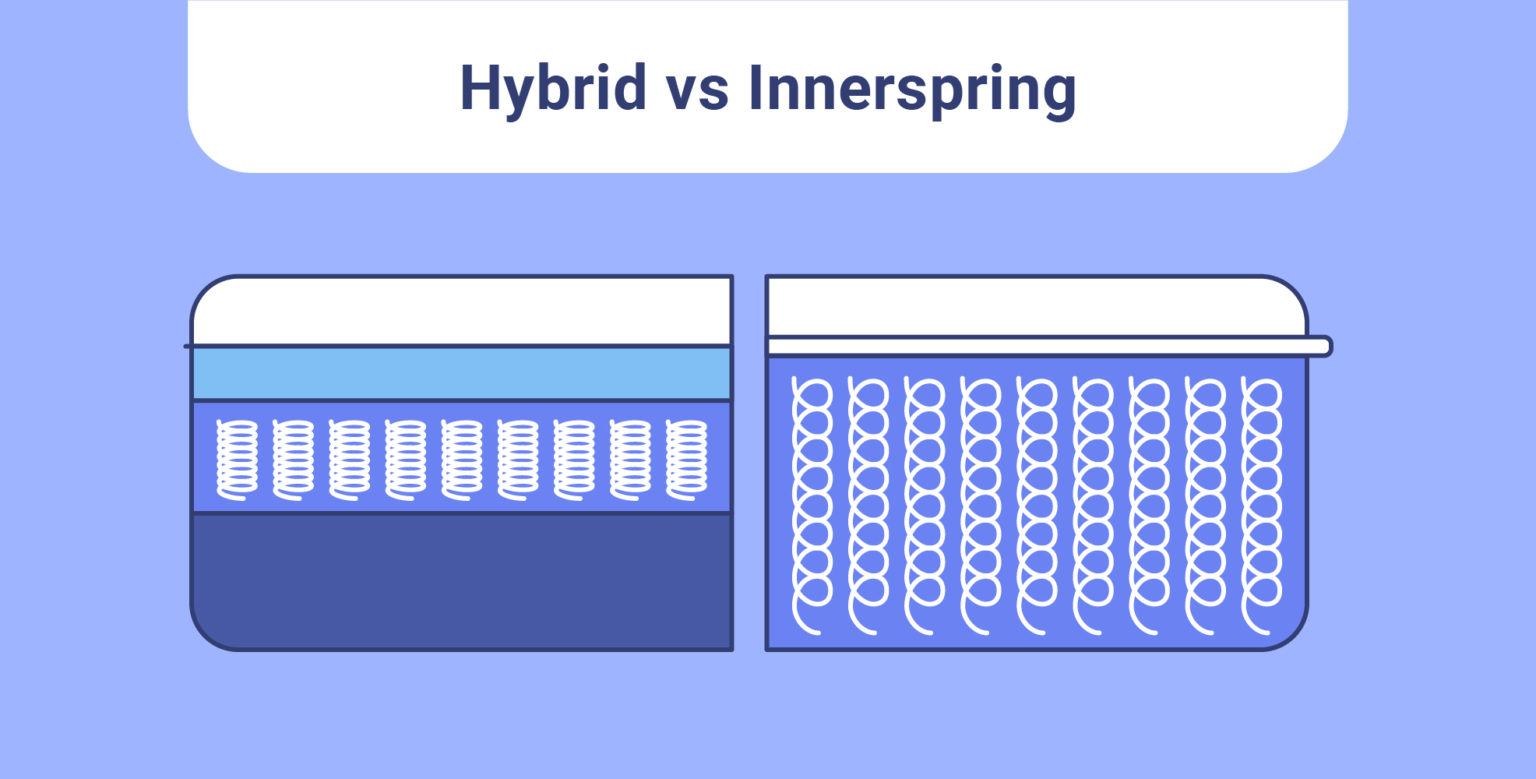

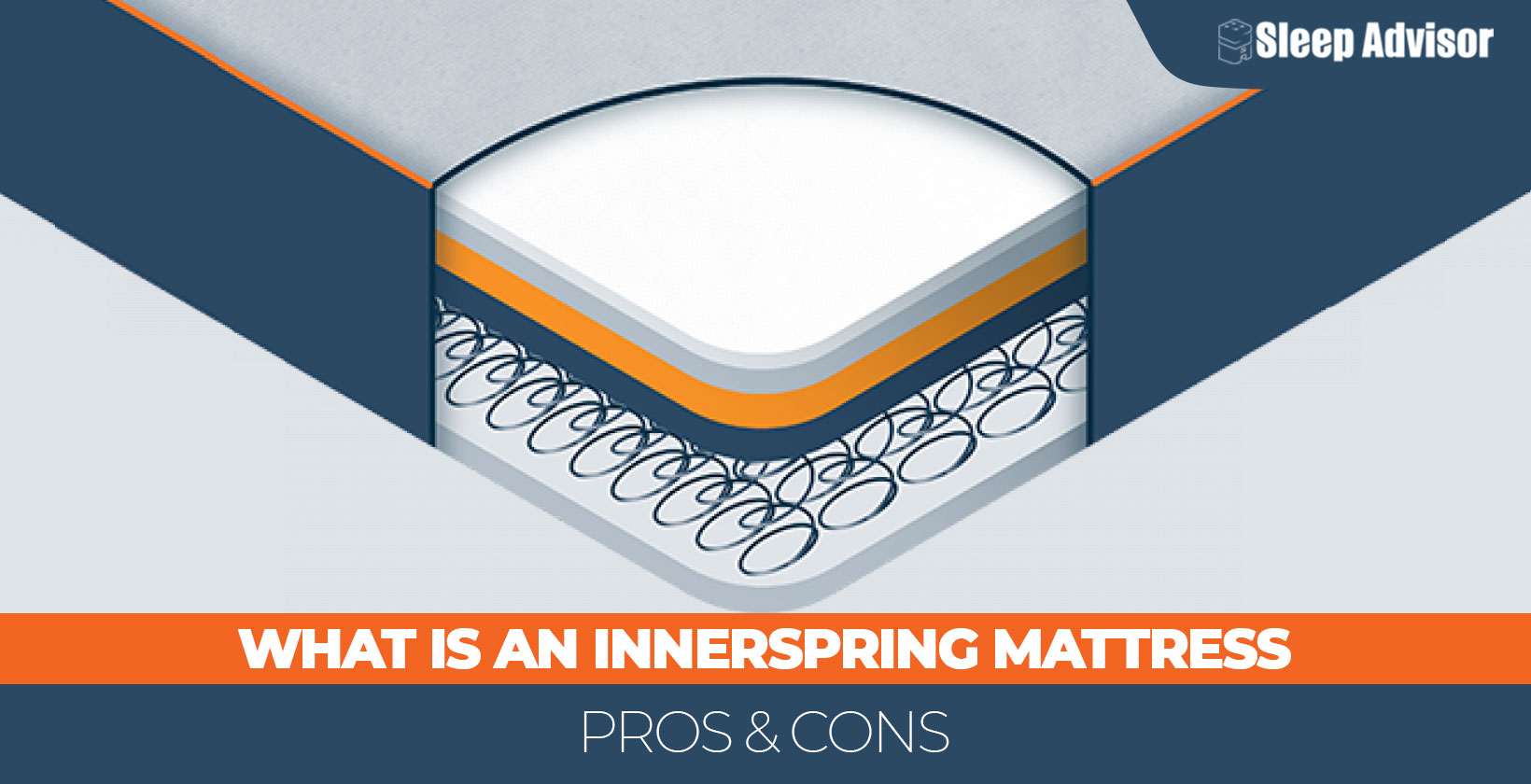

Innerspring mattresses are a type of spring mattress that use a system of interconnected springs to provide support. The HS code for innerspring mattresses is the same as the code for spring mattresses, 9404.29. However, it is important to specify that the mattress is an innerspring mattress when completing customs documentation.HS Code for Innerspring Mattress

The tariff code for innerspring mattresses, also known as the Harmonized Tariff Schedule (HTS) code, is 9404.29.0000. This code is used to determine the duty rate and any additional taxes or fees for importing or exporting innerspring mattresses. It is important to use the correct tariff code to avoid delays and potential fines.Innerspring Mattress Tariff Code

Pocket spring mattresses are a type of spring mattress that use individual springs in fabric pockets to provide support. The HS code for pocket spring mattresses is 9404.21, which falls under the category of articles of bedding and similar furnishing. It is important to use the correct code for pocket spring mattresses when completing customs documentation.HS Code for Pocket Spring Mattress

Introduction to House Design with Spring Mattress HS Code

What is a Spring Mattress HS Code?

When it comes to designing a house, choosing the right

mattress

is an important factor that often gets overlooked. However, with the development of technology and the increasing demand for comfort,

spring mattresses

have become a popular choice among homeowners. But what exactly is a

spring mattress HS code

and why is it important to consider in house design?

A

spring mattress HS code

is a special

harmonized system code

used to classify and identify spring mattresses for international trade. This standardized code is used by customs officials and businesses to classify and track

mattress

imports and exports. It contains information such as the material used, size and weight, and country of origin.

When it comes to designing a house, choosing the right

mattress

is an important factor that often gets overlooked. However, with the development of technology and the increasing demand for comfort,

spring mattresses

have become a popular choice among homeowners. But what exactly is a

spring mattress HS code

and why is it important to consider in house design?

A

spring mattress HS code

is a special

harmonized system code

used to classify and identify spring mattresses for international trade. This standardized code is used by customs officials and businesses to classify and track

mattress

imports and exports. It contains information such as the material used, size and weight, and country of origin.

Why Choose a Spring Mattress?

Spring

mattresses

are designed with a layer of metal coils or springs that provide support and comfort. These coils are individually wrapped or connected, allowing them to respond to the movement of the body and provide targeted support. This unique feature makes

spring mattresses

ideal for those who suffer from back pain or prefer a firmer sleeping surface.

Another advantage of

spring mattresses

is their breathability. The open structure of the coils allows for better air circulation, keeping the mattress cool and preventing the build-up of moisture. This is especially beneficial for those living in hot and humid climates.

Spring

mattresses

are designed with a layer of metal coils or springs that provide support and comfort. These coils are individually wrapped or connected, allowing them to respond to the movement of the body and provide targeted support. This unique feature makes

spring mattresses

ideal for those who suffer from back pain or prefer a firmer sleeping surface.

Another advantage of

spring mattresses

is their breathability. The open structure of the coils allows for better air circulation, keeping the mattress cool and preventing the build-up of moisture. This is especially beneficial for those living in hot and humid climates.

How to Incorporate Spring Mattresses in House Design?

When designing a house, it's important to consider the type of

mattress

you want to use in each room. For bedrooms, a

spring mattress

can provide the perfect balance of support and comfort for a good night's sleep. In the living room, a

spring mattress

can be incorporated into a sofa bed, providing an extra sleeping space for guests.

In addition,

spring mattresses

come in various sizes, making them suitable for different rooms and purposes. They can be used in bunk beds for kids' rooms, daybeds in home offices, and even in outdoor sitting areas for a comfortable lounging experience.

In conclusion, when designing a house, it's important to not only focus on the aesthetics but also on the functionality and comfort. Incorporating a

spring mattress HS code

in your house design can ensure that you have a comfortable and supportive sleeping surface, while also considering international standards for trade. So, next time you're designing a house, don't forget to consider the

spring mattress HS code

for a better sleeping experience.

When designing a house, it's important to consider the type of

mattress

you want to use in each room. For bedrooms, a

spring mattress

can provide the perfect balance of support and comfort for a good night's sleep. In the living room, a

spring mattress

can be incorporated into a sofa bed, providing an extra sleeping space for guests.

In addition,

spring mattresses

come in various sizes, making them suitable for different rooms and purposes. They can be used in bunk beds for kids' rooms, daybeds in home offices, and even in outdoor sitting areas for a comfortable lounging experience.

In conclusion, when designing a house, it's important to not only focus on the aesthetics but also on the functionality and comfort. Incorporating a

spring mattress HS code

in your house design can ensure that you have a comfortable and supportive sleeping surface, while also considering international standards for trade. So, next time you're designing a house, don't forget to consider the

spring mattress HS code

for a better sleeping experience.

:max_bytes(150000):strip_icc()/how-to-install-a-sink-drain-2718789-hero-24e898006ed94c9593a2a268b57989a3.jpg)