When it comes to purchasing a new mattress, there are many factors to consider, including the price. But one cost that often gets overlooked is the sales tax. For those interested in the popular Saatva mattress, it's important to understand the sales tax implications and how it can affect your total cost. In this guide, we'll break down everything you need to know about Saatva mattress sales tax and how to save money on your purchase.Saatva Mattress Sales Tax: What You Need to Know

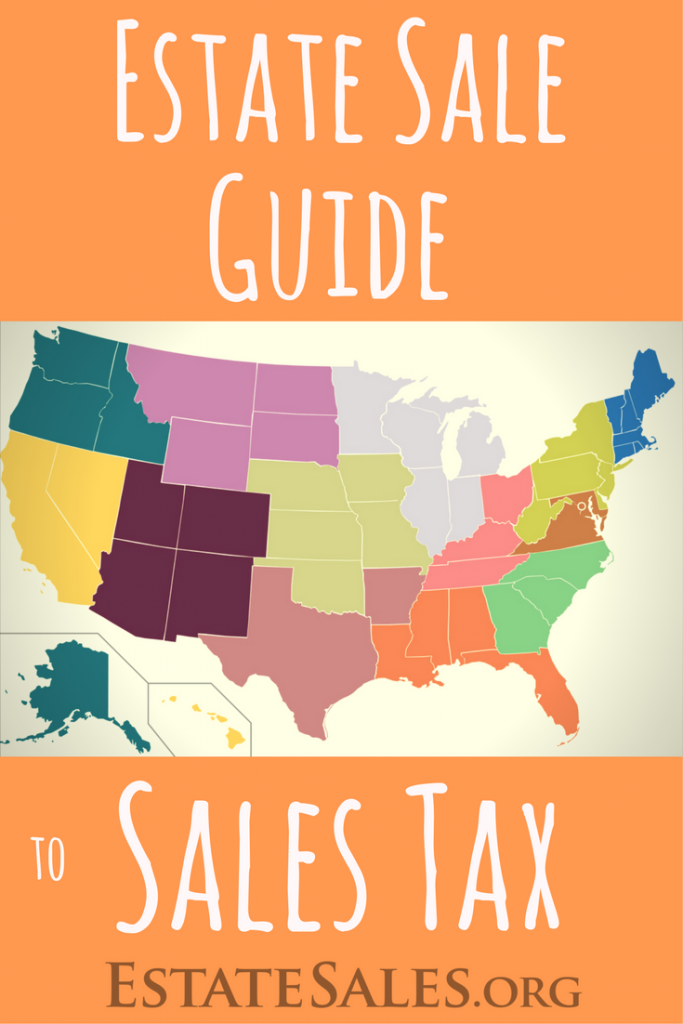

The amount of sales tax you will pay for a Saatva mattress depends on your state's tax rate. Currently, the average state sales tax rate in the United States is around 6%. However, some states have no sales tax at all, while others have rates as high as 10%. This means that the sales tax on a Saatva mattress can vary significantly depending on where you live.Saatva Mattress Sales Tax: How Much Will You Pay?

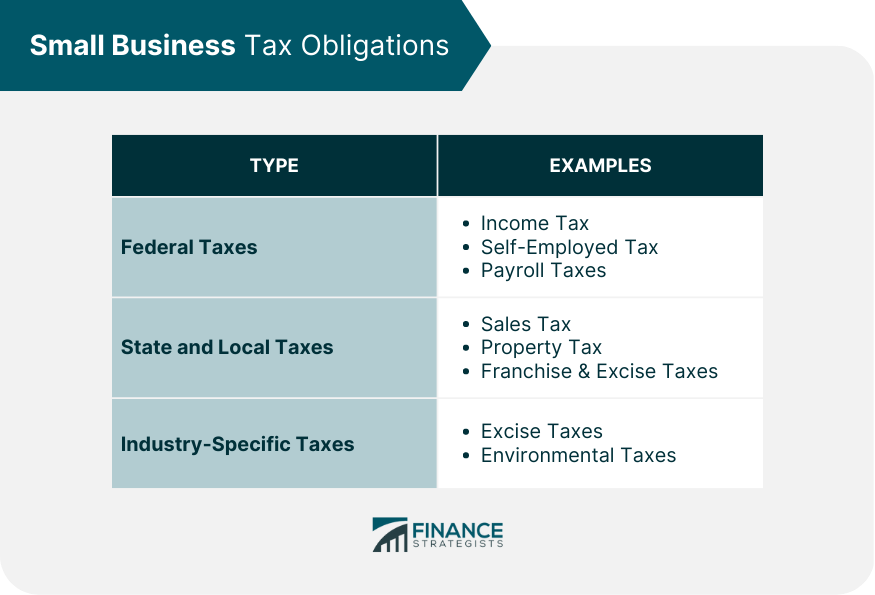

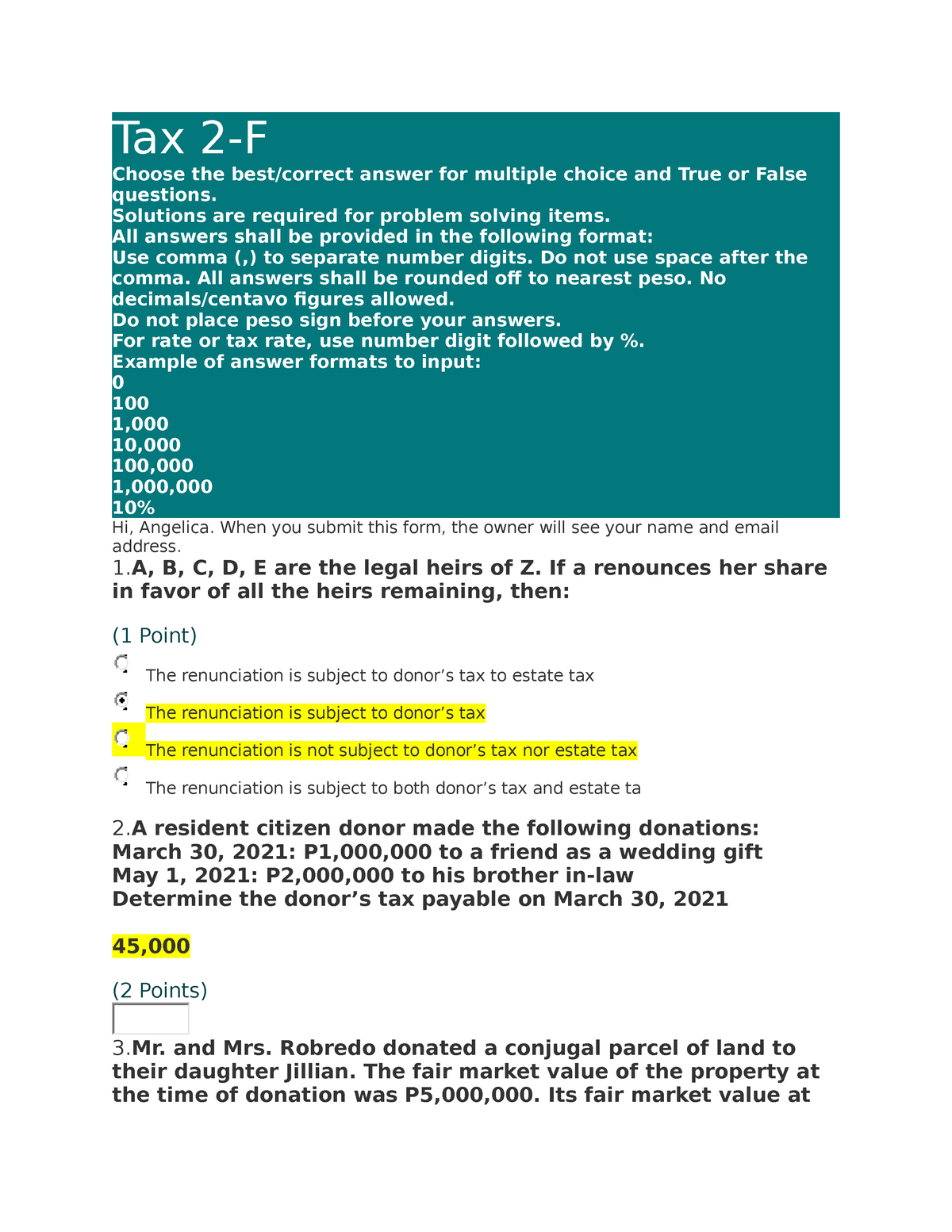

As a consumer, it's important to understand your tax obligations when making a purchase. In most cases, online retailers like Saatva will charge sales tax based on the shipping address provided. This means that if you live in a state with a higher sales tax rate, you will likely pay more for your Saatva mattress compared to someone in a state with a lower rate. Additionally, some states also have specific laws regarding sales tax on mattresses. For example, in California, mattresses are subject to a "mattress recycling fee" which is added on top of the sales tax. It's important to research your state's specific laws and regulations regarding mattress sales tax to avoid any surprises at checkout.Saatva Mattress Sales Tax: Understanding Your Tax Obligations

If you're looking to save money on your Saatva mattress purchase, there are a few tips you can follow. First, consider purchasing during a sale or promotion. Saatva often runs sales throughout the year, which can provide significant savings on your total cost. Additionally, some states offer tax-free holidays where sales tax is waived for certain items, including mattresses. Keep an eye out for these events and plan your purchase accordingly. Another way to save money on your Saatva mattress is by taking advantage of any available discounts or coupons. This can help lower the overall cost of your mattress and potentially offset the sales tax. Additionally, consider purchasing from a state with a lower sales tax rate if you live near a border or have the option to ship to a different address.Saatva Mattress Sales Tax: Tips for Saving Money on Your Purchase

As mentioned before, the sales tax on a Saatva mattress can vary depending on your state. To help you get a better idea of what to expect, here's a breakdown of the sales tax rates for each state in the United States: State - Sales Tax Rate Alabama - 4% Alaska - 0% Arizona - 5.6% Arkansas - 6.5% California - 7.25% Colorado - 2.9% Connecticut - 6.35% Delaware - 0% Florida - 6% Georgia - 4% Hawaii - 4% Idaho - 6% Illinois - 6.25% Indiana - 7% Iowa - 6% Kansas - 6.5% Kentucky - 6% Louisiana - 5% Maine - 5.5% Maryland - 6% Massachusetts - 6.25% Michigan - 6% Minnesota - 6.875% Mississippi - 7% Missouri - 4.225% Montana - 0% Nebraska - 5.5% Nevada - 6.85% New Hampshire - 0% New Jersey - 6.625% New Mexico - 5.125% New York - 4% North Carolina - 4.75% North Dakota - 5% Ohio - 5.75% Oklahoma - 4.5% Oregon - 0% Pennsylvania - 6% Rhode Island - 7% South Carolina - 6% South Dakota - 4.5% Tennessee - 7% Texas - 6.25% Utah - 4.85% Vermont - 6% Virginia - 6% Washington - 6.5% West Virginia - 6% Wisconsin - 5% Wyoming - 4%Saatva Mattress Sales Tax: State-by-State Guide

Here are some common questions and answers regarding Saatva mattress sales tax: Q: Is sales tax included in the price of a Saatva mattress? A: Yes, sales tax is typically included in the total cost of a Saatva mattress. Q: Can I avoid paying sales tax on a Saatva mattress? A: In most cases, no. Sales tax is a legal requirement and must be paid when purchasing a product, including mattresses. Q: Do I have to pay sales tax on a Saatva mattress if I live in a state with no sales tax? A: No, if you live in a state with no sales tax, you will not have to pay sales tax on your Saatva mattress purchase.Saatva Mattress Sales Tax: Common Questions and Answers

When shopping for a mattress, it's important to compare prices not just between different brands, but also between different states. As shown in the state-by-state guide above, the amount of sales tax you pay can vary significantly depending on where you live. This means that the total cost of a Saatva mattress can also differ from that of another brand, even if they have the same listed price. It's also important to consider any additional fees or taxes that may be included in the total cost of a mattress. For example, some states have a "mattress recycling fee" or a "mattress disposal fee" that can add to the overall cost. Be sure to research these fees and taxes when comparing prices between brands.Saatva Mattress Sales Tax: Comparing Prices and Taxes Across Brands

To calculate the total cost of a Saatva mattress, you will need to consider the listed price, any applicable sales tax, and any additional fees or taxes. To make it easier, many online retailers have a built-in calculator that can provide you with the total cost before checkout. If you're unsure of the exact sales tax rate for your state, you can also use an online sales tax calculator to estimate the amount you will pay.Saatva Mattress Sales Tax: How to Calculate Your Total Cost

If you're purchasing a Saatva mattress in-store, you may have the option to negotiate a lower price. To increase your chances of success, do some research beforehand and compare prices between different retailers. Additionally, look for any upcoming sales or promotions that you can use as leverage to negotiate a better price.Saatva Mattress Sales Tax: Tips for Negotiating a Lower Price

It's important to note that in some cases, you may be eligible for a sales tax exemption or discount on your Saatva mattress purchase. This can vary depending on your state and the specific laws and regulations in place. For example, some states offer sales tax exemptions for medical necessities, which can include mattresses. Be sure to research any potential exemptions or discounts that may apply to your purchase to save money. In conclusion, understanding the sales tax implications for a Saatva mattress purchase can help you budget and save money. By following our tips and doing your research, you can ensure that you're getting the best deal possible on your new mattress. Happy shopping!Saatva Mattress Sales Tax: Understanding Sales Tax Exemptions and Discounts

The Benefits of Choosing a Saatva Mattress and How Sales Tax Affects Your Purchase

Introduction

When it comes to designing your dream home, every detail matters. From the color of the walls to the furniture, you want everything to be perfect. And one important aspect of creating a comfortable and inviting space is choosing the right mattress. With so many options on the market, it can be overwhelming to decide which one is the best for you. That's where Saatva comes in. Not only do they offer high-quality mattresses, but they also provide exceptional customer service and a hassle-free buying experience. However, it's important to understand the added cost of sales tax when purchasing a Saatva mattress. In this article, we'll explore the benefits of choosing a Saatva mattress and how sales tax affects your purchase.

When it comes to designing your dream home, every detail matters. From the color of the walls to the furniture, you want everything to be perfect. And one important aspect of creating a comfortable and inviting space is choosing the right mattress. With so many options on the market, it can be overwhelming to decide which one is the best for you. That's where Saatva comes in. Not only do they offer high-quality mattresses, but they also provide exceptional customer service and a hassle-free buying experience. However, it's important to understand the added cost of sales tax when purchasing a Saatva mattress. In this article, we'll explore the benefits of choosing a Saatva mattress and how sales tax affects your purchase.

Why Choose a Saatva Mattress?

Saatva is a leading online mattress retailer that offers a wide range of mattresses to suit every sleep preference. They use eco-friendly materials and innovative technologies to provide the perfect balance of comfort and support. The company offers three different mattress options: the Saatva Classic, the Loom & Leaf, and the Zenhaven. Each mattress is carefully crafted to provide a luxurious and restful sleep experience. Additionally, Saatva offers a 180-night home trial, free white glove delivery, and a 15-year warranty – making the buying process stress-free and convenient.

Saatva is a leading online mattress retailer that offers a wide range of mattresses to suit every sleep preference. They use eco-friendly materials and innovative technologies to provide the perfect balance of comfort and support. The company offers three different mattress options: the Saatva Classic, the Loom & Leaf, and the Zenhaven. Each mattress is carefully crafted to provide a luxurious and restful sleep experience. Additionally, Saatva offers a 180-night home trial, free white glove delivery, and a 15-year warranty – making the buying process stress-free and convenient.

The Importance of Sales Tax

When purchasing a Saatva mattress, it's important to consider the added cost of sales tax. Sales tax is a percentage of the purchase price that is added to the total cost of the product. This tax varies depending on your state and can significantly impact the final price of your mattress. For example, if you live in a state with a 7% sales tax and purchase a Saatva Classic mattress for $1,000, you will end up paying an additional $70 in sales tax. It's important to factor in this cost when budgeting for your mattress purchase.

When purchasing a Saatva mattress, it's important to consider the added cost of sales tax. Sales tax is a percentage of the purchase price that is added to the total cost of the product. This tax varies depending on your state and can significantly impact the final price of your mattress. For example, if you live in a state with a 7% sales tax and purchase a Saatva Classic mattress for $1,000, you will end up paying an additional $70 in sales tax. It's important to factor in this cost when budgeting for your mattress purchase.

How Sales Tax Affects Your Purchase

While sales tax may seem like an added expense, it actually helps support your local economy. The tax revenue from sales goes towards funding public services such as schools, roads, and emergency services. By paying sales tax on your Saatva mattress, you are not only supporting your own comfort and well-being but also contributing to the betterment of your community.

Saatva

understands the importance of transparency and customer satisfaction. That's why they provide a sales tax calculator on their website to help customers estimate the final cost of their purchase. This allows you to make an informed decision and budget accordingly.

While sales tax may seem like an added expense, it actually helps support your local economy. The tax revenue from sales goes towards funding public services such as schools, roads, and emergency services. By paying sales tax on your Saatva mattress, you are not only supporting your own comfort and well-being but also contributing to the betterment of your community.

Saatva

understands the importance of transparency and customer satisfaction. That's why they provide a sales tax calculator on their website to help customers estimate the final cost of their purchase. This allows you to make an informed decision and budget accordingly.

In Conclusion

When it comes to designing your dream home, every detail matters – including your mattress. Choosing a Saatva mattress comes with many benefits, including exceptional comfort and customer service. However, it's important to remember the added cost of sales tax when making your purchase. By supporting your local economy and community, you are not only investing in a good night's sleep but also making a positive impact. So why wait? Head over to Saatva's website and start building your dream bedroom today!

When it comes to designing your dream home, every detail matters – including your mattress. Choosing a Saatva mattress comes with many benefits, including exceptional comfort and customer service. However, it's important to remember the added cost of sales tax when making your purchase. By supporting your local economy and community, you are not only investing in a good night's sleep but also making a positive impact. So why wait? Head over to Saatva's website and start building your dream bedroom today!

/cdn.vox-cdn.com/uploads/chorus_image/image/70916618/Saatva_Classic.0.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23591234/Saatva_Solaire.jpg)