Property tax deductions for bathroom renovations

If you're considering renovating your bathroom, you may be wondering about the potential property tax implications. The good news is that in some cases, bathroom renovations can actually lead to property tax deductions. This means that not only will you have a beautiful new bathroom, but you may also save money on your property taxes.

According to HomeLight, bathroom renovations are one of the top three home improvements that can increase your property value. And when your property value increases, so do your property taxes. However, there are some instances where you can deduct the cost of your bathroom renovation from your property taxes.

How many bathroom sinks affect property taxes?

When it comes to property taxes, the number of bathroom sinks in your home can play a role in how much you pay. In general, the more bathroom sinks you have, the higher your property taxes will be. This is because having more bathroom sinks typically means that your property value has increased, and therefore, your property taxes will be higher.

However, there are some exceptions to this rule. If you have a large house with many bathrooms, having more bathroom sinks may not necessarily affect your property taxes. This is because the number of bathrooms and overall square footage of your home are also taken into consideration when determining property taxes.

Calculating property taxes based on number of bathroom sinks

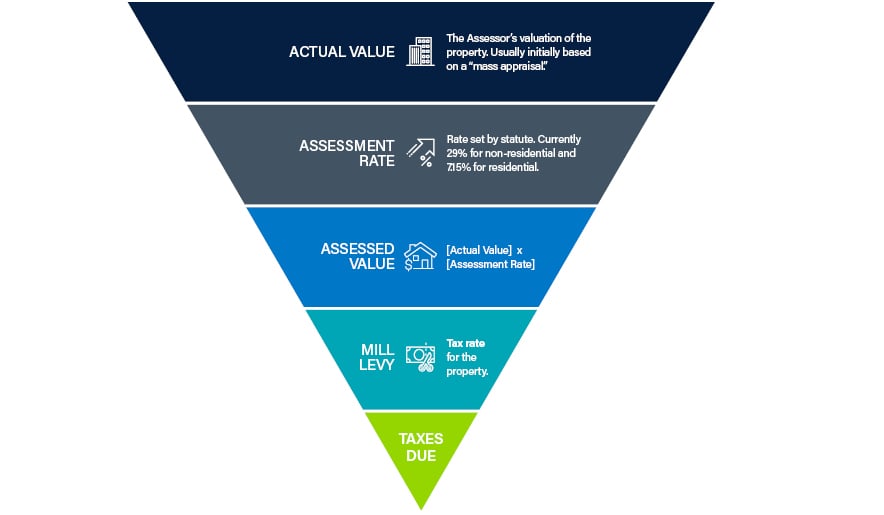

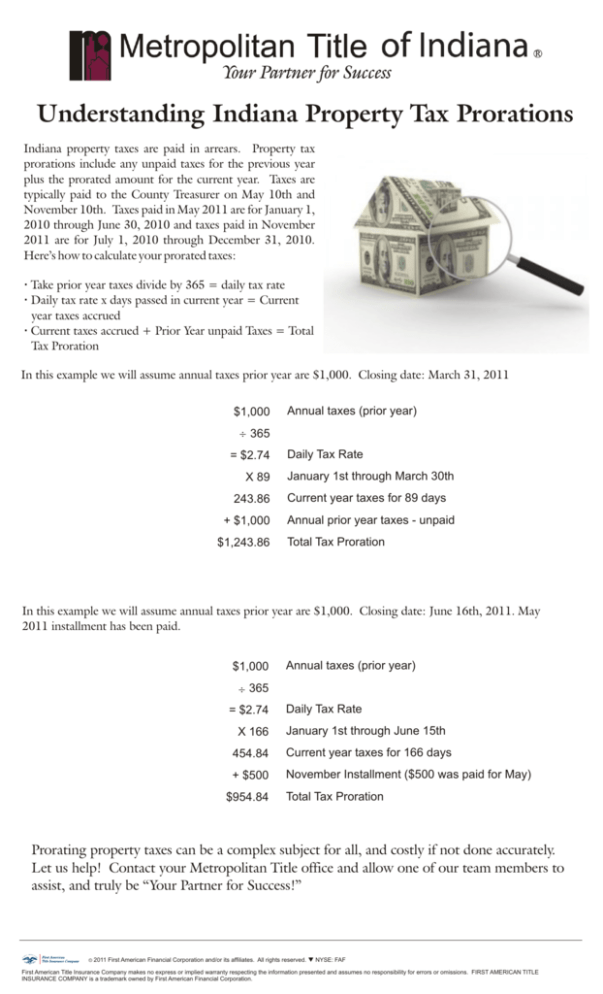

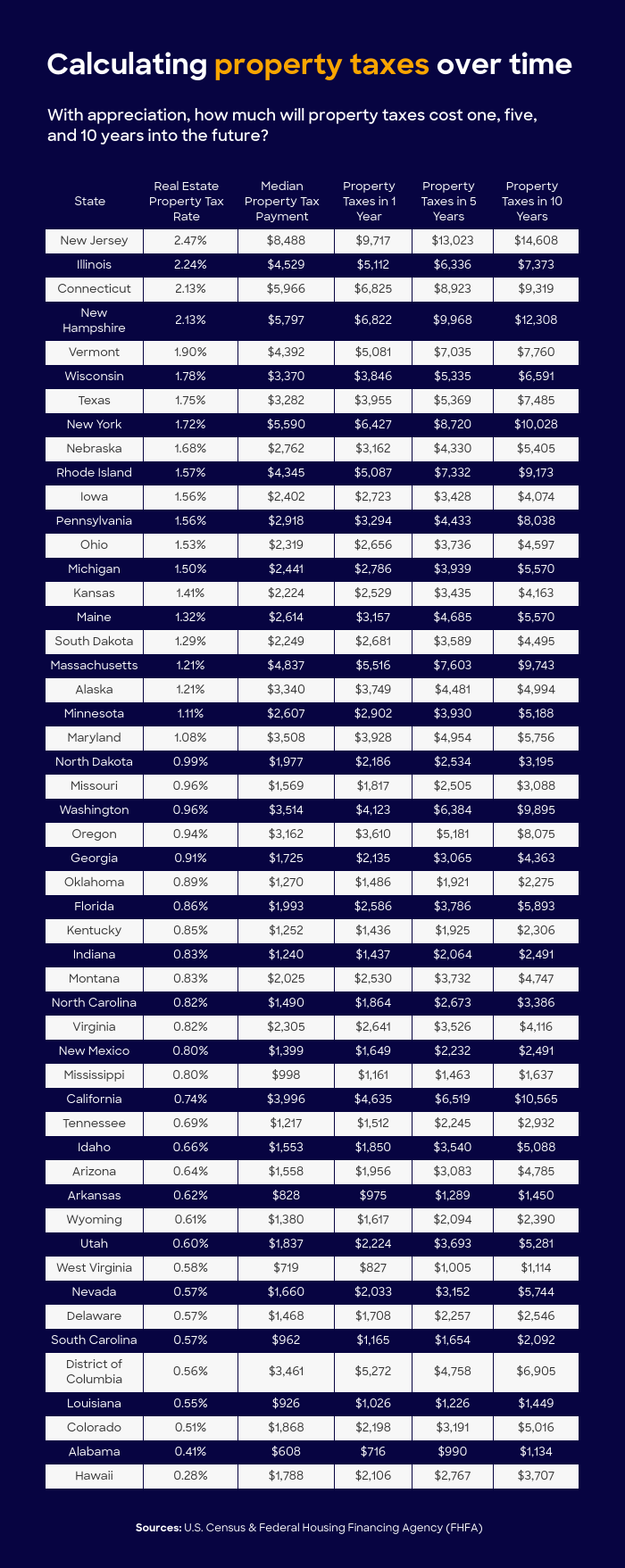

When it comes to calculating property taxes, the number of bathroom sinks is just one factor that is taken into consideration. Generally, property taxes are calculated based on the assessed value of your home, which is determined by your local tax assessor's office.

In most cases, the assessed value of your home will include the number of bathrooms and bathroom fixtures, such as sinks and toilets. However, the assessed value can also be affected by other factors like the age and condition of your home, as well as the local tax rate.

Property tax implications of adding a bathroom sink

Adding a bathroom sink to your home can have both positive and negative property tax implications. On one hand, adding a bathroom sink can increase the value of your home and therefore, your property taxes. However, if the added bathroom sink is part of a larger renovation project that increases the overall value of your home, you may be able to deduct the cost from your property taxes.

It's important to note that the property tax implications of adding a bathroom sink may vary depending on your location and local tax laws. It's always best to consult with a tax professional for specific advice on your situation.

Understanding property tax assessments for bathroom sinks

When it comes to property tax assessments for bathroom sinks, it's important to understand how these assessments are made. As mentioned, your local tax assessor's office will determine the assessed value of your home, which includes the number of bathroom sinks.

However, you may be able to appeal your property tax assessment if you believe it is too high. This is especially important if you have recently added a bathroom sink or other renovations that have increased your property value. Be sure to check with your local tax office for the appeals process and any deadlines you need to meet.

Maximizing property tax savings with bathroom sink upgrades

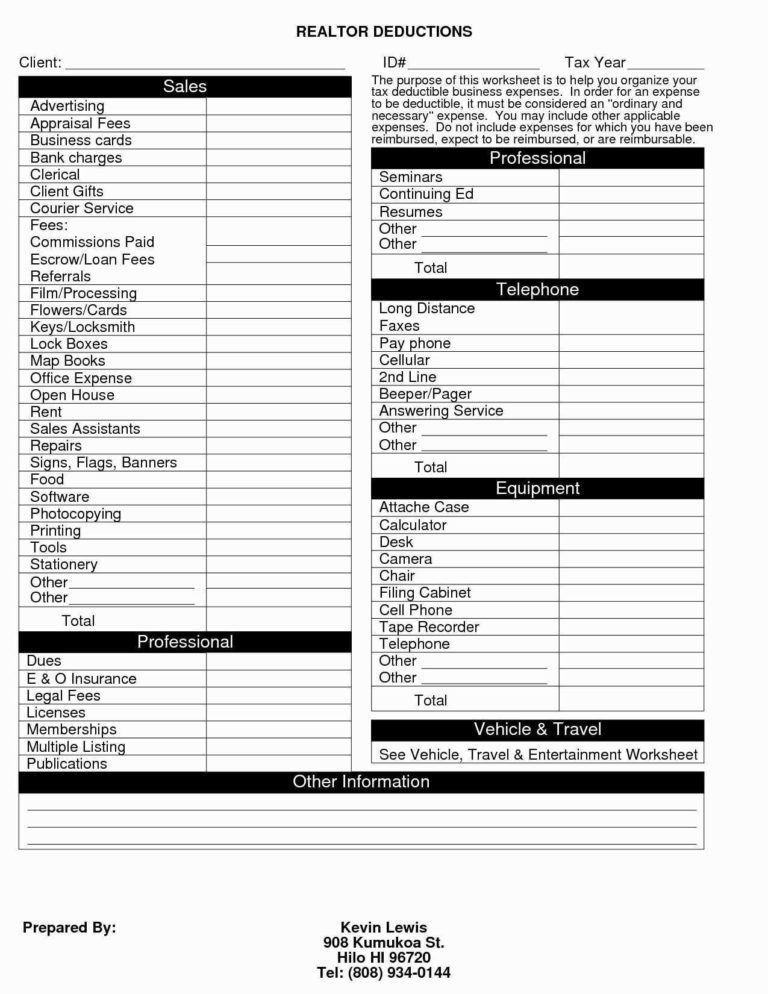

Bathroom sink upgrades can not only make your bathroom more functional and stylish, but they can also potentially save you money on your property taxes. As mentioned, certain bathroom renovations may be tax deductible, so it's important to keep track of any expenses related to your bathroom upgrades.

Additionally, if you opt for energy-efficient bathroom sinks, you may be eligible for property tax exemptions or credits. This is because energy-efficient upgrades are encouraged by the government and can help reduce your carbon footprint.

Property tax exemptions for energy-efficient bathroom sinks

As mentioned, energy-efficient bathroom sinks can potentially lead to property tax exemptions or credits. This is because these types of upgrades are seen as beneficial for the environment and can help reduce your energy consumption.

Be sure to check with your local tax office to see if there are any specific requirements or documentation needed to qualify for these exemptions or credits. In some cases, you may need to provide proof of the energy efficiency of your new bathroom sink.

Comparing property tax rates for different bathroom sink configurations

When it comes to property taxes, not all bathroom sink configurations are equal. For example, a home with one large bathroom and multiple sinks may have a different property tax rate than a home with several smaller bathrooms with only one sink each.

It's important to consider the layout and configuration of your bathroom sinks when determining how they may affect your property taxes. In some cases, it may be more beneficial to have a larger, more luxurious bathroom with multiple sinks, rather than several smaller bathrooms with only one sink each.

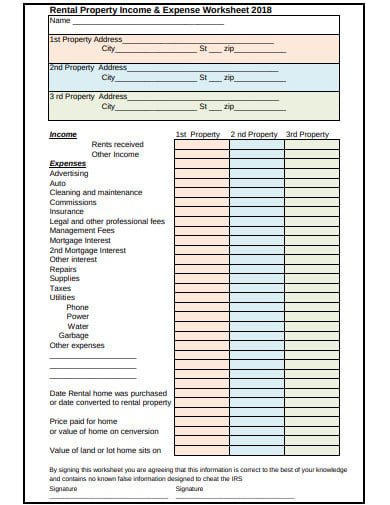

Property tax considerations for rental properties with multiple bathroom sinks

If you own a rental property with multiple bathroom sinks, it's important to keep in mind that your property taxes may be higher compared to a single-family home. This is because rental properties are typically assessed at a higher rate than primary residences.

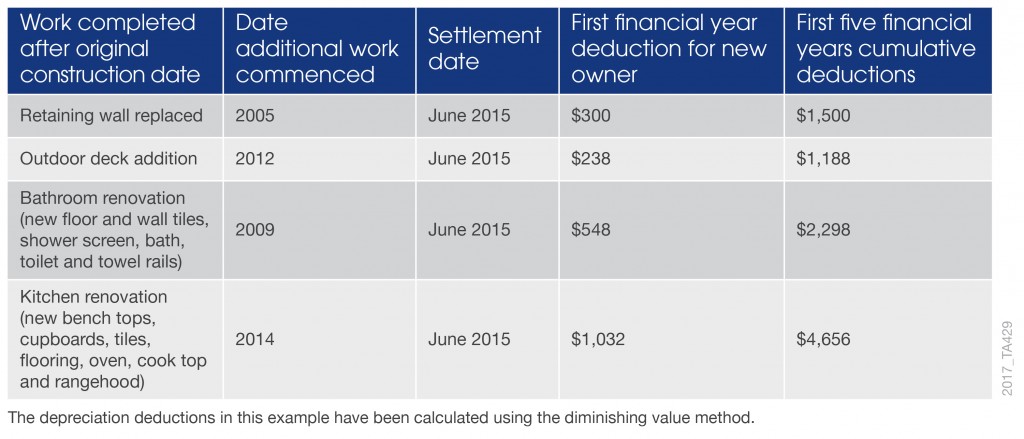

Additionally, if you have made any renovations or upgrades to your rental property, such as adding more bathroom sinks, you may be able to deduct these expenses from your rental income for tax purposes. However, it's always best to consult with a tax professional for specific advice on your rental property.

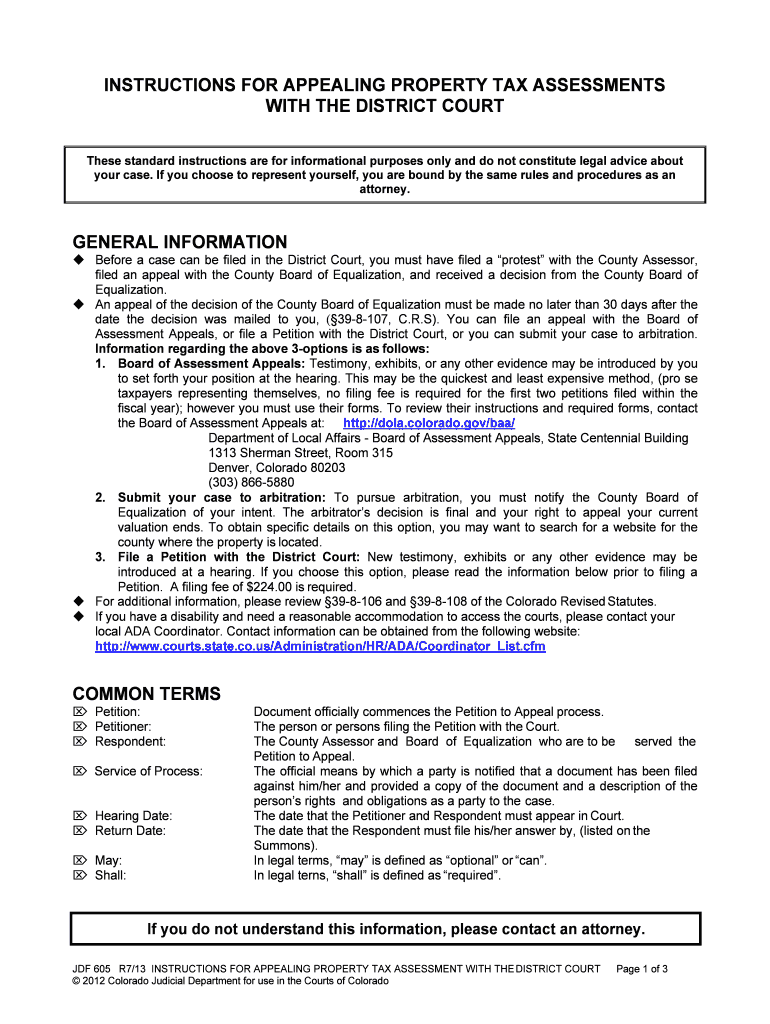

How to dispute property tax assessments based on bathroom sink values

If you believe your property tax assessment was made based on incorrect values for your bathroom sinks, you have the right to dispute it. This can be done by filing an appeal with your local tax assessor's office.

When disputing a property tax assessment, it's important to have evidence to support your claim. This can include receipts for renovations or upgrades, as well as any relevant documentation from a professional appraiser or contractor.

The Impact of Property Taxes Based on Bathroom Sinks on House Design

The Importance of House Design

When it comes to buying a house, one of the most important factors to consider is the design. A well-designed house not only provides aesthetic appeal but also offers functionality and comfort for its occupants. This is why homeowners often invest a considerable amount of time and money in creating their dream homes. However, with the introduction of property taxes based on bathroom sinks, the design of houses may see a significant change.

When it comes to buying a house, one of the most important factors to consider is the design. A well-designed house not only provides aesthetic appeal but also offers functionality and comfort for its occupants. This is why homeowners often invest a considerable amount of time and money in creating their dream homes. However, with the introduction of property taxes based on bathroom sinks, the design of houses may see a significant change.

The Controversy Surrounding Property Taxes Based on Bathroom Sinks

Recently, there has been a growing debate about property taxes being based on the number of bathroom sinks in a house. This means that homeowners with more bathroom sinks will have to pay higher property taxes compared to those with fewer sinks. Proponents argue that this system will generate more revenue for local governments and encourage homeowners to conserve water. However, opponents argue that it will unfairly target larger families and discourage creative house designs.

Recently, there has been a growing debate about property taxes being based on the number of bathroom sinks in a house. This means that homeowners with more bathroom sinks will have to pay higher property taxes compared to those with fewer sinks. Proponents argue that this system will generate more revenue for local governments and encourage homeowners to conserve water. However, opponents argue that it will unfairly target larger families and discourage creative house designs.

The Impact on House Design

The introduction of property taxes based on bathroom sinks can have a significant impact on the design of houses. Homeowners may start to opt for smaller houses with fewer bathrooms to avoid higher taxes, leading to a decrease in the demand for larger houses. This can also affect the real estate market, with smaller houses becoming more desirable and larger houses losing value. Moreover, this system can discourage unique and creative house designs, as homeowners may prioritize functionality over design to avoid higher taxes.

The introduction of property taxes based on bathroom sinks can have a significant impact on the design of houses. Homeowners may start to opt for smaller houses with fewer bathrooms to avoid higher taxes, leading to a decrease in the demand for larger houses. This can also affect the real estate market, with smaller houses becoming more desirable and larger houses losing value. Moreover, this system can discourage unique and creative house designs, as homeowners may prioritize functionality over design to avoid higher taxes.

The Importance of Finding a Balance

While the idea of property taxes based on bathroom sinks is still a topic of debate, it is crucial to find a balance that benefits both homeowners and local governments. Homeowners should not be penalized for wanting to have a comfortable and well-designed house, but at the same time, local governments need to generate revenue for public services. It is essential to find a fair and reasonable system that takes into consideration both the needs of homeowners and the responsibility of local governments.

In Conclusion

, house design plays a vital role in the real estate market, and any changes in property taxes can have a significant impact on it. The introduction of property taxes based on bathroom sinks may bring about a shift in the design of houses and the real estate market as a whole. It is crucial for policymakers to carefully consider the implications of such a system and find a balance that benefits all parties involved.

While the idea of property taxes based on bathroom sinks is still a topic of debate, it is crucial to find a balance that benefits both homeowners and local governments. Homeowners should not be penalized for wanting to have a comfortable and well-designed house, but at the same time, local governments need to generate revenue for public services. It is essential to find a fair and reasonable system that takes into consideration both the needs of homeowners and the responsibility of local governments.

In Conclusion

, house design plays a vital role in the real estate market, and any changes in property taxes can have a significant impact on it. The introduction of property taxes based on bathroom sinks may bring about a shift in the design of houses and the real estate market as a whole. It is crucial for policymakers to carefully consider the implications of such a system and find a balance that benefits all parties involved.

.jpg)

/WheretoFindRentalProperty-PeterDazeley-PhotographersChoice-GettyImages-56841a533df78ccc15cfe932.jpg)