Private equity investors have been making waves in the mattress industry, with major players acquiring and investing in top mattress companies. These private equity firms have brought in their expertise and capital to help these companies grow and expand their market reach. In this article, we take a look at the top 10 private equity investors in mattress firms and their impact on the industry.The Top 10 Private Equity Investors in Mattress Firms

With over 30 years of experience in private equity investments, Blackstone Group is a leading global investment firm that has made a significant impact in the mattress industry. In 2018, Blackstone acquired a majority stake in the popular mattress brand, Serta Simmons Bedding, in a deal worth $3.1 billion. This acquisition has helped Serta Simmons Bedding expand its product offerings and strengthen its position in the market.1. Blackstone Group

KKR & Co. is a global investment firm that has been actively investing in the mattress industry. In 2016, KKR acquired a majority stake in Mattress Firm, the largest mattress retailer in the United States, in a deal worth $3.8 billion. This investment has helped Mattress Firm expand its reach and open new stores across the country.2. KKR & Co.

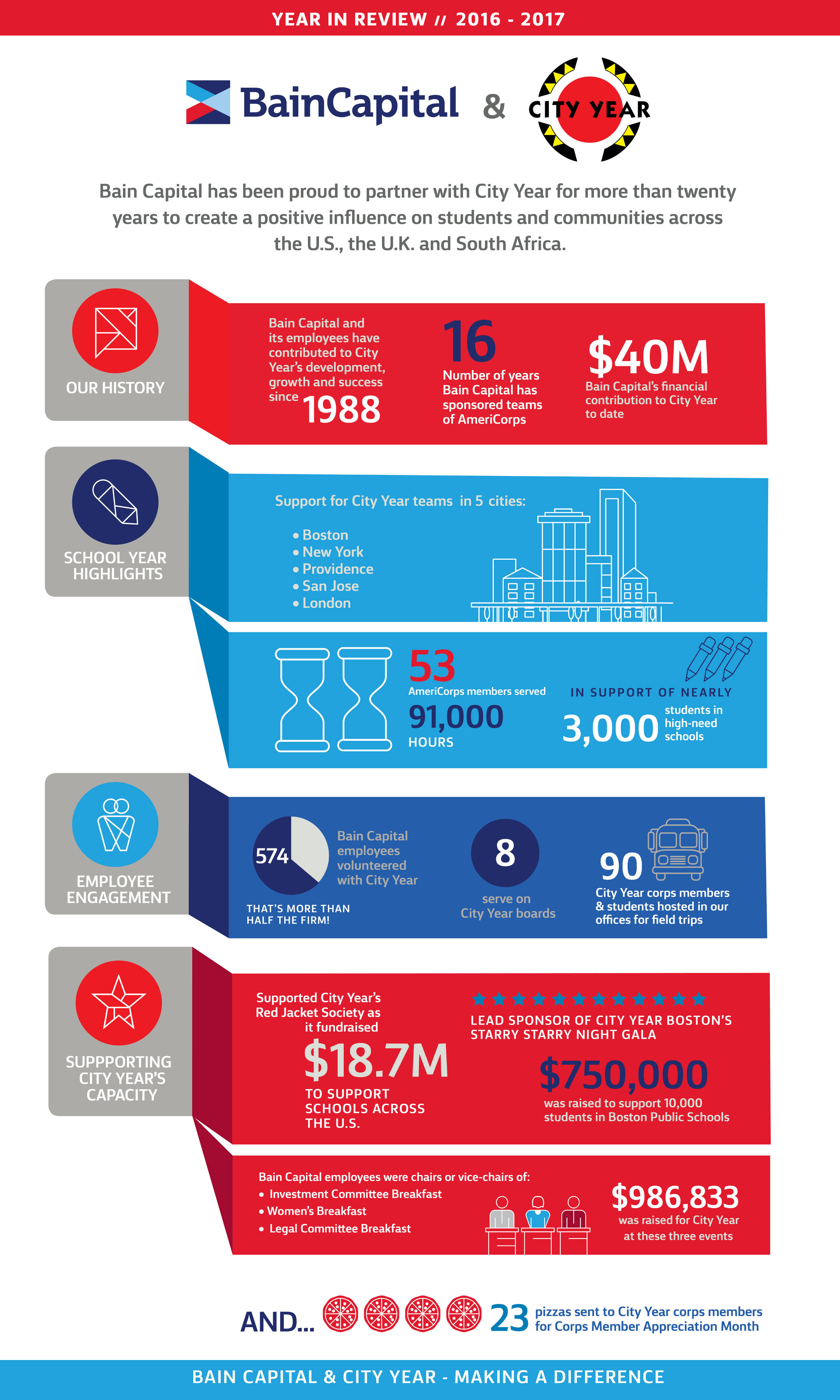

Bain Capital is a private investment firm that has been investing in the mattress industry for over two decades. In 2012, Bain Capital acquired a majority stake in Sealy Corporation, one of the largest mattress manufacturers in the world, in a deal worth $1.3 billion. This investment has helped Sealy Corporation expand its production capabilities and increase its market share.3. Bain Capital

Apollo Global Management is a private equity firm that has made a significant impact in the mattress industry. In 2013, Apollo acquired a majority stake in Simmons Bedding Company, one of the oldest and largest mattress manufacturers in the United States, in a deal worth $1.1 billion. This investment has helped Simmons Bedding Company modernize its production facilities and introduce new and innovative products to the market.4. Apollo Global Management

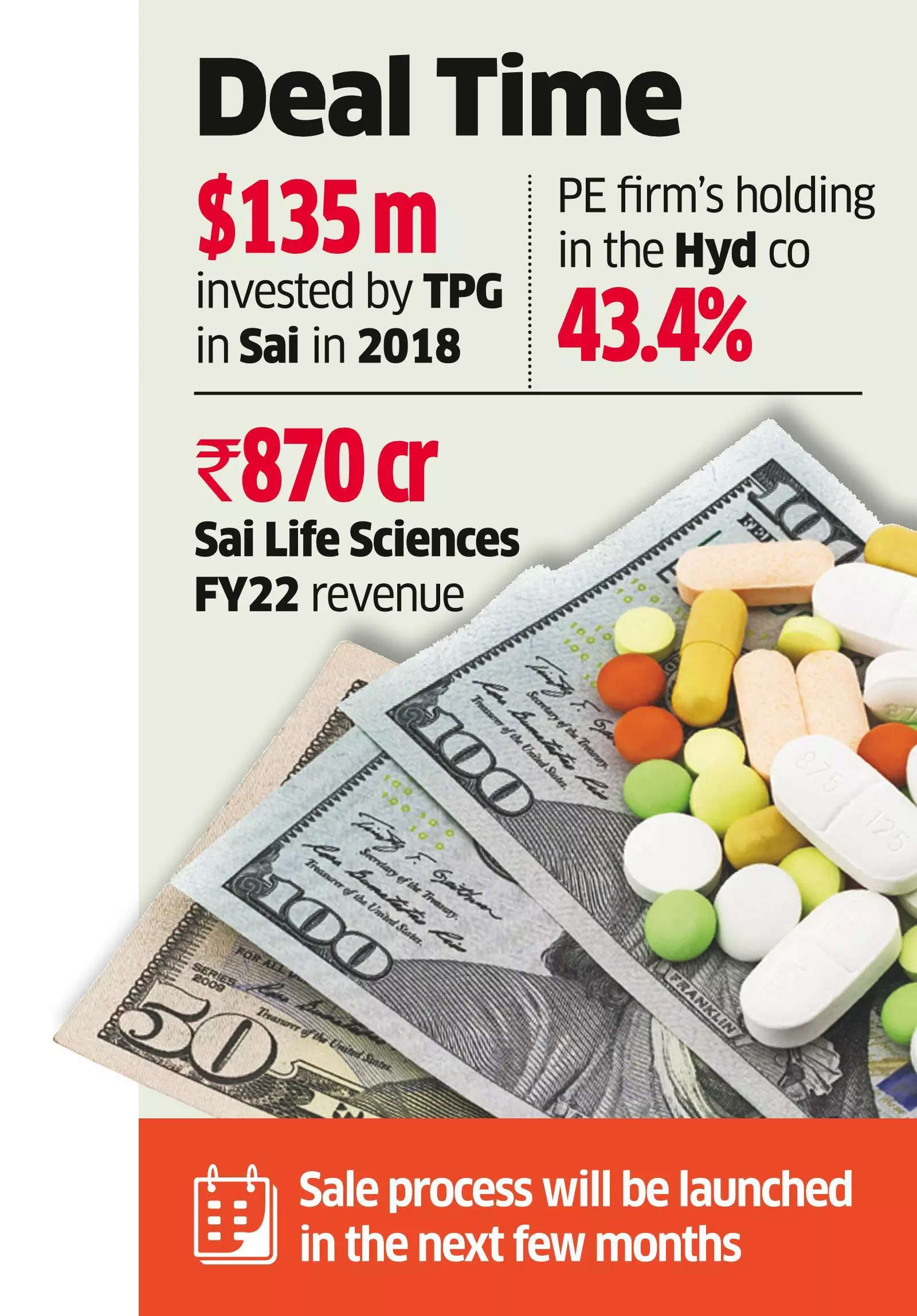

TPG Capital is a leading private equity firm that has invested in various industries, including the mattress industry. In 2017, TPG acquired a majority stake in Tempur Sealy International, one of the largest mattress manufacturers in the world, in a deal worth $1.3 billion. This investment has helped Tempur Sealy International expand its global presence and introduce new products to its portfolio.5. TPG Capital

Warburg Pincus is a global private equity firm that has been investing in the mattress industry for over two decades. In 2019, Warburg Pincus acquired a minority stake in Casper Sleep, an online mattress retailer, in a deal worth $100 million. This investment has helped Casper Sleep expand its online presence and reach a wider customer base.6. Warburg Pincus

Carlyle Group is a private equity firm that has been investing in the mattress industry for over a decade. In 2016, Carlyle Group acquired a majority stake in Hilding Anders, one of the largest mattress manufacturers in Europe, in a deal worth $1.6 billion. This investment has helped Hilding Anders expand its production capabilities and enter new markets.7. Carlyle Group

CVC Capital Partners is a global private equity firm that has invested in various industries, including the mattress industry. In 2018, CVC acquired a majority stake in Steinhoff Asia Pacific, the parent company of mattress brand Snooze, in a deal worth $800 million. This investment has helped Snooze expand its retail presence and introduce new products to its customers.8. CVC Capital Partners

Advent International is a private equity firm that has been investing in the mattress industry for over two decades. In 2017, Advent acquired a majority stake in DFS, the largest mattress retailer in the United Kingdom, in a deal worth $1.2 billion. This investment has helped DFS expand its retail operations and introduce new products to its customers.9. Advent International

The Benefits of Private Equity Investment in Mattress Firms

Introduction

When it comes to designing a house, every detail matters. From the color of the walls to the furniture, each element plays a crucial role in creating a comfortable and inviting space. One essential aspect that often gets overlooked is the mattress. However, private equity investors have recognized the importance of this item and have been actively investing in mattress firms. In this article, we will explore the benefits of private equity investment in mattress firms and how it can positively impact the house design industry.

When it comes to designing a house, every detail matters. From the color of the walls to the furniture, each element plays a crucial role in creating a comfortable and inviting space. One essential aspect that often gets overlooked is the mattress. However, private equity investors have recognized the importance of this item and have been actively investing in mattress firms. In this article, we will explore the benefits of private equity investment in mattress firms and how it can positively impact the house design industry.

Increased Innovation and Quality

One of the significant advantages of private equity investment in mattress firms is the increase in innovation and quality of products. Private equity investors bring in fresh perspectives and ideas to the table, pushing mattress firms to innovate and improve their products. They also provide the necessary funds for research and development, allowing mattress firms to create new and improved designs. This ultimately benefits house design as it provides consumers with a wider range of high-quality options to choose from.

One of the significant advantages of private equity investment in mattress firms is the increase in innovation and quality of products. Private equity investors bring in fresh perspectives and ideas to the table, pushing mattress firms to innovate and improve their products. They also provide the necessary funds for research and development, allowing mattress firms to create new and improved designs. This ultimately benefits house design as it provides consumers with a wider range of high-quality options to choose from.

Streamlined Operations and Efficient Processes

Private equity investors also bring in their expertise in streamlining operations and implementing efficient processes. By implementing best practices and cutting unnecessary costs, they help mattress firms become more profitable and sustainable. This, in turn, allows mattress firms to invest in better technology and resources, resulting in improved production and delivery processes. As a result, house design firms can expect to receive their mattress orders on time and in top-notch condition.

Private equity investors also bring in their expertise in streamlining operations and implementing efficient processes. By implementing best practices and cutting unnecessary costs, they help mattress firms become more profitable and sustainable. This, in turn, allows mattress firms to invest in better technology and resources, resulting in improved production and delivery processes. As a result, house design firms can expect to receive their mattress orders on time and in top-notch condition.

Increased Competition and Lower Prices

Private equity investment in mattress firms also leads to increased competition within the industry. With more investors and firms vying for a piece of the market, it results in lower prices for consumers. This is beneficial for house design as it allows for more affordable options when it comes to purchasing mattresses. Additionally, with increased competition, mattress firms are encouraged to constantly improve their products and services, ultimately benefiting consumers.

Private equity investment in mattress firms also leads to increased competition within the industry. With more investors and firms vying for a piece of the market, it results in lower prices for consumers. This is beneficial for house design as it allows for more affordable options when it comes to purchasing mattresses. Additionally, with increased competition, mattress firms are encouraged to constantly improve their products and services, ultimately benefiting consumers.

Conclusion

In conclusion, private equity investment in mattress firms has numerous benefits for the house design industry. From increased innovation and quality to improved operations and lower prices, it is clear that private equity investors play a vital role in driving the growth and success of mattress firms. As a result, consumers can expect to see a wider range of high-quality and affordable mattresses in the market, making house design a more comfortable and enjoyable experience.

In conclusion, private equity investment in mattress firms has numerous benefits for the house design industry. From increased innovation and quality to improved operations and lower prices, it is clear that private equity investors play a vital role in driving the growth and success of mattress firms. As a result, consumers can expect to see a wider range of high-quality and affordable mattresses in the market, making house design a more comfortable and enjoyable experience.