Located in the heart of the city, Neon Bar N Kitchen has become a popular spot for locals and tourists alike. With its vibrant atmosphere, delicious food, and exciting events, it's no wonder that this bar has a long list of loyal customers. However, with great success comes great responsibility, and that includes managing the finances of the business. In this article, we will take a closer look at the top 10 main neon bar n kitchen list of receivables and how they handle their accounting and financial records.Neon Bar N Kitchen: A Popular Hangout Spot

Accounting is an essential aspect of any business, and it involves keeping track of the financial transactions and records. This includes the money that comes in and goes out of the business, as well as managing debts and payments. For a busy and popular establishment like Neon Bar N Kitchen, having an efficient accounting system is crucial for its success. Let's explore the top 10 main neon bar n kitchen list of receivables and how they manage their financial records.The Importance of Accounting for a Business

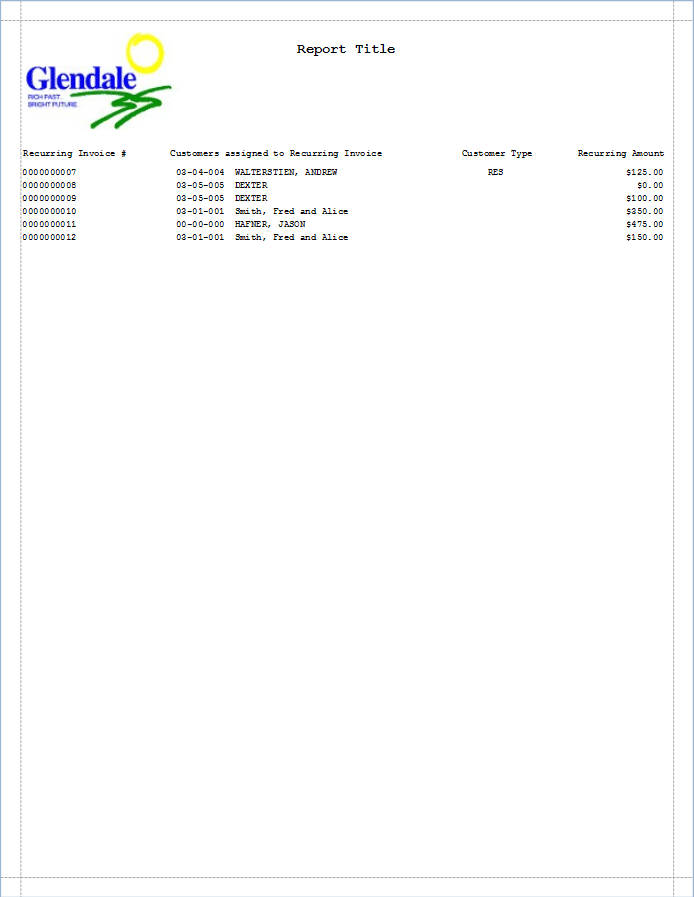

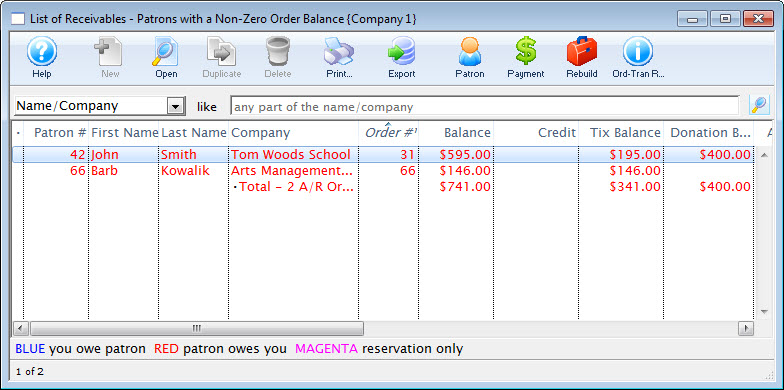

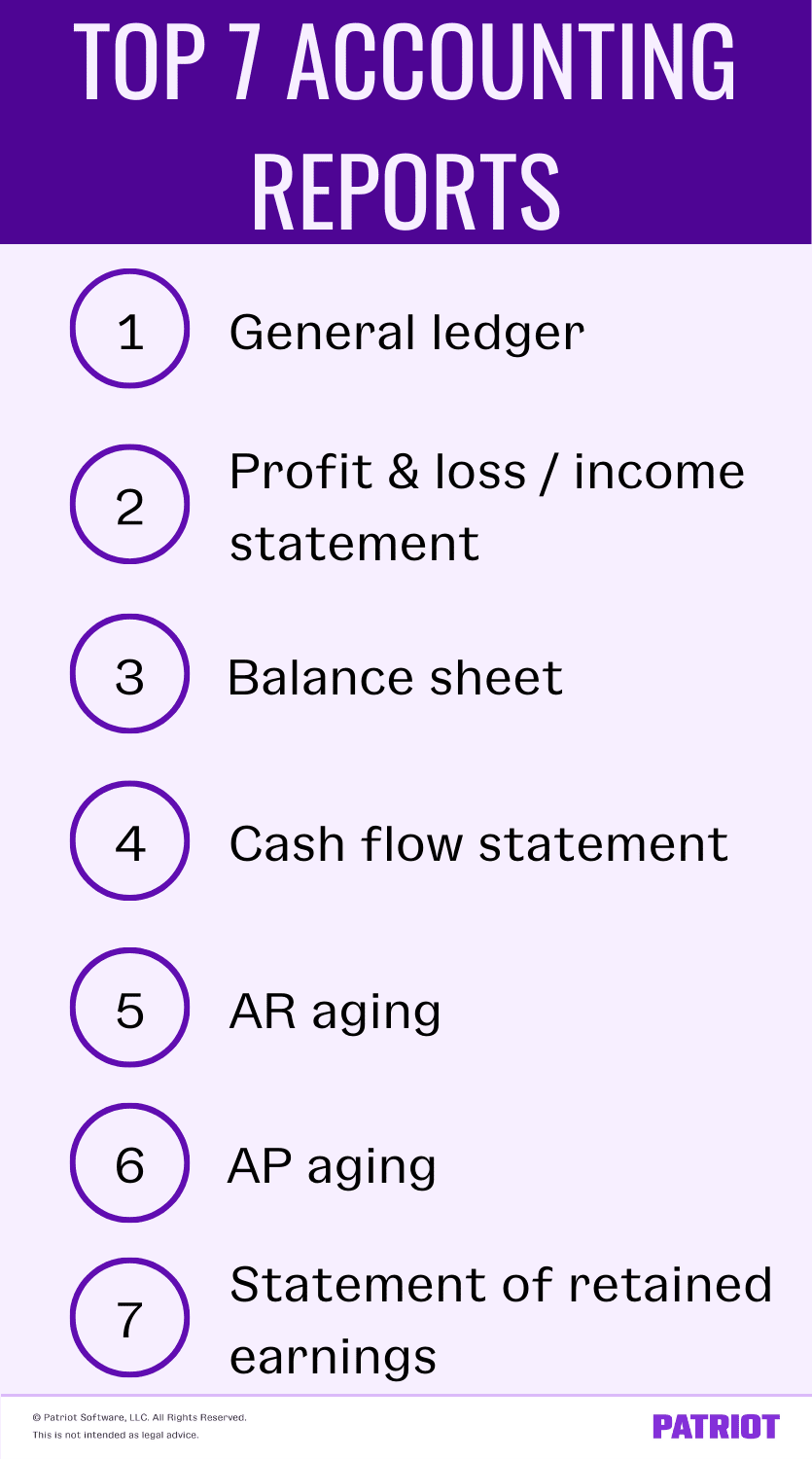

1. Accounts Receivable: This refers to the money owed to the bar by its customers for the products and services they have received. This includes food and drinks ordered, event tickets, and any other charges incurred by the customers. 2. Invoice Tracking: Neon Bar N Kitchen uses an electronic system to keep track of all their invoices, making it easier to monitor outstanding payments and send reminders to customers who have not yet settled their bills. 3. Payment Processing: With the rise of digital payments, the bar has adopted various payment methods to make it easier for customers to settle their bills. This includes credit and debit cards, online transfers, and mobile payment apps. 4. Credit Management: Managing credit is essential, especially for a business that offers tabs or allows customers to pay at a later date. The bar has a strict policy for extending credit and ensures that all credit transactions are properly recorded and monitored. 5. Collection Strategies: While the majority of customers settle their bills on time, there are always a few who may delay payments. Neon Bar N Kitchen has effective collection strategies in place to ensure that they receive their payments promptly. 6. Late Fees: To encourage customers to settle their bills on time, the bar has a policy of charging late fees for overdue payments. This not only helps in managing cash flow but also acts as a deterrent for customers who may be tempted to delay their payments. 7. Payment Terms: The bar has clear and specific payment terms for their customers, including the due date and acceptable methods of payment. This helps in avoiding any confusion or disputes regarding payments. 8. Debt Management: Like any other business, Neon Bar N Kitchen also has its share of debts, including loans and credit lines. They have a system in place to manage these debts and ensure that they are paid on time to avoid any financial issues. 9. Customer Records: The bar keeps detailed records of their customers, including their contact information, payment history, and any outstanding debts. This helps in maintaining good customer relationships and also assists in the accounting process. 10. Regular Audits: To ensure that everything is in order, the bar conducts regular audits of their accounting and financial records. This helps in identifying any discrepancies or errors and ensures that their financial records are accurate and up to date.Top 10 Main Neon Bar N Kitchen List of Receivables

Neon Bar N Kitchen has become a hotspot for many, and with good reason. However, behind the scenes, the bar has an efficient accounting system in place to manage their finances and ensure their success. From accounts receivable to regular audits, the top 10 main neon bar n kitchen list of receivables plays a crucial role in the business's financial management. With proper accounting and financial records, the bar can continue to thrive and provide its customers with a memorable experience.Conclusion

Creating a Unique and Vibrant Atmosphere with Neon Bar and Kitchen: A Must-Have in Your House Design

Adding a Touch of Neon to Your House Design

When it comes to designing your dream home, every detail matters. From the color scheme to the furniture, each element plays a crucial role in creating the perfect atmosphere. And one key element that can take your house design to the next level is a neon bar and kitchen. This trend has been gaining popularity in recent years, and for good reason. Not only does it add a unique and vibrant touch to your home, but it also serves as a functional space for entertaining guests and preparing meals.

Neon bar and kitchen

is not just limited to commercial spaces anymore. With the right design and placement, you can easily incorporate this feature into your home. Whether you want to add a pop of color to your modern minimalist home or create a retro vibe in your traditional house, a neon bar and kitchen can easily be customized to match your personal style and preferences.

When it comes to designing your dream home, every detail matters. From the color scheme to the furniture, each element plays a crucial role in creating the perfect atmosphere. And one key element that can take your house design to the next level is a neon bar and kitchen. This trend has been gaining popularity in recent years, and for good reason. Not only does it add a unique and vibrant touch to your home, but it also serves as a functional space for entertaining guests and preparing meals.

Neon bar and kitchen

is not just limited to commercial spaces anymore. With the right design and placement, you can easily incorporate this feature into your home. Whether you want to add a pop of color to your modern minimalist home or create a retro vibe in your traditional house, a neon bar and kitchen can easily be customized to match your personal style and preferences.

Creating an Eye-Catching Focal Point

One of the main benefits of having a neon bar and kitchen in your house design is its ability to serve as an eye-catching focal point. With its bright and bold colors, it can easily draw attention and become a conversation starter. You can choose from a variety of neon colors and designs to create a statement piece that reflects your personality. Additionally, a neon bar and kitchen can also act as a functional piece of art, adding character and personality to your home.

List of Receivables

Aside from its aesthetic appeal, a neon bar and kitchen also offers practical benefits. It can serve as a designated area for mixing and serving drinks, making it perfect for hosting parties and gatherings. It can also be a great space for preparing meals, with its ample countertop space and storage options. Furthermore, incorporating a neon bar and kitchen into your house design can increase the value of your home, making it a wise investment for the future.

In conclusion, a neon bar and kitchen is a must-have in any house design. It adds a unique and vibrant touch, serves as a functional space, and acts as an eye-catching focal point. So next time you're thinking about designing your dream home, be sure to consider incorporating a neon bar and kitchen into your plans. Trust us, you won't regret it.

One of the main benefits of having a neon bar and kitchen in your house design is its ability to serve as an eye-catching focal point. With its bright and bold colors, it can easily draw attention and become a conversation starter. You can choose from a variety of neon colors and designs to create a statement piece that reflects your personality. Additionally, a neon bar and kitchen can also act as a functional piece of art, adding character and personality to your home.

List of Receivables

Aside from its aesthetic appeal, a neon bar and kitchen also offers practical benefits. It can serve as a designated area for mixing and serving drinks, making it perfect for hosting parties and gatherings. It can also be a great space for preparing meals, with its ample countertop space and storage options. Furthermore, incorporating a neon bar and kitchen into your house design can increase the value of your home, making it a wise investment for the future.

In conclusion, a neon bar and kitchen is a must-have in any house design. It adds a unique and vibrant touch, serves as a functional space, and acts as an eye-catching focal point. So next time you're thinking about designing your dream home, be sure to consider incorporating a neon bar and kitchen into your plans. Trust us, you won't regret it.