If you're planning to purchase a new mattress in Minnesota, it's important to understand the state's sales tax laws. Sales tax is a percentage of the retail price that is added onto the final cost of a product. In Minnesota, sales tax is applied to most goods and services, including mattresses. However, the sales tax rate and exemptions for mattresses may vary depending on where you live in the state. Let's take a deeper look at the top 10 things you need to know about Minnesota sales tax on mattresses.Minnesota Sales Tax on Mattresses

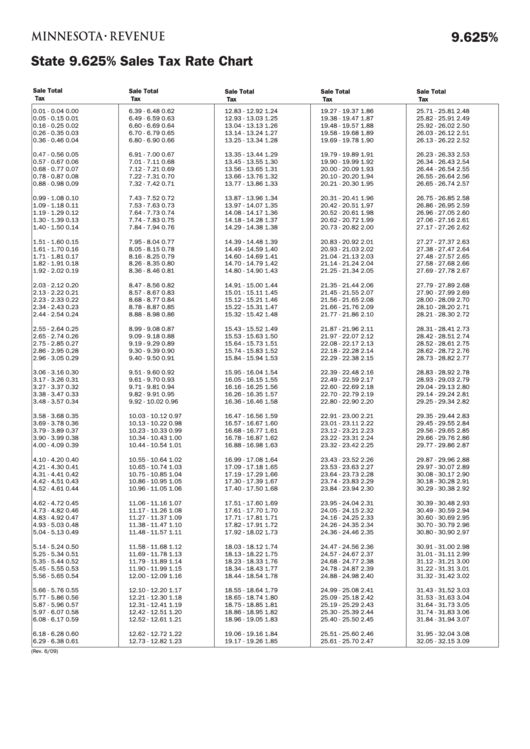

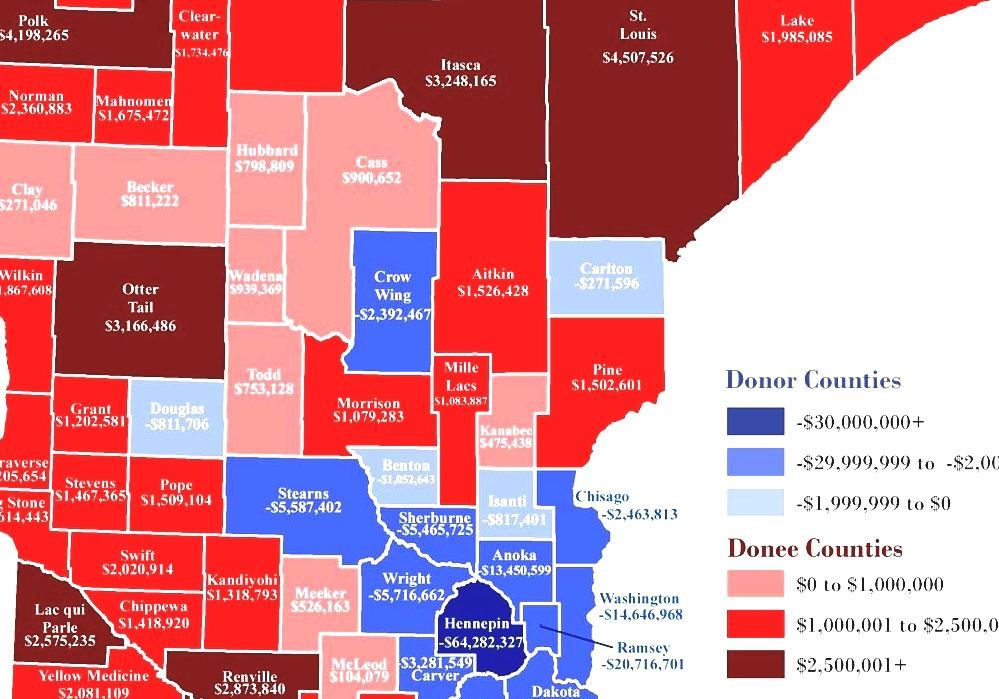

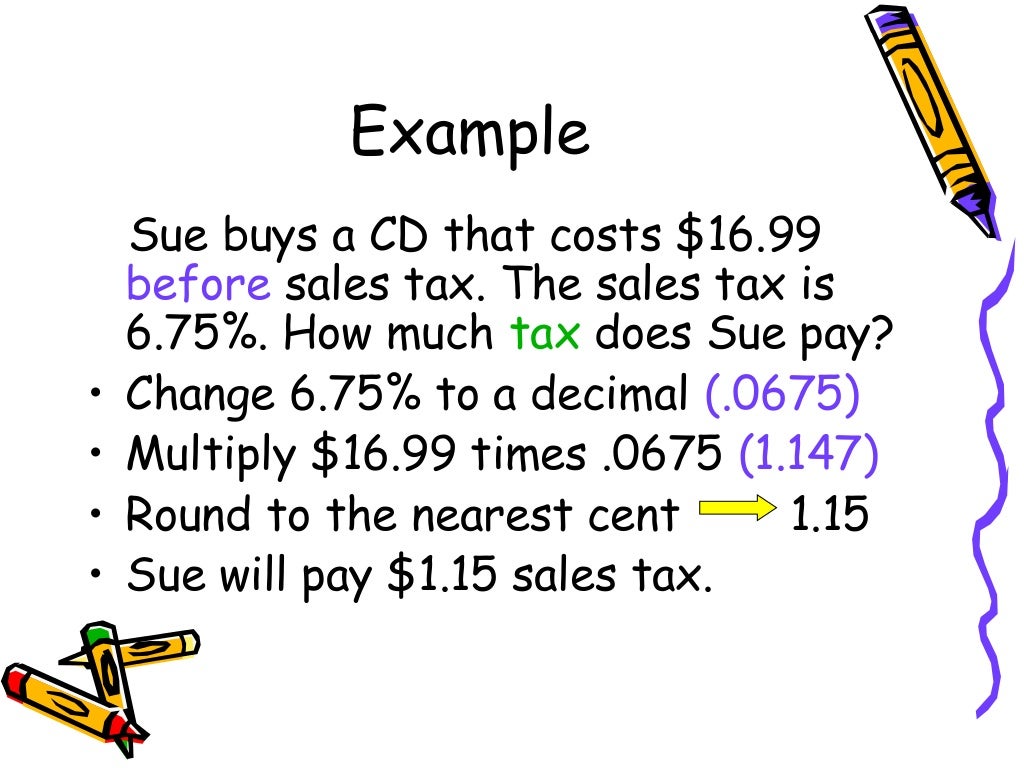

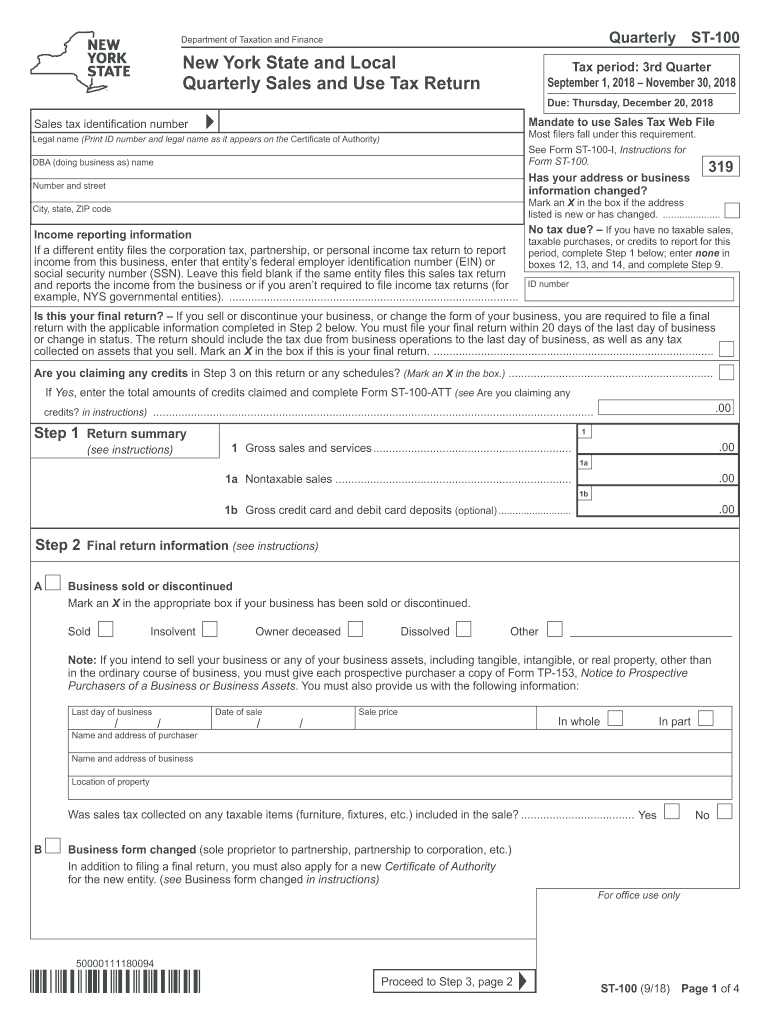

The sales tax rate in Minnesota is currently 6.875%, but some cities and counties may add an additional local tax, bringing the total rate to 7.875%. If you're purchasing a $319 mattress in an area with a 7.875% sales tax rate, you can expect to pay an additional $25.07 in sales tax. Keep in mind that this rate may change depending on where you live in the state.How Much is the Sales Tax on a $319 Mattress in Minnesota?

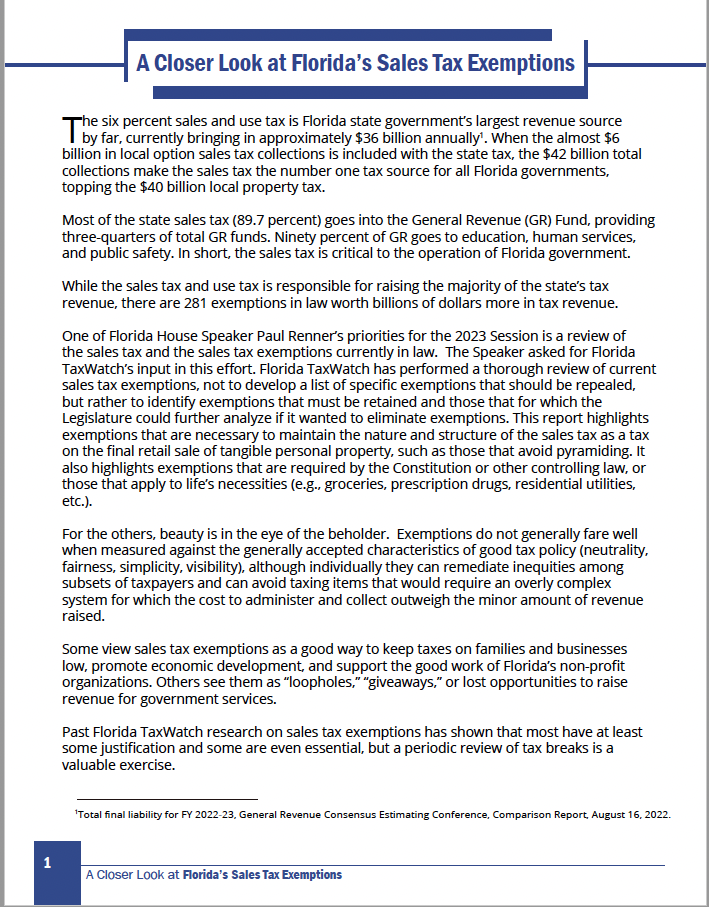

As mentioned earlier, the current sales tax rate for most goods and services in Minnesota is 6.875%. This rate applies to all mattresses sold in the state, including in-store and online purchases. However, some cities and counties may add an additional local tax, so it's important to check with your local government for the exact rate in your area.Minnesota Sales Tax Rate for Mattresses

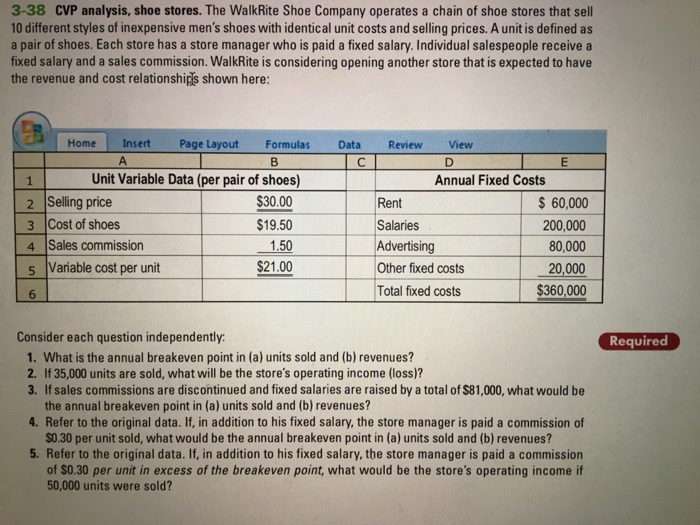

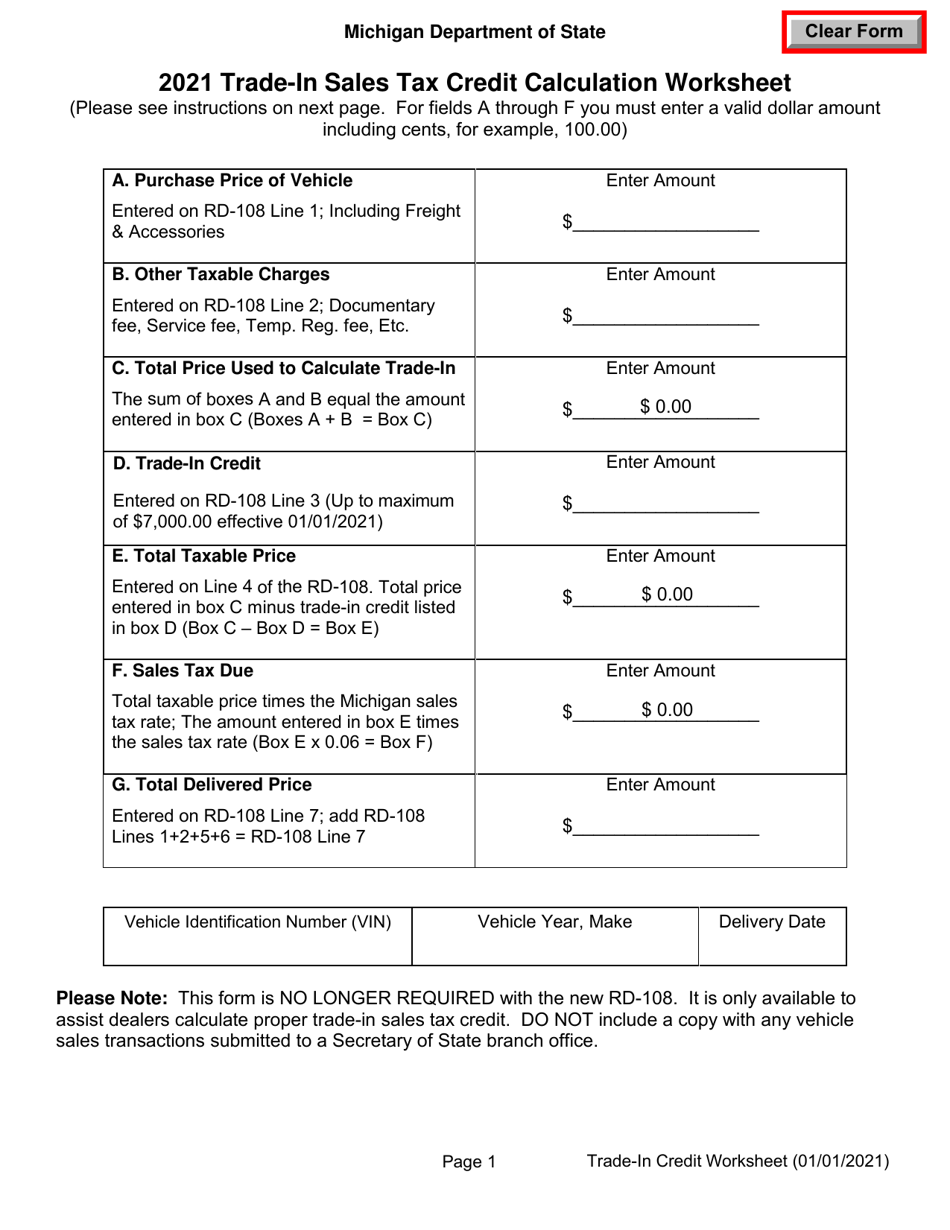

Calculating sales tax on a mattress in Minnesota is a fairly simple process. First, you'll need to determine the total cost of the mattress, including any additional fees such as delivery or disposal fees. Then, you can multiply the total cost by the sales tax rate in your area. For example, if you purchase a $500 mattress in an area with a 7.875% sales tax rate, you can expect to pay an additional $39.38 in sales tax.Calculating Sales Tax on a Mattress in Minnesota

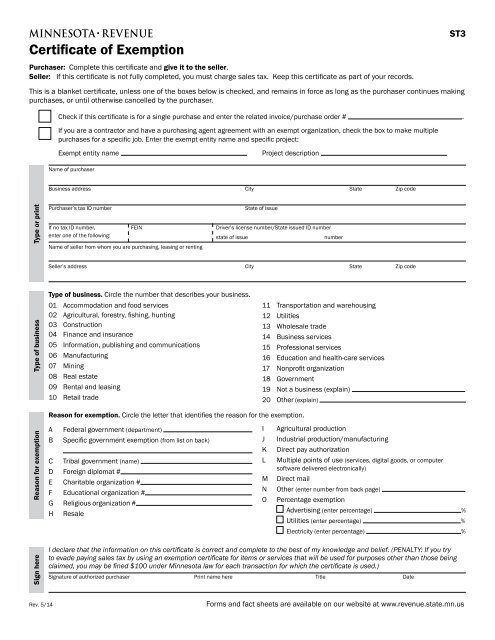

In some cases, you may be exempt from paying sales tax on your mattress purchase in Minnesota. For example, if you have a medical condition that requires a specific type of mattress, you may be able to get a tax exemption with a doctor's note. Additionally, if you purchase a mattress for resale purposes, you may not have to pay sales tax. However, it's important to check with your local government for specific exemptions and requirements.Minnesota Sales Tax Exemptions for Mattresses

It's important to understand that sales tax laws for mattresses in Minnesota can be complex and may vary depending on your location and situation. For example, the sales tax rate and exemptions may be different for in-store purchases versus online purchases. It's always a good idea to check with your local government or a tax professional for clarification on the sales tax laws in your area.Understanding Minnesota's Sales Tax Laws for Mattresses

If you're looking to save money on sales tax for your mattress purchase in Minnesota, there are a few tips you can follow. First, consider purchasing your mattress during a sales tax holiday, if available. These holidays typically occur during back-to-school season and can save you a significant amount on sales tax. You can also look for retailers that offer promotions or discounts on mattresses, which can help offset the cost of sales tax.Tips for Saving Money on Sales Tax for Mattresses in Minnesota

As mentioned earlier, sales tax is applied to both in-store and online purchases of mattresses in Minnesota. This means that if you purchase a mattress online from a retailer with a physical presence in the state, you will be charged sales tax. However, if you purchase a mattress from an out-of-state retailer, you may not have to pay sales tax, but you may be required to report and pay a use tax on the purchase.Minnesota Sales Tax on Online Purchases of Mattresses

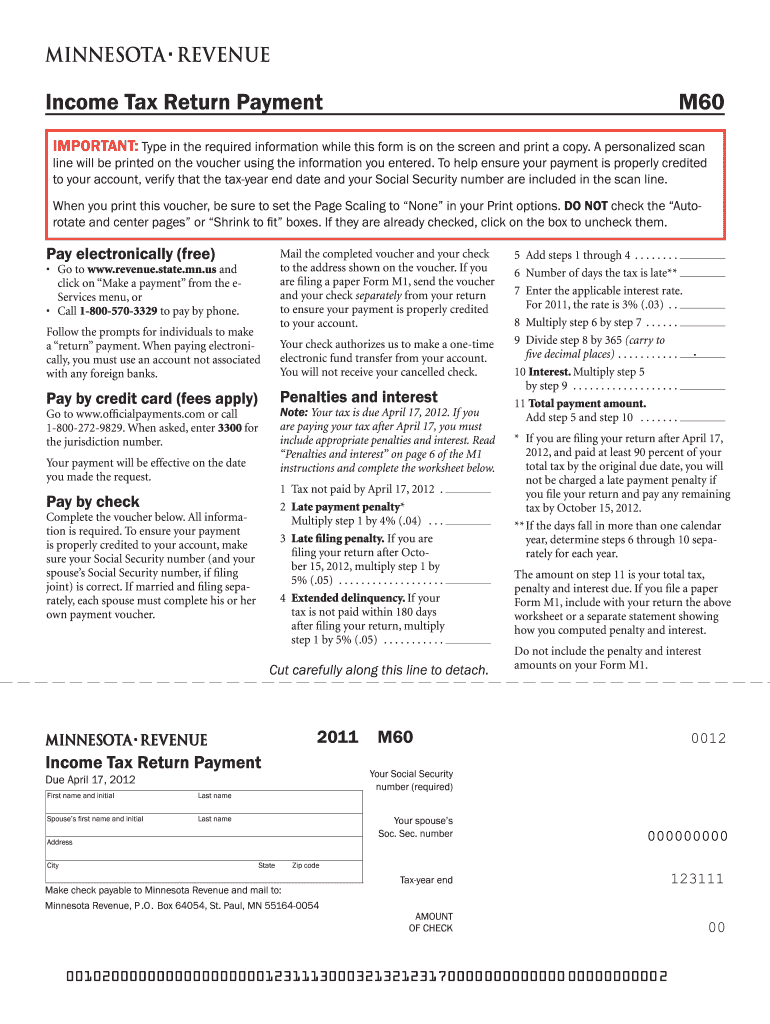

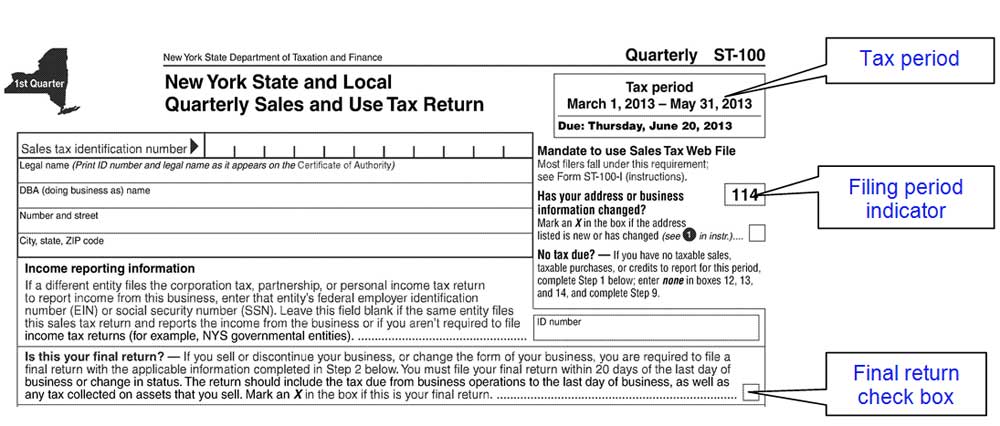

If you're a business owner in Minnesota selling mattresses, you will be responsible for collecting and remitting sales tax to the state. This can be done through the Minnesota Department of Revenue's online filing system or by mail. It's important to keep accurate records of your sales and sales tax collected to ensure proper reporting and payment.How to File Sales Tax for Mattresses in Minnesota

Here are some common questions people have about sales tax on mattresses in Minnesota:Common Questions About Sales Tax on Mattresses in Minnesota

How the Minnesota Sales Tax on 319 Mattress Affects House Design

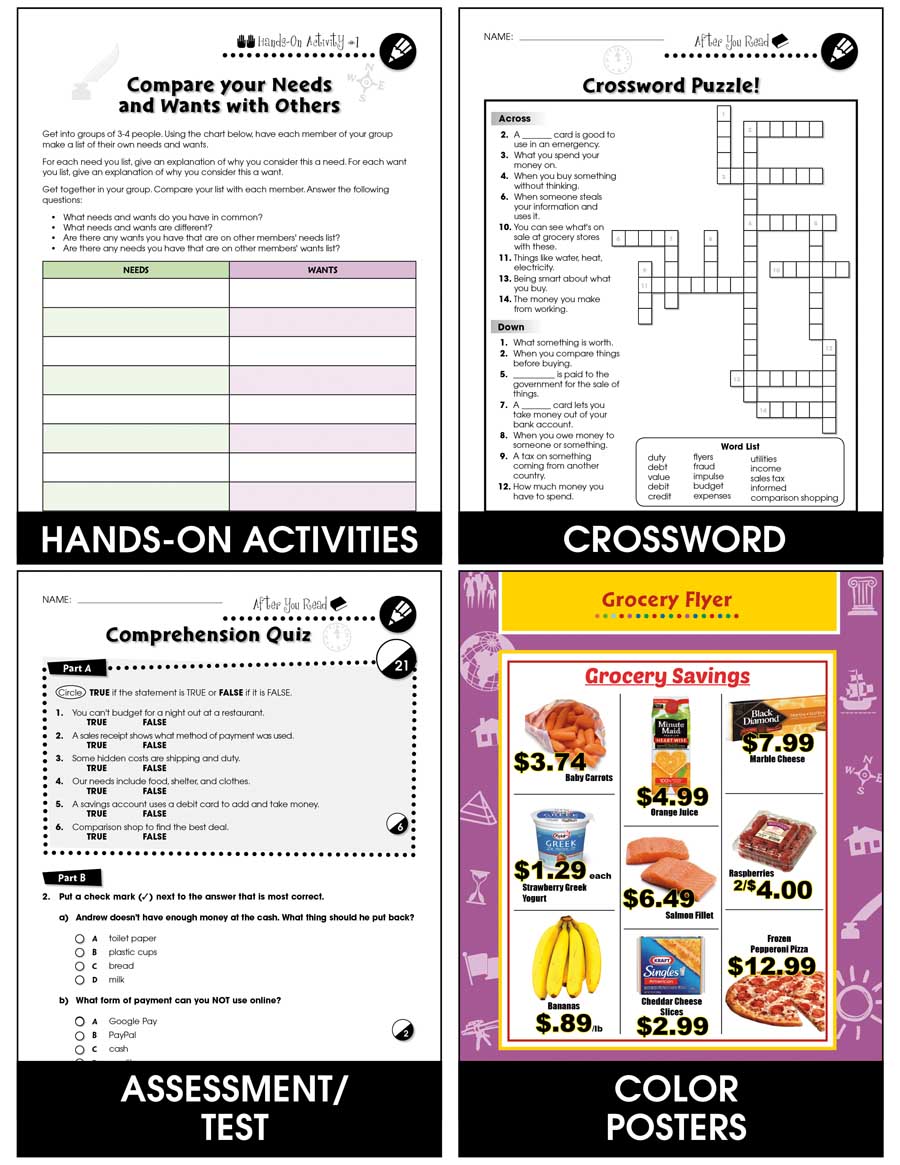

The Importance of Budget Planning in House Design

When it comes to designing a house, there are many factors to consider, such as location, size, and style. However, one often overlooked aspect is the budget. The amount of money you have available can greatly impact the design of your dream home. This is especially true when it comes to purchasing furniture and home decor, including mattresses. With the recent implementation of the Minnesota sales tax on 319 mattress, it has become even more crucial to carefully plan and budget for your house design.

House design is not just about aesthetics; it's about functionality and comfort as well.

And one of the most important elements of comfort in a home is the mattress. With the average person spending about one-third of their life sleeping, it's essential to invest in a good quality mattress. However, with the added expense of the Minnesota sales tax on 319 mattress, it's crucial to make informed decisions and budget accordingly.

When it comes to designing a house, there are many factors to consider, such as location, size, and style. However, one often overlooked aspect is the budget. The amount of money you have available can greatly impact the design of your dream home. This is especially true when it comes to purchasing furniture and home decor, including mattresses. With the recent implementation of the Minnesota sales tax on 319 mattress, it has become even more crucial to carefully plan and budget for your house design.

House design is not just about aesthetics; it's about functionality and comfort as well.

And one of the most important elements of comfort in a home is the mattress. With the average person spending about one-third of their life sleeping, it's essential to invest in a good quality mattress. However, with the added expense of the Minnesota sales tax on 319 mattress, it's crucial to make informed decisions and budget accordingly.

How the Minnesota Sales Tax on 319 Mattress Affects House Design

With the Minnesota sales tax on 319 mattress, the cost of purchasing a new mattress can significantly increase. This means that homeowners may have to make adjustments to their budget in order to accommodate this additional expense. For some, this may mean compromising on other aspects of their house design, such as opting for cheaper furniture or sacrificing certain design features.

Furthermore, the added expense of the sales tax may also limit the options for mattress brands and styles that homeowners can choose from. This can be particularly challenging for those with specific preferences or health conditions that require a certain type of mattress. It may also impact the overall design aesthetic of the bedroom, as the mattress is often a focal point in the room.

With the Minnesota sales tax on 319 mattress, the cost of purchasing a new mattress can significantly increase. This means that homeowners may have to make adjustments to their budget in order to accommodate this additional expense. For some, this may mean compromising on other aspects of their house design, such as opting for cheaper furniture or sacrificing certain design features.

Furthermore, the added expense of the sales tax may also limit the options for mattress brands and styles that homeowners can choose from. This can be particularly challenging for those with specific preferences or health conditions that require a certain type of mattress. It may also impact the overall design aesthetic of the bedroom, as the mattress is often a focal point in the room.

The Importance of Finding Alternatives

While the Minnesota sales tax on 319 mattress may seem like a hindrance to house design, there are ways to work around it. One option is to explore alternative mattress options that may not be subject to the sales tax, such as purchasing from a local manufacturer or online retailer. Another option is to consider purchasing a high-quality mattress that may have a longer lifespan, thereby reducing the need for frequent replacements and ultimately saving money in the long run.

In addition,

budgeting and planning ahead

can also help alleviate the impact of the sales tax on the overall house design. By setting a clear budget and prioritizing expenses, homeowners can make informed decisions and allocate their funds effectively.

In conclusion, the Minnesota sales tax on 319 mattress does have an impact on house design, particularly in terms of budgeting and decision-making. However, with careful planning and exploring alternative options, homeowners can still achieve their dream house design without compromising on comfort and quality.

While the Minnesota sales tax on 319 mattress may seem like a hindrance to house design, there are ways to work around it. One option is to explore alternative mattress options that may not be subject to the sales tax, such as purchasing from a local manufacturer or online retailer. Another option is to consider purchasing a high-quality mattress that may have a longer lifespan, thereby reducing the need for frequent replacements and ultimately saving money in the long run.

In addition,

budgeting and planning ahead

can also help alleviate the impact of the sales tax on the overall house design. By setting a clear budget and prioritizing expenses, homeowners can make informed decisions and allocate their funds effectively.

In conclusion, the Minnesota sales tax on 319 mattress does have an impact on house design, particularly in terms of budgeting and decision-making. However, with careful planning and exploring alternative options, homeowners can still achieve their dream house design without compromising on comfort and quality.