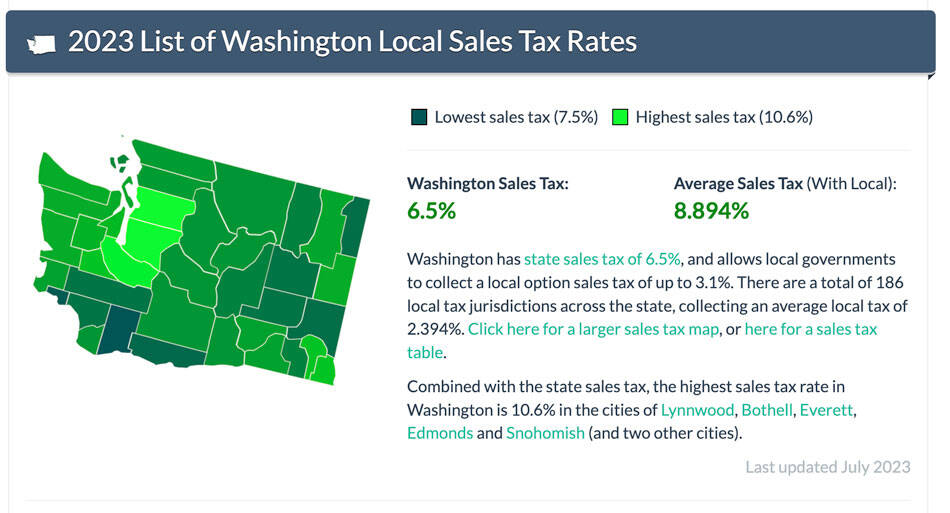

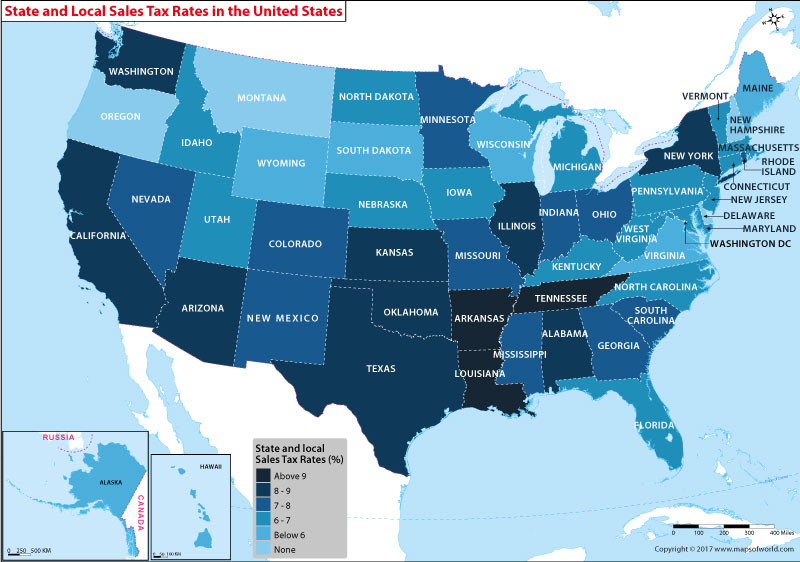

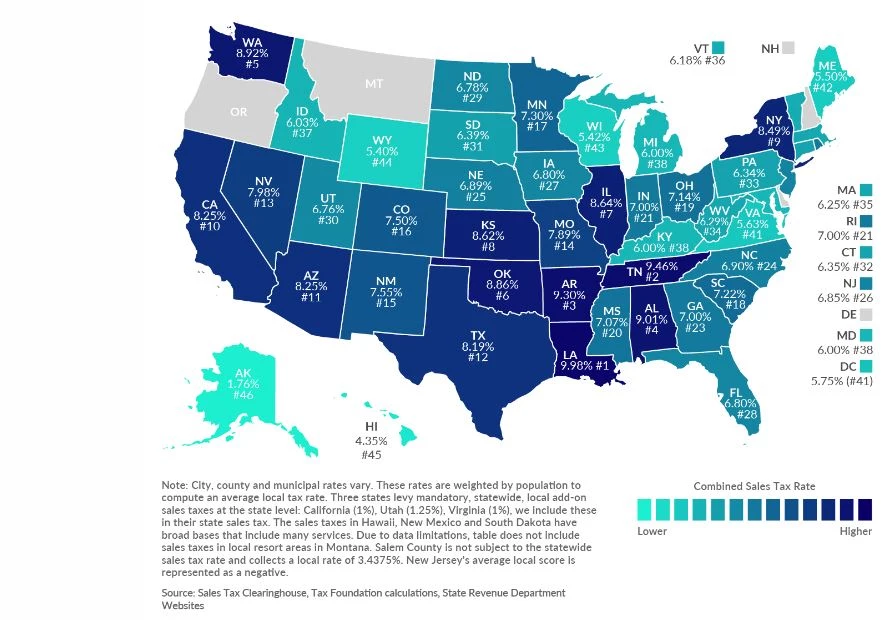

If you're in the market for a new mattress in Washington State, it's important to factor in sales tax when determining the total cost. Sales tax rates can vary significantly from city to city and county to county in the state, so it's important to know what to expect in your area. In this article, we'll break down the top 10 main sales tax rates for mattresses in Washington State, giving you a comprehensive guide to make an informed decision.Washington State Sales Tax Rates by City & County 2021

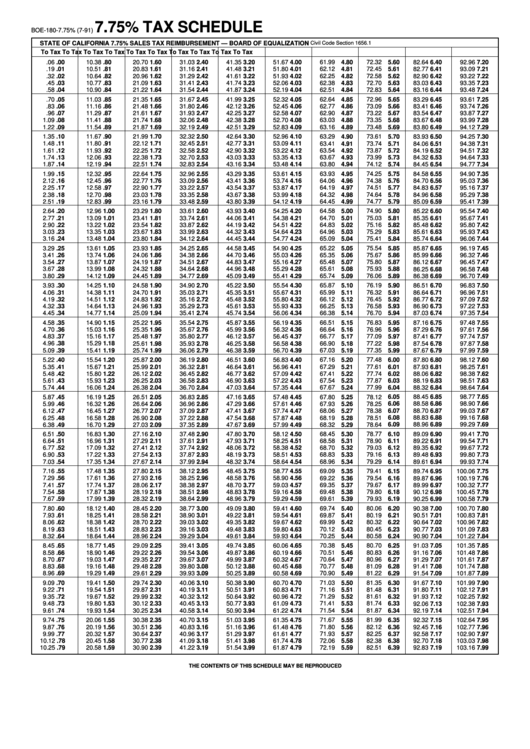

The city of Seattle has a sales tax rate of 10.1%, making it one of the highest in the state. This includes the state sales tax rate of 6.5%, the Seattle city sales tax rate of 3.6%, and the King County sales tax rate of 0%. If you're buying a mattress in Seattle, be prepared to pay a higher tax rate compared to other cities in Washington.1. Seattle

Spokane, located in eastern Washington, has a sales tax rate of 8.9%. This includes the state sales tax rate of 6.5%, the Spokane city sales tax rate of 1.9%, and the Spokane County sales tax rate of 0.5%. While still on the higher end, it is slightly lower than Seattle's sales tax rate.2. Spokane

Tacoma, located in Pierce County, has a sales tax rate of 10%. This includes the state sales tax rate of 6.5%, the Tacoma city sales tax rate of 3.5%, and the Pierce County sales tax rate of 0%. Like Seattle, buying a mattress in Tacoma will result in a higher sales tax rate.3. Tacoma

Vancouver, located in Clark County, has a sales tax rate of 8.4%. This includes the state sales tax rate of 6.5%, the Vancouver city sales tax rate of 1.2%, and the Clark County sales tax rate of 0.7%. While still on the higher end, it is slightly lower than Seattle and Tacoma's sales tax rates.4. Vancouver

Bellevue, located in King County, has a sales tax rate of 10.1%, the same as Seattle. This includes the state sales tax rate of 6.5%, the Bellevue city sales tax rate of 3.6%, and the King County sales tax rate of 0%.5. Bellevue

Kent, located in King County, has a sales tax rate of 10.1%, the same as Seattle and Bellevue. This includes the state sales tax rate of 6.5%, the Kent city sales tax rate of 3.6%, and the King County sales tax rate of 0%.6. Kent

Everett, located in Snohomish County, has a sales tax rate of 9.8%. This includes the state sales tax rate of 6.5%, the Everett city sales tax rate of 2.3%, and the Snohomish County sales tax rate of 1%. While still high, it is slightly lower than other cities in King County.7. Everett

Renton, located in King County, has a sales tax rate of 10.1%, the same as Seattle, Bellevue, and Kent. This includes the state sales tax rate of 6.5%, the Renton city sales tax rate of 3.6%, and the King County sales tax rate of 0%.8. Renton

Federal Way, located in King County, has a sales tax rate of 10.1%, the same as Seattle, Bellevue, Kent, and Renton. This includes the state sales tax rate of 6.5%, the Federal Way city sales tax rate of 3.6%, and the King County sales tax rate of 0%.9. Federal Way

The Impact of Sales Tax on Mattress World in Washington

The Importance of Sales Tax on Mattress Sales

When it comes to purchasing a new mattress, many consumers are often focused on finding the perfect level of comfort and support. However, there is another important factor that should not be overlooked – sales tax. In the state of Washington, sales tax plays a significant role in the mattress industry, directly impacting both retailers and consumers.

When it comes to purchasing a new mattress, many consumers are often focused on finding the perfect level of comfort and support. However, there is another important factor that should not be overlooked – sales tax. In the state of Washington, sales tax plays a significant role in the mattress industry, directly impacting both retailers and consumers.

The Current Sales Tax Situation in Washington

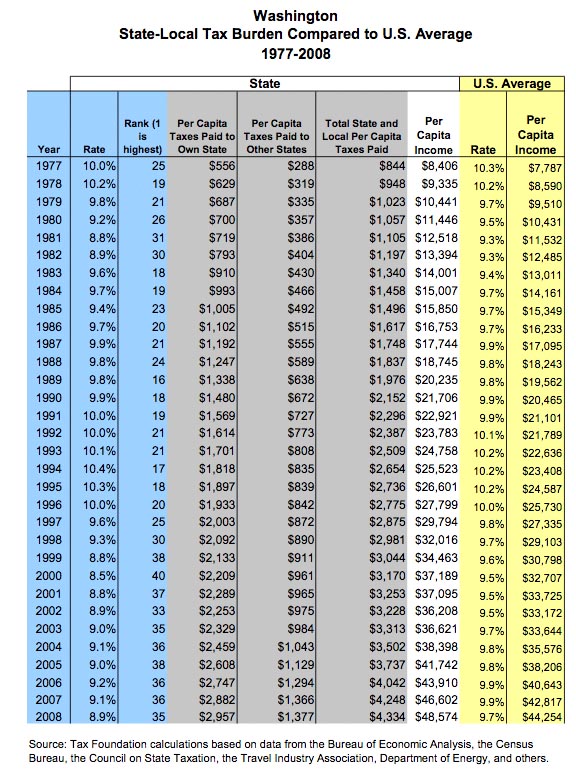

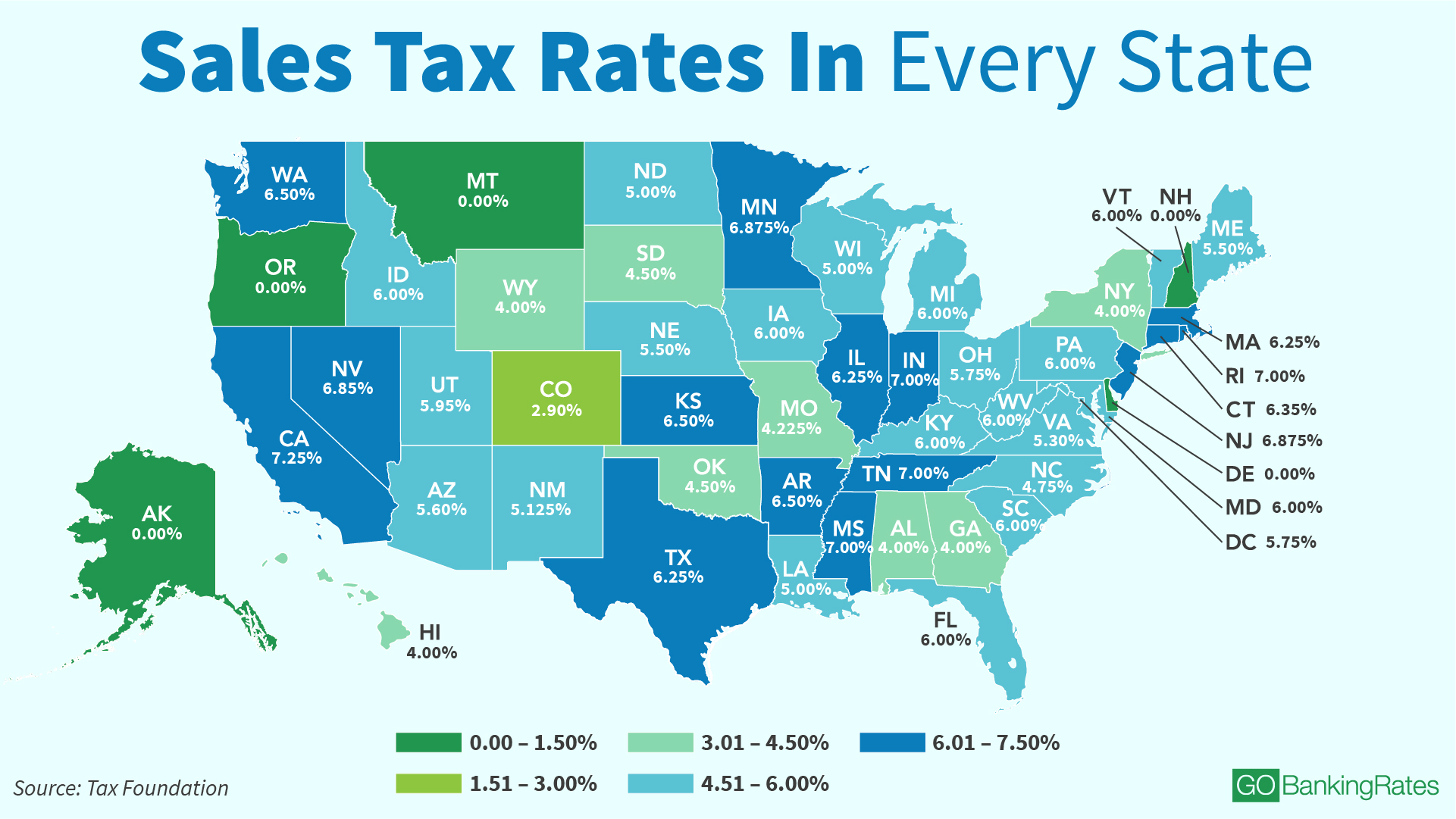

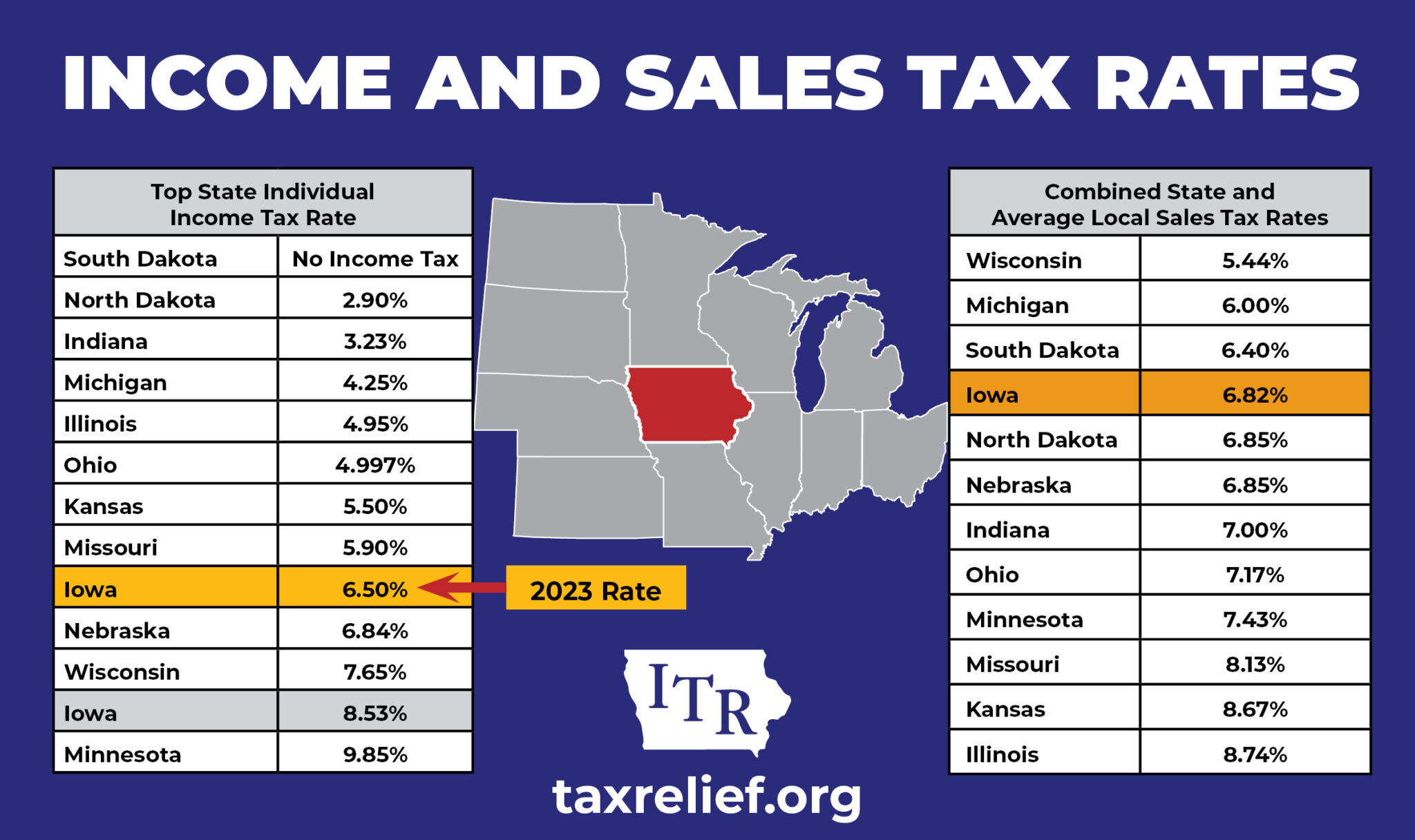

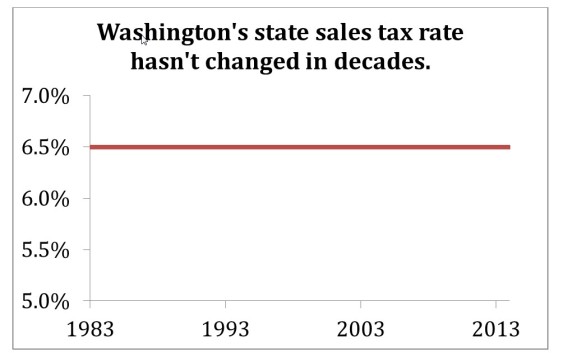

Currently, Washington state has a sales tax rate of 6.5%, with some local areas adding additional taxes. This means that when purchasing a mattress, consumers can expect to pay at least 6.5% more than the advertised price. This not only affects the final price of the product, but also the overall shopping experience.

Currently, Washington state has a sales tax rate of 6.5%, with some local areas adding additional taxes. This means that when purchasing a mattress, consumers can expect to pay at least 6.5% more than the advertised price. This not only affects the final price of the product, but also the overall shopping experience.

The Impact on Mattress Retailers

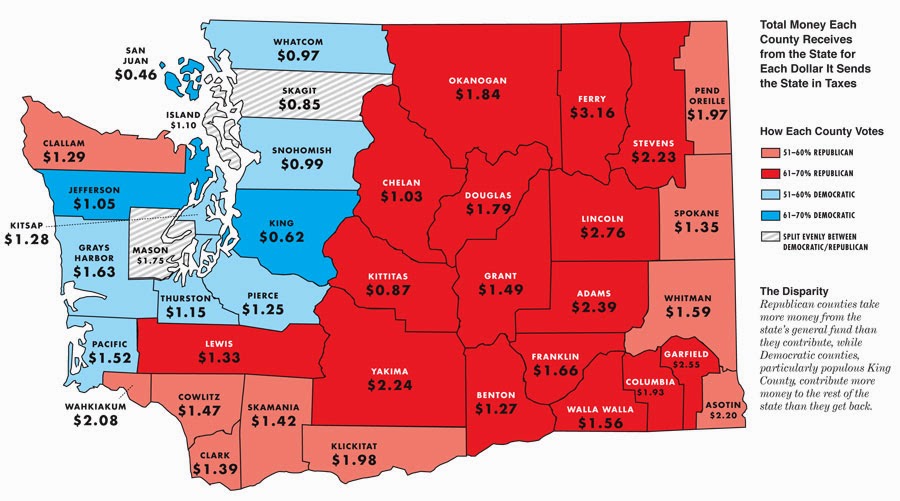

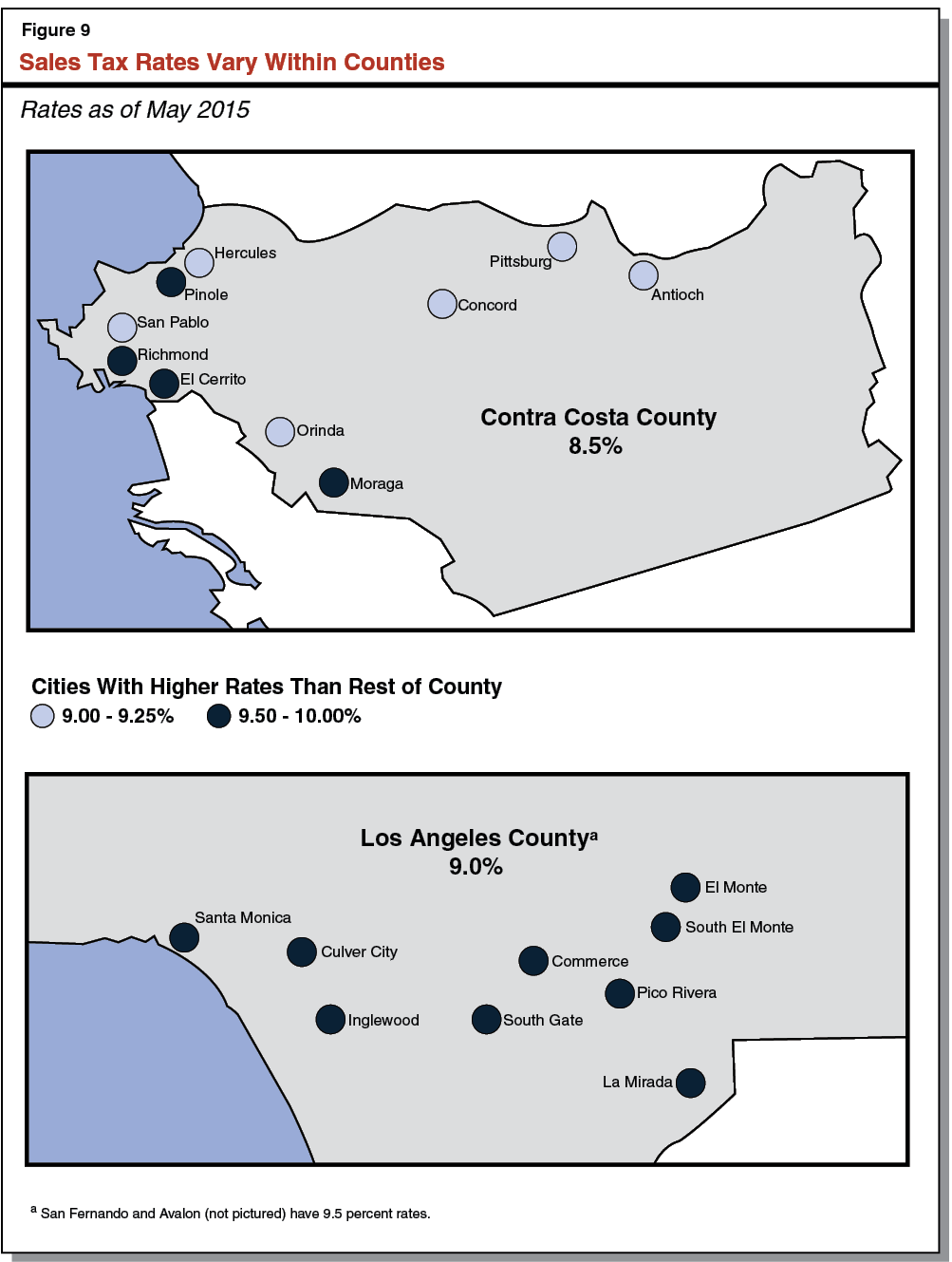

For mattress retailers, sales tax can greatly affect their profit margins. With the added 6.5% tax, retailers may have to adjust their pricing strategy to remain competitive. This can lead to lower profit margins or higher prices for consumers. Additionally, retailers must also keep track of the various local taxes in different areas, making it more challenging to offer consistent pricing across all locations.

For mattress retailers, sales tax can greatly affect their profit margins. With the added 6.5% tax, retailers may have to adjust their pricing strategy to remain competitive. This can lead to lower profit margins or higher prices for consumers. Additionally, retailers must also keep track of the various local taxes in different areas, making it more challenging to offer consistent pricing across all locations.

The Impact on Consumers

For consumers, the impact of sales tax on mattress purchases can be significant. With the added tax, the price of a mattress can increase by hundreds of dollars, making it more expensive than expected. This can be a deterrent for budget-conscious buyers, leading them to opt for cheaper alternatives or delay their purchase.

For consumers, the impact of sales tax on mattress purchases can be significant. With the added tax, the price of a mattress can increase by hundreds of dollars, making it more expensive than expected. This can be a deterrent for budget-conscious buyers, leading them to opt for cheaper alternatives or delay their purchase.

The Importance of Sales Tax Awareness

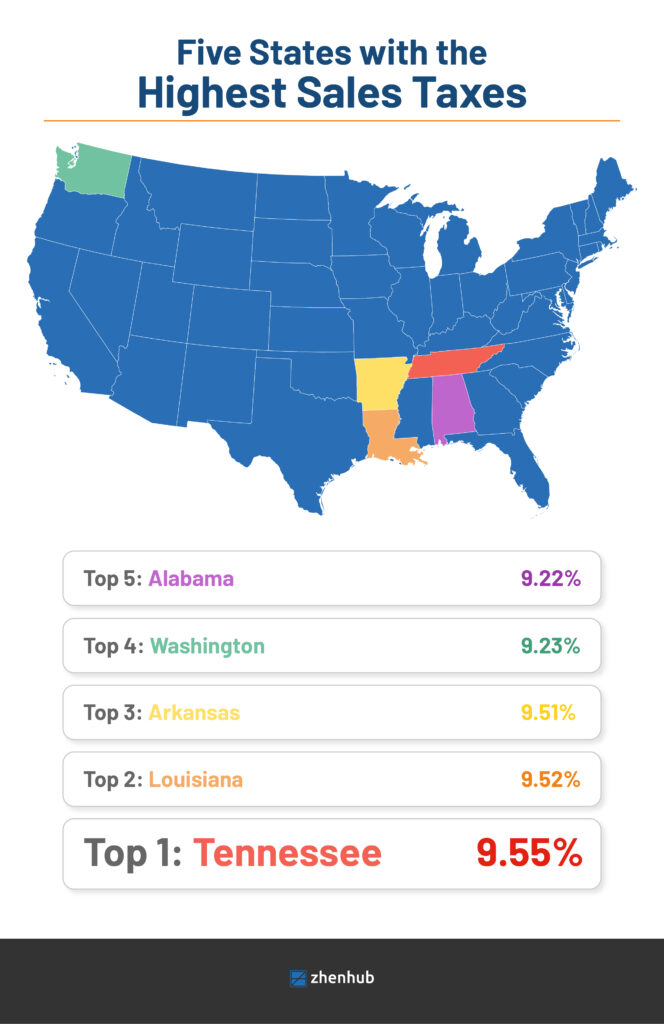

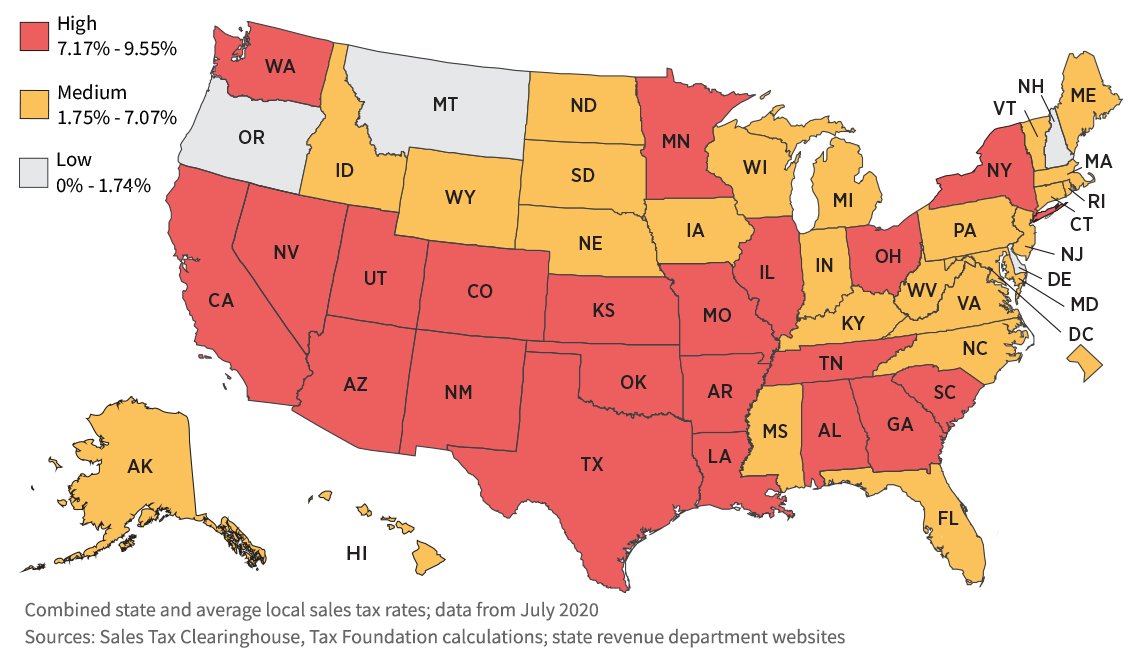

With the growing popularity of online mattress retailers, consumers may be able to find better deals by shopping in other states with lower sales tax rates. This highlights the importance of sales tax awareness when making a mattress purchase. By understanding the sales tax rates in different areas, consumers can make more informed decisions and potentially save money.

With the growing popularity of online mattress retailers, consumers may be able to find better deals by shopping in other states with lower sales tax rates. This highlights the importance of sales tax awareness when making a mattress purchase. By understanding the sales tax rates in different areas, consumers can make more informed decisions and potentially save money.

Conclusion

In conclusion, sales tax plays a crucial role in the mattress industry in Washington. It not only affects retailers and their profit margins, but also has a significant impact on consumers and their purchasing decisions. As the mattress industry continues to evolve, it is important for both retailers and consumers to be aware of the sales tax rates and its implications on the overall shopping experience.

In conclusion, sales tax plays a crucial role in the mattress industry in Washington. It not only affects retailers and their profit margins, but also has a significant impact on consumers and their purchasing decisions. As the mattress industry continues to evolve, it is important for both retailers and consumers to be aware of the sales tax rates and its implications on the overall shopping experience.