HSN Code for Mattress Protector

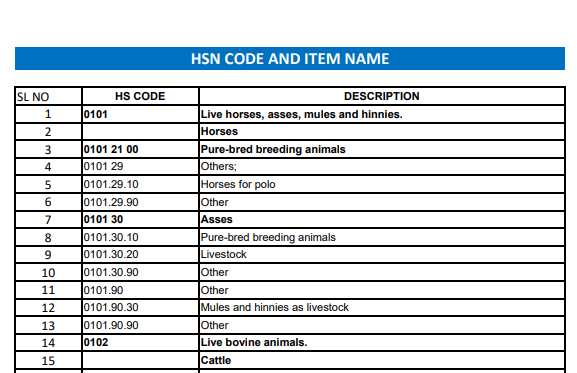

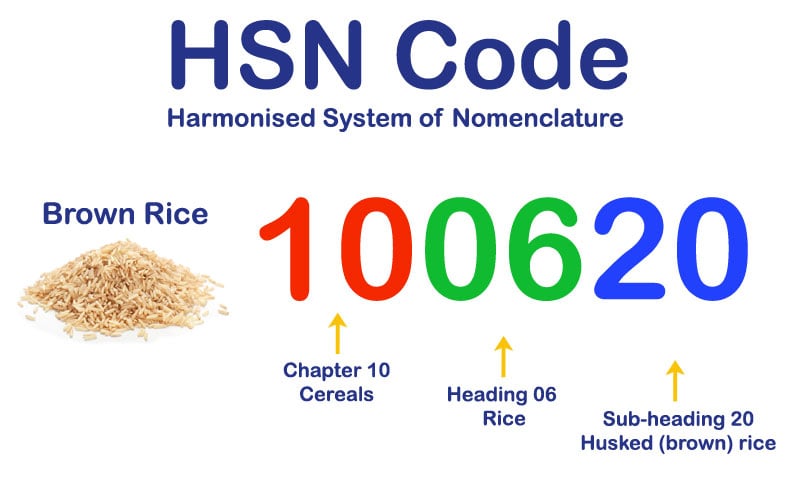

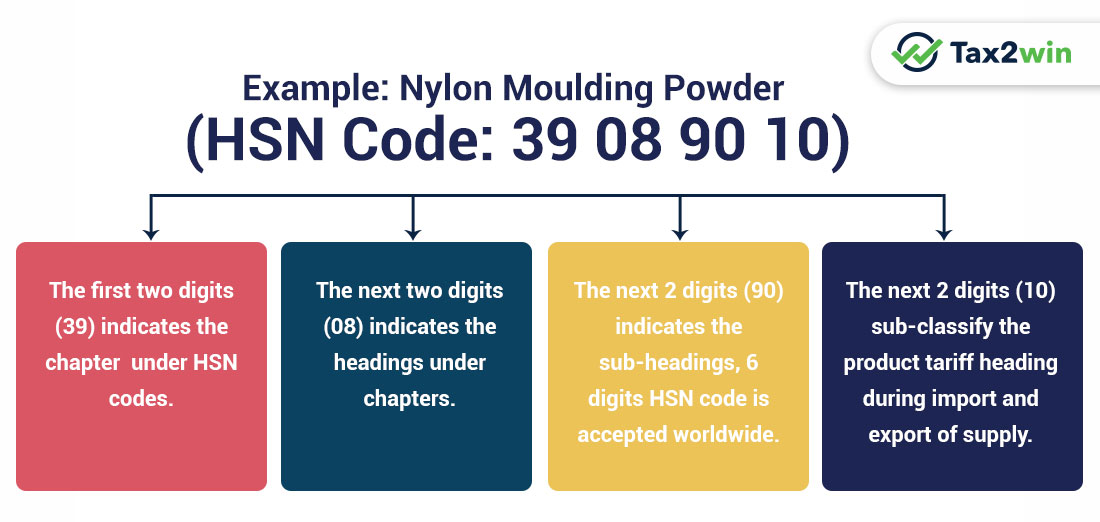

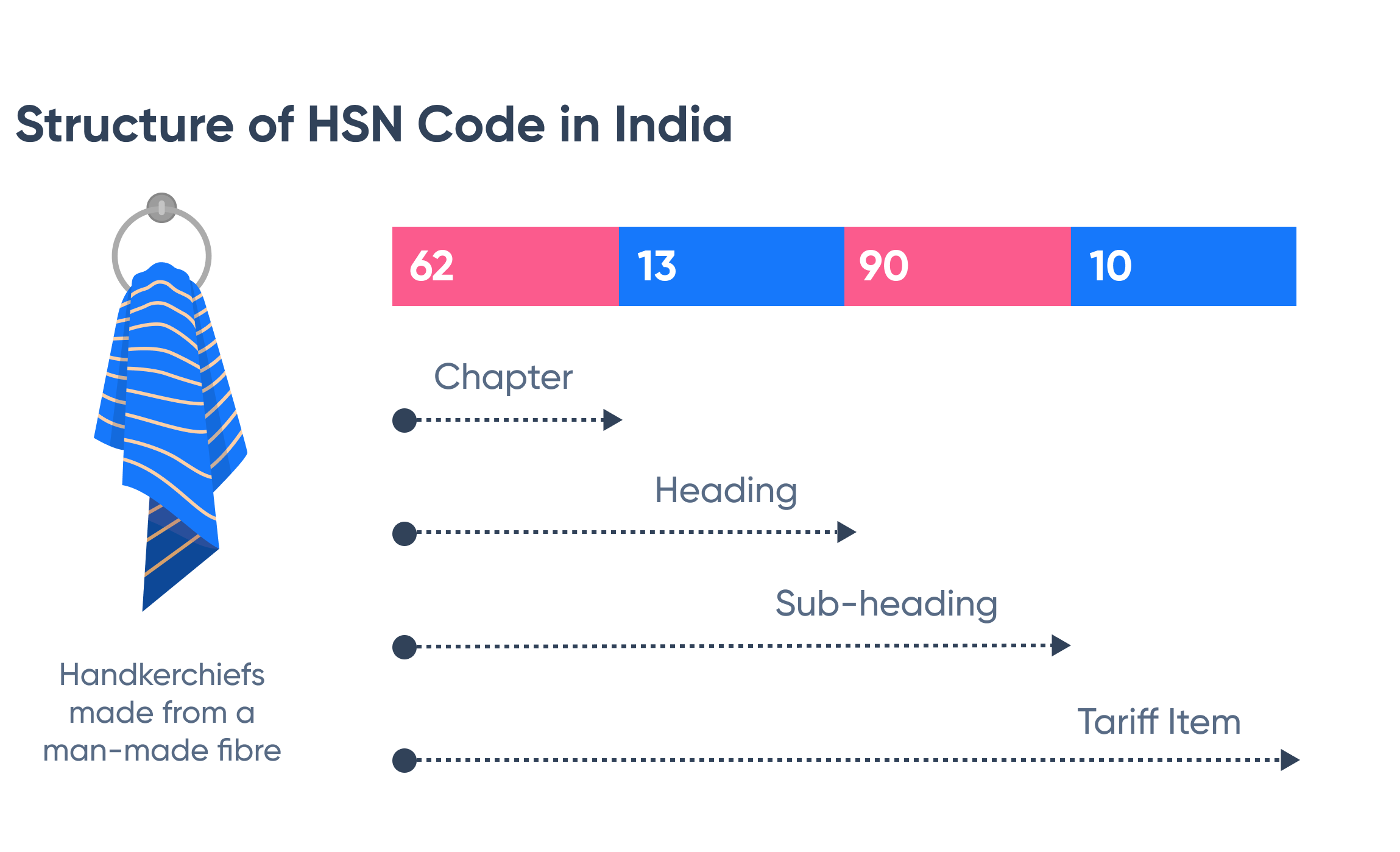

When it comes to purchasing a mattress protector, it is important to know the HSN code associated with it. The HSN code, also known as the Harmonized System of Nomenclature, is a code used to classify goods for taxation purposes. In this article, we will delve into the top 10 HSN codes for mattress protectors and their corresponding GST rates.

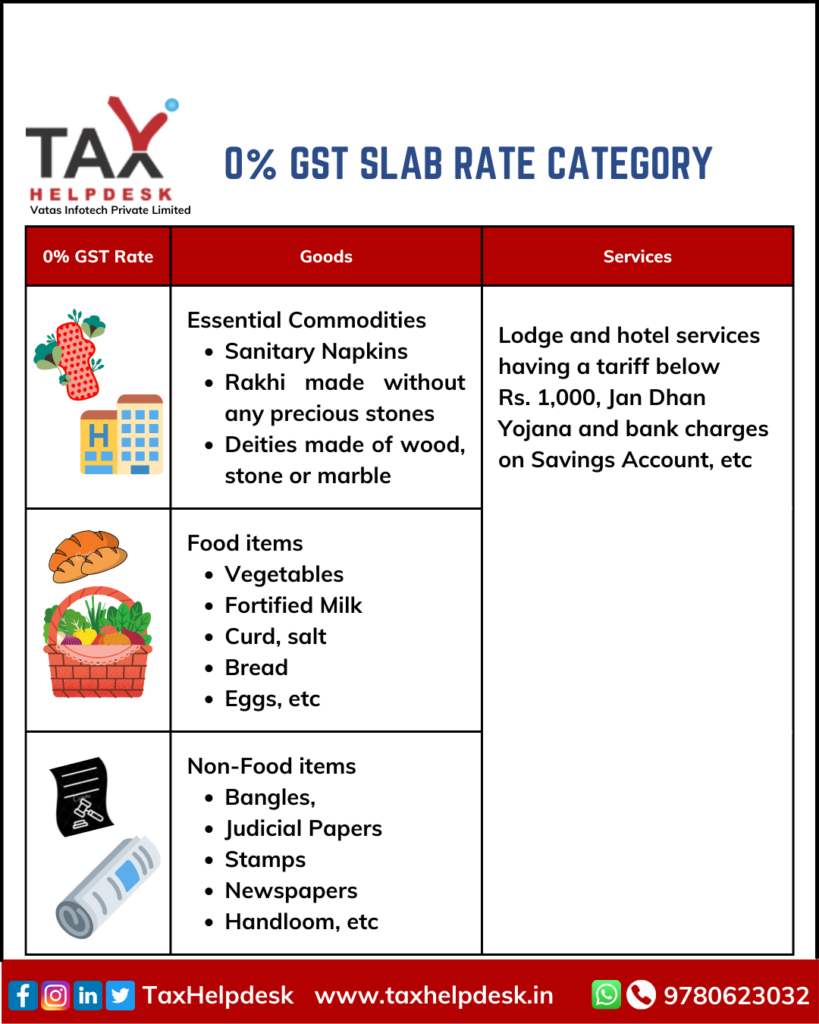

GST Rate for Mattress Protector

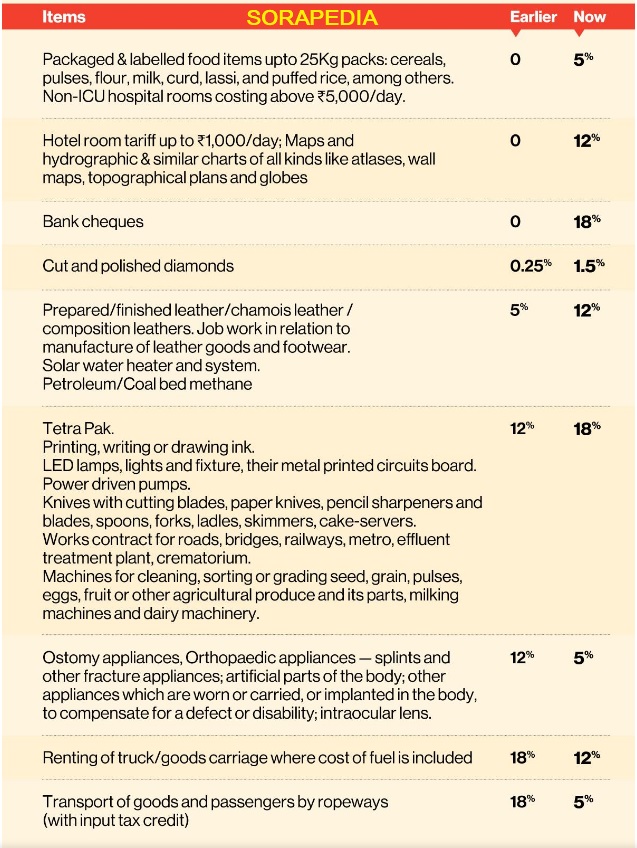

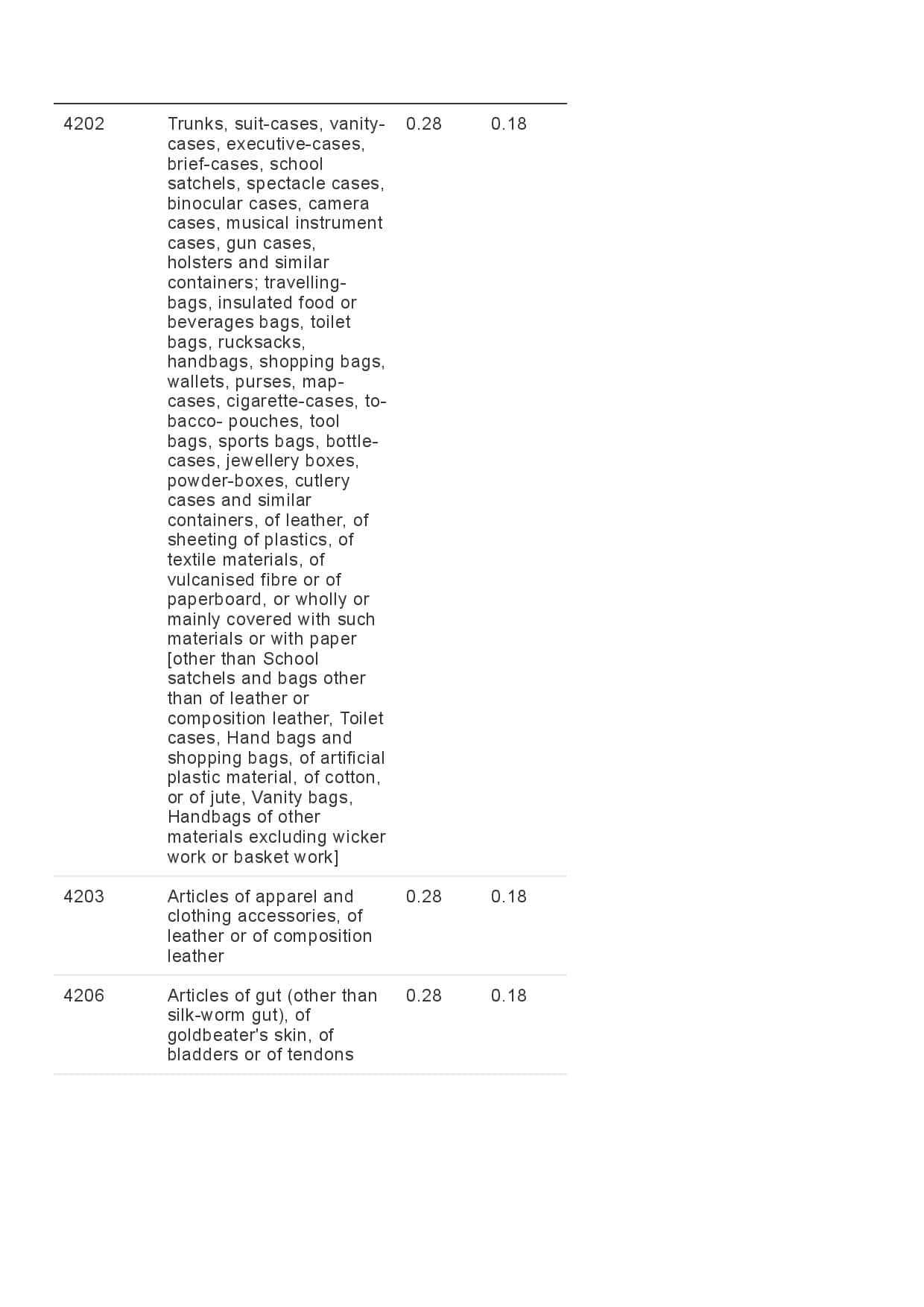

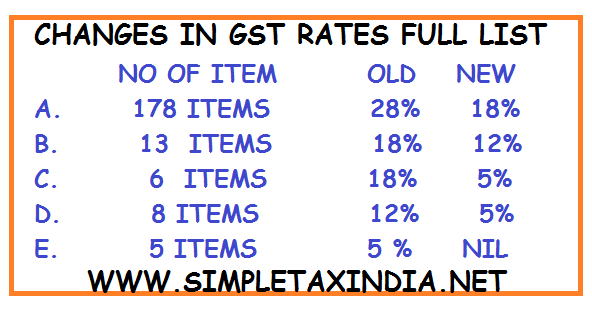

The GST rate for mattress protectors falls under the category of "Textile, Yarn, Fabrics, and Related Products" and is taxed at a rate of 18%. This rate is applicable to all types of mattress protectors, including waterproof, anti-allergen, and bed bug proof protectors. Let's take a closer look at the different HSN codes and rates for various types of mattress protectors.

HSN Code for Mattress Cover

One of the most common types of mattress protectors is the mattress cover, which is essentially a fitted sheet that goes over the mattress. The HSN code for a mattress cover is 6301, and it falls under the GST rate of 18%. This code is used for all types of mattress covers, including those made of cotton, polyester, or a blend of materials.

GST Rate for Mattress Cover

The GST rate for a mattress cover, with the HSN code of 6301, is 18%. This rate applies to all types of mattress covers, regardless of the material it is made of. However, it is important to note that if the mattress cover is sold as a part of a set with a mattress, the GST rate will be calculated based on the entire set, not just the cover itself.

HSN Code for Bedding Protectors

Bedding protectors, which include mattress protectors as well as pillow protectors, have the HSN code of 6307. This code falls under the GST rate of 18% and is applicable to all types of bedding protectors, whether they are sold separately or as part of a set.

GST Rate for Bedding Protectors

The GST rate for bedding protectors, with the HSN code of 6307, is 18%. This rate applies to all types of bedding protectors, including those made of cotton, polyester, or any other material. If bedding protectors are sold as part of a set with a mattress or pillows, the GST rate will be calculated based on the entire set.

HSN Code for Waterproof Mattress Protector

A waterproof mattress protector is designed to protect your mattress from spills, stains, and other liquids. The HSN code for a waterproof mattress protector is 6302 and falls under the GST rate of 18%. This code is applicable to all types of waterproof mattress protectors, whether they are made of cotton, polyester, or a blend of materials.

GST Rate for Waterproof Mattress Protector

The GST rate for a waterproof mattress protector, with the HSN code of 6302, is 18%. This rate applies to all types of waterproof mattress protectors, regardless of the material it is made of. However, if the waterproof protector is sold as part of a set with a mattress, the GST rate will be calculated based on the entire set.

HSN Code for Mattress Encasement

A mattress encasement is a protective cover that completely encases the mattress, providing full protection against bed bugs, dust mites, and other allergens. The HSN code for a mattress encasement is 6302 and falls under the GST rate of 18%. This code is applicable to all types of mattress encasements, whether they are made of cotton, polyester, or a blend of materials.

GST Rate for Mattress Encasement

The GST rate for a mattress encasement, with the HSN code of 6302, is 18%. This rate applies to all types of mattress encasements, regardless of the material it is made of. If the mattress encasement is sold as part of a set with a mattress, the GST rate will be calculated based on the entire set.

In conclusion, when purchasing a mattress protector, it is important to know the HSN code and GST rate associated with it. This knowledge can help you make an informed decision and ensure that you are paying the correct taxes. We hope this article has provided you with the necessary information to make your mattress protector purchase a breeze.

The Importance of Mattress Protectors in House Design

Protect Your Investment

When it comes to designing the perfect home, every detail counts. From the color of the walls to the furniture placement, homeowners want their space to be both functional and aesthetically pleasing. One aspect of house design that is often overlooked is the use of

mattress protectors

. However, these simple accessories can play a crucial role in the overall design of your home.

Not only do

mattress protectors

help to extend the life of your mattress, but they also provide an extra layer of protection against spills, stains, and even bed bugs. Investing in a high-quality

mattress protector

can save you from having to replace your mattress prematurely, ultimately saving you time and money in the long run.

When it comes to designing the perfect home, every detail counts. From the color of the walls to the furniture placement, homeowners want their space to be both functional and aesthetically pleasing. One aspect of house design that is often overlooked is the use of

mattress protectors

. However, these simple accessories can play a crucial role in the overall design of your home.

Not only do

mattress protectors

help to extend the life of your mattress, but they also provide an extra layer of protection against spills, stains, and even bed bugs. Investing in a high-quality

mattress protector

can save you from having to replace your mattress prematurely, ultimately saving you time and money in the long run.

Keep Your Home Clean and Fresh

Another important aspect of house design is maintaining a clean and fresh living space. Without proper protection, mattresses can become breeding grounds for bacteria, dust mites, and other allergens. This can lead to unpleasant odors and potential health issues for you and your family.

By using a

mattress protector

, you can prevent these contaminants from seeping into your mattress and creating an unhealthy environment in your home. This not only helps to keep your home clean and fresh, but it can also promote better sleep and overall well-being for you and your loved ones.

Another important aspect of house design is maintaining a clean and fresh living space. Without proper protection, mattresses can become breeding grounds for bacteria, dust mites, and other allergens. This can lead to unpleasant odors and potential health issues for you and your family.

By using a

mattress protector

, you can prevent these contaminants from seeping into your mattress and creating an unhealthy environment in your home. This not only helps to keep your home clean and fresh, but it can also promote better sleep and overall well-being for you and your loved ones.

A Variety of Options to Suit Your Needs

When it comes to

mattress protectors

, there is no one-size-fits-all solution. That's why it's important to consider your specific needs and preferences when choosing the right protector for your home. Whether you prefer a waterproof barrier, extra cushioning, or hypoallergenic materials, there is a

mattress protector

option out there for you.

In addition to providing protection and promoting a healthier living environment,

mattress protectors

can also add a touch of style to your bedroom. With a wide range of colors, patterns, and fabrics to choose from, you can easily incorporate a

mattress protector

into your house design and tie together the overall look of your space.

In conclusion,

mattress protectors

may seem like a small detail in house design, but they can have a big impact on the overall functionality and aesthetics of your home. From protecting your investment to promoting a clean and fresh environment,

mattress protectors

are a must-have accessory for any homeowner. So don't forget to include them in your house design plans and enjoy the benefits they have to offer.

When it comes to

mattress protectors

, there is no one-size-fits-all solution. That's why it's important to consider your specific needs and preferences when choosing the right protector for your home. Whether you prefer a waterproof barrier, extra cushioning, or hypoallergenic materials, there is a

mattress protector

option out there for you.

In addition to providing protection and promoting a healthier living environment,

mattress protectors

can also add a touch of style to your bedroom. With a wide range of colors, patterns, and fabrics to choose from, you can easily incorporate a

mattress protector

into your house design and tie together the overall look of your space.

In conclusion,

mattress protectors

may seem like a small detail in house design, but they can have a big impact on the overall functionality and aesthetics of your home. From protecting your investment to promoting a clean and fresh environment,

mattress protectors

are a must-have accessory for any homeowner. So don't forget to include them in your house design plans and enjoy the benefits they have to offer.

-compressed (1).jpg)