Mattress Firm Holding Corp. (MFRM) Stock Analysis | Nasdaq

Mattress Firm Holding Corp. (MFRM) is a well-known mattress retailer that has been in the industry for over 30 years. The company has a strong presence in the United States, with over 2,500 stores under its belt. In recent years, the company has faced some challenges, but its stock has remained resilient. In this article, we will take a closer look at MFRM stock and analyze its performance.

Mattress Firm Holding Corp. (MFRM) Stock Price, Quote, History and Analysis

MFRM stock has been traded on the Nasdaq exchange since 2011, under the ticker symbol MFRM. The company's stock price has experienced its fair share of ups and downs over the years, but it has remained relatively stable in recent months. As of August 2020, MFRM stock is trading at $9.63 per share, with a market capitalization of $944 million.

Mattress Firm Holding Corp. (MFRM) Stock Price, News, Quote and Analysis

One of the main factors that can affect a company's stock performance is its financial health. In the case of MFRM, the company has reported a steady revenue growth over the past few years, with a revenue of $3.2 billion in 2019. However, the company's net income has been declining, and it reported a net loss of $86 million in 2019. This could be a cause for concern for investors, but it is essential to look at the company's overall financial performance and not just one metric.

Mattress Firm Holding Corp. (MFRM) Stock Price Today, Quote and Analysis

Another important aspect to consider when analyzing a company's stock is its industry and competition. MFRM operates in the retail industry, which has been facing challenges due to the rise of e-commerce. However, the company has been able to maintain its competitive edge by offering a diverse range of products, including mattresses, bedding, and furniture. It also offers a price match guarantee, making it a popular choice for consumers.

Mattress Firm Holding Corp. (MFRM) Stock Price, Quote, History and Analysis

MFRM stock has also been affected by external factors, such as the COVID-19 pandemic. The company's sales were impacted in the first half of 2020 due to temporary store closures. However, with the easing of lockdown restrictions, the company has seen a gradual recovery in its sales. This shows the resilience of the company and its ability to adapt to changing market conditions.

Mattress Firm Holding Corp. (MFRM) Stock Price, Quote, History and Analysis

When considering investing in MFRM stock, it is crucial to look at the company's future prospects. MFRM has been expanding its online presence, which could help the company compete with e-commerce giants. It has also been focusing on improving its customer experience and has launched a subscription service for its products, providing a recurring revenue stream. These initiatives show the company's commitment to growth and innovation.

Mattress Firm Holding Corp. (MFRM) Stock Price, Quote, History and Analysis

One potential drawback for MFRM stock is its high level of debt, which stands at $2.9 billion as of 2019. This could make the company vulnerable during economic downturns. However, the company has taken steps to reduce its debt by restructuring its operations and closing underperforming stores. It also has a strong cash flow and has been able to meet its debt obligations.

Mattress Firm Holding Corp. (MFRM) Stock Price, Quote, History and Analysis

In summary, MFRM stock has faced its share of challenges, but the company has shown resilience and the ability to adapt to changing market conditions. It has a strong presence in the industry and has been taking steps to improve its financial performance and expand its online presence. With a focus on innovation and customer experience, MFRM has the potential for long-term growth. However, investors should still consider the company's debt level and competition in the industry before making an investment decision.

Mattress Firm Holding Corp. (MFRM) Stock Price, Quote, History and Analysis

In conclusion, MFRM stock may be a good investment opportunity for those looking for a stable and established company in the retail industry. With a strong brand presence, a diverse product range, and a commitment to growth and innovation, MFRM has the potential to generate long-term returns for investors. However, it is essential to conduct thorough research and consider all factors before making an investment decision.

The Importance of Choosing the Right Mattress for Your Home

When it comes to designing and furnishing our homes, we often focus on the aesthetic aspects such as color schemes, furniture styles, and decor. However, one crucial element that can greatly impact our daily lives is often overlooked - the

mattress

. A poor choice in

mattresses

can lead to discomfort, lack of sleep, and even health issues. That's why it's essential to carefully consider

mattresses

when designing your home, and

Mattress Firm Holding

is here to help.

When it comes to designing and furnishing our homes, we often focus on the aesthetic aspects such as color schemes, furniture styles, and decor. However, one crucial element that can greatly impact our daily lives is often overlooked - the

mattress

. A poor choice in

mattresses

can lead to discomfort, lack of sleep, and even health issues. That's why it's essential to carefully consider

mattresses

when designing your home, and

Mattress Firm Holding

is here to help.

Comfort and Support

Quality and Durability

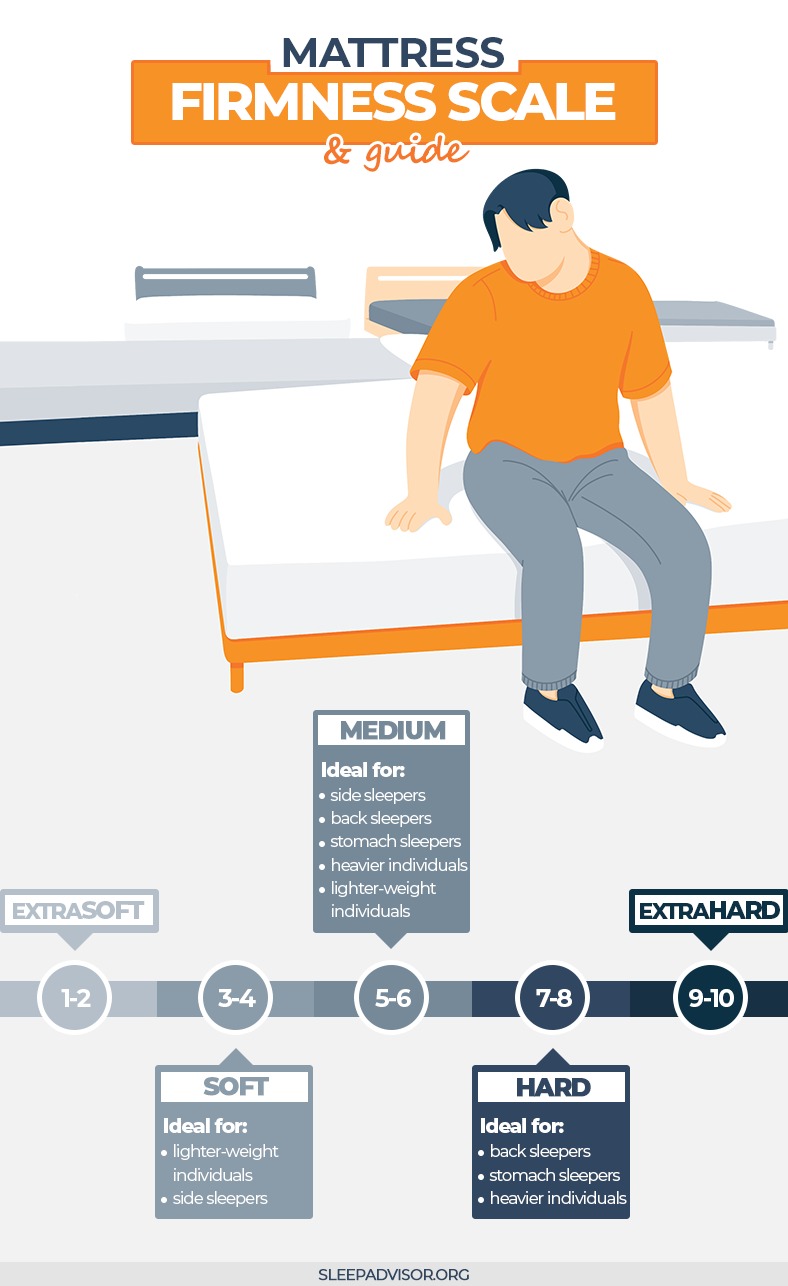

Customization and Personalization

Everyone has different

mattress

needs and preferences, and at

Mattress Firm Holding

, we understand that. That's why we offer a wide range of

mattresses

with various features such as cooling technology, adjustable firmness, and customized support for different sleeping positions. With our expert staff's guidance, you can find the perfect

mattress

that caters to your specific needs.

In conclusion,

mattresses

are a crucial aspect of any home design, and choosing the right one can greatly impact your daily life. With

Mattress Firm Holding's

wide selection, commitment to quality, and personalized services, you can find the perfect

mattress

for your home and ensure a comfortable and restful sleep every night. Don't overlook the importance of your

mattress

- visit

Mattress Firm Holding

today and experience the difference for yourself.

Everyone has different

mattress

needs and preferences, and at

Mattress Firm Holding

, we understand that. That's why we offer a wide range of

mattresses

with various features such as cooling technology, adjustable firmness, and customized support for different sleeping positions. With our expert staff's guidance, you can find the perfect

mattress

that caters to your specific needs.

In conclusion,

mattresses

are a crucial aspect of any home design, and choosing the right one can greatly impact your daily life. With

Mattress Firm Holding's

wide selection, commitment to quality, and personalized services, you can find the perfect

mattress

for your home and ensure a comfortable and restful sleep every night. Don't overlook the importance of your

mattress

- visit

Mattress Firm Holding

today and experience the difference for yourself.