How to Check Your Mattress Firm Credit Card Score

If you have a Mattress Firm credit card, it’s important to regularly check your credit score to ensure it’s in good standing. Your credit score is a numerical representation of your creditworthiness and is used by lenders to determine your eligibility for loans, credit cards, and other financial products.

To check your Mattress Firm credit card score, you can log into your online account or check your monthly statement. You can also request a free credit report from the three major credit bureaus – Experian, TransUnion, and Equifax – once a year. Make sure to review your credit report for any errors or discrepancies that could be negatively affecting your score.

How to Improve Your Mattress Firm Credit Card Score

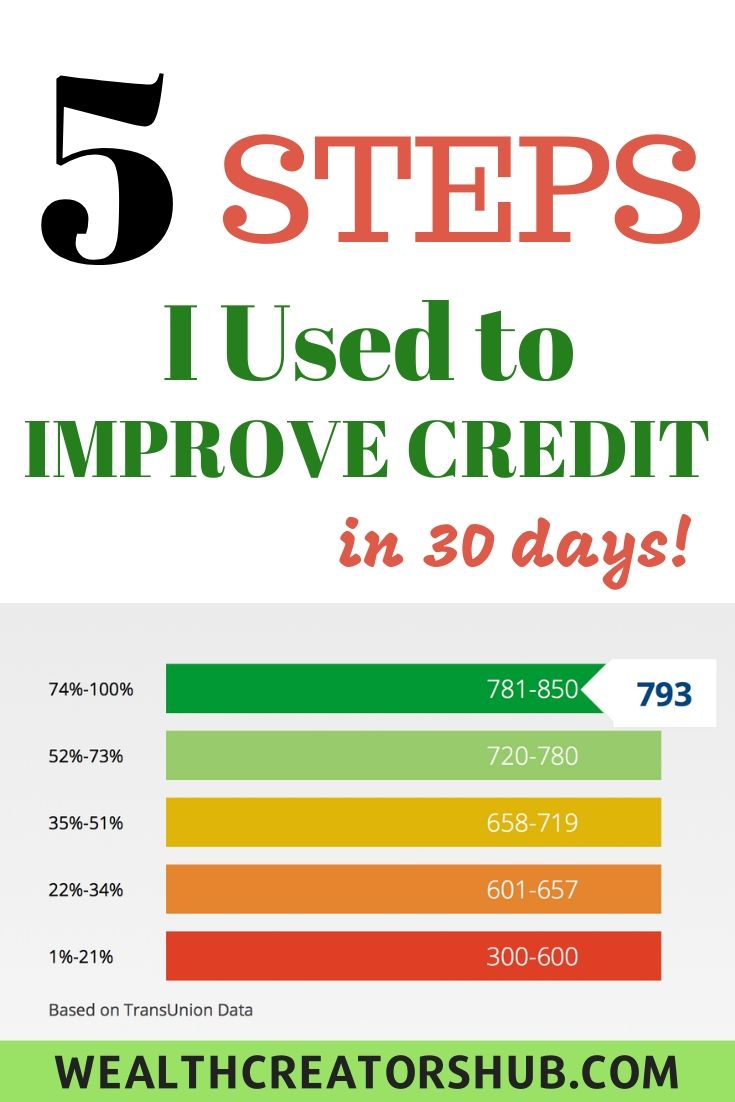

If your Mattress Firm credit card score is not where you want it to be, there are steps you can take to improve it.

First, make sure to pay your credit card bill on time every month. Payment history is the most important factor in determining your credit score, so consistently making on-time payments will have a positive impact.

Second, try to keep your credit card balances low. High credit card balances can negatively affect your credit utilization ratio, which is the amount of credit you are using compared to your overall credit limit.

Lastly, avoid opening too many new credit accounts at once. Each time you apply for credit, a hard inquiry is made on your credit report, which can lower your score temporarily.

Understanding Your Mattress Firm Credit Card Score

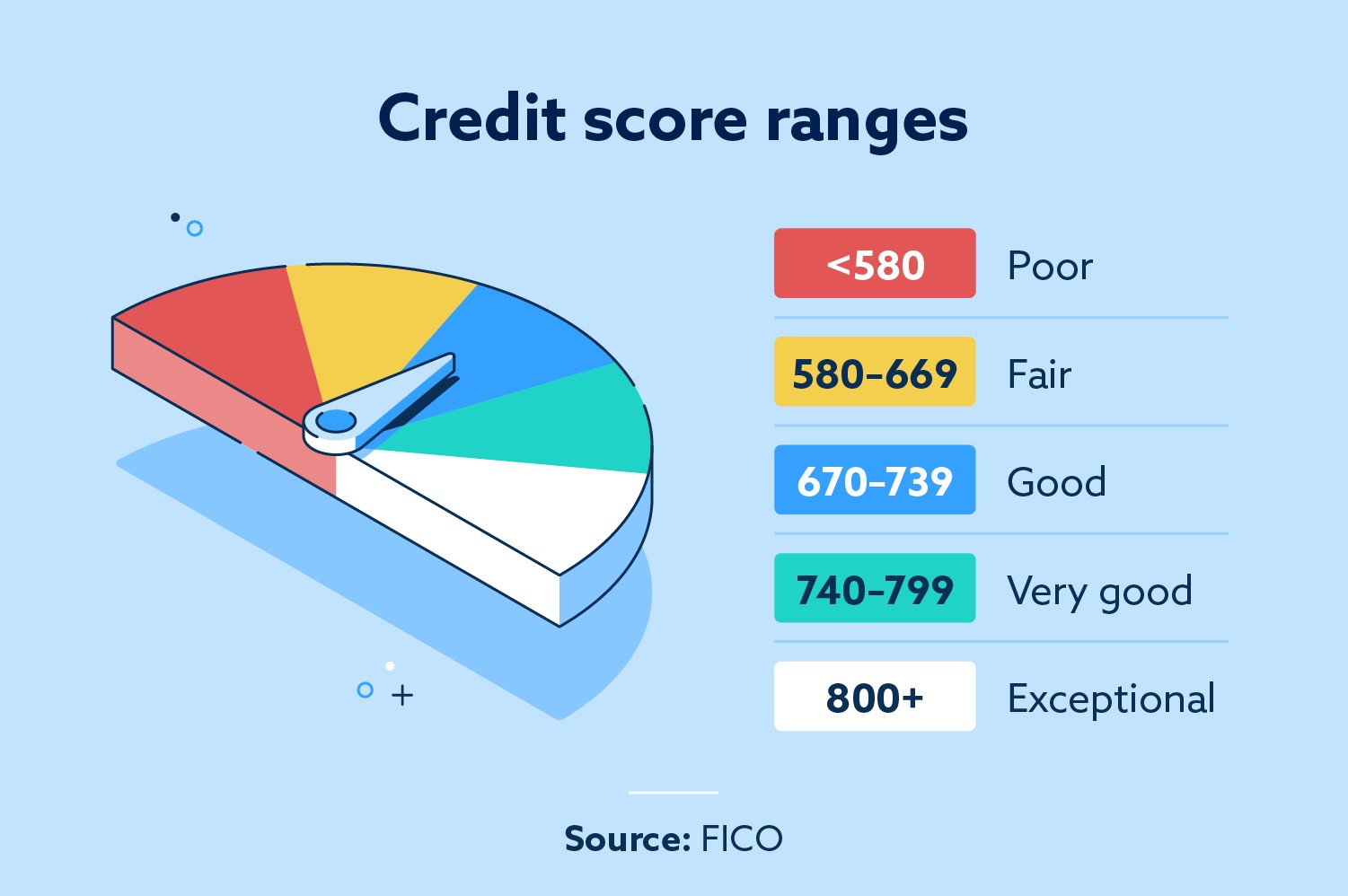

Your Mattress Firm credit card score is based on a few different factors, including your payment history, credit utilization ratio, length of credit history, new credit, and credit mix. Each of these factors is weighted differently and can have a varying impact on your overall credit score.

Payment history makes up 35% of your credit score, while credit utilization ratio accounts for 30%. Length of credit history makes up 15%, and new credit and credit mix each make up 10%.

Benefits of Having a Good Mattress Firm Credit Card Score

Having a good Mattress Firm credit card score can bring a variety of benefits. First and foremost, it can increase your chances of being approved for loans and credit cards with favorable terms and interest rates.

A good credit score can also save you money in the long run. With a higher credit score, you may be able to qualify for lower interest rates on credit cards, mortgages, and other loans, which can save you hundreds or even thousands of dollars over time.

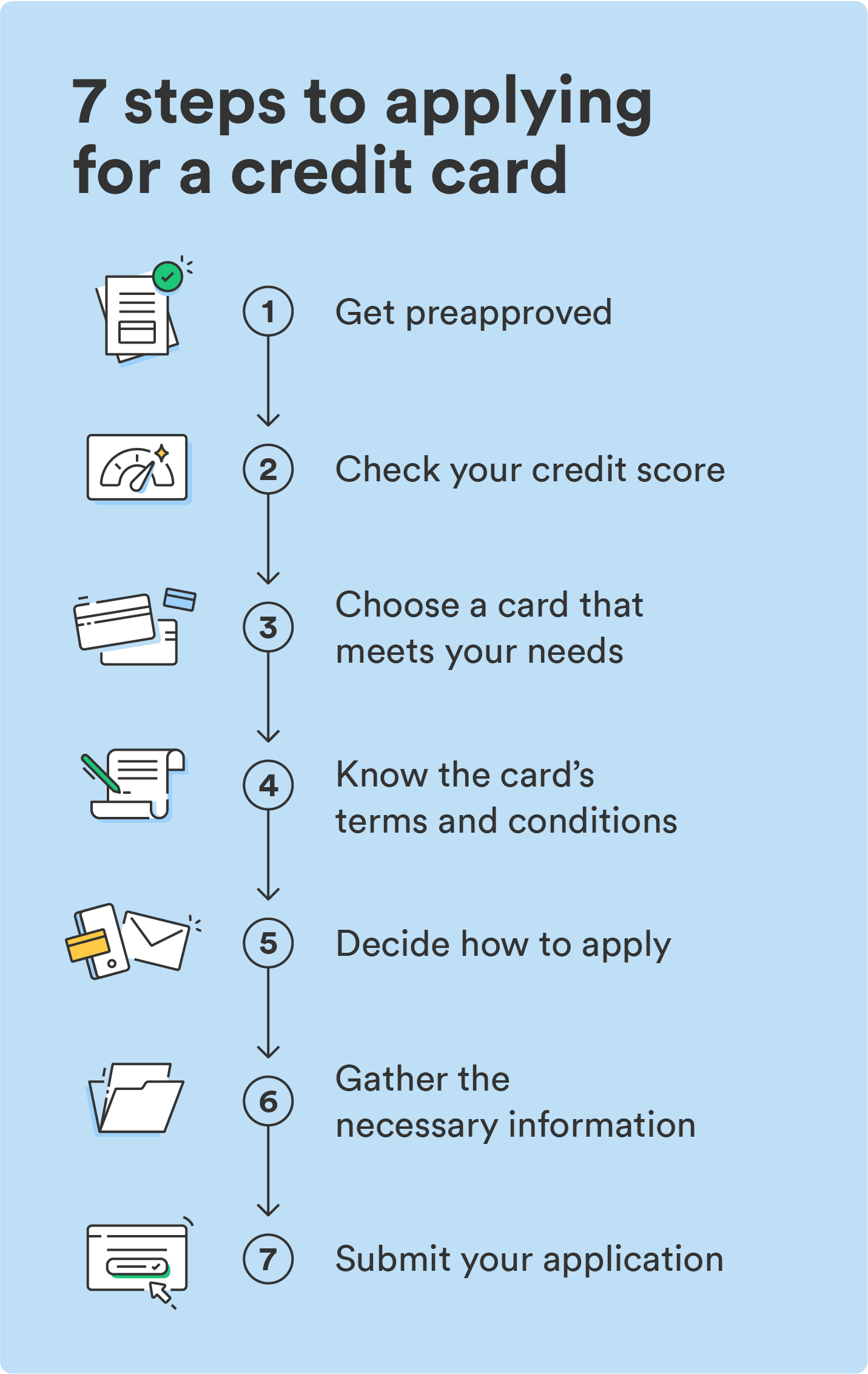

How to Apply for a Mattress Firm Credit Card

If you don’t already have a Mattress Firm credit card, you can apply for one online or in-store. To be eligible for the card, you must be at least 18 years old and have a valid Social Security number. You will also need to provide information about your income and employment.

If you are approved, you will receive your card in the mail within a few weeks. Make sure to activate your card and set up your online account to start managing your credit card and building your credit score.

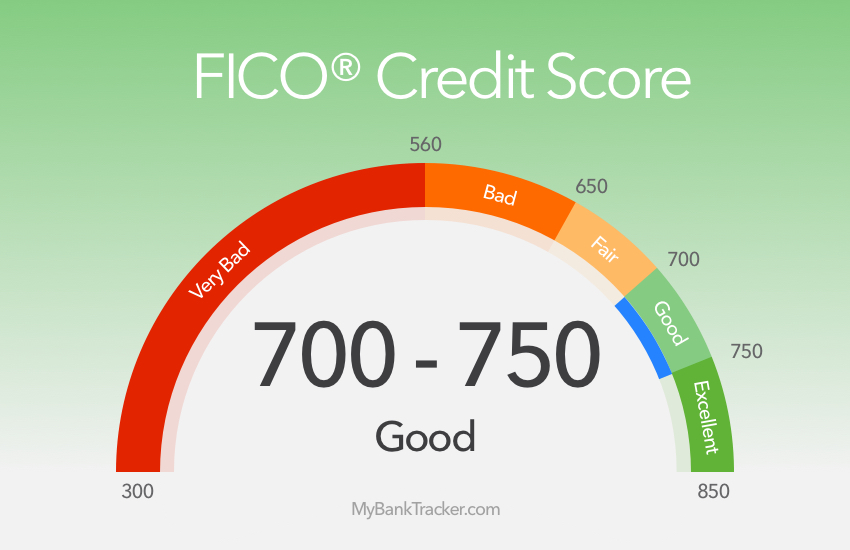

Mattress Firm Credit Card Score Requirements

There is no specific credit score requirement for the Mattress Firm credit card, as credit scores can vary depending on the credit bureau and scoring model used. However, it’s generally recommended to have a credit score of at least 700 to have a good chance of being approved for the card.

Other factors, such as your income and credit history, will also be considered in the approval process. If you are denied for the card, you will receive a letter in the mail with the reason for the denial.

Tips for Managing Your Mattress Firm Credit Card Score

Once you have your Mattress Firm credit card and are working on building your credit score, there are a few tips you can follow to manage your credit responsibly.

First, make sure to pay your bill on time every month. Late payments can have a significant negative impact on your credit score.

Second, try to keep your credit utilization ratio below 30%. This means using no more than 30% of your available credit at any given time.

Lastly, regularly review your credit report and dispute any errors or discrepancies. Keeping an eye on your credit can help you catch and correct any mistakes that could be hurting your score.

Common Mistakes That Can Hurt Your Mattress Firm Credit Card Score

There are a few common mistakes that can hurt your Mattress Firm credit card score. These include consistently making late payments, maxing out your credit card, and closing old credit accounts.

It’s important to stay on top of your credit habits and make responsible decisions to avoid these mistakes and maintain a good credit score.

How to Dispute Errors on Your Mattress Firm Credit Card Score

If you notice any errors or discrepancies on your credit report that could be negatively affecting your Mattress Firm credit card score, you have the right to dispute them. You can do so by contacting the credit bureau that provided the report and providing evidence to support your claim.

The credit bureau is required to investigate your dispute within 30 days and make any necessary corrections to your credit report.

Alternatives to the Mattress Firm Credit Card for Building Credit

If the Mattress Firm credit card is not the right fit for you, there are other options available for building credit. One alternative is a secured credit card, which requires a cash deposit as collateral and typically has lower credit requirements.

You can also become an authorized user on someone else’s credit card, which can help you build credit as long as the primary cardholder uses the card responsibly.

Regardless of which method you choose, make sure to use credit responsibly and make timely payments to build a solid credit history and improve your credit score over time.

The Benefits of Using a Mattress Firm Credit Card for Improving Your Credit Score

Introduction

When it comes to purchasing household items, many people rely on credit cards to make big-ticket purchases more manageable. However, not all credit cards are created equal, and some may offer more benefits than others. One credit card that is gaining popularity for its unique benefits is the

mattress firm credit card

. In addition to providing financing options for purchasing a new mattress, this credit card also has the potential to improve your

credit score

. In this article, we will explore how using a mattress firm credit card can not only help you get a good night's sleep but also boost your credit score.

When it comes to purchasing household items, many people rely on credit cards to make big-ticket purchases more manageable. However, not all credit cards are created equal, and some may offer more benefits than others. One credit card that is gaining popularity for its unique benefits is the

mattress firm credit card

. In addition to providing financing options for purchasing a new mattress, this credit card also has the potential to improve your

credit score

. In this article, we will explore how using a mattress firm credit card can not only help you get a good night's sleep but also boost your credit score.

How a Mattress Firm Credit Card Can Help Improve Your Credit Score

A credit card is an essential tool for building and maintaining a good credit score. By using it responsibly, you can demonstrate your creditworthiness and increase your chances of being approved for future loans and credit cards. The

mattress firm credit card

offers unique benefits that can help you achieve this goal.

One way this credit card can improve your credit score is through its financing options. The mattress firm credit card allows you to finance your purchase over a certain period, usually with no interest if paid in full within a set timeframe. This type of financing can help you manage your budget better and make timely payments, which are crucial for improving your credit score.

Furthermore, the mattress firm credit card also offers special financing promotions, such as 0% interest for a specific period, which can help you pay off your mattress purchase without incurring any additional costs. By taking advantage of these promotions, you can save money and improve your credit score by making on-time payments.

A credit card is an essential tool for building and maintaining a good credit score. By using it responsibly, you can demonstrate your creditworthiness and increase your chances of being approved for future loans and credit cards. The

mattress firm credit card

offers unique benefits that can help you achieve this goal.

One way this credit card can improve your credit score is through its financing options. The mattress firm credit card allows you to finance your purchase over a certain period, usually with no interest if paid in full within a set timeframe. This type of financing can help you manage your budget better and make timely payments, which are crucial for improving your credit score.

Furthermore, the mattress firm credit card also offers special financing promotions, such as 0% interest for a specific period, which can help you pay off your mattress purchase without incurring any additional costs. By taking advantage of these promotions, you can save money and improve your credit score by making on-time payments.

Other Benefits of Using a Mattress Firm Credit Card

In addition to improving your credit score, the mattress firm credit card also offers other benefits that can make your mattress purchase more convenient and affordable. With this credit card, you can enjoy exclusive discounts and special offers on mattresses and other products at Mattress Firm stores. You can also earn rewards for every purchase made with the card, which can be redeemed for future purchases.

Moreover, the mattress firm credit card offers flexible payment options, allowing you to choose the best payment plan that fits your budget and financial goals. You can also manage your account and make payments online, making it easier to stay on top of your credit card payments and improve your credit score.

In addition to improving your credit score, the mattress firm credit card also offers other benefits that can make your mattress purchase more convenient and affordable. With this credit card, you can enjoy exclusive discounts and special offers on mattresses and other products at Mattress Firm stores. You can also earn rewards for every purchase made with the card, which can be redeemed for future purchases.

Moreover, the mattress firm credit card offers flexible payment options, allowing you to choose the best payment plan that fits your budget and financial goals. You can also manage your account and make payments online, making it easier to stay on top of your credit card payments and improve your credit score.

Conclusion

A mattress firm credit card is not only a convenient way to finance your mattress purchase, but it also has the potential to improve your credit score. By taking advantage of its financing options, special promotions, and other benefits, you can not only get a good night's sleep but also take a step towards a better credit score. With responsible use, the mattress firm credit card can help you achieve your financial goals and make your house design dreams a reality.

A mattress firm credit card is not only a convenient way to finance your mattress purchase, but it also has the potential to improve your credit score. By taking advantage of its financing options, special promotions, and other benefits, you can not only get a good night's sleep but also take a step towards a better credit score. With responsible use, the mattress firm credit card can help you achieve your financial goals and make your house design dreams a reality.