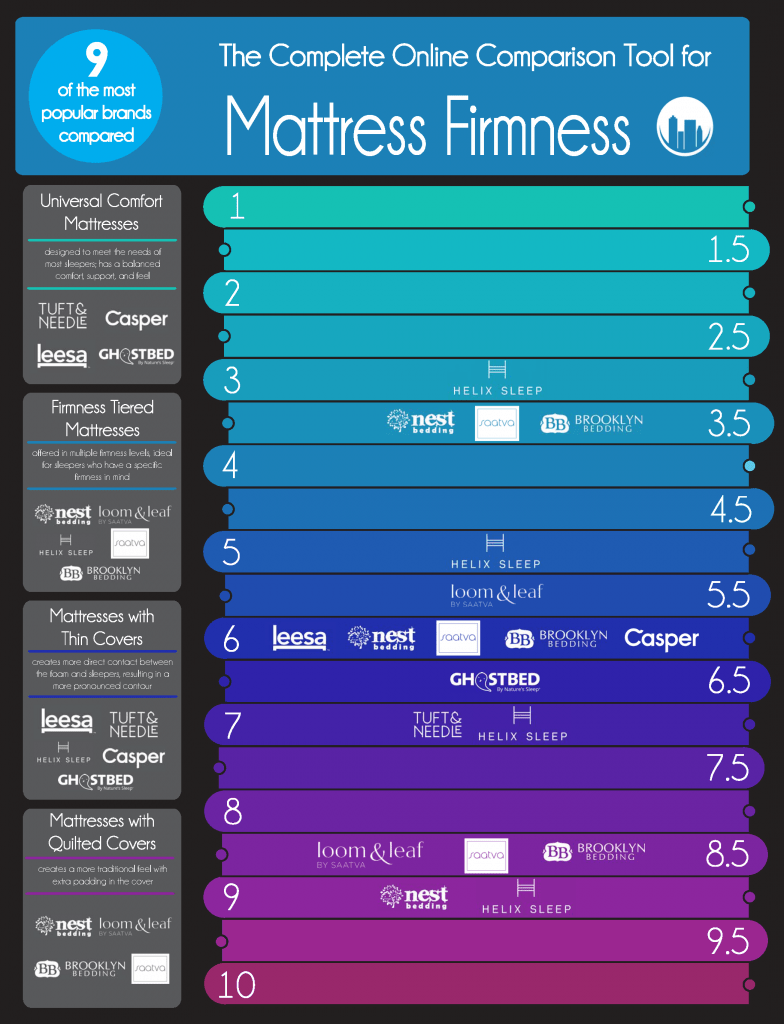

If you're in the market for a new mattress, chances are you've come across the option to finance your purchase with a Mattress Firm credit card. But before you sign up for this store credit card, it's important to understand the potential fees associated with it, including the annual fee. The Mattress Firm credit card comes with an annual fee of $0. This means that you won't have to pay any additional fees on top of your purchases made with the card. This can be a great benefit for those who plan on using the card regularly and want to avoid any additional costs. However, it's important to note that the annual fee may vary depending on your creditworthiness. If you have a lower credit score, you may be subject to a higher annual fee or even be denied for the card altogether. It's always a good idea to check your credit score before applying for any credit card, including the Mattress Firm credit card. This will give you an idea of where you stand and what you can expect in terms of fees and interest rates.1. Mattress Firm Credit Card Annual Fee

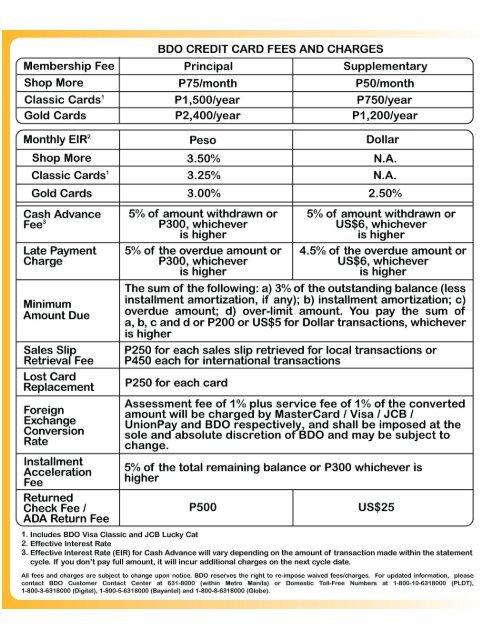

In addition to the annual fee, the Mattress Firm credit card may also come with other fees that you should be aware of. These fees can include late payment fees, returned payment fees, and cash advance fees. The late payment fee for the Mattress Firm credit card is up to $38, depending on your state of residence. This fee is charged if you do not make at least the minimum payment by the due date. It's important to make your payments on time to avoid this fee and any potential damage to your credit score. The returned payment fee is also up to $38 and is charged if your payment is returned for any reason, such as insufficient funds. It's important to always ensure that you have enough funds in your account before making a payment to avoid this fee. The Mattress Firm credit card also has a cash advance fee of either $10 or 5% of the amount of each transfer, whichever is greater. This fee is charged if you use your credit card to withdraw cash from an ATM or make a cash advance transaction.2. Mattress Firm Credit Card Fees

In addition to the fees mentioned above, the Mattress Firm credit card may also come with other charges that you should be aware of. These charges can include interest charges, balance transfer fees, and foreign transaction fees. The interest rate for the Mattress Firm credit card is currently 29.99%, which is a variable rate based on the Prime Rate. This means that if the Prime Rate goes up, your interest rate will also increase. It's important to pay off your balance in full each month to avoid paying high interest charges. If you're planning on transferring a balance from another credit card to the Mattress Firm credit card, you may be subject to a balance transfer fee of either $10 or 5% of the amount of each transfer, whichever is greater. Lastly, if you plan on using your Mattress Firm credit card while traveling internationally, you may be subject to a foreign transaction fee of 3% of each transaction in U.S. dollars. This fee applies to any purchases made outside of the United States.3. Mattress Firm Credit Card Charges

While the Mattress Firm credit card may come with some fees and charges, it also offers some benefits that can help offset these costs. One of the main benefits is the option to finance your mattress purchase with 0% interest for a set period of time. This means that you can spread out the cost of your mattress over several months without having to pay any interest. However, it's important to pay off your balance in full before the promotional period ends to avoid paying any interest charges. The Mattress Firm credit card also offers rewards for every purchase made with the card. You can earn 2 points for every $1 spent at Mattress Firm and 1 point for every $1 spent elsewhere. These points can then be redeemed for discounts on future purchases at Mattress Firm.4. Mattress Firm Credit Card Costs

As mentioned earlier, the interest rate for the Mattress Firm credit card is currently 29.99%. This high interest rate is typical for store credit cards and is something to be aware of when considering this card. If you plan on carrying a balance on your credit card, it's important to calculate how much interest you will end up paying over time. This can help you decide if the benefits of the card outweigh the potential costs. It's also important to keep in mind that the interest rate may vary depending on your creditworthiness. If you have a lower credit score, you may end up with a higher interest rate, making it even more important to pay off your balance in full each month.5. Mattress Firm Credit Card Interest Rates

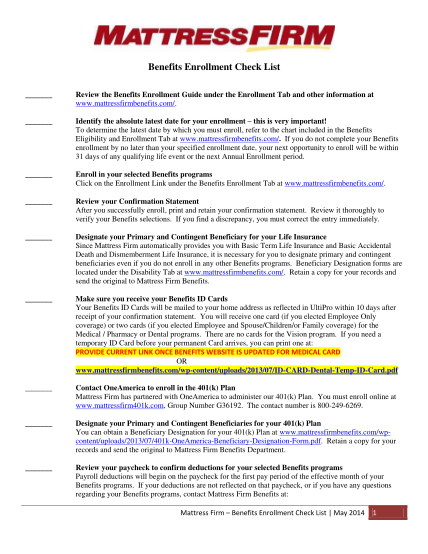

The Mattress Firm credit card offers several payment options to make it easy for you to manage your account. You can make payments online, by phone, or by mail. You can also set up automatic payments to ensure that your payments are always made on time. If you're having trouble making your payments, it's important to contact the credit card issuer right away. They may be able to work with you to come up with a payment plan or offer some other form of assistance. It's also important to note that making your payments on time can help improve your credit score, which can lead to better credit card offers in the future.6. Mattress Firm Credit Card Payment Options

One of the main perks of the Mattress Firm credit card is the rewards program. As mentioned earlier, you can earn 2 points for every $1 spent at Mattress Firm and 1 point for every $1 spent elsewhere. Once you accumulate enough points, you can redeem them for discounts on future purchases at Mattress Firm. This can be a great way to save money on your next mattress or other bedding products. It's important to note that the rewards program is subject to change at any time, so it's always a good idea to check the terms and conditions for the most up-to-date information.7. Mattress Firm Credit Card Rewards

In addition to the rewards program, the Mattress Firm credit card also offers other benefits that can make using the card more convenient. These benefits can include online account management, fraud protection, and special financing offers. With online account management, you can easily track your purchases, make payments, and view your rewards balance all in one place. The fraud protection feature can also give you peace of mind knowing that you won't be held responsible for any unauthorized charges on your account. Lastly, the Mattress Firm credit card may offer special financing offers throughout the year, such as 0% interest for a certain period of time. These offers can help you save money on interest and make larger purchases more affordable.8. Mattress Firm Credit Card Benefits

Before signing up for the Mattress Firm credit card, it's important to read and understand the terms and conditions. This will give you all the information you need to know about the card, including fees, interest rates, and rewards. It's also important to note that the terms and conditions may change at any time, so it's a good idea to review them periodically to stay informed. If you have any questions or concerns about the terms and conditions, don't hesitate to reach out to the credit card issuer for clarification.9. Mattress Firm Credit Card Terms and Conditions

The annual percentage rate (APR) is an important factor to consider when choosing a credit card. The APR for the Mattress Firm credit card is currently 29.99%, which is a high rate compared to other credit cards. It's important to keep in mind that the APR is a variable rate based on the Prime Rate, so it may change over time. It's also important to pay off your balance in full each month to avoid paying any interest on your purchases.10. Mattress Firm Credit Card Annual Percentage Rate

Why Choosing a Mattress Firm Credit Card May Not Be Worth the Annual Fee

Higher Interest Rates and Hidden Fees

One of the main selling points of the

mattress firm credit card

is the promise of affordable financing for a new mattress. However, what many consumers may not realize is that this card often comes with higher interest rates compared to other credit cards. Additionally, there may be hidden fees such as late payment fees and balance transfer fees that can quickly add up and negate any benefits of the card.

Related main keywords:

financing, interest rates, credit cards, late payment fees, balance transfer fees

One of the main selling points of the

mattress firm credit card

is the promise of affordable financing for a new mattress. However, what many consumers may not realize is that this card often comes with higher interest rates compared to other credit cards. Additionally, there may be hidden fees such as late payment fees and balance transfer fees that can quickly add up and negate any benefits of the card.

Related main keywords:

financing, interest rates, credit cards, late payment fees, balance transfer fees

Limited Use and Rewards Program

While the

mattress firm credit card

offers financing options for mattresses at their store, it has limited use outside of that. This means that cardholders may not be able to use it for other purchases or at other retailers. Furthermore, the rewards program for this card may not be as attractive as other credit cards, making it less appealing for everyday use.

Related main keywords:

limited use, rewards program, retailers, everyday use

While the

mattress firm credit card

offers financing options for mattresses at their store, it has limited use outside of that. This means that cardholders may not be able to use it for other purchases or at other retailers. Furthermore, the rewards program for this card may not be as attractive as other credit cards, making it less appealing for everyday use.

Related main keywords:

limited use, rewards program, retailers, everyday use

Alternatives to Consider

Before signing up for a

mattress firm credit card

, it's important to consider the alternatives. Many major credit cards offer 0% APR introductory periods for new cardholders, which can be used for financing a new mattress. Additionally, some retailers offer their own financing options without the need for a credit card. It's important to compare these options and their terms carefully to find the best option for your specific needs and financial situation.

Related main keywords:

alternatives, 0% APR, introductory periods, retailers, financing options

Before signing up for a

mattress firm credit card

, it's important to consider the alternatives. Many major credit cards offer 0% APR introductory periods for new cardholders, which can be used for financing a new mattress. Additionally, some retailers offer their own financing options without the need for a credit card. It's important to compare these options and their terms carefully to find the best option for your specific needs and financial situation.

Related main keywords:

alternatives, 0% APR, introductory periods, retailers, financing options

In Conclusion

While the idea of a

mattress firm credit card

may seem appealing, the potential drawbacks and limited benefits may not make it worth the annual fee. As with any financial decision, it's important to carefully consider all options and their terms before committing to a credit card. And if you do decide to get a mattress firm credit card, be sure to read the fine print and understand all fees and terms to avoid any surprises down the line.

While the idea of a

mattress firm credit card

may seem appealing, the potential drawbacks and limited benefits may not make it worth the annual fee. As with any financial decision, it's important to carefully consider all options and their terms before committing to a credit card. And if you do decide to get a mattress firm credit card, be sure to read the fine print and understand all fees and terms to avoid any surprises down the line.