If you're in the market for a new mattress in Massachusetts, you may be wondering about the sales tax. Like most states, Massachusetts has a sales tax on most retail purchases, including mattresses. However, there are some exemptions and special laws that you should be aware of before making your purchase. In this article, we'll break down everything you need to know about sales tax on mattresses in Massachusetts.Understanding Sales Tax on Mattresses in Massachusetts

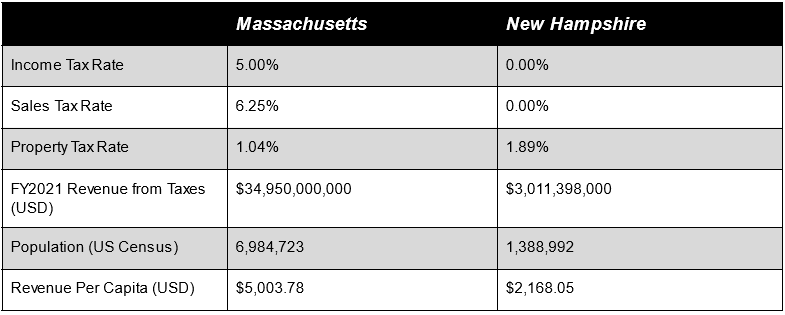

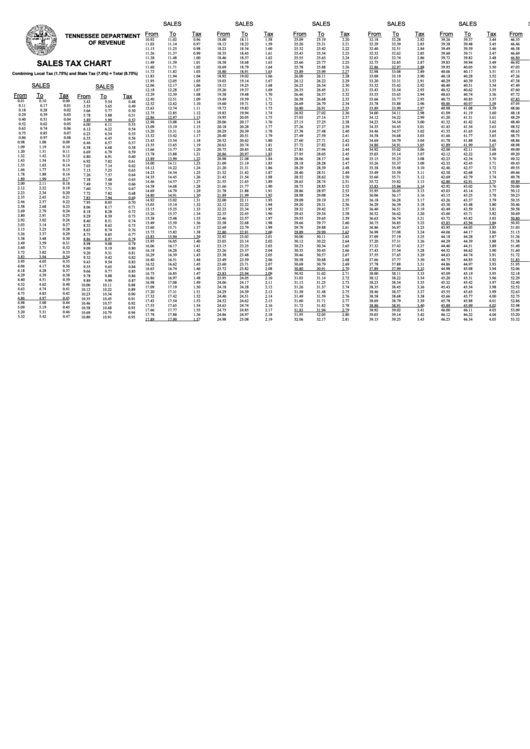

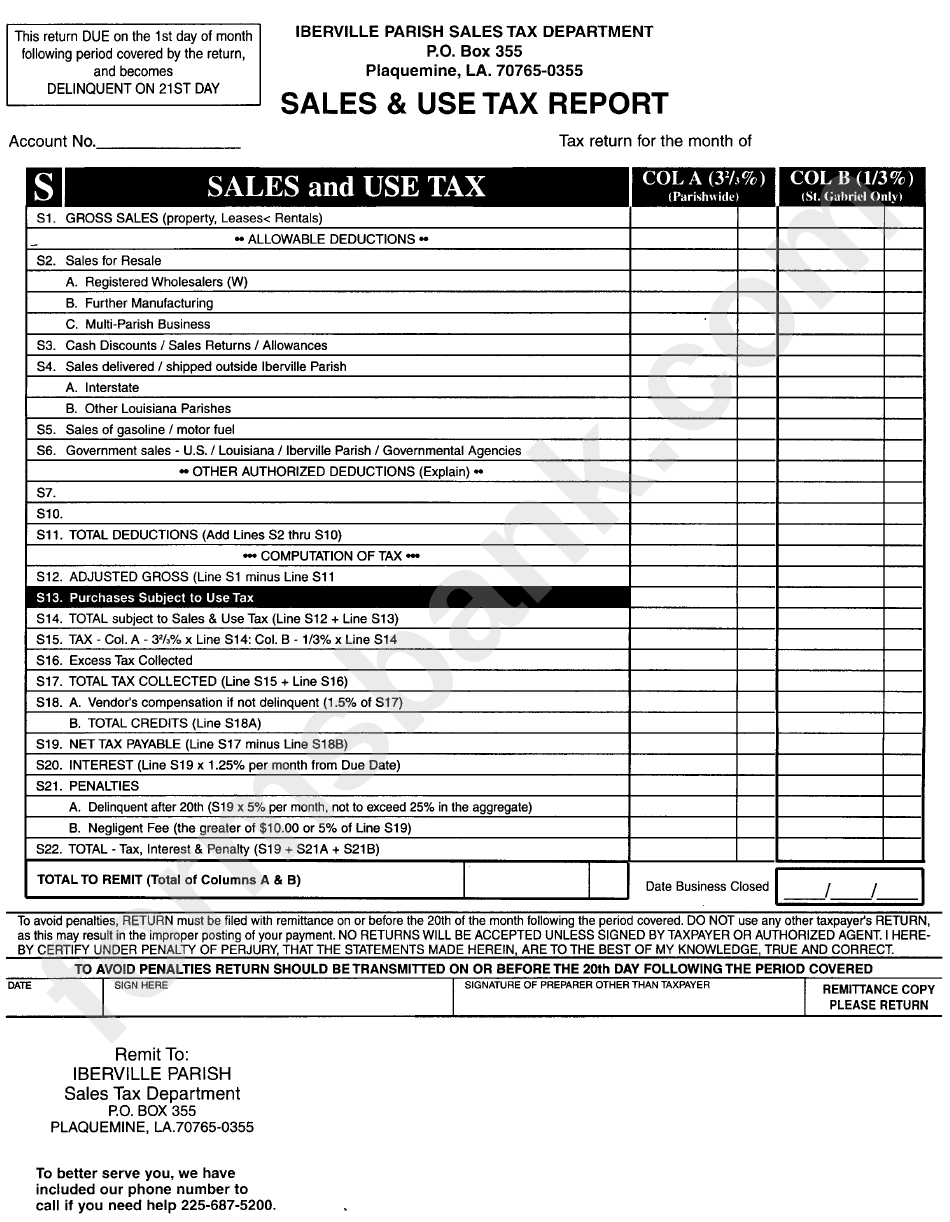

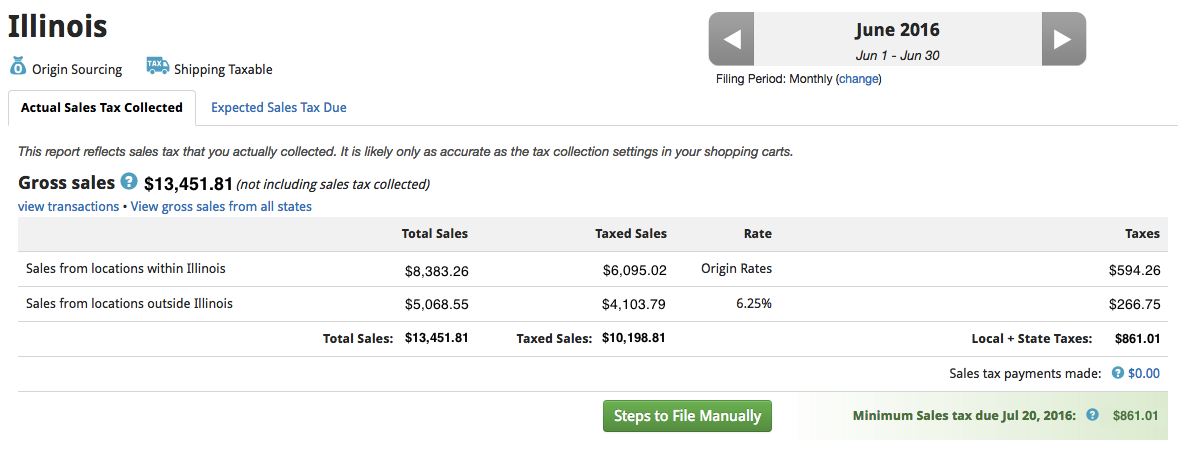

The current sales tax rate in Massachusetts is 6.25%. This means that for every $100 you spend on a mattress, you will pay an additional $6.25 in sales tax. To calculate the total cost of your mattress including sales tax, simply multiply the price of the mattress by 1.0625. For example, if your mattress costs $500, the total cost with sales tax will be $531.25.How to Calculate Sales Tax on Mattresses in Massachusetts

While most retail purchases in Massachusetts are subject to sales tax, there are some exemptions for certain items, including mattresses. If you have a prescription for a mattress from a doctor, you may be able to receive an exemption from sales tax. Additionally, mattresses purchased for resale or for use in a business may also be exempt from sales tax. Be sure to keep documentation of your purchase to claim these exemptions.Exemptions from Sales Tax on Mattresses in Massachusetts

In Massachusetts, mattresses are considered tangible personal property, which means they are subject to sales tax. However, there are some specific laws and regulations that apply to the sale of mattresses. For example, retailers are required to collect and remit sales tax on mattresses sold in Massachusetts. There are also regulations on advertising and pricing of mattresses, so be sure to do your research and work with a reputable retailer.Massachusetts Sales Tax Laws for Mattresses

Before making your purchase, it's important to understand the implications of sales tax on mattresses in Massachusetts. Keep in mind that sales tax can add a significant amount to the total cost of your mattress. It's also important to understand the exemptions and laws surrounding sales tax on mattresses to ensure you are making a smart and legal purchase.Buying a Mattress in Massachusetts: What You Need to Know About Sales Tax

If you're looking to save some money on your mattress purchase, there are some ways to potentially avoid paying sales tax in Massachusetts. As mentioned earlier, if you have a prescription for a mattress or are purchasing for resale or business use, you may be able to claim an exemption. Additionally, some retailers may offer sales or discounts that can help offset the cost of sales tax.How to Avoid Paying Sales Tax on Mattresses in Massachusetts

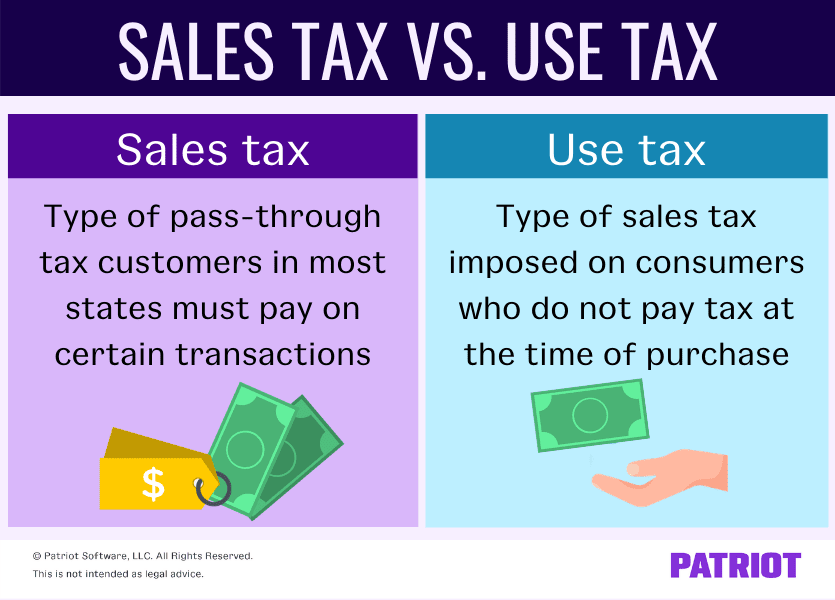

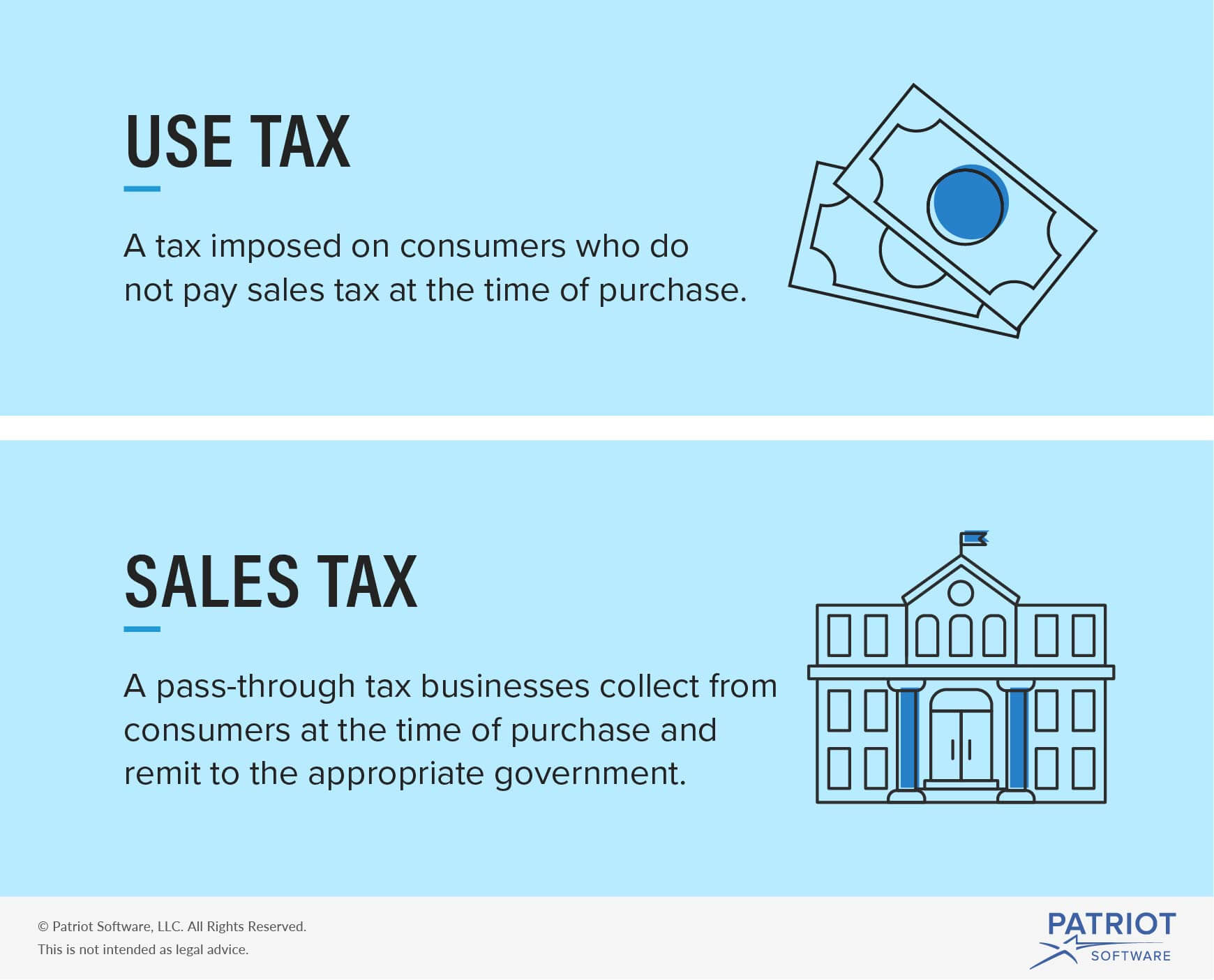

In addition to sales tax, some states also have a use tax. While sales tax is collected at the time of purchase, use tax is applied to items that are purchased out of state or online and used in Massachusetts. This means that if you purchase a mattress from a retailer located outside of Massachusetts, you may still be responsible for paying use tax on the item. Be sure to check the laws and regulations surrounding use tax in Massachusetts.Understanding the Difference Between Sales Tax and Use Tax on Mattresses in Massachusetts

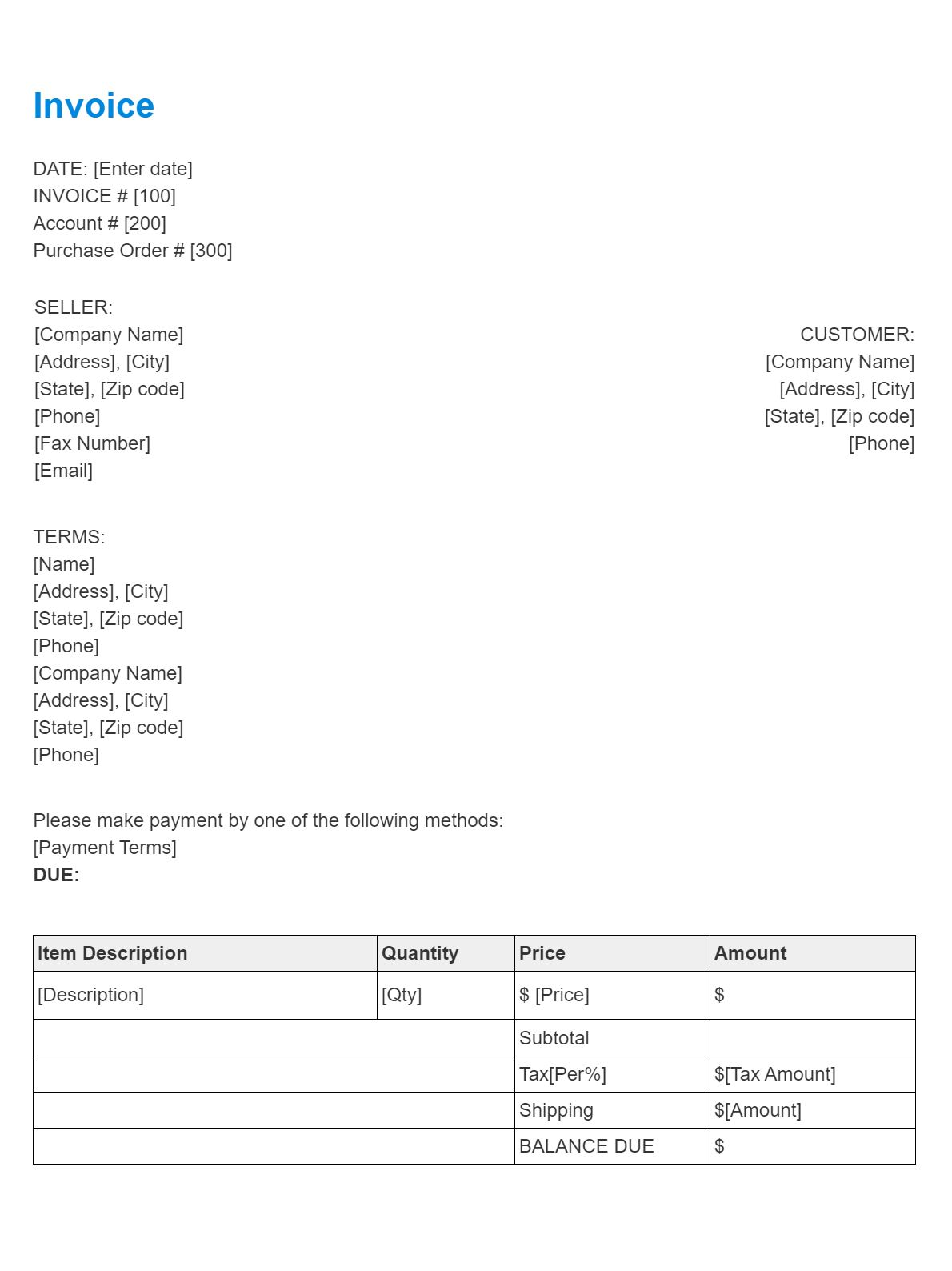

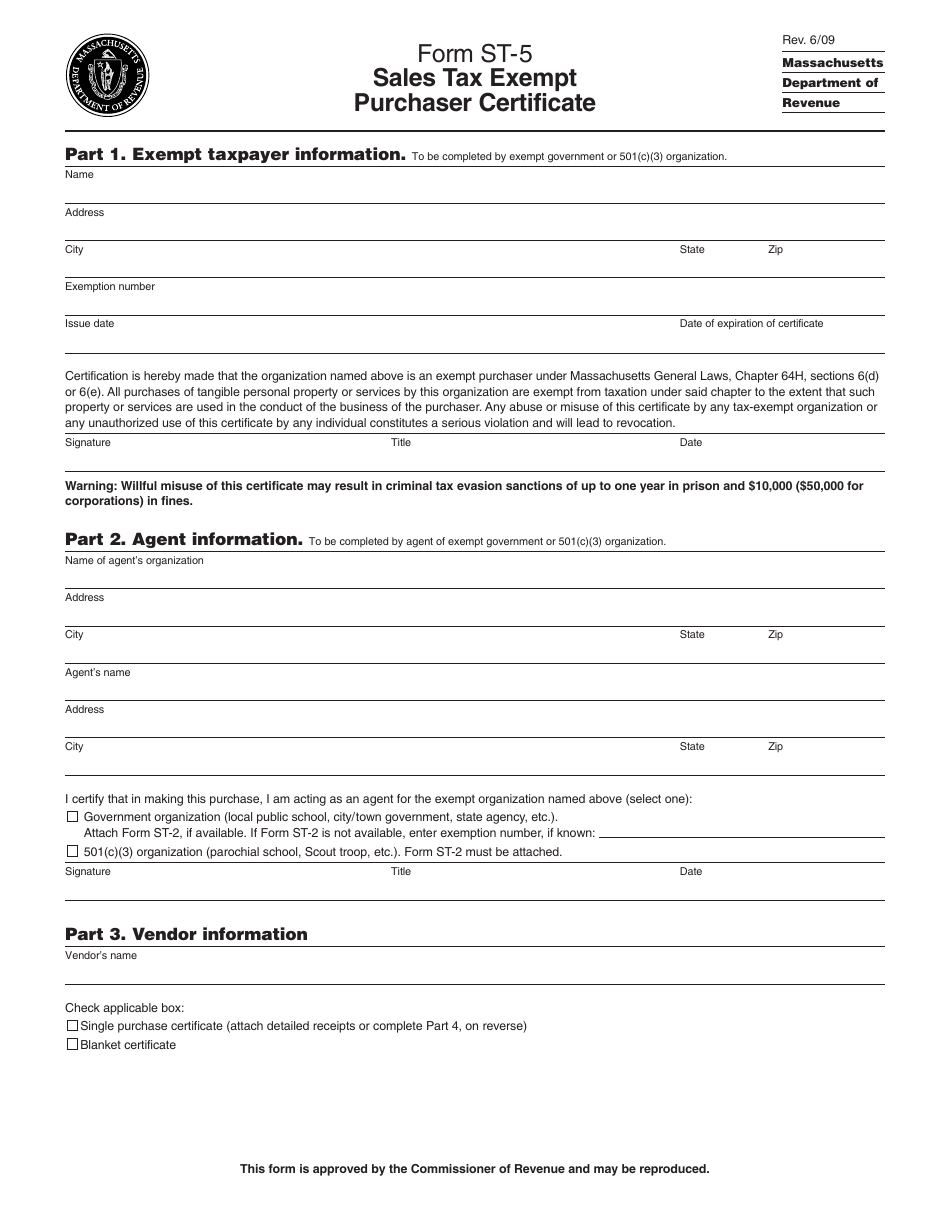

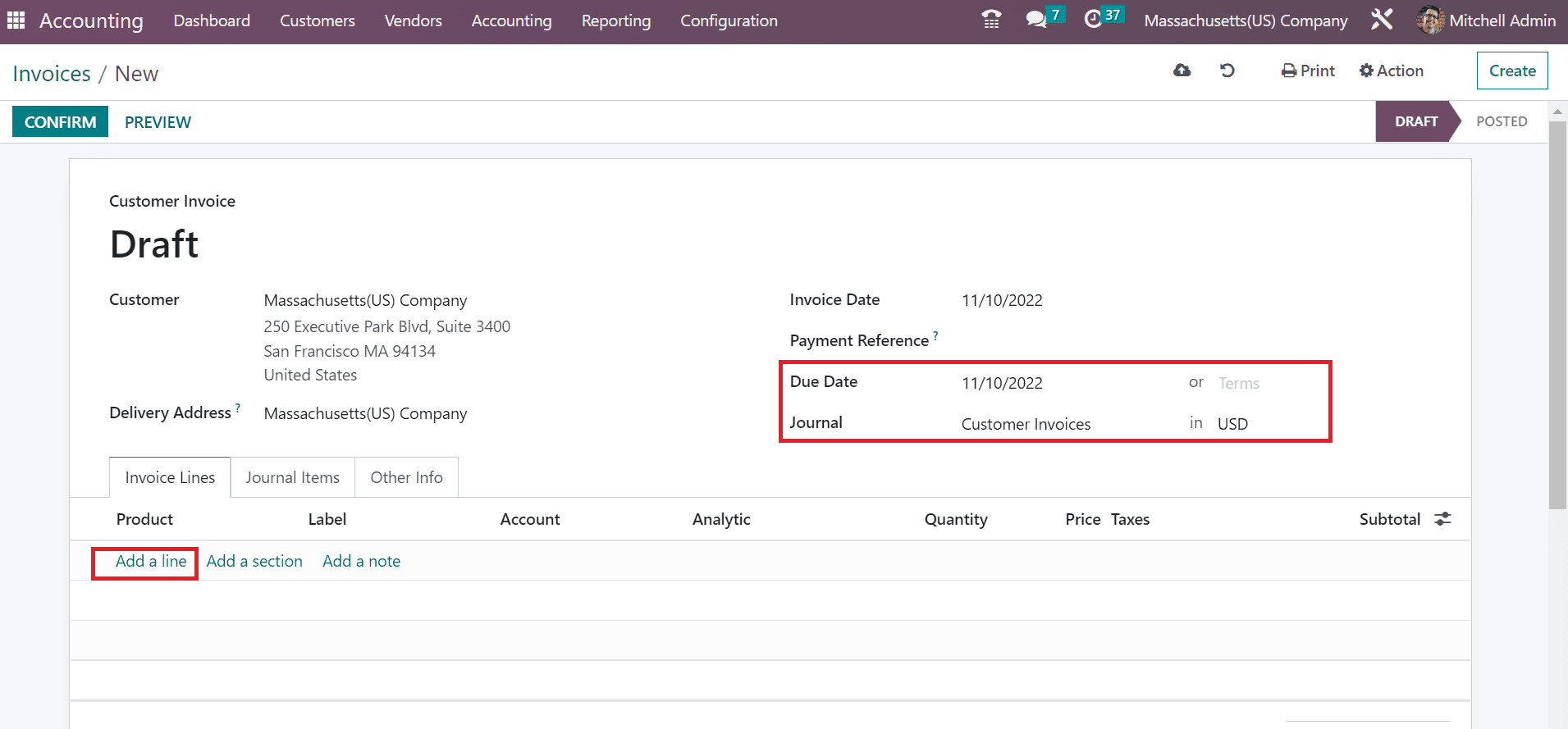

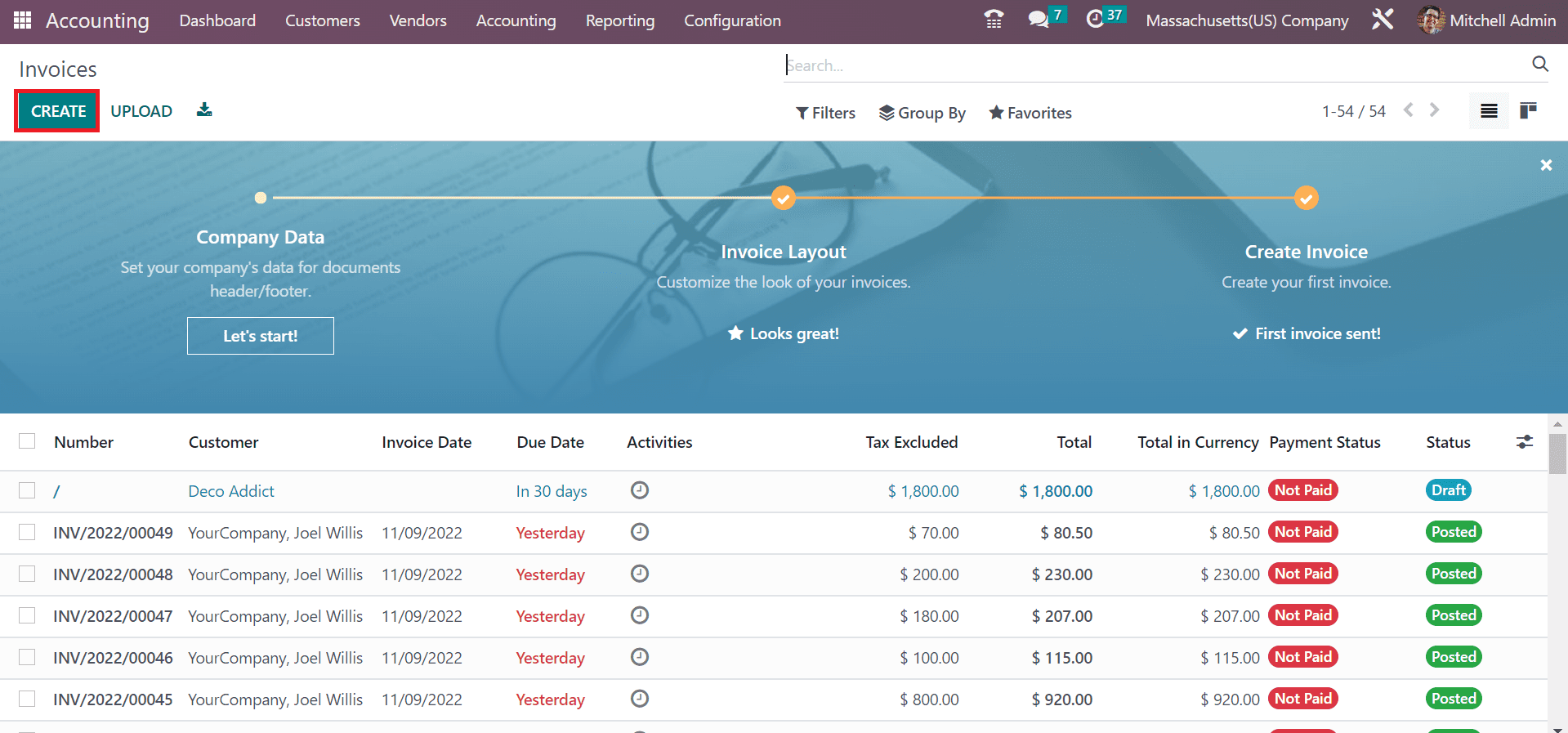

If you are a retailer selling mattresses in Massachusetts, it is your responsibility to collect and remit sales tax to the state. This can be done through the Massachusetts Department of Revenue's online tax portal. If you are an individual purchasing a mattress for personal use, the retailer will collect and report sales tax on your behalf.How to Report and Pay Sales Tax on Mattresses in Massachusetts

Here are some commonly asked questions about sales tax on mattresses in Massachusetts:Common Questions About Sales Tax and Mattresses in Massachusetts

If you're looking to save some money on sales tax when buying a mattress in Massachusetts, here are some tips:Tips for Saving Money on Sales Tax When Purchasing a Mattress in Massachusetts

The Impact of Mass Sales Tax on Mattresses and the House Design Industry

.jpeg?1560128104)

The Burden of Mass Sales Tax on Mattresses

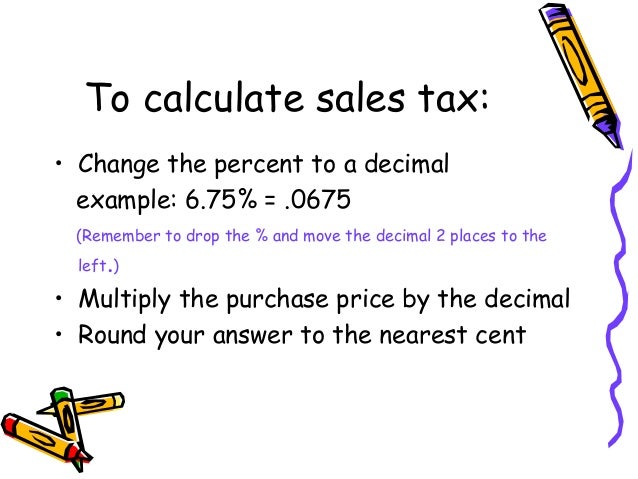

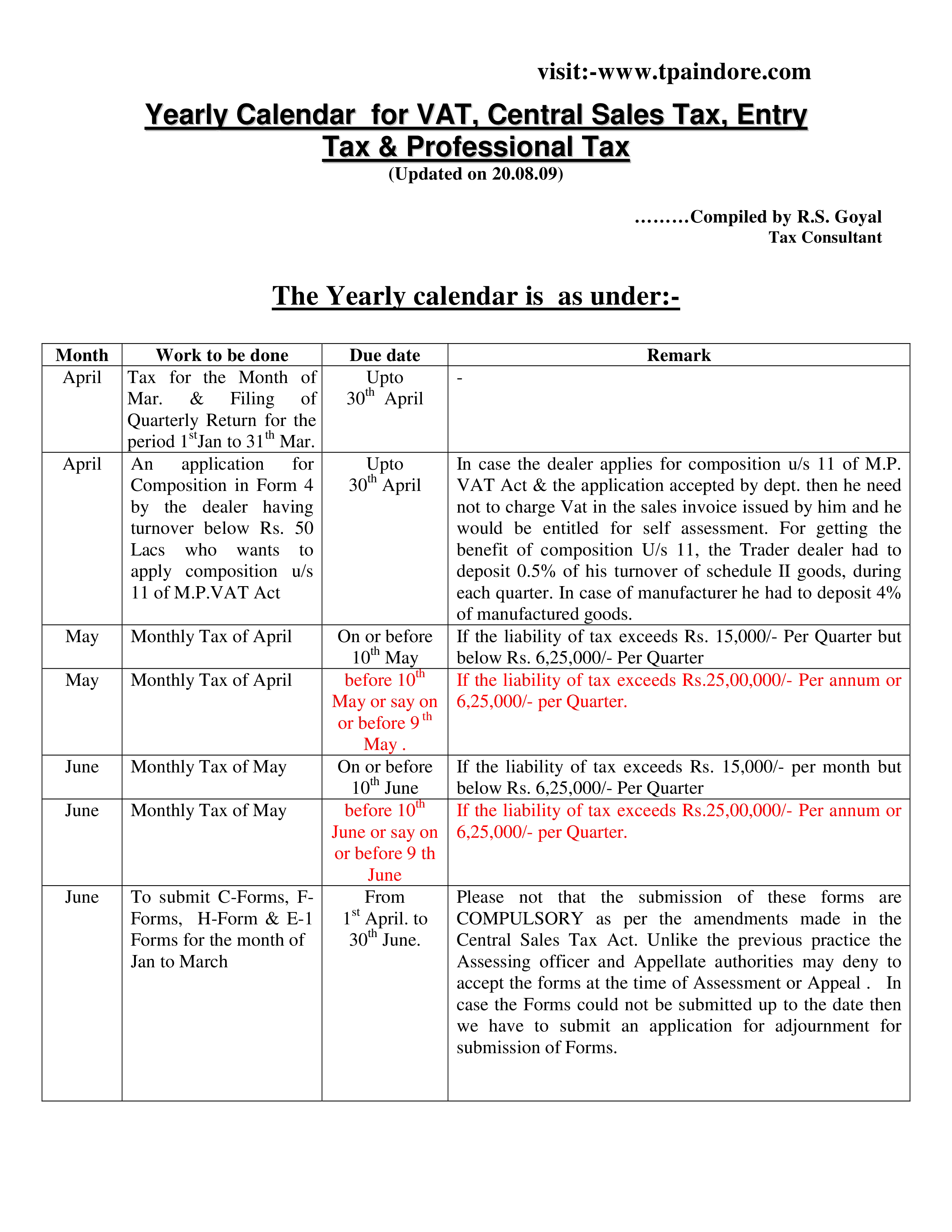

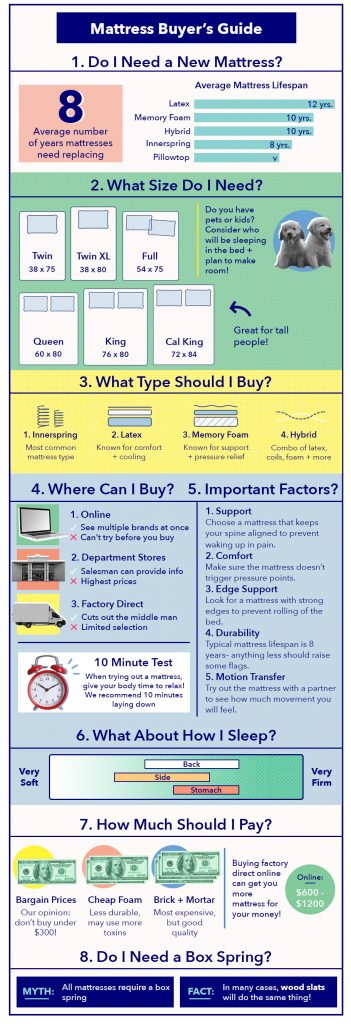

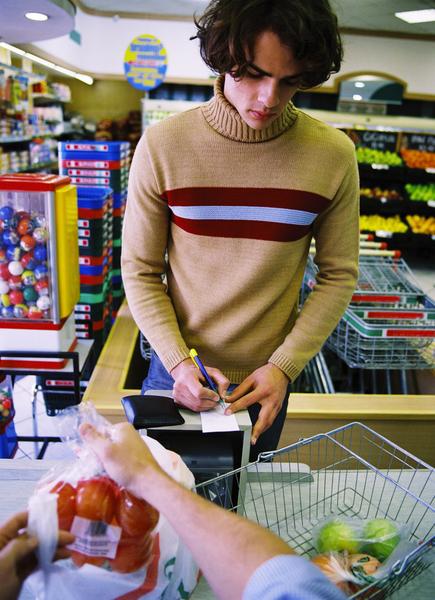

Mass sales tax has been a hot topic in recent years, with many states implementing it to generate revenue. However, the impact of this tax on certain industries, such as the house design industry, should not be overlooked. One particular area that has been greatly affected by mass sales tax is the sale of mattresses.

Mattresses are an essential element in any home, and their cost can significantly impact the overall budget for house design. With the addition of mass sales tax, the burden on consumers has increased, making it more challenging to afford quality mattresses. This has led to a decrease in sales for mattress companies and has also affected the variety of options available to consumers.

Mass sales tax has been a hot topic in recent years, with many states implementing it to generate revenue. However, the impact of this tax on certain industries, such as the house design industry, should not be overlooked. One particular area that has been greatly affected by mass sales tax is the sale of mattresses.

Mattresses are an essential element in any home, and their cost can significantly impact the overall budget for house design. With the addition of mass sales tax, the burden on consumers has increased, making it more challenging to afford quality mattresses. This has led to a decrease in sales for mattress companies and has also affected the variety of options available to consumers.

The Effect on House Design

The impact of mass sales tax on mattresses has also trickled down to the house design industry. With consumers spending more on mattresses, they have less disposable income to invest in other aspects of house design. This has resulted in a decrease in demand for home decor and furniture, affecting the overall revenue of the industry.

Moreover, the limited options available for mattresses due to the increased cost have also affected the creativity and design choices of homeowners. With a smaller budget, they are forced to compromise on their dream house design and settle for cheaper alternatives.

The impact of mass sales tax on mattresses has also trickled down to the house design industry. With consumers spending more on mattresses, they have less disposable income to invest in other aspects of house design. This has resulted in a decrease in demand for home decor and furniture, affecting the overall revenue of the industry.

Moreover, the limited options available for mattresses due to the increased cost have also affected the creativity and design choices of homeowners. With a smaller budget, they are forced to compromise on their dream house design and settle for cheaper alternatives.

The Need for a Solution

The burden of mass sales tax on mattresses and its ripple effect on the house design industry highlights the need for a solution. Many experts believe that a fair and balanced tax system is essential for the growth of any industry. This includes considering the impact of mass sales tax on specific products and finding alternative ways to generate revenue.

In addition, consumers can also play a role in finding a solution by being mindful of their spending and supporting local businesses that offer more affordable options. This can help alleviate the burden of mass sales tax and promote a healthy and thriving house design industry.

The burden of mass sales tax on mattresses and its ripple effect on the house design industry highlights the need for a solution. Many experts believe that a fair and balanced tax system is essential for the growth of any industry. This includes considering the impact of mass sales tax on specific products and finding alternative ways to generate revenue.

In addition, consumers can also play a role in finding a solution by being mindful of their spending and supporting local businesses that offer more affordable options. This can help alleviate the burden of mass sales tax and promote a healthy and thriving house design industry.

In Conclusion

In conclusion, the impact of mass sales tax on mattresses cannot be ignored, especially in the house design industry. It has not only affected the affordability of mattresses for consumers but also the overall revenue and creativity in the industry. By finding a fair and balanced solution, we can ensure the growth of both the mattress and house design industries.

In conclusion, the impact of mass sales tax on mattresses cannot be ignored, especially in the house design industry. It has not only affected the affordability of mattresses for consumers but also the overall revenue and creativity in the industry. By finding a fair and balanced solution, we can ensure the growth of both the mattress and house design industries.

/GettyImages-1821495482-5705498d3df78c7d9e8f2455.jpg)