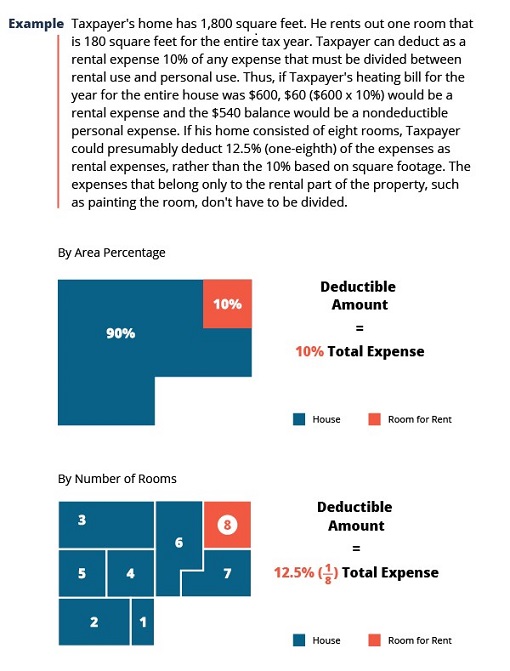

The living room tax is a term used to describe a tax on unused or underutilized living space in a home. It is typically applied to homeowners who have an extra room or space in their house that they are not using regularly. This tax is meant to encourage homeowners to make the most of their living space and to reduce the housing shortage in many areas.

If you are a homeowner and have an extra room or space in your living room that you are not utilizing, you may be subject to the living room tax. This tax can vary by location, but it is important to understand the potential impact it could have on your finances.

Living Room Tax: What It Is and How to Avoid It

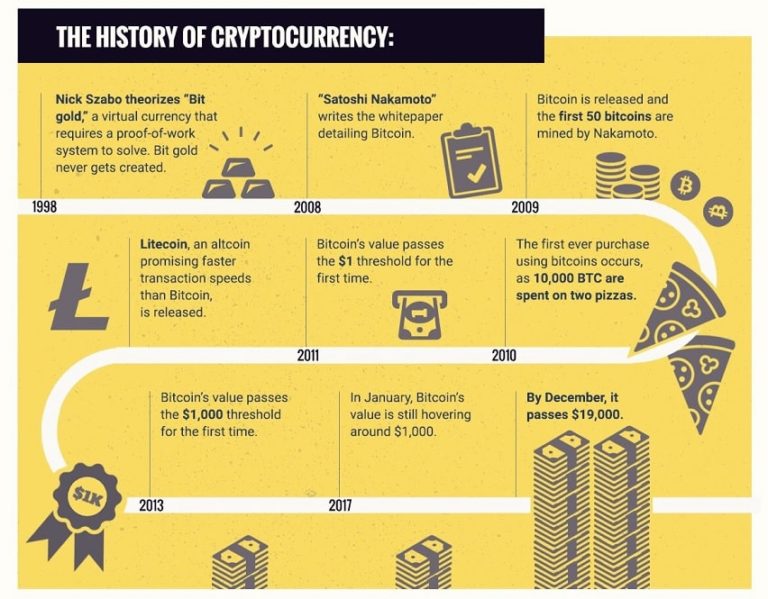

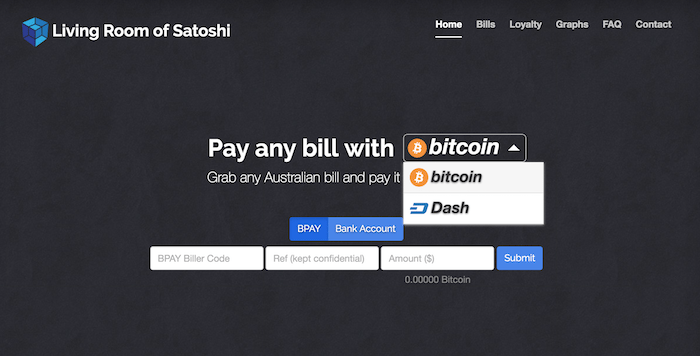

Satoshi Nakamoto is the pseudonym used by the mysterious creator of Bitcoin, the first and most well-known cryptocurrency. While the true identity of Satoshi Nakamoto is still unknown, their contributions to the world of cryptocurrency cannot be overlooked.

It is believed that Satoshi Nakamoto is a person or group of people who developed the original Bitcoin software and released it in 2009. Their goal was to create a decentralized digital currency that would not be controlled by any government or financial institution.

Satoshi Nakamoto: The Creator of Bitcoin

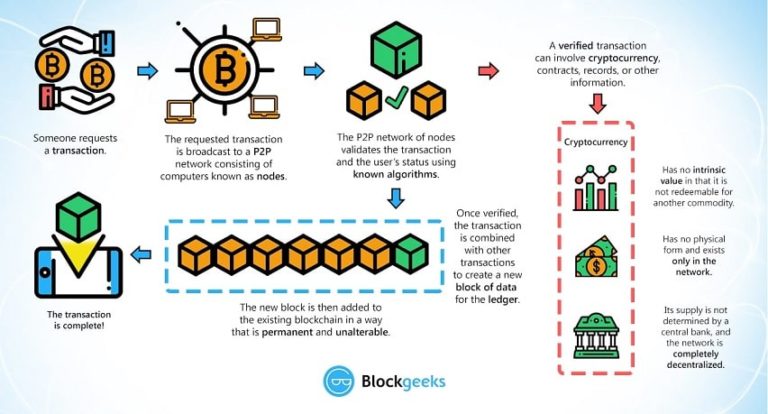

Cryptocurrency has become a popular investment option in recent years, with many people investing in Bitcoin and other digital currencies. However, with any investment, there are tax implications to consider. In the case of cryptocurrency, one of the biggest tax considerations is capital gains tax.

When you sell or exchange your cryptocurrency for a profit, you may be subject to capital gains tax. This tax is based on the difference between the purchase price and the selling price of your cryptocurrency. It is important to keep track of your cryptocurrency transactions and report them accurately on your tax return to avoid any penalties or fines.

Understanding Capital Gains Tax on Cryptocurrency

For those who work from home, having a designated home office can provide significant tax deductions. These deductions can include expenses such as rent, utilities, and office supplies. However, in order to claim these deductions, your home office must meet certain criteria.

To qualify for home office tax deductions, your home office must be used exclusively for work purposes and regularly used as your primary place of business. Additionally, you must be able to prove that your home office is necessary for the operation of your business. By maximizing these tax deductions, you can potentially save a significant amount of money on your taxes.

Maximizing Tax Deductions for Your Home Office

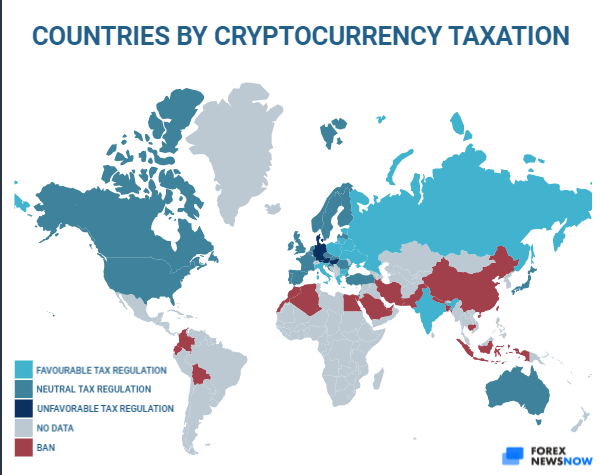

As cryptocurrency becomes more popular and mainstream, it is starting to have a significant impact on tax laws. Governments around the world are struggling to keep up with the constantly evolving world of cryptocurrency and how it should be taxed.

Some countries have chosen to treat cryptocurrency as a form of property, subjecting it to capital gains tax. Others have created specific laws for taxing cryptocurrency transactions. It is important for cryptocurrency investors to stay up-to-date on tax laws in their respective countries to ensure compliance and avoid any potential penalties.

The Impact of Cryptocurrency on Tax Laws

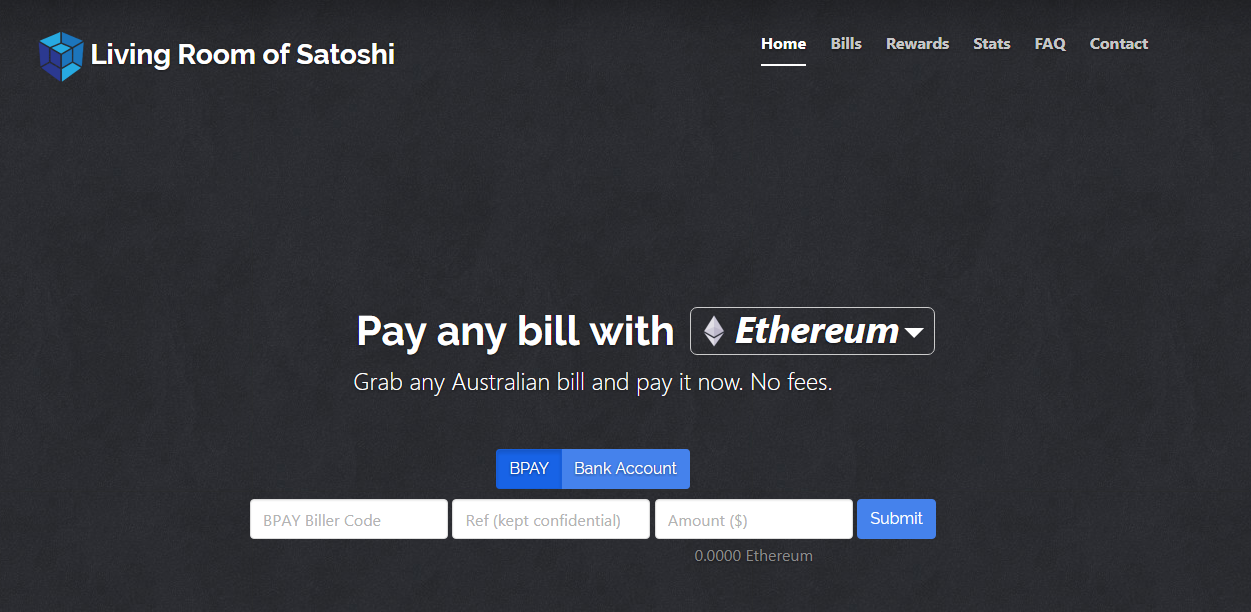

Calculating and reporting cryptocurrency taxes can be a daunting task, especially for those who are new to the world of digital currency. However, there are resources and tools available to help make this process easier.

There are various software programs and websites that can help you track your cryptocurrency transactions and calculate your taxes. It is important to keep detailed records of all your transactions, including the date, type, and value of each transaction. This will make it much easier to accurately report your cryptocurrency taxes and avoid any potential issues with the IRS.

How to Calculate and Report Cryptocurrency Taxes

If you are a homeowner and want to avoid the living room tax, there are ways to make your living space more tax-efficient. One option is to rent out the extra room in your living room to a roommate or through a short-term rental platform such as Airbnb. This can help offset the cost of the living room tax and potentially even generate additional income.

Another option is to use the extra space in your living room for a home office or creative workspace. By using this space for work purposes, you may be able to deduct certain expenses and potentially lower your overall tax liability. It is important to consult with a tax professional to ensure you are taking advantage of all available deductions and staying compliant with tax laws.

Creating a Tax-Efficient Investment Strategy for Your Living Room

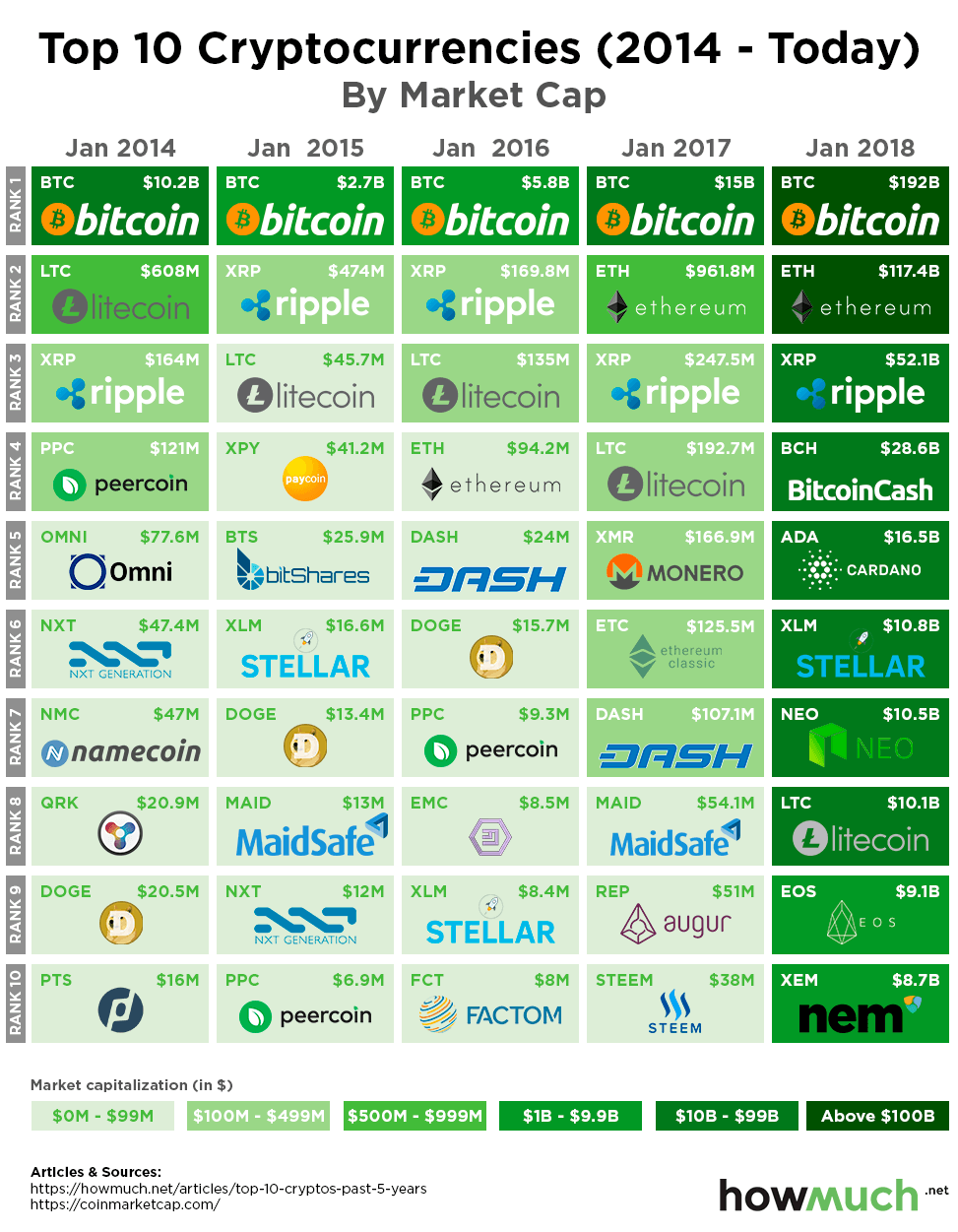

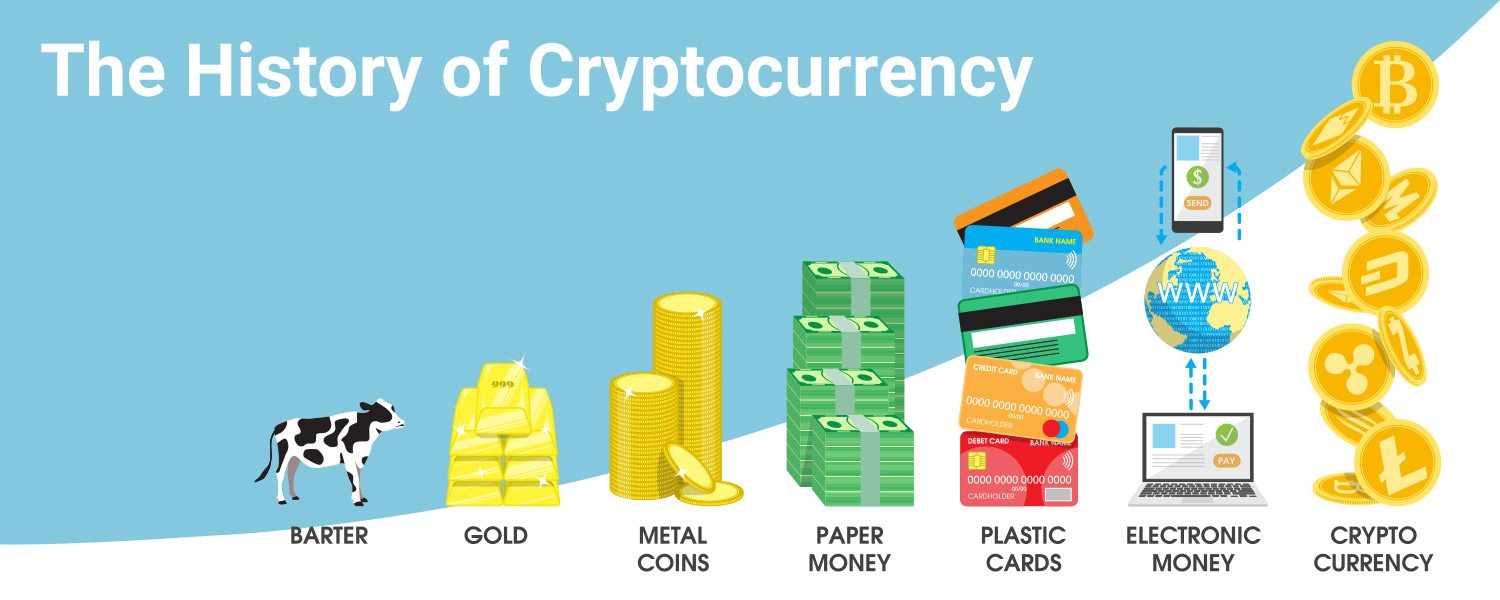

Cryptocurrency taxation is a relatively new concept, and it has evolved significantly since the creation of Bitcoin in 2009. In the early days of cryptocurrency, many investors were unaware of their tax obligations and the IRS had yet to issue any specific guidance.

However, as the popularity of cryptocurrency grew, so did the need for clear tax laws and regulations. In 2014, the IRS classified cryptocurrency as property for tax purposes, and in 2019, they issued new guidelines for reporting cryptocurrency transactions. As the world of cryptocurrency continues to evolve, it is likely that tax laws will also continue to evolve and adapt.

The History and Evolution of Cryptocurrency Taxation

Home renovations can be a great way to improve your living space and potentially save on taxes. Certain home improvements, such as energy-efficient upgrades, can qualify for tax credits. Additionally, home renovations that increase the value of your property can potentially lower your capital gains tax when you sell your home in the future.

It is important to keep track of all expenses related to home renovations and consult with a tax professional to determine which expenses may be eligible for tax savings. By strategically planning your home renovations, you can potentially save money on taxes while also improving your living space.

Maximizing Tax Savings with Home Renovations

While the true identity of Satoshi Nakamoto remains a mystery, their impact on the cryptocurrency community is undeniable. By creating Bitcoin, Satoshi Nakamoto sparked a revolution in the financial world and paved the way for the development of other digital currencies.

The Role of Satoshi Nakamoto in the Cryptocurrency Community

The Importance of a Well-Designed Living Room

Maximizing Space and Functionality

A well-designed living room is essential for any home. Not only is it the main gathering space for family and friends, but it also sets the tone for the rest of the house. When properly designed, a living room can maximize space and functionality, making it a comfortable and welcoming area for all to enjoy.

A well-designed living room is essential for any home. Not only is it the main gathering space for family and friends, but it also sets the tone for the rest of the house. When properly designed, a living room can maximize space and functionality, making it a comfortable and welcoming area for all to enjoy.

The Role of the Living Room in House Design

The living room is often referred to as the heart of the home. It is where we relax, entertain, and spend quality time with our loved ones. As such, it is important to create a space that is both functional and aesthetically pleasing. A well-designed living room can enhance the overall look and feel of a house, making it more inviting and comfortable for everyone.

The living room is often referred to as the heart of the home. It is where we relax, entertain, and spend quality time with our loved ones. As such, it is important to create a space that is both functional and aesthetically pleasing. A well-designed living room can enhance the overall look and feel of a house, making it more inviting and comfortable for everyone.

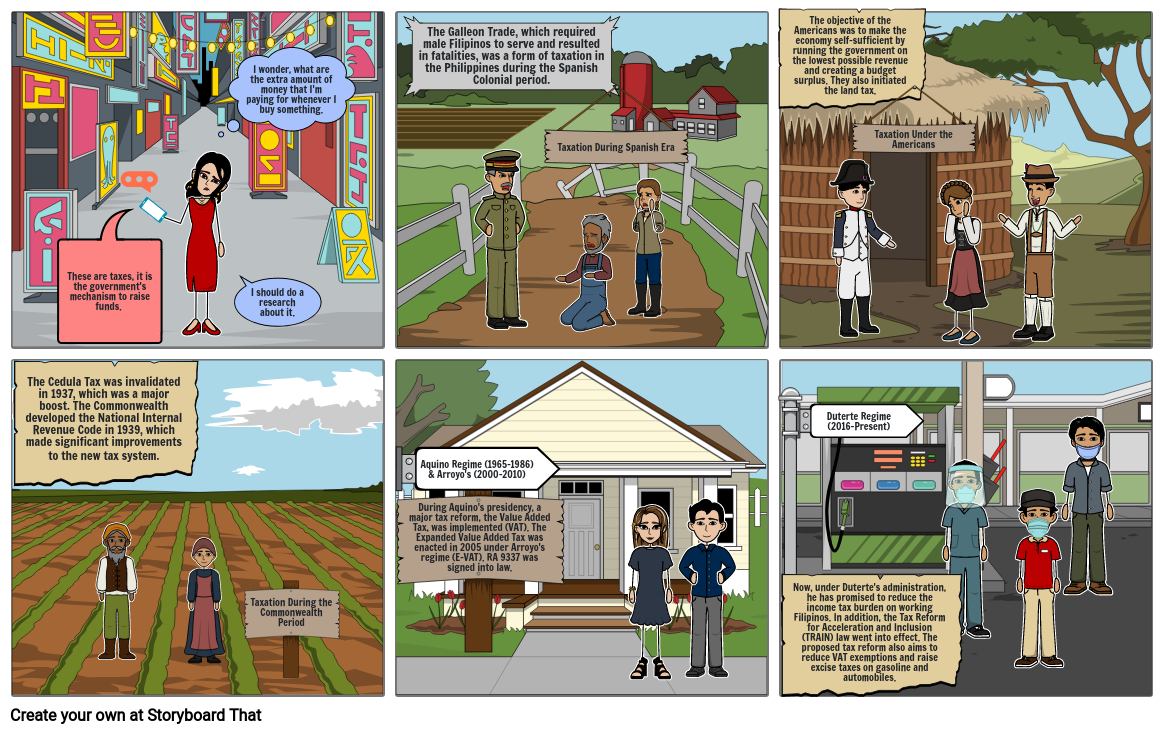

The Impact of the "Living Room Satoshi Tax"

In recent years, the concept of the "living room satoshi tax" has gained popularity in the world of house design. This term refers to the idea that the living room should be the most well-designed and well-furnished room in the house, as it is the space where we spend the most time and entertain guests. By investing in the design of your living room, you are essentially adding value to your home and increasing its appeal to potential buyers.

In recent years, the concept of the "living room satoshi tax" has gained popularity in the world of house design. This term refers to the idea that the living room should be the most well-designed and well-furnished room in the house, as it is the space where we spend the most time and entertain guests. By investing in the design of your living room, you are essentially adding value to your home and increasing its appeal to potential buyers.

The Benefits of a Well-Designed Living Room

A well-designed living room not only adds value to your home, but it also offers numerous benefits for you and your family. By carefully planning and organizing the layout and design of your living room, you can create a functional and comfortable space that meets the needs of your household. This can include incorporating storage solutions, maximizing natural light, and choosing furniture that fits the space perfectly.

A well-designed living room not only adds value to your home, but it also offers numerous benefits for you and your family. By carefully planning and organizing the layout and design of your living room, you can create a functional and comfortable space that meets the needs of your household. This can include incorporating storage solutions, maximizing natural light, and choosing furniture that fits the space perfectly.

Incorporating Your Personal Style

When designing your living room, it is important to incorporate your personal style and taste. This is the space where you will spend a significant amount of time, so it should reflect your personality and preferences. Whether you prefer a modern and minimalist look or a cozy and traditional feel, a well-designed living room can be tailored to your individual style.

When designing your living room, it is important to incorporate your personal style and taste. This is the space where you will spend a significant amount of time, so it should reflect your personality and preferences. Whether you prefer a modern and minimalist look or a cozy and traditional feel, a well-designed living room can be tailored to your individual style.

Conclusion

In conclusion, a well-designed living room is a crucial element of house design. It not only adds value to your home but also enhances the functionality and overall appeal of your living space. By carefully considering the layout, furniture, and personal style, you can create a living room that is both practical and aesthetically pleasing. So don't underestimate the importance of a well-designed living room and start creating your perfect space today.

In conclusion, a well-designed living room is a crucial element of house design. It not only adds value to your home but also enhances the functionality and overall appeal of your living space. By carefully considering the layout, furniture, and personal style, you can create a living room that is both practical and aesthetically pleasing. So don't underestimate the importance of a well-designed living room and start creating your perfect space today.