Yes Bank: The Kitchen Sinking of a Bank

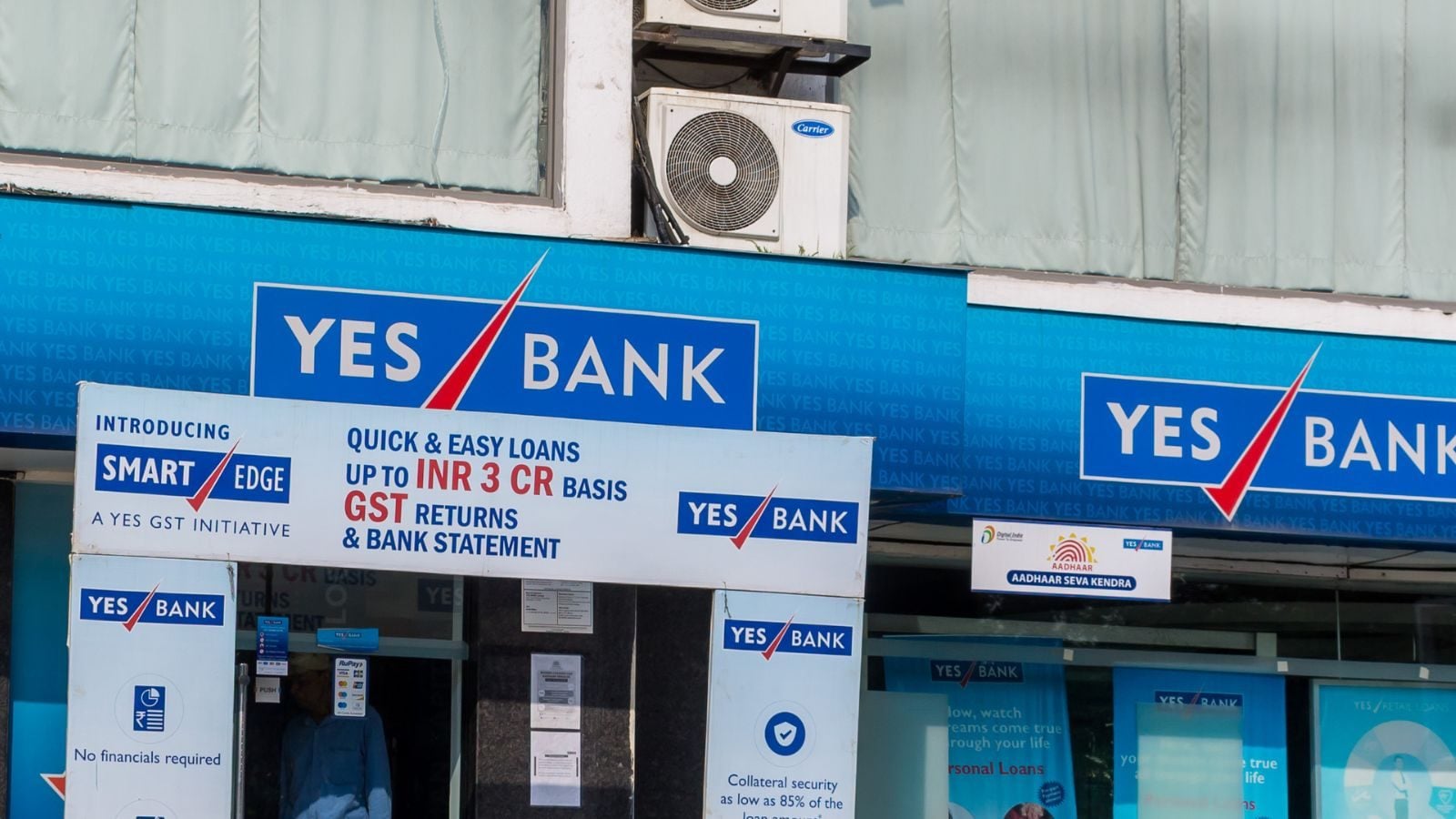

Yes Bank has been making headlines in recent years due to its controversial kitchen sinking. This once-promising bank has faced a tumultuous journey, with its downfall leaving investors and customers reeling. In this article, we will dive into the details of Yes Bank's kitchen sinking and its repercussions on the Indian banking industry.

Yes Bank: The Kitchen Sinking of a Bank Explained

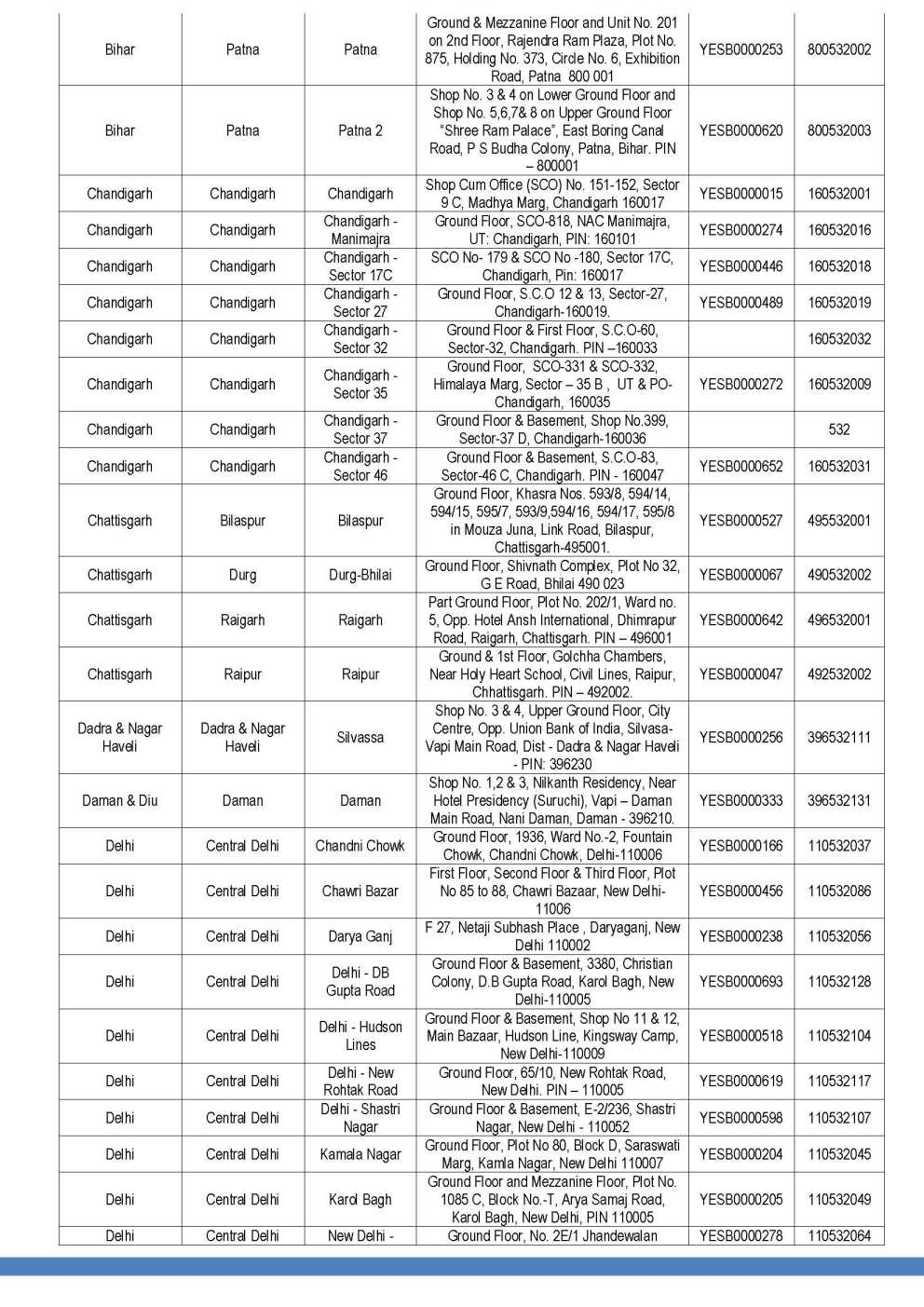

So, what exactly is a kitchen sinking? In simple terms, it is a strategy used by a company to write off a significant amount of its assets, usually due to poor performance or financial instability. In the case of Yes Bank, it involved writing off a whopping Rs. 10,000 crores of its loans and advances in order to clean up its balance sheet. This move caused a major shock in the banking sector and raised questions about the bank's financial health.

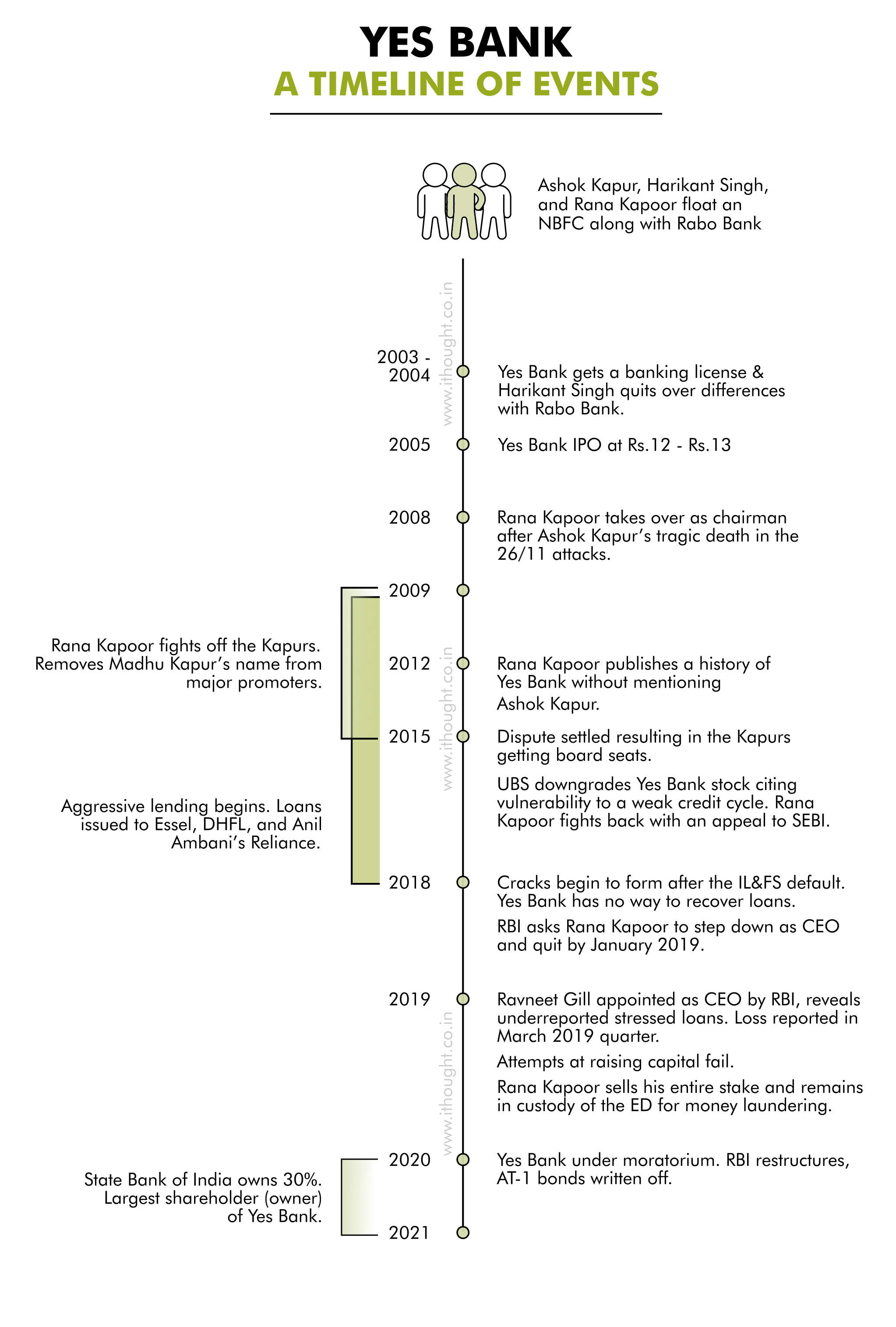

Yes Bank: The Story of a Banking Crisis

The kitchen sinking of Yes Bank was not an overnight decision. It was the culmination of a series of events that led to the bank's downfall. From corporate governance issues to under-reporting of bad loans, Yes Bank was plagued by various controversies and regulatory concerns. The Reserve Bank of India (RBI) had also raised red flags about the bank's financial stability, which ultimately led to the kitchen sinking.

Yes Bank: The Fall of a Promising Bank

Yes Bank was once considered a rising star in the Indian banking industry. With its innovative products and services, it quickly gained a loyal customer base and the trust of investors. However, the bank's rapid expansion and risky lending practices eventually caught up with them, resulting in a sharp decline in its financials. The kitchen sinking was seen as a last resort to salvage the bank's reputation and regain investor confidence.

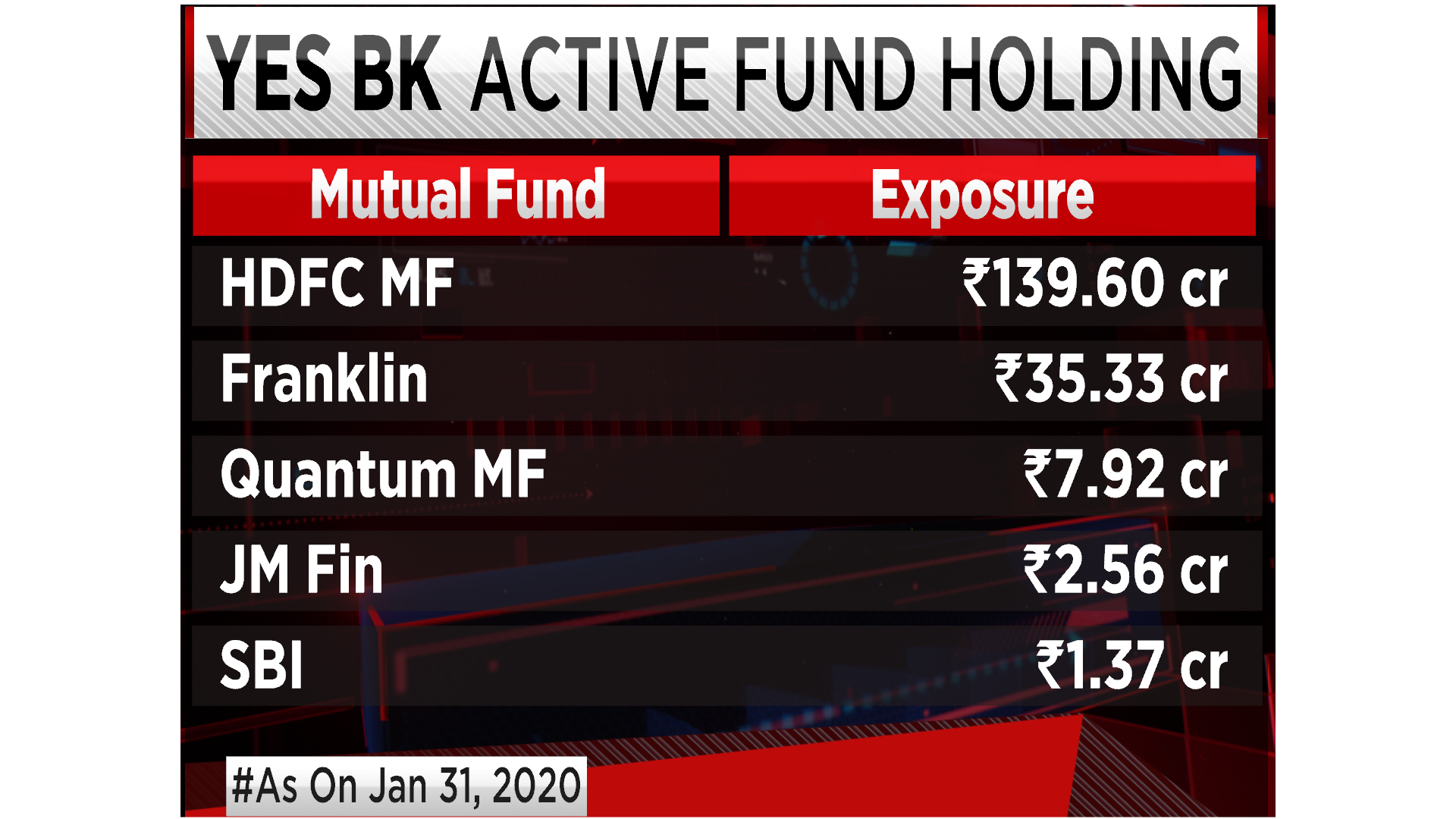

Yes Bank: The Impact of the Kitchen Sinking on Investors

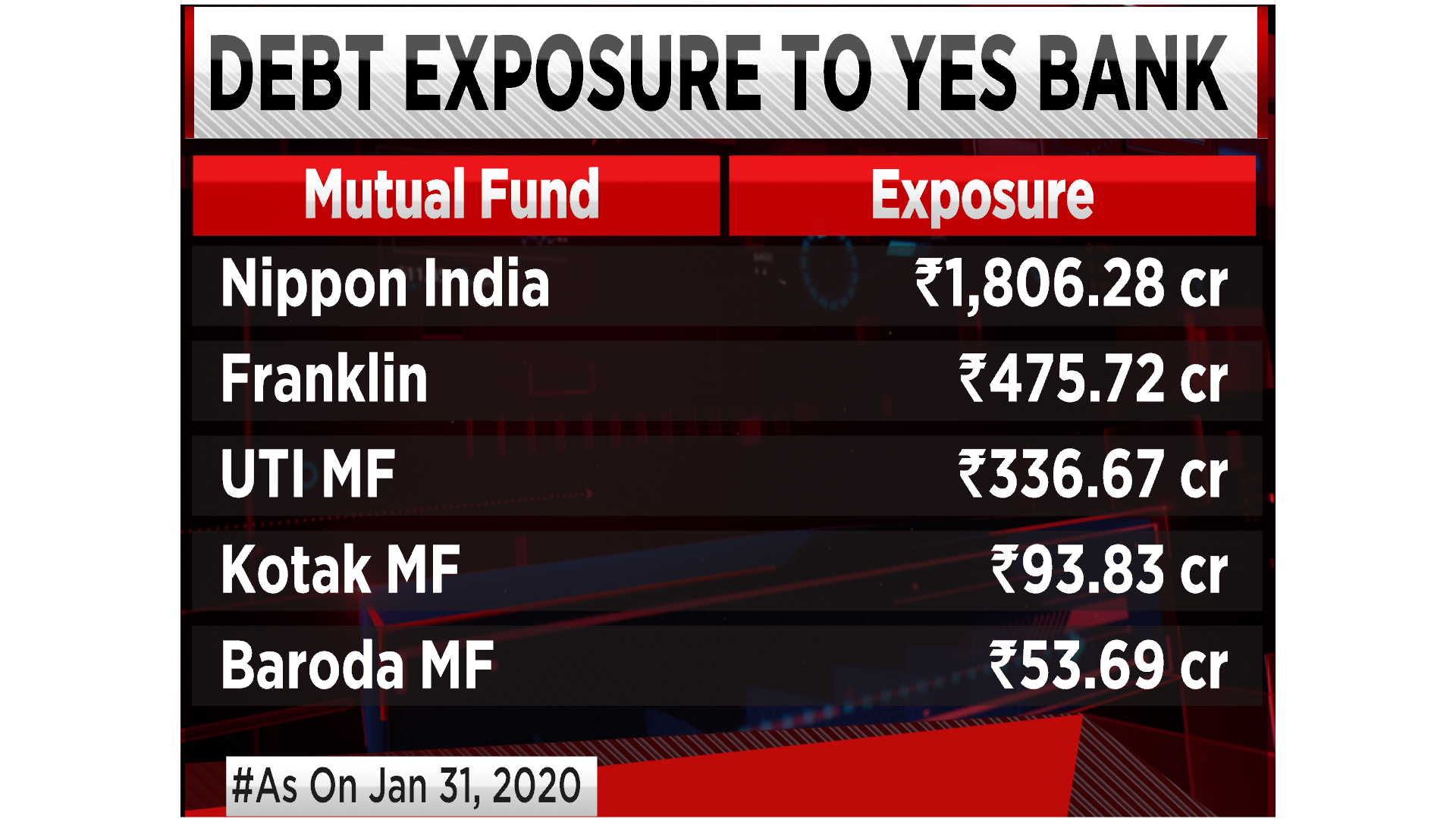

The kitchen sinking of Yes Bank had a significant impact on its investors, especially those who held a large number of shares in the bank. The sudden write-off of loans caused a steep drop in the bank's stock prices, resulting in heavy losses for shareholders. This move also led to a loss of trust in the bank, with many investors choosing to exit their investments in fear of further losses.

Yes Bank: The Role of the Reserve Bank of India

The RBI played a crucial role in the kitchen sinking of Yes Bank. As the regulator of the banking sector, it is responsible for ensuring the stability and integrity of banks. The RBI had been closely monitoring Yes Bank's financials and had repeatedly issued warnings about its precarious position. The kitchen sinking was ultimately initiated by the RBI as a means to save the bank from collapse.

Yes Bank: The Controversial Merger with SBI

In the aftermath of the kitchen sinking, Yes Bank was left with a significant capital shortfall and a fragile balance sheet. This led to talks of a possible merger with the State Bank of India (SBI), the country's largest bank. However, the merger was met with resistance from both investors and customers, who feared the dilution of their investments and the loss of the bank's identity.

Yes Bank: The Future of the Bank After the Kitchen Sinking

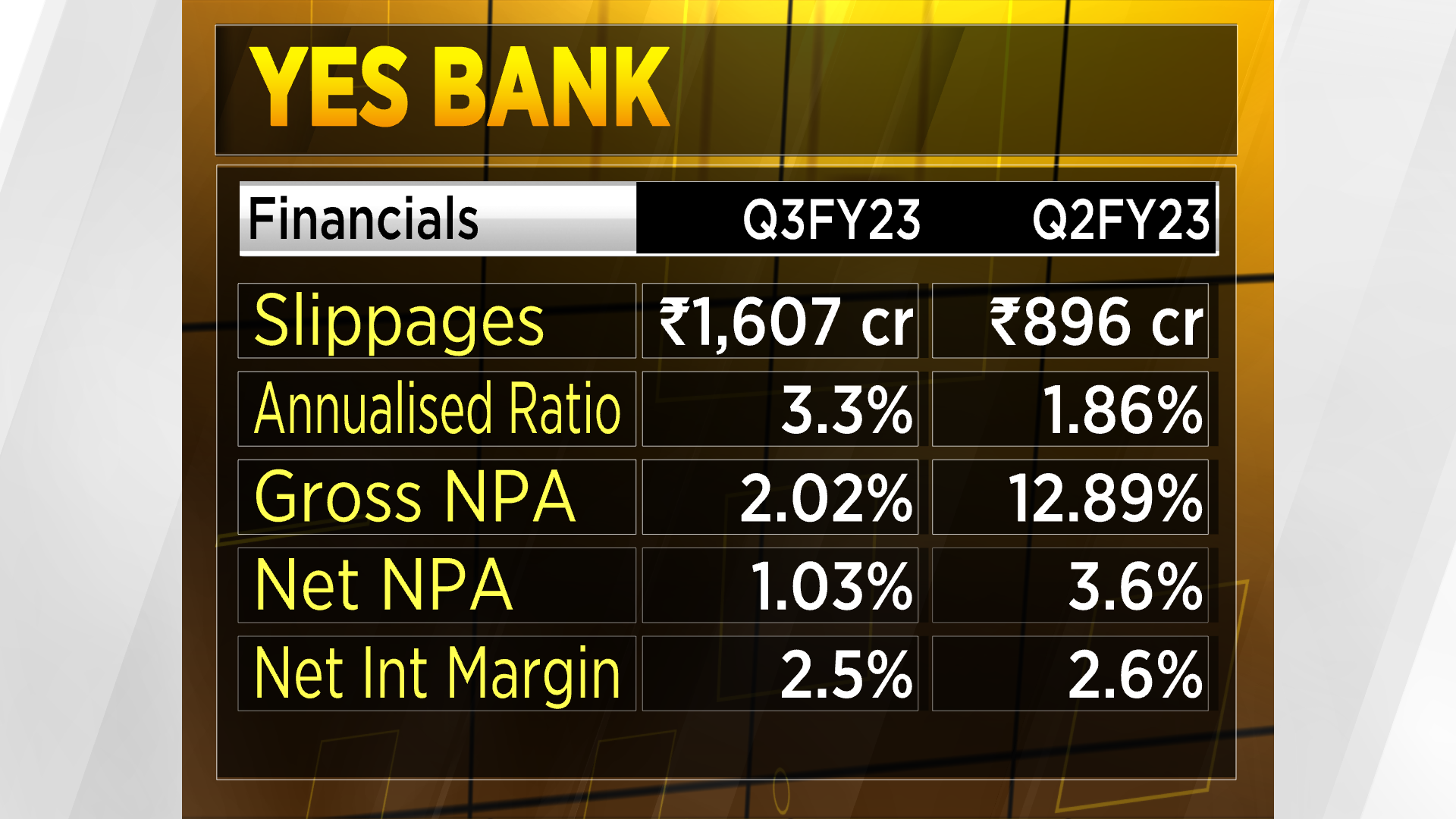

Currently, Yes Bank is on the road to recovery after the kitchen sinking. The bank has undergone a major restructuring, with new management and a renewed focus on risk management and compliance. The merger with SBI has also been approved by the RBI, which is expected to provide much-needed stability and support to Yes Bank.

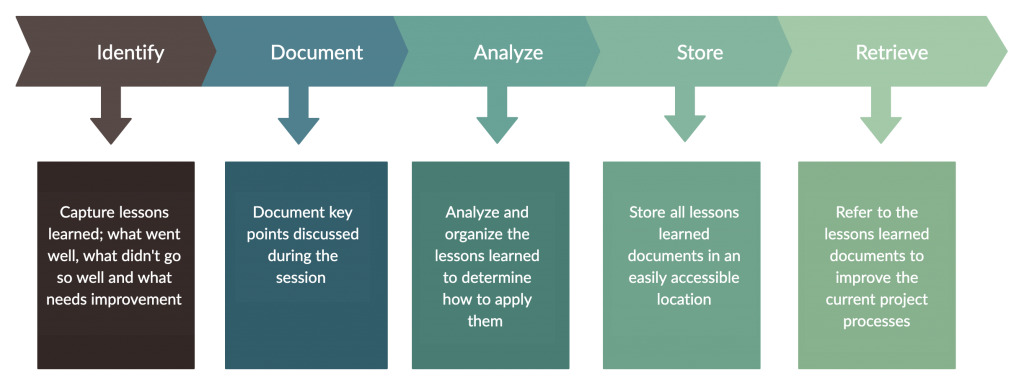

Yes Bank: The Lessons Learned from the Kitchen Sinking

The kitchen sinking of Yes Bank serves as a cautionary tale for the Indian banking industry. It highlights the importance of strong corporate governance, risk management, and transparency in financial reporting. It also emphasizes the need for effective regulation and oversight to prevent such crises from occurring in the future.

Yes Bank: The Road to Recovery for the Troubled Bank

Yes Bank's journey to recovery after the kitchen sinking will not be easy. The bank still faces challenges such as asset quality issues, capital constraints, and investor skepticism. However, with a new management team and the support of SBI, it is expected to slowly regain its position as a trusted and stable bank in the Indian market.

The Rise and Fall of Yes Bank: A Cautionary Tale on Kitchen Sinking

Kitchen Sinking: A Definition

Kitchen sinking

is a term used in the banking industry to describe the practice of writing off a large amount of

bad loans

at once in order to improve a bank's financial standing. This tactic is often used when a bank is facing financial distress and is struggling to meet its capital requirements. While it may provide a temporary solution, it can also have long-term consequences for the bank and its customers.

Kitchen sinking

is a term used in the banking industry to describe the practice of writing off a large amount of

bad loans

at once in order to improve a bank's financial standing. This tactic is often used when a bank is facing financial distress and is struggling to meet its capital requirements. While it may provide a temporary solution, it can also have long-term consequences for the bank and its customers.

The Fall of Yes Bank

Yes Bank

was once considered one of the fastest-growing banks in India, known for its innovative and aggressive approach to banking. However, in recent years, the bank has faced a series of setbacks, including allegations of

fraud

and

mismanagement

. This led to a sharp decline in the bank's stock price and a loss of investor confidence. As a result, Yes Bank was forced to resort to

kitchen sinking

in order to salvage its financial situation.

Yes Bank

was once considered one of the fastest-growing banks in India, known for its innovative and aggressive approach to banking. However, in recent years, the bank has faced a series of setbacks, including allegations of

fraud

and

mismanagement

. This led to a sharp decline in the bank's stock price and a loss of investor confidence. As a result, Yes Bank was forced to resort to

kitchen sinking

in order to salvage its financial situation.

The Impact of Kitchen Sinking

While

kitchen sinking

may provide a short-term boost to a bank's financials, it can have long-term consequences for both the bank and its customers. Writing off a large amount of bad loans can significantly impact the bank's profitability and shareholder value. It can also result in a loss of trust and credibility with customers, who may see their savings and investments at risk.

While

kitchen sinking

may provide a short-term boost to a bank's financials, it can have long-term consequences for both the bank and its customers. Writing off a large amount of bad loans can significantly impact the bank's profitability and shareholder value. It can also result in a loss of trust and credibility with customers, who may see their savings and investments at risk.

Lessons Learned

The downfall of Yes Bank serves as a cautionary tale for the banking industry, highlighting the dangers of aggressive lending practices and

kitchen sinking

. Banks must prioritize responsible lending and sound risk management strategies to prevent a similar fate. It is also crucial for regulators to closely monitor and regulate banks to ensure their stability and protect the interests of customers.

The downfall of Yes Bank serves as a cautionary tale for the banking industry, highlighting the dangers of aggressive lending practices and

kitchen sinking

. Banks must prioritize responsible lending and sound risk management strategies to prevent a similar fate. It is also crucial for regulators to closely monitor and regulate banks to ensure their stability and protect the interests of customers.

The Road to Recovery

Despite its challenges, Yes Bank has shown signs of recovery in recent months, with a new leadership team in place and a focus on rebuilding trust and credibility. The bank has also implemented stricter lending policies and improved its risk management practices. Time will tell if Yes Bank can fully recover from its

kitchen sinking

debacle and regain its position as a leading bank in India.

Despite its challenges, Yes Bank has shown signs of recovery in recent months, with a new leadership team in place and a focus on rebuilding trust and credibility. The bank has also implemented stricter lending policies and improved its risk management practices. Time will tell if Yes Bank can fully recover from its

kitchen sinking

debacle and regain its position as a leading bank in India.

.jpg&h=630&w=1200&q=100&v=ddde6cfb82&c=1)