When it comes to protecting your home, having the right insurance coverage is crucial. This includes coverage for any damage that may occur in your bathroom. From water leaks to sink damage, your bathroom is a high-risk area for potential damage to your home. That's why it's important to understand what your home insurance covers in terms of bathroom damage. Home insurance is designed to protect homeowners from financial loss due to damage or destruction to their property. This includes coverage for damage to the structure of your home, as well as personal belongings and liability protection. But when it comes to bathroom damage, there are certain considerations to keep in mind. Home insurance coverage for bathroom damage

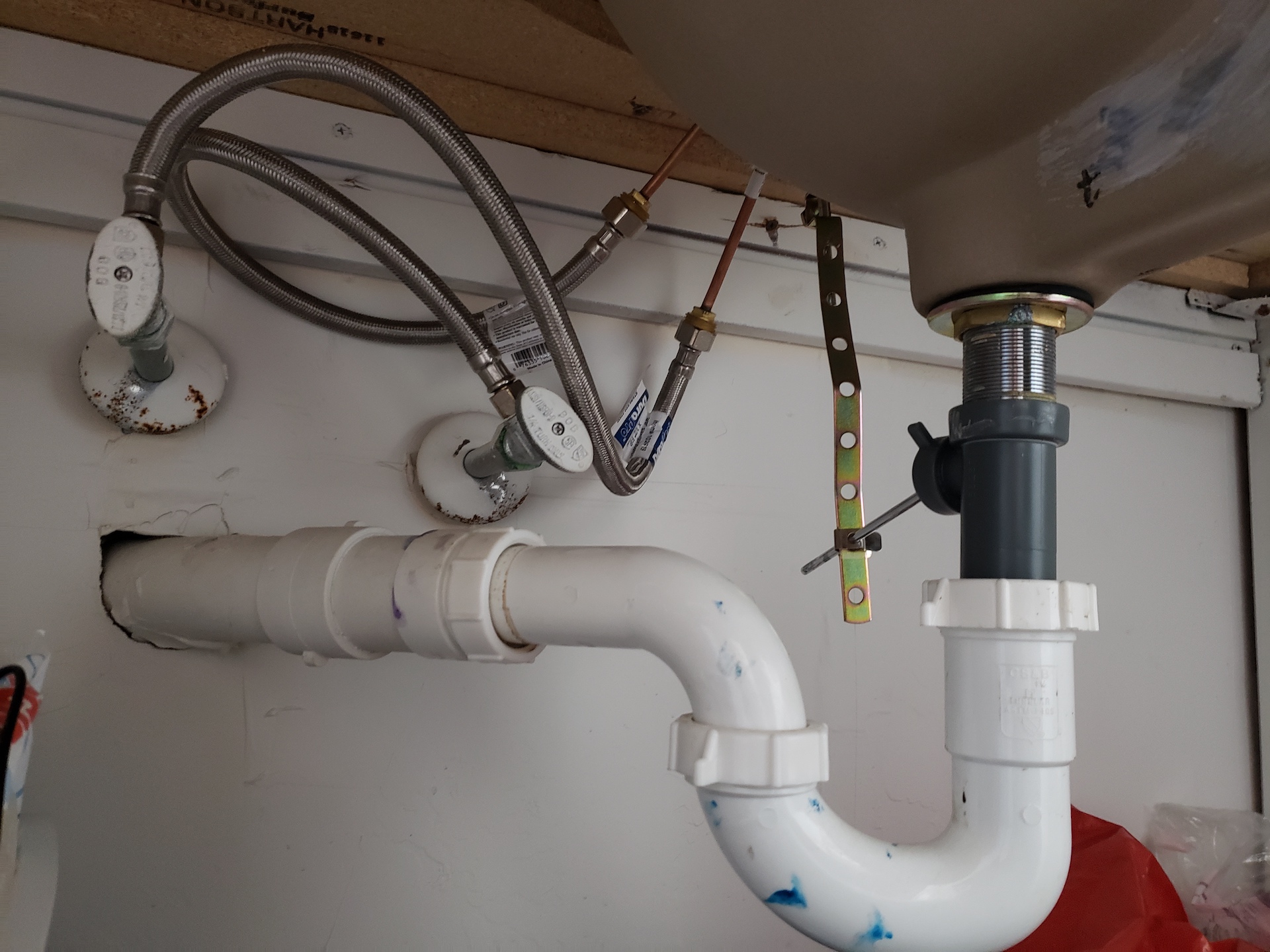

Your bathroom sink is one of the most used fixtures in your home, making it susceptible to wear and tear over time. But what happens if your sink becomes damaged? Will your home insurance cover the cost of repairs or replacement? The answer is, it depends. If the damage to your sink is due to a covered peril, such as a fire or burst pipe, then your home insurance should cover the cost of repairs or replacement. However, if the damage is due to regular wear and tear, your home insurance may not cover the cost. Sink damage and home insurance

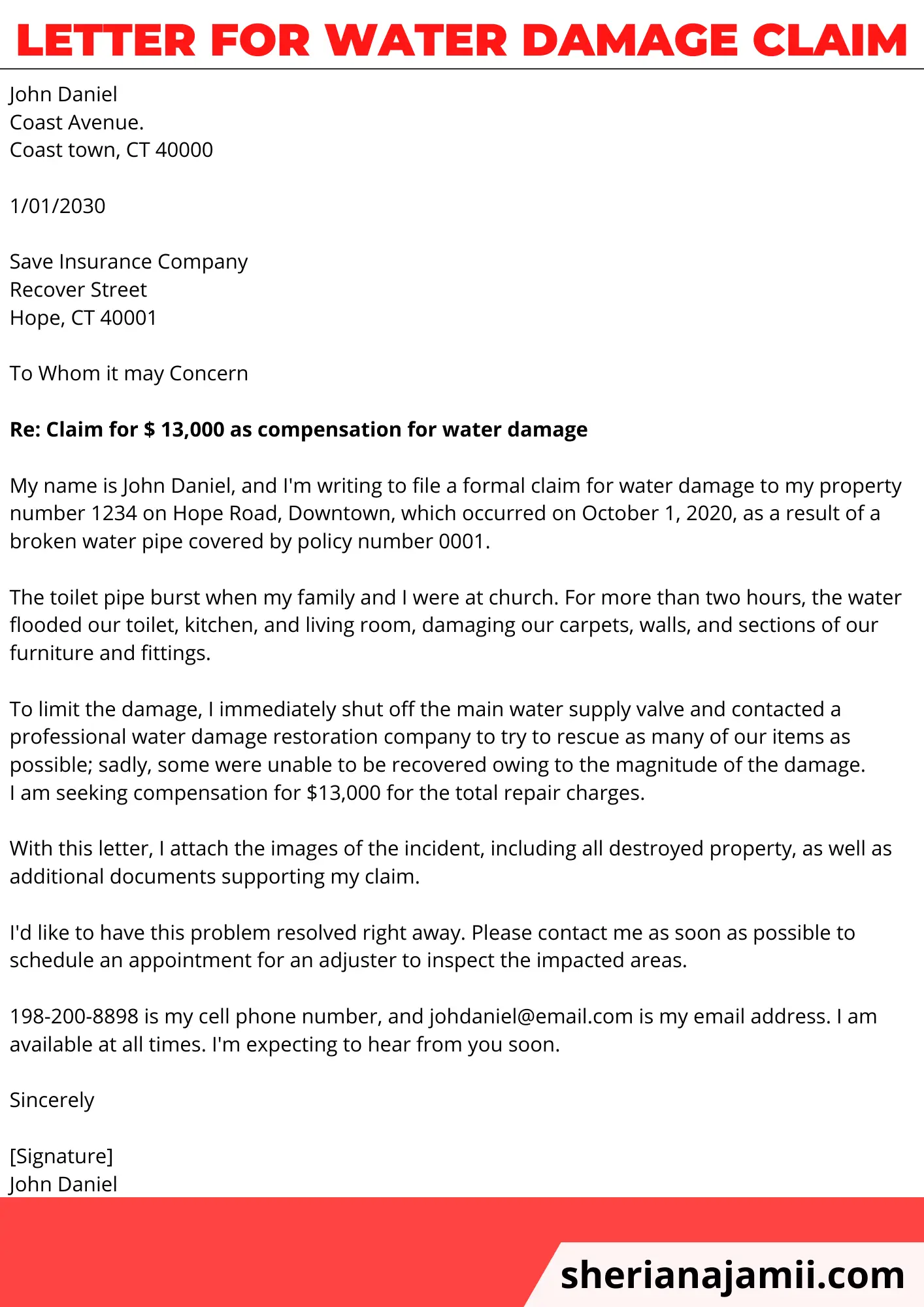

If your bathroom sink becomes damaged and you need to file an insurance claim, there are a few steps you should take. First, document the damage by taking photos or videos. This will provide evidence for your claim and help the insurance company assess the extent of the damage. Next, contact your insurance company and inform them of the damage. They will guide you through the claims process and let you know what documentation is needed. It's important to note that filing too many insurance claims can result in higher premiums, so it's best to weigh the cost of repairs before deciding to file a claim. Bathroom sink damage and insurance claims

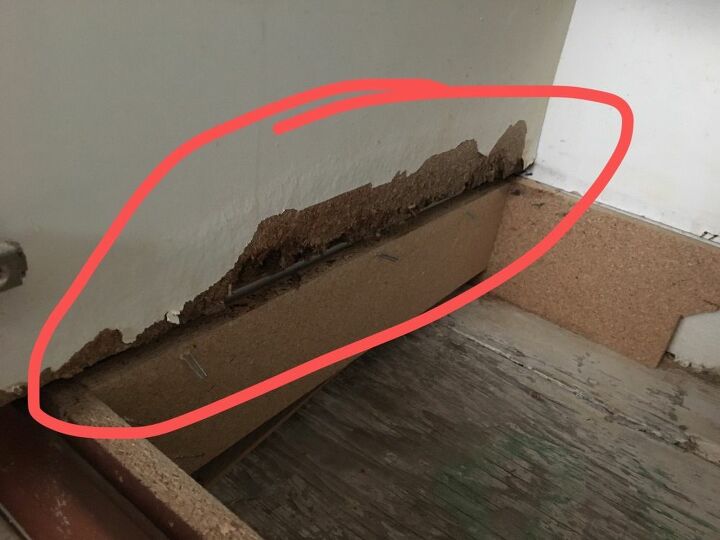

One of the most common causes of bathroom damage is water leaks. If your sink has a leak, it can cause damage to the surrounding area and even spread to other parts of your home. So, will your home insurance cover the cost of water damage from a sink leak? Again, it depends. If the leak is sudden and accidental, your home insurance may cover the cost of repairs. However, if the leak is due to regular wear and tear or lack of maintenance, your insurance may not cover the cost. Home insurance for bathroom sink leaks

As a homeowner, it's important to understand the coverage provided by your insurance policy. Sink damage can be a costly and unexpected expense, so it's important to know if your homeowners insurance will cover the cost. In addition to bathroom sink damage, your homeowners insurance may also cover damage to other fixtures and appliances in your home, such as the bathtub, toilet, and shower. However, it's always best to check with your insurance provider to understand the specifics of your coverage. Sink damage and homeowners insurance

When it comes to bathroom sink damage, it's important to understand the coverage provided by your insurance policy. In most cases, your home insurance will cover the cost of repairs or replacement if the damage is sudden and accidental. However, if the damage is due to regular wear and tear, you may have to cover the cost out of pocket. It's also important to note that some insurance policies may offer additional coverage for specific types of damage, such as mold or water damage. Be sure to review your policy to see if you have this coverage. Bathroom sink damage and insurance coverage

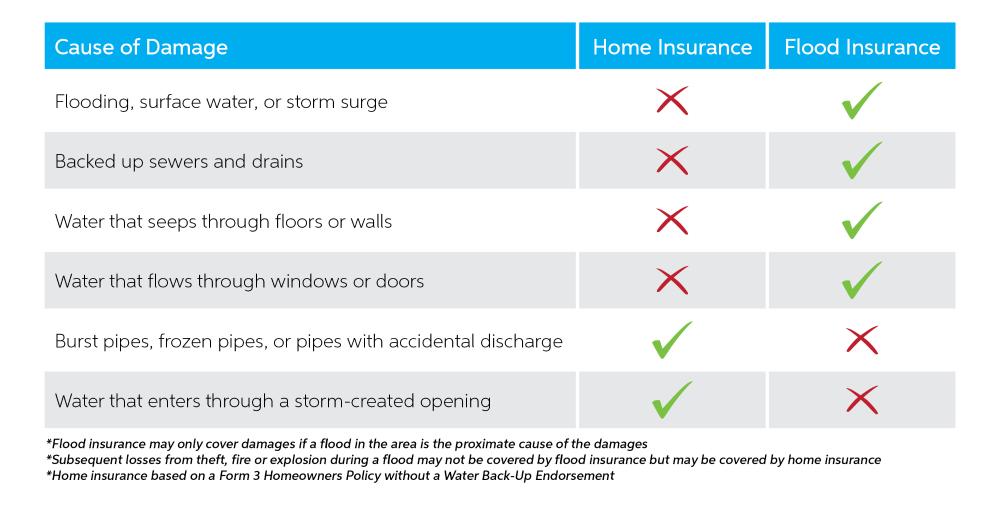

Water damage in your bathroom can be a costly and stressful experience. From leaky pipes to overflowing toilets, there are many potential causes of water damage in your bathroom. But will your home insurance cover the cost of repairs? In most cases, your home insurance will cover the cost of water damage from a covered peril, such as a burst pipe or roof leak. However, it's important to review your policy to understand the specifics of your coverage and any exclusions. Home insurance for bathroom water damage

As previously mentioned, filing too many insurance claims can result in higher premiums. So, it's important to weigh the cost of repairs before deciding to file a claim for sink damage. If the damage is minor and can be easily fixed, it may be more cost-effective to cover the cost yourself rather than filing a claim. However, if the damage is extensive and costly, it's best to file a claim and have your insurance cover the expenses. Just be sure to carefully review your policy and understand the potential impact on your premiums. Sink damage and insurance claims

Ultimately, the coverage provided by your home insurance for bathroom sink damage will depend on the specific details of your policy. It's important to review your policy and understand what is covered and what isn't when it comes to bathroom damage. If you have any questions or concerns, don't hesitate to reach out to your insurance provider for clarification. Being informed about your coverage can save you time, money, and stress in the event of bathroom damage. Bathroom sink damage and home insurance coverage

If your bathroom sink becomes damaged and you need to make repairs, it's important to understand what your home insurance will cover. In most cases, your insurance will cover the cost of repairs if the damage is sudden and accidental. However, if the damage is due to regular wear and tear, you may have to cover the cost yourself. It's also worth noting that some insurance policies may offer coverage for temporary accommodations if your bathroom is unusable during repairs. This can provide peace of mind and financial assistance during a stressful time. Home insurance for bathroom sink repairs

Bathroom Damage and Home Insurance: Protecting Your Sink and Your Wallet

The Importance of Properly Insuring Your Home's Bathroom

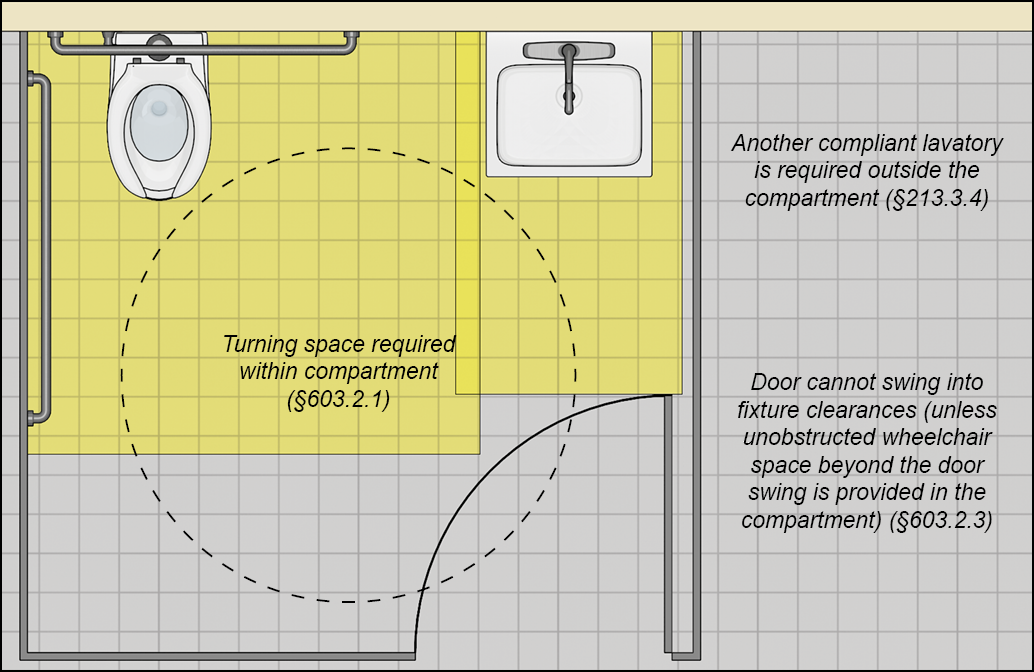

When it comes to designing and decorating our homes, the bathroom is often overlooked. But it is an essential part of our daily routine and a space that can greatly impact the overall value of our homes. This is why it is crucial to not only have a well-designed bathroom, but also to have proper insurance coverage in case of any damage.

When it comes to designing and decorating our homes, the bathroom is often overlooked. But it is an essential part of our daily routine and a space that can greatly impact the overall value of our homes. This is why it is crucial to not only have a well-designed bathroom, but also to have proper insurance coverage in case of any damage.

The Vulnerability of Bathroom Sinks

One of the most common areas for damage in a bathroom is the sink. We use it multiple times a day for various tasks, making it susceptible to wear and tear. From accidental spills and leaks to plumbing issues, there are many ways that a sink can become damaged and cause costly repairs. This is where having the right home insurance coverage comes into play.

Home insurance policies

typically cover damage to your home's structure and attached fixtures, including sinks. However, it is essential to review your policy and make sure that your bathroom sink is specifically listed as a covered item.

Water damage

caused by burst pipes or overflowing sinks may also be covered, but it is always best to check with your insurance provider to confirm.

One of the most common areas for damage in a bathroom is the sink. We use it multiple times a day for various tasks, making it susceptible to wear and tear. From accidental spills and leaks to plumbing issues, there are many ways that a sink can become damaged and cause costly repairs. This is where having the right home insurance coverage comes into play.

Home insurance policies

typically cover damage to your home's structure and attached fixtures, including sinks. However, it is essential to review your policy and make sure that your bathroom sink is specifically listed as a covered item.

Water damage

caused by burst pipes or overflowing sinks may also be covered, but it is always best to check with your insurance provider to confirm.

Types of Home Insurance Coverage for Bathroom Damage

There are various types of home insurance coverage that can protect your bathroom sink and the surrounding areas.

Basic homeowners insurance

typically covers damage caused by perils such as fire, wind, and theft. However, it may not cover damage caused by water leaks or flooding. This is where additional coverage, such as

flood insurance

or

water damage insurance

, can be beneficial.

Water damage insurance

specifically covers damage caused by water leaks, burst pipes, and other plumbing issues. It can help cover the cost of repairs and replacements for not only your sink but also any damage to your walls, floors, and other fixtures in the bathroom. On the other hand,

flood insurance

is designed to protect your home in the event of a natural disaster or severe weather that causes flooding.

There are various types of home insurance coverage that can protect your bathroom sink and the surrounding areas.

Basic homeowners insurance

typically covers damage caused by perils such as fire, wind, and theft. However, it may not cover damage caused by water leaks or flooding. This is where additional coverage, such as

flood insurance

or

water damage insurance

, can be beneficial.

Water damage insurance

specifically covers damage caused by water leaks, burst pipes, and other plumbing issues. It can help cover the cost of repairs and replacements for not only your sink but also any damage to your walls, floors, and other fixtures in the bathroom. On the other hand,

flood insurance

is designed to protect your home in the event of a natural disaster or severe weather that causes flooding.

Tips for Preventing Bathroom Sink Damage

While having the right insurance coverage is crucial, it is also essential to take preventative measures to avoid damage to your bathroom sink. Regular maintenance and inspections can help identify any potential issues before they become more significant problems. Here are a few simple tips for preventing bathroom sink damage:

While having the right insurance coverage is crucial, it is also essential to take preventative measures to avoid damage to your bathroom sink. Regular maintenance and inspections can help identify any potential issues before they become more significant problems. Here are a few simple tips for preventing bathroom sink damage:

- Check for any leaks or drips and address them promptly.

- Keep your sink clean and free of any clogs.

- Regularly inspect the pipes and plumbing for any signs of wear or damage.

- Consider installing a leak detection system to alert you of any issues.

- Take precautions during extreme weather, such as insulating pipes to prevent freezing and bursting.

In Conclusion

In summary, your bathroom sink is a vital part of your home and should not be overlooked when it comes to insurance coverage. By reviewing your policy and considering additional coverage options, you can protect yourself from unexpected costs in case of any damage. Remember to also take preventative measures to keep your bathroom sink in good condition and avoid any potential issues. With the right insurance and maintenance, you can have both a beautiful and functional bathroom without breaking the bank.

In summary, your bathroom sink is a vital part of your home and should not be overlooked when it comes to insurance coverage. By reviewing your policy and considering additional coverage options, you can protect yourself from unexpected costs in case of any damage. Remember to also take preventative measures to keep your bathroom sink in good condition and avoid any potential issues. With the right insurance and maintenance, you can have both a beautiful and functional bathroom without breaking the bank.