When it comes to purchasing a new mattress, there are a lot of factors to consider - comfort, support, size, and of course, cost. But one factor that many people may not think about is sales tax. In the state of Florida, sales tax is applied to most purchases, including mattresses. However, there are exemptions in place for certain types of purchases, including prescription mattresses. Let's take a closer look at how sales tax applies to prescription mattresses in Florida.Florida Sales Tax on Prescription Mattresses

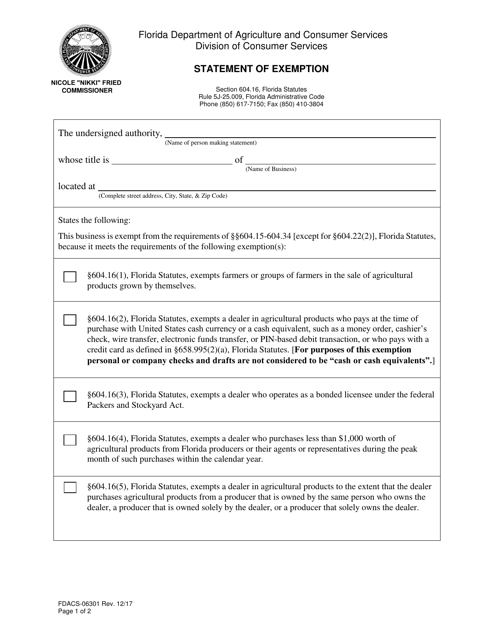

In Florida, prescription mattresses are considered to be medical equipment, and as such, they are exempt from sales tax. This means that if you have a valid prescription from a licensed physician for a mattress, you will not have to pay sales tax on that purchase. This exemption not only applies to mattresses, but also to other types of medical equipment such as wheelchairs, hospital beds, and oxygen tanks.Florida Sales Tax Exemption for Prescription Mattresses

In order to be eligible for the sales tax exemption on prescription mattresses, you must have a valid prescription from a licensed physician. This prescription must be specific to the type and size of mattress you are purchasing. For example, if you have a prescription for a twin-sized mattress, you cannot use it to purchase a queen-sized mattress and still be eligible for the exemption. It is important to note that over-the-counter mattresses, even those marketed as "medical" or "orthopedic" mattresses, are not eligible for this exemption.Florida Sales Tax Exemption for Physician Prescriptions

In addition to prescription mattresses, there are other types of medical equipment that are also exempt from sales tax in Florida. This includes items such as walkers, canes, and crutches, as well as specialized medical equipment like prosthetics and hearing aids. The purpose of this exemption is to make these necessary medical supplies more affordable for those who need them, without the added burden of sales tax.Florida Sales Tax Exemption for Medical Equipment

Healthcare providers in Florida, such as hospitals and clinics, are also eligible for sales tax exemptions on certain purchases. This includes medical supplies and equipment used for patient care, as well as prescription drugs. This exemption helps to keep healthcare costs down for providers, which in turn can help to keep costs down for patients as well.Florida Sales Tax Exemptions for Healthcare Providers

It is important to note that not all medical supplies are exempt from sales tax in Florida. For example, items such as bandages, gauze, and other first aid supplies are still subject to sales tax. However, items that are considered to be durable medical equipment, such as wheelchairs and oxygen tanks, are exempt from sales tax with a valid prescription.Florida Sales Tax Laws for Medical Supplies

Just as healthcare providers are eligible for sales tax exemptions, so are healthcare facilities. This includes nursing homes, assisted living facilities, and hospices. These exemptions apply to both purchases made for the facility itself, as well as for the care and treatment of patients residing there.Florida Sales Tax Exemptions for Healthcare Facilities

In addition to prescription mattresses, prescription drugs are also exempt from sales tax in Florida. This includes both prescription medications and over-the-counter medications that require a prescription. This exemption helps to make necessary medications more affordable for patients, particularly those who are on multiple medications.Florida Sales Tax Exemptions for Prescription Drugs

Medical devices, such as blood pressure monitors, glucose meters, and nebulizers, are also eligible for sales tax exemptions in Florida. These items must be prescribed by a physician and used for the treatment or management of a medical condition. Again, over-the-counter devices are not eligible for this exemption.Florida Sales Tax Exemptions for Medical Devices

Finally, certain healthcare services are also exempt from sales tax in Florida. This includes services such as physical therapy, chiropractic care, and dental services. These exemptions help to make these necessary healthcare services more affordable for patients, particularly those who may not have insurance coverage. In conclusion, while sales tax may not be the first thing on your mind when purchasing a new mattress, it is important to understand how it applies to prescription mattresses in Florida. By having a valid prescription from a licensed physician, you can take advantage of the sales tax exemption and save money on your purchase. And don't forget, this exemption also applies to other types of medical equipment and supplies, making it easier to afford necessary healthcare items and services.Florida Sales Tax Exemptions for Healthcare Services

The Impact of Florida Sales Tax on Purchasing Physician-Prescribed Mattresses

Understanding the Florida Sales Tax Law

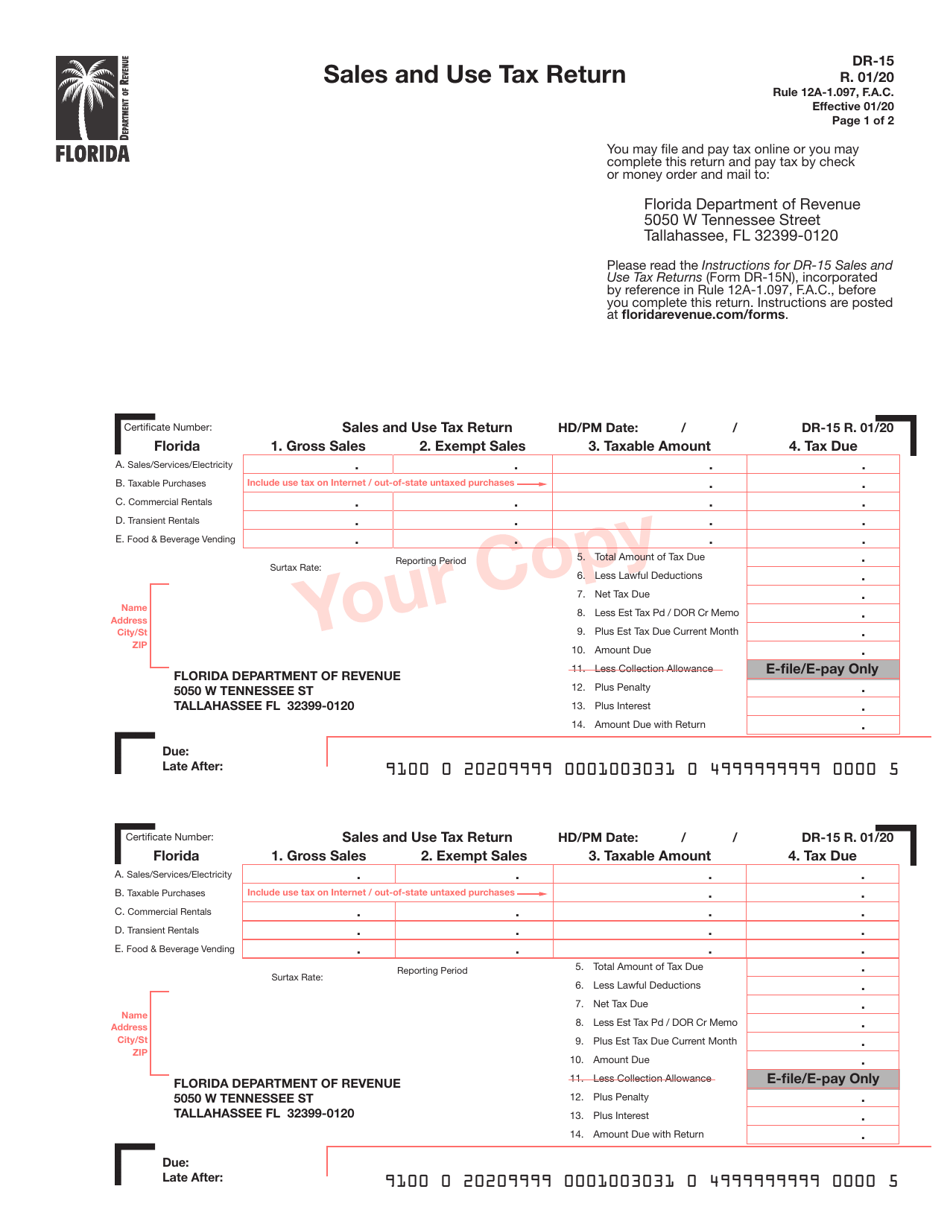

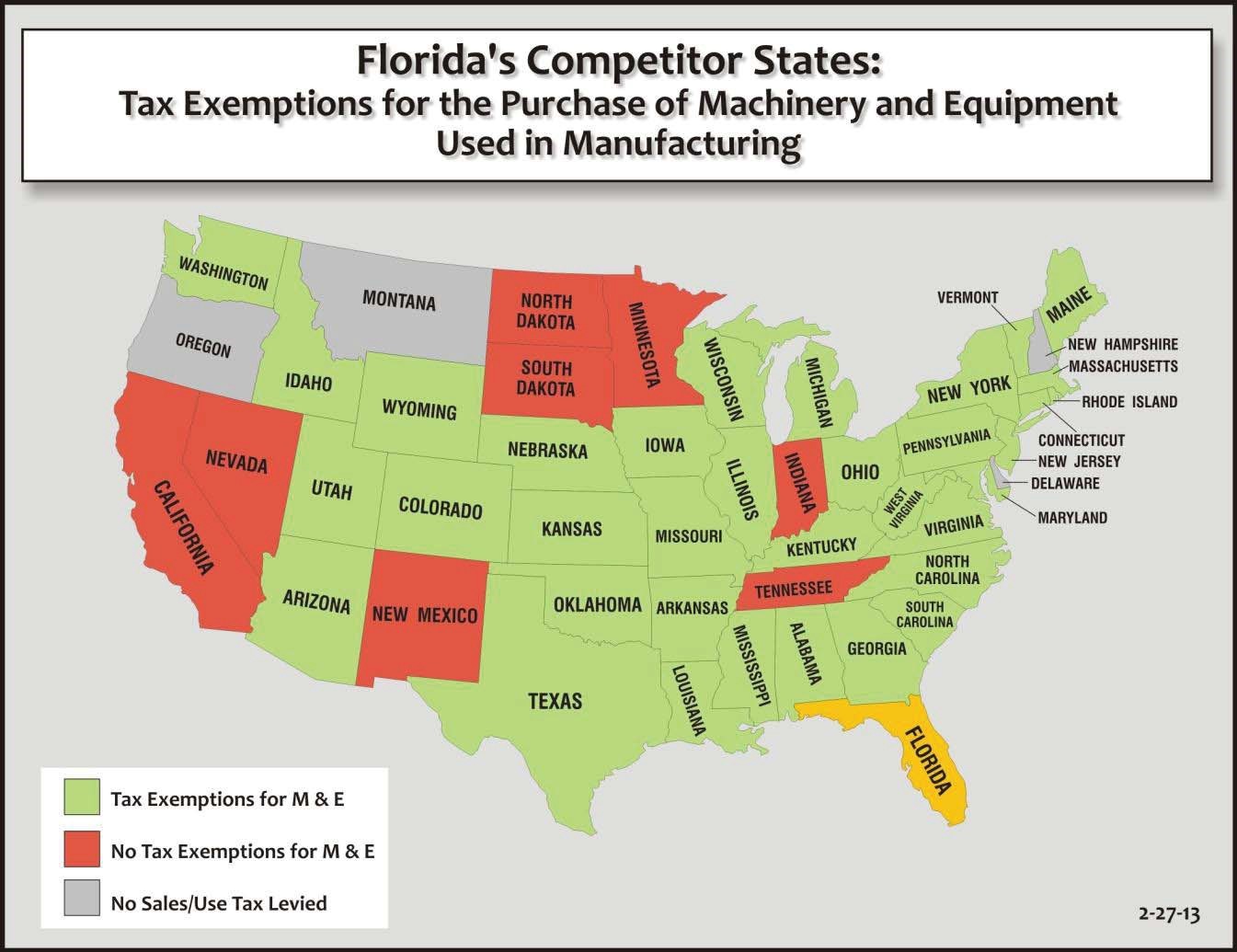

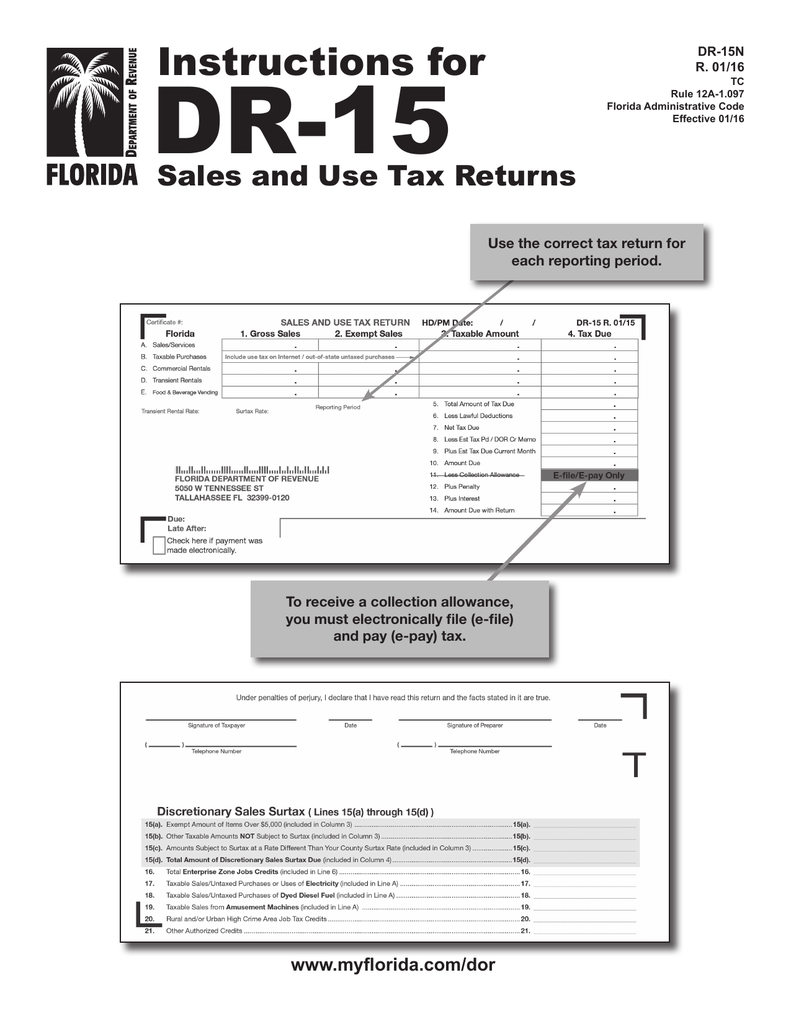

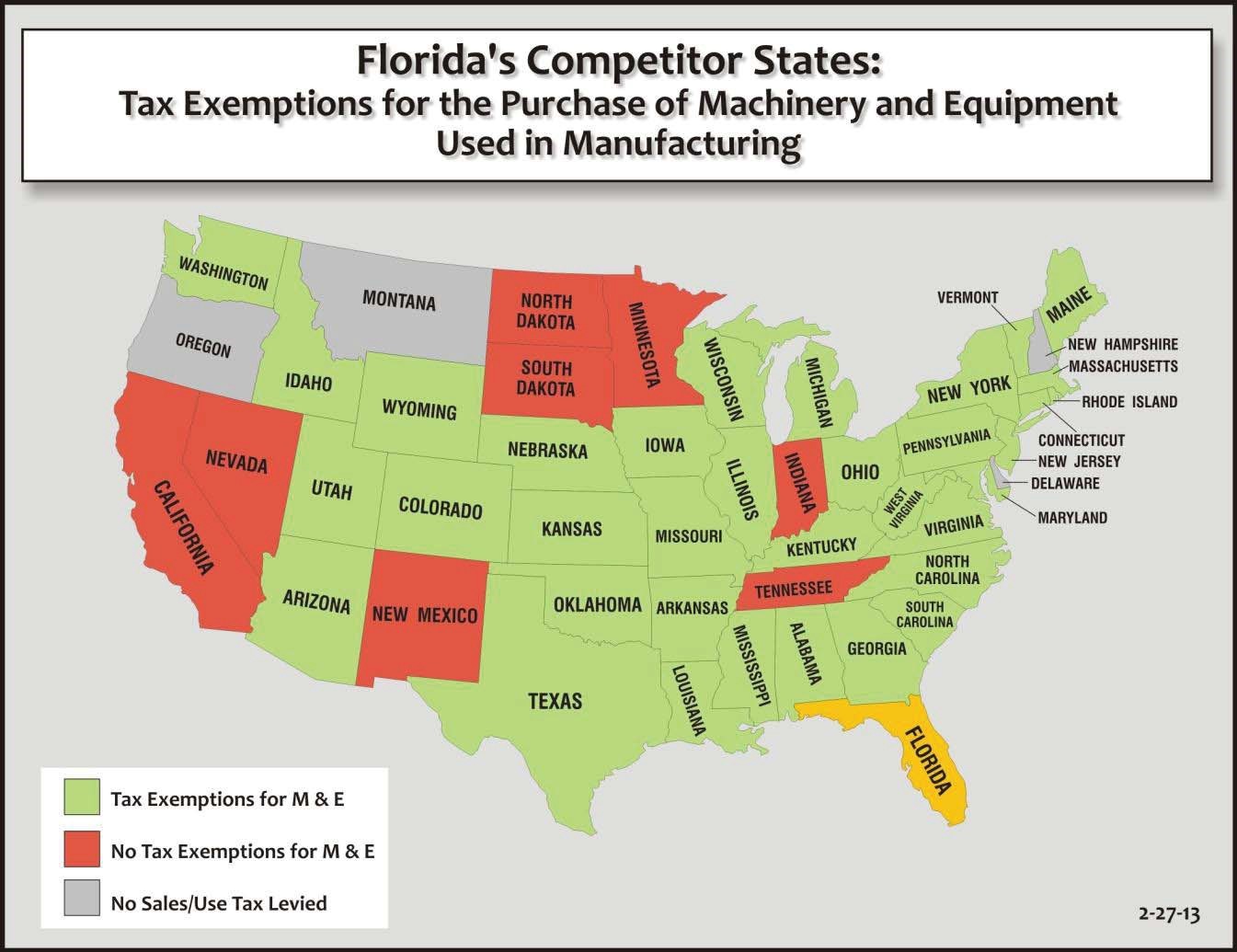

When it comes to purchasing a new mattress, many factors may influence your decision. One factor that is often overlooked is the sales tax. In Florida, the state sales tax rate is currently 6%. However, this rate can increase depending on the county or city you live in. Additionally, certain products may be exempt from sales tax, while others are subject to it. This includes items such as groceries, prescription medications, and, you guessed it, mattresses.

When it comes to purchasing a new mattress, many factors may influence your decision. One factor that is often overlooked is the sales tax. In Florida, the state sales tax rate is currently 6%. However, this rate can increase depending on the county or city you live in. Additionally, certain products may be exempt from sales tax, while others are subject to it. This includes items such as groceries, prescription medications, and, you guessed it, mattresses.

The Prescription Mattress Exemption

According to Florida law, mattresses that are prescribed by a licensed physician are exempt from sales tax. This means that if your doctor prescribes you a specific type of mattress for medical reasons, you can avoid paying the 6% sales tax. This exemption was put in place to help individuals who suffer from chronic pain or other medical conditions that require a specialized mattress for comfort and support.

According to Florida law, mattresses that are prescribed by a licensed physician are exempt from sales tax. This means that if your doctor prescribes you a specific type of mattress for medical reasons, you can avoid paying the 6% sales tax. This exemption was put in place to help individuals who suffer from chronic pain or other medical conditions that require a specialized mattress for comfort and support.

The Importance of Consultation with a Physician

While the exemption may seem like a great way to save money, it's important to note that it only applies to mattresses that are prescribed by a licensed physician. This means that simply having a doctor's note may not be enough to qualify for the exemption. It's crucial to consult with your doctor and get a written prescription for a specific type of mattress in order to take advantage of this tax break.

While the exemption may seem like a great way to save money, it's important to note that it only applies to mattresses that are prescribed by a licensed physician. This means that simply having a doctor's note may not be enough to qualify for the exemption. It's crucial to consult with your doctor and get a written prescription for a specific type of mattress in order to take advantage of this tax break.

Implications for House Design

The Florida sales tax on physician-prescribed mattresses has implications for house design and furniture choices. With this exemption in place, homeowners may be more inclined to invest in a high-quality mattress that is specifically tailored to their medical needs. This can impact the design and layout of bedrooms, as well as the types of furniture and accessories chosen for the space. Additionally, this exemption may also encourage more individuals to seek medical advice for sleep-related issues, leading to better overall health and wellness.

In conclusion, understanding the impact of Florida sales tax on purchasing a physician-prescribed mattress is important for both homeowners and medical professionals. By taking advantage of this exemption, individuals can save money and improve their overall well-being through a more personalized and comfortable sleep experience.

The Florida sales tax on physician-prescribed mattresses has implications for house design and furniture choices. With this exemption in place, homeowners may be more inclined to invest in a high-quality mattress that is specifically tailored to their medical needs. This can impact the design and layout of bedrooms, as well as the types of furniture and accessories chosen for the space. Additionally, this exemption may also encourage more individuals to seek medical advice for sleep-related issues, leading to better overall health and wellness.

In conclusion, understanding the impact of Florida sales tax on purchasing a physician-prescribed mattress is important for both homeowners and medical professionals. By taking advantage of this exemption, individuals can save money and improve their overall well-being through a more personalized and comfortable sleep experience.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/JB55YLQWQ5DLTL3ZBVZZ2FWXDY.png)