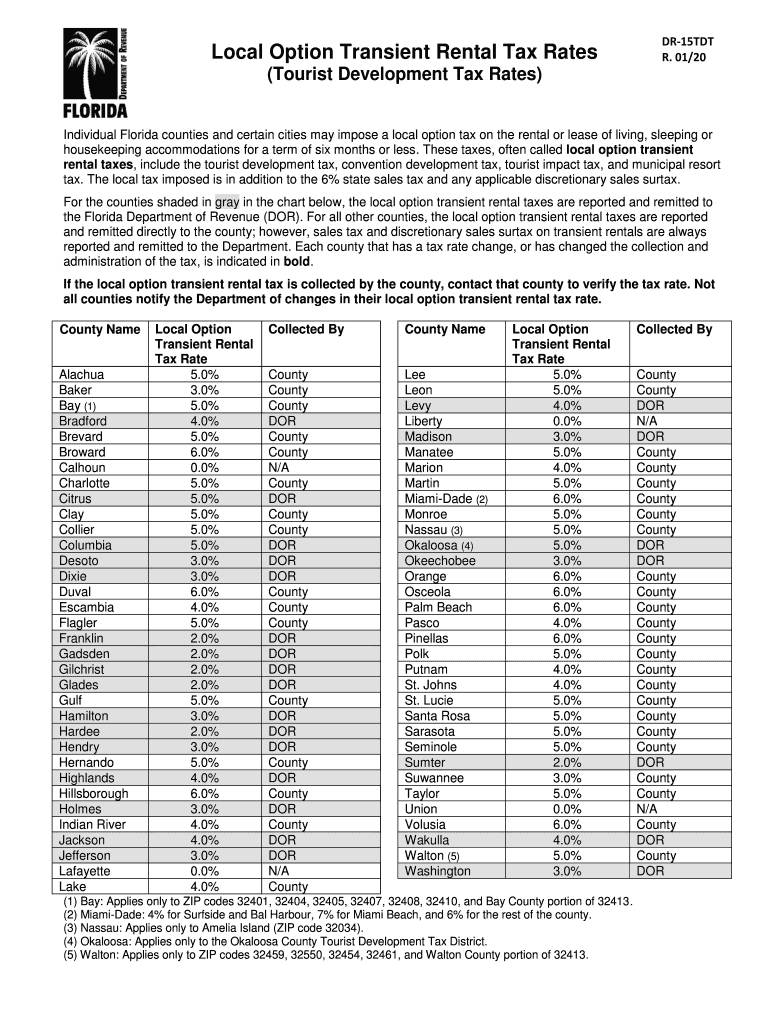

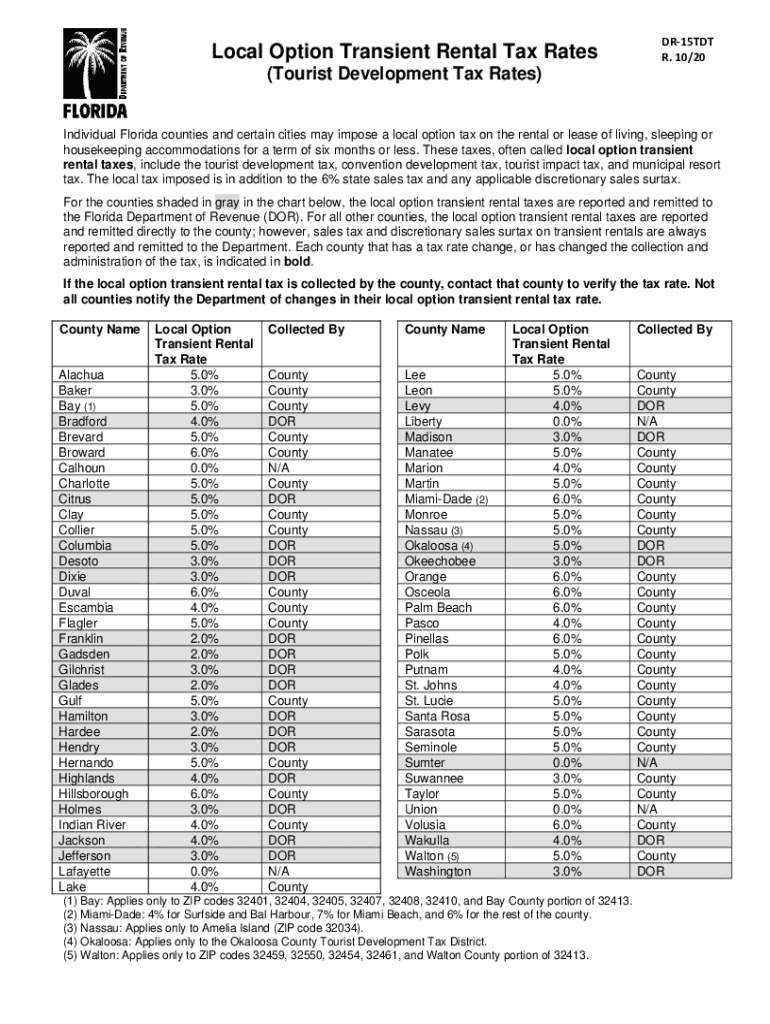

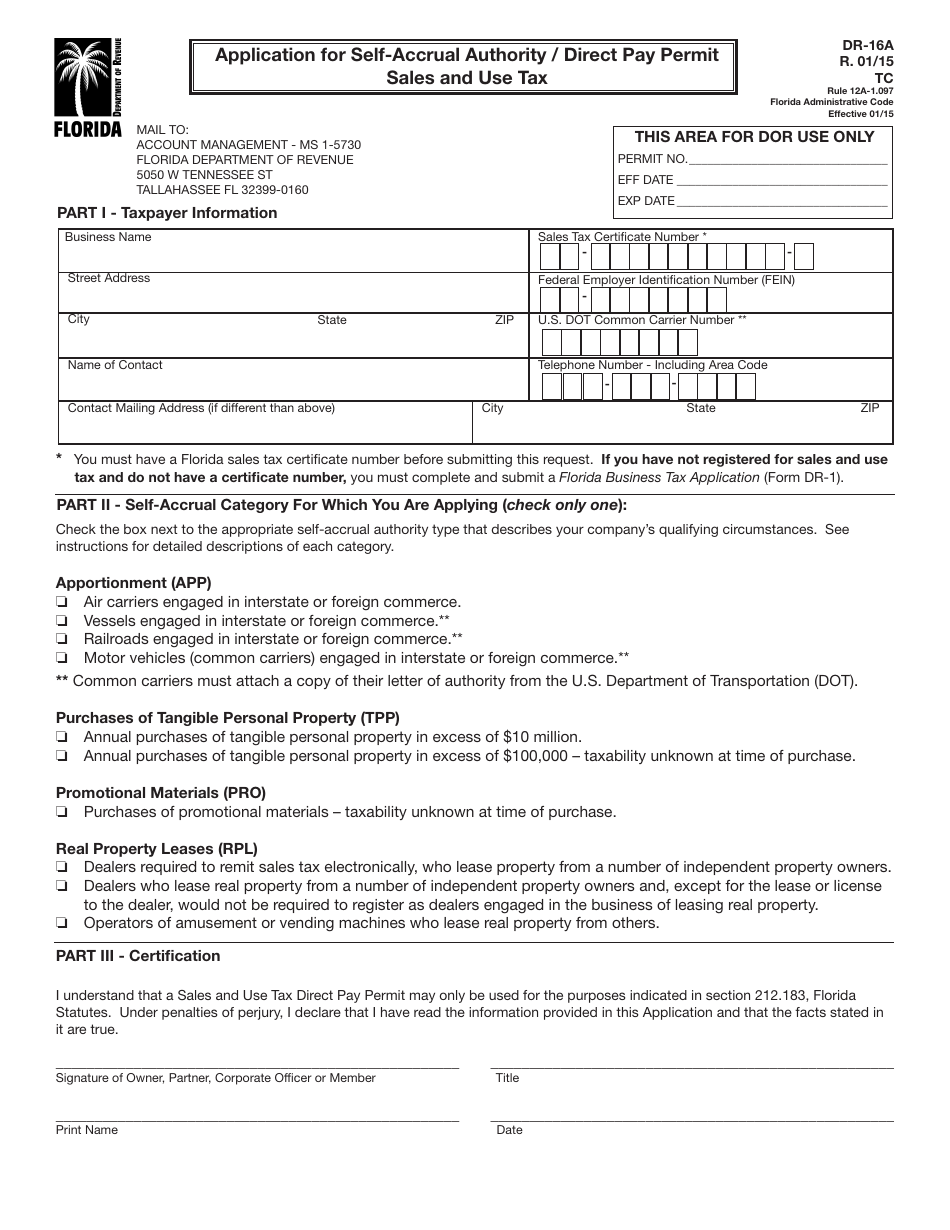

The Florida Department of Revenue is responsible for administering the state's sales and use tax, which applies to the sale, rental, lease, or license of goods and certain services in the state. This tax is collected by businesses and then remitted to the state. It is important for businesses to understand their responsibilities when it comes to collecting and remitting sales and use tax in Florida.Florida Department of Revenue - Sales and Use Tax

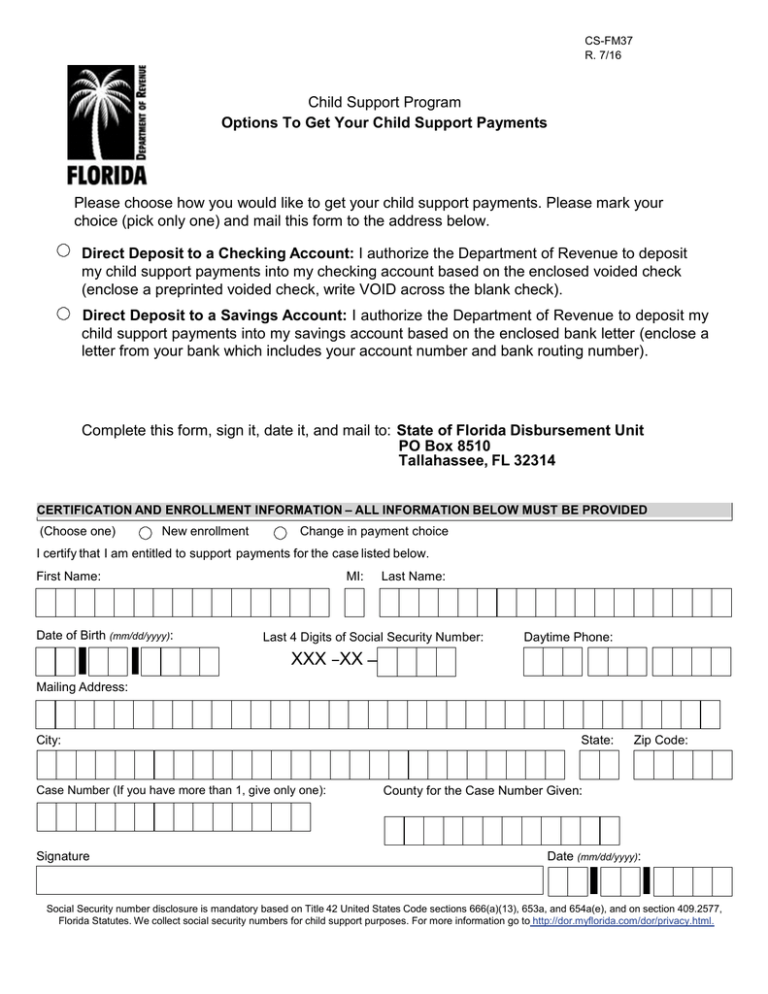

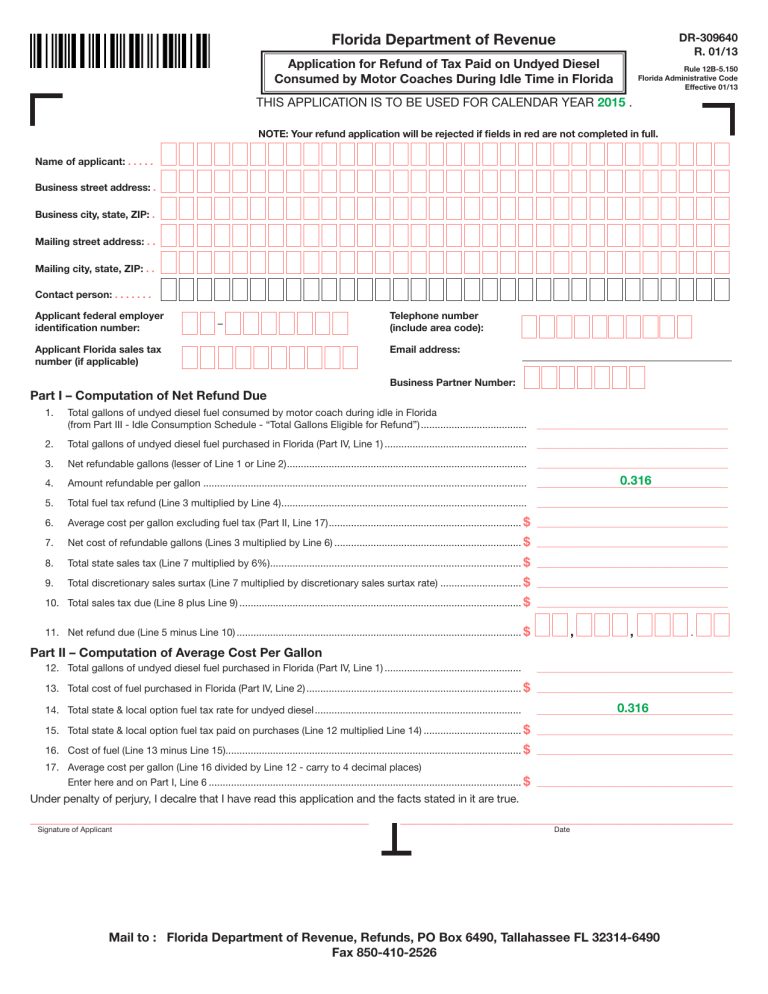

In certain situations, individuals and businesses may be eligible to receive a refund of sales and use tax paid to the state. This could include overpayment of tax, tax paid on exempt items, or tax paid in error. The Florida Department of Revenue has a process in place for requesting a refund and it is important to follow the guidelines to ensure a timely and accurate refund is received.Florida Department of Revenue - Refunds

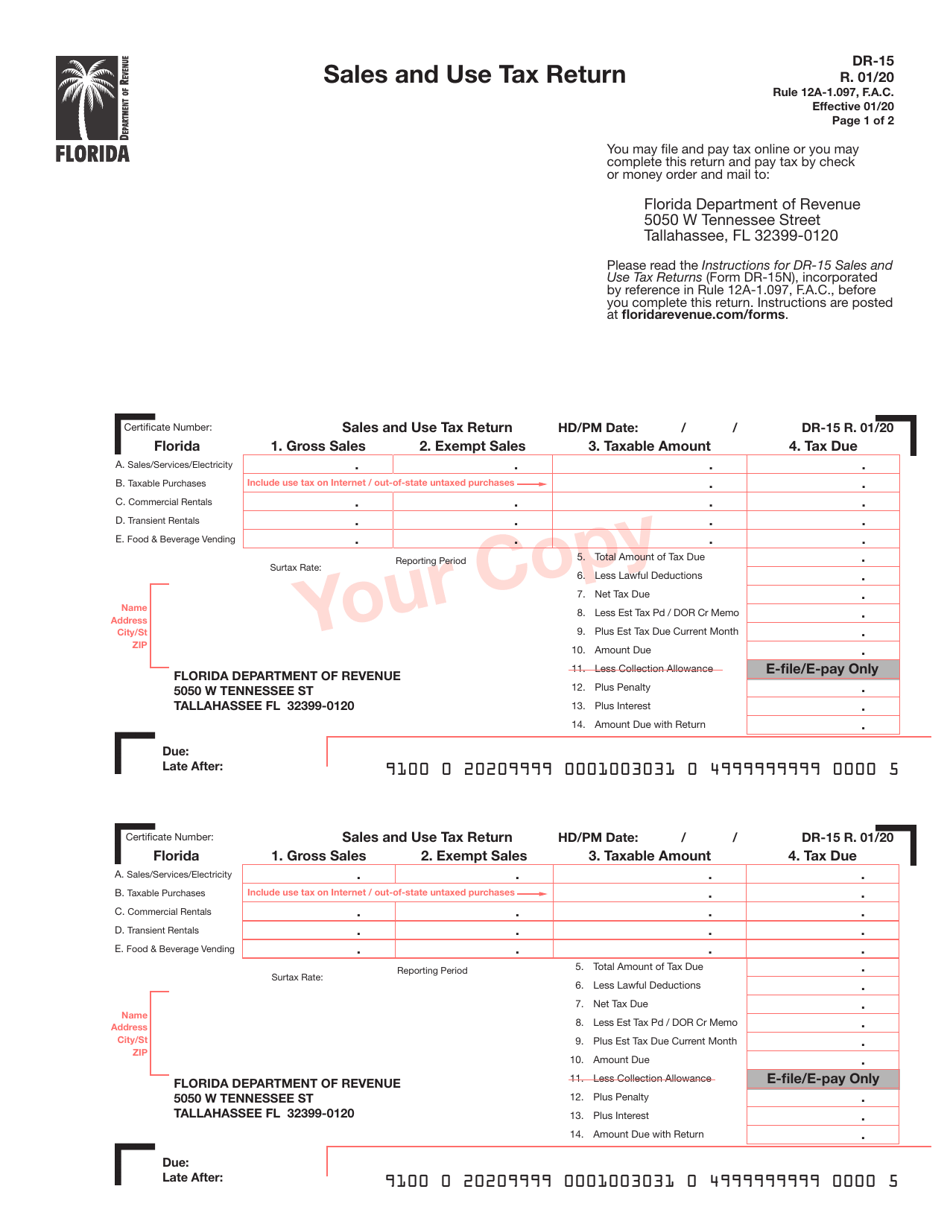

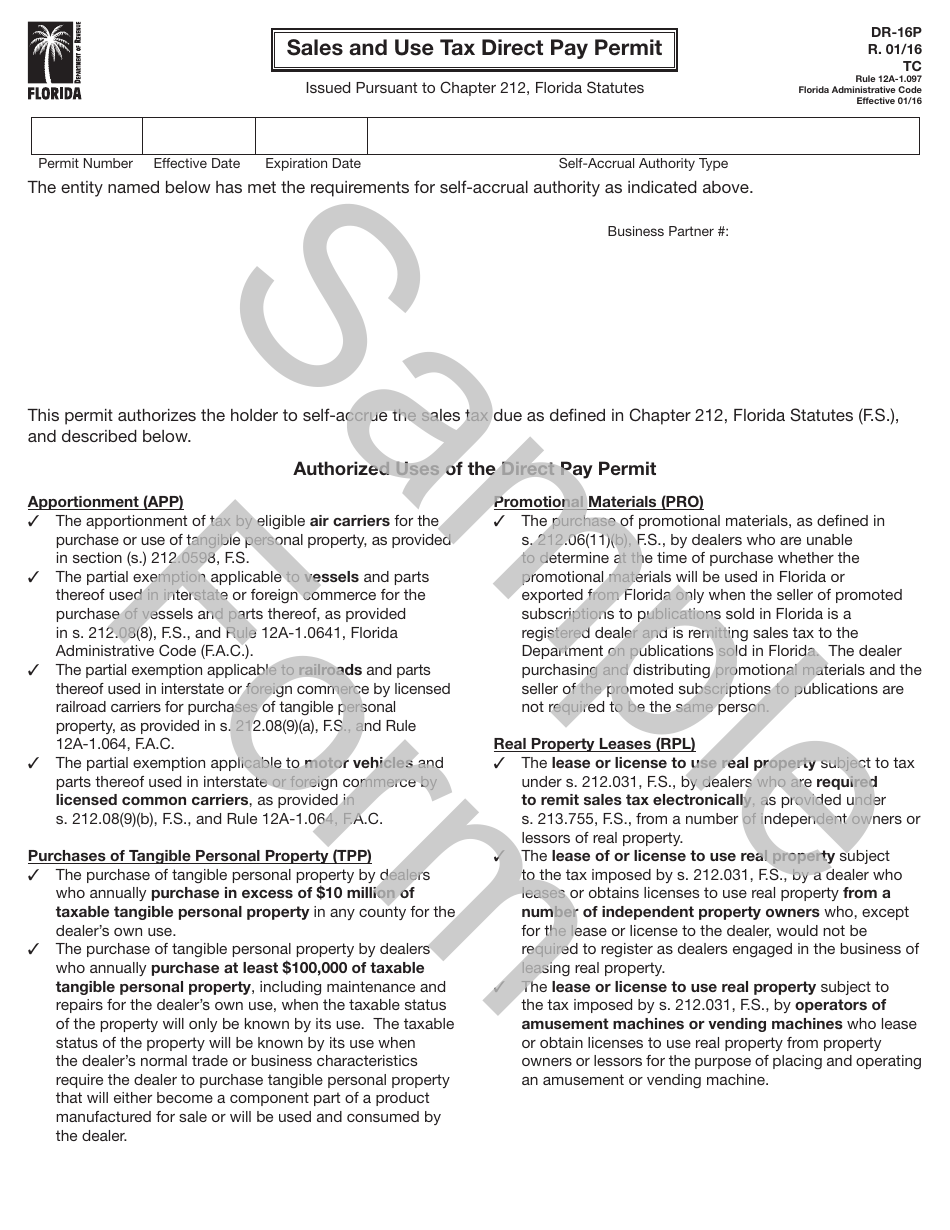

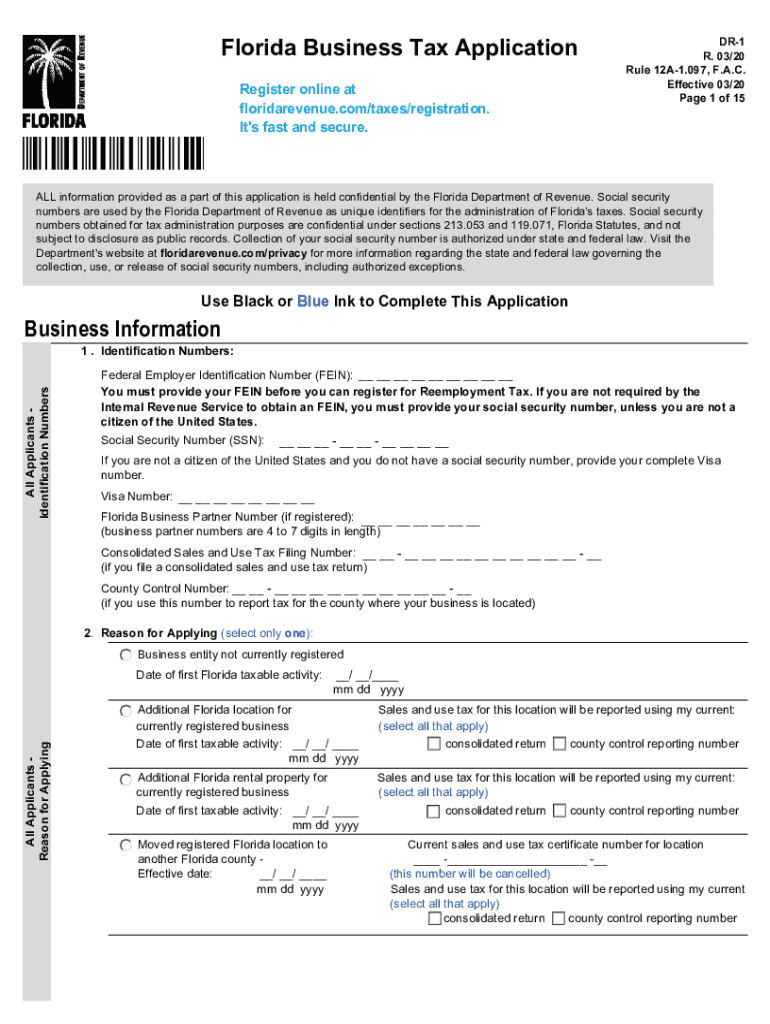

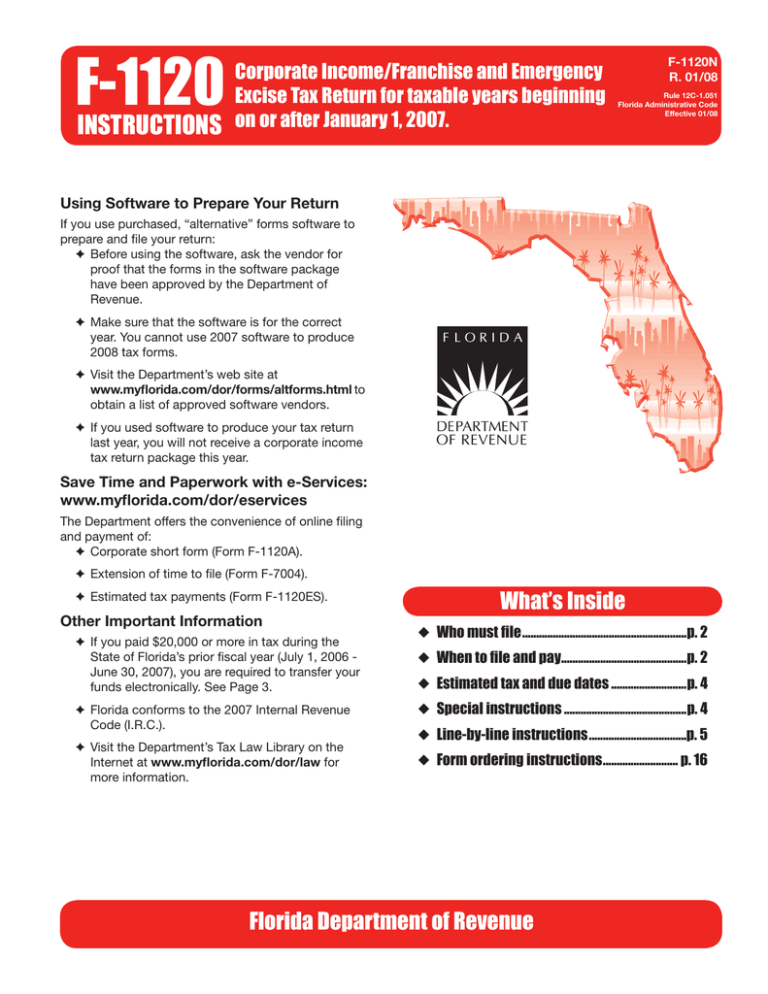

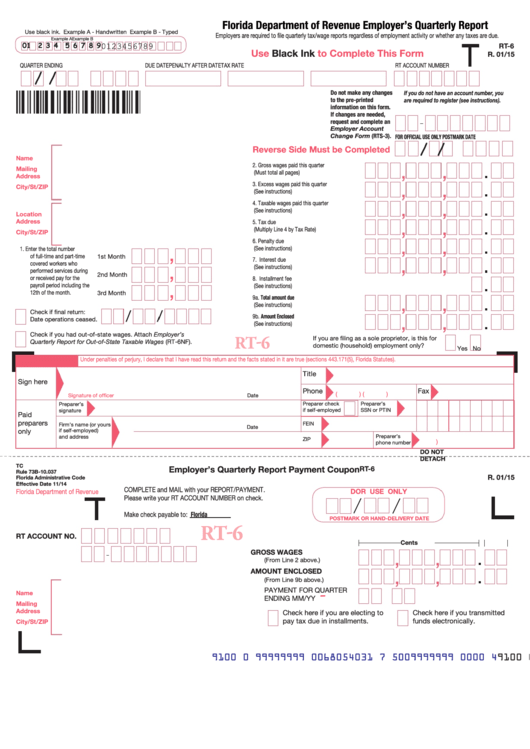

Businesses in Florida are responsible for collecting and remitting sales and use tax to the state. This includes registering for a sales and use tax account, collecting the correct amount of tax, and filing and paying tax returns on time. The Florida Department of Revenue provides resources and information to help businesses understand and comply with their tax obligations.Florida Department of Revenue - Tax Information for Businesses

Individuals may also have sales and use tax obligations in Florida, such as when making purchases from out-of-state sellers or renting taxable items. It is important for individuals to understand their responsibilities when it comes to paying sales and use tax in Florida. The Florida Department of Revenue provides resources and information to help individuals understand and comply with their tax obligations.Florida Department of Revenue - Tax Information for Individuals

The Florida Department of Revenue offers various resources and assistance to taxpayers, including a taxpayer helpline, online chat support, and tax workshops. Taxpayers can also request assistance with their tax questions or issues through the department's website. It is important for taxpayers to take advantage of these resources to ensure they are meeting their tax obligations correctly.Florida Department of Revenue - Taxpayer Assistance

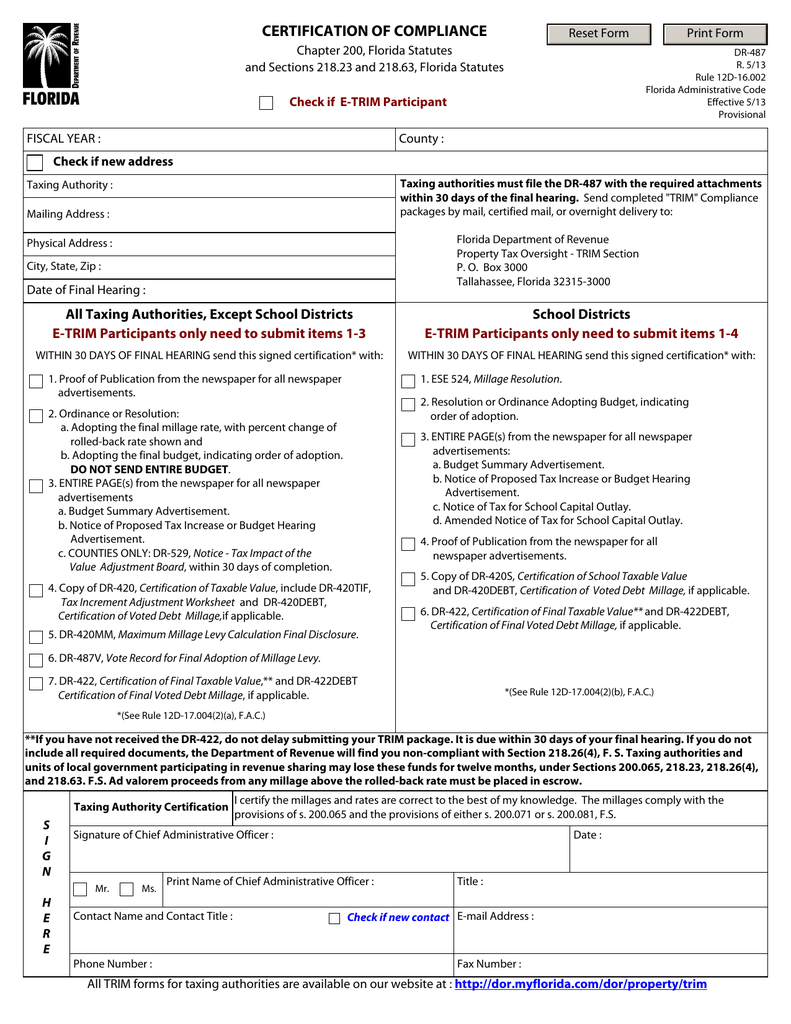

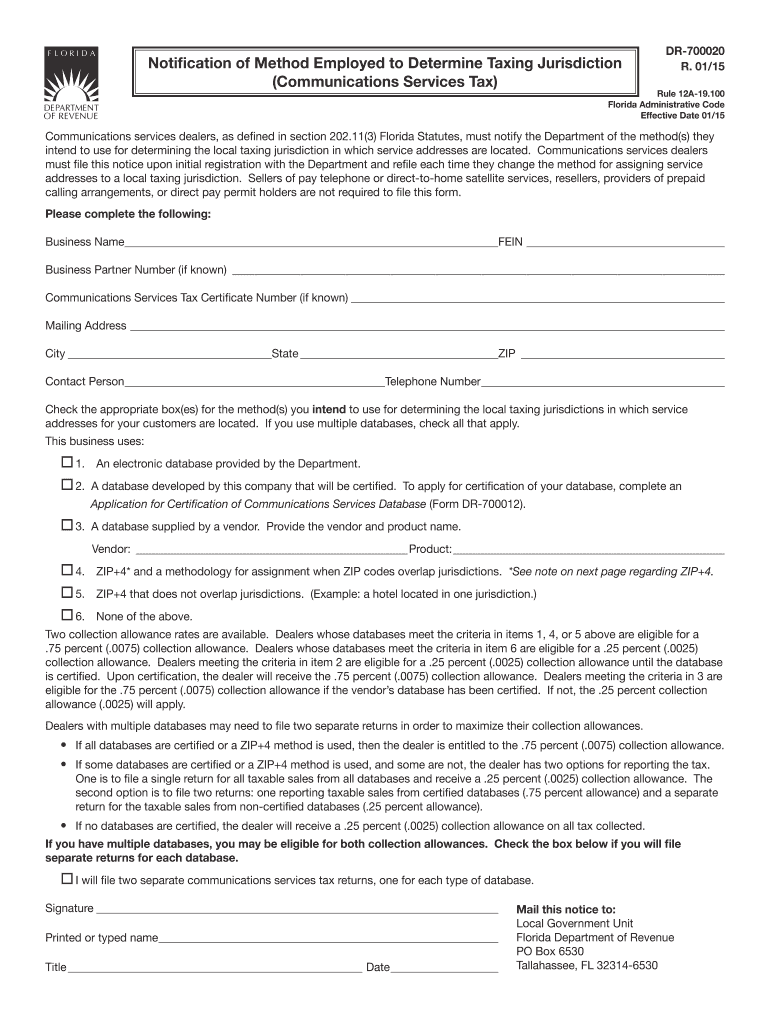

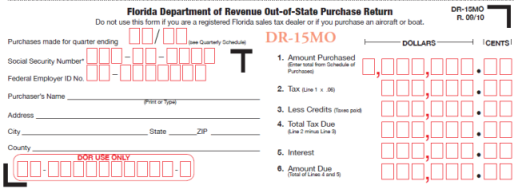

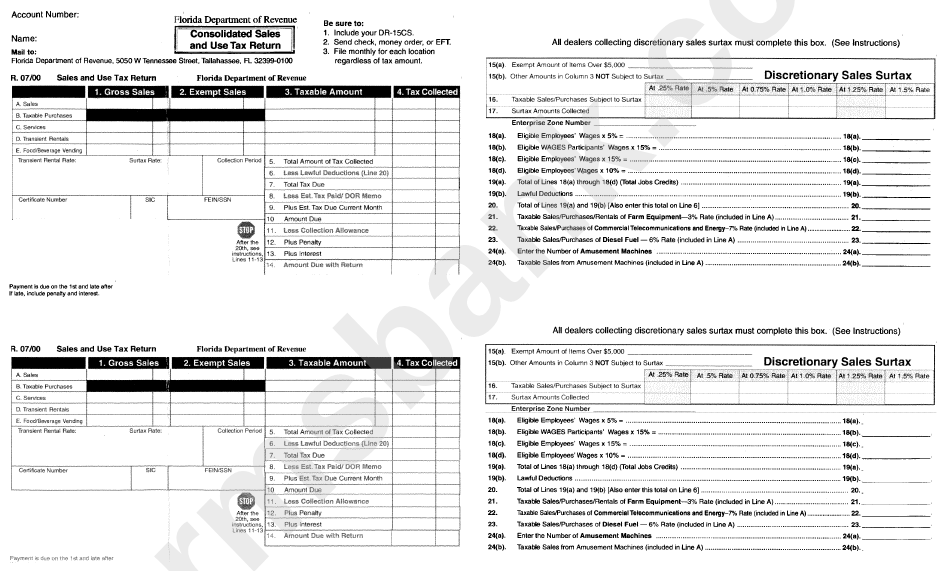

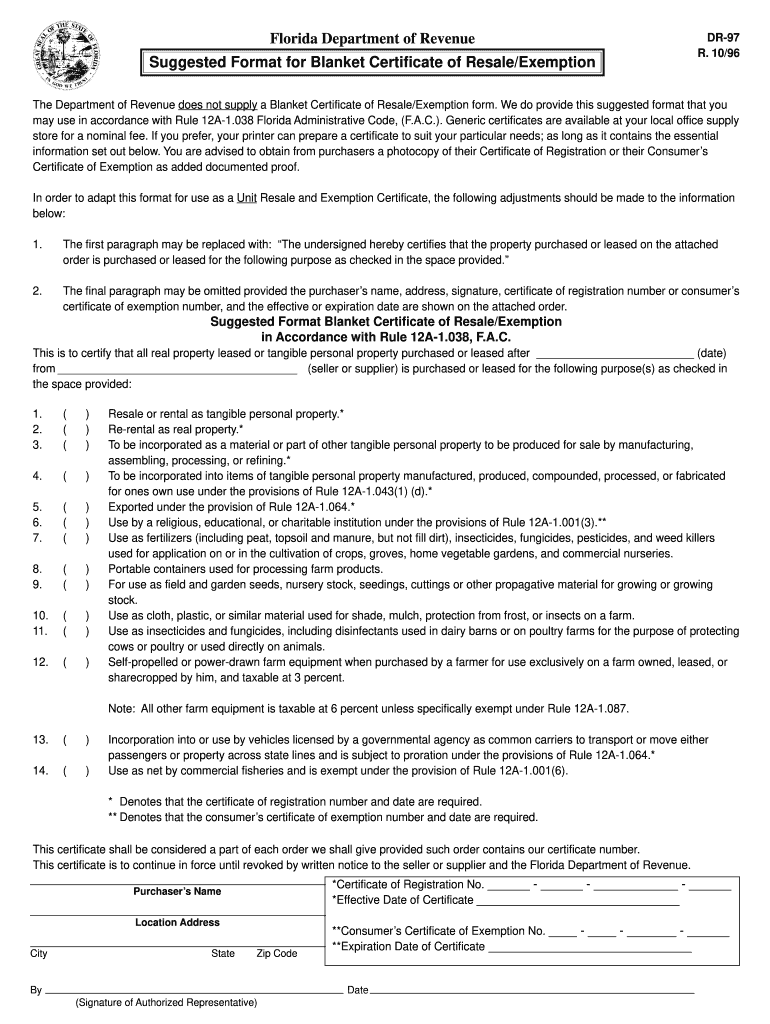

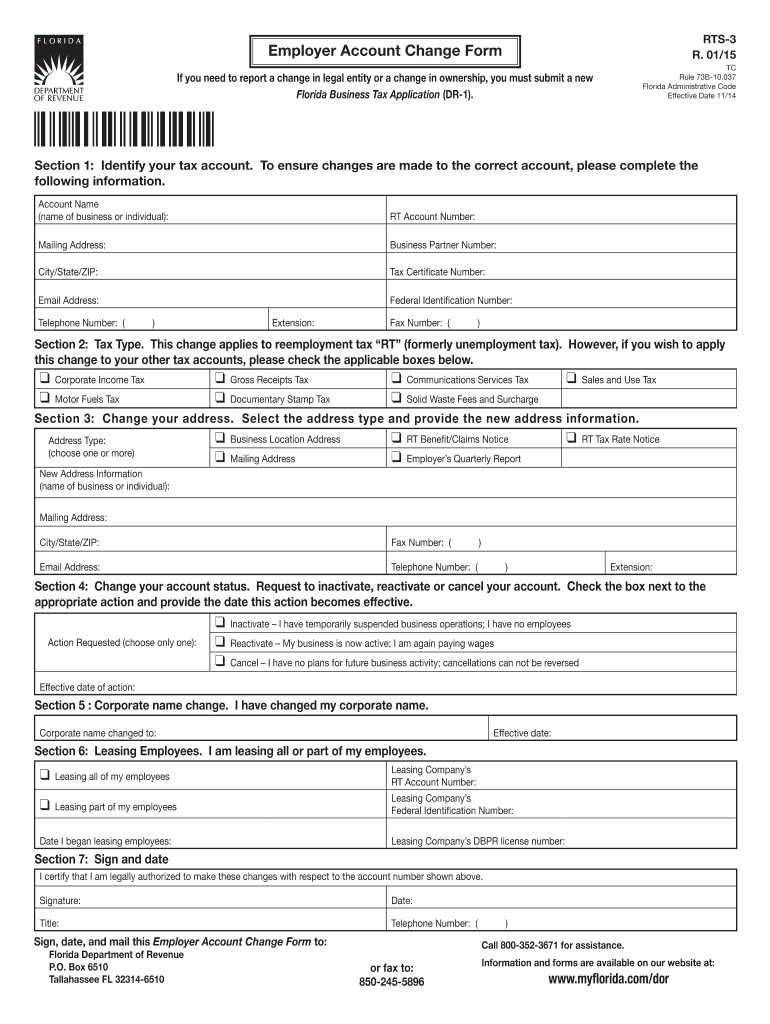

The Florida Department of Revenue provides a variety of tax forms for businesses and individuals to use when filing and paying their sales and use tax. These forms can be downloaded from the department's website or requested by mail. It is important for taxpayers to use the correct form and fill it out accurately to avoid delays or errors in their tax filings.Florida Department of Revenue - Tax Forms

Taxpayers in Florida have certain rights and responsibilities when it comes to their sales and use tax obligations. These include the right to confidentiality and privacy, the right to appeal a tax decision, and the responsibility to maintain accurate records. It is important for taxpayers to understand and exercise their rights, as well as fulfill their responsibilities, when it comes to sales and use tax in Florida.Florida Department of Revenue - Taxpayer Rights and Responsibilities

The Florida Department of Revenue offers various services to taxpayers, such as online account management, electronic filing and payment options, and tax compliance reviews. These services can help taxpayers stay organized and ensure they are meeting their tax obligations correctly and on time. It is important for taxpayers to take advantage of these services to make their tax filing process more efficient.Florida Department of Revenue - Taxpayer Services

The Florida Department of Revenue provides educational resources to help taxpayers understand their sales and use tax obligations. This includes online tutorials, webinars, and informational videos. Taxpayers can also attend in-person workshops and seminars offered by the department. It is important for taxpayers to stay informed and educated about their tax obligations to avoid mistakes and penalties.Florida Department of Revenue - Taxpayer Education

The Florida Department of Revenue has a variety of resources available to help taxpayers with their sales and use tax obligations. These include publications, tax guides, and frequently asked questions (FAQs). Taxpayers can also find information on the department's website or contact the department directly for assistance. It is important for taxpayers to utilize these resources to ensure they are meeting their tax obligations correctly and efficiently.Florida Department of Revenue - Taxpayer Resources

The Benefits of Investing in a Quality Mattress for Your Florida Home

Experience Better Sleep with a Quality Mattress

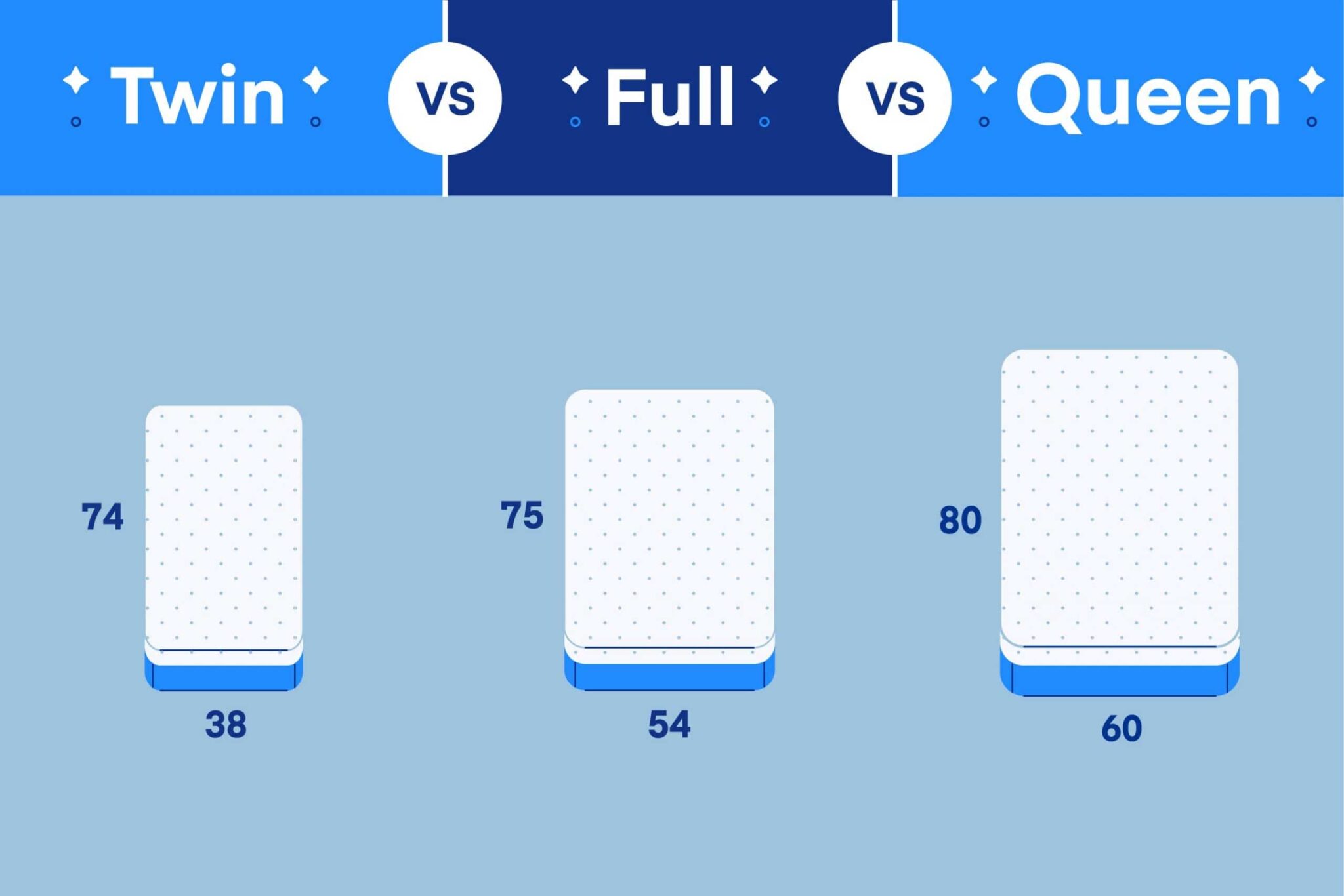

When it comes to designing your dream home in Florida, investing in a quality mattress may not be the first thing that comes to mind. However, a good night's sleep is essential for overall health and well-being, and a comfortable and supportive mattress plays a crucial role in achieving this. Not only that, but a quality mattress can also improve your daily productivity and mood, making it a worthwhile investment for your home.

According to sleep experts, the average person spends about one-third of their life sleeping.

That's why it's important to prioritize your sleeping environment and ensure that you have a comfortable and supportive mattress. A quality mattress can help alleviate common sleep issues such as back pain, tossing and turning, and discomfort, allowing you to wake up feeling refreshed and rejuvenated.

When it comes to designing your dream home in Florida, investing in a quality mattress may not be the first thing that comes to mind. However, a good night's sleep is essential for overall health and well-being, and a comfortable and supportive mattress plays a crucial role in achieving this. Not only that, but a quality mattress can also improve your daily productivity and mood, making it a worthwhile investment for your home.

According to sleep experts, the average person spends about one-third of their life sleeping.

That's why it's important to prioritize your sleeping environment and ensure that you have a comfortable and supportive mattress. A quality mattress can help alleviate common sleep issues such as back pain, tossing and turning, and discomfort, allowing you to wake up feeling refreshed and rejuvenated.

Save Money with a Mattress Sales Tax Refund

.png) Aside from the numerous health benefits, there's another compelling reason to invest in a quality mattress for your Florida home - the mattress sales tax refund. Florida is one of the few states that offer a sales tax refund for mattresses purchased for residential use. This means you can save a significant amount of money on your mattress purchase, making it a more affordable option for homeowners.

The state of Florida offers a sales tax refund of up to $750 for mattresses priced at $5,000 or less.

This can make a significant difference in your budget and allow you to invest in a higher quality mattress that may have been out of reach otherwise. Additionally, if you plan on using your mattress for rental properties, you may also be eligible for a sales tax refund.

Aside from the numerous health benefits, there's another compelling reason to invest in a quality mattress for your Florida home - the mattress sales tax refund. Florida is one of the few states that offer a sales tax refund for mattresses purchased for residential use. This means you can save a significant amount of money on your mattress purchase, making it a more affordable option for homeowners.

The state of Florida offers a sales tax refund of up to $750 for mattresses priced at $5,000 or less.

This can make a significant difference in your budget and allow you to invest in a higher quality mattress that may have been out of reach otherwise. Additionally, if you plan on using your mattress for rental properties, you may also be eligible for a sales tax refund.

Improve the Aesthetic of Your Bedroom

Apart from the practical benefits, a quality mattress can also enhance the overall aesthetic of your bedroom. With a wide range of styles, designs, and materials to choose from, you can find a mattress that not only provides comfort but also complements the design of your home. Whether you prefer a modern and sleek look or a cozy and traditional feel, there's a mattress that can fit your unique style and taste.

Apart from the practical benefits, a quality mattress can also enhance the overall aesthetic of your bedroom. With a wide range of styles, designs, and materials to choose from, you can find a mattress that not only provides comfort but also complements the design of your home. Whether you prefer a modern and sleek look or a cozy and traditional feel, there's a mattress that can fit your unique style and taste.

.jpg)