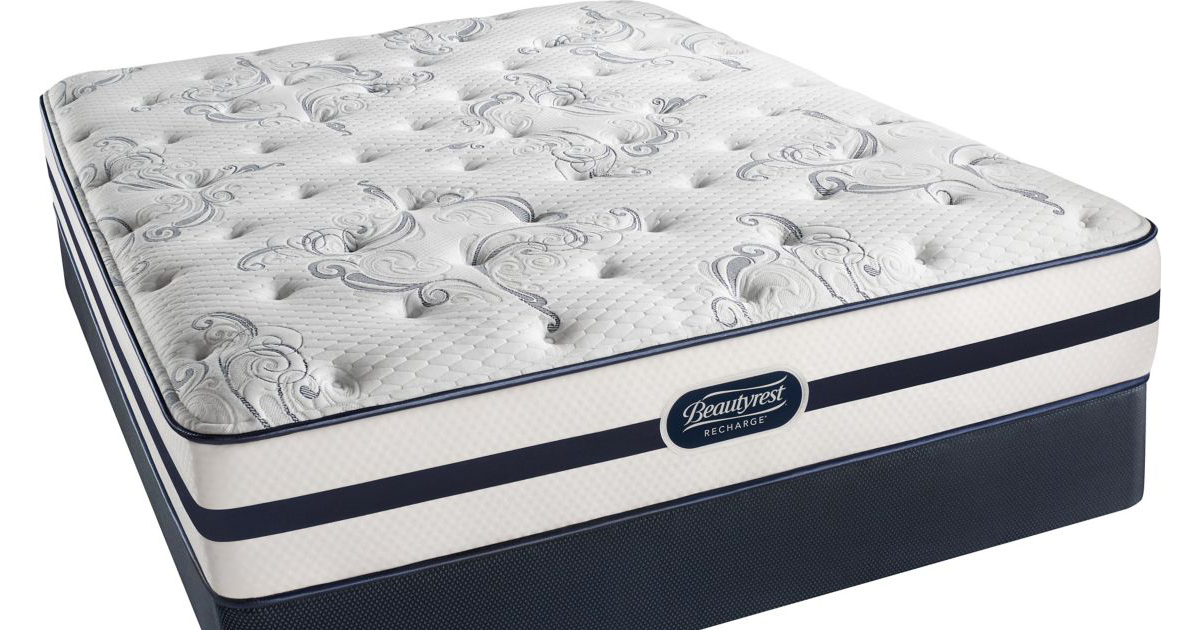

1. Florida Mattress: The Ultimate Guide to Tax-Free Shopping

If you're in the market for a new mattress in Florida, you're in luck. Florida is one of the few states that offer tax exemptions on certain purchases, including mattresses. But what exactly does that mean for you? In this guide, we'll break down everything you need to know about Florida mattress tax exemptions, how to take advantage of them, and the benefits of using a doctor's note to save even more.

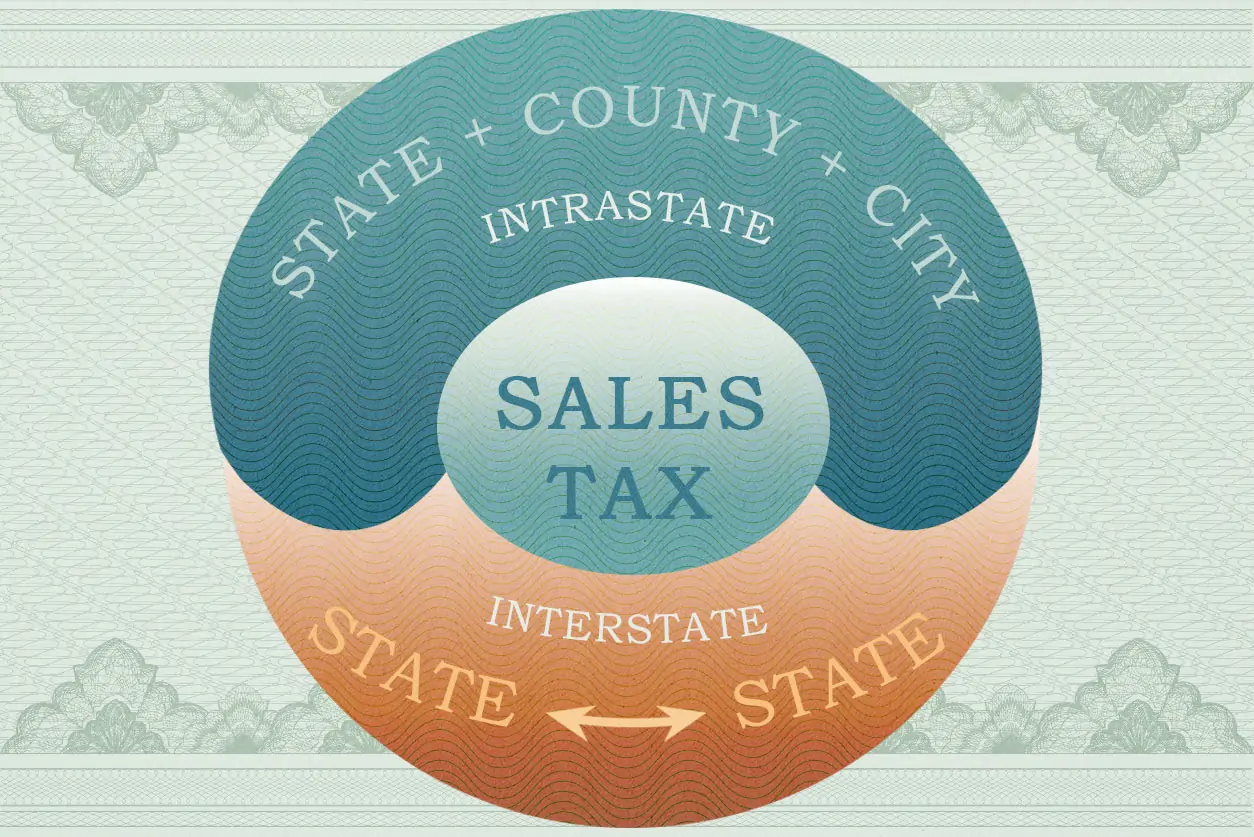

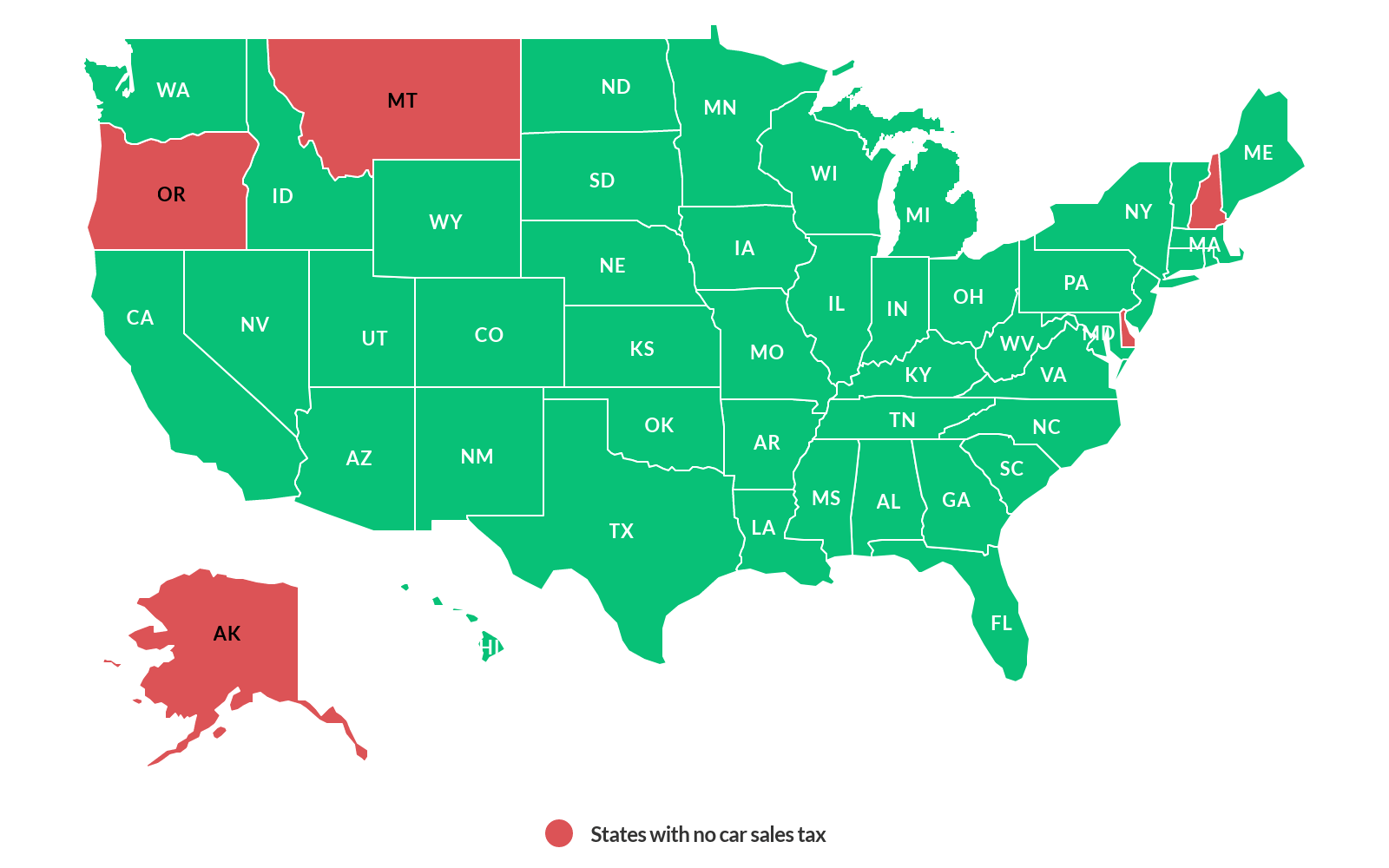

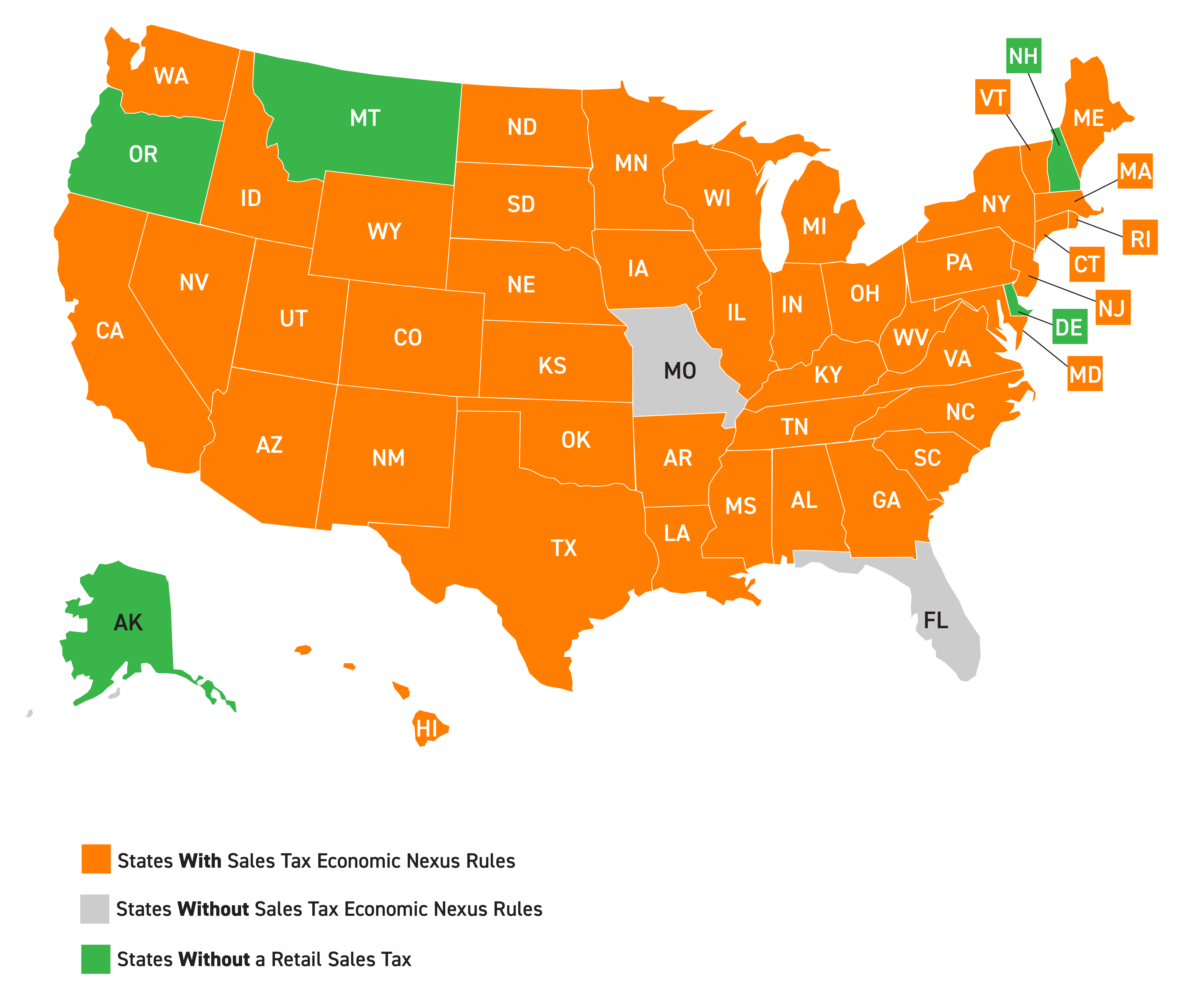

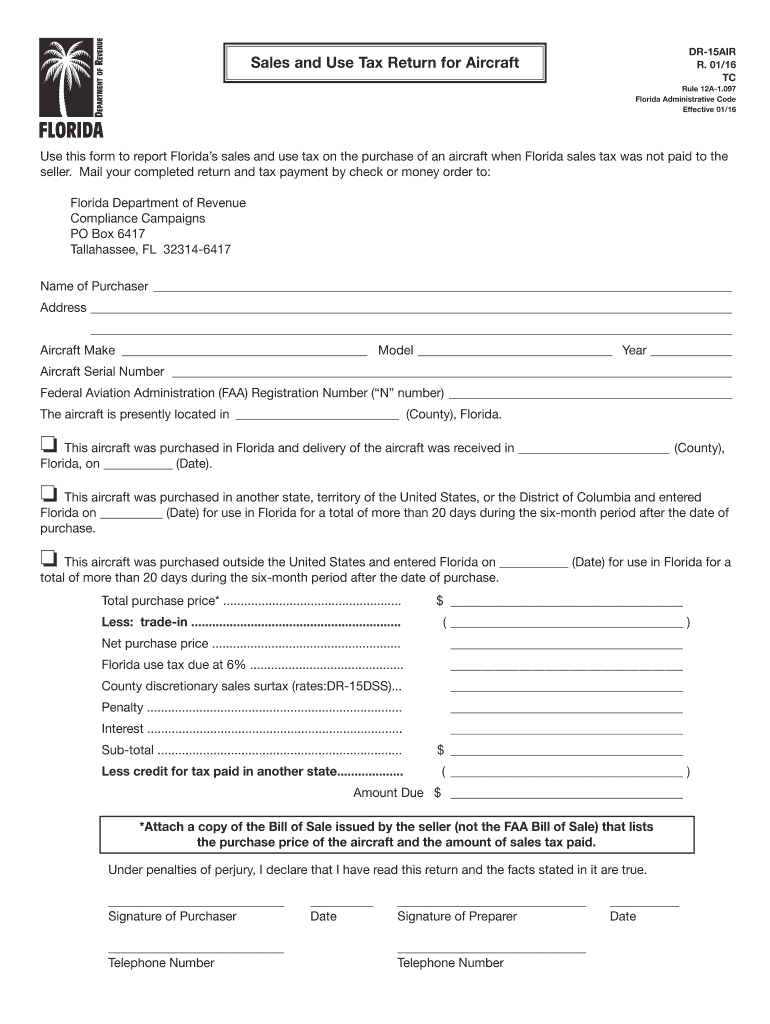

2. No Sales Tax on Mattresses in Florida

Unlike many other states, Florida does not charge sales tax on mattresses. This means that when you purchase a mattress in Florida, you won't have to pay an extra percentage of your purchase in taxes. This can save you hundreds of dollars, depending on the price of your mattress.

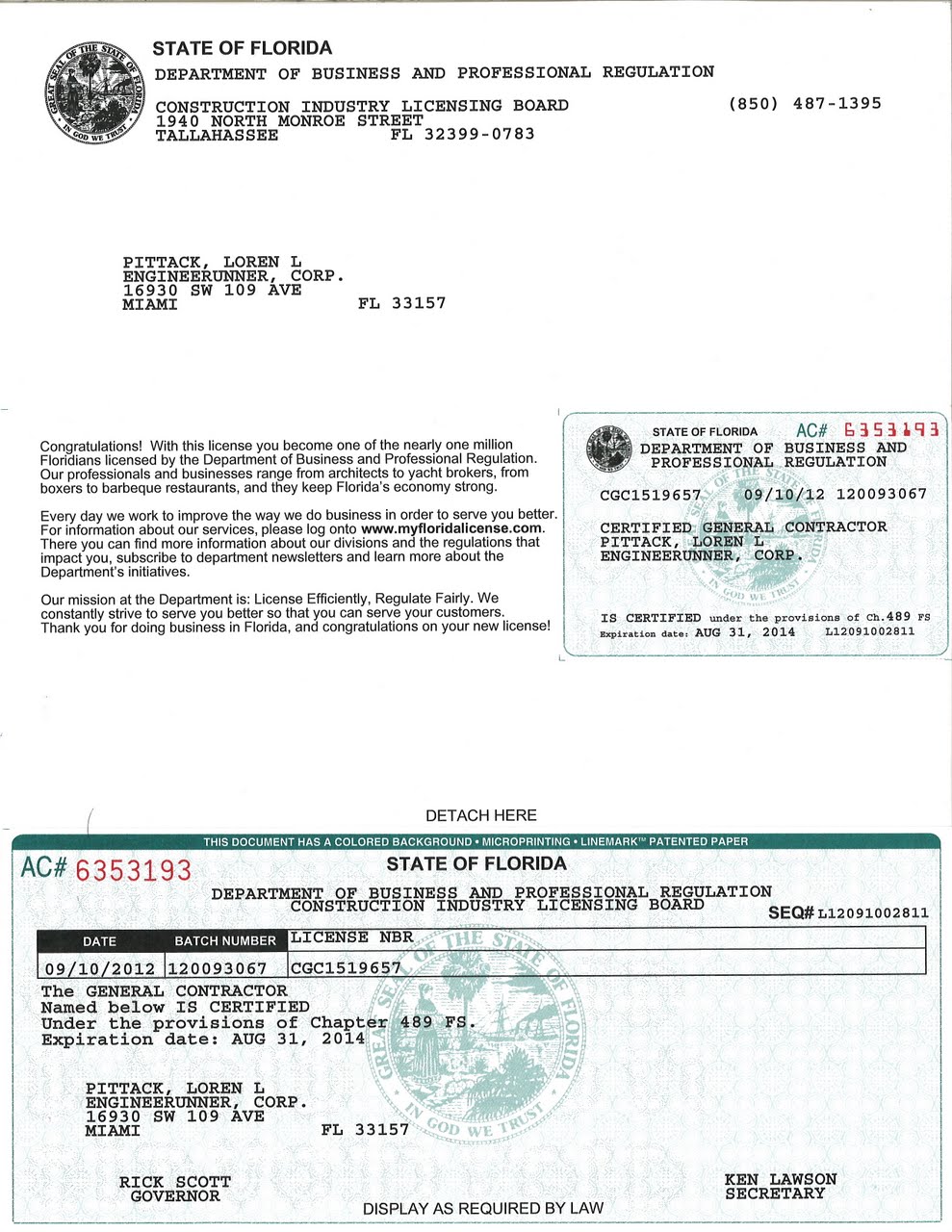

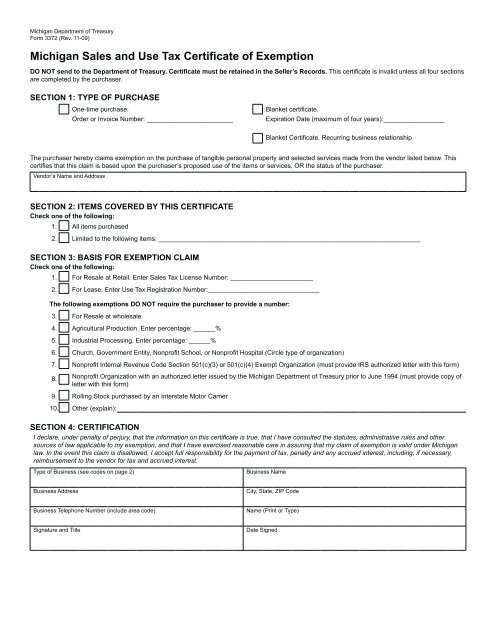

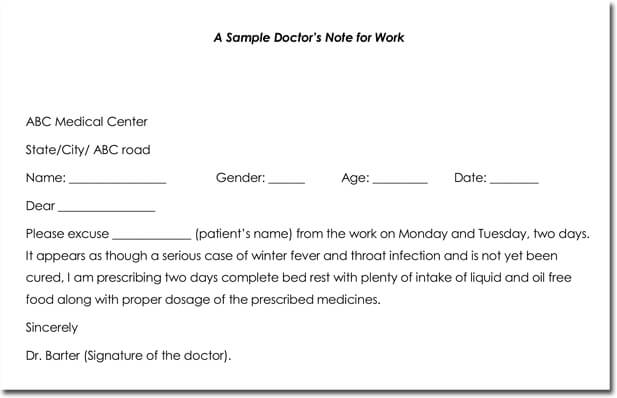

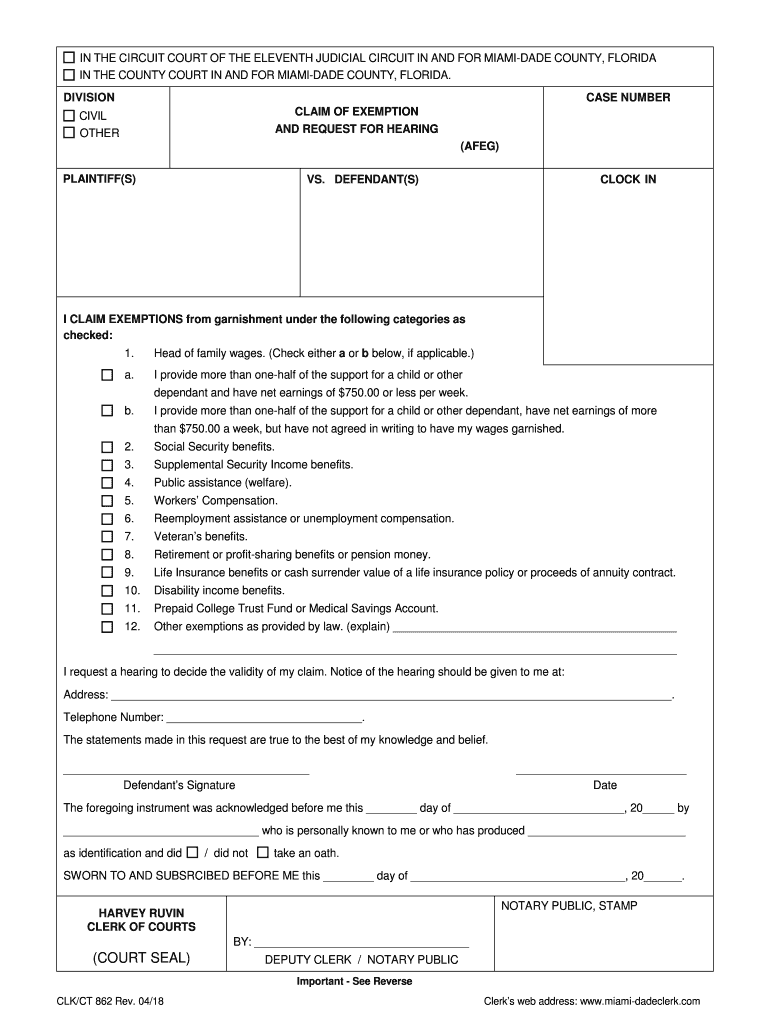

3. A Doctor's Note for Even More Savings

While there is no sales tax on mattresses in Florida, there is still a small percentage of tax on certain purchases, including mattresses. However, with a doctor's note, you can waive this tax and save even more money on your mattress purchase.

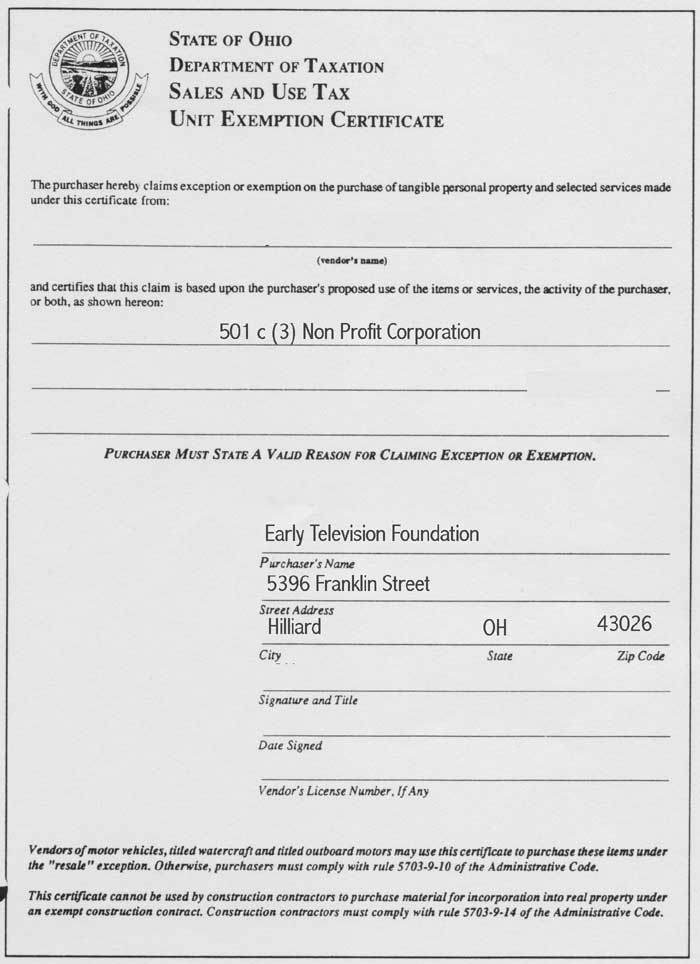

4. Florida Mattress Tax Exemption

The Florida mattress tax exemption applies to any purchase made for medical reasons. This includes mattresses that are prescribed by a doctor for health issues such as back pain, sleep disorders, or other medical conditions. With a valid doctor's note, you can avoid paying taxes on your mattress purchase.

5. Take Advantage of Florida Mattress Sales

With the added benefit of no sales tax, it's the perfect time to take advantage of mattress sales in Florida. Many retailers offer discounts, promotions, and special deals on mattresses, especially during holiday weekends. Keep an eye out for these sales and combine them with your tax exemption for maximum savings.

6. Tax-Free Shopping for Your Mattress

Shopping for a new mattress can be a big investment, and any savings can make a significant difference. With Florida's tax exemption on mattresses, you can enjoy tax-free shopping and save money on your purchase. This can make your mattress shopping experience much more enjoyable and stress-free.

7. Tax-Free Weekend for Mattress Purchases

Florida also offers a tax-free weekend each year, typically in August, where you can purchase certain items without paying sales tax. This includes mattresses, making it the perfect time to upgrade your sleep set up. Combine this with a doctor's note, and you can save even more on your mattress purchase.

8. Take Advantage of Tax-Free Sales

Many retailers in Florida also offer tax-free sales throughout the year, where you can purchase a mattress without paying any taxes. These sales can be a great time to buy, especially if you have a doctor's note for additional savings. Keep an eye out for these sales and take advantage of the tax-free benefits.

9. Tax-Free Purchase with a Doctor's Note

If you have a medical condition that requires a specific type of mattress, such as a memory foam or adjustable bed, you can save even more with a doctor's note. With a valid prescription, you can avoid paying sales tax on your mattress purchase, making it a tax-free purchase.

10. Enjoy a Good Night's Sleep and Tax-Free Savings

Not only will you enjoy a comfortable and supportive mattress, but you'll also save money on your purchase with Florida's tax exemptions. With the added benefit of a doctor's note, you can save even more and make your mattress shopping experience stress-free and enjoyable.

The Benefits of a Customized Mattress for a Better Night's Sleep

Why a Florida Mattress with No Sales Tax is the Perfect Solution

When it comes to designing the perfect bedroom, one of the most important elements to consider is your mattress. After all, the quality of your sleep has a direct impact on your overall health and well-being. However, many people overlook the importance of investing in a high-quality mattress, often opting for cheaper options that may not provide the necessary comfort and support. This is where a customized mattress from Florida can make all the difference.

A customized mattress

allows you to choose the perfect combination of materials and firmness to suit your individual needs. This means that you can say goodbye to tossing and turning, and hello to a peaceful and restful night's sleep. And the best part? By getting a

doctor's note

stating that a customized mattress is medically necessary for your specific needs, you can

avoid paying sales tax

on your purchase in Florida.

But why is a customized mattress the ideal solution for a better night's sleep? For starters, it allows you to choose the level of firmness that best suits your body and sleeping habits. Whether you prefer a soft, plush feel or a firmer, more supportive mattress, a customized option can be tailored to your exact preferences. This is especially beneficial for those who have specific medical conditions, such as back pain or joint issues, as a customized mattress can provide the necessary support and alleviate discomfort.

Another benefit of a customized mattress is that it can be

designed to fit your body's unique shape and size

. This means that you won't have to worry about sinking into uncomfortable areas or feeling pressure points on your body. Instead, the mattress will contour to your body, providing support where you need it most. This can also help improve your posture and reduce any aches and pains that may be caused by an ill-fitting mattress.

In addition to the physical benefits, a customized mattress can also have a positive impact on your mental well-being. By choosing a mattress that provides the perfect level of comfort, you can

improve your sleep quality and overall mood

. This can lead to increased productivity and a happier, more energized you. Plus, with the added bonus of

no sales tax

, investing in a customized mattress becomes an even more appealing option.

In the end, a customized mattress from Florida with no sales tax and a doctor's note is the perfect solution for those looking to improve their sleep experience. With its ability to provide tailored comfort and support, it's a worthwhile investment for anyone looking to prioritize their health and well-being. So why settle for a generic mattress when you can have a truly customized and luxurious sleep experience?

When it comes to designing the perfect bedroom, one of the most important elements to consider is your mattress. After all, the quality of your sleep has a direct impact on your overall health and well-being. However, many people overlook the importance of investing in a high-quality mattress, often opting for cheaper options that may not provide the necessary comfort and support. This is where a customized mattress from Florida can make all the difference.

A customized mattress

allows you to choose the perfect combination of materials and firmness to suit your individual needs. This means that you can say goodbye to tossing and turning, and hello to a peaceful and restful night's sleep. And the best part? By getting a

doctor's note

stating that a customized mattress is medically necessary for your specific needs, you can

avoid paying sales tax

on your purchase in Florida.

But why is a customized mattress the ideal solution for a better night's sleep? For starters, it allows you to choose the level of firmness that best suits your body and sleeping habits. Whether you prefer a soft, plush feel or a firmer, more supportive mattress, a customized option can be tailored to your exact preferences. This is especially beneficial for those who have specific medical conditions, such as back pain or joint issues, as a customized mattress can provide the necessary support and alleviate discomfort.

Another benefit of a customized mattress is that it can be

designed to fit your body's unique shape and size

. This means that you won't have to worry about sinking into uncomfortable areas or feeling pressure points on your body. Instead, the mattress will contour to your body, providing support where you need it most. This can also help improve your posture and reduce any aches and pains that may be caused by an ill-fitting mattress.

In addition to the physical benefits, a customized mattress can also have a positive impact on your mental well-being. By choosing a mattress that provides the perfect level of comfort, you can

improve your sleep quality and overall mood

. This can lead to increased productivity and a happier, more energized you. Plus, with the added bonus of

no sales tax

, investing in a customized mattress becomes an even more appealing option.

In the end, a customized mattress from Florida with no sales tax and a doctor's note is the perfect solution for those looking to improve their sleep experience. With its ability to provide tailored comfort and support, it's a worthwhile investment for anyone looking to prioritize their health and well-being. So why settle for a generic mattress when you can have a truly customized and luxurious sleep experience?

)

/https://specials-images.forbesimg.com/imageserve/610022da8070ccb5caf23908/0x0.jpg%3FcropX1%3D0%26cropX2%3D1503%26cropY1%3D143%26cropY2%3D1145)